Clinical Trial Software Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Clinical Trial Software Market is Segmented By Features of Software (EDC, eCOA/ePRO, eConsent), By Type of Deployment (On-cloud, On-premises). The rep....

Clinical Trial Software Market Size

Market Size in USD Bn

CAGR14.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 14.3% |

| Market Concentration | Medium |

| Major Players | Advarra, Arisglobal, AssistRx, Calyx, Clario and Among Others. |

please let us know !

Clinical Trial Software Market Analysis

The clinical trial software market is estimated to be valued at USD 0.9 Bn in 2024 and is expected to reach USD 2.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 14.3% from 2024 to 2031. The increased investment in R&D by pharmaceutical companies and rising demand for improved data capture & clinical trial management systems is driving the growth of this market.

The clinical trial software market is expected to grow steadily during the forecast period. With advances in technology and pressure to increase efficiency, there is demand for clinical trial management systems that allow risk-based monitoring, remote monitoring techniques and use of telehealth for patient follow ups. This will help organizations streamline processes and decrease operational costs related to clinical trials.

Clinical Trial Software Market Trends

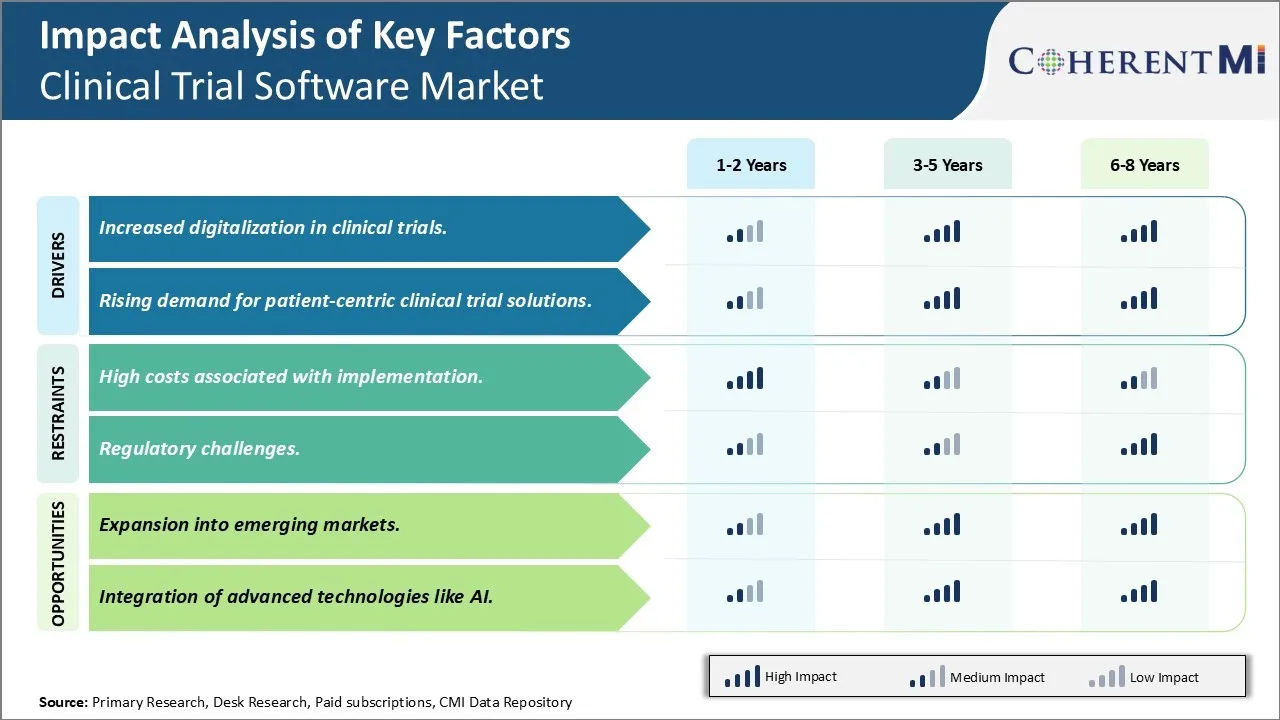

Market Driver - Increased digitalization in clinical trials

Digitalization is rapidly increasing in the healthcare industry and clinical trials are no exception. Electronic health records, telehealth, remote patient monitoring, and other digital solutions have made their way into mainstream healthcare practices and the same trend is being witnessed in clinical trials. The pandemic further accelerated this shift as travel restrictions and social distancing norms made it challenging to conduct in-person clinical trial visits and traditional ways of paper-based data collection were not feasible anymore.

This pushed clinical trial stakeholders to adopt digital technologies and solutions to ensure trial continuity. Technologies like electronic data capture systems, eConsenting, wearables, apps, remote monitoring devices, and telehealth are being leveraged now to digitally capture clinical trial data from sites as well as patients. Decentralized and hybrid clinical trial models have become more popular which involve elements of decentralized and/or virtual patient visits. All these changes have increased the reliance on clinical trial software to power digital clinical trials. Clinical trial software solutions provide features like electronic clinical outcome assessment, ePROs, eDiary, digital drug supply management, remote data collection etc. that help in connecting patients and sites virtually and ensuring seamless data capture.

This growing digital transformation indicates that traditional paper-based methods alone will not be sufficient to address current and future demands of complex clinical research. Digital solutions bring advantages like improved data quality and reliability, enabled patient engagement, optimized site performance, and ability to include diverse patient populations remotely. They also help overcome barriers like inaccurate or incomplete data, loss to follow ups, reporting delays etc. that plague conventional trials. This drives the need amongst clinical trial stakeholders to adopt specialized software to enable an end-to-end digital clinical trial workflow and help transform traditional trials. Going forward, digital technologies are expected to remain core elements of clinical trial designs and greater integration of these tools with clinical trial software will be important for future trials.

Market Driver - Rising demand for patient-centric clinical trial solutions

There is a growing emphasis on patient-centric approaches in clinical research and trials. Patients are recognized as important partners rather than mere subjects. Their perspectives, quality of life, comfort, and overall trial experience is gaining more attention from regulators, sponsors and ethics boards. This shift is driven both by altruistic considerations as well as difficulties in patient recruitment and retention that plague many trials leading to delays or complete failure. Addressing patient needs and making trials more participant-friendly and engaging is viewed as critical to improve trial feasibility.

Clinical trial software providers are recognizing this shift and developing more patient-centric features and functions. This includes easy to use eConsenting processes, interactive ePROs and eDiary available across devices, customizable reminders, ability to upload any kind of data from home monitoring devices, option to chat with doctors and coordinators, status tracking, awards and achievements etc. The goal is to transform data collection into a more engaging process for patients that can be seamlessly fitted into daily lives. Sponsors are also leveraging patient communities and digital tools to better understand patient needs, educate them about diseases and improve health literacy. This is helping improve awareness, recruitment rates as well as boost participation and compliance.

Another driver for patient-centric tools is decentralization of trials. Decentralized and hybrid models involve elements of virtual and/or home-based visits which require patient self-management abilities to a larger extent. This necessitates clinical trial software designed specifically keeping the patient perspective in mind so they can easily navigate decentralized workflows. Emerging technologies like AI, virtual assistants are also being explored to provide personalized information, reminders as well as remote assistance to patients actively participating in decentralized trials.

Market Challenge - High costs associated with implementation

One of the major challenges faced by the clinical trial software market is the high costs associated with implementation of these solutions. Clinical trial software solutions require a sizable initial investment and have high deployment and maintenance costs. This is because clinical trial software deals with complex tasks related to patient recruitment, drug assignments, data capture, and regulatory compliance. Sophisticated software tools are required to efficiently manage these complex tasks.

Additionally, clinical trial software often needs to be customized as per the specific requirements of individual customers and the nature of the clinical trial. All these factors contribute to significantly high implementation costs. The rising costs put pressure on small and mid-sized pharma/biotech companies and clinical research organizations. With tight budgets, it is difficult for many players to justify the investments required. This high entry barrier restricts the adoption of advanced clinical trial software especially in developing markets.

Market Opportunity - Expansion into emerging markets

One of the major opportunities for players in the clinical trial software market is the potential for expansion into emerging markets. Currently, the clinical trial software market is highly concentrated in developed regions such as North America and Western Europe due to the high concentration of pharmaceutical R&D. However, emerging markets in Asia Pacific, Latin America, Eastern Europe, the Middle East and Africa are expected to offer lucrative growth prospects going forward. Factors such as growing healthcare expenditure, increasing contract research organization activities, and rising adoption of clinical trial outsourcing models are fueling demand in emerging regions.

Additionally, with enhanced regulatory frameworks and development of local pharmaceutical industries, more clinical trials are shifting to low-cost emerging markets. This presents significant opportunities for clinical trial software vendors to tap into the relatively untapped emerging markets. Efforts to customize solutions as per requirements and budgets of customers in emerging regions will be crucial to driving adoption.

Key winning strategies adopted by key players of Clinical Trial Software Market

Continual innovation is key to success in this dynamic market. Companies like Medidata Solutions have invested heavily in R&D to develop new features in their software like patient engagement portals, eConsent tools, clinical supply chain management etc. Their Medidata Rave platform is considered the gold standard due to regular upgrades. They acquired new companies like TrialPay to bolster their platform.

Many players have transitioned from standalone software licenses to cloud-based Software as a Service (SaaS) models which are more scalable and offer lower upfront costs. CASTOR EDC was one of the early movers to the SaaS model in 2015 which helped them gain market share.

Players partner with CROs, patient recruitment platforms and other ecosystem players to offer integrated end-to-end clinical trial solutions. In 2019, Bioclinica partnered with Signant Health to integrate eCOA capabilities into its EDC platform. Such partnerships enhance value for customers.

Focus on customer success: Companies focus on implementing best practices like account management, customer trainings and 24/7 support. Science 37 uses a dedicated sciences team and advisory boards to better understand user pain points. Their 98% customer retention rate shows the impact of such efforts.

Smaller players have found niches in areas like decentralized/virtual trials which saw demand boost during the pandemic. Medable focuses only on these use cases and raised $100 million in 2021 to accelerate growth. Such targeting of specialized verticals has worked well.

Segmental Analysis of Clinical Trial Software Market

Insights, By Features of Software: Indispensable nature of EDC in clinical trials

In terms of features of software, EDC sub-segment contributes the highest share of 40.7% in the market owing to its indispensable nature in clinical trials.

Electronic data capture (EDC) software contributes the highest share in the clinical trial software market in terms of features owing to its indispensable nature in clinical trials. EDC software digitizes clinical data collected on paper case report forms (CRFs) and replaces the manual process of data collection and site monitoring. It provides a centralized platform for collecting clinical study data in electronic format for remote and centralized monitoring of ongoing trials. EDC eliminates transcription errors and allows for remote data review in real time. It ensures data accuracy and consistency across multiple sites by implementing validations and automated checks. EDC also speeds up the clinical development process by reducing data collection and management time. With increasing complexity of clinical trials, EDC has become mandatory to effectively manage large clinical datasets generated across global study sites from phase III and IV clinical trials. Its ability to streamline processes, enhance compliance, and facilitate remote oversight of global trials drives its widespread adoption among sponsors and CROs.

Insights, By Type of Deployment: Scalability and affordability of on-cloud

In terms of type of deployment, on-cloud sub-segment contributes the highest share of 55.6% in the market owing to scalability and affordability.

Software solutions deployed on cloud-based platforms hold the highest share of the clinical trial software market in terms of deployment type. Cloud deployment of clinical trial software provides flexibility, scalability and affordability that On-premises solutions cannot match. Cloud EDC can easily scale up or down depending on fluctuating data volumes and project needs without incurring additional infrastructure costs. It eliminates upfront capital investments required for procuring servers and other IT equipment for On-premises solutions. Cloud solutions are also more affordable on pay-as-you-go licensing models. With multi-tenant architecture, cloud EDC facilitates sharing of computing resources and costs among various research projects. This makes it a more viable option for small to mid-sized sponsors and CROs compared to expensive on-premises systems. Cloud deployment also ensures easy accessibility to clinical data from any location and integrates seamlessly with other cloud-based clinical applications. Its centralized management and automated software upgrades further reduce IT management overheads. These factors have made cloud-based platforms the dominant mode of EDC deployment.

Additional Insights of Clinical Trial Software Market

- The clinical trial software market is poised for substantial growth due to advancements in digital health technologies. Clinical trial management systems are increasingly utilized to streamline trial processes, enhance data management, and improve patient recruitment and retention. The market is witnessing significant investment and partnership activities, highlighting the growing importance of these technologies in drug development. The adoption of virtual trials is particularly noteworthy, offering greater flexibility and efficiency in trial conduct.

Competitive overview of Clinical Trial Software Market

The major players operating in the clinical trial software market include Advarra, Arisglobal, AssistRx, Calyx, Clario, IBM, IQVIA, Medidata, Oracle, Signant Health, and Veeva.

Clinical Trial Software Market Leaders

- Advarra

- Arisglobal

- AssistRx

- Calyx

- Clario

Clinical Trial Software Market - Competitive Rivalry, 2024

Clinical Trial Software Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Clinical Trial Software Market

- In August 2023, Texas Tech University Health Sciences Center collaborated with Deep 6 AI to launch an AI program for clinical trials.

- In August 2023, Globant partnered with Medocity to accelerate digitalization in clinical research.

- In July 2023, ClinOne formed a joint venture with PRIMR to enhance clinical trial engagement.

Clinical Trial Software Market Segmentation

- By Features of Software

- EDC

- eCOA/ePRO

- eConsent

- By Type of Deployment

- On-cloud

- On-premises

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the clinical trial software market?

The high costs associated with implementation and regulatory challenges are the major factors hampering the growth of the clinical trial software market.

What are the major factors driving the clinical trial software market growth?

The increased digitalization in clinical trials and rising demand for patient-centric clinical trial solutions are the major factors driving the clinical trial software market.

Which are the leading Features Of Software in the clinical trial software market?

The leading Features Of Software segment is EDC.

Which are the major players operating in the clinical trial software market?

Advarra, Arisglobal, AssistRx, Calyx, Clario, IBM, IQVIA, Medidata, Oracle, Signant Health, and Veeva are the major players.

What will be the CAGR of the clinical trial software market?

The CAGR of the clinical trial software market is projected to be 14.3% from 2024-2031.