Bacterial Vaginosis Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Bacterial Vaginosis Market is segmented By Treatment (Antibiotics (Metronidazole, Clindamycin, Tinidazole), Antifungal AgentsProbiotics), By Route of ....

Bacterial Vaginosis Market Size

Market Size in USD Bn

CAGR8.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.7% |

| Market Concentration | Medium |

| Major Players | Symbiomix Therapeutics (Lupin Pharmaceuticals), Bayer AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries and Among Others. |

please let us know !

Bacterial Vaginosis Market Analysis

The bacterial vaginosis market is estimated to be valued at USD 3.48 billion in 2024 and is expected to reach USD 6.26 billion by 2031, growing at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2031.

The market has been witnessing positive trends over the past few years. Factors such as rising prevalence of bacterial vaginosis infections and growth in female population have been driving the adoption of bacterial vaginosis treatment and diagnostics.

Bacterial Vaginosis Market Trends

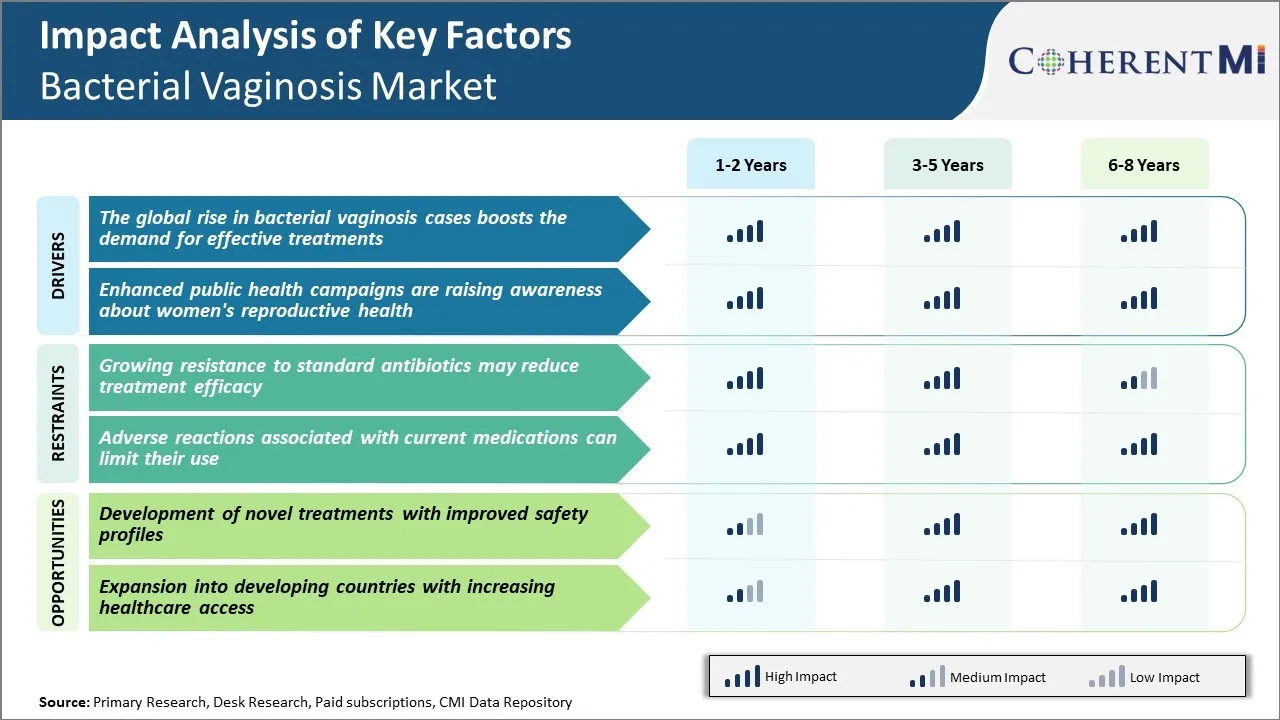

Market Driver - Global Rise in Bacterial Vaginosis Cases Boosts the Demand for Effective Treatments

Bacterial vaginosis or BV is one of the most common causes of vaginal infections amongst women. As per our research, over the last few years the worldwide prevalence of BV cases has shown a notable rise. BV often causes unpleasant symptoms such as abnormal vaginal discharge and fishy odor which impacts the quality of life and well-being of affected women. This has led to a growing demand for effective therapies that can alleviate discomfort faster and cure the infection completely.

Pharmaceutical companies engaged in developing treatment options for BV have reported sizable gains as more patients now opt for medication rather than ignoring the problem or relying only on over-the-counter remedies which often provide temporary relief. Prescription drugs containing antibacterial and anti-inflammatory agents are preferred for their targeted approach at getting rid of the causative bacteria and prevention of recurrence once the course is complete.

The rising global disease prevalence consequently spurs the total market demand for reliable BV therapies. Pharma firms actively work on new drug formulations, combination therapies and diagnostic tools to address unmet needs and expand their market share. Overall modern medicine appears to be benefitting the most from this upward trend in infections caused by bacterial vaginosis worldwide.

Market Driver - Enhanced Public Health Campaigns are Raising Awareness About Women's Reproductive Health

In recent times, with improving education levels and growing openness in society, conversations around women's reproductive health issues have become less taboo. Various non-profit organizations and public entities have launched extensive awareness programs through different mediums to educate women about common gynecological infections like bacterial vaginosis or BV and the importance of timely diagnosis and treatment.

These campaigns highlight how frequent vaginal infections can disrupt the natural pH balance in the genital tract making women more susceptible to contracting sexually transmitted diseases. They emphasize that BV, though a mild condition by itself should not be ignored, as it could potentially enable opportunistic infections to take hold.

Several television, radio and digital advertisements present candid yet sensible messaging on signs and symptoms of abnormalities that warrant medical review. While being mindful not to cause unnecessary worry or dispel misinformation, they motivate women to respect their bodies and take informed healthcare decisions without facing social stigma.

A result of these sustained drives has been a surge in health-seeking behavior. More women now visit general physicians or gynecologists on noticing any unusual vaginal discharge. Overall, such cultivation of knowledge aids both individual well-being and public health by curbing complications at mass scale.

Market Challenge - Growing Resistance to Standard Antibiotics may Reduce Treatment Efficacy

One of the major challenges facing the bacterial vaginosis market is the growing resistance to standard antibiotic treatments being used currently. Bacterial vaginosis is commonly treated with antibiotics like metronidazole and clindamycin.

However, studies show that there is emerging resistance to these first-line treatment options. Resistance to metronidazole, the most commonly prescribed antibiotic for BV, has been reported to range between 15-40% globally. Similarly, resistance to other standard antibiotics is also on the rise. This poses a significant threat as it can reduce the efficacy of current treatment regimens and make BV increasingly difficult to treat.

With limited treatment options available, antibiotic resistance can potentially worsen patient outcomes and may lead to more frequent relapses or recurrent infections. It could also drive-up healthcare costs if patients need longer or more complex or expensive therapy options. This growing resistance further highlights the need for novel treatment alternatives with new mechanisms of action to circumvent emerging resistance issues and provide more effective solutions for BV management over the long term.

Market Opportunity - Development of Novel Treatments with Improved Safety Profiles

One of the major opportunities in the bacterial vaginosis market is the development of novel treatment options that have improved safety profiles over standard antibiotic therapies. Current first-line treatments like metronidazole and clindamycin are often associated with side effects like nausea, vomiting and diarrhea which can affect patient compliance.

Also, recent studies have indicated potential long-term side effects with prolonged antibiotic usage including increased risks of antibiotic resistance, allergy and opportunistic infections. This presents a large unmet need for safer and better-tolerated non-antibiotic treatment alternatives.

Novel drug formulations, new drug classes, probiotics or microbiome-based therapies can potentially address this need by providing safer options for BV with kinder profiles and potentially improved efficacy too. Their successful development and commercialization will capture a significant share of the market as they address the tolerability limitations of existing standard of care antibiotics greatly enhancing the patient experience and clinical outcomes for bacterial vaginosis treatment.

Prescribers preferences of Bacterial Vaginosis Market

Bacterial Vaginosis (BV) is commonly treated via a two-line approach. For mild cases, doctors typically prescribe a short course of topical therapy with anti-bacterials like clindamycin vaginal cream (Clindesse). This line of treatment provides relief from symptoms like discharge and odor within a week.

For moderate to severe cases, physicians opt for oral administration over a five-day period. First-line oral treatments include metronidazole (Flagyl) and tinidazole (Tindamax), which are generally low-cost generic options. If oral therapies don't work or symptoms reoccur after the firstline, doctors switch to second-line regimens. Secnidazole (Solosec) is a good second-line option as it requires just a single 2g dose. Another preferred choice is clindamycin capsules (Cleocin), though its longer seven-day course affects compliance.

The stage and recurrence rate of the infection also guides prescribers. Chronic or recurrent BV may signal underlying issues, prompting the use of combination therapy like metronidazole with vaginal probiotics or estrogen. Cost, ease of administration, and insurance coverage further impact drug selection at each line of treatment. This ensures a balance between efficacy, safety, adherence, and affordability for the patient.

Treatment Option Analysis of Bacterial Vaginosis Market

Bacterial Vaginosis has three main stages - mild, moderate, and severe - determined by symptoms and test results. For mild cases, over-the-counter treatment options include clindamycin creams applied intravaginally for 5-7 days. Brand names include Clindagel and Clindesse. This is a good first-line option due to ease of use.

For moderate to severe cases, oral antibiotics are preferred. Metronidazole is usually the first choice due to low cost and clinical evidence of effectiveness. Common brands are Flagyl and Metrogel. A 7-day regimen of 500mg twice daily is most effective. If metronidazole fails or is unsuitable, clindamycin pills (brand names Cleocin and Dalacin) can be prescribed for 7 days at 300mg twice daily. Combination therapy using metronidazole pills followed by clindamycin cream is also recommended for severe or recurrent cases to improve cure rates.

If the initial antibiotic treatment does not work, further testing is required to rule out other infections or to determine if the identified organism has developed resistance. Second-line options depend on risk factors and culture/sensitivity results but may include 10–14-day courses of newer antibiotics like tinidazole (Tindamax) or longer-term suppressive therapy using acidifying gels like Balance Activ. Close monitoring of high-risk cases is also imperative to manage recurrences early.

Key winning strategies adopted by key players of Bacterial Vaginosis Market

Product innovation and expansion: Launching new and improved treatment solutions has helped companies gain an edge. For instance, in 2019, Bayer launched a new treatment option Clindamax CV, an expansion of its existing Clindamycin products for BV. The gel formulation ensures higher concentration of the drug in the vaginal tissues where it is needed.

Acquisitions: Companies have grown their market share and product portfolios through strategic acquisitions. In 2020, Pfizer acquired Array BioPharma, adding several clinical-stage products to its pipeline including ARRay 514, an oral treatment under Phase 2 trials for BV. This strengthened Pfizer's position in women's health and the acquisition also brought in Array's R&D expertise.

Co-marketing agreements: Partnerships allow companies to leverage each other's core competencies and marketing networks. In 2016, Therapic signed an agreement with Meda Pharma to co-market and sell its prescription gel for BV, Solosec, across European markets. Within a year of launch, Solosec recorded €12 million in sales. This validated Therapic's marketing strategy of teaming up with an experienced partner in women's health.

Focus on emerging markets: With growing awareness and improving access to care, companies are investing in emerging regions like Asia Pacific and Latin America which are expected to be high growth markets.

Segmental Analysis of Bacterial Vaginosis Market

Insights, By Treatment: High Efficacy in Eradicating Causative Bacteria Drives Antibiotics Segment Dominance

In terms of treatment, antibiotics contributes the highest share of the market owing to their high efficacy in eradicating the causative bacteria. Antibiotics such as metronidazole are considered the first line treatment for bacterial vaginosis due to their ability to kill anaerobic bacteria like Gardnerella vaginalis that cause the infection.

Metronidazole, in particular, is highly effective due to its ability to penetrate the vaginal epithelium and maintain therapeutic concentrations in the vaginal fluid for extended periods. This ensures optimal treatment of the infection.

Other antibiotics used include clindamycin and tinidazole which also exhibit strong bactericidal activity against anaerobes. The immediate relief from symptoms provided by antibiotics further increases patient compliance with the treatment regimen. This leads to higher cure rates and reduces the risk of recurrence when compared to alternative treatment options.

The proven track record of antibiotics in symptom resolution coupled with physician recommendations drive their widespread adoption among patients and physicians alike. This widespread acceptance and proven efficacy have enabled antibiotics to capture the largest share of the bacterial vaginosis market.

Insights, By Route of Administration: Oral administration Enhances Treatment Convenience and Adherence

Among the routes of administration for bacterial vaginosis treatment, the oral segment contributes the highest share to the market owing to enhanced convenience and adherence. The oral route provides hassle-free self-administration of medication without the involvement of a healthcare provider. This allows for discreet treatment of the infection from the privacy of one's home.

The oral medications also do not require special applicators for insertion like topical formulations. This avoids any pain or mess associated with creams and gels. Further, oral medications have consistent and sustained release of the active ingredient, achieving therapeutic drug levels efficiently. Their simple once or twice daily dosing regimen fits well into patient's daily schedules. This boosts treatment adherence and compliance substantially.

As a result, the oral route delivers a more reliable treatment experience compared to topical options. The non-invasive nature and convenience of oral administration addresses a major patient preference for discreet and hassle-free treatment. This drives significantly higher uptake and adherences to oral medications compared to other administration routes in the bacterial vaginosis market.

Insights, By Distribution Channels: Accessibility and Wide Acceptance Drives Hospital Segment Leadership

Among the distribution channels in the bacterial vaginosis market, hospitals contribute the highest share owing to widespread accessibility and acceptance. As the primary point of care for most bacterial vaginosis patients, hospitals provide easy access to diagnosis and treatment options. Comprehensive gynecology services under one roof address all patient needs efficiently.

The hospital infrastructure also allows seamless coordination between specialist doctors, diagnostic facilities, pharmacies and support staff. This streamlines the patient journey from diagnosis to prescription and adherence management. Hospitals also benefit from large patient volumes enabling procurement of quality medicines in bulk at economical rates. The cost savings are passed on to patients in the form of affordable treatment packages.

Further, hospitals enjoy high credibility and trustworthiness among patients accustomed to receiving specialist care in this setting. Established brands and positive past experiences drive repeat patronization of hospital-based treatment. The confidence in hospital expertise combined with accessibility and affordability has made this the preferred and most widely accepted channel for bacterial vaginosis management.

Additional Insights of Bacterial Vaginosis Market

- High Recurrence Rates: Studies indicate that up to 30% of women experience a recurrence of bacterial vaginosis within three months of treatment, highlighting the need for more effective therapies.

- Global Impact: Bacterial vaginosis affects an estimated 21 million women worldwide annually, making it the most common vaginal infection among women of reproductive age.

- Introduction of Single-Dose Therapies: The approval of single-dose oral treatments like Solosec has significantly improved patient adherence by simplifying dosing regimens.

- Collaborative Research Efforts: Partnerships between pharmaceutical companies and research institutions are focusing on understanding the microbiome's role in bacterial vaginosis, which may lead to more targeted therapies.

Competitive overview of Bacterial Vaginosis Market

The major players operating in the Bacterial Vaginosis Market include Symbiomix Therapeutics (Lupin Pharmaceuticals), Bayer AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries, Abbott Laboratories, Novartis AG, Johnson & Johnson, and Merck & Co., Inc.

Bacterial Vaginosis Market Leaders

- Symbiomix Therapeutics (Lupin Pharmaceuticals)

- Bayer AG

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries

Bacterial Vaginosis Market - Competitive Rivalry, 2024

Bacterial Vaginosis Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Bacterial Vaginosis Market

- In June 2023, Symbiomix Therapeutics expanded the availability of Solosec to European markets. This move aims to enhance access to single-dose treatments, potentially improving patient compliance and outcomes. Symbiomix Therapeutics was acquired by Lupin Pharmaceuticals in 2017. While Lupin has a global presence, there were no official statements or regulatory approvals reported that confirm the expansion of Solosec into Europe by that date.

- In September 2023, Pfizer Inc. launched a clinical trial for a new probiotic therapy targeting bacterial vaginosis. The initiative could lead to alternative treatments that reduce reliance on antibiotics and address antibiotic resistance concerns.

Bacterial Vaginosis Market Segmentation

- By Treatment

- Antibiotics

- Metronidazole

- Clindamycin

- Tinidazole

- Antifungal Agents

- Probiotics

- Antibiotics

- By Route of Administration

- Oral

- Topical

- Creams

- Gels

- Suppositories

- By Distribution Channel

- Hospitals

- Clinics

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the bacterial vaginosis market?

The bacterial vaginosis market is estimated to be valued at USD 3.48 billion in 2024 and is expected to reach USD 6.26 billion by 2031.

What are the key factors hampering the growth of the bacterial vaginosis market?

The growing resistance to standard antibiotics may reduce treatment efficacy and adverse reactions associated with current medications can limit their use are the major factors hampering the growth of the bacterial vaginosis market.

What are the major factors driving the bacterial vaginosis market growth?

The global rise in bacterial vaginosis cases boosts the demand for effective treatments and enhanced public health campaigns are raising awareness about women's reproductive health are the major factors driving the bacterial vaginosis market.

Which is the leading treatment in the bacterial vaginosis market?

The leading treatment segment is antibiotics.

Which are the major players operating in the bacterial vaginosis market?

Symbiomix Therapeutics (Lupin Pharmaceuticals), Bayer AG, Pfizer Inc., Sanofi S.A., Teva Pharmaceutical Industries, Abbott Laboratories, Novartis AG, Johnson & Johnson, and Merck & Co., Inc. are the major players.

What will be the CAGR of the bacterial vaginosis market?

The CAGR of the Bacterial Vaginosis Market is projected to be 8.7% from 2024-2031.