At-home Fitness Equipment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

At-home Fitness Equipment Market is segmented By Equipment (Cardiovascular Training Equipment, Strength Training Equipment), By Distribution Channel (....

At-home Fitness Equipment Market Size

Market Size in USD Bn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | High |

| Major Players | Louis Vuitton, Keiser Corporation, Precor Incorporated, Peloton Interactive, Inc., iFIT Health & Fitness Inc. and Among Others. |

please let us know !

At-home Fitness Equipment Market Analysis

The at-home fitness equipment market is estimated to be valued at USD 9.34 Bn in 2024 and is expected to reach USD 16.23 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031. Factors such as rising health consciousness among people and increasing disposable income are driving the demand in at-home fitness equipment market.

At-home Fitness Equipment Market Trends

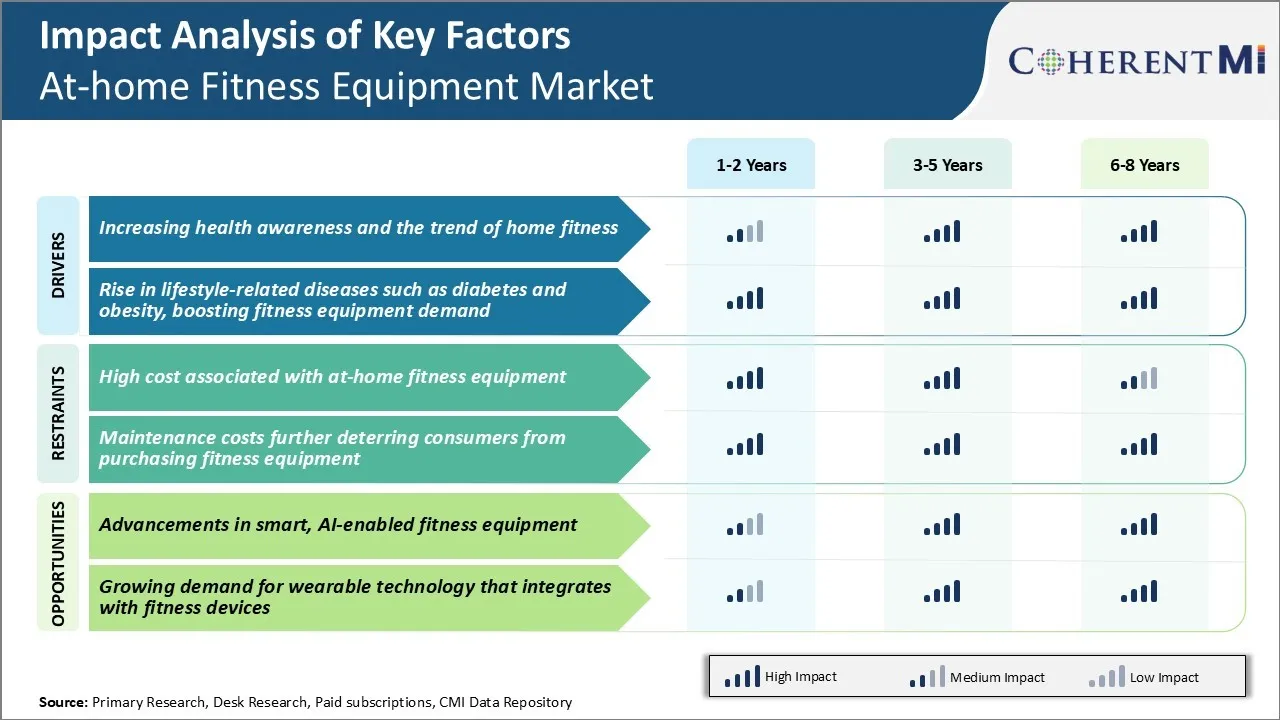

Market Driver - Increasing Health Awareness and the Trend of Home Fitness

With the increasing focus on health and wellness, consumers are gradually moving away from traditional gym memberships and embracing home workouts. Leading increasingly busy lifestyles, people find it difficult to dedicate time for expensive gym subscriptions and commuting when alternative options are available. The Covid-19 pandemic has further fueled this trend as lockdowns and social distancing restrictions made visiting gyms unsafe.

Staying fit within the comfort of one's home is proving more convenient given the flexibility and time savings it allows. Various digital innovations have played a key role in supporting home workouts. Apps offering online classes and training programs have enabled accessing a wide variety of exercises without needing expensive equipment.

Meanwhile, improving internet penetration and rising focus on connected devices have augmented the scope for at-home fitness equipment. Smart forms of equipment with in-built sensors and connectivity options are enhancing the experience for users, which is primarily driving growth of the at-home fitness equipment market.

Market Driver - Rise in Lifestyle-related Diseases such as Diabetes and Obesity, Boosting At-home Fitness Equipment Demand

In the U.S alone, over 100 million people struggle with diabetes or pre-diabetes today, according to recent statistics. Health experts have time and again emphasized lifestyle changes including enhanced physical activity and dietary modifications to counter these risks.

Growing awareness about health risks associated with lifestyle diseases is prompting consumers to invest in their fitness and wellness. Various types of fitness equipment allow versatile workouts catered to specific health goals, age groups and bodily requirements. The availability of affordable entry-level products as well as high-end smart equipment has supported uptake.

Given substantial costs associated with treating lifestyle-centric illnesses, demand for at-home fitness solutions is expected to rise as a preventive investment. This will remain growth catalyst for the at-home fitness equipment market in the coming years.

Market Challenge - High Cost Associated with At-home Fitness Equipment

One of the major challenges faced by the at-home fitness equipment market is the high cost associated with purchasing such equipment. While having home fitness solutions provide convenience and flexibility to users, the initial investment required tends to be significantly high. Thereby, high entry price point prevents a large segment of potential customers from investing in at-home fitness solutions, creating a hurdle for players in the at-home fitness equipment market.

Additionally, as technology advances, the equipment also needs periodic upgrades which leads to additional expenses. High costs especially discourage first-time users and fitness beginners who are still experimenting with different workout routines and machines. The expensive price tags pose a significant barrier for many individuals looking to include fitness activities from home.

Manufacturers in the at-home fitness equipment market need to focus on developing more affordable options without compromising heavily on quality and functionality. This, in turn, will attract more users and penetrate lower tier cities and towns.

Market Opportunity - Advancements in Smart, AI-enabled Fitness Equipment

One major opportunity for the at-home fitness equipment market lies in continued advancements in smart and AI-enabled technology solutions. With the rapid rise of the connected devices ecosystem, there is a huge scope for integrating these technologies into home exercise machines and platforms.

Fitness equipment that comes integrated with smart features like in-built sensors, virtual coaching through AI, wireless connectivity, and app-based interfaces have the potential to transform the home workout experience. Advanced data analytics capabilities can provide personalized feedback, monitor progress, adapt workout routines, and encourage users with virtual motivational support and gamification elements. These smart upgrades further add an engaging element to solo home workouts.

The integration of such intelligent features would help address issues like lack of real-time guidance or training at home. It can also help maintain user interest and consistency in workouts for achieving targets if delivered in an effective manner. Thus, innovations in smart fitness technology are expected to be a major driver of growth for at-home fitness equipment market.

Key winning strategies adopted by key players of At-home Fitness Equipment Market

Focus on Innovation: One of the biggest strategies that has worked well for players like Peloton and Mirror is continuous innovation. Peloton launched new connected fitness bike models and a treadmill in recent years that have enabled immersive at-home workouts.

Enhance Connectivity: Most modern at-home equipment offerings focus heavily on connectivity and integrating with users' mobile devices and apps. This allows users to track metrics, engage in virtual group classes, and compete with friends. Equipment from NordicTrack, Echelon, Bowflex etc. comes with integrations that make workouts more interactive and social.

Expand Content Selection: Having a diverse collection of workout classes, programs and instructor offerings helps drive higher engagement and retention of users. Peloton, for example, saw over 21 million connected fitness subscribers in 2020 due to its massive library of cardio, yoga, running and other classes from top instructors.

Focus on Affordability: While premium equipment offer the best experience, making quality gear accessible to the mass market has helped fitness brands like Icon create a loyal customer base. Icon offers popular gear like treadmills, ellipticals etc starting at $999, making connected home workouts affordable for average users.

Segmental Analysis of At-home Fitness Equipment Market

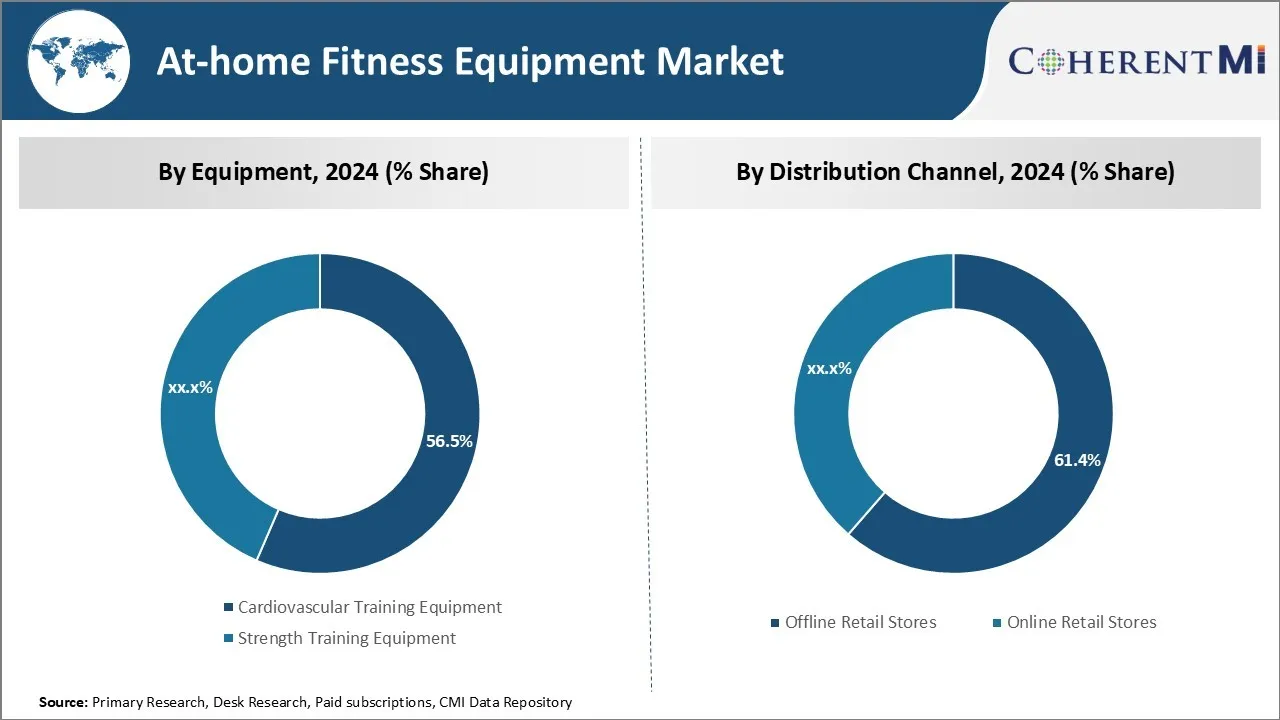

Insights, By Equipment: Fitness Enthusiasts' Evolving Needs Drive Growth in Cardiovascular Training Equipment

In terms of equipment, cardiovascular training equipment contributes 56.5% share of the at-home fitness equipment market in 2024, owning to evolving consumer needs and preferences for versatile home workout options. Cardiovascular training equipment sees high demand as it allows users to choose from a variety of low-impact options like elliptical machines and stationary bikes as alternatives to running outdoors. This is ideal for those concerned about joint issues or living in extreme weather conditions.

Within cardiovascular training at-home fitness equipment, treadmills continue to lead the segment. However, the share of elliptical machines and stationary bikes is rising as they provide full-body cardio workouts with lower impact on knees and ankles.

Rowing machines are also gaining traction among those seeking an intense but low-impact total body routine. The increasing health awareness and focus on heart health have further boosted the adoption of cardiovascular training equipment for regular home workouts.

Insights, By Distribution Channel: Offline Retail Stores Lead in Distribution

In terms of distribution channel, offline retail stores contribute the highest share of the at-home fitness equipment market. People prefer purchasing expensive fitness equipment like treadmills and bikes after comparing different options available in stores. Retail chains stock a variety of popular brands and allow users to test equipment, seek sales assistance and get answers to queries in person.

Also, at times of deliveries getting delayed due to logistical issues, the immediacy of buying from brick-and-mortar stores holds value. Stores offer additional attractive offers, lucrative return-replacement policies and personalized training sessions to boost sales. Many retail outlets have expanded robustly online during the pandemic with virtual product demos and doorstep delivery.

However, consumers still rely heavily on neighborhood specialty stores known for authentic products, maintenance support and community rapport built over the years. As people prefer seeing, touching, and relying on local stores for after-sales support of at-home fitness gear, offline retail stores will likely continue dominating the distribution channel in the at-home fitness equipment market.

Insights, By End User: Residential Segment Dominates with Young Professionals Embracing Home Workouts

In terms of end user, the residential segment dominates the at-home fitness equipment market owing to changing lifestyles and growing health awareness among young professionals and families. Urban populations are increasingly appreciating the benefits of small-space home workout solutions amid busy schedules and premium gym memberships. This provides opportunities for versatile at-home training equipment tailored for small areas.

Additionally, the longer duration spent at home during the work-from-home period has prompted homebody individuals to invest in their physical fitness with easy access to equipment. These factors have spurred demand from the residential segment, making it the highest revenue generator within the overall at-home fitness equipment market.

Additional Insights of At-home Fitness Equipment Market

- North America holds the largest share in the at-home fitness equipment market due to rising health concerns, obesity rates, and a focus on fitness.

- The mid-price point segment in the at-home fitness equipment market dominates, with consumers seeking cost-effective, high-quality equipment.

- The online distribution channel is growing rapidly, supported by the expansion of e-commerce platforms and the convenience of shopping from home.

- The at-home fitness equipment market appears moderately fragmented, with key players like Louis Vuitton and Peloton dominating. However, new entrants and a growing number of smaller players contribute to market diversity.

Competitive overview of At-home Fitness Equipment Market

The major players operating in the at-home fitness equipment market include Louis Vuitton, Keiser Corporation, Precor Incorporated, Peloton Interactive, Inc., iFIT Health & Fitness Inc., Nautilus, Inc., Johnson Health Tech Co., Ltd., Technogym S.p.A., Precor Incorporated, Life Fitness, Echelon Fitness Multimedia LLC, Torque Fitness LLC, and Bowflex (Brand of Nautilus, Inc.).

At-home Fitness Equipment Market Leaders

- Louis Vuitton

- Keiser Corporation

- Precor Incorporated

- Peloton Interactive, Inc.

- iFIT Health & Fitness Inc.

At-home Fitness Equipment Market - Competitive Rivalry, 2024

At-home Fitness Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in At-home Fitness Equipment Market

- In September 2024, iFIT launched a new lineup of smart products, including the AI Coach feature. This innovative AI Coach, currently in beta, aims to enhance user interactivity in at-home fitness equipment by selecting and recommending workouts tailored to individual fitness levels. It communicates through text messages, helping users build fitness habits and offering workout scheduling that integrates seamlessly with iFIT-enabled machines.

- In May 2024, Sunny Health & Fitness announced the launch of its new Smart Stepper line, marking a significant advancement in connected at-home fitness equipment. This innovative line integrates smart technology with traditional stepper machines, allowing users to connect to the SunnyFit app.

- In February 2024, graduates from IIT Delhi launched Aroleap X, a smart at-home fitness equipment in form of a wall-mounted home gym system designed for compact living spaces. The product features over 150 exercises, utilizes AI guidance, and incorporates motor-powered resistance, making it suitable for various fitness goals.

- In January 2024, IKEA introduced the DAJLIEN home training collection, focusing on offering affordable and versatile at-home fitness equipment. This new line includes 19 products designed to help integrate fitness into daily life, featuring items like gym mats, weights, and multifunctional storage solutions that can blend seamlessly with home decor.

At-home Fitness Equipment Market Segmentation

- By Equipment

- Cardiovascular Training Equipment

- Treadmills

- Stationary Bikes

- Elliptical Machines

- Rowing Machines

- Others

- Strength Training Equipment

- Free Weight

- Resistance Bands

- Weight Machines

- Others

- Cardiovascular Training Equipment

- By Distribution Channel

- Offline Retail Stores

- Specialty Stores

- Hypermarkets/Supermarkets

- Online Retail Stores

- Company Websites

- E-commerce Platforms

- Offline Retail Stores

- By End User

- Residential

- Commercial

- By Price Point

- Low

- Mid

- Luxury

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the at-home fitness equipment market?

The at-home fitness equipment market is estimated to be valued at USD 9.34 Bn in 2024 and is expected to reach USD 16.23 Bn by 2031.

What are the key factors hampering the growth of the at-home fitness equipment market?

High cost associated with at-home fitness equipment and maintenance costs, which deter consumers from purchasing at-home fitness equipment, are the major factors hampering the growth of the at-home fitness equipment market.

What are the major factors driving the at-home fitness equipment market growth?

Increasing health awareness and the trend of home fitness and rise in lifestyle-related diseases, such as diabetes and obesity, are the major factors driving the at-home fitness equipment market.

Which is the leading equipment in the at-home fitness equipment market?

The leading equipment segment is cardiovascular training equipment.

Which are the major players operating in the at-home fitness equipment market?

Louis Vuitton, Keiser Corporation, Precor Incorporated, Peloton Interactive, Inc., iFIT Health & Fitness Inc., Nautilus, Inc., Johnson Health Tech Co., Ltd., Technogym S.p.A., Precor Incorporated, Life Fitness, Echelon Fitness Multimedia LLC, Torque Fitness LLC, and Bowflex (Brand of Nautilus, Inc.) are the major players.

What will be the CAGR of the at-home fitness equipment market?

The CAGR of the at-home fitness equipment market is projected to be 8.2% from 2024-2031.