Sterilization Pouches Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Sterilization Pouches Market is segmented By Application (Hospitals, CSSDs, Clinics, Others), By End User (Healthcare, Food & Beverages, Cosmetics, Ho....

Sterilization Pouches Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | Medium |

| Major Players | Amcor plc, Mondi Group, Berry Global, 3M Company, Dynarex Corporation and Among Others. |

please let us know !

Sterilization Pouches Market Analysis

The sterilization pouches market is estimated to be valued at USD 50.14 Bn in 2024 and is expected to reach USD 81.05 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. Growing need for sterilization of medical instruments and surgical kits across hospitals and clinics has been a major driver of growth for the sterilization pouches market.

Sterilization Pouches Market Trends

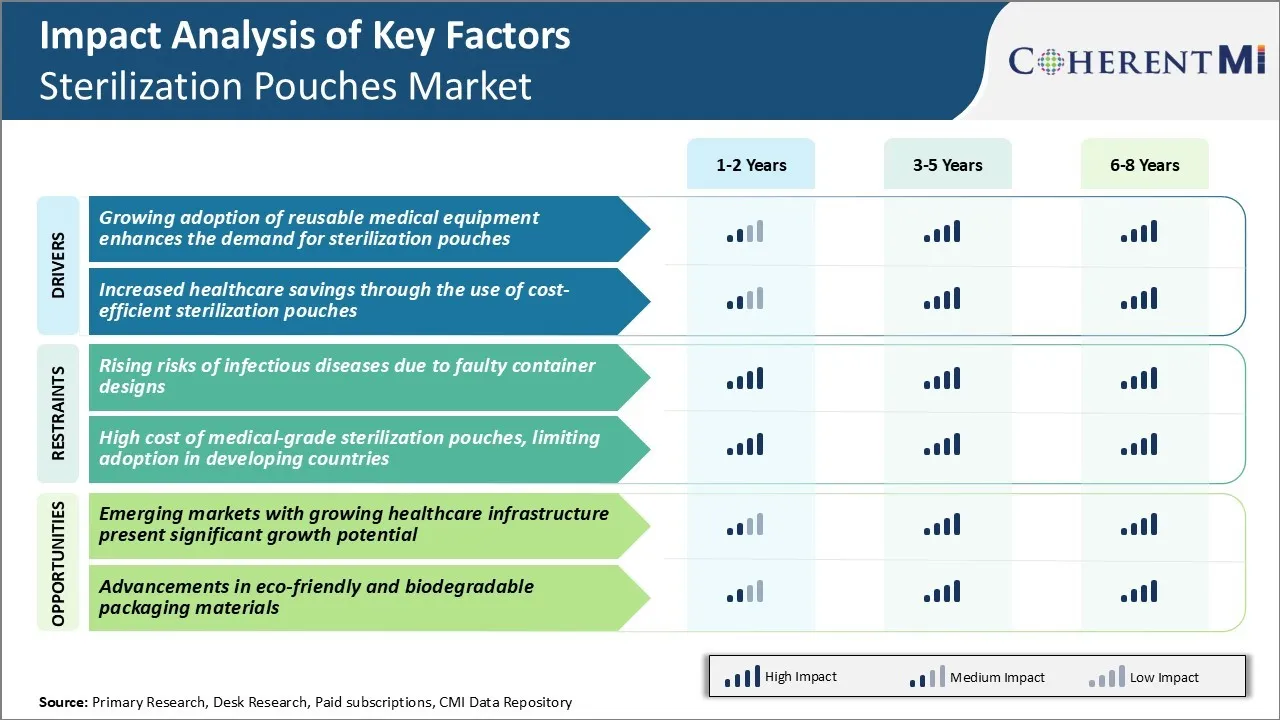

Market Driver - Growing adoption of reusable medical equipment enhances the demand for sterilization pouches

Healthcare facilities around the world are increasingly relying on sterilization pouches to safely sterilize and store surgical tools and other medical devices that can withstand repeated sterilization cycles. As more facilities invest in reusable equipment to maximize savings, the demand for high-quality sterilization pouches designed for heat, chemical, or radiation sterilization methods continues growing.

Sterilization pouches play an important role in the sterilization workflow by providing an effective barrier that maintains sterility after processing. While other sterilization methods such as steam processing are effective at eliminating microorganisms, reusable equipment still needs to be securely packaged prior to storage and transport in sterilized condition.

Manufactured from breathable, non-woven fabric laminated with a microbial barrier to lock in sterilized contents, sterilization pouches prevent recontamination and let facilities safely reuse equipment multiple times. For heat-sensitive items, pouches designed for lower-temperature sterilization methods such as ethylene oxide gas sterilization are growing in usage.

Market Driver - Increased Healthcare Savings Through the Use of Cost-efficient Sterilization Pouches

Rising healthcare costs have prompted many facilities to explore cost-saving measures across their operations, including in areas such as reusable medical equipment processing and the purchasing of disposable products. When selecting sterilization packaging, facilities are paying closer attention to the total cost of ownership over the lifecycle to maximize savings. Cost-efficient sterilization pouches offer an affordable option compared to more premium pouches made from raw materials like plastic.

Additionally, sterilization pouch manufacturers are offering pouches in bulk quantities and economic multi-pack configurations. For medical device manufacturers outsourcing equipment processing services, budget-friendly sterilization pouches allow them to offer competitive package deals to customers. With pressure to reduce overall procedural costs and keep device prices low, such packaged sterilization solutions are gaining wider acceptance.

At the same time, basic sterilization pouches continue enhancing efficiency in sterilization departments by minimizing costs associated with purchase of packaging stock and disposal of used packaging waste. Combined with cost benefits of reusable equipment, affordable sterilization pouches contribute significantly towards healthcare savings goals industry-wide.

Market Challenge - Rising Risks of Infectious Diseases due to Faulty Container Designs

One of the key challenges faced by the sterilization pouches market is the rising risks of infections being spread due to faulty container designs. Sterilization pouches are used for packaging medical instruments and devices that need to remain sterile prior to use on patients. However, some sterilization pouch manufacturers have been using substandard materials or failing to follow proper aseptic packaging protocols.

Hospital acquired infections remain a major issue globally and faulty sterilization pouches have contributed to this problem. Regulators are now more closely scrutinizing sterilization pouch standards and new quality certifications. This increases compliance costs for manufacturers. There is also the risk of brands being damaged if defective pouches lead to high profile infection outbreaks.

Overall, these quality-related issues raise concerns among healthcare professionals and hospitals about the reliability of certain sterilization pouch market players. Addressing defects and improving packaging standards needs to become a priority to mitigate infectious disease risks.

Market Opportunity: Emerging Markets with Growing Healthcare Infrastructure Present Significant Growth Potential

Emerging markets in regions such as Asia Pacific, Latin America, Middle East and Africa present significant growth opportunities for players in the sterilization pouches market. Healthcare infrastructure and access to medical services is rapidly expanding in many developing countries, driven by economic development, rising living standards and government initiatives. This is increasing the need for sterile packaging solutions across hospital supply chains. The number of surgical procedures and use of disposable medical devices is growing sharply. At the same time, the regulatory environment and standards in emerging markets are also evolving to mandate use of sterilization pouches and validated packaging protocols. Domestic production of sterile medical supplies is increasing as well.

All of these factors are expected to drive strong demand for sterilization pouches. International brands have an opportunity to forge partnerships with local players to target these high growth regions. Also, localizing manufacturing to emerging regions in the sterilization pouches market can help address cost and supply chain related concerns.

Key winning strategies adopted by key players of Sterilization Pouches Market

Strategy: Focus on product innovation to meet evolving customer needs

Companies like Amcor, Bemis, Berry Global, Mondi, and 3M have seen great success through continuous product innovation. Amcor launched new eco-friendly pouches made from renewable plant-based materials in 2020.

Strategy: Expand geographically through strategic acquisitions

Players in the sterilization pouches market have expanded globally through strategic acquisitions. In 2017, Amcor acquired Canada-based Alucam for ~$80 million to strengthen their presence in North America. This helped Amcor gain new customers in the lucrative US medical products market.

Strategy: Focus on private label brands and value market segments

Companies like Dynarex adopted the strategy of focusing on value market segments and private label offerings which yielded results. By 2016, their private label sterile pouches business grew 48% and accounted for over 30% of their revenues.

Segmental Analysis of Sterilization Pouches Market

Insights, By Application: Rising Need for Sterilized Medical Equipment Drives Demand from Hospitals

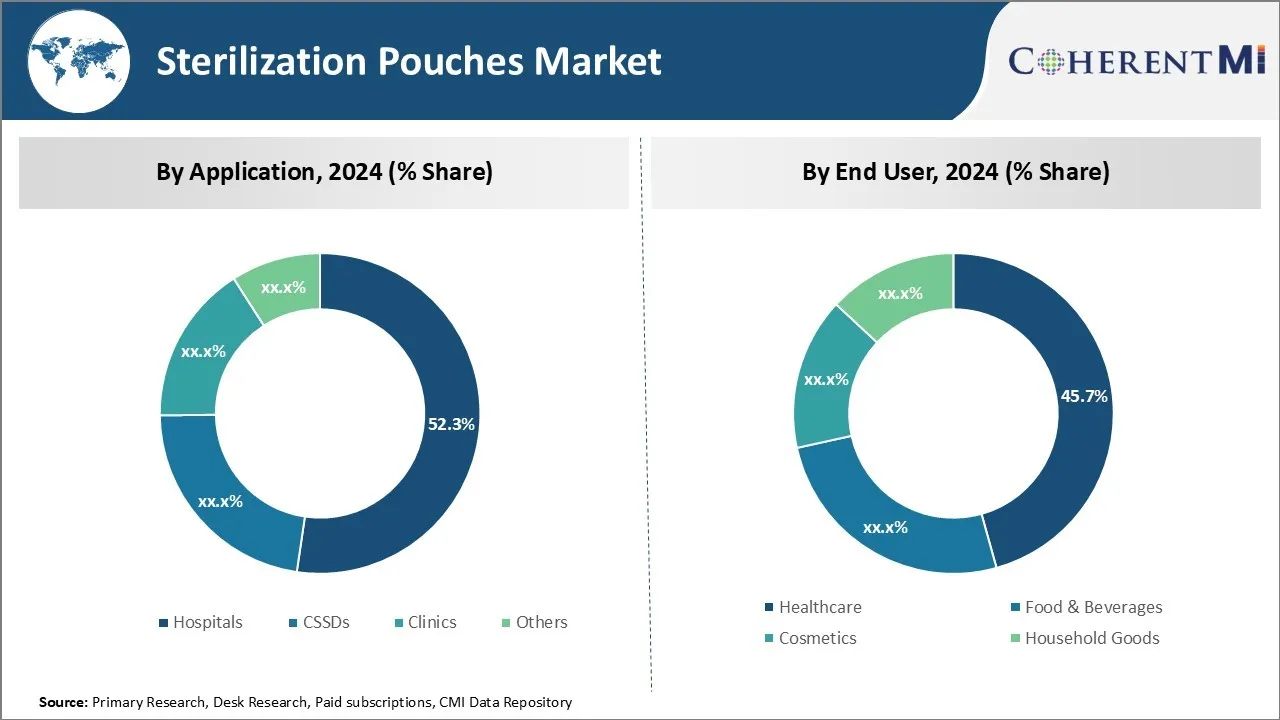

In terms of application, hospitals contributes 52.3% share of the sterilization pouches market in 2024, owning to the rising need for proper sterilization of medical equipment and surgical instruments. Hospitals utilize a large variety of medical devices and tools on a daily basis that require sterilization between each use to prevent the spread of infections. This has significantly increased the amount of equipment, implants, and single-use items that need sterilization before every procedure.

Sterilization pouches provide an effective and convenient solution for safely transporting and storing sterilized items until they are ready to be used in operations or examinations. Their ability to maintain sterilization integrity for lengthy periods helps maximize the utilization of medical tools and equipment.

Maintaining strict hygienic protocols is crucial for hospitals to prevent the spread of hospital-acquired infections and ensure positive patient outcomes. This makes sterilization pouches an essential part of standardized sterilization workflows in hospitals.

Insights, By End User: Broad Applicability in Healthcare Sector Boosts Adoption among Healthcare Providers

In terms of end user, the healthcare sector contributes 45.7% share of the sterilization pouches market in 2024. It is owing to the widespread need for sterilization across various medical settings. Sterilization pouches find applications in not only hospitals but also other healthcare establishments like clinics, diagnostic centers, nursing homes, and blood banks. Sterile packaging solutions are necessary to safely transfer medical items that have been sterilized, whether during surgeries or general examinations.

In addition to single-use surgical kits and implant packages, sterilization pouches are used for securely containing and transporting sterilized linen, gowns, drapes, and other supplies throughout the healthcare facility. Their transparency and seal integrity inspection capabilities add an extra layer of safety assurance. This amplifies the volumes of medical tools and supplies needing sterilization and sterile transport, propelling growth of sterilization pouches market.

Insights, By Type: Advantages over Alternatives Drive Preference for Sterilization Pouches

In terms of type, sterilization pouches contribute the highest share in the sterilization pouches market owing to their distinct advantages over competing product types. When compared to sterilization wrapping or containers, sterilization pouches provide superior protection, convenience and versatility. Their multi-layer breathable films and sealed edges ensure maintained sterility even during transportation or storage. Sterilization pouches are also easier to use compared to rigid containers - medical staff can quickly load contents, seal, and label pouches without difficulty.

Moreover, sterilization pouches allow visualizing contents through their transparent material. Users can easily inspect package integrity and contents without having to open the sealed pouch. This uphold sterility and convenience benefits. Paper and plastic pouches have limitations like tear resistance, durability, or moisture barrier capabilities compared to specialized sterilization pouch materials.

Additional Insights of Sterilization Pouches Market

- Sterilization pouches are critical in ensuring hygienic reuse of medical equipment, reducing healthcare costs. The shift toward single-use pouches is driven by cost-efficiency and convenience, especially in high-demand hospital environments.

Competitive overview of Sterilization Pouches Market

The major players operating in the sterilization pouches market include Amcor plc, Mondi Group, Berry Global, 3M Company, Dynarex Corporation, Getinge Group, PMS Healthcare Technologies, Smurfit Kappa, STERIS plc., and Shanghai Jianzhong Medical Equipment Packing Co., Ltd.

Sterilization Pouches Market Leaders

- Amcor plc

- Mondi Group

- Berry Global

- 3M Company

- Dynarex Corporation

Sterilization Pouches Market - Competitive Rivalry, 2024

Sterilization Pouches Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Sterilization Pouches Market

- In December 2019, M&Q Packaging introduced an innovative solution to address challenges associated with sterilization pouch closures, particularly for dry heat and steam sterilization processes. Responding to a customer's difficulties with consistently sealing pouches using the traditional fold-over and tape method, M&Q's engineering team developed the "easy close" perforated flap.

Sterilization Pouches Market Segmentation

- By Application

- Hospitals

- CSSDs

- Clinics

- Others

- By End User

- Healthcare

- Food & Beverages

- Cosmetics

- Household Goods

- By Type

- Sterilization Pouches

- Paper Pouches

- Plastic Pouches

- Sterilization Wrapping

- Sterilization Containers

- Others

- Sterilization Pouches

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the sterilization pouches market?

The sterilization pouches market is estimated to be valued at USD 50.14 Bn in 2024 and is expected to reach USD 81.05 Bn by 2031.

What are the key factors hampering the growth of the sterilization pouches market?

Rising risks of infectious diseases due to faulty container designs and high cost of medical-grade sterilization pouches, limiting adoption in developing countries are the major factors hampering the growth of the sterilization pouches market.

What are the major factors driving the sterilization pouches market growth?

Growing adoption of reusable medical equipment and increased healthcare savings through the use of cost-efficient sterilization pouches are the major factors driving the sterilization pouches market.

Which is the leading application in the sterilization pouches market?

The leading application segment is hospitals.

Which are the major players operating in the sterilization pouches market?

Amcor plc, Mondi Group, Berry Global, 3M Company, Dynarex Corporation, Getinge Group, PMS Healthcare Technologies, Smurfit Kappa, STERIS plc, and Shanghai Jianzhong Medical Equipment Packing Co., Ltd. are the major players.

What will be the CAGR of the sterilization pouches market?

The CAGR of the sterilization pouches market is projected to be 7.1% from 2024-2031.