Battery Energy Storage System Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Battery Energy Storage System Market is segmented By Battery Type (Lithium-ion Battery, Lead Acid Battery, Flywheel Battery, Other Battery Types), By ....

Battery Energy Storage System Market Size

Market Size in USD Bn

CAGR29.16%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 29.16% |

| Market Concentration | High |

| Major Players | EnerSys, BYD Company Limited, Siemens AG, LG Energy Solutions, Tesla Inc. and Among Others. |

please let us know !

Battery Energy Storage System Market Analysis

The battery energy storage system market is estimated to be valued at USD 8.15 Bn in 2024 and is expected to reach USD 48.88 Bn by 2031, growing at a compound annual growth rate (CAGR) of 29.16% from 2024 to 2031. Growth of the battery energy storage system market has been propelled by the need for reliable and sustainable sources of energy.

Battery Energy Storage System Market Trends

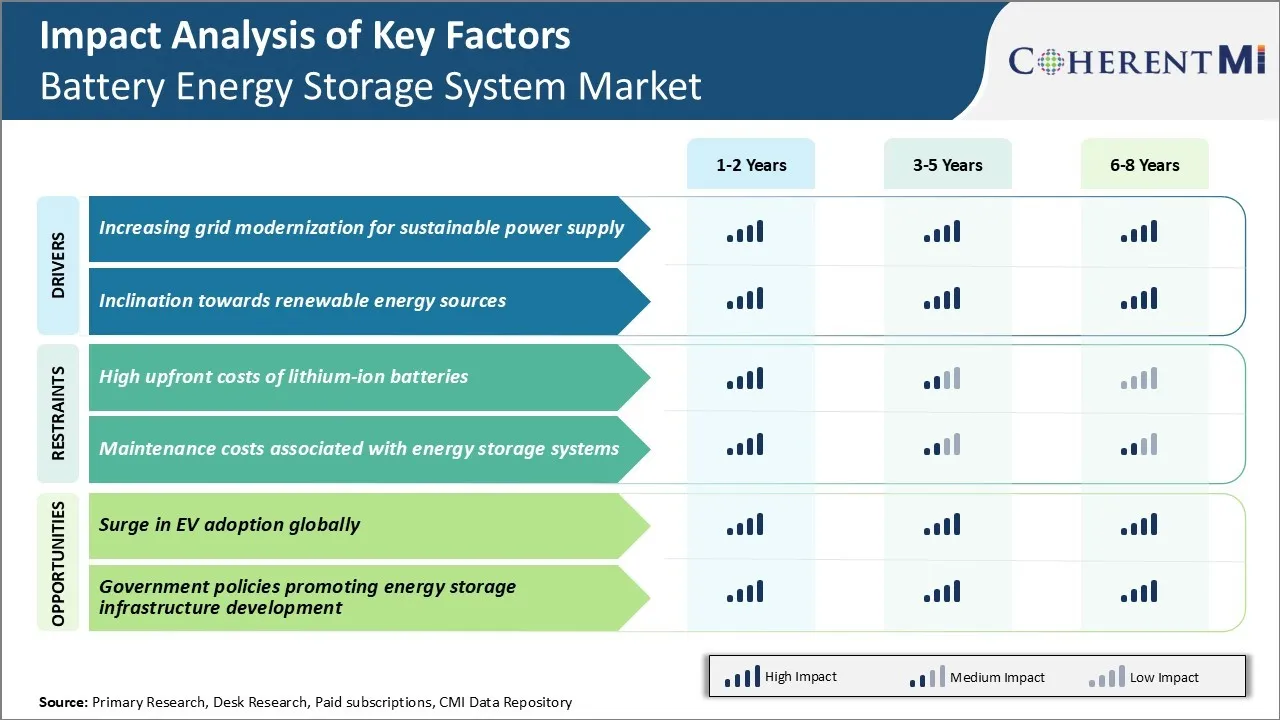

Market Driver - Increasing Grid Modernization for Sustainable Power Supply

With rise in population and increased industrialization, the demand for power is rising exponentially. Many countries are facing challenges to meet the growing demand as conventional power generation methods are limited. Advanced technologies such as battery energy storage systems play a crucial role in achieving the goals of grid modernization.

Battery energy storage systems act as a buffer by storing power when renewable production is high and supplementary power source when generation drops. It enhances the usability of clean power and allows for greater renewable integration within the existing electric grid framework. The capability to store energy from variable resources for use during demand peaks or grid failure makes battery energy storage systems key enablers for modern power infrastructure.

Investments in battery storage are thus integral to ongoing modernization programs worldwide. Strategic deployment of these flexible resources can fundamentally transform the grid into a smarter, sustainable and climate-friendly system. This is expected to drive growth of the battery energy storage system market.

Market Driver - Inclination Towards Renewable Energy Sources

According to projections, renewables are likely to contribute over 50% of total new power installation by 2050 globally. This massive scale transition brings opportunities as well challenges that battery energy storage systems can help address.

Proliferation of renewable power plants impacts grid operations as solar and wind power output fluctuates with weather and time of the day. However, restricting renewable curtailment is critical to meeting sustainability goals. Battery energy storage emerges as an attractive solution for this variability issue. Batteries can absorb excess generation from resources like solar during sunlight hours and discharge after sunset to supplement supply. For wind as well, they offset peaks and troughs in output helping grid integrate higher shares of this intermittent power source.

Batteries on site along renewables act as an energy management interface enabling seamless integration of distributed systems into centralized grid operations. Such localized battery energy storage systems facilitate clean self-consumption of power, reduces grid congestion and cost of transmission infrastructure expansion. This will continue to support growth of the battery energy storage system market in coming years.

Market Challenge - High Upfront Costs of Lithium-ion Batteries

One of the key challenges currently facing the battery energy storage system market is the high upfront costs of lithium-ion batteries. Lithium-ion batteries are considered crucial for energy storage applications due to their high energy density and long lifespan.

However, lithium-ion batteries also have significantly higher costs compared to other battery chemistries. The high content of cobalt and other rare earth materials needed for their production adds to these costs. At present, lithium-ion batteries can account for over 50% of the total upfront capital costs for large-scale energy storage projects. This high initial investment poses a hurdle for many potential commercial and industrial consumers to adopt battery energy storage systems.

Providers in the battery energy storage system market will need to drive down the costs of lithium-ion battery packs. It can be done through innovations in battery chemistry and manufacturing in order to make these systems more cost-competitive compared to traditional power generation sources. They may also offer innovative leasing options or long-term service contracts to help lower the financial barriers for customers.

Market Opportunity - Surge in EV Adoption Globally

One significant market opportunity for the battery energy storage industry is the surge in global adoption of electric vehicles. Most projections estimate that EVs will comprise a significant percentage of total vehicle sales worldwide within the next decade as concerns over emissions and fossil fuel dependence increase. This rising EV market will drive massive demand for lithium-ion battery production to meet these vehicles' energy storage needs.

While a majority of this demand will be absorbed by the automotive industry initially, it is also likely to result in economies of scale for lithium-ion battery manufacturing. This scale could facilitate reductions in battery costs over time and make battery storage technologies more viable for other applications. The boom in EV battery manufacturing may very well drive down costs to a point where energy storage becomes competitive with traditional generators across many use cases.

Key winning strategies adopted by key players of Battery Energy Storage System Market

Focus on lowering battery costs - One of the major factors impacting the battery energy storage systems market is the high cost of battery storage technologies. Players like Tesla, LG Chem and BYD have heavily invested in R&D to lower battery costs through economies of scale and technological advancements. Mass production efforts by Asian players have played a key role in bringing down module/pack level battery costs below $100/kWh in 2021, making BESS economically viable for more applications.

Diversify business models - AES Corporation implemented this strategy in 2017 and has since secured over 1.6 GW of contracted BESS projects globally. Similarly, Fluence offers storage systems along with software, ownership and operational support. This full-service model has helped the company sign deals for projects exceeding 2.1 GWh worldwide.

Bolster integration capabilities - The ability to integrate storage seamlessly into complex renewable energy and grid systems is crucial. Tesla acquired solar installer SolarCity in 2016 to combine solar and storage offerings. This allowed it to provide combined solar+storage solutions and helped Tesla capture over 80% of the California residential solar+storage market by 2020.

Segmental Analysis of Battery Energy Storage System Market

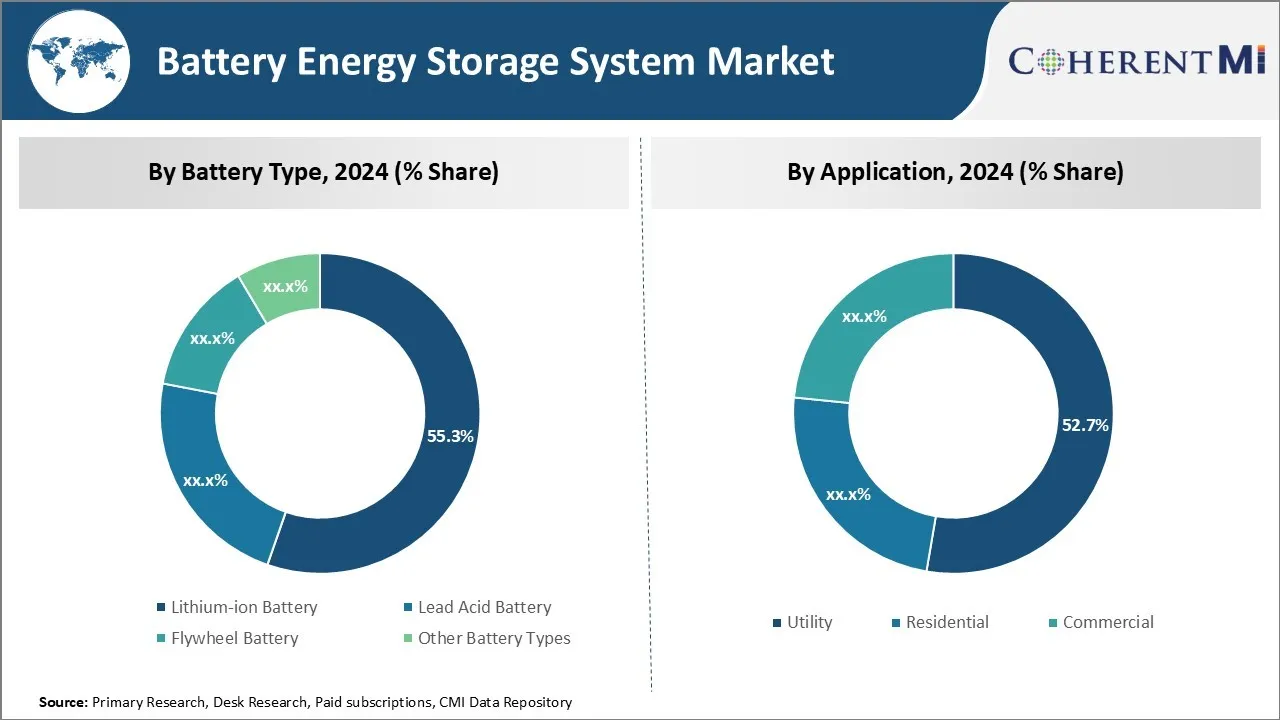

Insights, By Battery Type: Advancements in Lithium-ion Battery Technology

In terms of battery type, lithium-ion battery contributes 55.3% share of the battery energy storage system market in 2024, owning to continuous advancements made in lithium-ion battery technology in recent years. Lithium-ion batteries have seen significant rise in energy density and lifespan, making them a preferred choice for battery storage across various end-use industries.

Factors such as improved battery management systems, innovative cell chemistries and focus on battery safety have enhanced the reliability and performance of lithium-ion batteries. Their high energy-to-weight ratio allows for flexible modular design of battery packs for optimal power requirements.

Moreover, lithium-ion batteries can be rapidly charged and discharged multiple times before needing replacement. Leading battery manufacturers have also successfully reduced production costs of lithium-ion batteries through economies of scale and technical expertise gained over the years. This has increased their competitiveness against other battery types.

Overall, the superior technical capabilities of lithium-ion batteries have established their dominance in the battery energy storage system market.

Insights, By Application: Upsurge in Renewable Energy Integration

In terms of application, utility segment contributes the 52.7% share of the battery energy storage system market in 2024. This can be attributed to the upsurge in integration of renewable energy sources like solar and wind across power grids. Battery energy storage solutions play a pivotal role in mitigating the intermittent nature of renewable power generation. They help balance electricity demand and supply by absorbing excess renewable energy during off-peak periods and supporting the grid during deficit times. This enables greater utilization of clean energy resources. Government policies and regulations encouraging higher renewable portfolio standards have also boosted deployments of large-scale battery installations by utility companies. Energy storage augment the stability, flexibility and resilience of power networks integrated with renewable sources on a large scale.

Insights, By Connection Type: Proliferation of Microgrids

In terms of connection type, on-grid contributes the highest share of the battery energy storage system market. This growth can be credited to the proliferation of microgrids that leverage battery energy storage in conjunction with on-grid connections.

Microgrids incorporating distributed energy resources and battery storage optimize power delivery at the community level. They provide increased energy independence and reliability to remote areas as well as support primary grids during outages. Considerable research efforts are underway to develop advanced control strategies for islanded and grid-tied operations of microgrids. This offers avenues for greater synergy between on-grid battery energy storage systems and microgrid developments.

Capitalizing on such prospects will further augment adoption of on-grid battery energy storage solutions and growth of the battery energy storage system market going forward.

Additional Insights of Battery Energy Storage System Market

- Regional Dominance: The Asia-Pacific region leads the battery energy storage system market due to rapid industrialization, urbanization, and supportive government initiatives promoting energy storage adoption.

- Technology Preference: Lithium-ion batteries hold the largest share in battery energy storage system market due to their high energy density, efficiency, and declining costs.

- Utility Adoption: Several utilities are implementing large-scale battery energy storage projects to balance supply and demand, reduce reliance on fossil fuels, and improve grid resilience.

- Residential Growth: Homeowners are increasingly installing battery energy storage systems in conjunction with solar panels to achieve energy independence and cost savings. This drives important trends in the battery energy storage system market.

Competitive overview of Battery Energy Storage System Market

The major players operating in the battery energy storage system market include EnerSys, BYD Company Limited, Siemens AG, LG Energy Solutions, Tesla Inc., EVE Energy, Fluence Energy, General Electric, TotalEnergies, Tata Power Company Limited, Samsung SDI, Nissan Motor, VRB Energy, Black & Veatch Holding Company, ABB Ltd., Kokam, and Narada Asia Pacific.

Battery Energy Storage System Market Leaders

- EnerSys

- BYD Company Limited

- Siemens AG

- LG Energy Solutions

- Tesla Inc.

Battery Energy Storage System Market - Competitive Rivalry, 2024

Battery Energy Storage System Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Battery Energy Storage System Market

- In September 2023, Samsung SDI partnered with a leading renewable energy company to develop advanced battery storage solutions, focusing on enhancing energy density and lifecycle. This collaboration is set to accelerate innovation in the energy storage sector.

- In June 2023, LG Energy Solution announced a $1 billion investment in expanding its battery manufacturing facilities in Europe, aiming to meet the growing demand for battery energy storage systems. This expansion is expected to improve supply chains and reduce costs.

- In March 2023, Tesla, Inc. unveiled the Megapack XL, a large-scale battery designed for utility projects, enhancing grid stability and supporting renewable energy integration. This development strengthens Tesla's position in the battery energy storage system market.

Battery Energy Storage System Market Segmentation

- By Battery Type

- Lithium-ion Battery

- Lead Acid Battery

- Flywheel Battery

- Other Battery Types

- By Application

- Utility

- Residential

- Commercial

- By Connection Type

- On-grid

- Off-grid

- By Ownership

- Customer-owned

- Third-party-owned

- Utility-owned

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the battery energy storage system market?

The battery energy storage system market is estimated to be valued at USD 8.15 Bn in 2024 and is expected to reach USD 48.88 Bn by 2031.

What are the key factors hampering the growth of the battery energy storage system market?

High upfront costs of lithium-ion batteries and maintenance costs associated with energy storage systems are the major factors hampering the growth of the battery energy storage system market.

What are the major factors driving the battery energy storage system market growth?

Increasing grid modernization for sustainable power supply and inclination towards renewable energy sources are the major factors driving the battery energy storage system market.

Which is the leading battery type in the battery energy storage system market?

The leading battery type segment is lithium-ion battery.

Which are the major players operating in the battery energy storage system market?

EnerSys, BYD Company Limited, Siemens AG, LG Energy Solutions, Tesla Inc., EVE Energy, Fluence Energy, General Electric, TotalEnergies, Tata Power Company Limited, Samsung SDI, Nissan Motor, VRB Energy, Black & Veatch Holding Company, ABB Ltd., Kokam, and Narada Asia Pacific are the major players.

What will be the CAGR of the battery energy storage system market?

The CAGR of the battery energy storage system market is projected to be 29.16% from 2024-2031.