Thermostat Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Thermostat Market is segmented By Product (Smart Thermostat, Mechanical Thermostat, , Programmable Thermostat, Others (Intrinsic Thermostat)), By Depl....

Thermostat Market Size

Market Size in USD Bn

CAGR12.9%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 12.9% |

| Market Concentration | High |

| Major Players | Honeywell International, Inc., Google Nest, Ecobee, Emerson Electric Co., Johnson Controls and Among Others. |

please let us know !

Thermostat Market Analysis

The thermostat market is estimated to be valued at USD 6.47 Bn in 2024 and is expected to reach USD 15.13 Bn by 2031. It is expected to grow at a compound annual growth rate (CAGR) of 12.9% from 2024 to 2031. The thermostat market has been driven by increasing demand for smart and energy efficient thermostats across both residential as well as commercial sectors.

Thermostat Market Trends

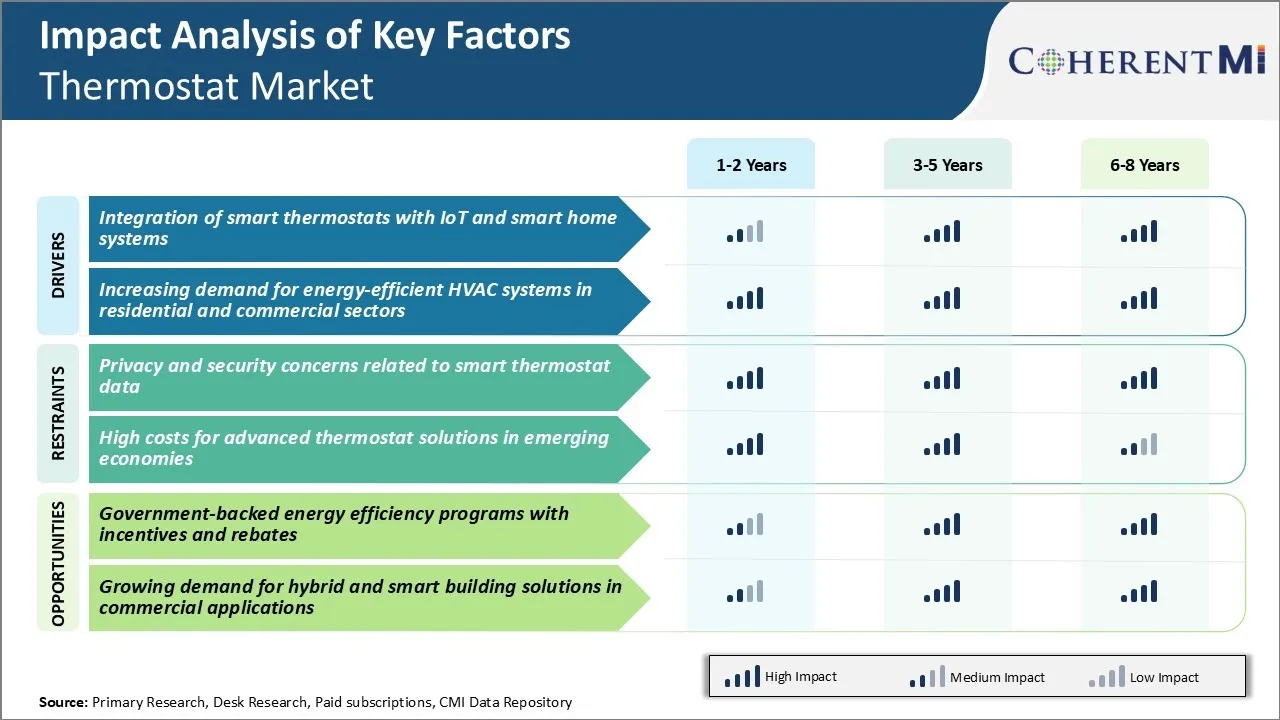

Market Driver - Integration of Smart Thermostats with IoT and Smart Home Systems

One of the major drivers that is expected to fuel the growth of the thermostat market is the increasing integration of smart thermostats with Internet of Things (IoT) and smart home systems. In recent years, there has been a rise in the adoption of connected devices and smart home technologies among consumers.

Smart thermostats offer an easy way to control and manage home heating and cooling systems remotely using smartphones and devices. Leading thermostat manufacturers are focusing on enhancing the connectivity and compatibility of their products with various virtual assistants, smart speakers, security cameras and other smart appliances.

Furthermore, integration with smart home platforms also enables users to monitor and manage their home's energy usage from anywhere. The growing popularity of smart home devices and emphasis on convenience is a key factor spurring thermostat market players to integrate their offerings with the expanding IoT ecosystem.

This ensures that modern households can leverage smart thermostats to their fullest potential for achieving enhanced control, comfort, and efficiency.

Market Driver - Increasing Demand for Energy-efficient HVAC Systems in Residential and Commercial Sectors

Another major driver for the growth of the thermostat market is the rising demand for energy-efficient heating, ventilation, and air conditioning (HVAC) systems across the residential and commercial sectors. End-users are increasingly seeking ways to reduce their operating expenses and carbon footprint associated with HVAC equipment. Programmable thermostats also allow setting separate weekday and weekend schedules according to different usage routines.

Commercial building owners are also under pressure to enhance the energy-efficiency of HVAC systems to lower costs. Smart thermostats integrated with sensors and controls provide centralized monitoring and management of multiple zones with varying occupancy and heating/cooling needs. The demand for smart, connected thermostats supporting efficient HVAC operations is expected to rise substantially in the coming years.

Both individual consumers and commercial establishments recognize their role in conserving natural resources and minimizing environmental impacts. The energy-saving ability of smart thermostats addresses this need perfectly, making it a driving factor behind thermostat market growth.

Market Challenge - Privacy and Security Concerns Related to Smart Thermostat Data

One of the major challenges faced by the smart thermostat market is privacy and security concerns related to the data collected by these connected devices. Smart thermostats can access data about users' home environment and activities which raises privacy issues.

There are ongoing debates around how device manufacturers and energy service providers can access and use personal information collected via smart home technologies. Some users fear that the detailed energy usage and occupancy data collected could be hacked or misused. Regulatory authorities have also raised concerns about data privacy and strengthened laws around how customer data should be protected.

Dealing with these privacy issues is important for gaining widespread consumer acceptance and boosting adoption rates of smart thermostats. Manufacturers in the thermostat market need to focus on enhancing cybersecurity of the devices and networks as well as establish transparent data privacy policies to win user trust.

Market Opportunity - Government-backed Energy Efficiency Programs with Incentives and Rebates

One significant opportunity for the smart thermostat market is the various government-backed energy efficiency programs that incentivize the adoption of smart energy solutions through incentives and rebates. Many countries and states offer subsidies, tax credits as well as bill discounts or rebates for consumers who install smart thermostats and other home energy management technologies.

For instance, utilities in the US provide rebates of up to $100 for smart thermostats under their energy efficiency programs. Similarly, the UK government offers grants up to £75 for smart thermostats that qualify under the Energy Company Obligation scheme. Such financial incentives help boost demand by lowering the upfront costs for consumers.

They also encourage energy savings and conservation goals set by governments. Smart thermostat manufacturers can leverage these programs to raise awareness, education and sales of their products.

Key winning strategies adopted by key players of Thermostat Market

Product Innovation: Nest Labs was one of the early innovators in the smart thermostat space with the launch of the Nest Learning Thermostat in 2011. The product leveraged advanced technology like wifi connectivity, motion detection and machine learning to optimize heating/cooling based on user behavior patterns.

Advanced Connectivity: As the "Internet of Things" grew, connectivity became a key differentiator. Emerson launched its Sensi touch WiFi thermostat in 2018 with enhanced WiFi and partnerships with smart device manufacturers.

Aggressive Pricing: Low pricing has been an important tactic to drive mass adoption, especially in emerging markets.

Strategic Partnerships: Collaboration has emerged as a win-win for OEMs and other players.

Segmental Analysis of Thermostat Market

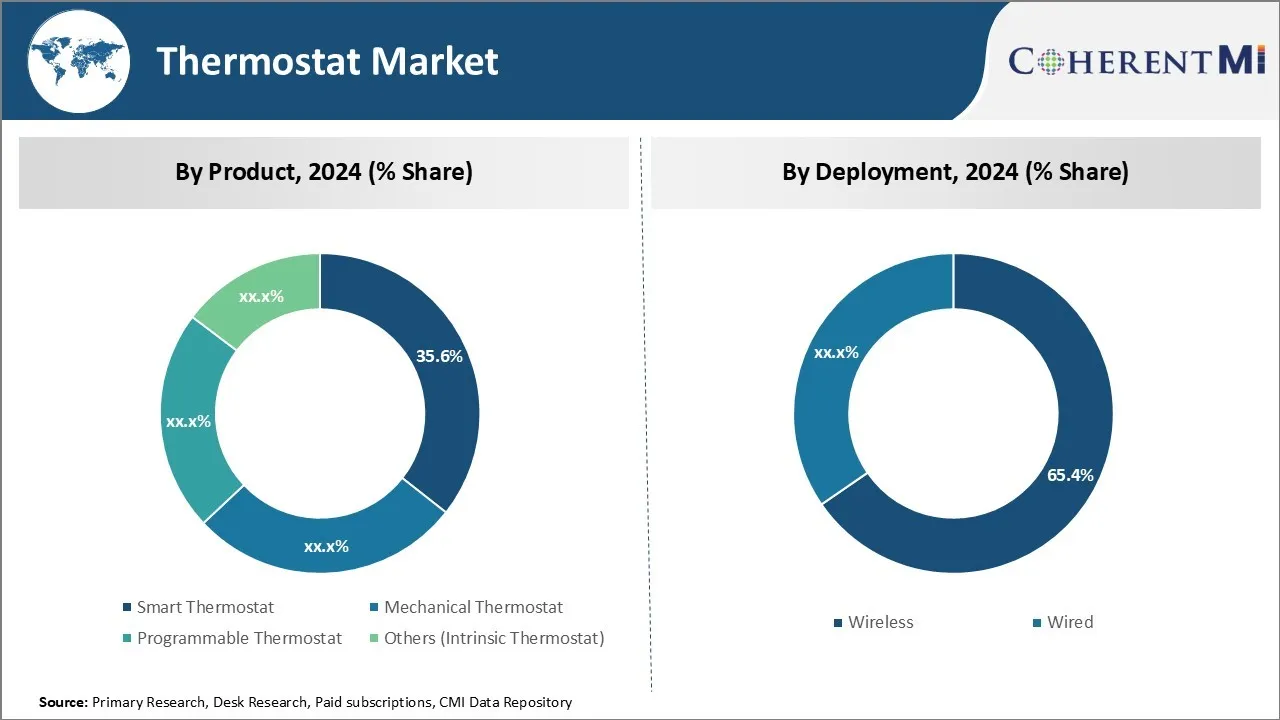

Insights, By Product: Smart Technology Meets Today’s Consumer Needs

In terms of product, smart thermostat contributes 35.6%% share of the thermostat market in 2024, owning to its ability to meet modern consumer demands. As technology has evolved rapidly in recent years, homeowners and building managers increasingly desire smart appliances and devices that can be controlled remotely through apps or voice assistants. The smart thermostat satisfies this desire through its WiFi connectivity and compatibility with various virtual assistants.

Users can check and adjust the temperature wherever they are through a mobile app. They can also turn the thermostat up or down using simple voice commands to Alexa or Google Home. This level of remote control and convenience has resonated strongly with customers.

Smart thermostats also integrate with other smart home devices, enabling whole-home automation through one unified system. For example, users can set the thermostat to adjust temperature settings when smart lights, locks or appliances are activated through the same app.

As this tech-savvy demographic continues to grow and more smart home devices come online, demand for smart thermostats poised to remain strong over the coming years.

Insights, By Deployment: Wireless Convenience Prevails

In terms of deployment, the wireless segment contributes 65.4% share of the thermostat market in 2024. This is due to its installation simplicity and flexibility. Unlike wired thermostats which require running new wires, wireless models can be set up with no rewiring or installation hassles.

Wireless connectivity also offers more placement freedom. Thermostats do not need to be located near an existing wire and can be mounted on any interior wall within range of the HVAC system. This enhances design flexibility and aesthetic appeal. Wireless models have become increasingly popular as a result. Their lack of wiring requirement means lower upfront equipment and labor costs as well. Wireless connectivity also simplifies thermostat relocation during remodeling projects. These installation benefits have fueled the rapid adoption of wireless HVAC controls over recent years.

Insights, By Application: Residential Demand Heats Up the Market

When analyzed according to application, the residential segment captures the highest market share due to growing thermostat penetration within private homes. A steadily rising number of homeowners see smart thermostats as convenient tools to reduce energy bills and gain remote temperature oversight.

Residential adoption has also been encouraged by technological improvements and falling product prices. Early smart thermostats were complex to set up and operate, but user interfaces have since become more intuitive with easy smartphone pairing.

The ability of smart thermostats to integrate with other smart home technology creates additional incentive for residential uptake. Homeowners appreciate consolidated remote control through unified apps and compatibility with other smart devices including lights, locks and security systems. This has made thermostats a popular addition to evolving smart homes aimed at enhanced energy usage oversight, convenience and home automation functions. As smart technology continues advancing the connected home, residential demand for connected thermostats will maintain its fast pace.

Additional Insights of Thermostat Market

- North America accounted for the largest revenue share of 38% of the thermostat market in 2023, driven by technological infrastructure and energy efficiency mandates.

- Asia-Pacific is estimated to grow at the fastest CAGR in the global thermostat market, propelled by rapid urbanization and energy-efficient infrastructure developments.

- The wireless deployment segment held a significant 65% share of the thermostat market in 2023 due to easy installation and remote accessibility.

- The residential segment dominated with 45% share of the thermostat market in 2023, supported by smart home automation trends and energy-saving initiatives.

Competitive overview of Thermostat Market

The major players operating in the thermostat market include Honeywell International, Inc., Google Nest, Ecobee, Emerson Electric Co., Johnson Controls, Schneider Electric, tado° GmbH, Siemens AG, Carrier Corporation, Trane Technologies, Sensi.AI, Lux Products, The Danfoss Group, Bosch Thermotechnology, and Glas by Johnson Controls.

Thermostat Market Leaders

- Honeywell International, Inc.

- Google Nest

- Ecobee

- Emerson Electric Co.

- Johnson Controls

Thermostat Market - Competitive Rivalry, 2024

Thermostat Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Thermostat Market

- In September 2022, AutoGrid, a leading Virtual Power Plant (VPP) provider, announced a collaboration with Mysa, a Canadian manufacturer of smart thermostats for electric heating and cooling systems. This partnership aims to launch utility-scale VPP projects that integrate Mysa's smart thermostat technology to modernize power grids.

- In May 2022, Ecobee introduced two new smart thermostats: the Smart Thermostat Premium and the Smart Thermostat Enhanced. Both models feature advanced radar sensor technology, enhancing occupancy and motion detection for improved energy management and performance.

Thermostat Market Segmentation

- By Product

- Smart Thermostat

- Mechanical Thermostat

- Programmable Thermostat

- Others (Intrinsic Thermostat)

- By Deployment

- Wireless

- Wired

- By Application

- Residential

- Commercial

- Industrial

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the thermostat market?

The thermostat market is estimated to be valued at USD 6.47 Bn in 2024 and is expected to reach USD 15.13 Bn by 2031.

What are the key factors hampering the growth of the thermostat market?

Privacy and security concerns related to smart thermostat data and high costs for advanced thermostat solutions in emerging economies are the major factors hampering the growth of the thermostat market.

What are the major factors driving the thermostat market growth?

Integration of smart thermostats with IoT and smart home systems and increasing demand for energy-efficient HVAC systems in residential and commercial sectors are the major factors driving the thermostat market.

Which is the leading product in the thermostat market?

The leading product segment is smart thermostat.

Which are the major players operating in the thermostat market?

Honeywell International, Inc., Google Nest, Ecobee, Emerson Electric Co., Johnson Controls, Schneider Electric, tado° GmbH, Siemens AG, Carrier Corporation, Trane Technologies, Sensi.AI, Lux Products, The Danfoss Group, Bosch Thermotechnology, and Glas by Johnson Controls are the major players.

What will be the CAGR of the thermostat market?

The CAGR of the thermostat market is projected to be 12.9% from 2024-2031.