Chronic Pulmonary Hypertension Diagnostic Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Chronic Pulmonary Hypertension Diagnostic Market is segmented By Drug Class (Endothelin Receptor Antagonists, Phosphodiesterase-5 Inhibitors, Prostacy....

Chronic Pulmonary Hypertension Diagnostic Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | High |

| Major Players | Johnson & Johnson (Actelion Pharmaceuticals), Bayer AG, United Therapeutics Corporation, GlaxoSmithKline plc, Pfizer Inc. and Among Others. |

please let us know !

Chronic Pulmonary Hypertension Diagnostic Market Analysis

The chronic pulmonary hypertension diagnostic market is estimated to be valued at USD 7.5 billion in 2024 and is expected to reach USD 12.15 billion by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. The increasing prevalence of chronic pulmonary hypertension globally is driving the need for early and accurate diagnosis of the condition. Rising healthcare expenditure and improved access to diagnostic tests are also fueling the growth of this market.

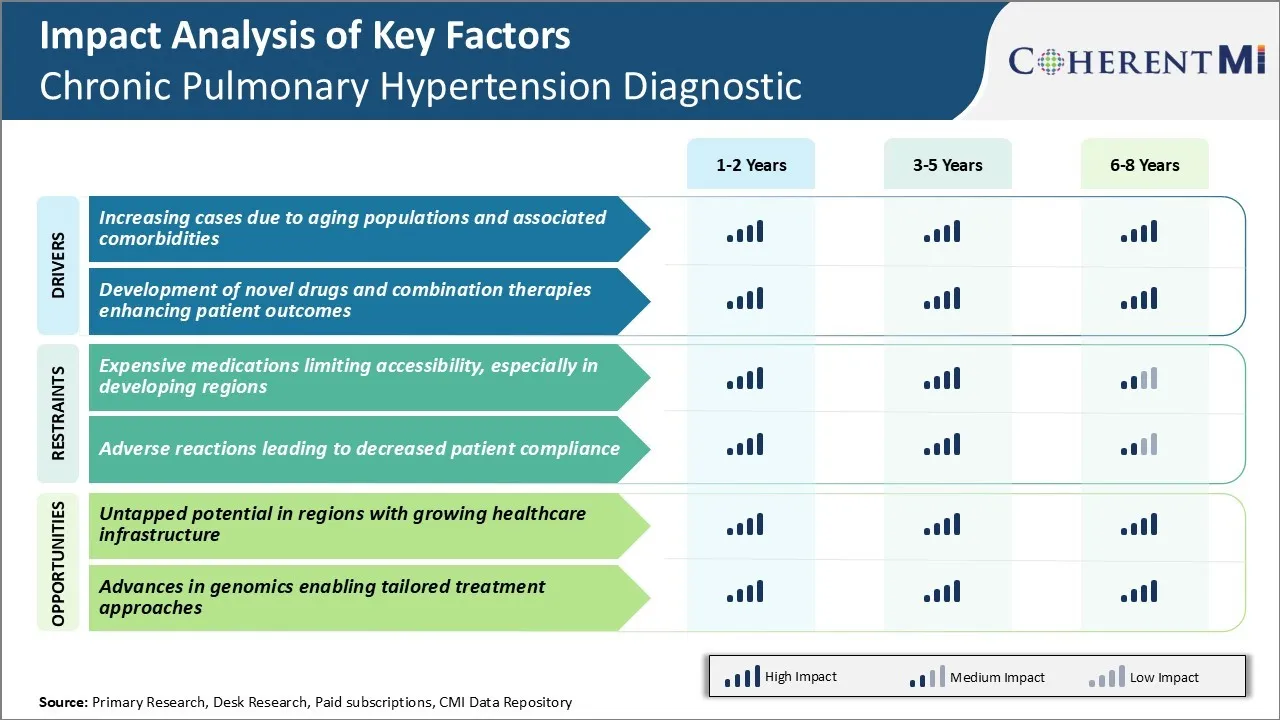

Chronic Pulmonary Hypertension Diagnostic Market Trends

Market Driver - Increasing Cases due to Aging Populations and Associated Comorbidities

Chronic Pulmonary Hypertension is a serious lung condition where the blood pressure in the pulmonary arteries and vessels that carry blood from the heart to the lungs rises to dangerously high levels. This put unnecessary strain on the heart and limits its ability to pump blood to the lungs so that they can oxygenate it. The condition is usually seen in elderly population above the age of 65 years.

As the general population continues to age globally, the prevalence of age-related comorbid conditions such as chronic obstructive pulmonary disease (COPD) and interstitial lung disease which are known risk factors for COPD are also increasing. With low respiratory reserve and decreased lung function, the aged lungs become more susceptible to develop pulmonary vascular remodeling and hypertension over time.

It has been well established that COPD occurs more commonly as a secondary condition in patients with other predisposing diseases rather than as a primary pulmonary disorder alone. Therefore, the rising burden of COPD, lung fibrosis and other lung infections in sync with overall global aging trends is expected to translate into a growing pool of at-risk patients developing COPD in the coming years.

Market Driver - Development of Novel Drugs and Combination Therapies Enhancing Patient Outcomes

Traditionally, right heart failure due to long-standing severe pulmonary hypertension was largely untreatable and carried a very poor prognosis with average survival of less than 3 years from time of diagnosis. However, better understanding of the patho-physiological mechanisms has facilitated development of new targeted drugs with novel mechanisms of action.

More recently, the approval of newer compounds like Seralini, Riociguat and Selexipag acting via different pathways have provided clinicians with improved options to combine these agents based on individual patient profile to derive maximum therapeutic benefits. The availability of oral as well as nebulized forms of these modern drugs compared to only parenteral prostanoids previously has also enhanced treatment convenience.

Moreover, the recognition of various clinical subtypes and phenotypes of PH has enabled personalized combination regimen approaches tailored for a given patient. All these favorable changes in diagnostic evaluation and management over time are translating to appreciable increases in median as well as long term survival figures for PH patients when treated at experienced centers using the latest treatment algorithms.

Market Challenge - Expensive Medications Limiting Accessibility, Especially in Developing Regions

One of the key challenges faced by the Chronic Pulmonary Hypertension Diagnostic Market is the high cost of medications, limiting their accessibility especially in developing regions. Treating chronic pulmonary hypertension requires lifelong medication, usually generic versions of endothelin receptor antagonists, PDE-5 inhibitors or prostanoids.

However, these drugs can be quite expensive, costing thousands of dollars annually for patients in countries with advanced healthcare systems. This high cost becomes a significant barrier in developing countries with lower incomes and weaker healthcare infrastructure and insurance systems.

As a result, many patients in Africa, Latin America and parts of Asia simply cannot afford the required lifelong medication therapy. This leads to poor disease control and management of chronic pulmonary hypertension in these regions. While generic versions provide some relief, the overall treatment cost remains beyond the reach of a large population globally.

Unless more cost-effective solutions are developed, this market access issue will continue to hamper full realization of growth potential across all regions.

Market Opportunity - Untapped Potential in Regions with Growing Healthcare Infrastructure

One major opportunity area for the chronic pulmonary hypertension diagnostic market lies in regions that are witnessing increased investments and expansion of their healthcare infrastructure. Many developing countries in Asia, Latin America, Eastern Europe and parts of Africa have been steadily devoting greater resources to strengthen their healthcare systems over the past decade. This includes aspects like greater health insurance coverage, more public medical facilities and higher healthcare spending as a proportion of GDP.

As a result, populations in these regions now have enhanced access to diagnosis, monitoring and prescription medication facilities for chronic conditions. Chronic pulmonary hypertension represents an untapped potential market segment in such countries.

With growing awareness and ability to pay for treatment, demand is poised to rise sharply in the coming years. Market players need to leverage these healthcare infrastructure developments and target these emerging markets proactively with appropriate solutions. This will ensure maximum penetration of diagnostic testing and medication for chronic pulmonary hypertension management across global patient populations.

Prescribers preferences of Chronic Pulmonary Hypertension Diagnostic Market

Chronic pulmonary hypertension (CPH) is classified into four functional stages based on worsening symptoms and limitation in physical activity. In early stages 1-2, prescribers typically opt for calcium channel blockers (CCBs) like Amlodipine as first-line treatment to lower pulmonary arterial pressure. Ambrisentan (Letairis) and Bosentan (Tracleer), endothelin receptor antagonists (ERAs), are also prescribed either as monotherapy or in combination with PDE-5 inhibitors.

As the disease progresses to stages 3-4, intravenous/subcutaneous prostacyclin analogs like Epoprostenol (Flolan) and Iloprost (Ventavis) which work via vasodilation are added. Long-acting prostanoids like Treprostinil (Tyvaso, Remodulin) which can be inhaled or administered via infusion are increasingly preferred over short-acting forms due to better quality of life and comfort.

When prostanoids fail to control symptoms, prescribers resort to combination therapy involving one or more drugs from different classes - an ERA with a PDE-5 inhibitor (e.g. Tadalafil/Adcirca along with Uptravi) or an analogue (Treprostinil along with Orenitram). Lung transplantation is considered for eligible patients at stage 4 as medical management fails.

Factors like severity of symptoms, side effect profiles, route of administration, insurance coverage and cost heavily influence the choice of medications at each stage of CPH management.

Treatment Option Analysis of Chronic Pulmonary Hypertension Diagnostic Market

CPH has four stages based on the severity of symptoms and limitations to physical activity. Stage I involves mild symptoms with slight limitations. Stage II shows meaningful symptoms with moderate exertion. Stage III reflects severe symptoms at rest. Stage IV is advanced disease with inability to perform even simple tasks.

For Stage I/II, monotherapy with endothelial receptor antagonists is preferred. These relax pulmonary arteries and improve hemodynamics with minimal side effects. Tracleer (bosentan) and Letairis (ambrisentan) are commonly used due to favorable safety profiles.

As symptoms progress to Stage III, combination therapy is recommended to better control symptoms. Adding a Phosphodiesterase type-5 inhibitor to an endothelin receptor antagonist leverages dual mechanisms of action. Adcirca (tadalafil) paired with Tracleer provides marked improvements to 6-minute walk distance and pulmonary hemodynamics compared to either drug alone.

For advanced Stage III/IV cases where tolerability or refractoriness occur, prostanoids may be introduced. Prostacyclin analogs like Orenitram (treprostinil) and Tyvaso (treprostinil inhalation solution) carry higher risks but can stabilize the disease in many severe patients. Sildenafil can also be substituted for tadalafil if needed.

Overall, a stepped approach moving from monotherapy to combinations to prostanoids allows maximizing benefits while balancing tolerability based on the stage of CPH.

Key winning strategies adopted by key players of Chronic Pulmonary Hypertension Diagnostic Market

Focus on innovation and new product launches: One of the most successful strategies adopted by leading players like Philips Healthcare and GE Healthcare has been continuous investment and focus on innovation. Both companies have regularly launched new and advanced diagnostic tools that help detect pulmonary hypertension more accurately and aid in timely diagnosis. For example, in 2018 Philips launched HeartModel A.I., an artificial intelligence-based diagnostic solution for echocardiograms that can help detect pulmonary hypertension at early stages.

Strategic acquisitions and partnerships: Players have strengthened their portfolio and market presence through strategic acquisitions and partnerships. For example, in 2017 GE acquired Uptake Technologies, an industrial A.I. company to augment its cardiac diagnostic solutions with advanced data analytics capabilities. Similarly, BioTek Instruments expanded its pulmonary hypertension diagnostics offerings through the acquisition of Molecular Devices in 2020. Such deals have allowed companies to offer more comprehensive solutions.

Focus on emerging markets: Given the increasing prevalence of pulmonary hypertension globally, leading players have focused on expanding into high-growth emerging markets like Asia Pacific and Latin America through localized manufacturing and marketing strategies. This helped companies like Siemens Healthineers capture over 30% market share in Asia by 2020.

Segmental Analysis of Chronic Pulmonary Hypertension Diagnostic Market

Insights, By Drug Class: Effective Treatment Options Drive Growth of Endothelin Receptor Antagonists

The endothelin receptor antagonists (ERAs) segment contributes the highest share to the chronic pulmonary hypertension diagnostic market owing to the effective treatment options available within the class. ERAs work by blocking the endothelin receptors, which are involved in the vasoconstriction of blood vessels. By blocking these receptors, ERAs help dilate blood vessels and lower blood pressure.

Within the ERA class, bosentan was the first drug approved for treatment and remains an important oral option. However, newer drugs like macitentan have improved characteristics such as once daily dosing and less risk of serious liver problems compared to bosentan. Macitentan's enhanced tolerability profile has increased its popularity among physicians and patients.

ERAs provide a well-established treatment pathway for PAH that can improve symptoms, exercise ability and quality of life when used as monotherapy or in combination with other drugs. Clinical trials have demonstrated their effectiveness in reducing risk of hospitalization and mortality for patients. This efficacy, along with convenient oral dosing options, drives strong demand for ERAs from healthcare providers. Their first-line treatment role helps maintain the segment's market leading position.

Insights, By Disease Type: Prevalence of PAH Drives Growth of Pulmonary Arterial Hypertension Segment

Within the disease types segmenting the chronic pulmonary hypertension diagnostic market, Pulmonary Arterial Hypertension (PAH) contributes the highest share. PAH refers to high blood pressure in the arteries connecting the heart and lungs. It can result from various causes but leads to strain on the right side of the heart. If left untreated, PAH can cause heart failure and death.

PAH is the most common form of high blood pressure in the lungs. It has an estimated prevalence of 15 to 50 cases per million globally. With no known cure currently, lifelong treatment is required to manage symptoms. As such, the need to properly diagnose and treat PAH patients sustains steady demand for PAH-related drugs, devices and other associated technologies.

Due to the chronic and life-threatening nature of PAH, intensive patient monitoring and customized treatment plans are standard practice. This involves usage of various drugs that impact the pathways involved in PAH development. A multi-disciplinary treatment approach is also common. Together, these factors drive treatment costs and diagnostic requirements, supporting the PAH segment's market leadership. Efforts to diagnose PAH earlier could potentially further increase revenues over time.

Insights, By Route of Administration: Convenience of Oral Delivery Upholds its Dominance in Administration Route

Within the route of administration segment of the Chronic Pulmonary Hypertension Diagnostic Market, the oral route contributes the highest share. A key factor behind this position is the ease and convenience provided by oral dosing compared to alternatives like injections. PAH patients generally require lifelong management of their condition. As such, oral delivery provides an adminstration method that is preferable for continuous, long-term use.

Oral medications allow for self-administration at home, avoiding inconvenience of hospital or clinic visits for injections or infusions. This improves adherence to treatment regimens. Plus, oral delivery produces minimal discomfort versus injectable options. Some PAH drugs also come in convenient once-daily dosing formats that patients find easy to incorporate into daily routines. Additionally, oral medications see little variation in absorption rates between patients in general.

Physicians typically start treatment via the oral route where possible due to these patient-centered advantages. Only severe cases may later require addition of parenteral therapy. With a strong drug portfolio available in oral formats across different drug classes, this route maintains its significant stake in the diagnostic market for chronic pulmonary hypertension.

Additional Insights of Chronic Pulmonary Hypertension Diagnostic Market

- Global Prevalence: Chronic pulmonary hypertension affects about 1% of the global population, with higher incidence in older adults.

- Economic Impact: The disease poses a substantial economic burden due to high treatment costs and hospitalization expenses, emphasizing the need for cost-effective therapies.

- Survival Rates: Without appropriate treatment, the average survival time for pulmonary arterial hypertension patients is less than 3 years post-diagnosis.

Competitive overview of Chronic Pulmonary Hypertension Diagnostic Market

The major players operating in the chronic pulmonary hypertension diagnostic market include Johnson & Johnson (Actelion Pharmaceuticals), Bayer AG, United Therapeutics Corporation, GlaxoSmithKline plc, Pfizer Inc., Eli Lilly and Company, and Gilead Sciences, Inc.

Chronic Pulmonary Hypertension Diagnostic Market Leaders

- Johnson & Johnson (Actelion Pharmaceuticals)

- Bayer AG

- United Therapeutics Corporation

- GlaxoSmithKline plc

- Pfizer Inc.

Chronic Pulmonary Hypertension Diagnostic Market - Competitive Rivalry, 2024

Chronic Pulmonary Hypertension Diagnostic Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Chronic Pulmonary Hypertension Diagnostic Market

- In March 2024, Johnson & Johnson received FDA approval for Opsynvi, a once-daily combination tablet consisting of macitentan (an endothelin receptor antagonist) and tadalafil (a phosphodiesterase 5 inhibitor) for PAH. This approval was based on positive results from the A DUE study, which showed that Opsynvi significantly improved blood flow in patients with PAH compared to monotherapies of its components. The trial demonstrated a 29% reduction in pulmonary vascular resistance (PVR), making Opsynvi a promising treatment to enhance patient outcomes and potentially strengthen Johnson & Johnson's position in the PAH market.

- In August 2024, Eli Lilly and Company entered a strategic partnership with a biotech firm to develop innovative gene therapies targeting the root causes of pulmonary hypertension, potentially revolutionizing treatment paradigms and expanding their product portfolio. In September 2024, Lilly partnered with HAYA Therapeutics to explore RNA-guided gene therapies, but this was aimed at metabolic diseases rather than pulmonary hypertension.

Chronic Pulmonary Hypertension Diagnostic Market Segmentation

- By Drug Class

- Endothelin Receptor Antagonists (ERAs)

- Ambrisentan

- Bosentan

- Macitentan

- Phosphodiesterase-5 (PDE-5) Inhibitors

- Sildenafil

- Tadalafil

- Prostacyclin Analogues

- Epoprostenol

- Treprostinil

- Iloprost

- Soluble Guanylate Cyclase (sGC) Stimulators

- Riociguat

- Endothelin Receptor Antagonists (ERAs)

- By Disease Type

- Pulmonary Arterial Hypertension (PAH)

- Chronic Thromboembolic Pulmonary Hypertension (CTEPH)

- Hypoxic Pulmonary Hypertension

- Pulmonary Venous Hypertension

- By Route of Administration

- Oral

- Injectable

- Inhalation

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the chronic pulmonary hypertension diagnostic market?

The chronic pulmonary hypertension diagnostic market is estimated to be valued at USD 7.5 billion in 2024 and is expected to reach USD 12.15 billion by 2031.

What are the key factors hampering the growth of the chronic pulmonary hypertension diagnostic market?

The expensive medications limiting accessibility, especially in developing regions and adverse reactions leading to decreased patient compliance are the major factors hampering the growth of the chronic pulmonary hypertension diagnostic market.

What are the major factors driving the chronic pulmonary hypertension diagnostic market growth?

The increasing cases due to aging populations and associated comorbidities and development of novel drugs and combination therapies enhancing patient outcomes are the major factors driving the chronic pulmonary hypertension diagnostic market.

Which is the leading drug class in the chronic pulmonary hypertension diagnostic market?

The leading drug class segment is endothelin receptor antagonists (ERAs).

Which are the major players operating in the chronic pulmonary hypertension diagnostic market?

Johnson & Johnson (Actelion Pharmaceuticals), Bayer AG, United Therapeutics Corporation, GlaxoSmithKline plc, Pfizer Inc., Eli Lilly and Company, Gilead Sciences, Inc. are the major players.

What will be the CAGR of the chronic pulmonary hypertension diagnostic market?

The CAGR of the chronic pulmonary hypertension diagnostic market is projected to be 7.1% from 2024-2031.