Automotive Wrap Films Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Automotive Wrap Films Market is segmented By Film (Wraps Films, Window Films, Paint Protection Films), By Vehicle (Passenger Cars, Buses, Trucks), By ....

Automotive Wrap Films Market Size

Market Size in USD Bn

CAGR18.6%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 18.6% |

| Market Concentration | Medium |

| Major Players | Orafol Group, Vvivid Vinyl, Hexis S.A., Avery Dennison, JMR Graphics, Inc. and Among Others. |

please let us know !

Automotive Wrap Films Market Analysis

The automotive wrap films market is estimated to be valued at USD 8.47 Bn in 2024 and is expected to reach USD 27.95 Bn by 2031. It is estimated to grow at a compound annual growth rate (CAGR) of 18.6% from 2024 to 2031. Automotive wrap films market is experiencing increasing demand as more vehicle owners are looking for options to customize and protect the exterior of their cars, trucks and fleet vehicles.

Automotive Wrap Films Market Trends

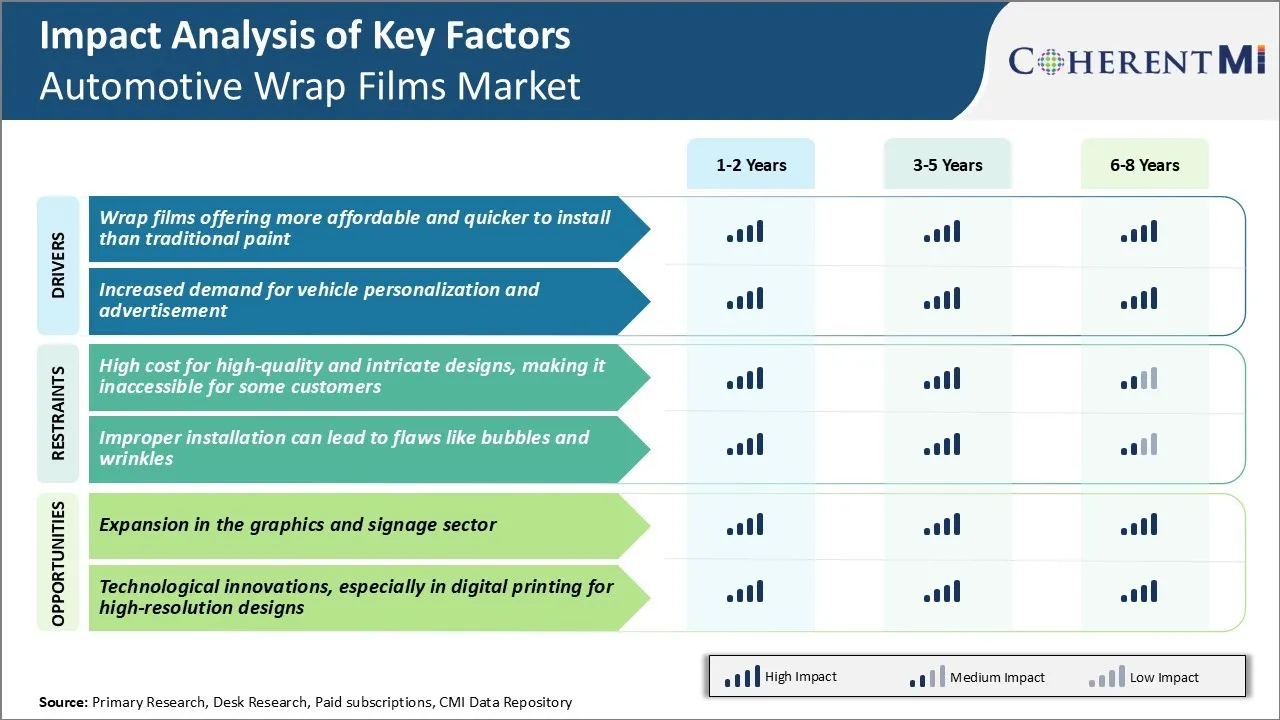

Market Driver - Wrap Films Offering More Affordable and Quicker to Install than Traditional Paint

Automotive wrap films have emerged as a popular and cost-effective alternative to traditional vehicle painting. Unlike paint jobs that require extensive surface preparation, automotive wrap films can be installed over an existing clean paint surface. This makes them much quicker to apply compared to repainting a vehicle.

The installation process of automotive wrap films is also simpler as it does not require the use of paint guns, spray booths, and other equipment needed for painting. Professional installers can wrap cars using only high-quality films and specialized application tools like squeegees and heat guns.

From a cost perspective as well, wraps under $3,000 can completely transform a vehicle's appearance compared to an average paint job pricing anywhere between $3,000 to $8,000 depending on the car size and additional work required. Some luxury vehicle owners looking for one-of-a-kind custom graphics or matte finishes that are not easy to achieve with traditional spray painting, are turning to automotive wrap films as well.

Market Driver - Increased Demand for Vehicle Personalization and Advertisement

There is a strong trend of vehicle owners customizing or personalizing their rides with unique color patterns, graphics, and messages in recent times. This has opened opportunities for automotive wraps beyond just protecting a car's original paint. Vehicle owners especially enthusiasts are looking at innovative wrap designs and materials available today as a form of self-expression. With a wide variety of film textures and colors to choose from, wraps allow personalizing even the exterior body lines and panels of a car.

Advertisers have also recognized vehicle wraps as an effective mobile marketing tool. From small local businesses displaying their phone numbers to global brands wanting nationwide brand visibility, vehicle advertising opens whole new avenues. As digital and static advertising becomes crowded, vehicle wraps effectively cut through the noise by helping messages travel.

Growing recognition of wraps' promotional potential continues to support healthy demand. This will continue to drive growth of the automotive wrap films market in the coming years.

Market Challenge - High Cost for High-Quality and Intricate Designs

One of the major challenges faced by the automotive wrap films market is the high cost associated with films that offer high-quality and intricate designs. While such premium automotive wrap films deliver aesthetically pleasing finishes and protection from the elements, their cost can run several thousands of dollars. This steep price tag puts these types of automotive wrap films out of reach for many individual customers and smaller fleet owners.

Even for larger companies, the costs need to be carefully justified based on the intended usage and lifetime of the vehicle. Often basic or solid color wraps that do not utilize the full capabilities of the material are preferred for their lower costs. However, this limits the creative design options available to customers.

The automotive wrap films market has yet to achieve a proper balance between delivering high-quality graphic capabilities without a steep increase in prices. This remains a bottleneck inhibiting broader adoption across all customer segments.

Market Opportunity - Expansion in the Graphics and Signage Sector

One key area that presents a major opportunity for growth in the automotive wrap films market is the graphics and signage applications sector. While vehicle wraps enable branding and promotion, companies are increasingly looking at other out of home media like bus shelters, bike racks, trash cans and more to leverage their branding dollars.

The adaptability and durability of automotive wrap films make them well-suited for a wide variety of short and long-term graphics needs. The materials can deliver vibrant, detailed graphics while withstanding the outdoor elements and high-traffic environments. This provides an appealing proposition for organizations and municipal authorities looking to update signage or deploy temporary ads.

It is predicted that the automotive wrap films market will witness rising penetration in applications like fleet graphics, building wraps, wall murals and more in the coming years. Automotive wrap film manufacturers are well-positioned to capitalize on this demand by offering tailored products and installation services.

Key winning strategies adopted by key players of Automotive Wrap Films Market

Focus on new product launches and innovation - Major players like 3M, Avery Dennison, Arlon Graphics, LLC, etc. continuously invest in R&D to develop new and innovative products. For example, in 2020, 3M launched a new line of cast vinyl films specifically designed for wrapping electric vehicles.

Strategic partnerships and collaborations – Players in the automotive wrap films marketbn partner and collaborate with vehicle manufacturers, aftermarket modifiers, and graphic installers to better understand customer needs and ensure product availability.

Focus on emerging markets - As the automotive industry is growing in developing countries, leading players focus on expanding in high-growth regions like Asia and Latin America.

Aggressive marketing campaigns - Companies spend substantially on marketing activities like trade shows, digital campaigns, sponsorships etc. to promote their offerings. For example, at the SEMA Show in 2021, 3M spent over $500,000 on promotions and giveaways which helped them gain awareness among installers.

Segmental Analysis of Automotive Wrap Films Market

Insights, By Film: Branding and Customization Drives Highest Share of Wraps Films

In terms of film, wraps films contributes 45.7% share of the automotive wrap films market owning to its ability to efficiently brand vehicles. Wraps films are extensively used by businesses ranging from taxi and transport operators to food delivery fleets to prominently display their brand colors, logos, phone numbers, and other details on their vehicles. This helps in effective marketing and branding for these companies on the move.

Individuals also opt for wraps films to customize the look and feel of their vehicles with graphics, images, and color themes of their choice. The customizable nature and vibrant colors of wraps films make for an engaging branding medium and allow vehicle owners to reflect their personality and interests. High adoption of wraps films for branding and customization purposes has helped it capture the dominant share in the automotive wrap films market share.

Insights, By Vehicle: Passenger Cars Sees Highest Demand Driven by Safety and Advertisement Needs

In terms of vehicle, passenger cars contributes 54.2% share of the automotive wrap films market in 2024. This is primarily due to the dual purposes of safety and advertisement it fulfills. Passenger cars make up the largest vehicle category globally and have a higher visibility on roads compared to other segments like trucks and buses. This makes them attractive for various advertisement campaigns where auto wrap films are deployed to prominently display messages and designs.

At the same time, as private vehicles used to ferry families including children, safety features offered by auto wrap films such as UV protection and glare reduction are highly valued by passenger car owners. The large fleet size and dual functionality for advertisement and safety has led passenger cars to have the highest demand for auto wrap films.

Insights, By Application: Safety Concerns Drive Highest Usage of Auto Wrap Films in Safety Applications

When considering the application segment, safety contributes the highest share in the automotive wrap films market. This is primarily due to growing concerns over UV radiation and heat. Prolonged exposure to sun rays can damage a vehicle exterior and poses health risks. Auto wrap films help address this by blocking 99% of UV rays. They also aid in reducing interior heat buildup and provide glare reduction which improves driver safety.

Beyond individual usage, auto wrap films are widely used in fleet vehicles to safeguard both drivers and passengers from UV exposure during long hours of commute. Their ability to protect the vehicle body for a longer period without fading or peeling also attracts usage. Thus, the safety benefits offered ensure this application segment sees the maximum adoption of automotive wrap films.

Additional Insights of Automotive Wrap Films Market

- he demand for vehicle wraps has surged in North America due to growing interest in customizable vehicle graphics, especially for businesses seeking brand promotion.

- In the automotive sector, window films have gained significant popularity due to their ability to reduce solar light and enhance privacy, improving the driving experience and vehicle protection.

- North America led the automotive wrap films market in 2023, contributing over 39.14% of total market revenue.

- The passenger car segment held 54% of the automotive wrap films market share in 2023, driven by rising consumer demand for vehicle customization.

Competitive overview of Automotive Wrap Films Market

The major players operating in the automotive wrap films market include Orafol Group, Vvivid Vinyl, Hexis S.A., Avery Dennison, JMR Graphics, Inc., 3M Company (originally the Minnesota Mining and Manufacturing Company), Kay Premium Marking Films (KPMF), Ritrama S.p.A., Guangzhou Carbins Film Co., LTD, and Arlon Graphics, LLC.

Automotive Wrap Films Market Leaders

- Orafol Group

- Vvivid Vinyl

- Hexis S.A.

- Avery Dennison

- JMR Graphics, Inc.

Automotive Wrap Films Market - Competitive Rivalry, 2024

Automotive Wrap Films Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Automotive Wrap Films Market

- In February 2023, leading companies in the automotive wrap films sector, such as Hexis, Orafol, 3M, and Avery Dennison, unveil new products designed to meet the increasing demand for innovative solutions in the automotive wrap films market. These innovations typically focus on enhancing durability, aesthetics, and ease of application, as well as improving sustainability with eco-friendly materials.

- In July 2022, ORAFOL launched PVC-free films and laminates at the Berlin FESPA Global Print Expo 2022, designed for high-demand sectors like advertising and automotive.

Automotive Wrap Films Market Segmentation

- By Film

- Wraps Films

- Window Films

- Paint Protection Films

- By Vehicle

- Passenger Cars

- Buses

- Trucks

- By Application

- Safety

- Advertisement

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the automotive wrap films market?

The automotive wrap films market is estimated to be valued at USD 8.47 Bn in 2024 and is expected to reach USD 27.95 Bn by 2031.

What are the key factors hampering the growth of the automotive wrap films market?

High cost for high-quality and intricate designs, making it inaccessible for some customers and improper installation can lead to flaws like bubbles and wrinkles are the major factors hampering the growth of the automotive wrap films market.

What are the major factors driving the automotive wrap films market growth?

Wrap films offering more affordable and quicker to install than traditional paint and increased demand for vehicle personalization and advertisement are the major factors driving the automotive wrap films market.

Which is the leading film in the automotive wrap films market?

The leading film segment is wrap films.

Which are the major players operating in the automotive wrap films market?

Orafol Group, Vvivid Vinyl, Hexis S.A., Avery Dennison, JMR Graphics, Inc., 3M Company (originally the Minnesota Mining and Manufacturing Company), Kay Premium Marking Films (KPMF), Ritrama S.p.A., Guangzhou Carbins Film Co., LTD, and Arlon Graphics, LLC are the major players.

What will be the CAGR of the automotive wrap films market?

The CAGR of the automotive wrap films market is projected to be 18.6% from 2024-2031.