Monocrystalline Solar Cell Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Monocrystalline Solar Cell Market is segmented By Grid Type (Grid Connected, Off-Grid), By Application (Industrial, Commercial, Residential, Power Uti....

Monocrystalline Solar Cell Market Size

Market Size in USD Bn

CAGR8.51%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.51% |

| Market Concentration | High |

| Major Players | LONGi Green Energy Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Trina Solar Limited, Canadian Solar Inc., JA Solar Holdings Co., Ltd. and Among Others. |

please let us know !

Monocrystalline Solar Cell Market Analysis

The monocrystalline solar cell market is estimated to be valued at USD 6.55 Bn in 2024 and is expected to reach USD 11.6 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 8.51% from 2024 to 2031. Factors such as rising concern over emission of greenhouse gases and focus on alternative renewable sources of energy are driving increased demand in the monocrystalline solar cell market.

Monocrystalline Solar Cell Market Trends

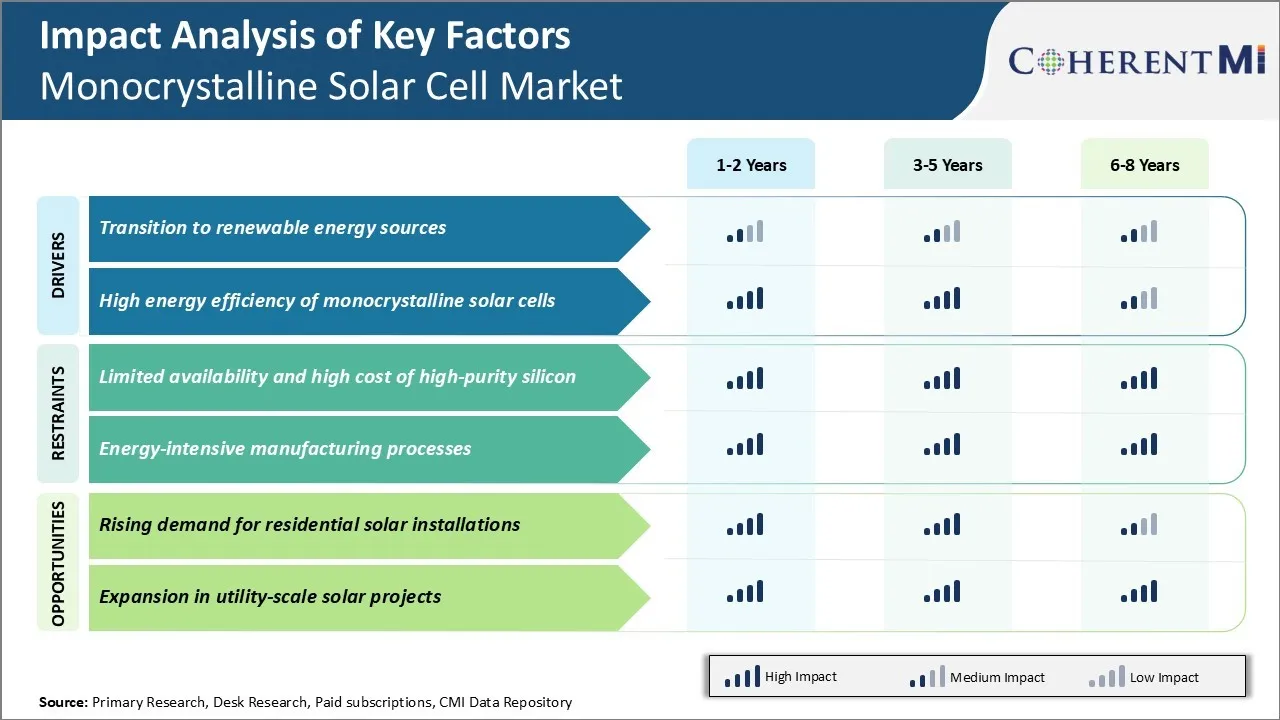

Market Driver - Transition to Renewable Energy Sources

Climate change is becoming an increasingly pressing issue across the globe. So, countries and governments are looking to reduce their carbon emissions and dependence on fossil fuels. Solar energy offers a clean and renewable alternative that is gaining much momentum. Countries have announced ambitious solar energy targets and are providing various policy incentives to boost solar power generation and adoption.

Monocrystalline solar cells are currently one of the most efficient and widely used technologies in the solar energy sector. They offer consistent performance over time and are able to generate more power from the same amount of sunlight compared to other solar cell technologies.

Countries and states are committing to source larger parts of their energy requirement from solar photovoltaics as a clean, inexhaustible source. Thereby, monocrystalline solar cell panels will see increased usage on both residential and commercial rooftops as well as large utility-scale projects. Solar panel manufacturers are ramping up monocrystalline solar cell production capacities considerably to meet this growing market demand.

Market Driver - High Energy Efficiency of Monocrystalline Solar Cells

Monocrystalline solar cells are considered to be the most efficient photovoltaic technology currently available in the market. They can convert up to 25% of the sunlight that falls on them directly into electricity. This is significantly higher than other solar cell technologies like thin film which have an energy conversion rate of around 13-15%.

The high efficiency of monocrystalline solar cells gives them an edge over polycrystalline or thin film panels especially for commercial and utility-scale projects where every additional unit of power generation helps optimize returns. Customers including installers, commercial establishments and project developers are willing to pay a slight premium for monocrystalline solar cell panels. They generate more electricity from the same rooftop or project area and maintain that performance level throughout their lifetime.

Residential homeowners also prefer monocrystalline due to the great bang for the buck. This consistent high efficiency drives further demand which is a key factor propelling the growth of the monocrystalline solar cell market globally.

Market Challenge - Limited Availability and High Cost of High-purity Silicon

One of the key challenges faced by the monocrystalline solar cell market is the limited availability and high cost of high-purity silicon. Solar cells require at least 99.9999% pure silicon to function efficiently, however producing silicon with such a high level of purity at scale is an energy intensive process.

Obtaining silicon feedstock itself requires extraction from silica sand or quartz followed by additional processing that includes reactions at very high temperatures to achieve the required purity levels. With rising demand from the expanding monocrystalline solar cell market, prices of purified silicon have witnessed substantial increases over the past few years restricting further growth.

The shortage of high-purity silicon feedstock at affordable prices presents a significant hurdle to the industry. It restricts its efforts for cost reduction and making solar power more competitive against fossil fuel based sources of electricity generation.

Market Opportunity - Rising Demand for Residential Solar Installations

One major opportunity for the monocrystalline solar cell market is the rising demand for residential solar installations across regions. With global initiatives and policies focusing on carbon neutrality and increasing use of renewable energy sources, the market for rooftop solar panels for residential buildings is growing steadily. The ease of installation, zero operational costs and long term returns are driving higher adoption of residential solar systems worldwide.

Monocrystalline solar cells are preferred in the residential applications segment owing to their high efficiency over other technologies. Countries like United States, China, Japan are seeing strong demands from the residential sector for solar panel installations to supplement electricity needs and enable energy independence.

Falling prices of solar equipment including monocrystalline solar cells over the years have made residential solar power generation more affordable and achievable for homeowners. This continuing rise in installations of rooftop solar energy systems underscores robust opportunities ahead for manufacturers in the monocrystalline solar cell market.

Key winning strategies adopted by key players of Monocrystalline Solar Cell Market

Focus On Cost Reduction Through Technological Innovation: One of the biggest strategies adopted by leading players like JinkoSolar, Longi Solar, Canadian Solar etc. has been continuously investing in R&D to drive costs down through technological innovation.

Capacity Expansion: Players are expanding production capacity globally to achieve economies of scale and cater to rising demand.

Improving Efficiencies: Adopting new cell technologies like PERC (Passivated Emitter and Rear Cell), TOPCon (Tunnel Oxide Passivated Contact) etc. that improve energy conversion efficiencies.

Focus On Downstream Integration: Companies are moving beyond manufacturing to developing utility-scale projects, selling solutions to commercial/industrial customers.

Mergers and acquisitions: Strategic M&A allows players to rapidly gain new capabilities, customers and market share. Jinko acquired Nextracker in 2021 to become a leading solution provider boosting its market share.

Segmental Analysis of Monocrystalline Solar Cell Market

Insights, By Grid Type: Convenience and accessibility drive demand for grid-connected systems

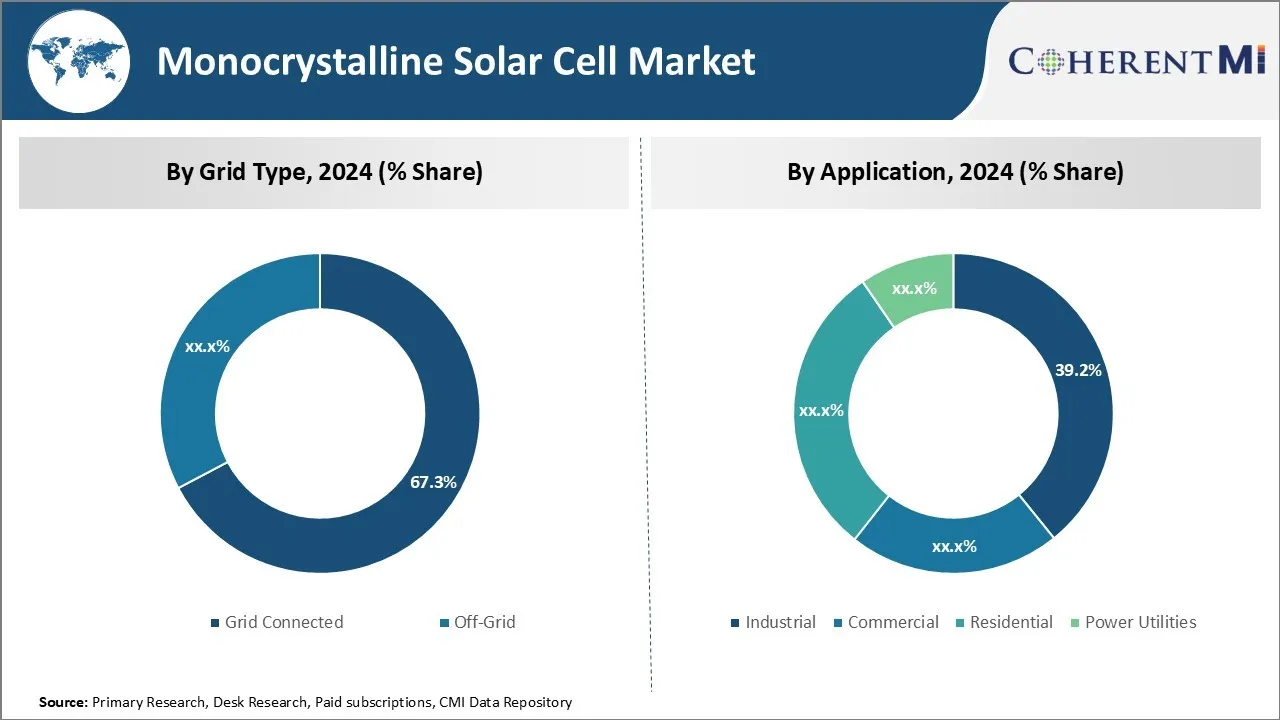

In terms of grid type, grid-connected monocrystalline solar cells contribute 67.3% share of the monocrystalline solar cell market in 2024, owning to the convenience and accessibility it provides. Grid-connected systems are directly hooked up to the electrical grid, allowing any excess power generated from solar panels to be fed directly into the grid for others to use. This bi-directional energy exchange ensures optimum utilization of solar power at all times of the day.

Home and business owners with grid-tied setups have the flexibility of using grid supply during nights and overcast days while being able to sell surplus power during peak generation hours. The grid essentially acts as a large 'battery' to store excess renewable energy.

Not having to install expensive battery backup solutions makes grid-connected systems more economically viable for commercial and industrial applications compared to off-grid systems. Reliable grid backup further enhances the appeal of these solutions for residential prosumers.

Insights, By Application: Industrial Use at Largest Scale Drives Demand in Industrial Applications

In terms of application, industrial contributes 39.2% share of the monocrystalline solar cell market in 2024. This is primarily due to the significantly larger scale at which solar systems can be installed on industrial facilities and warehouses. Large, open ground spaces and rooftops of industrial buildings provide ample opportunities to install photovoltaic arrays spanning multiple kilowatts to megawatts of generating capacity. This taps solar power at an industrial level to meet a substantial portion of the daily electricity needs of manufacturing plants.

When aggregated, the industrial sector’s consumption of renewable energy far surpasses other application segments in the monocrystalline solar cell market. Economic incentives for business owners, focus on reducing carbon footprints, and ability to generate power on-site in large volumes are major drivers that sustain robust demand from industrial consumers.

Insights, By Application: Crystalline Silicon Technology is the Dominant Force

In terms of technology, crystalline silicon cells contribute the highest share of the monocrystalline solar cell market. This is because crystalline silicon technology, thanks to its long research and development history spanning decades, offers a unique combination of high performance, reliability, and cost-effectiveness that other alternatives are yet to match.

Monocrystalline cells in particular demonstrate highest conversion efficiencies of over 25% for converting sunlight into electricity. They produce more power per unit area and have longer operational lifetimes compared to thin film and ultra-thin film technologies. Robust manufacturing infrastructure, stable long-term supply of raw materials, and continual silicon cell improvements have made crystalline silicon the photovoltaic technology of choice worldwide.

With a strong foothold across applications and geographic regions, crystalline silicon variants will continue to drive overall market revenues in the foreseeable future.

Additional Insights of Monocrystalline Solar Cell Market

- North America accounted for 36% share of the monocrystalline solar cell market in 2023.

- The grid-connected segment dominated with 67% revenue share of the global monocrystalline solar cell market in 2023.

- Industrial applications held the largest market share at 39% in the monocrystalline solar cell market in 2023.

- Monocrystalline solar cells are heavily used in residential, commercial, and industrial applications due to their high efficiency.

- Emerging markets such as Asia-Pacific and Africa are seeing increased adoption due to government subsidies and lower production costs.

Competitive overview of Monocrystalline Solar Cell Market

The major players operating in the monocrystalline solar cell market include LONGi Green Energy Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Trina Solar Limited, Canadian Solar Inc., JA Solar Holdings Co., Ltd., Hanwha Q CELLS Co., Ltd., SunPower Corporation, Yingli Solar, SunPower Corporation, REC Group, and LG Electronics Inc.

Monocrystalline Solar Cell Market Leaders

- LONGi Green Energy Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Limited

- Canadian Solar Inc.

- JA Solar Holdings Co., Ltd.

Monocrystalline Solar Cell Market - Competitive Rivalry, 2024

Monocrystalline Solar Cell Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Monocrystalline Solar Cell Market

- In August 2024, JinkoSolar introduced an advanced monocrystalline solar cell with enhanced perovskite layering. This innovation improved cell efficiency and longevity, allowing the company to strengthen its global market presence and competitiveness.

- In July 2023, Trina Solar established a new manufacturing facility in Southeast Asia. This facility reduced production costs, ensured shorter lead times for regional customers, and supported local clean energy initiatives, solidifying Trina’s dominance in the regional monocrystalline solar cell market.

- In March 2024, LONGi Green Energy finalized a strategic partnership with a leading European utilities firm. The agreement focused on delivering high-efficiency monocrystalline panels, aiding sustainable infrastructure development and reinforcing LONGi’s footprint in the European monocrystalline solar cell market.

Monocrystalline Solar Cell Market Segmentation

- By Grid Type

- Grid Connected

- Off-Grid

- By Application

- Industrial

- Commercial

- Residential

- Power Utilities

- By Technology

- Crystalline Silicon Cells

- Thin Film Cells

- Ultra-Thin Film Cells

- By Installation

- Ground-Mount

- Rooftop Solar PV

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the monocrystalline solar cell market?

The monocrystalline solar cell market is estimated to be valued at USD 6.55 Bn in 2024 and is expected to reach USD 11.6 Bn by 2031.

What are the key factors hampering the growth of the monocrystalline solar cell market?

Limited availability and high cost of high-purity silicon and energy-intensive manufacturing processes are the major factors hampering the growth of the monocrystalline solar cell market.

What are the major factors driving the monocrystalline solar cell market growth?

Transition to renewable energy sources and high energy efficiency of monocrystalline solar cells are the major factors driving the monocrystalline solar cell market.

Which is the leading grid type in the monocrystalline solar cell market?

The leading grid type segment is grid connected.

Which are the major players operating in the monocrystalline solar cell market?

LONGi Green Energy Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Trina Solar Limited, Canadian Solar Inc., JA Solar Holdings Co., Ltd., Hanwha Q CELLS Co., Ltd., SunPower Corporation, Yingli Solar, SunPower Corporation, REC Group, and LG Electronics Inc. are the major players.

What will be the CAGR of the monocrystalline solar cell market?

The CAGR of the monocrystalline solar cell market is projected to be 8.51% from 2024-2031.