Cellulose Fiber Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Cellulose Fiber Market is segmented By Fiber Type (Natural Cellulose Fibers, Manufactured Cellulose Fibers), Triacetate), By Application (Textiles, He....

Cellulose Fiber Market Size

Market Size in USD Bn

CAGR4.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.8% |

| Market Concentration | Medium |

| Major Players | Lenzing AG, Sateri Holdings Limited, Grasim Industries Limited, Kelheim Fibres GmbH, Tangshan Sanyou Group and Among Others. |

please let us know !

Cellulose Fiber Market Analysis

The cellulose fiber market is estimated to be valued at USD 43.72 Bn in 2024 and is expected to reach USD 60.65 Bn by 2031, growing at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2031. The cellulose fiber market is expected to witness positive trends over the forecast period owing to growing awareness among consumers regarding benefits of cellulose fibers.

Cellulose Fiber Market Trends

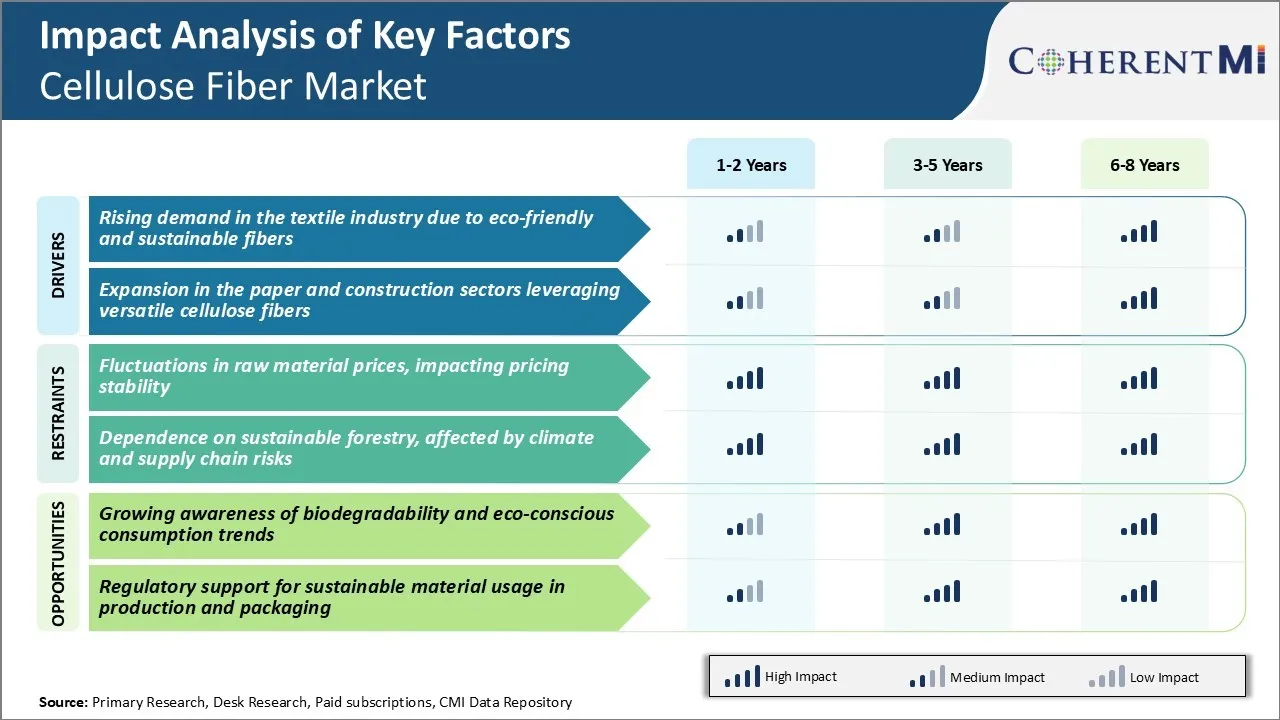

Market Driver - Rising Demand in the Textile Industry due to Eco-friendly and Sustainable Fibers

The textile industry has been increasingly adopting eco-friendly and sustainable fibers to reduce dependency on synthetic fabrics. Cellulose fibers offer textile manufactures an environmentally responsible alternative that maintains the high quality and aesthetics demanded by fashion brands and consumers alike.

Cellulose fibers are gaining huge popularity in the apparel segment. Leading brands and retailers recognize that trend-savvy, ethically-conscious Millennial and Gen Z consumers are willing to pay a premium for apparel made from sustainable materials. The comfort, softness, and breathability of cellulose fiber fabrics also make them appropriate for various seasonal collections. The apparel industry's shift towards eco-materials is fueling cellulose fiber demand, enabling manufacturers to expand output and driving overall revenue in cellulose fiber market.

Rising environmental regulations around the world pose an additional challenge for synthetic fiber producers. Strict norms governing effluent discharge and microfiber pollution from artificial fabrics present operational hurdles. This regulatory advantage is an important driver for the textile industry to incorporate more cellulose into future product mixes, which will also drive growth for cellulose fiber market.

Market Driver - Expansion in the Paper and Construction Sectors Leveraging Versatile Cellulose Fibers

Cellulose fibers find multifarious applications beyond apparel and home textiles. Their unique combination of high strength, flexibility, and moisture-resistance makes them invaluable to the paper and construction sectors. In paper manufacturing, cellulose fibers provide the raw material base and play a key structural role. This is attributable to proliferating e-commerce, as well as demand from food and pharmaceutical sectors during the current scenario in cellulose fiber market.

In construction, cellulose insulation batts made of recycled newspaper are gaining widespread acceptance. With excellent soundproofing and thermal insulation ability, cellulose batts help builders achieve important sustainability milestones mandated by green building standards. The construction industry is also newly exploring cellulose fiber composites for building components.

Thus, versatile applications across major end-use sectors highlight cellulose fibers as invaluable renewable resources. Continuous investments in R&D are expected to uncover even more innovative ways of leveraging their unique properties. This will propel growth avenues for players in the cellulose fiber market in paper, construction as well as other end-use sectors.

Market Challenge - Fluctuations in Raw Material Prices, Impacting Pricing Stability

One of the key challenges faced by the cellulose fiber market is fluctuations in raw material prices. As cellulose fiber is primarily made from plant-based renewable raw materials like wood pulp and plant fibers, the industry is highly dependent on agricultural commodities market.

Prices of these raw materials tend to witness significant fluctuations depending on various factors like weather conditions impacting crop yields, global supply-demand dynamics and geopolitical issues. The unpredictable nature of raw material costs forces fiber manufacturers to frequently revise their selling prices. This can adversely impact their sales volumes as well as long term customer relationships.

It also restricts medium to large firms from committing to strategic long term supply agreements. While some pricing power can be negotiated with large brand owners, small businesses find it extremely challenging to deal with fluctuating production costs. Overall, instability in key input prices poses a major risk for sustainable business planning and growth projections for players in the cellulose fiber market.

Market Opportunity - Growing Awareness of Biodegradability and Eco-conscious Consumption Trends

One of the major opportunities for the cellulose fiber market is the increasing focus on sustainability globally. With rising environmental concerns, there is a growing consumer awareness about the need to reduce plastic pollution and use of renewable fibers.

More shoppers are now seeking apparels, home textiles and other products containing fibers like cotton, jute and bamboo which have lower environmental footprint. This works as a unique selling point for cellulose fiber producers to market their products as environment-friendly alternatives.

With policy level support as well, the biodegradability aspect is becoming an important driver of demand across industries utilizing fibers. Manufacturers can capitalize on the growing eco-conscious consumption trend by developing innovative applications of cellulose fibers in food packaging, agricultural textiles, personal care etc.

Key winning strategies adopted by key players of Cellulose Fiber Market

Product innovation: Developing new and innovative products is a key strategy that has helped players in cellulose fiber market like Lenzing AG gain an edge. In 2018, Lenzing launched its new REFibra cellulose fiber made from recycled wood and cotton waste. This fiber has high sustainability credentials. Through continuous innovation, Lenzing has established itself as a leader in specialty fibers including Tencel and EcoVero.

Market expansion: Companies are expanding their presence in Asia, which is a major market for cellulose fibers used in clothing and hygiene products. In 2020, Grasim Industries acquired the viscose business of Lenzing AG to strengthen its position in India and expand in Asia.

Sustainability focus: Customers are increasingly preferring eco-friendly cellulose products. Companies like Lenzing and Aditya Birla have therefore focused on sustainable forestry, using renewable raw materials and reducing environmental footprint.

Segmental Analysis of Cellulose Fiber Market

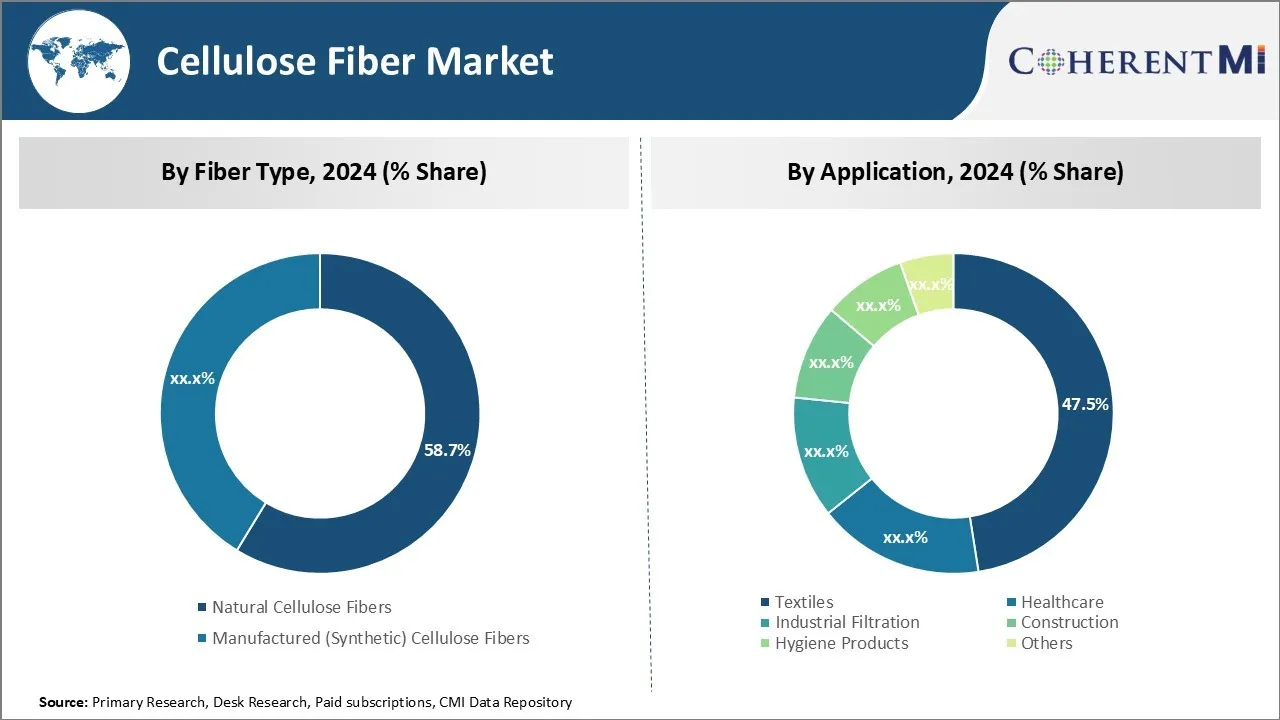

Insights, By Fiber Type: Natural Cellulose Fibers - Natural is Naturally Superior

In terms of fiber type, natural cellulose fibers contribute 58.7% share of the cellulose fiber market in 2024, owing to their inherent advantages over synthetic options. As plants' original means of structural support and protection, cotton, jute, and wood pulp possess a chemical composition finely tuned by evolution for strength, flexibility, and sustainability. Breathability is another key advantage - the tight weave of natural fibers allows air circulation while blocking unwelcome elements like pollen or pollutants.

Perhaps most importantly, natural cellulosics are fully biodegradable at the end of their useful lifespan. Breaking down readily without harming the environment, they alleviate concerns over plastic pollution and need for landfill space. This environmental friendliness appeals strongly to eco-conscious consumers and industries aiming for greener credentials.

Some fibers even improve with wear, taking on a softened patina endorsed by aficionados of everything from classic denim to handwoven khadi. Their inherent nostalgia and connection to nature nourish demand in an era where authenticity and wellness increasingly drive purchasing decisions.

Insights, By Application: Textiles is Where the Growth Lies

Within applications of cellulosic fibers, the textiles segment contributes 47.5% share in cellulose fiber market in 2024. This is due to extensive, versatile use across all levels of clothing manufacture. From intimate apparel to heavy outerwear, cellulose-derived threads are indispensable in almost every type of fabric. They form the backbone of essential commodities like cotton t-shirts and polyester trousers as well as elevated luxury materials incorporated into high fashion.

Demographics also favor ongoing growth in textiles. Consumer priorities around fitness, wellness and sustainability further lift cellulosic fibers as preferences pivot toward natural, breathable materials perceived as healthier for active lifestyles and the planet.

Technical textiles represent another area of expansion. Specialized cellulose-based products meet exacting requirements in medical fabrics, filters, geotextiles and other industrial nonwovens. Here, properties like biocompatibility, fine microstructures, uniformity, and tailored polymer mixtures optimize functionality. This will drive important trends in the cellulose fiber market in the coming years.

Additional Insights of Cellulose Fiber Market

- Asia-Pacific Dominance: The region holds the largest share in the cellulose fiber market due to abundant raw material availability and a robust textile industry.

- Environmental Impact Awareness: Growing awareness about the environmental impact of synthetic fibers is steering consumers towards cellulose fibers.

- The shift of major fashion brands towards sustainable materials has led to increased partnerships with cellulose fiber manufacturers.

- Governments in Asia-Pacific countries are promoting the use of natural fibers to boost rural economies, influencing market dynamics in the cellulose fiber market.

Competitive overview of Cellulose Fiber Market

The major players operating in the cellulose fiber market include Lenzing AG, Sateri Holdings Limited, Grasim Industries Limited, Tangshan Sanyou Group, Kelheim Fibres GmbH, Fulida Group Holdings Co., Ltd., Eastman Chemical Company, Thai Rayon Public Co. Ltd., CFF GmbH & Co. KG, China Bambro Textile Co., Ltd., Shandong Helon Textile Sci. & Tech. Co. Ltd., and China Hi-Tech Group Corporation.

Cellulose Fiber Market Leaders

- Lenzing AG

- Sateri Holdings Limited

- Grasim Industries Limited

- Kelheim Fibres GmbH

- Tangshan Sanyou Group

Cellulose Fiber Market - Competitive Rivalry, 2024

Cellulose Fiber Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cellulose Fiber Market

- In June 2024, Eastman introduced Naia™ Renew, a sustainable fiber composed of 60% sustainably sourced wood pulp and 40% certified recycled content. This innovative material is produced through Eastman's molecular recycling technology. The technology breaks down hard-to-recycle waste into its molecular components, combining them with wood pulp to create new cellulose fibers.

- In February 2024, Eastman and Cargill partnered to create bio-based packaging materials, boosting eco-friendly packaging options.

- In August 2023, Sateri expanded its Lyocell fiber production capacity by 10,000 tonnes. This increase was achieved through the successful commencement of production at Sateri (Nantong) Fibre Co., Ltd., bringing Sateri's total annual Lyocell capacity to 250,000 tonnes.

- In May 2023, Daicel Corporation announced a significant investment to expand its cellulose esters production capacity in Japan, aiming to meet the increasing demand in the region.

Cellulose Fiber Market Segmentation

- By Fiber Type

- Natural Cellulose Fibers

- Cotton

- Jute

- Wood Pulp

- Others

- Manufactured (Synthetic) Cellulose Fibers

- Viscose

- Lyocell

- Modal

- Acetate

- Triacetate

- Natural Cellulose Fibers

- By Application

- Textiles

- Healthcare

- Industrial Filtration

- Construction

- Hygiene Products

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the cellulose fiber market size?

The cellulose fiber market is estimated to be valued at USD 43.72 Bn in 2024 and is expected to reach USD 60.65 Bn by 2031.

What are the key factors hampering the growth of the cellulose fiber market?

Fluctuations in raw material prices, impacting pricing stability, and dependence on sustainable forestry, affected by climate and supply chain risks, are the major factors hampering the growth of the cellulose fiber market.

What are the major factors driving the cellulose fiber market growth?

Rising demand in the textile industry and expansion in the paper and construction sectors leveraging versatile cellulose fibers are the major factors driving the cellulose fiber market.

Which is the leading fiber type in the cellulose fiber market?

The leading fiber type segment is natural cellulose fibers.

Which are the major players operating in the cellulose fiber market?

Lenzing AG, Sateri Holdings Limited, Grasim Industries Limited, Tangshan Sanyou Group, Kelheim Fibres GmbH, Fulida Group Holdings Co., Ltd., Eastman Chemical Company, Thai Rayon Public Co. Ltd., CFF GmbH & Co. KG, China Bambro Textile Co., Ltd., Shandong Helon Textile Sci. & Tech. Co. Ltd (China), and China Hi-Tech Group Corporation are the major players.

What will be the CAGR of the cellulose fiber market?

The CAGR of the cellulose fiber market is projected to be 4.8% from 2024-2031.