AL Amyloidosis Diagnostic Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

AL Amyloidosis Diagnostic Market is segmented By Treatment Type (Chemotherapy, Monoclonal Antibodies...

AL Amyloidosis Diagnostic Market Size - Analysis

The AL amyloidosis diagnostic market is estimated to be valued at USD 1.068 billion in 2024 and is expected to reach USD 1.693 billion by 2031, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2031.

The market is experiencing positive growth due to the increasing prevalence of AL amyloidosis and rising awareness about the disease. In addition, rising healthcare expenditure and growing geriatric population are also propelling the market growth.

Market Size in USD Bn

CAGR6.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.8% |

| Market Concentration | High |

| Major Players | Janssen Pharmaceuticals, Prothena, AstraZeneca (Caelum Biosciences), Bristol-Myers Squibb, Oncopeptides AB and Among Others |

please let us know !

AL Amyloidosis Diagnostic Market Trends

Market Driver - Increased Early Diagnosis of AL Amyloidosis due to Improved Diagnostic Methods

As with many diseases, the earlier AL amyloidosis can be detected, the better the chances are of successful treatment and improved patient outcomes. Advanced blood tests can now more precisely detect and measure abnormal forms of immunoglobulins known as light chains that often indicate the presence of AL amyloidosis. This allows for amyloidosis to potentially be identified before damage occurs or when symptoms are just beginning to develop.

In addition, newer scanning techniques provide invaluable information for establishing an accurate diagnosis. Advanced imaging now makes it feasible to view amyloid deposits in the heart or other internal organs with greater resolution and clarity. Combined with biopsy analysis when needed, physicians can now correlate clinical suspicions with positive diagnostic findings at an earlier stage. This represents crucial progress given early diagnosis is pivotal for initiating timely treatment intervention in AL amyloidosis.

Furthermore, greater awareness among the medical community regarding the disease has led to improved recognition of its varied clinical presentations. Doctors are better trained to consider amyloidosis as a possible diagnosis when patients report nonspecific symptoms that were previously more difficult to link to this condition. With a higher index of suspicion, appropriate testing can be ordered to either rule out or confirm amyloid deposits.

Market Driver - Advanced Therapies Expand Treatment Options

In recent years, biopharmaceutical innovation has augmented the medical arsenal for combating AL amyloidosis in meaningful ways. Where options were once severely limited, targeted therapies are broadening treatment possibilities and changing the scope of effective options.

Areas of significant progress include the development of several novel monoclonal antibody treatments. Specifically designed to interfere with the pathological production and accumulation of abnormal immunoglobulin light chains, these therapeutic antibodies offer potential advantage over traditional chemotherapy regimens. Through selective mechanisms of action, they may quell the disease driver with improved tolerability compared to non-specific cytotoxic agents.

Excitingly, there also continues to be meaningful headway in optimizing current options. For instance, more intensive combination therapies are being explored to deepen and lengthen responses. Investigators also work tirelessly to identify biomarkers predicting who will best answer particular therapies, enabling optimized, individualized care. Such efforts hold promise to drive improved outcomes by defining what approaches may work for different patients based on disease-specific characteristics.

Undoubtedly, the fruitful work of researchers has ushered in a period of exiting progress for AL amyloidosis treatment. New tools at physicians' disposal are helping more patients achieve remission and extended survival. Results emphasize the considerable promise of emerging modalities to transform the landscape and boost options for fighting this unpredictable disease.

Market Challenge - Advanced Treatments, Especially Biologics, are Expensive and may not be Accessible to all Patients

One of the major challenges facing the AL amyloidosis diagnostic market is access to advanced treatments, especially biologics, which are increasingly becoming the standard of care but remain extremely expensive. While newer therapies that target the underlying causes of AL amyloidosis are revolutionizing treatment outcomes, the costs associated with these innovative drugs and regimes can be prohibitive for many patients.

Monoclonal antibodies and other biologic agents regularly command five-figure annual price tags in many countries. Even for those with insurance, co-pays and deductibles may stretch budgets. The financial burden means that advanced diagnostic testing to determine treatment eligibility and monitor response could also be out of reach for some.

This challenge presents market risks, as undertreatment of the disease may lead to worse outcomes and greater downstream healthcare costs. It also represents a barrier to maximizing the patient pool that could benefit from earlier diagnosis and optimized management using the latest therapies.

Market Opportunity - Growing Healthcare Infrastructure in Emerging Markets

One major opportunity for the continued growth of the AL amyloidosis diagnostic market lies in rising healthcare infrastructure in emerging economies. Regions such as Asia Pacific and Latin America are experiencing growing diagnostic capabilities and access to care as a result of increasing urbanization, healthcare reforms, and investments in medical facilities and technologies. This expanding healthcare infrastructure opens new patient populations and regions for therapeutic area expansion.

As diagnosis and treatment become more locally available, more cases of AL amyloidosis that previously may have gone undiagnosed can enter the formal healthcare system. Rising disease awareness among physicians coupled with the establishment of specialized amyloidosis treatment centers could drive earlier detection and intervention.

The growing medical capabilities in emerging nations thereby presents significant market potential for companies to establish partnerships, trials, and reimbursement processes to expand access to diagnostic testing and management of AL amyloidosis.

Prescribers preferences of AL Amyloidosis Diagnostic Market

AL amyloidosis treatment follows a step-wise approach based on disease severity and organ involvement. For early stage disease with minimal organ dysfunction, frontline options include oral melphalan with dexamethasone (Alkeran/Dexamethasone). This is preferred for its mild side effect profile suiting frail patients.

More advanced disease progresses to second-line therapy with proteasome inhibitors such as bortezomib (Velcade)± dexamethasone. These aim to achieve deeper responses while mitigating toxicity risks. Prescribers favor bortezomib for its ability to safely access high-risk organs like heart and kidneys.

For relapsed/refractory patients, Darzalex (daratumumab) is gaining strong interest as it delivers superior organ responses versus standard therapies. Its monoclonal antibody mechanism provides an alternative mode of action for tackling residual disease.

Transplant-eligible/intolerant patients may receive high-dose melphalan with stem cell rescue if deemed fit. Prescribers weigh careful patient selection against potential high mortality risks.

Other influences include a drug's side effect manageability, dosing convenience, and overall tolerability tailored to individual frailty levels and comorbidities. Prescriber experience with specific regimens also plays an important role.

Treatment Option Analysis of AL Amyloidosis Diagnostic Market

AL amyloidosis treatment depends on the stage and severity of disease. Patients are typically classified into 3 categories - early, intermediate, and advanced stage.

For early-stage disease with mild organ involvement and no major symptoms, initial treatment involves drugs such as melphalan and dexamethasone in combination. These oral chemotherapy drugs help suppress plasma cell overproduction and deposition of amyloid fibrils.

Intermediate stage with moderate organ dysfunction is treated with melphalan-dexamethasone along with proteasome inhibitors like bortezomib or carfilzomib. Proteasome inhibitors help degrade misfolded amyloid protein subunits more effectively. Bortezomib administered intravenously in combination with oral melphalan-dexamethasone is preferred due to favourable side effect profile and response rates exceeding 50%.

Advanced stage AL amyloidosis with severe organ damage requires stem cell transplant. The standard of care involves oral chemotherapy followed by high-dose melphalan and autologous stem cell transplant. This aggressive approach aims to completely eradicate the abnormal plasma cell clone depositing amyloid fibrils through high-intensity conditioning with melphalan. Post-transplant consolidation with bortezomib or daratumumab helps maintains remission.

In summary, treatment selection depends on amyloid burden and organ dysfunction. A risk-adapted stepwise approach balancing efficacy and safety yields best long-term outcomes for patients across all stages of this challenging disease.

Key winning strategies adopted by key players of AL Amyloidosis Diagnostic Market

Product innovation: Developing advanced diagnostic kits has been a core strategy for market leaders. In 2018, Siemens launched an ELISA-based serum amyloid A (SAA) assay called N Latex SAA which can aid early AL diagnosis with high sensitivity and specificity. It provides quantitative results to monitor response to treatment.

Geographic expansion: Leading companies have focused on expanding their geographic footprint in high growth areas. In 2020, Pfizer acquired Global Blood Therapeutics, mainly for its amyloidosis drug Inclusig. This helped Pfizer enter new emerging markets in Asia and Latin America where AL amyloidosis prevalence is rising steadily. The acquisition strengthened Pfizer's global diagnostic and treatment offerings.

Strategic collaborations: Forming partnerships with hospitals, clinics and research organizations has benefited market players. In 2019, IMMY entered a collaboration with Boston Medical Center to develop a novel biopsy-free diagnostic test using proteomics analysis of blood samples.

Aggressive marketing: Companies invest heavily in promoting awareness about AL amyloidosis symptoms and available diagnostic tests. For example, Alnylam Pharmaceuticals spends over 30% of its revenue on marketing to create demand for its gene silencing drug Onpattro. Its initiatives like "Light the Light" campaign and partnerships with disease advocacy groups have increased test uptake and revenue for diagnostic labs as well.

Segmental Analysis of AL Amyloidosis Diagnostic Market

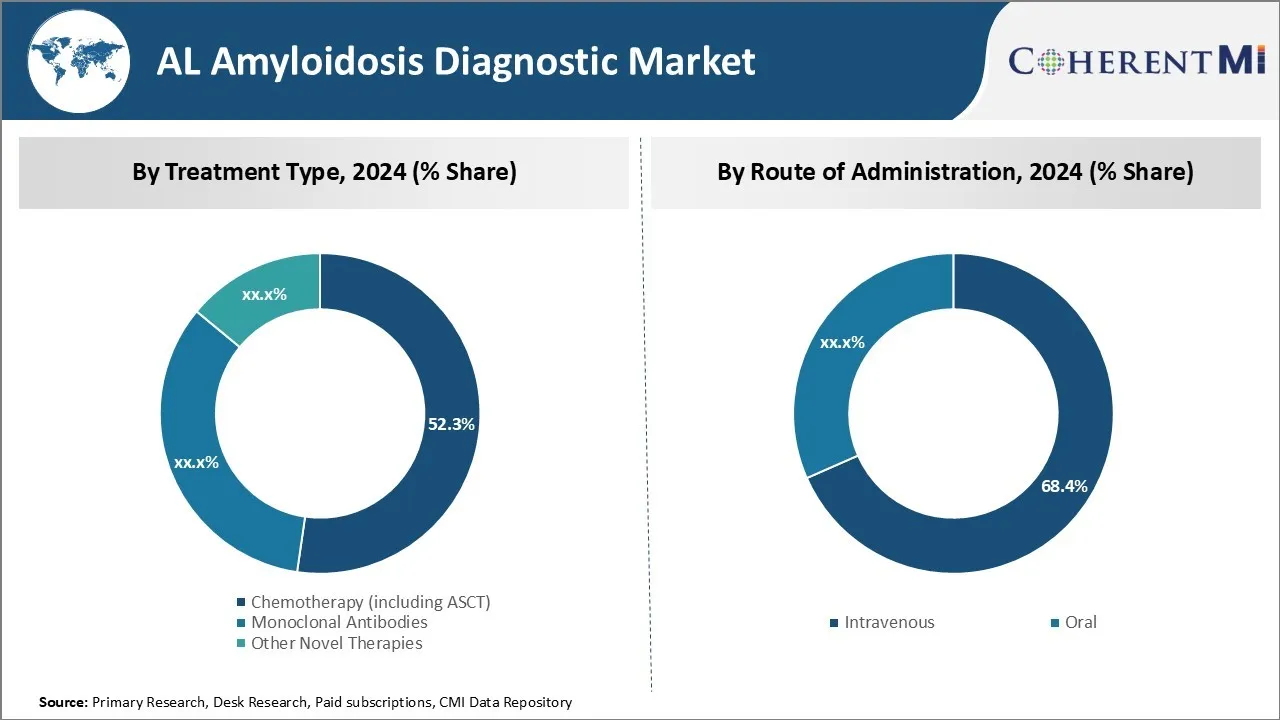

Insights, By Treatment Type: Chemotherapy's efficacy drives market dominance

Chemotherapy focuses directly on killing cancer cells through the use of cytotoxic drugs. Its benefit is that it treats the underlying cause of AL amyloidosis by targeting plasma cell clones producing amyloidogenic light chains. Unlike novel therapies still progressing through clinical trials, chemotherapy including stem cell transplantation has a solid evidence base from extensive past clinical use demonstrating meaningful organ response rates and extended survival times.

Specifically, high-dose melphalan followed by ASCT has become the standard first-line treatment capable of achieving complete hematologic response in 50-60% of patients. This intensive therapy aims to eradicate the entire plasma cell pool producing amyloid proteins, offering the greatest probability of organ improvement or stabilization.

While toxicities can be severe requiring months of recovery, long-term outcomes justify its role as the cornerstone induction treatment prior to less intensive consolidation/maintenance therapies. Additional approved regimens incorporating proteasome inhibitors like bortezomib or immunomodulatory drugs as part of initial therapy provide alternatives for those ineligibles for ASCT, with comparable organ response rates.

In summary, chemotherapy's ability to directly target the pathogenic process driving AL amyloidosis through well-established treatment protocols gives it the largest market share.

Insights, By Route of Administration: Ease of Administration Leads Intravenous Route

In terms of route of administration, the intravenous route contributes the highest share due to its ease of administration compared to oral therapies. For invasive and life-threatening conditions like AL amyloidosis where rapid therapeutic effect is desirable, intravenous delivery allows drugs to immediately enter the bloodstream achieving high and predictable systemic concentrations. This ensures maximal exposure of malignant plasma cells to cytotoxic compounds.

Most chemotherapy agents and monoclonal antibodies used for AL amyloidosis treatment are administered intravenously as well. Their parenteral formulation bypasses the unpredictable absorption of oral medications from the gastrointestinal tract, reducing risk of subtherapeutic drug levels from factors like delayed gastric emptying, metabolism by hepatic enzymes, or interactions with food/medications. Intravenous chemotherapy can also be carefully titrated and monitored in a hospital setting, important for regimens employing stem cell mobilization and transplantation which require intensive inpatient care.

While oral therapies offer convenience, challenges remain in ensuring consistent absorption and medication adherence over time, which can translate to diminished efficacy for chronic diseases like amyloidosis. Therefore, intravenous treatment enjoys higher preference among providers for upfront intensive induction therapy where outcomes depend greatly on achieving defined pharmacokinetic targets through controlled parenteral delivery. This drives its dominance in the AL amyloidosis diagnostic market.

Insights, By Clinical Phase: Early clinical testing needed propels phase I

In terms of clinical phase, phase I contributes the highest market share due to the need for extensive safety and dose-finding testing of novel agents in early human trials. AL amyloidosis therapy lags behind other hematologic malignancies in treatment options, necessitating aggressive development of newer therapeutic strategies targeting amyloid fibril deposition or their production. However, these drugs often belong to new molecular classes carrying unknown toxicity liabilities when administered to humans.

Therefore, Phase I clinical trials assume prominence in the diagnostic market as they represent the critical first step assessing novel compounds' maximum tolerated dose, dose-limiting toxicities, safety profile, and preliminary efficacy signals in a small patient cohort. Their objective is to rapidly translate preclinical findings into initial human data to inform subsequent Phase II expansion into defined patient subgroups. Through dose-escalation studies typically involving a few dose levels and fewer than 30-100 participants, Phase I trials acquire understanding of a new therapy's risk-benefit balance to proceed further into larger efficacy trials.

Additional Insights of AL Amyloidosis Diagnostic Market

- AL Amyloidosis remains a rare and complex disease, with about 4,000 new cases diagnosed annually in the U.S. The condition primarily affects the heart, kidneys, and liver, necessitating specialized treatments and management strategies.

Competitive overview of AL Amyloidosis Diagnostic Market

The major players operating in the AL Amyloidosis Diagnostic Market include Janssen Pharmaceuticals, Prothena, AstraZeneca (Caelum Biosciences), Bristol-Myers Squibb, Oncopeptides AB, Merck, Acrotech Biopharma, and Astellas Pharma GmbH.

AL Amyloidosis Diagnostic Market Leaders

- Janssen Pharmaceuticals

- Prothena

- AstraZeneca (Caelum Biosciences)

- Bristol-Myers Squibb

- Oncopeptides AB

AL Amyloidosis Diagnostic Market - Competitive Rivalry

AL Amyloidosis Diagnostic Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in AL Amyloidosis Diagnostic Market

- In August 2020, Caelum Biosciences initiated a Phase III clinical trial for CAEL-101, an antibody therapy, to evaluate its effectiveness in improving overall survival in patients with cardiac AL (light chain) amyloidosis. This study aimed to assess the safety and efficacy of CAEL-101 in combination with standard-of-care therapy for newly diagnosed patients. The goal was to address the severe unmet need in this patient population, particularly focusing on improving cardiac outcomes, which are a critical aspect of the disease.

- In January 2021, Janssen Pharmaceuticals received FDA accelerated approval for Daratumumab as a first-line therapy for AL Amyloidosis based on Phase III ANDROMEDA study results, demonstrating significant survival benefits. Specifically, the study showed a 42.1% response rate in the Darzalex Faspro group compared to 13.5% in the control group, with an odds ratio of 4.8, indicating substantial clinical benefit.

AL Amyloidosis Diagnostic Market Segmentation

- By Treatment Type

- Chemotherapy (including ASCT)

- Monoclonal Antibodies

- Other Novel Therapies

- By Route of Administration

- Intravenous

- Oral

- By Clinical Phase

- Phase I

- Phase II

- Phase III

Would you like to explore the option of buyingindividual sections of this report?

Abhijeet Kale is a results-driven management consultant with five years of specialized experience in the biotech and clinical diagnostics sectors. With a strong background in scientific research and business strategy, Abhijeet helps organizations identify potential revenue pockets, and in turn helping clients with market entry strategies. He assists clients in developing robust strategies for navigating FDA and EMA requirements.

Frequently Asked Questions :

How big is the AL amyloidosis diagnostic market?

The AL amyloidosis diagnostic market is estimated to be valued at USD 1.068 billion in 2024 and is expected to reach USD 1.693 billion by 2031.

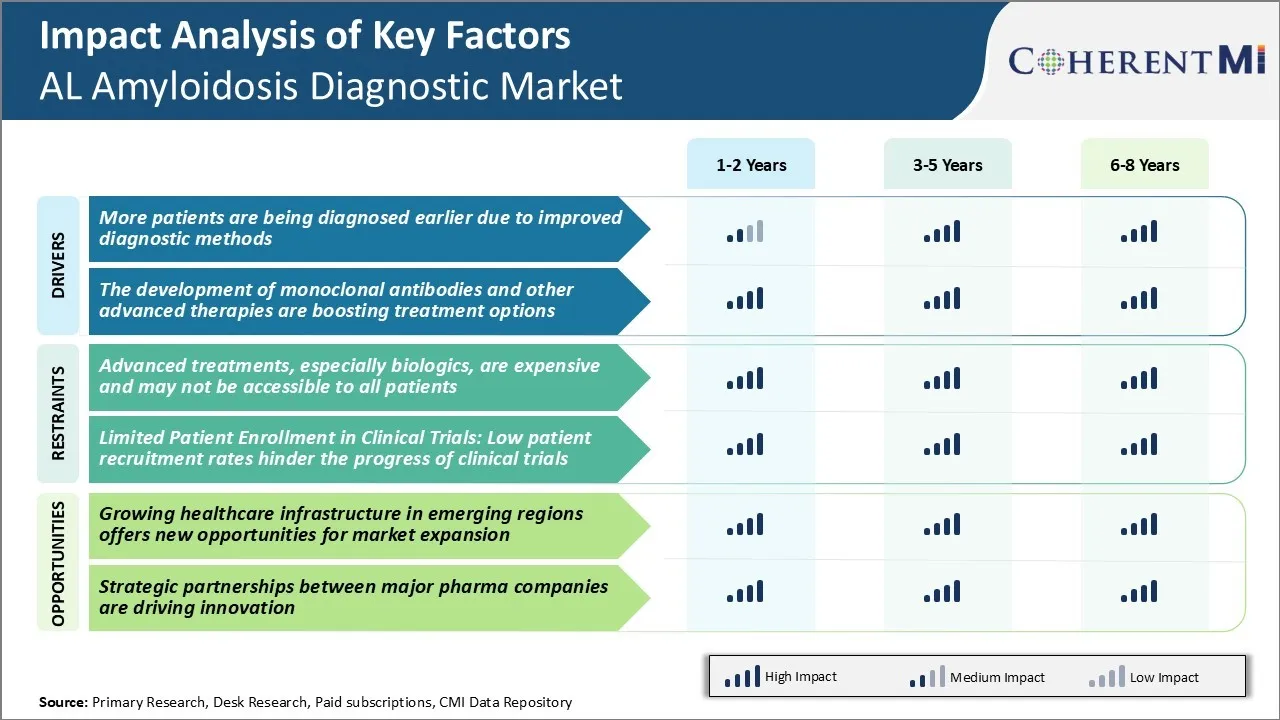

What are the key factors hampering the growth of the AL amyloidosis diagnostic market?

The advanced treatments, especially biologics, are expensive and may not be accessible to all patients. Furthermore, low patient recruitment rates hinder the progress of clinical trials. These are the major factors hampering the growth of the AL amyloidosis diagnostic market.

What are the major factors driving the AL amyloidosis diagnostic market growth?

More patients are being diagnosed earlier due to improved diagnostic methods available today. In addition to this, the development of monoclonal antibodies and other advanced therapies are boosting treatment options in the AL amyloidosis diagnostic market.

Which is the leading treatment type in the AL amyloidosis diagnostic market?

The leading treatment type segment is chemotherapy (including ASCT).

Which are the major players operating in the AL amyloidosis diagnostic market?

Janssen Pharmaceuticals, Prothena, AstraZeneca (Caelum Biosciences), Bristol-Myers Squibb, Oncopeptides AB, Merck, Acrotech Biopharma, and Astellas Pharma GmbH are the major players.

What will be the CAGR of the AL amyloidosis diagnostic market?

The CAGR of the AL amyloidosis diagnostic market is projected to be 6.8% from 2024-2031.