Arteriovenous Malformations Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

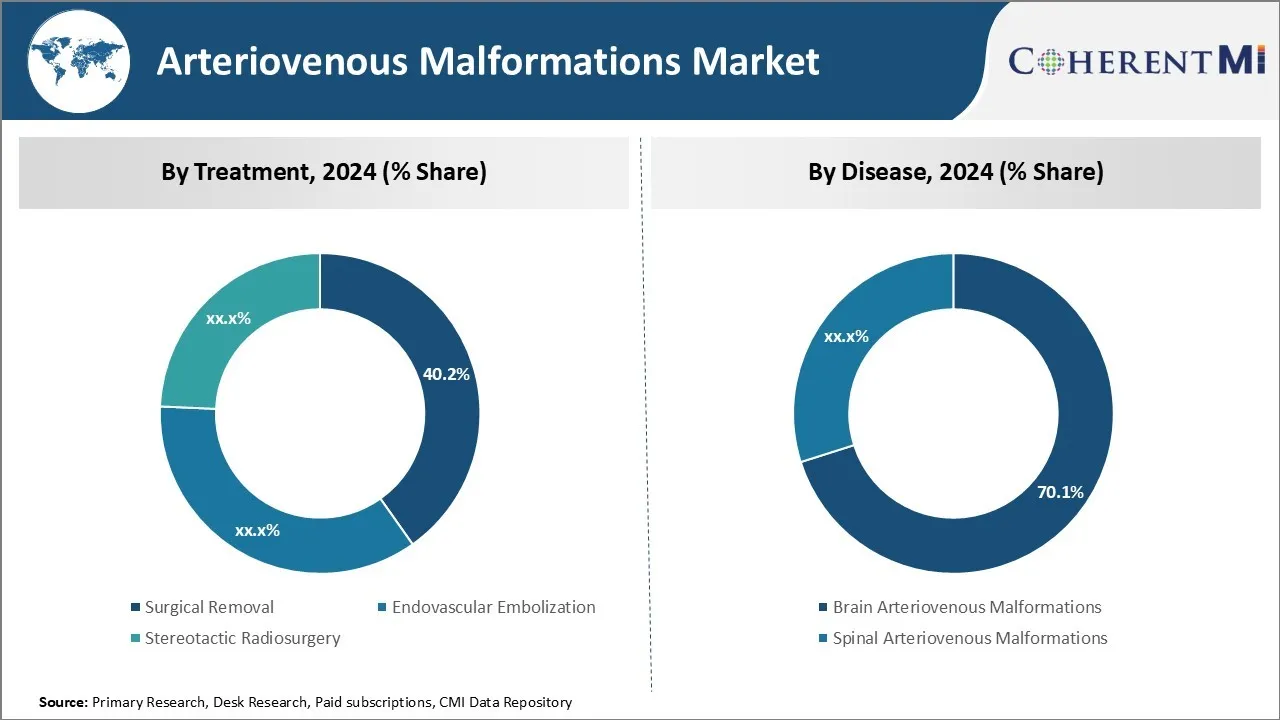

Arteriovenous Malformations Market is segmented By Treatment (Surgical Removal, Endovascular Embolization, Stereotactic Radiosurgery), By Disease (Bra....

Arteriovenous Malformations Market Size

Market Size in USD Bn

CAGR6.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.8% |

| Market Concentration | Medium |

| Major Players | Medtronic, Johnson & Johnson, Stryker Corporation, Penumbra Inc., MicroVention, Inc. and Among Others. |

please let us know !

Arteriovenous Malformations Market Analysis

The arteriovenous malformations market is estimated to be valued at USD 3.14 Bn in 2024 and is expected to reach USD 4.99 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2031. Growing adoption of gamma knife radiosurgery and endovascular embolization is expected to drive the demand. Moreover, increasing healthcare expenditure and availability of advanced treatment options in developing nations will further aid the arteriovenous malformations market expansion over the forecast period.

Arteriovenous Malformations Market Trends

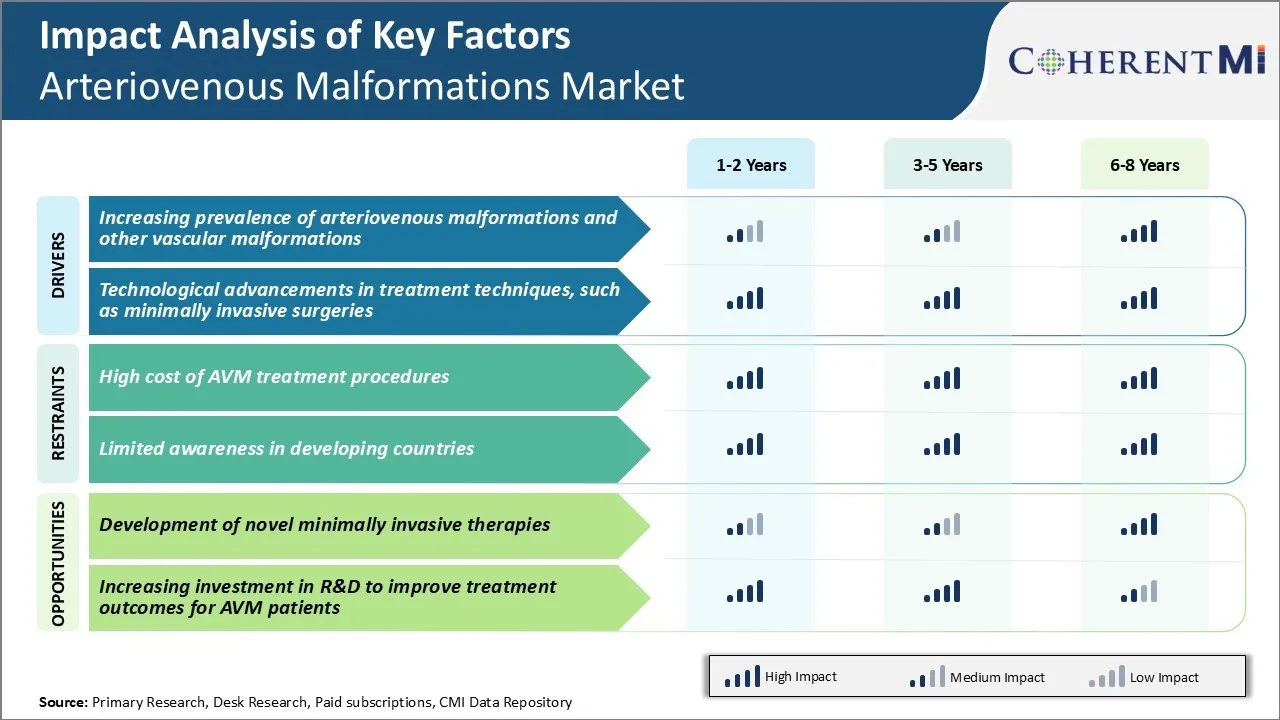

Market Driver - Increasing Prevalence of Arteriovenous Malformations and Other Vascular Malformations

The increasing number of people being diagnosed with arteriovenous malformations (AVMs) and other vascular anomalies worldwide is presenting a massive market opportunity in this sector. Healthcare experts indicate that around 1-2% of the global population lives with some form of vascular abnormality though a majority remain undiagnosed for long periods.

The high financial and quality of life costs associated with living with untreated AVMs are also driving more patients to actively seek evaluation and treatment. Left unattended, these abnormal connections between arteries and veins in the brain or other parts of the body can cause excruciating headaches, seizures, hemorrhaging or other debilitating symptoms over time. With more individuals experiencing episodes of hemorrhage or progressive neurological deficits, the tendency to delay or ignore symptoms is decreasing. At the same time, shifting social trends where patients are more educated and informed about their health is translating into early detection and management of such conditions.

With prevalence anticipated to continue growing in step with aging populations worldwide, especially in developed nations, this driver will remain a force shaping long term market prospects.

Market Driver - Technological Advancements in Treatment Techniques, such as Minimally Invasive Surgeries

Over the years, significant advances have occurred in the techniques and technologies employed for AVM treatment. The increasing use of minimally invasive endovascular embolization procedures either pre-operatively or as a standalone option represents a major step forward. Such intra-arterial approaches which involve threading catheters into cerebral arteries and injecting embolic materials like liquid polymers, particles or coils to occlude the AVM from within the blood vessel have gained popularity.

Innovations in catheter technology allowing for improved navigation of tortuous cerebral vessels as well as new embolic products claiming higher occlusion rates with just a single treatment have further spurred the adoption of endovascular techniques. Additionally, real-time multi-directional 3D visualization platforms and robotic navigation systems now aid interventional neuroradiologists in meticulously planning treatment strategies and performing even intricate procedures with precision. Newer options like MR-guided focused ultrasound which can non-invasively coagulate targeted regions of the AVM without breaking the blood-brain barrier are also expanding the scope of minimally invasive solutions.

As technology enables enhanced outcomes in a minimally invasive paradigm, the AVM treatment landscape will keep evolving favorably around such innovations and techniques.

Market Challenge - High Cost of AVM Treatment Procedures

One of the major challenges currently being faced in the arteriovenous malformations (AVM) market is the high cost associated with AVM treatment procedures. Treating AVMs often requires complex neurosurgical or radiosurgical procedures that have significant price tags. For example, stereotactic radiosurgery which uses precision-guided radiation to destroy abnormal blood vessels costs between $25,000 to $50,000 per treatment.

Similarly, traditional open brain surgeries for AVM resection average over $100,000 in total procedure costs. These prices do not include any pre-surgical testing, post-surgical follow-up imaging, nursing care or additional treatments that may be required. The financial burden of such expensive procedures is discouraging many patients from undergoing recommended treatment, especially in developing countries with lower reimbursement rates. This is negatively impacting the revenues of product manufacturers and healthcare providers in this market.

In order to improve clinical outcomes and expand access to care, there is an urgent need for more cost-effective treatment alternatives for AVMs.

Market Opportunity - Development of Novel Minimally Invasive Therapies

One of the key opportunities in the AVM market is the development of novel minimally invasive therapies. Currently available treatment options such as neurosurgery and radiosurgery often require general anesthesia and carry risks of complications like neurological deficits. This has driven immense interest in developing less invasive alternatives.

Companies are increasingly investing in therapies involving catheter-based embolization procedures, focused ultrasound ablation techniques and drug-device combination products. These methods can precisely target AVMs under imaging guidance without neurosurgical incisions. They offer potential advantages like shorter hospital stays, faster recovery times and reduced healthcare costs.

As these novel technologies receive regulatory approvals and demonstrate positive patient outcomes, they are expected to drive significant growth in the AVM market. This will provide patients with safer, more tolerable options while opening up new revenue streams for medtech innovators.

Prescribers preferences of Arteriovenous Malformations Market

Arteriovenous malformations (AVMs) are abnormal connections between arteries and veins, bypassing the capillary system. Treatment depends on the stage and size of the AVM. For small, incidentally found AVMs, a conservative approach with MRI monitoring every 6-12 months is preferred initially.

For symptomatic or enlarging AVMs, endovascular embolization is the first-line treatment. Onyx by Medtronic and Glubran by GEM are commonly used liquid embolic agents to occlude the AVM nidus from within the feeding arteries. This is usually performed in stages to gradually reduce the AVM size prior to definitive treatment.

Larger or deep-seated AVMs require multimodality therapy. Prescribers commonly combine embolization with radiosurgery using the Gamma Knife or Cyberknife systems. Brands like Leksell GammaPlan by Elekta are used to plan these focused radiation doses. For residual AVMs, prescribers may recommend microsurgical resection.

Location of the AVM, associated aneurysms or bleeds, and patient age/health influence prescriber preferences. Completely occluding the AVM to prevent rebleeding is the primary goal. Cost of treatment is another factor - embolization and radiosurgery being less invasive and expensive than surgery. Multidisciplinary team discussions help decide the most effective, personalized management strategy in each case.

Treatment Option Analysis of Arteriovenous Malformations Market

AVMs are classified into four stages based on their size and location. Stage I AVMs are small superficial lesions. Stage II are larger superficial lesions. Stage III are deep lesions less than 3 cm. Stage IV are large or giant deep lesions greater than 3 cm.

The first line of treatment for Stage I-II AVMs is surgical resection to completely remove the abnormal blood vessels. This provides the highest cure rates for local control. Endovascular embolization using ethylene-vinyl alcohol copolymer (Onyx) or n-butyl cyanoacrylate glue is also used pre-operatively to reduce the AVM size and make surgical resection safer.

For Stage III AVMs, stereotactic radiosurgery (SRS) using a linear accelerator is the primary treatment due to depth and risk of surgery. SRS delivers a high, precise radiation dose to the AVM which occludes the vessels over 1-3 years without surgery. Alternatively, endovascular embolization alone or prior to SRS is used to decrease radiosurgical doses required.

Stage IV AVMs pose the greatest risk due to size. The treatment approach involves endovascular embolization to reduce the AVM volume in multiple staged procedures followed by SRS to complete the occlusion.

Key winning strategies adopted by key players of Arteriovenous Malformations Market

Strategy 1: Focus on developing advanced treatment technologies:

One of the major players, Medtronic adopted this strategy between 2015-2020. It focused on developing technologies like Concentric Microcatheters and GuideLiner microcatheters which allow precise navigation of smaller vessels and selective catheterization of arteries/veins. This helped improve treatment outcomes for complex AVMs.

Strategy 2: Expand indications of existing products:

In 2020, Stryker expanded the indications of its Onyx liquid embolic system to include cerebral arteriovenous malformations (AVMs), after positive clinical trial results. This allowed it to tap into a larger market size. AVMs represents about 2% of all neurological procedures annually in the U.S.

Strategy 3: Pursue mergers and acquisitions:

Between 2017-2019, Johnson & Johnson acquired companies like Abbott Vascular and Cordis which strengthened its portfolio of neurovascular and endovascular products. This helped J&J become a full-service provider of comprehensive treatment solutions for AVMs.

Strategy 4: Focus on geographic expansion:

Players like Medtronic and Stryker focused on expanding their commercial footprint in emerging markets like Asia Pacific and Latin America between 2018-2022. This is proving effective as in many countries, the prevalence of AVMs is higher than Western countries.

Segmental Analysis of Arteriovenous Malformations Market

Insights, By Treatment: Advances in Surgical Techniques Drive Demand for Surgical Removal

The surgical removal segment dominates with a 40.2% revenue share in the arteriovenous malformations market in 2024, owing to continuous technological advancements that improve treatment outcomes. Surgical excision has traditionally been the gold standard treatment for accessible AVM lesions, as it completely eliminates the abnormal vascular structure. However, surgery also poses risks such as hemorrhage and neurologic deficits.

In recent years, advanced microsurgical techniques combined with improved imaging and neuromonitoring have significantly lowered procedure-related morbidity and mortality rates for surgical removal.

Specifically, the use of advanced microscope systems with high-resolution cameras and digital imaging enhancements enables highly precise dissection of AVMs under optimal viewing conditions. Neurosurgeons can clearly identify and safely clip or coagulate individual feeding arteries and draining veins with minimal collateral damage to surrounding tissues. Advances in neurophysiological monitoring including motor and sensory evoked potential monitoring during surgery also allow intraoperative assessment of neural function and guidance on safe resection limits.

The availability of refined instrumentation such as micro-scissors, dissectors, aspirators and coagulation devices optimized for microsurgery further enhance control and precision.

Together, these technological and clinical improvements in microsurgical techniques have driven the use of surgical excision as the front-line approach for operable AVM lesions, sustaining the Surgical Removal segment's leadership.

Insights, By Disease: Advances in Endovascular Tools Facilitate Complex Embolization Procedures

In terms of by disease, brain arteriovenous malformations segment is expected to hold 70.1% share of the market in 2024, due to heightened awareness and improved diagnostic capabilities. As AVMs can spontaneously bleed with sometimes devastating consequences, detecting asymptomatic brain lesions before a hemorrhagic event occurs is paramount.

Community education campaigns stress signs and symptoms should not be ignored. Rapid access to MRI and other advanced scans also allows many brain malformations to be incidentally found. Once cerebral AVMs are discovered, physicians are motivated to intervene proactively rather than wait for an unpredictable bleed.

Compared to less accessible areas of the body, the brain's premium function justifies aggressive evaluation and targeted solutions. Established screening protocols therefore capture brain anomalies earlier in development, driving a disproportionate volume within the disease segment.

Insights, By Age Group: Lifelong Management Needs Drive Rates in Adult Patients

In terms of by age group, adult patients contribute the highest share of the market due to demands of continuous long-term care. While rates of pediatric AVMs have peaked, adults diagnosed or living with malformations decades prior still require observation and treatment as needed.

As patients age, they become more susceptible to new complications like aneurysms, further bleeding events, or disability from previously endured bleeds. Physicians must diligently monitor for these risks to intervene before morbidity occurs. Adults also face lifestyle considerations like employment responsibilities magnifying disease impacts, motivating optimal management.

Reinterventions become more complex with patient age but support earned livelihoods. The cohort therefore relies heavily on continual specialty care and various minimally invasive solutions suited to veteran malformations. Commitment to comprehensive longitudinal support for this vulnerable population sustains provider revenues well after initial diagnosis.

Additional Insights of Arteriovenous Malformations Market

- AVMs are congenital vascular malformations, occurring in approximately 1 in 100,000 people globally. The majority of cases are diagnosed in patients between the ages of 20 and 40, with brain AVMs being more common than spinal AVMs.

- The United States holds the largest market share for arteriovenous malformations therapies due to the higher prevalence of the disease and greater healthcare expenditure. The EU5 and Japan follow closely behind.

- Stereotactic radiosurgery has gained significant traction as a preferred treatment for AVMs due to its precision in targeting malformations without invasive surgery, particularly for brain AVMs.

Competitive overview of Arteriovenous Malformations Market

The major players operating in the arteriovenous malformations market include Medtronic, Johnson & Johnson, Stryker Corporation, Penumbra Inc., MicroVention, Inc., Novartis, Pfizer, Merck, and AstraZeneca.

Arteriovenous Malformations Market Leaders

- Medtronic

- Johnson & Johnson

- Stryker Corporation

- Penumbra Inc.

- MicroVention, Inc.

Arteriovenous Malformations Market - Competitive Rivalry, 2024

Arteriovenous Malformations Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Arteriovenous Malformations Market

- In May 2024, Stryker Corporation expanded its neurosurgical product line to include advanced radiosurgical systems for treating complex brain AVMs, enhancing precision and reducing patient recovery time. Stryker's focus in 2024 was more on expanding solutions for intracerebral hemorrhage and brain tumor resection, rather than radiosurgical systems. If you're seeking further details, checking Stryker’s official news releases or product updates may provide more specific information on product line expansions.

- In August 2023, Novartis announced a partnership with a leading academic institution to explore gene therapy approaches in Arteriovenous Malformations. The collaboration is expected to bring novel therapeutic approaches, potentially revolutionizing treatment. Research and collaboration on AVMs and related gene therapies are actively ongoing in various medical fields, including the exploration of genetic mechanisms behind vascular malformations. These efforts include advancements in personalized medicine and targeted therapies, but specific details linking Novartis to such a development have not been found.

- In January 2023, Medtronic launched a new minimally invasive embolization device targeting AVMs, significantly reducing procedure time and improving outcomes. Medtronic also offers devices such as the Apollo™ and Marathon™ flow-directed microcatheters that assist in AVM embolization, but these products have been available for some time, and no new versions were released in early 2023.

- In May 2022, Pfizer's recent pipeline therapy for Arteriovenous Malformations entered phase III clinical trials. This therapy focuses on less invasive procedures and aims to improve patient outcomes with fewer side effects.

Arteriovenous Malformations Market Segmentation

- By Treatment

- Surgical Removal

- Endovascular Embolization

- Stereotactic Radiosurgery

- By Disease

- Brain Arteriovenous Malformations

- Spinal Arteriovenous Malformations

- By Age Group

- Adult Patients

- Pediatric Patients

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the arteriovenous malformations market?

The arteriovenous malformations market is estimated to be valued at USD 3.14 Bn in 2024 and is expected to reach USD 4.99 Bn by 2031.

What are the key factors hampering the growth of the arteriovenous malformations market?

High cost of AVM treatment procedures and limited awareness in developing countries are the major factors hampering the growth of the arteriovenous malformations market.

What are the major factors driving the arteriovenous malformations market growth?

Increasing prevalence of arteriovenous malformations and other vascular malformations and technological advancements in treatment techniques, such as minimally invasive surgeries, are the major factors driving the arteriovenous malformations market.

Which is the leading treatment in the arteriovenous malformations market?

The leading treatment segment is surgical removal.

Which are the major players operating in the arteriovenous malformations market?

Medtronic, Johnson & Johnson, Stryker Corporation, Penumbra Inc., MicroVention, Inc., Novartis, Pfizer, Merck, and AstraZeneca are the major players.

What will be the CAGR of the arteriovenous malformations market?

The CAGR of the arteriovenous malformations market is projected to be 6.8% from 2024-2031.