Clinical Trial Patient Recruitment Services Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Clinical Trial Patient Recruitment Services Market is Segmented By Patient Recruitment Step (Pre-screening, Screening), By Trial Phase (Phase I, Phase....

Clinical Trial Patient Recruitment Services Market Size

Market Size in USD Bn

CAGR8.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 8.2% |

| Market Concentration | High |

| Major Players | IQVIA, Syneos Health, Parexel, PPD, PRA Health Sciences and Among Others. |

please let us know !

Clinical Trial Patient Recruitment Services Market Analysis

The clinical trial patient recruitment services market is estimated to be valued at USD 9.4 Bn in 2024 and is expected to reach USD 19.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2031.

The market has been witnessing significant growth in recent years due to increase in the number of clinical trials conducted globally each year. Pharmaceutical and biotechnology companies have been outsourcing patient recruitment services to optimize costs and improve the recruitment process which has fueled demand. Furthermore, challenges in identifying eligible patients, difficulty in reaching out to a mass population, and lack of centralized databases have compelled clinical research organizations to rely on specialized patient recruitment service providers.

Clinical Trial Patient Recruitment Services Market Trends

Market Driver - Increase in the number of clinical trials

With numerous pharmaceutical and biotechnology companies engaged in drug research and development, there has been a notable rise in the number of clinical drug trials over the past decade. As per estimates, over 350,000 clinical trials are currently underway across various indications worldwide. Successful recruitment of adequate number of participants is crucial for timely completion of these trials and bringing potential new therapies to market. However, factors such as improved diagnostics, advanced screening protocols, stringent eligibility criteria and narrow therapeutic index of investigational drugs have elevated the difficulty in patient enrollment.

Clinical trial sponsors and CROs recognize that traditional recruitment methods alone may not suffice anymore. They have started exploring specialized patient recruitment service providers who leverage advanced technologies and data-driven strategies to identify and enroll eligible candidates. These service providers supplement the recruitment process through maintenance of extensive databases of potential participants, employing targeted digital advertising and using social media platforms to raise awareness. They also establish relationships with patient advocacy groups and physician networks to facilitate referrals. Some even offer on-site coordination and at recruitment centers run by their staff. As clinical trials continue to get more complex due to evolving treatment landscapes and regulatory oversight, sponsors are increasingly outsourcing recruitment activities to dedicated partners who offer end-to-end solutions instead of piecemeal assistance. This is projected to further augment demand for well-organized patient recruitment services in the coming years.

Market Driver - Rising complexity in patient enrollment processes

With advancement in medical research, new indications are continuously being identified and novel targeted therapies are being evaluated. This has led to highly selective eligibility criteria for enrollment in clinical studies. Investigational drugs are now designed for narrowly defined patient subsets characterized by specific biomarkers, genetic profiles or treatment histories. Identifying patients that precisely meet all protocol requirements has become a big challenge. Additionally, regulatory authorities now mandate more aggressive safety monitoring and expanded informed consent procedures during trials. These evolving good clinical practice guidelines have added to the operational difficulty in recruiting participants.

Service providers in this industry help overcome such complexities through their expertise and dedicated technology platforms. Some have developed advanced screening algorithms by analyzing vast volumes of past patient data. These algorithms powered by machine learning can quickly scan electronic health records and other data sources to pre-screen individuals with high probability of fulfilling trial criteria. Service providers also assist with customized consent forms, clinical events tracking solutions and flexible eCRF designs to simplify data capture tasks for investigators. Their nationwide networks of investigator sites and community outreach programs make participant identification more efficient. As clinical protocols get increasingly specialized with each passing year, the need for highly knowledgeable recruitment experts is surging. Their value-added services are enabling easier navigation of intricate enrollment landscape and timely completion of complex clinical research. This is certainly driving higher spend on specialized patient recruitment services globally.

Market Challenge - High costs associated with patient recruitment

One of the major challenges faced by the clinical trial patient recruitment services market is the high costs associated with patient recruitment. Recruiting suitable patients for clinical trials is a lengthy, complex and resource intensive process. Pharmaceutical and biotechnology companies have to spend huge amounts of money on various recruitment activities such as identifying potential patients, screening and enrolling them, travel reimbursements, patient fees and other related expenses. Maintaining a large pool of potential patients and coordinating with multiple recruitment sites also involves significant operational costs. Additionally, factors such as narrow eligibility criteria, competition from other ongoing trials and lack of awareness among patients further exacerbate the recruitment challenges. This leads to delayed trial timelines and increased budget overruns for sponsors. With rising R&D expenditures, high patient recruitment costs have become a major roadblock for the growth of the overall clinical trials market. Service providers and sponsors need to focus on leveraging new technologies and alternative recruitment strategies to enhance efficiency and reduce costs associated with patient recruitment.

Market Opportunity - Expansion into emerging markets

One promising opportunity for players in the clinical trial patient recruitment services market is expansion into emerging markets. With improving healthcare infrastructure and increasing investments in clinical research, several emerging countries now offer a large untapped pool of potential patients. Countries like China, India, Brazil and certain countries in Eastern Europe present lucrative prospects for clinical trial patient recruitment. Their demographic diversity, treatment naïve populations and less stringent regulations make patient recruitment much easier compared to developed markets. Furthermore, the cost of conducting clinical trials is substantially lower in emerging markets. This allows sponsors and CROs to recruit larger number of patients and complete trials in shorter time periods at reduced costs. To capitalize on this opportunity, service providers are focusing on strengthening their presence in high growth emerging markets through partnerships, acquisitions and by setting up local offices. This expansion will allow greater access to patient populations in these regions and drive higher revenues for players over the coming years.

Key winning strategies adopted by key players of Clinical Trial Patient Recruitment Services Market

An effective strategy adopted in recent years involves the use of social media and digital marketing channels for patient recruitment. In 2017, QuintilesIMS partnered with Facebook to launch a patient recruitment initiative using Facebook advertising. Through targeted ads, they were able to efficiently recruit patients for rare disease studies. This helped reduce recruitment timelines significantly.

Other CROs like PPD and Syneos Health have also launched social media campaigns to promote ongoing trials. PPD used Facebook ads along with awareness videos on YouTube to recruit 2000+ patients for an oncology study in 2018.

CROs have built huge patient databases over the years by collecting patient profiles and medical histories. Players like ICON, PRA Health Sciences, and PAREXEL utilize these comprehensive databases to pre-screen and shortlist potential candidates matching the inclusion criteria.

In 2019, PAREXEL recruited over 3000 patients in just 6 months for a Phase III neurological disorder trial by screening its database of over 2.5 million candidates. This allowed them to meet aggressive timelines set by the client.

Collaborating with relevant patient advocacy groups and non-profits has proven effective for rare disease recruitment. In 2020, Syneos Health partnered with the Cystic Fibrosis Foundation to promote a CF drug trial using the foundation’s network of over 30,000 patients and caregivers. They were able to fully enroll the difficult-to-recruit study within a year.

Segmental Analysis of Clinical Trial Patient Recruitment Services Market

Insights, By Patient Recruitment Step: Increased focus on patient screening

In terms of patient recruitment step, pre-screening sub-segment contributes the highest share of 51.3% in the market owing to increased focus on patient screening.

The clinical trial patient recruitment services market segment for pre-screening contributes the highest share due to increased focus of sponsors and CROs on ensuring right patients are selected for clinical trials. Pre-screening involves evaluating patients' medical history and determining their eligibility as per the trial protocol at an initial phase, before they are formally screened. This helps avoid the costs involved in screening those patients who are unlikely to be suitable as per eligibility criteria.

With rising costs of clinical trials, sponsors and CROs are more focused on eliminating potentially ineligible patients as early as possible to improve screening efficiency. Pre-screening allows them to filter out patients who have no probability of enrolling for a particular study based on pre-defined parameters. This saves significant time and resources during the later screening stage. Moreover, pre-screening data collected from patients can be utilized to select the most suitable sites for actual patient recruitment.

Advanced technologies including AI and machine learning are also being leveraged more during pre-screening. Tools enabling virtual pre-screening of electronic health records allow automating the initial screening process and prioritizing suitable patients. This is further expediting the pre-screening stage. The use of real-world data for pre-screening purposes is also on the rise. Overall factors like the focus on efficiency, advanced tools, and real-world data are propelling the pre-screening segment in the clinical trial patient recruitment services market.

Insights, By Trial Phase: Higher patient screening requirements

The phase I sub-segment holds the highest share of 27.9% among trial phase segmentation due to the significantly higher number of patients required to be screened during this initial testing stage. Phase I trials are mostly first-in-human studies involving small groups of healthy volunteers or patients.

The primary aim of phase I is to evaluate a compound's safety, tolerability, pharmacokinetics and pharmacodynamics. To achieve this safely, sponsors need to screen extensively to identify suitable healthy subjects or patients based on stringent eligibility criteria and exclusion factors. Sometimes hundreds of individuals need to be assessed to enroll less than a hundred patients across low dose escalation cohorts in phase I.

Moreover, given the exploratory nature of phase I studies, eligibility parameters may change depending on early dose-response and toxicity results. This necessitates rescreening of additional patients. The higher number of screening cycles makes patient recruitment more challenging compared to later phases. CROs play a critical role in sourcing, pre-screening and formally screening large pools of potential candidates to identify and enroll the correct patients.

As phase I forms the platform for subsequent clinical development, sponsors dedicate significant resources to its recruitment planning and place greater reliance on CRO expertise. This drives significant demand for patient recruitment services specializing in the critical phase I segment.

Additional Insights of Clinical Trial Patient Recruitment Services Market

- The global clinical trial patient recruitment services market is driven by the increasing complexity and cost of patient enrollment in clinical trials. Delays in trials due to insufficient recruitment and high dropout rates significantly impact financial investments and product timelines. The adoption of digital solutions and outsourcing to specialized firms is becoming common. Growth is anticipated in emerging markets, particularly in Asia-Pacific. New technologies, such as EHRs and RWE, are improving recruitment efficiency.

Competitive overview of Clinical Trial Patient Recruitment Services Market

The major players operating in the clinical trial patient recruitment services market include IQVIA, Syneos Health, Parexel, PPD, PRA Health Sciences, Medpace, ICON, Labcorp Drug Development, Worldwide Clinical Trials and Charles River Laboratories.

Clinical Trial Patient Recruitment Services Market Leaders

- IQVIA

- Syneos Health

- Parexel

- PPD

- PRA Health Sciences

Clinical Trial Patient Recruitment Services Market - Competitive Rivalry, 2024

Clinical Trial Patient Recruitment Services Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Clinical Trial Patient Recruitment Services Market

- In August 2023, Ripple Science appointed Mike Stratton as VP of Business Development to enhance their patient recruitment technology platform.

- In July 2023, TrialWire received Citeline Best Patient-facing Technology Initiative 2023 award for their proprietary recruitment platform.

- In June 2023, Syneos Health entered into an agreement with uMotif to develop a patient-centric platform offering recruitment, engagement, and retention solutions.

Clinical Trial Patient Recruitment Services Market Segmentation

- By Patient Recruitment Step

- Pre-screening

- Screening

- By Trial Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the clinical trial patient recruitment services market?

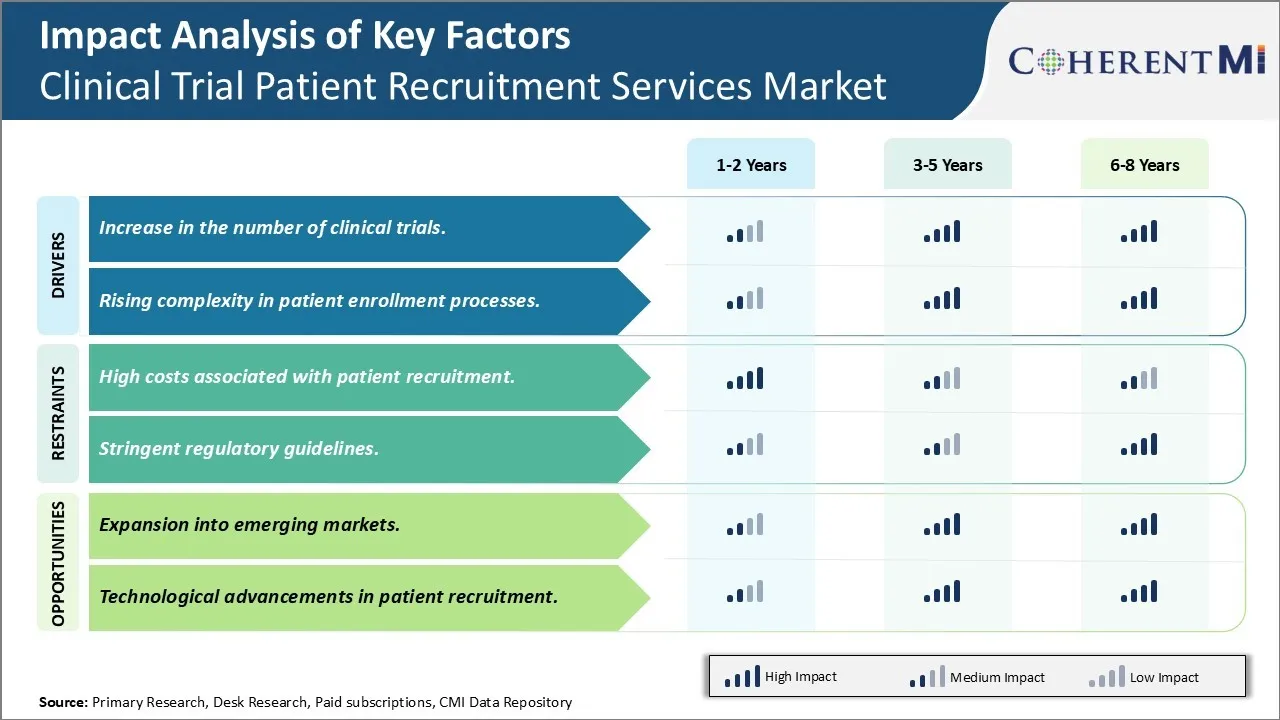

The high costs associated with patient recruitment and stringent regulatory guidelines are the major factors hampering the growth of the clinical trial patient recruitment services market.

What are the major factors driving the clinical trial patient recruitment services market growth?

The increase in the number of clinical trials and rising complexity in patient enrollment processes are the major factors driving the clinical trial patient recruitment services market.

Which is the leading patient recruitment step in the clinical trial patient recruitment services market?

The leading Patient Recruitment Step segment is Screening.

Which are the major players operating in the clinical trial patient recruitment services market?

IQVIA, Syneos Health, Parexel, PPD, PRA Health Sciences, Medpace, ICON, Labcorp Drug Development, Worldwide Clinical Trials, Charles River Laboratories are the major players.

What will be the CAGR of the clinical trial patient recruitment services market?

The CAGR of the clinical trial patient recruitment services market is projected to be 8.2% from 2024-2031.