Power Generation Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Power Generation Market is segmented By Type (Fossil Fuel Electricity, Hydroelectricity, Nuclear Electricity, Solar Electricity, Wind Electricity, Geo....

Power Generation Market Size

Market Size in USD Tn

CAGR8.05%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.05% |

| Market Concentration | High |

| Major Players | General Electric (GE), Siemens AG, Mitsubishi Heavy Industries, Ltd., Hitachi Energy Ltd., Caterpillar Inc. and Among Others. |

please let us know !

Power Generation Market Analysis

The power generation market is estimated to be valued at USD 2.1 Tn in 2024 and is expected to reach USD 3.61 Tn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 8.05% from 2024 to 2031. The power generation market is expected to see a definite shift towards more renewable sources of energy like solar and wind over the coming decade.

Power Generation Market Trends

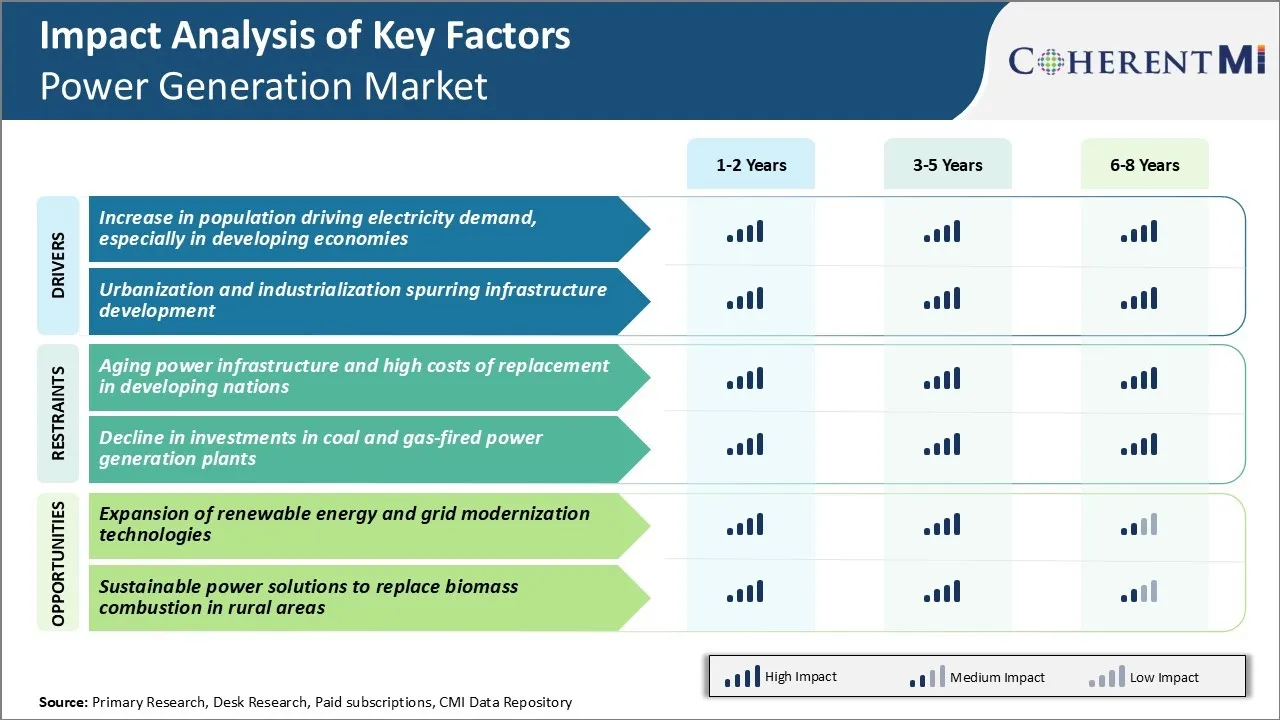

Market Driver - Increase in Population Driving Electricity Demand, Especially in Developing Economies

As the population levels continue rising around the world, the demand for electricity is also witnessing a proportional surge. Countries like India, Nigeria, Indonesia, Pakistan etc. are experiencing high population growth rates annually. With more individuals being added each year, the requirement for powering homes, communities and industries increases substantially.

With large young populations in these nations, there is also a growing middle class segment that wishes to enjoy modern amenities associated with urban lifestyles. This consumerism further accentuates the need for reliable energy sources. Overall, with a ballooning customer base needing growing amounts of power, the worldwide population explosion serves as a major driver of the global power generation market.

Market Driver - Urbanization and Industrialization Spurring Infrastructure Development

The ongoing trends of rapid urbanization and industrialization are placing tremendous pressure on existing infrastructure in many developing economies. Urban settlements now account for over half of the total population in numerous developing countries.

Megacities are emerging and expanding rapidly without adequate planning, putting existing civic facilities under immense strain. Continuous development of urban centers is raising the requirement for reliable and quality power supply to these densely populated residential and commercial districts on a round-the-clock basis.

At the same time, countries are aggressively trying to court foreign investments and drive manufacturing to bolster their economies. Reliable, quality and cost-effective electricity is a necessity to attract and retain industries amid fierce global competition. As a result, both the commercial and industrial segments across urbanizing regions have emerged as major growth facilitators for the power generation market.

Market Challenge - Aging Power Infrastructure and High Costs of Replacement in Developing Nations

One of the major challenges currently faced by the power generation market in many developing nations is aging power infrastructure and the high costs associated with replacing or upgrading it. The electrical grids and power plants in these countries have been in use for several decades in many cases and are reaching the end of their useful lifespan.

However, overhauling or modernizing widespread infrastructure requires massive investments that are not easily affordable. The costs of decommissioning old power plants, building new high-capacity generation units, and installing updated transmission are prohibitively high for many developing economies with limited budgets. This outdated infrastructure also results in greater transmission and distribution losses, lowering operational efficiency.

Unless significant capital is invested in revamping national power systems, the issue of aging infrastructure will continue to hamper reliable electricity access and economic growth prospects in these developing markets.

Market Opportunity - Expansion of Renewable Energy and Grid Modernization Technologies

One major opportunity available for players in the power generation industry is the expansion of renewable energy and grid modernization technologies. Many countries have ambitious targets to increase the share of electricity from greener sources like solar and wind power in the coming years. This translates to a massive demand for various renewable energy components including solar panels, wind turbines, energy storage solutions, green hydrogen equipment etc.

At the same time, innovations in areas like smart grid, microgrids, demand response programs are enabling modernization of aging grid infrastructure with two-way digital communications and remote monitoring capabilities. The growing deployment of these cutting-edge power technologies provides immense opportunities for manufacturers to cater to the needs of global energy transition.

Investments and partnerships across renewable energy supply chains and grid modernization programs will be a major driver of revenue growth in the power generation market.

Key winning strategies adopted by key players of Power Generation Market

Focus on renewable energy sources: Many big players like GE, Siemens, and Vestas have significantly increased their focus and investments in renewable sources like solar and wind over the past decade as these segments are seeing strong growth.

Strategic acquisitions: Companies acquire smaller innovative firms to gain new technologies and solutions. For example, in 2017, Siemens acquired the wind turbine maker Gamesa to become a leader in wind power business.

Local manufacturing: Establishing local manufacturing plants is a key strategy to win contracts from governments that mandate localization.

After-sales services: Players focus on after-sales services, operations, and maintenance contracts which provide strong recurring revenue streams over the plant lifecycle.

Segmental Analysis of Power Generation Market

Insights, By Type: Technology Drives Fossil Fuel Demand

In terms of type, fossil fuel electricity contributes 57.2% share of the power generation market in 2024. This is owning to continuous technological advancement. Fossil fuels remain a reliable source of bulk electricity generation due to improving combustion and power generation techniques. Developments in gas turbine power plants have enhanced thermal efficiencies, reducing fuel needs and emissions.

Coal power is also getting cleaner with advancements like integrated gasification combined cycle (IGCC) and carbon capture, utilization and storage (CCUS). IGCC gasifies coal into synthesis gas which is then burned in a combined-cycle plant. CCUS transforms emissions into useful products or safely stores them underground. These technologies make fossil fuels more sustainable and economically viable compared to alternatives.

Insights, By End Use: Residential Demand Drives Decentralized Growth

In terms of end use, residential contributes 36.5% share of the power generation market in 2024. This is due to the growing trend of distributed energy resources. Residential properties face unique power requirements with varied and intermittent load profiles. They provide energy autonomy as well as economic benefits through net metering policies. This facilitates consumer involvement in smart grids with two-way power and data exchange.

Major utility companies have also rolled out residential community microgrids powered by renewable mini-grids and smart inverters. These ensure power supply even during outages and enable billing based on real-time usage. Moreover, the development of electric vehicles and home heating/cooling systems is integrating power further into everyday residential services. All these factors are strengthening decentralized power structures best suited for diverse residential consumer needs in the power generation market.

Insights, By Source: Policy Drives Renewable Adoption

In terms of source, renewable sources are gaining market share supported by evolving public policy. While conventional sources still dominate, their long-term outlook is dependent on environmental regulations. Many governments globally have imposed carbon pricing or set renewable portfolio standards to accelerate clean energy commercialization. These include feed-in tariffs to make renewable power projects financially viable. Supportive regulations have spurred massive private sector investments and technological advancement in various renewable sub-segments.

Solar and wind power have seen the most dramatic price declines on economies of scale. Offshore wind farms are tapping vast untapped wind sources. Geothermal and biomass power are establishing themselves as reliable baseload alternatives. Hydroelectricity remains a mainstream renewable resource.

However, most growth is visible in decentralized applications utilizing solar, wind, waste-to-energy plants. Strong policy nudges have massified renewable capacity additions worldwide. This is slowly tilting the overall generation mix towards cleaner energy sources thereby lowering dependence on conventional power sources.

Additional Insights of Power Generation Market

- Asia-Pacific Growth: Asia-Pacific leads the power generation market, with favorable geographic and technological conditions for renewable energy growth. Asia-Pacific power generation market size in 2024 was USD 1.05 trillion.

- Europe and North America: Regions showing significant power demand, adopting renewable technologies.

- Government Support: Investments in grid infrastructure and renewable projects driving market growth globally.

- 57% of the power generation comes from fossil fuels. In the global power generation market, 69% share belongs to non-renewable sources.

Competitive overview of Power Generation Market

The major players operating in the power generation market include General Electric (GE), Siemens AG, Mitsubishi Heavy Industries, Ltd., Hitachi Energy Ltd., Caterpillar Inc., Enel SpA, Electricite De France SA, State Power Investment Corporation, E.ON SE, Engie SA, Huaneng Power International, Inc., Exelon Corp, Endesa SA, Datang International Power Generation Company Limited, Inter RAO UES, Power Grid Corporation of India Limited, NTPC Limited, Tata Power, Adani Power, NHPC Limited, Guodian Corporation, Hokkaido Electric Power Company, Tohoku Electric Power Co, AGL Energy, EDF Energy, RWE AG, Scottish Power, and Centrica plc.

Power Generation Market Leaders

- General Electric (GE)

- Siemens AG

- Mitsubishi Heavy Industries, Ltd.

- Hitachi Energy Ltd.

- Caterpillar Inc.

Power Generation Market - Competitive Rivalry, 2024

Power Generation Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Power Generation Market

- In November 2024, Mitsubishi Heavy Industries announced a strategic partnership with a major solar developer. The partnership focuses on integrating high-efficiency turbines with large-scale solar PV farms, enabling hybrid power generation solutions that reduce carbon footprints and secure a stable, cost-effective energy supply.

- In July 2024, GE Vernova introduced a smart monitoring platform for wind and hydro plants. By leveraging real-time analytics, the system improves maintenance schedules, cuts downtime, and enhances asset longevity. This innovation strengthens GE’s role in digitalizing renewable power generation and optimizing performance.

- In March 2024, Siemens AG launched a next-generation gas turbine designed for maximum efficiency and reduced emissions. The new turbine integrates advanced materials and AI-driven controls, boosting reliability and lowering operational costs, thereby enhancing Siemens’ competitive position in the power generation market globally.

Power Generation Market Segmentation

- By Type

- Fossil Fuel Electricity

- Hydroelectricity

- Nuclear Electricity

- Solar Electricity

- Wind Electricity

- Geothermal Electricity

- Biomass Electricity

- By End Use

- Residential

- Industrial

- Commercial

- Transportation

- By Source

- Conventional/Non-Renewable Source

- Renewable Source

- By Grid

- Off Grid

- On Grid

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the power generation market?

The power generation market is estimated to be valued at USD 2.1 Tn in 2024 and is expected to reach USD 3.61 Tn by 2031.

What are the key factors hampering the growth of the power generation market?

Aging power infrastructure and high costs of replacement in developing nations and decline in investments in coal and gas-fired power generation plants are the major factors hampering the growth of the power generation market.

What are the major factors driving the power generation market growth?

Increase in population driving electricity demand, especially in developing economies and urbanization and industrialization spurring infrastructure development are the major factors driving the Power Generation Market.

Which is the leading type in the power generation market?

The leading type segment is fossil fuel electricity.

Which are the major players operating in the power generation market?

General Electric (GE), Siemens AG, Mitsubishi Heavy Industries, Ltd., Hitachi Energy Ltd., Caterpillar Inc., Enel SpA, Electricite De France SA, State Power Investment Corporation, E.ON SE, Engie SA, Huaneng Power International, Inc., Exelon Corp, Endesa SA, Datang International Power Generation Company Limited, Inter RAO UES, Power Grid Corporation of India Limited, NTPC Limited, Tata Power, Adani Power, NHPC Limited, Guodian Corporation, Hokkaido Electric Power Company, Tohoku Electric Power Co, AGL Energy, EDF Energy, RWE AG, Scottish Power, and Centrica plc are the major players.

What will be the CAGR of the power generation market?

The CAGR of the power generation market is projected to be 8.05% from 2024-2031.