Ceramic Sanitary Ware Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Ceramic Sanitary Ware Market is segmented By Product Type (Toilets (One-Piece Toilets, Two-Piece Toilets, Wall-Hung Toilets), Wash Basins (Pedestal Ba....

Ceramic Sanitary Ware Market Size

Market Size in USD Bn

CAGR7.88%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.88% |

| Market Concentration | Medium |

| Major Players | Roca Sanitario S.A., Toto Ltd., Kohler Co., Villeroy & Boch AG, Duravit AG and Among Others. |

please let us know !

Ceramic Sanitary Ware Market Analysis

The ceramic sanitary ware market is estimated to be valued at USD 47.71 Bn in 2024 and is expected to reach USD 81.15 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.88% from 2024 to 2031. The ceramic sanitary ware market is expected to witness significant growth with rising commercial and residential construction activities across developed and developing nations are supporting the market expansion.

Ceramic Sanitary Ware Market Trends

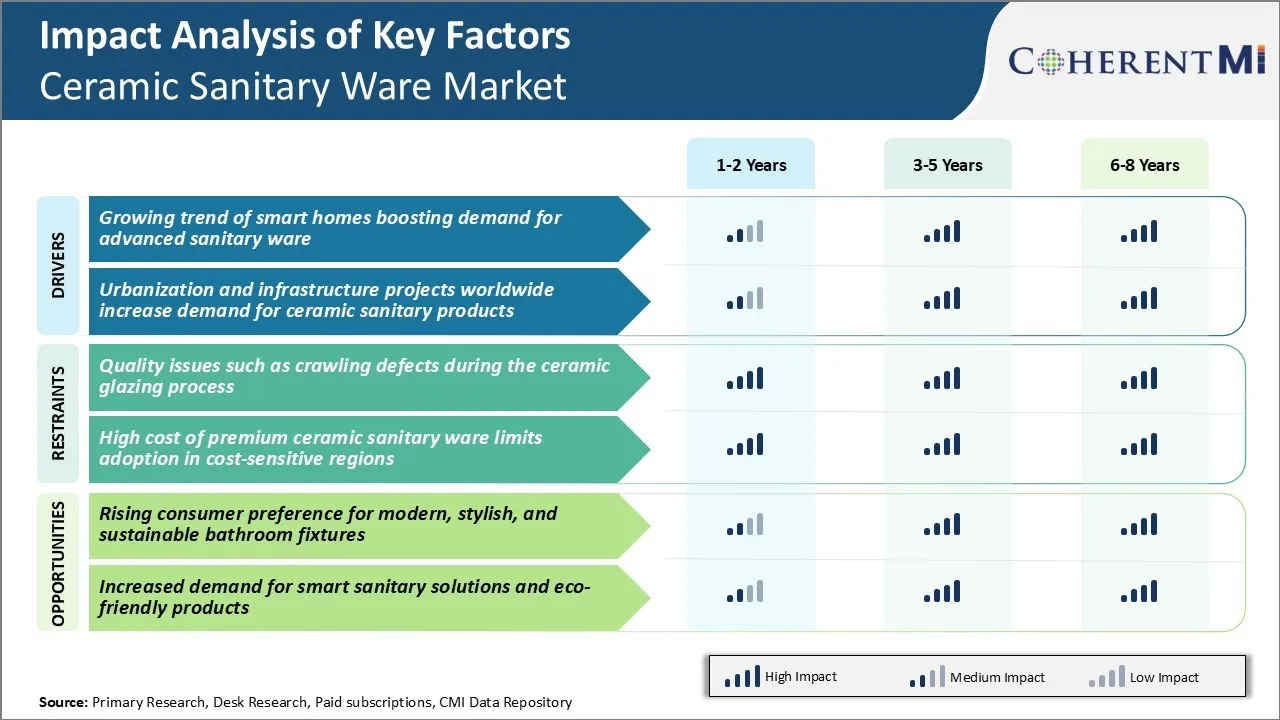

Market Driver - Growing Trend of Smart Homes Boosting Demand for Advanced Sanitary Ware

More homes become increasingly connected and integrated systems become the norm. This growing trend towards smart homes is boosting demand for advanced sanitary ware solutions. Homeowners want to outfit their homes not only with aesthetic and durable products, but ones that enhance functionality, convenience, and overall user experience through innovative technologies and features.

Ceramic sanitary ware manufacturers have recognized this shift in consumer preferences. Smart toilets represent a pioneering innovation in this space, enabling hands-free flushing and lids that open automatically upon approach. Voice assistants have also been incorporated, allowing users to operate functions like flush, open/close lid, bidet nozzle position through simple voice commands. Furthering convenience and hygiene, some advanced models include integrated nightlights, warm air dryers, heated seats, and automatic closing mechanisms.

Wireless connectivity further enhances usability, with the ability to adjust settings, monitor supplies and receive alerts through accompanying mobile apps. Luxury brands are differentiating themselves through spa-like additions like aroma-therapy, water purification systems and streamers simulating natural sunlight.

As smart home technologies become more mainstream, design innovations marrying simplicity, minimalism, and multifunctionality will continue to drive growth of the ceramic sanitary ware market.

Market Driver - Urbanization and Infrastructure Projects Worldwide Increase Demand for Ceramic Sanitary Ware

Over half of the global population now lives in urban areas, driving massive construction activity for housing, commercial and industrial infrastructure. International agencies estimate that annual global infrastructure investment needs could exceed $94 trillion by 2040 to accommodate rising urbanization. Trillions of dollars have already been committed to such transformative urban infrastructure projects over the next decades.

Rapid rates of urban construction generate immense demand for sanitary fixtures across industries like housing, real estate, hospitality and commercial offices. Bathroom suites, water closets, lavatories, commercial urinals, and bidets constitute the core product segments.

Infrastructure projects additionally create opportunities in areas such as ceramic tile manufacturing for flooring/walls as well as vitrified pipes for sewage networks. With urbanization set to accelerate in the decades ahead, steady consumption growth can be expected from emerging ceramic sanitary ware markets involved in large-scale urban development programs.

Market Challenge - Quality Issues such as Crawling Defects During the Ceramic Glazing Process

One of the major challenges faced by the ceramic sanitary ware market is the quality issues arising during the ceramic glazing process. The glazing process involves applying a glaze or enamel coating to the ceramic objects to make them waterproof and durable.

However, there are chances of defects creeping in during this stage. Issues such as crawling defects can occur where the glaze cracks or bubbles when being fired. These crawling defects can compromise the water resistance and structural integrity of the ceramic sanitaryware. Such quality issues damage the brand value of manufacturers and lead to warranty claims. Considerable time and effort are spent in quality checking and re-working defective products, raising production costs.

Players in the ceramic sanitary ware market need to invest in advanced glazing technology and stringent quality control systems to minimize such defects. Improving the glazing process consistency remains a key area of focus for ceramic sanitaryware producers to deliver a defect-free customer experience.

Market Opportunity - Rising Demand for Modern, Stylish, and Sustainable Bathroom Fixtures

The ceramic sanitary ware market is presented with a tremendous opportunity in the rising consumer preference for modern, stylish and sustainable bathroom fixtures. Younger consumers today seek designer and avant-garde bathroom products that reflect their personality and taste. This has prompted manufacturers to launch new collections with on-trend colors, unique textures and stylish features on a frequent basis.

There is also growing demand for eco-friendly sanitaryware made from recycled materials or ones that optimize water usage. Producing sophisticated yet environment-friendly ranges that appeal to today's lifestyle-focused customers can unlock exponential growth prospects. Market players need to closely track design trends and sustainability aspects.

Developing collaborative ties with architects and interior designers will help gain insights into future bathroom aesthetics. Those able to quickly adapt to emerging consumer demands stand to boost their market share in the growing ceramic sanitary ware market.

Key winning strategies adopted by key players of Ceramic Sanitary Ware Market

Focus on product innovation - In 2015, Kohler launched its DTV+ collection with revolutionary dual-flush toilets that use 30% less water per flush. This helped Kohler to differentiate its offering and gain revenue share in ceramic sanitary ware market.

Leverage digital marketing – In 2018, Roca spent over 20% of its marketing budget on SEO, social media campaigns, and content marketing. This helped Roca to increase online visibility and conversations around its brand.

Expand into new markets - In 2020, Lixil acquired American Standard, a leading brand in North America, to strengthen its presence and market share in the US and Canada.

Enhance distribution networks - In the last 5 years, Duravit has expanded its dealer networks in Europe, China, and India by over 25%. Today it reaches customers in 150+ countries through numerous wholesale showrooms and retail stores.

Focus on cost efficiencies - Between 2017-20, Rioc adapted Industry 4.0 technologies in its plants, cutting production costs by 12-15% and boosting margins.

Segmental Analysis of Ceramic Sanitary Ware Market

Insights, By Product Type: Rising Hygiene Standards Drive Toilet Segment Growth

In terms of product type, toilets are projected to account for 42.4% share of the ceramic sanitary ware market in 2024. This is due to rapidly rising hygiene standards among consumers. Toilets have become an essential product for any bathroom space in residential as well as commercial properties. The increasing disposable incomes have enabled consumers to invest in quality toilets from leading brands.

Two-piece toilets have gained more popularity compared to one-piece models as they offer easier cleaning and maintenance. Wall-hung variants are also gaining traction because of their modern aesthetic appeal and space saving capability.

Leading manufacturers have introduced innovative designs, personalized styling options and hands-free flushing mechanisms to cater to the changing consumer preferences. Growing health awareness and focus on hygienic living has ensured steady demand growth of the toilet segment over other bathroom fixtures.

Insights, By Application: Residential Segment Leads on Back of Housing Growth and Infra Modernization

In terms of application, residential contributes 66.7% share of the ceramic sanitary ware market in 2024. This is due to robust growth of the housing sector and infrastructure modernization initiatives undertaken by various governments. Rapid urbanization and growing nuclear families have fueled demand for new residential constructions across major countries.

Additionally, rising disposable incomes have encouraged homeowners to refurbish or renovate their bathroom spaces more frequently. This presents a recurring sales opportunity for ceramic sanitary ware producers in the residential segment. Both individual home builders as well as large real estate developers are making significant investments in building world-class residential complexes with modern interior finishes including premium ceramic sanitary ware products.

Insights, By Technology: Slip Casting Most Preferred for its Cost Effectiveness and Productivity

In terms of technology, slip casting contributes the highest share of the ceramic sanitary ware market in 2024, owing to its inherent advantages over other manufacturing processes. Slip casting allows for mass production of standardized ceramic sanitary ware designs in a cost-effective manner meeting large scale demand.

In slip casting, clay suspensions known as slips are poured into porous plaster molds where water is absorbed leaving behind a clay wall that takes the shape of the mold. After drying and firing, durable ceramic pieces are obtained. Compared to pressure and tape casting methods, slip casting yields more uniform thickness and intricate detailing in finished products.

It also enables quick mold turnover and modification. Given the high-volume requirements of the industry, slip casting has remained the technology of choice for most established ceramic sanitary ware manufacturers.

Additional Insights of Ceramic Sanitary Ware Market

- Consumer Preference Trends: There is a growing inclination towards minimalist designs and space-saving sanitary ware solutions in urban housing projects.

- Impact of COVID-19: The pandemic heightened the focus on hygiene, accelerating the adoption of touchless and antibacterial ceramic sanitary ware products.

- Asia Pacific dominated the ceramic sanitary ware market in 2023 with a 54% share, driven by large infrastructure projects.

- North America is rapidly expanding due to the popularity of high-end bathroom renovations.

- The washbasins segment is expected to grow the fastest, meeting demand for aesthetically pleasing and advanced ceramic sanitary ware.

Competitive overview of Ceramic Sanitary Ware Market

The major players operating in the ceramic sanitary ware market include Roca Sanitario S.A., Toto Ltd., Kohler Co., Villeroy & Boch AG, Duravit AG, LIXIL Group Corporation, Hansgrohe Group, Geberit International AG, CERA Sanitaryware Ltd., Somany Ceramics Ltd., Jaquar Group, HSIL Limited, and Ideal Standard International S.A.

Ceramic Sanitary Ware Market Leaders

- Roca Sanitario S.A.

- Toto Ltd.

- Kohler Co.

- Villeroy & Boch AG

- Duravit AG

Ceramic Sanitary Ware Market - Competitive Rivalry, 2024

Ceramic Sanitary Ware Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Ceramic Sanitary Ware Market

- In August 2023, Kohler Co. launched a new line of smart toilets featuring voice-activated controls and personalized cleansing settings, enhancing user convenience and hygiene.

- In August 2023, Duravit AG announced plans to establish the world's first climate-neutral ceramic production facility in Matane, Québec, Canada. This initiative aims to enhance sustainability in the sanitaryware industry. The facility is scheduled to commence operations in early 2025 and is expected to create 240 new jobs.

- In June 2023, Toto Ltd. announced the expansion of its manufacturing facility in Vietnam to meet the increasing demand in the Asia Pacific region, aiming to reduce production costs and delivery times.

- In June 2023, Prince Pipes and Fittings Limited introduced a luxury collection of faucets and sanitaryware under the brand name "Prince Bathware." This collection of ceramic sanitary ware draws inspiration from European bathware trends. It includes a comprehensive range of products such as overhead showers, hand showers, health faucets, sensor taps, and various bathroom accessories.

- In February 2023, GROHE introduced the Lineare faucet collection, emphasizing a minimalist and cosmopolitan design. The Lineare series features sleek, cylindrical bodies paired with thin rectangular spouts and handles. It creates harmonious compositions that align with modern architectural aesthetics.

Ceramic Sanitary Ware Market Segmentation

- By Product Type

- Toilets

- One-Piece Toilets

- Two-Piece Toilets

- Wall-Hung Toilets

- Wash Basins

- Pedestal Basins

- Wall-Hung Basins

- Countertop Basins

- Corner Basins

- Urinals

- Stall Urinals

- Corner Urinals

- Sensor Urinals

- Cisterns and Bidets

- Toilets

- By Application

- Residential

- Commercial

- Hospitality

- Healthcare Facilities

- Corporate Offices

- Public Infrastructure

- By Technology

- Slip Casting

- Pressure Casting

- Tape Casting

- Isostatic Casting

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the ceramic sanitary ware market?

The ceramic sanitary ware market is estimated to be valued at USD 47.71 Bn in 2024 and is expected to reach USD 81.15 Bn by 2031.

What are the key factors hampering the growth of the ceramic sanitary ware market?

Quality issues such as crawling defects during the ceramic glazing process, and high cost of premium ceramic sanitary ware are the major factors hampering the growth of the ceramic sanitary ware market.

What are the major factors driving the ceramic sanitary ware market growth?

Growing trend of smart homes boosting demand for advanced sanitary ware and growing infrastructure projects worldwide, which increase demand for ceramic sanitary products, are the major factors driving the ceramic sanitary ware market.

Which is the leading product type in the ceramic sanitary ware market?

The leading product type segment is toilets.

Which are the major players operating in the ceramic sanitary ware market?

Roca Sanitario S.A., Toto Ltd., Kohler Co., Villeroy & Boch AG, Duravit AG, LIXIL Group Corporation, Hansgrohe Group, Geberit International AG, CERA Sanitaryware Ltd., Somany Ceramics Ltd., Jaquar Group, HSIL Limited, and Ideal Standard International S.A. are the major players.

What will be the CAGR of the ceramic sanitary ware market?

The CAGR of the ceramic sanitary ware market is projected to be 7.88% from 2024-2031.