Brushless DC Motor Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Brushless DC Motor Market is segmented By Rotor Type (Inner Rotor, Outer Rotor), By Power Range (750 W-3 KW, 0-750 W, More than 3 KW), By End User (Au....

Brushless DC Motor Market Size

Market Size in USD Bn

CAGR5.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.4% |

| Market Concentration | Medium |

| Major Players | Johnson Electric, ABB Ltd, Regal Beloit Corp, Baldor Electric Company, Inc., Allied Motion Technologies, Inc. and Among Others. |

please let us know !

Brushless DC Motor Market Analysis

The brushless DC motor market is estimated to be valued at USD 21.19 Bn in 2024 and is expected to reach USD 30.62 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2031. Growth of the brushless DC motor market can be attributed to rising demand for brushless DC motors across various industries such as automotive, industrial machinery, HVAC equipment, and consumer electronics.

Brushless DC Motor Market Trends

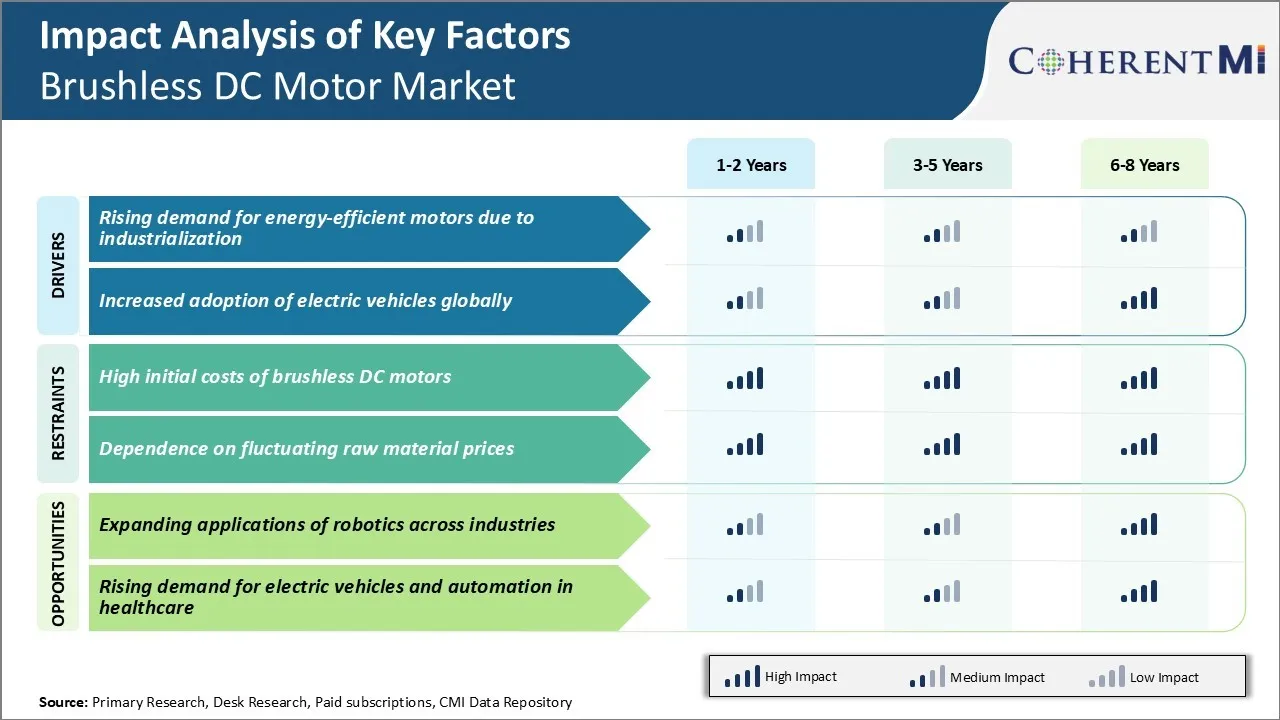

Market Driver - Rising Demand for Energy-efficient Motors due to Industrialization

Brushless DC motors have emerged as one of the most promising technologies that satisfy the dual objectives of higher performance as well as energy savings. Compared to traditional brushed DC motors, brushless DC motors provide superior speed control and higher torque even at low RPMs. They also have a longer operational lifespan as there is no physical contact between the stationary part and the rotating part like in a brushed motor.

Leading automation firms have already integrated brushless DC motors technologies into several of their industrial equipment offerings. Many processing plants and factories now prefer to install energy-efficient brushless DC motors rather than conventional alternatives. Governments in regions like China, India, SE Asia etc. have also been supporting R&D projects targeted at developing localized brushless DC motors solutions for OEMs and component manufacturers.

While initially higher in cost compared to universal motors or induction motors commonly used earlier, the total cost of ownership favors brushless DC motors over time due to energy savings. This has made industries willing to invest more in augmenting their motor fleets with energy-efficient brushless options.

Market Driver - Increased Adoption of Electric Vehicles Globally

The electric vehicle revolution has transformed mobility in a very short span of time. Factors such as stringent emissions regulations, consumer push for sustainable transportation, falling battery prices and improving charging infrastructure have all pushed the EV industry into the mainstream.

Established leaders like Tesla continue to leverage innovative BLDC motor technologies to enhance performance and range of their cars continuously. New entrants in the EV space like NIO, Xpeng, Lucid etc. are also integrating powerful and efficient BLDC drive units at the core of their EV platforms.

Over 1.5 million new electric passenger vehicles were sold globally in the first half of 2021 alone. As OEMs scale up EV manufacturing capacities and new models are rolled out constantly, the volume of brushless DC motors required for each vehicle continues to rise exponentially. With global EV sales expected to have a compound annual growth rate well over 25-30% for this decade, the brushless DC motor market is bound to experience a parallel upswing to match this momentum in the automotive industry.

Market Challenge - High Initial Costs of Brushless DC Motors

One of the key challenges faced by the brushless DC motor market is the high initial costs associated with these motors. Brushless DC motors contain advanced electronic components like motor controllers and Hall effect sensors which make the manufacturing process more complex. Additionally, the R&D investments needed to continuously upgrade the technology and improve performance also contributes to the higher costs.

All these factors collectively make brushless DC motors much more expensive compared to brushed DC motors currently used in many applications. This price difference is a major hindrance for their mass adoption, especially in cost-sensitive and mass market applications.

Manufacturers find it difficult to justify the higher costs for customers through modest savings in maintenance and energy efficiency alone. This challenge of affordability restricts the brushless DC motor market from fully realizing its growth potential. Overcoming the cost barriers through economies of scale, technology advancements and lower cost alternatives will be the key for the brushless DC motor market's success going forward.

Market Opportunity - Expanding Applications of Robotics Across Industries

One of the biggest opportunities for the brushless DC motor market lies in the expanding applications of robotics across different industries. Robots are increasingly being deployed for a wide variety of tasks across sectors like automotive, electronics, food and beverages, logistics, and warehousing.

Similarly, service robots utilized for applications like agriculture, construction, healthcare and domestic assistance also rely on these high-performance motors. With robotics adoption growing rapidly driven by factors like rising labor costs, automation needs and advanced technologies, the demand for specialized brushless DC motors from the robotics industry is projected to surge.

The brushless DC motor market is well-positioned to leverage this opportunity by developing innovative motor solutions catering to emerging robotics applications. Customized products with advanced features like IP rating, sensor integration and safety controls will accelerate their usage in robotics. Expanding relationship between brushless DC motors and robotics is estimated to be a major growth driver for the brushless DC motor market.

Key winning strategies adopted by key players of Brushless DC Motor Market

Focus on innovation and new product development: Players like Nidec, Allied Motion, and Johnson Electric have attained strong market positions by continuously innovating and developing new products. For example, in 2019, Nidec launched an oil-free and air-cooled sensorless BLDC motor, expanding its e-mobility product portfolio.

Acquisitions for technology and portfolio enhancement: Acquisitions have been a major strategy for top players to enhance their product portfolios and technology capabilities. For example, in 2016, Nidec acquired Emerson Electric's global motors business, expanding its industrial automation product range.

Focus on fast growing applications: Players target applications witnessing high growth such as e-mobility, factory automation, HVAC, and medical devices. For example, over 2015-2019, Johnson Electric focused on developing motors and controls for e-mobility, with revenues from e-vehicles growing at over 15% annually.

Strong geographic expansion: Leading players like Nidec and Allied Motion have expanded globally through new facilities, partnerships and acquisitions. For example, between 2010-2018, Allied Motion expanded to over 20 countries through eight acquisitions and new facilities.

Segmental Analysis of Brushless DC Motor Market

Insights, By Rotor Type: Rotor Design Innovation Fuels Inner Rotor Segment Growth

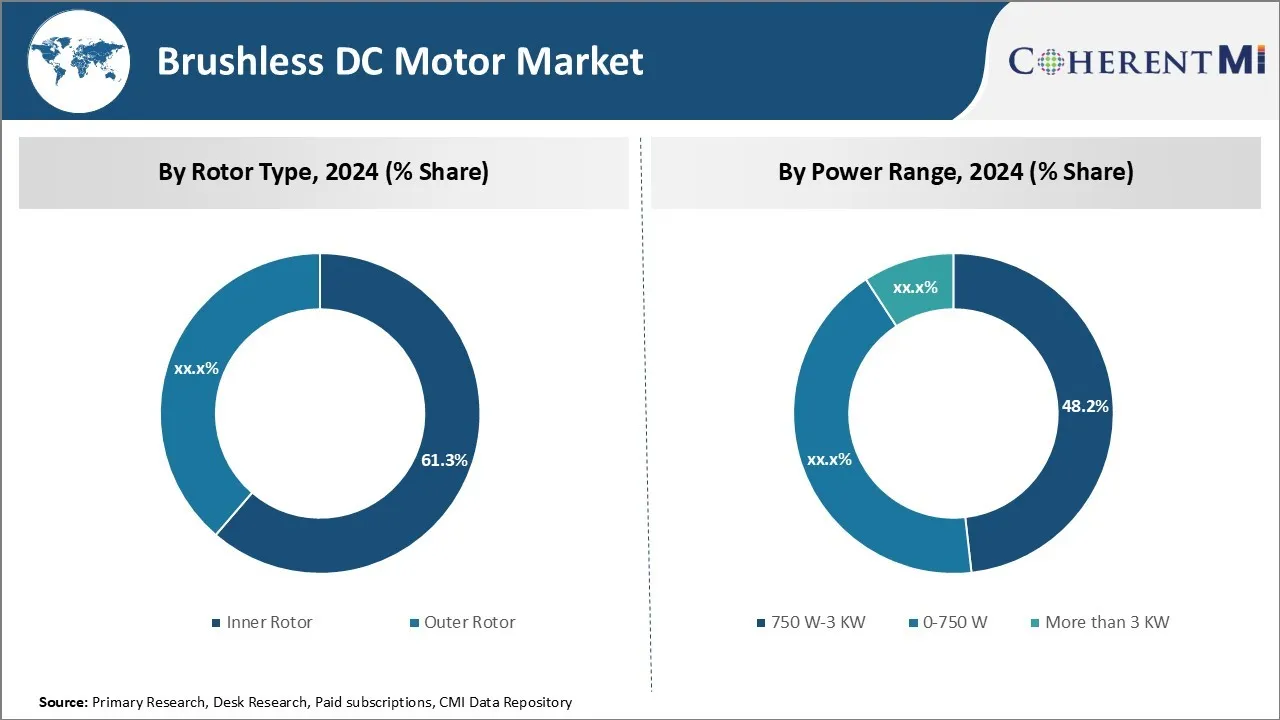

In terms of rotor type, inner rotor contributes 61.3% share of the brushless DC motor market in 2024, owing to continued innovation in rotor design and fabrication. Motors with inner rotor configuration offer distinct advantages over outer rotor types as they allow for a more compact size and higher power density. This makes them particularly well-suited for applications where space is constrained.

Significant improvements in 3D printing and micro-molding technologies have enabled manufacturers to produce increasingly complex yet lightweight inner rotor structures. At the same time, advances in rare-earth magnet materials provide designers with options to miniaturize magnetic circuits while boosting motor efficiency and torque density. These combined factors have spurred novel product concepts like integrated gear motors and direct drive fans, bolstering demand across a variety of industries.

Going forward, as compact packaging and high power-to-weight ratios gain more importance, the inner rotor segment seems poised to maintain its lead position within the brushless DC motor market.

Insights, By Power Range: Application Diversity Powers Mid-Power Range

In terms of power range, the 750 W-3 kW segment contributes 48.2% share due to its ability to serve a diverse array of applications. Motors in this mid-power range offer an attractive combination of decent efficiency and torque delivery along with reasonable size and cost. They can easily substitute traditional AC induction motors in many general machinery tasks involving moderate load handling or speed control requirements. Examples encompass conveyor lines, machine tools, blowers, mixers, small pumps and so on.

Additionally, the steady electrification of automotive functions opens new prospects as component manufacturers seek to replace hydraulic/pneumatic actuators with intelligent brushless systems. Developing nations also increasingly utilizing mid-power DC motors for agricultural equipment, construction vehicles as well as industrial automation needs. Backed by such a versatile application base spread across major economic sectors, the 750W-3kW power band continues to dominate brushless motor installations globally.

Insights, By End User: e-Mobility Revolution Touches Automotive Segment

In terms of end user, the automotive segment contributes the highest share as the adoption of electric vehicles gains momentum on a global scale. Countries worldwide are formulating stringent emission norms along with fiscal incentives to promote battery-powered transport in a bid to curb air pollution and reduce dependence on fossil fuels.

A key factor driving this E-mobility revolution is the transition occurring within vehicle powertrains - away from traditional combustion engines towards smarter electric architectures comprising high-precision brushless drives. Current and upcoming EV models virtually all rely on multiphase brushless PM motors to deliver robust yet responsive acceleration and regenerative braking.

Application scope has also widened beyond traction to include diverse chassis, steering, and comfort functions. With several automobile manufacturers now aiming to electrify over 50% of new vehicle sales within the next decade, unprecedented demand is taking shape for automotive-grade brushless DC motors optimized for reliability, efficiency and durability under adverse road conditions.

Additional Insights of Brushless DC Motor Market

- Brushless DC motors are highly efficient, energy-saving devices essential for industrial automation, robotics, and electric vehicles. The growing focus on sustainable energy and regulations promoting energy-efficient solutions are primary growth drivers. The Asia Pacific leads the brushless DC motor market, benefiting from increasing industrialization and electric vehicle adoption.

Competitive overview of Brushless DC Motor Market

The major players operating in the brushless DC motor market include Johnson Electric, ABB Ltd, Regal Beloit Corp, Baldor Electric Company, Inc., Allied Motion Technologies, Inc., North American Electric Inc., Electro Craft, Portescap, and Ametek, Inc.

Brushless DC Motor Market Leaders

- Johnson Electric

- ABB Ltd

- Regal Beloit Corp

- Baldor Electric Company, Inc.

- Allied Motion Technologies, Inc.

Brushless DC Motor Market - Competitive Rivalry, 2024

Brushless DC Motor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Brushless DC Motor Market

- In February 2023, Usha International introduced a new range of energy-efficient ceiling fans for the Indian market. These fans are equipped with Brushless DC (BLDC) motors and come with RF remote controls for user convenience.

- In February 2023, Syska Group introduced the BLDC Effecta SFR 1500 ceiling fan, featuring a brushless DC motor designed to reduce electricity consumption by up to 50%. This energy-efficient fan operates at 30 watts and includes a remote control for convenient operation.

- In January 2023, Kent RO Systems Limited, renowned for its water purifiers, expanded into energy-saving appliances by launching the Kühl Stylish Fans series. These ceiling fans are equipped with Brushless Direct Current (BLDC) motors, which utilize permanent magnets to reduce friction, motor noise, and wear, resulting in silent operation and extended motor life.

Brushless DC Motor Market Segmentation

- By Rotor Type

- Inner Rotor

- Outer Rotor

- By Power Range

- 750 W-3 KW

- 0-750 W

- More than 3 KW

- By End User

- Automotive

- Industrial Machinery

- Healthcare

- HVAC Industry

- Power Tools

- Others

- By Speed

- Less than 500 RPM

- 501-2000 RPM

- 2001-10000 RPM

- More than 10000 RPM

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the brushless DC motor market?

The brushless DC motor market is estimated to be valued at USD 21.19 Bn in 2024 and is expected to reach USD 30.62 Bn by 2031.

What are the key factors hampering the growth of the brushless DC motor market?

High initial costs of brushless dc motors and dependence on fluctuating raw material prices are the major factors hampering the growth of the brushless DC motor market.

What are the major factors driving the brushless DC motor market growth?

Rising demand for energy-efficient motors due to industrialization and increased adoption of electric vehicles globally are the major factors driving the brushless DC motor market.

Which is the leading rotor type in the brushless DC motor market?

The leading rotor type segment is inner rotor.

Which are the major players operating in the brushless DC motor market?

Johnson Electric, ABB Ltd, Regal Beloit Corp, Baldor Electric Company, Inc., Allied Motion Technologies, Inc., North American Electric Inc., Electro Craft, Portescap, and Ametek, Inc. are the major players.

What will be the CAGR of the brushless DC motor market?

The CAGR of the brushless DC motor market is projected to be 5.4% from 2024-2031.