Automotive Switch Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Automotive Switch Market is segmented By Type (HVAC Switches, Steering Wheel Switches, Ignition Switches, Door & Window Switches, Others), By Vehicle ....

Automotive Switch Market Size

Market Size in USD Bn

CAGR4.50%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.50% |

| Market Concentration | Medium |

| Major Players | ZF Friedrichshafen AG, Delphi Technologies, Valeo, Panasonic Automotive Systems Co., TRW Automotive US LLC and Among Others. |

please let us know !

Automotive Switch Market Analysis

The Global Automotive Switch Market is estimated to be valued at USD 7.6 Bn in 2024 and is expected to reach USD 11.9 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.50% from 2024 to 2031.

The automotive switch market is expected to witness significant growth over the forecast period. The growing demand for luxury and electric vehicles along with increasing electrification of automotive systems is augmenting the adoption of switches. Additionally, the growing need for enhanced comfort, connectivity, and safety features is further propelling the demand for switches from automakers. Manufacturers are also developing advanced switches with multi-functional control and touch-based input that provide convenience and ease of use to the driver. Integration of switches with technologies such as surround view cameras, blind spot assistance, gesture control, and telematics is further expected to drive their demand going forward. However, high development cost of advanced switches and growing penetration of electric vehicles with fewer mechanical components may hamper the market growth to some extent during the forecast period.

Automotive Switch Market Trends

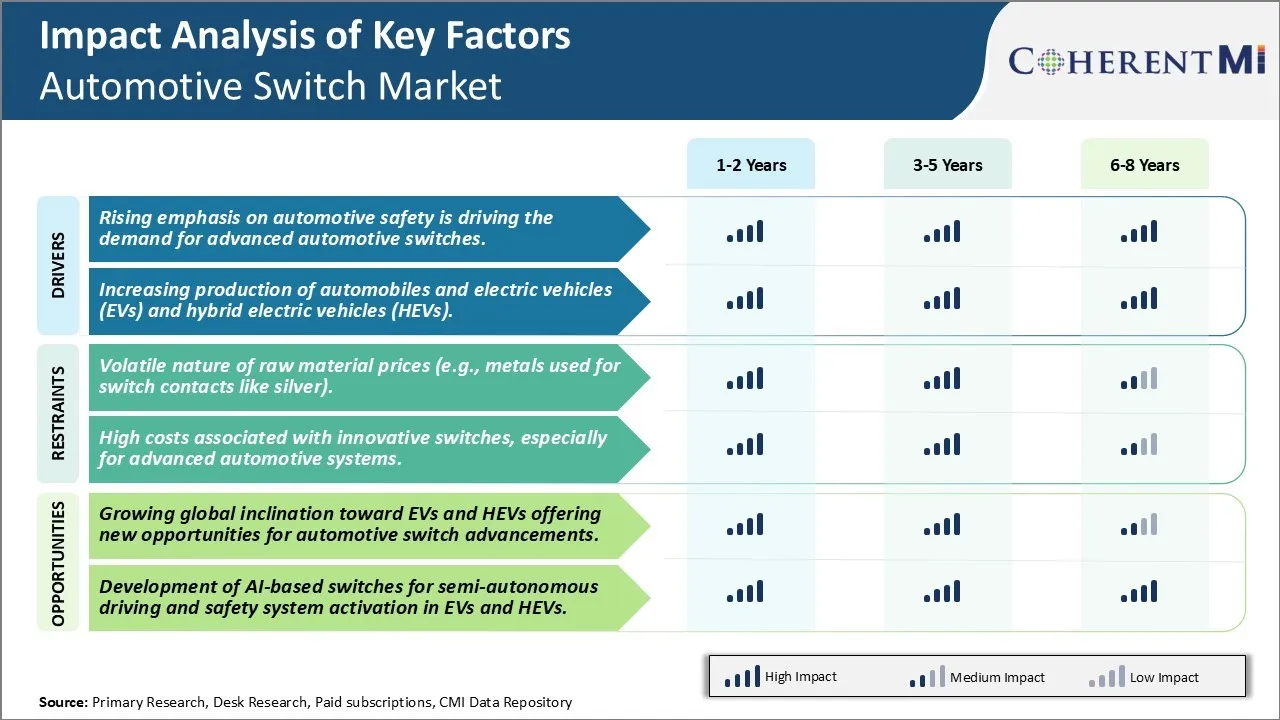

Market Driver - Rising Emphasis on Automotive Safety is Driving the Demand for Advanced Automotive Switches.

The automotive industry has witnessed exponential growth in the past few decades. However, with increasing vehicular traffic on roads, safety has become a major concern. Customers are becoming more aware and demanding advanced safety features in vehicles. This has compelled automakers to integrate innovative safety technologies. Advanced switches that can withstand high temperatures and accidental errors are vital in technologies like adaptive cruise control, blind spot monitoring systems and autonomous emergency braking. Such features require switches to operate intricate algorithms and driver assistance mechanisms smoothly.

To reduce accidents, switches are being designed to alert drivers with tactile feedback in critical situations. For instance, proximity sensing switches near airbags warn drivers instantly against dangerous zones with a vibration. Advanced electromechanical switches with waterproof casings are gaining popularity as they withstand dust, moisture and harsh outdoor conditions better. Their long operational life and reliability ensure safety systems function accurately even in remote areas. Automakers are also focusing on switches within infotainment and connectivity units to prevent distraction of drivers. Well-illuminated switches allow convenient access to calls and music without diverting attention from the road.

The rising complexity of automotive electrical architecture demands switches with enhanced functionalities. They are being made versatile to control multiple safety functions through fewer switches located ergonomically. This consolidates switch hardware thus freeing more space. It also simplifies manufacturing and repair works. Ultimately, it helps automakers pass safety benefits to customers economically. With stricter safety laws and consumer expectations, emphasis on automotive safety will propel the demand for advanced automotive switches in the foreseeable future.

Market Driver - Increasing Production of Automobiles and Electric Vehicles (EVs And Hybrid Electric Vehicles (HEVs)

Rising disposable incomes and expanding middle classes in developing nations have bolstered the global automobile sector rapidly. Proliferation of shared mobility services along with growth in nuclear families has stimulated car ownership as well. Automakers are launching versatile models and variants to capture varied customer segments worldwide. This has aggregated automotive production volumes heavily. As automobiles are becoming highly complex machines packed with hundreds of switches, rising vehicle production directly boosts demand for switches.

In addition, governments across regions are incentivizing electric vehicles to curb emissions. This has accelerated adoption of battery-powered EVs and hybrid electric vehicles blending combustion engines with electric motors. EVs rely majorly on switches to operate diverse functions like regeneration braking, energy recuperation and battery management smoothly. HEVs require robust switches for their advanced powertrain and electric assist systems. Manufacturers are witnessing expanded outsourcing opportunities from auto giants pushing green vehicles actively.

Moreover, automated driving will rely on rapid and smart switching of countless sensors, controls and computing mechanisms within vehicles. Transition to electric and self-driving fleets will further magnify the scope of innovative switches. Their miniaturization and durability make EVs and HEVs reliable. Overall, exponential increase in automobile manufacturing fueled by emerging powertrain technologies will drive consistent demand for automotive switches in the long-term. This presents lucrative prospects for aspirational switch brands to capture this untapped market.

Market Challenge - Volatile Nature of Raw Material Prices (e.g., metals used for switch contacts like silver).

One of the key challenges this industry faces is the volatile prices of raw materials used in switch components. One such material that experiences significant price fluctuations is silver, which is commonly used for switch contacts due to its high electrical conductivity and resistance to corrosion. However, silver is a precious metal whose prices depend on global demand and supply dynamics in commodity markets. In recent times, silver prices have witnessed wild swings—rising over 30% some years and falling by similar margins in others.

These unpredictable raw material cost trends make it difficult for switch manufacturers to set stable product prices over the long run. Any rise in silver costs needs to be passed on to automakers but frequency of such price revisions can strain customer relationships. It also complicates production budgeting and profit forecasting for switch companies. While attempts have been made to substitute silver, its unrivaled electrical properties pose difficulties in complete replacement. The only options are either absorbing such volatility impacts or engaging in hedging activities like futures trading, both of which affect long-term investment plans and competitiveness.

Market Opportunity - Growing Global Inclination Toward EVs and HEVs Offering New Opportunities for Automotive Switch Advancements

The global shift toward electric vehicles (EVs) and hybrid electric vehicles (HEVs) presents a promising opportunity for innovation and growth in the automotive switch market. EVs and HEVs rely extensively on sophisticated switchgear to control various electric drive systems, battery packs and HVAC functions safely and seamlessly. Compared to conventional internal combustion engine vehicles, electric drivetrains require switches that can withstand higher voltage loads as well as endure harsh under-hood temperatures over vehicle lifespan.

This rising demand for switches catering to advanced EV/HEV architectures is driving the development of new switch technologies. Front-running switch producers are investing in materials, components and manufacturing processes to deliver switches with higher amperage ratings, faster actuation speeds and longer lifespan under severe operating conditions. Significant progress is also being made in the areas of waterproofing, minimizing in-cabin NVH levels and enhancing overall reliability/safety. As more automakers commit bigger production volumes to EVs and plug-in hybrids, the global electric mobility transition will keep opening up expanded revenue pools for advanced automotive switches. It provides the industry a multi-year growth runway to drive innovation as well as achieve scale economies.

Key winning strategies adopted by key players of Automotive Switch Market

Focus On Design and Innovation: Leading switch manufacturers like Continental, ZF, and Alps Electric have heavily invested in R&D to develop new and innovative switch designs.

Leverage Connectivity and Autonomy: With the rise of connected and autonomous vehicles, switch makers are integrating their switches with infotainment and advanced driver assistance systems.

Expand Product Portfolio: Market leaders have succeeded in offering a diverse portfolio addressing all vehicle segments and types of switches.

Strategic Partnerships and Collaborations: Players partner with OEMs and other automotive system suppliers to integrate their switches and control solutions.

Segmental Analysis of Automotive Switch Market

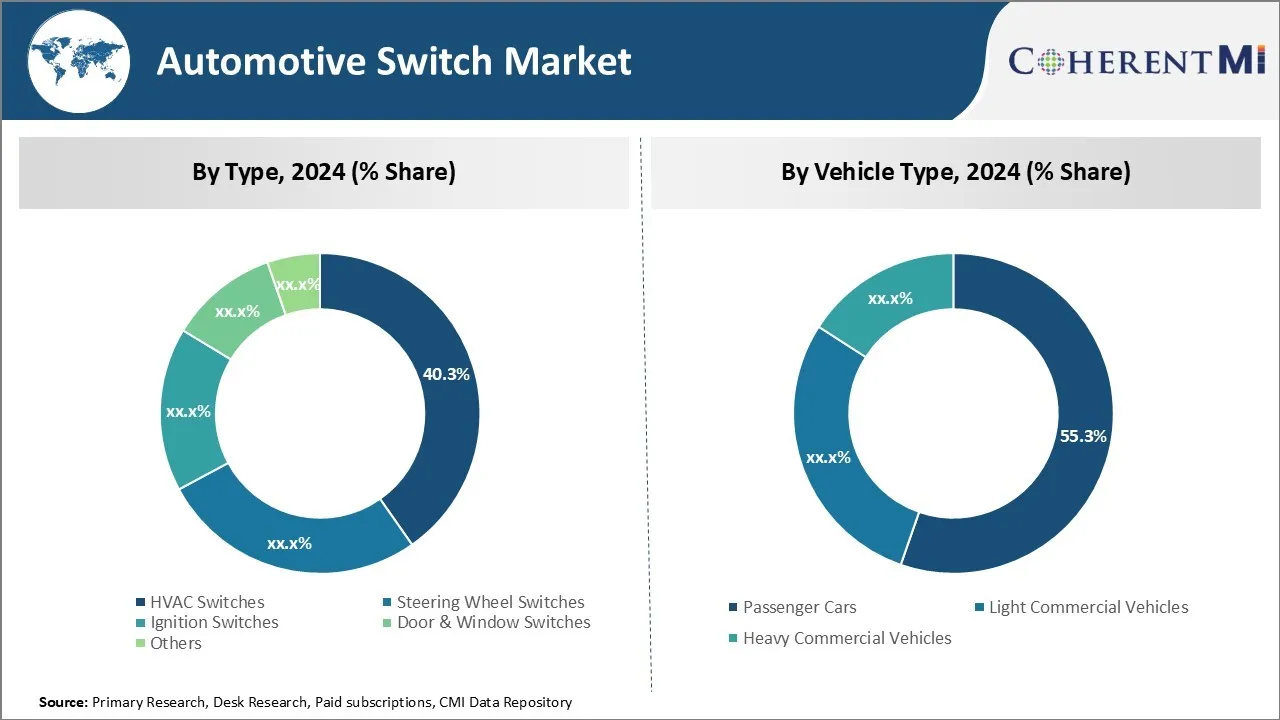

Insights, By Type, Comfort and Convenience Drive Demand for HVAC Switches.

By Type, HVAC switches are expected to contribute 40.3% market share in 2024 owing to consumers' rising preference for comfort and convenience while driving. HVAC switches allow drivers to easily adjust the temperature, fan speed, and air flow within vehicles with the push of a button. As automotive technologies continue to advance and vehicles become more like mobile offices and living spaces, passengers expect higher levels of climate control. This has significant spurred the development and adoption of sophisticated HVAC systems equipped with digital interfaces and multi-function switches. Moreover, climate conditions vary widely between regions, creating regional demand patterns. Areas with extreme temperatures experience greater HVAC system usage which drives aftermarket replacement of worn switches. With mobility trends like ride-sharing on the rise, maintaining optimal in-cabin comfort has become increasingly important for automakers. This is propelling continuous innovation in switch technologies to meet the comfort needs of diverse consumer groups.

Insights, By Vehicle Type Ease of Use and Safety Drive Predominance of Passenger Cars in Vehicle Type Segment

By Vehicle Type, the passenger cars segment is expected to contribute 55.3% market share in 2024 owing to priorities of ease of use and safety among consumers. The intricate dashboards and center consoles of modern passenger vehicles require switches to control an array of electronics and mechanical systems in a seamless manner. This has motivated intensive research into human-centered switch design by automakers. Meanwhile, tightening safety norms necessitate switches that can be located and operated without visual confirmation or complex multi-step sequences. Passenger cars also see more widespread daily usage compared to commercial vehicles. This translates to higher wear-and-tear rates and replacement needs for switches. Additionally, advanced driver assistance systems depend on switches to engage crucial functions. As autonomous driving technologies proliferate, switches accommodating seamless manual-to-automatic transitions will be crucial for passenger acceptance.

Insights, By Sales Channel, Original Equipment Manufacturing Leads in Sales Channels Due To Quality Priorities.

By Sales Channel, OEM is expected to contribute the highest share of the market owing to customers prioritizing quality assurance when it comes to mission-critical components. Automotive switches sourced, installed and backed by automakers theoretically undergo more stringent reliability testing before sale. This provides drivers with peace of mind that switches will perform as designed over the lifespan of increasingly high-tech vehicles. Aftermarket switches, while cheaper, may not always replicate the craftsmanship or use same-brand parts as originals. Furthermore, automakers can leverage platforms to precisely engineer switches during production alongside other interlocking systems. This level of integration is challenging for third parties to achieve after a vehicle is on the road. OEMs also offer free switch replacements within warranty periods if faults arise. As cars become computing devices on wheels dependent on intricate switch interfaces, consumers show confidence in switches carrying the manufacturer's trusted brand name and standards.

Additional Insights of Automotive Switch Market

The global automotive switch market is evolving rapidly, driven by the growing adoption of electric and hybrid vehicles (EVs and HEVs), as well as advancements in vehicle safety and convenience features. Companies like ZF Friedrichshafen and Panasonic Automotive Systems are at the forefront of developing advanced switches that integrate AI-based features, transforming the functionality of modern automobiles. As the industry moves from mechanical to electronic components, the demand for switches capable of managing more complex systems, such as HVAC controls and steering wheel functionalities, has surged. The focus on safety has led to innovations in automatic switches that activate in emergency situations, including lane-keeping systems and collision warning systems. The market is expected to see steady growth over the next decade, particularly in regions like Asia Pacific, where the adoption of EVs is being supported by government incentives. The market's future lies in its ability to adapt to the electrification trend while continuing to innovate in safety and user convenience.

Competitive overview of Automotive Switch Market

The major players operating in the Automotive Switch Market include ZF Friedrichshafen AG, Delphi Technologies, Valeo, Panasonic Automotive Systems Co., TRW Automotive US LLC, Marquardt GmbH, Preh GmbH, Diamond Electric Manufacturing Corporation, E-Switch Inc and Honeywell Inc.

Automotive Switch Market Leaders

- ZF Friedrichshafen AG

- Delphi Technologies

- Valeo

- Panasonic Automotive Systems Co.

- TRW Automotive US LLC

Automotive Switch Market - Competitive Rivalry, 2024

Automotive Switch Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automotive Switch Market

- In January 2024, ZF Friedrichshafen AG announced its new belt tensioner with multiple switchable load limiters (MSLL), further reducing accident impacts.

- In April 2024, Switch Mobility launched its first electric light commercial vehicle (IeV 4), from its facility in Hosur, marking significant progress in electric commercial vehicles.

- In June 2023, Marvell Technology, Inc. introduced the Brightlane Q622x family of central automotive Ethernet switches, supporting advanced safety systems for next-gen vehicles.

Automotive Switch Market Segmentation

- By Type

- HVAC Switches

- Steering Wheel Switches

- Ignition Switches

- Door & Window Switches

- Others

- By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- By Sales Channel

- OEM

- Aftermarket

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Automotive Switch Market?

The Global Automotive Switch Market is estimated to be valued at USD 7.6 Bn in 2024 and is expected to reach USD 11.9 Bn by 2031.

What are the major factors driving the Automotive Switch Market growth?

The rising emphasis on automotive safety is driving the demand for advanced automotive switches and increasing production of automobiles and electric vehicles (EVs) and hybrid electric vehicles (HEVs) are the major factors driving the Automotive Switch Market.

What are the key factors hampering the growth of the Automotive Switch Market?

The volatile nature of raw material prices (e.g., metals used for switch contacts like silver). High costs associated with innovative switches, especially for advanced automotive systems are the major factor hampering the growth of the Automotive Switch Market.

Which is the leading Type in the Automotive Switch Market?

HVAC Switches are the leading Type segment.

Which are the major players operating in the Automotive Switch Market?

ZF Friedrichshafen AG, Delphi Technologies, Valeo, Panasonic Automotive Systems Co., TRW Automotive US LLC, Marquardt GmbH, Preh GmbH, Diamond Electric Manufacturing Corporation, E-Switch Inc, Honeywell Inc. are the major players.

What will be the CAGR of the Automotive Switch Market?

The CAGR of the Automotive Switch Market is projected to be 4.50% from 2024 to 2031.