Australia Recycled Plastic Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Australia Recycled Plastic Market is Segmented By Product Type (Polyethylene Terephthalate (PET), Polyethylene (PE), Polyvinyl Chloride (PVC), Polypro....

Australia Recycled Plastic Market Size

Market Size in USD Mn

CAGR8.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.7% |

| Market Concentration | High |

| Major Players | Synergy Packaging, Amcor PLC, Vanden Global Ltd, Corex, Pact Group Holdings Australia Pty Ltd and Among Others. |

please let us know !

Australia Recycled Plastic Market Analysis

The Australia Recycled Plastic Market is estimated to be valued at USD 798.1 Mn in 2024 and is expected to reach USD 1,552.9 Mn by 2031, growing at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2031.

Strict regulations regarding plastic waste management and rising awareness about sustainability are driving increased collection and recycling of plastic waste in Australia. There is also a growing demand for recycled plastic from industries such as packaging, construction, and automotive due to its cost effectiveness. The recycled plastic market in Australia is expected to witness positive growth over the forecast period. Major factors such as implementation of policies mandating use of post-consumer recycled plastic by brands and manufacturers as well as investment in advanced recycling technologies will promote greater collection and recycling of plastic waste. Furthermore, initiatives to reduce reliance on virgin plastic and create circular economy model are expected to propel the demand for recycled plastic in Australia.

Australia Recycled Plastic Market Trends

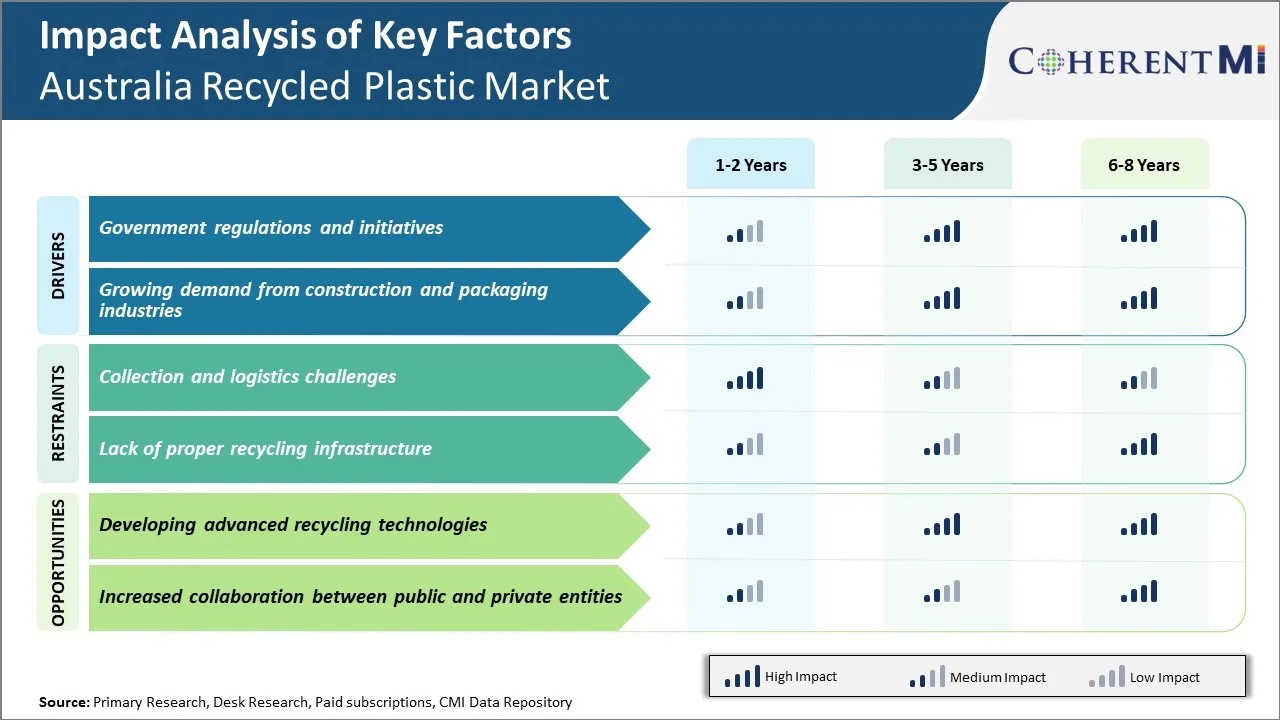

Market Driver – Government regulations and initiatives

The Australian government has been taking strong initiatives in recent years to reduce plastic pollution and move towards a circular economy model. Major regulations and policies around extended producer responsibility and bans on certain single-use plastic items have incentivized both manufacturers and consumers to increase use of recycled plastic. The 2020 National Waste Policy Action Plan sets ambitious targets for all levels of government to work together and ensure 70% of average annual plastic waste generated is recycled or composted by 2025.

To achieve these goals, state governments have launched numerous programs to curb waste sent to landfills and promote recycling. For example, the New South Wales Government implemented the Plastics Action Plan in 2021 focusing on bans, product stewardship schemes and education campaigns. As a result of these policies, collection of plastic recycling jumped by over 25% from 2020 to 2021 according to NSW EPA data. Similarly, other states like South Australia and Queensland have introduced various initiatives like rebate schemes on recycled content products and funding for plastic sorting facilities.

Market Driver – Growing demand from construction and packaging industries

The demand for recycled plastics has seen a steady rise in Australia mainly due to strong growth in the construction and packaging industries. The construction sector has been relying heavily on plastic pipes, fittings and sheets for building materials due to their durability and resistance to degradation. As new infrastructure projects come up coupled with rehabilitation of existing structures, large volumes of plastic scrap is generated annually which is then recycled by plastic manufacturers to produce new materials. Similarly, the packaging industry has witnessed a boom with rise in e-commerce and demand for packaged consumer goods. Being a lightweight and low-cost material, plastics have become the primary choice for packaging of all types of products. However, single-use plastics pose serious waste management issues. Both industries are therefore increasingly procuring recycled plastic granules and pellets for production needs.

Market Challenge: Collection and logistics challenges

Collection and logistics challenges pose a major hindrance to the growth of Australia's recycled plastic market. Sorting, processing, and transporting vast quantities of post-consumer plastic waste requires sophisticated collection infrastructure and streamlined supply chains, both of which are still lacking throughout much of the country. Due to its large geographical expanse and small population outside major cities, plastic collection points are sparse in many rural and remote areas of Australia. This makes it difficult for individuals and businesses to segregate and send their recyclables through formal recycling channels. Many communities have basic kerbside collection but no dedicated processes for plastic only. As a result, a significant portion of recyclable plastic ends up in landfill rather than being diverted for reprocessing.

Market Opportunity: Developing advanced recycling technologies

Advanced recycling technologies offer a major opportunity for growth in Australia's recycled plastic market. Developing capabilities for chemical and feedstock recycling would help address some of the key challenges that currently limit plastic recycling rates and demand for recycled plastic materials. Chemical recycling technologies like pyrolysis and gasification can break down mixed waste plastic streams of different resin types and colors into their fundamental chemical building blocks like oils and waxes. This unlocks a much wider range of mixed and dirty plastics from being recycled that currently often ends up in landfill or export. It overcomes issues with traditional mechanical recycling which requires separation of resin types and can only reprocess clean plastic a few times before quality degraded. Chemical recycling produces outputs that can re-enter the production process as virgin-quality plastic or other petrochemicals, commanding a higher price.

Key winning strategies adopted by key players of Australia Recycled Plastic Market

Investment in Advanced Recycling Technologies: Leading players like Visy and Suez have heavily invested in advanced recycling technologies that can process mixed plastics waste streams into high-quality recycled plastic materials. For example, in 2018 Visy invested $50 million to build one of the world's largest plastic recycling facilities in New South Wales featuring advanced sorting and cleaning technologies. This allows them to produce food-grade rPET flakes and pellets from mixed plastics. Such investments help secure access to recyclable feedstocks and address concerns around plastic waste.

Strategic Partnerships for Waste Supply: Companies have partnered with local councils and waste management groups to secure access to post-consumer plastic waste streams. For example, in 2019 Suez partnered with Sydney Water to recycle 100% of hard-to-recycle plastic collected from kerbside recycling bins in Greater Sydney. Such partnerships ensure steady supply of raw materials. Suez reported recycling over 16,000 tons of plastics through this program in its first year.

Investing in Brand Ownership Models: Companies like Veolia and Cleanaway have implemented brand ownership models where they partner with consumer brands to takeback and recycle branded plastic packaging, thereby closing the loop. For example, Cleanaway partners with Nestle for its packaged water brand ‘Pure Cycle’ whereby Cleanaway markets the brand on its bottles and collects/recycles them after use. This ensures higher collection rates and recycling of difficult plastic waste streams.

Certification to Green Standards: Major players get their recycled plastic products certified to Australian standards like the Australian Recycled Certified scheme. This gives their products a competitive edge in the market as end users seek certified sustainable options. For example, Visy's rPET flakes are ARC certified providing assurance of quality and sustainability to bottlers.

Segmental Analysis of Australia Recycled Plastic Market

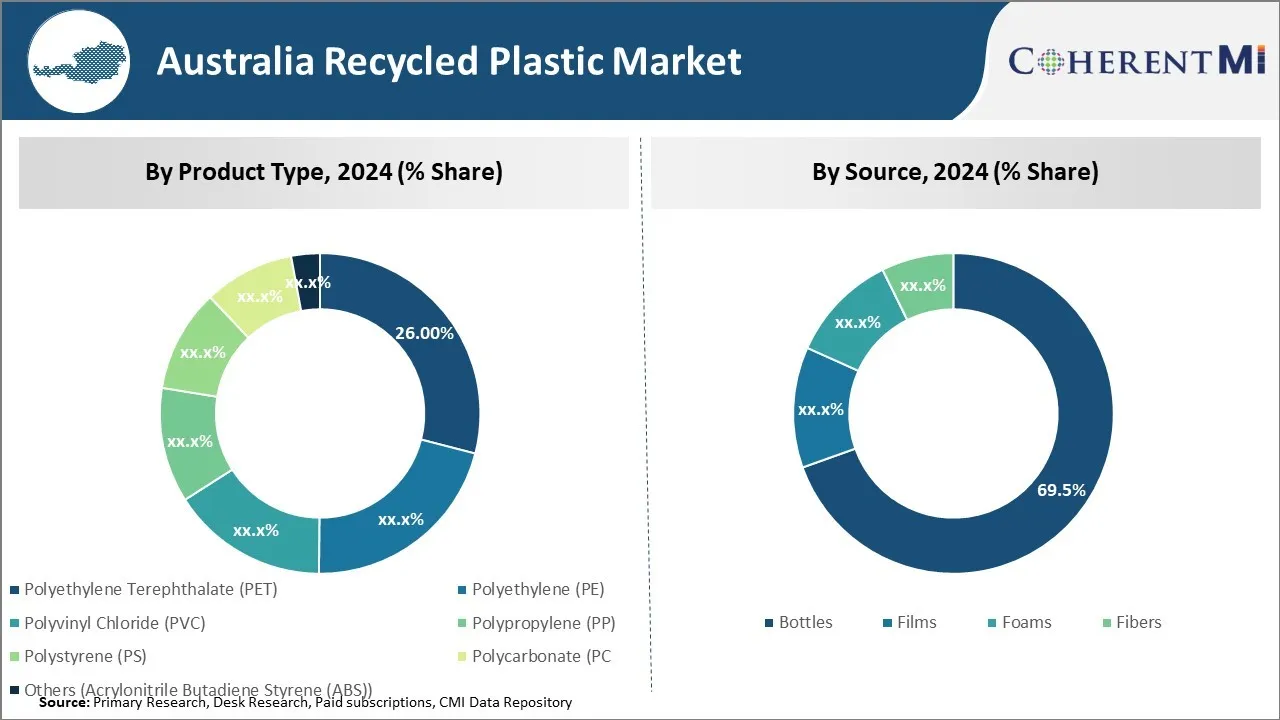

Insights by product type: Widespread use and recyclability

In terms of Product Type, Polyethylene Terephthalate (PET) contributes the 26.00% share of the market in 2024. Polyethylene terephthalate, commonly referred to as PET, has become the leading recycled plastic product type in Australia. This is primarily due to PET's prevalence in beverage bottles. As Australians consume vast amounts of bottled water and soft drinks on a daily basis, empty PET bottles make up a substantial portion of the recycling waste stream. Many grocery stores and retailers have implemented "container deposit schemes" where consumers receive a small refund for returning their bottles. This widespread bottle recycling infrastructure helps ensure a consistent supply of PET flakes and pellets that can be remanufactured.

PET is also favored for its properties that make it well-suited for recycling multiple times. It maintains its strength and integrity even after undergoing the melting and remolding process. PET recycled bottles can be converted into new bottles or other plastic products like polyester fiber without significant loss of quality. In addition, food-grade quality can be preserved through the recycling of PET. This means recycled PET flakes and pellets are permissible for direct food contact applications like new beverage bottles.

The abundance of recyclable PET sources combined with its high technical recyclability has enabled Australia's PET recycling industry to scale up operations in order to process large volumes of material. As public awareness of plastic pollution increases, more attention is being paid to recycling rates and labels claim PEP content. This helps grow overall demand for recycled PET and consolidates its position as Australia's leading recycled plastic product type.

Insights by application: Bottles lead the way as Australia's top recycled plastic source due to national container deposit initiatives

Empty beverage bottles, predominantly made from PET plastic, comprise the highest source material segment for Australia's recycled plastic industry with 69.5% share in 2024. This dominant market position stems from the success of container deposit schemes that have motivated widespread bottle recycling for decades. Examples include South Australia's "Containers for Change" and New South Wales's "Return and Earn" programs. These recycling programs offer refunds between 10-15 cents for every container returned to redemption centers.

The financial incentive and convenience of these schemes have proven highly effective at diverting used bottles from landfill. By some estimates, container deposit initiatives recover over 80% of eligible containers. With Australians consuming over 15 billion bottles per year, this translates to a massive supply of cleaned and baled plastic bottles supplied to reprocessors and end-use manufacturers. While other plastic types like HDPE milk jugs are also recyclable, bottles make up the most consistent and voluminous source stream. Bag drop-off services at major retailers and annual cleanup events organized through programs like Clean Up Australia Day also supplement bottle returns. However, it is largely thanks to container deposit programs that bottles continue outperforming other recycled plastic sources like films and foams. As environmentally-focused policies gain traction across Australia's states and territories, there is an ongoing push to expand container deposit schemes to additional container types and improve national standardization. Such developments would only work to further reinforce bottles as the leading feedstock for the country's recycled plastic industry.

Competitive overview of Australia Recycled Plastic Market

The major players operating in the Australia Recycled Plastic Market include Synergy Packaging, Amcor PLC, Vanden Global Ltd, Corex, Pact Group Holdings Australia Pty Ltd

Australia Recycled Plastic Market Leaders

- Synergy Packaging

- Amcor PLC

- Vanden Global Ltd

- Corex

- Pact Group Holdings Australia Pty Ltd

Australia Recycled Plastic Market - Competitive Rivalry, 2024

Australia Recycled Plastic Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Australia Recycled Plastic Market

- On 15 February 2024 Soft plastic recycling is back after the REDcycle collapse, but only in 12 supermarkets.

Australia Recycled Plastic Market Segmentation

- By Product Type

- Polyethylene Terephthalate (PET)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Polystyrene (PS)

- Polycarbonate (PC)

- Others (Acrylonitrile Butadiene Styrene (ABS))

- By Source

- Bottles

- Films

- Foams

- Fibers

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the Australia Recycled Plastic Market?

The collection and logistics challenges and lack of proper recycling infrastructure are the major factor hampering the growth of the Australia Recycled Plastic Market.

What are the major factors driving the Australia Recycled Plastic Market growth?

The government regulations and initiatives and growing demand from construction and packaging industries are the major factor driving the Australia Recycled Plastic Market.

Which is the leading Product Type in the Australia Recycled Plastic Market?

The leading Product Type segment is Polyethylene Terephthalate (PET).

Which are the major players operating in the Australia Recycled Plastic Market?

Pact Group Holdings Australia Pty Ltd, Synergy Packaging, Amcor PLC, Kangaroo Plastics Technology Pty. Ltd, Vanden Global Ltd, Circular Plastics Australia, Corex, Australian Recycled Plastics Pty Ltd, OLIMA FIBRE PROCESSORS PTY. LTD. are the major players.

What will be the CAGR of the Australia Recycled Plastic Market?

The CAGR of the Australia Recycled Plastic Market is projected to be 8.7% from 2024-2031.