Marché de l'emballage cadeau ANALYSE DE LA TAILLE ET DU PARTAGE - TENDANCES DE CROISSANCE ET PRÉVISIONS (2024 - 2031)

Le marché de l'emballage cadeau est segmenté par type d'emballage (primaire, secondaire, tertiaire), par matériel (plastique, papier et carton, métaux....

Marché de l'emballage cadeau Taille

Taille du marché en USD Bn

TCAC5.4%

| Période d'étude | 2024 - 2031 |

| Année de base de l'estimation | 2023 |

| TCAC | 5.4% |

| Concentration du marché | High |

| Principaux acteurs | Cartes de repère, Plaquette, Groupe Smurfit Kappa, Ebro Colour GmbH, Interemballage et parmi d'autres |

Merci de nous le faire savoir !

Marché de l'emballage cadeau Analyse

Le marché mondial de l'emballage cadeau est estimé à 25,4 dollars des États-Unis Bn en 2024 et devrait atteindre USD 38,9 Bn par 2031, en croissance à un taux de croissance annuel composé (TCAC) de 5,4% entre 2024 et 2031. Le marché a connu une croissance constante au cours des dernières années et cette tendance devrait se poursuivre au cours de la période de prévision soutenue par l'augmentation des ventes durant les saisons de fête et les occasions à travers le monde. La demande d'emballages durables et respectueux de l'environnement a augmenté sur le marché. Les acteurs se concentrent sur le développement d'emballages à partir de matériaux recyclables ou biodégradables comme le papier et les cartons pour répondre aux préoccupations croissantes des consommateurs en matière d'environnement. L'innovation dans la conception d'emballages et l'ajout de caractéristiques à valeur ajoutée comme le gaufrage, les embellissements de ruban alimentent également les ventes. L'augmentation des achats en ligne a encore stimulé la demande de solutions d'emballage élégantes et sécurisées pour les articles cadeaux.

Marché de l'emballage cadeau Tendances

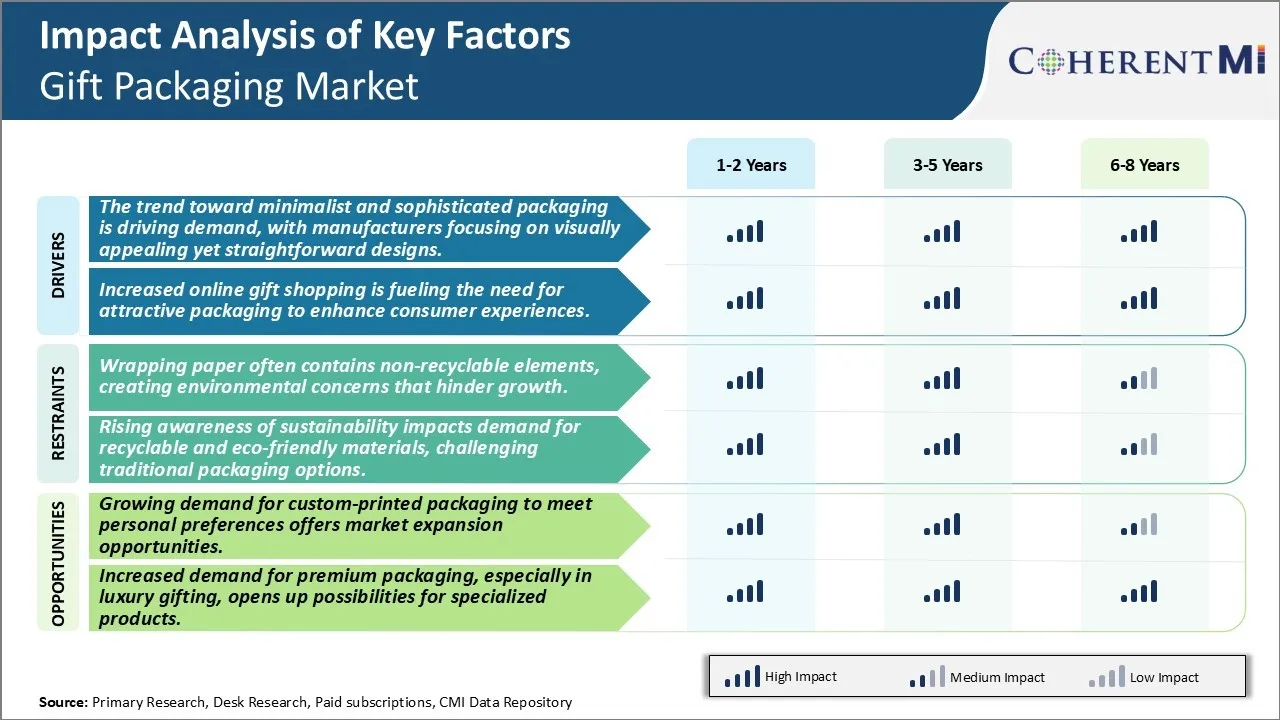

Pilote du marché - La tendance à l'emballage minimaliste et sophistiqué est à la demande, les fabricants se concentrant sur l'appel visuel et les dessins directs

L'industrie de l'emballage a vu des tendances en évolution au cours des dernières années qui influencent les modèles et les styles que les consommateurs choisissent. Il y a eu un changement notable vers des styles d'emballage moins décoratifs et plus minimalistes. Les marques ont réalisé que les acheteurs recherchent des designs élégants et discrets qui laissent le cadeau briller à travers plutôt que de dominer l'attrait visuel avec des éléments étrangers sur l'emballage.

Cela a amené de nombreux fabricants à passer d'imprimés et de rubans fortement illustrés à des enveloppes, boîtes et sacs élégants faits de matériaux de première qualité comme des papiers, tissus et plastiques recyclables. Le blocage de couleur simple, le gaufrage ou le débossage sont utilisés plutôt que des motifs complexes pour donner à l'emballage une aura de sophistication et de luxe. Les marques subtiles ou les messages sont préférés aux dessins à haute intensité. Des teintes neutres comme taupe, blanc, noir avec pastels sont principalement sélectionnées pour fournir une toile pour le cadeau lui-même. La conscience de l'environnement a également augmenté et les options écologiques basées sur le papier ou réutilisables gagnent en popularité.

La tendance minimaliste s'harmonise parfaitement avec la préférence croissante pour des styles esthétiquement raffinés mais modestes. Les jeunes consommateurs apprécient particulièrement l'élégance sous-estimée et les distractions minimales. Les marques ont pris note et sont en train de personnaliser leurs conceptions pour transmettre la qualité premium par la simplicité intelligente. Même les occasions qui étaient auparavant jugées appropriées pour des cadeaux bien couverts comme des fêtes, sont maintenant orientées vers des objets discrètement enveloppés. Ce passage à la sophistication nuancée grâce à un emballage minimaliste offre de nombreuses possibilités aux fabricants qui expérimentent des sensibilités de conception raffinées.

Pilote du marché - L'achat de cadeaux en ligne augmente le besoin d'emballage attrayant pour améliorer l'expérience des consommateurs

L'explosion de l'ecommerce a complètement changé la façon dont les gens achètent les cadeaux de nos jours. Alors que physiquement aller dans les magasins était la norme, une part importante des achats actuels se produit maintenant à distance par le biais de sites Web et d'applications. Ce phénomène a également eu un impact considérable sur l'industrie de l'emballage. Lorsque vous magasinez en ligne, les clients ne peuvent pas voir ou sentir les produits personnellement. L'emballage assume ensuite le rôle critique de faire une première impression et de transmettre la sensation et la valeur de l'article joint. Des boîtes et des couvertures attrayantes et protectrices qui s'alignent bien avec les saisons et les occasions festives sont devenues importantes pour offrir le bon contexte et se sentir à travers l'expérience de déboxage. Les donneurs de cadeaux veulent que le destinataire se sente spécial même par l'ouverture initiale du colis.

En tant que tel, les fabricants se concentrent sur la création d'emballages standout mais sécurisés qui peuvent être affichés et affichés. Les boîtes imprimées numériquement, les sacs avec poignées design, les cartes cadeaux personnalisées et les rubans sont en hausse en demande. Les matériaux comme le papier kraft, les tissus hessians rendent une touche artisanale. Les conceptions intelligentes impliquent des composants pop-up, des révélations multicouches, une personnalisation personnalisée à travers des polices et des couleurs assorties pour imiter la relation entre donneur et récepteur.

Avec le voyage d'achat maintenant détaché de l'expérience de magasin physique, l'emballage cadeau de protection a remarquablement augmenté la signification dans la marque du produit ainsi que d'améliorer le plaisir des clients par son apparence et sa fonctionnalité en ligne. C'est un facteur clé qui stimule l'innovation dans l'industrie.

Défi du marché - Le papier d'emballage contient souvent des éléments non recyclables, créant des préoccupations environnementales qui entravent la croissance

L'un des principaux défis auxquels est confronté le marché des emballages cadeaux est que le papier d'emballage contient souvent des éléments non recyclables, ce qui crée des préoccupations environnementales importantes. La plupart des papiers d'emballage sont enduits de couches de plastique ou contiennent des encres métalliques et des paillettes qui ne peuvent pas être traitées par des installations de recyclage régulières. Lorsque de tels emballages cadeaux sont jetés après utilisation, ils finissent dans des décharges et prennent très longtemps pour se décomposer. Cela a une incidence négative sur l'environnement et contribue à la pollution. La sensibilisation accrue des consommateurs à la durabilité et à l'économie circulaire les pousse à choisir des options plus respectueuses de l'environnement ayant une empreinte environnementale minimale. Cependant, la plupart des entreprises de l'industrie de l'emballage cadeau ne trouvent pas encore d'alternatives rentables aux matériaux non recyclables actuels. De plus, les capacités de l'infrastructure de gestion des déchets doivent également évoluer pour traiter des types particuliers de recyclables. À moins que ces défis ne soient correctement résolus, les préoccupations environnementales pourraient entraver les perspectives de croissance du marché des emballages cadeaux.

Opportunité de marché - La demande croissante d'emballage imprimé sur mesure stimule la croissance de l'industrie

Le marché de l'emballage cadeau offre une possibilité de croissance significative dans la demande croissante de solutions d'emballage imprimées et personnalisées. Avec l'évolution des préférences des consommateurs, les gens veulent maintenant des emballages qui correspondent à leurs goûts personnels et complètent l'expérience de don. Ils recherchent des dessins, des thèmes et des images uniques sur des emballages, des sacs et des boîtes selon l'occasion ou le destinataire. Les entreprises de l'industrie peuvent profiter de cette demande en offrant des services d'impression numérique personnalisables. Ils peuvent construire des plateformes et des applications qui permettent aux clients de choisir facilement à partir de différents modèles de conception, télécharger leurs propres photos et obtenir l'emballage livré. Cela ouvre aux fournisseurs la possibilité d'améliorer leurs portefeuilles, de bâtir des bases de clients fidèles et d'accroître leurs parts de marché. À mesure que la personnalisation augmentera en popularité, elle stimulera la demande d'impressions dynamiques, de papiers spécialisés et d'options de finition innovantes. Les entreprises dynamiques et agiles qui s'adaptent à cette tendance croissante peuvent tirer parti des possibilités d'expansion pour augmenter leurs revenus et leurs positions sur le marché.

Stratégies gagnantes clés adoptées par les principaux acteurs de Marché de l'emballage cadeau

- Personnalisation et personnalisation : Permettre aux clients de personnaliser l'emballage cadeau en fonction de l'occasion, du destinataire ou de toute autre préférence a été une stratégie extrêmement réussie. Des détaillants comme Harry & David et Ferns N Petals ont offert des boîtes personnalisées, des rubans et des messages en ligne qui pourraient être ajoutés lors de la caisse. Cela a permis aux clients de donner un forfait entièrement personnalisé qui se sentait plus personnel.

- Intégration du commerce électronique: L'alignement des solutions d'emballage sur les besoins du secteur du commerce électronique, y compris l'optimisation des emballages pour une expédition efficace et l'amélioration de l'expérience de désemballage, contribue à la satisfaction et à la fidélité des clients.

- Partenariats et acquisitions stratégiques: Collaborer avec ou acquérir des entreprises qui fournissent des produits ou des technologies complémentaires permet aux entreprises d'élargir leur portefeuille de produits et leur portée sur le marché.

- Expansion géographique: L'entrée sur les marchés émergents, notamment dans des régions comme l'Asie-Pacifique, permet aux entreprises d'exploiter de nouvelles bases de clients et de capitaliser sur la demande croissante de solutions d'emballage cadeau.

L'engagement personnalisé des clients et l'introduction de conceptions visuelles intéressantes qui intègrent les tendances ont été des stratégies gagnantes éprouvées dans le secteur de l'emballage cadeau hautement concurrentiel. Tant les détaillants de masse que les marques de niche ont exploité ces tactiques avec succès pour stimuler les ventes et l'image de marque.

Analyse segmentaire de Marché de l'emballage cadeau

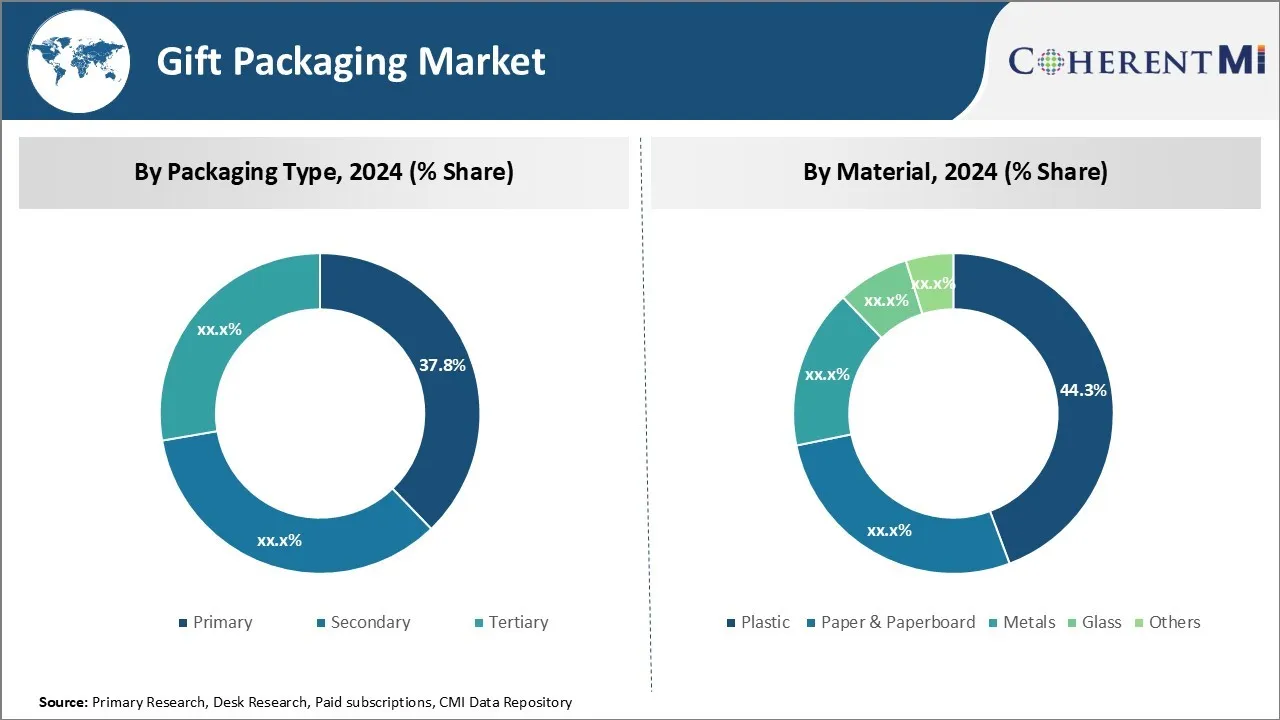

Insights, par type d'emballage, commodité et protection

Par type, l'emballage primaire devrait représenter 37,8 % en 2024. L'emballage primaire sur le marché de l'emballage cadeau fait référence à l'emballage qui est en contact direct avec le produit et fournit le niveau de base de confinement et de protection. L'emballage primaire représente la part la plus élevée du marché global de l'emballage cadeau en raison de sa fonction essentielle de logement pratique et de transport sécuritaire des articles cadeaux. Qu'il s'agisse d'un bijou délicat, d'une figurine à collectionner ou d'une boîte de chocolats, l'emballage primaire joue un rôle essentiel dans la prévention des dommages pendant le transport du donneur au destinataire. Des choses comme des boîtes cadeaux, des contenants, des emballages et des sacs minimisent les ruptures ou les fuites qui pourraient ruiner la surprise ou l'article cadeau lui-même.

De plus, l'emballage primaire offre une commodité aux donneurs et aux destinataires. Pour les donneurs, les articles emballés dans des boîtes, des sacs ou des baignoires permettent au cadeau d'être facilement entreposé, manipulé, emballé au besoin, adressé, expédié ou livré. Au bout du destinataire, les paquets primaires contiennent l'élément soigneusement et permettent une ouverture facile sans lutte. Des choses comme des boîtes, des sacs avec des mécanismes de fermeture et des contenants avec couvercles offrent une expérience de désemballage satisfaisante.

Le choix du matériau est également important pour les colis primaires pour accomplir des fonctions de protection. Les boîtes rigides fabriquées à partir de carton, de tubes en plastique et de baignoires fabriqués à partir de matériaux tels que le plastique et le métal maintiennent solidement les articles en place, ce qui empêche les dommages d'écraser ou de frapper. Même les emballages primaires délicats pour les chocolats ou les bonbons utilisent des matériaux conçus pour fournir une structure sans compromettre l'expérience cadeau. Dans l'ensemble, les caractéristiques de commodité et de protection de l'emballage primaire font partie intégrante de la livraison sécuritaire des cadeaux, ce qui entraîne sa part de marché principale.

Perspectives, par matière, la durabilité stimule la croissance des matériaux papier et carton

Les matériaux, les papiers et les cartons devraient enregistrer 44,3 % en 2024. Dans le segment des matériaux du marché de l'emballage cadeau, le papier et le carton occupent actuellement la deuxième place derrière le plastique. Cela est dû à l'importance croissante accordée à la durabilité tant dans l'industrie de l'emballage que dans les préférences des consommateurs. Tant les donneurs que les destinataires sont plus consciencieux de réduire les déchets et d'opter pour des options respectueuses de l'environnement dans la mesure du possible. Les emballages en papier et carton sont largement reconnus pour leurs qualités renouvelables et biodégradables. Il peut provenir de forêts gérées de manière responsable et être plus facilement recyclé ou composté à la fin de son cycle de vie que les plastiques. Les innovations en ingénierie du papier lui permettent également de rivaliser sur les caractéristiques de performance comme la durabilité, l'imprimabilité et la structure pour la sécurité. Les entreprises utilisent des revêtements, des conceptions multicouches et des matériaux renforcés pour fabriquer des emballages en papier et en carton qui peuvent protéger même des cadeaux fragiles.

Au fur et à mesure que la durabilité s'élève sur la liste des priorités, un plus grand nombre de marques et de détaillants se tournent vers le papier et le carton comme alternative durable pour l'emballage cadeau. Les gouvernements et les organisations encouragent également son utilisation au moyen de politiques d'achats écologiques et de certifications/étiquettes de durabilité. Au fil du temps, on s'attend à ce que la croissance des parts de marché du papier et du carton s'accélère à mesure que la gérance de l'environnement sera de plus en plus appréciée au sein de l'industrie et par les consommateurs dans leur ensemble. Ses attributs naturels et responsables la positionnent bien pour la préférence à long terme et la croissance de la demande.

Insights, par produit, la variété des options conduit le segment des boîtes cadeaux

Dans le segment de produits du marché de l'emballage cadeau, les boîtes cadeaux contribuent la plus grande part en raison de la variété des styles, des tailles et des options de personnalisation qu'elles offrent. Qu'il s'agisse d'une simple boîte pliée, d'un assemblage multipièces, d'un cube personnalisé ou d'une forme spécialisée, les boîtes offrent une flexibilité maximale et un attrait esthétique par rapport aux contenants, sacs ou autres formes.

Les boîtes cadeaux permettent aux donneurs de choisir le navire parfait pour afficher leur cadeau en fonction de facteurs tels que le type d'article, le thème, le budget et le niveau de formalité. Un large assortiment de constructions de boîtes, de fermetures, d'embellissements et d'add-ons comme des rubans, des arcs et des sacs assurent une option pour chaque besoin. Boîtes spéciales en forme de cœur, les flocons de neige des étoiles capitalisent sur les tendances saisonnières.

En outre, les boîtes cadeaux fournissent généralement le visage immobilier nécessaire à l'expression créative par l'impression ou l'étiquetage. Les messages, les illustrations et les marques peuvent être présentés de façon visible. Les entreprises qui produisent des boîtes cadeaux offrent également des capacités de personnalisation de masse pour le co-marquage, l'étiquetage privé et les versions spécifiques aux campagnes.

Dans l'ensemble, les boîtes-cadeaux de diversité fournissent dans la présentation esthétique conduit leur position de leader dans le segment plus large des produits d'emballage cadeau. Avec la possibilité de faire une impression visuelle forte et sur mesure, les boîtes restent le meilleur choix pour le don créatif. Leur personnalisation ne fait qu'augmenter la préférence et répéter l'achat par rapport à d'autres formulaires de présentation plus simples.

Informations supplémentaires sur Marché de l'emballage cadeau

Le marché de l'emballage cadeau continue d'évoluer à mesure que les préférences des consommateurs évoluent vers des options écologiques et personnalisables. Les conceptions minimalistes ont gagné en traction, les entreprises utilisant de plus en plus des emballages sous-estimés mais percutants pour attirer les clients. Les préoccupations environnementales remodelent l'industrie, car les consommateurs cherchent maintenant des options recyclables et biodégradables pour minimiser leur empreinte écologique. Dans des régions comme l'Asie-Pacifique, où le don est profondément ancré dans les pratiques culturelles, la demande d'emballages haut de gamme et personnalisés augmente, en particulier chez les consommateurs urbains à revenu élevé. Les principaux acteurs du marché réagissent en investissant dans des matériaux innovants et des options de personnalisation pour répondre à diverses préférences des consommateurs. Avec l'expansion du commerce électronique, la demande de solutions d'emballage durables et esthétiques qui améliorent l'expérience client continue d'augmenter, soutenant ainsi la trajectoire de croissance du marché.

Aperçu concurrentiel de Marché de l'emballage cadeau

Les principaux acteurs du marché de l'emballage cadeau sont les cartes Hallmark, Packlane, Smurfit Kappa Group, Ebro Colour GmbH, Interpack, Card Factory, DS Smith plc, IG Design Group plc, Karl Knauer KG, Mondi plc, Manjushree Technopack Limited, Qwikcilver Solutions et Diageo.

Marché de l'emballage cadeau Leaders

- Cartes de repère

- Plaquette

- Groupe Smurfit Kappa

- Ebro Colour GmbH

- Interemballage

Marché de l'emballage cadeau - Rivalité concurrentielle

Marché de l'emballage cadeau

(Dominé par des acteurs majeurs)

(Très compétitif avec de nombreux acteurs.)

Développements récents dans Marché de l'emballage cadeau

- En septembre 2023, Louis Vuitton introduisit une collection de boîtes cadeaux inspirées par l'artisanat, honorant son engagement sur le marché chinois. Cet emballage, modelé selon des modèles traditionnels, s'harmonise avec la marque de luxe en Chine.

- En août 2023, Hallmark et Venmo ont lancé des cartes de vente à Hallmark + Venmo, en simplifiant le processus de don en permettant aux consommateurs d'envoyer des cadeaux d'argent numériquement, en améliorant la commodité et la personnalisation.

- En septembre 2023, l'Hôtel Eclat Pékin a publié une boîte-cadeau en édition limitée avec le design de l'artiste Eirds Ragnarsdóttir, célébrant le Mid-Autumn Festival et combinant l'art culturel et le don.

- En mai 2022, Smurfit Kappa a acquis Atlas Packaging, élargissant ses solutions d'emballages ondulés, améliorant la variété des produits pour le marché de l'emballage cadeau.

Marché de l'emballage cadeau Segmentation

- Par type d'emballage

- Enseignement primaire

- Secondaire

- Titre

- Par matière

- Plastique

- Papier et carton

- Métaux

- Verre

- Autres

- Par produit

- Boîtes cadeaux

- Conteneurs

- Ruban & Bows

- Sacs cadeaux

- Sacs cadeaux

- Autres

Souhaitez-vous explorer l'option d'achat sections individuelles de ce rapport ?

Questions fréquemment posées :

Quelle est la taille du marché de l'emballage cadeau?

Le marché mondial de l'emballage cadeau est estimé à US$ 25,4 Bn en 2024 et devrait atteindre USD 38,9 Bn avant 2031.

Quel sera le TCAC du marché de l'emballage cadeau?

Le TCAC du marché de l'emballage cadeau devrait passer de 5,4 % de 2024 à 2031.

Quels sont les principaux facteurs à l'origine de la croissance du marché des emballages cadeaux?

La tendance à l'emballage minimaliste et sophistiqué conduit la demande, les fabricants se concentrant sur des conceptions visuellement attrayantes mais simples et l'augmentation des achats de cadeaux en ligne alimentent le besoin d'emballage attrayant pour améliorer l'expérience des consommateurs sont les principaux facteurs moteurs du marché de l'emballage cadeau.

Quels sont les principaux facteurs qui entravent la croissance du marché de l'emballage cadeau?

Le papier d'emballage contient souvent des éléments non recyclables, ce qui crée des préoccupations environnementales qui entravent la croissance et la sensibilisation croissante à l'impact de la durabilité sur la demande de matériaux recyclables et respectueux de l'environnement.

Quel est le premier type d'emballage sur le marché de l'emballage cadeau?

Primary est le premier segment du type d'emballage.

Quels sont les principaux acteurs du marché de l'emballage cadeau ?

Hallmark Cards, Packlane, Smurfit Kappa Group, Ebro Colour GmbH, Interpack, Card Factory, DS Smith plc, IG Design Group plc, Karl Knauer KG, Mondi plc, Manjushree Technopack Limited, Qwikcilver Solutions, Diageo sont les principaux acteurs.