DNA Data Storage Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

DNA Data Storage Market is Segmented By Type (Cloud, On-premises), By Technology (Sequence-based DNA data storage, Structure-based DNA data storage), ....

DNA Data Storage Market Size

Market Size in USD Mn

CAGR27.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 27.8% |

| Market Concentration | Medium |

| Major Players | Illumina, Inc., Microsoft, Iridia, Inc., Twist Bioscience, Catalog Technologies and Among Others. |

please let us know !

DNA Data Storage Market Analysis

The DNA Data Storage Market is estimated to be valued at USD 33.5 Mn in 2024 and is expected to reach USD 184.10 Mn by 2031, growing at a compound annual growth rate (CAGR) of 27.8% from 2024 to 2031.

The market has been witnessing significant growth in recent times due to the increasing demand for data storage. With more data being generated every day and need for storing data for longer periods, DNA data storage is emerging as a promising technology. The traditional storage technologies are not sufficient to handle large volumes of data being generated. DNA storage allows tremendous amounts of data to be stored in a very small physical space and also has the capability to preserve the data for thousands of years. With continuous technological advancements to make DNA storage more efficient and cost-effective, it is expected that the market will continue to grow steadily over the next few years. Key players are also investing increasingly in R&D to develop advanced solutions and drive the adoption of DNA data storage technology.

DNA Data Storage Market Trends

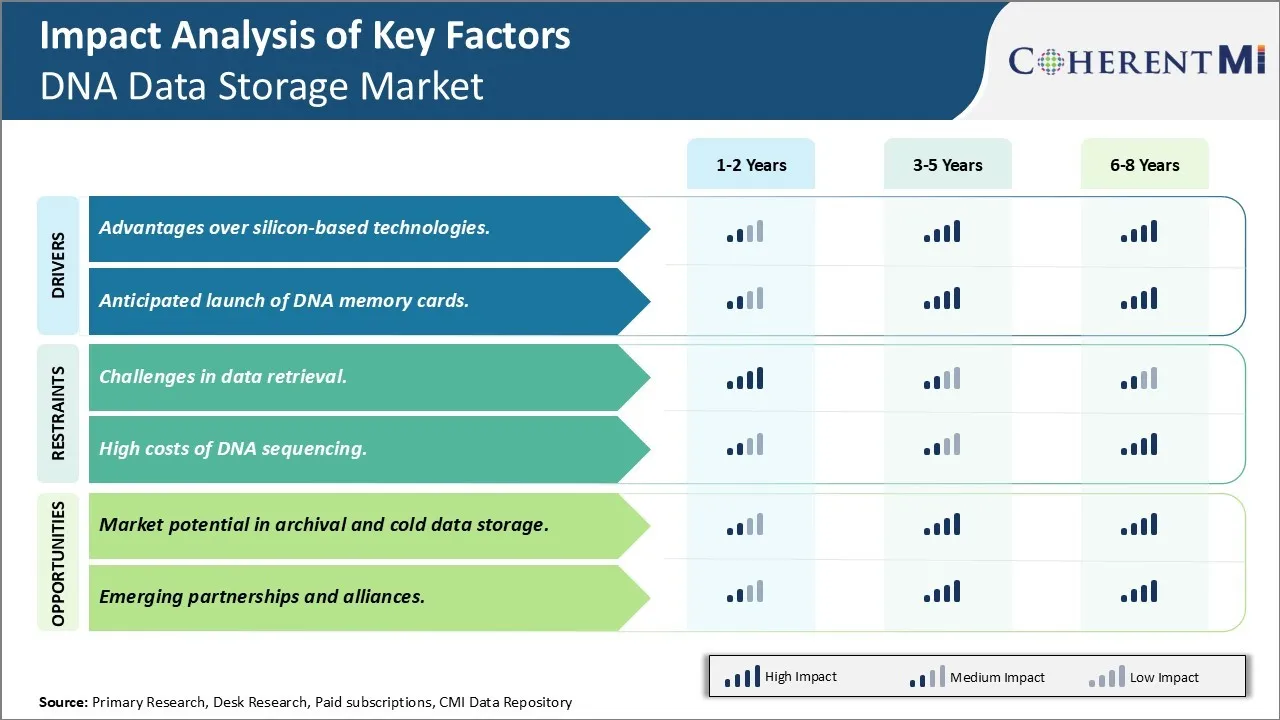

Market Driver - Advantages over silicon-based technologies.

Silicon has served the storage industry exceptionally well for several decades now, however with the exponential growth in data being generated every day, alternative storage technologies are being explored. DNA emerges as a very promising contender owing to its exceptionally high information density. As opposed to silicon drives which are reaching their physical limits, DNA has the potential to store far more data in much smaller volumes. While silicon chips rely on transistors of just a few nanometers in size, DNA represents information through just four nucleotide bases of double-helix DNA. This allows DNA to achieve densities of up to 1 exabyte of information per single gram whereas a microSD card stores only around 1 terabyte using silicon.

Moreover, DNA is highly resistant to damage from heat, radiation and the passage of time. Properly stored DNA samples have been retrieved after thousands of years with only minor sequence errors. On the other hand, traditional silicon drives require careful handling and mild environmental conditions to retain data integrity over longer periods of time. This makes DNA an attractive option for archiving important information that needs to remain accessible for future generations. Loss or corruption of data is a huge concern in today's digitally driven world and DNA storage could provide an ultra-reliable solution to preserve critical information in a format that withstands environmental changes.

Another key attribute of DNA data storage is its sustainability. Unlike silicon chips which have large carbon footprints due to energy-intensive manufacturing processes, DNA can be produced through biological processes that are greener. It utilizes the natural mechanisms of cells to replicate information efficiently and at large scales without heavy industrial operations. With growing environmental pressures to reduce electronic waste, DNA data systems may emerge as a sustainable alternative in the future if development efforts continue yielding promising results.

Anticipated Launch of Dna Memory Cards

One of the companies at the forefront of commercializing DNA data storage technology is the US-based startup Anthropic. After years of extensive research and development, they recently announced plans to launch the first ever consumer DNA memory cards later this year. Called as "DNA Drive", these cards will utilize a new DNA storage technique developed by Anthropic that can achieve storage capacities of over 1TB in a single gram of DNA. Unlike early industry prototypes that only demonstrated basic “hello world” proofs of concept, these commercial drives will provide usable storage capacity on par with current generation flash memory cards.

Anthropic's launch of the DNA Drive is a significant landmark toward establishing DNA as a viable supplement or even successor to traditional silicon drives. It will provide researchers and early adopters the first opportunity to truly experience a DNA storage product and test its capabilities. Any initial issues encountered can help Anthropic further refine and strengthen the technology. Successful deployment of DNA Drive cards could also attract greater research funding and industry partnership deals, accelerating the pace of future product development. Early feedback from users will be vital to demonstrate DNA storage's real-world feasibility for various applications.

Longer term, Anthropic hopes this first launch can create wider awareness and acceptance of DNA data systems. As manufacturing is scaled up and costs reduced through experience, DNA drives may evolve into competitively priced mainstream storage alternatives within this decade. Their established head start in the consumer market puts Anthropic in a strong position to lead commercialization efforts. If all goes well, we could see accelerated follow-up launches delivering even higher DNA capacities and transforming this innovative concept into a practical data storage solution.

Market Challenge - Challenges in data retrieval.

One of the key challenges currently facing the DNA data storage market is the speed and reliability of data retrieval. While DNA as a storage medium offers extremely high density and the potential for archiving data for very long periods, retrieving and reading the encoded information remains a complex process. Converting the genetic sequence back into a digital file requires multiple biochemical steps including DNA sequencing and decoding. These processes can take several hours to a few days to complete depending on the size of the data being retrieved. Additionally, there exists the possibility of errors creeping in during the sequencing and decoding phases due to limitations in existing biological and chemical techniques. If incorrect or incomplete data is retrieved, it can render the stored information useless. DNA data storage also requires specialized laboratory facilities and trained personnel to handle the encoding and retrieval workflows. This increases costs and may limit widespread commercial adoption compared to traditional electronic storage solutions where retrieval is near-instantaneous. Overall, further refinements are necessary in sequencing and decoding technologies and methodologies to realize the full promise of DNA-based archival storage solutions.

Market potential in archival and cold data storage.

Despite the present challenges in data retrieval, DNA-based storage offers immense potential in the long-term archival and cold storage market. With DNA’s ultra-high density packing ability far exceeding any other physical medium, it provides a uniquely suited solution for organizations and institutions looking to archive massive amounts of non-critical data and information for decades or centuries into the future. Examples include storage of government records, historical archives, scientific research papers and datasets, photo/video libraries and other culturally significant non-changing content. By removing such cold data from active retrieval systems, DNA archives could free up costly space in traditional electronic storage infrastructures. Additionally, stored information would theoretically be secure and intact even centuries later due to the inherent stability and longevity of synthetic DNA strands when properly preserved. If retrieval methodologies continue advancing to resolve current slow speeds and error rates, DNA promises to revolutionize the entire archival landscape by offering secure, ultra-dense, virtually permanent non-electronic data vaults. This creates a huge opportunity for DNA storage firms to capture a major share of the multibillion-dollar long-term archival/preservation market in the coming decades.

Key winning strategies adopted by key players of DNA Data Storage Market

Microsoft’s Project Silica (2017): One of the early pioneers, Microsoft proved DNA's potential for long-term data archiving with Project Silica. They were the first to successfully store and retrieve a full-length movie encoded in DNA that was several hundred megabytes in size. This seminal effort validated DNA as a viable option for archival storage, demonstrated accuracy levels surpassing tape/HDD. It showcased DNA's potential to store data for centuries with minimal maintenance.

Illumina's IHG partnership (2019): Illumina, the DNA sequencing giant, partnered with Anthropic to apply deep learning to the encoding/decoding process. This helped improve storage density and lowered write/read times. Their joint work with the International Human Genome Project (IHG) to store significant portions of the human genome as digital DNA data helped gain credibility in the archival domain. It reinforced DNA's archival capability at petabyte scales.

Catalog partnership (2021): Catalog partnered with Twist Bioscience to reduce DNA data storage costs. Leveraging Twist's gene synthesis capabilities, Catalog demonstrated a 10x improvement in US$/GB costs compared to Microsoft's demonstration. By streamlining encode/synthesize processes and optimizing oligo design, Catalog proved DNA storage could be cost-effective even at small scales for research/personal use cases.

As the examples show, early pioneers like Microsoft validated DNA's technical potential through ambitious proof-of-concept projects at huge scales. Illumina brought in powerful AI tools to optimize the storage process. Recent strategic partnerships by players like Catalog and Twist have helped reduce costs substantially to make DNA storage more commercially viable even for niche applications. Overall, collaborative R&D and optimization of the encode-synthesize workflows have been key winning strategies to advance this frontier technology.

Segmental Analysis of DNA Data Storage Market

By Type- Subscription-based economic benefits drive Cloud adoption

The DNA data storage market segment for Cloud services has seen significant growth in market share owing to the economic benefits it offers over on-premises solutions. Cloud storage removes the need for large upfront capital expenditures on servers and infrastructure that are associated with building and maintaining an on-premises DNA data center. With the Cloud model, users can avoid these costs and pay only for what they use on a subscription basis. This pay-as-you-go approach appeals greatly to research institutes and technology companies with fluctuating storage needs and tight budgets that do not want to deal with infrastructure maintenance. Cloud services also provide shared resources and virtually unlimited scalability, allowing customers to easily scale their storage capacity up or down depending on project requirements without being constrained by their existing hardware. The operational efficiencies afforded by multi-tenant cloud platforms have also helped drive costs down further. Overall, the subscription model offered by Cloud DNA data storage allows organizations more flexibility and cost savings compared to traditional perpetual licensing models. These economic benefits have contributed significantly to the rising popularity and market share held by Cloud services.

By Technology- Rapid developments in sequencing technologies favor Sequence-based storage

The Sequence-based DNA data storage segment dominates the overall technology market share owing to ongoing advances in DNA sequencing technologies. Unlike Structure-based approaches which require expensive custom synthesis of DNA, Sequence-based storage leverages continued improvements in next-generation sequencing (NGS) technologies which have drastically reduced the time and cost required for high-throughput DNA sequencing readout and writing. Key players in the NGS space such as Illumina, Pacific Biosciences, and Oxford Nanopore are developing newer sequencing platforms each year with higher throughput, longer read lengths, and lower per-base sequencing costs. These reductions in sequencing costs have increased the economic viability of using DNA to store digital data and fueled Sequence-based storage adoption rates across markets. Additionally, Sequence-based storage benefits from leveraging the highly standardized workflows and widespread availability of sequencing infrastructure prevalent in research labs. The simplicity and compatibility with existing sequencing infrastructure give Sequence-based DNA storage an advantage over more technically challenging Structure-based approaches requiring custom synthesis techniques. Overall, ongoing sequencing price reductions coupled with increased standardization of sequencing workflows have driven Sequence-based storage to higher market share.

By End-User- Storage of vital datasets drives interest among Research Institutes

The Research Institutes segment holds the largest market share of the overall DNA data storage end-user markets due to specific needs for archiving large volumes of vital datasets. Research institutes generate enormous amounts of data annually from genome and protein sequencing, scientific simulations, microscopy imaging techniques, and other data-intensive research applications. With data volumes doubling every 2-3 years, these institutes face serious challenges around long-term preservation and access to past datasets which are essential for conducting future research. DNA provides an attractive solution for archiving terabytes to petabytes of research data extremely long-term in a compact format due to the exceptionally high data density possible. Research institutes prioritize keeping past datasets accessible for many decades or centuries, making DNA an ideal preservation medium. Additionally, DNA data can withstand environmental damage better than existing digital or physical storage. For research institutes looking to guarantee perpetual access to valuable datasets, DNA has become the technology of choice over traditional storage mediums with far more limited lifespans. This ability to securely store massive volumes of data for centuries drives research institutes' highest market share in DNA data storage adoption.

Additional Insights of DNA Data Storage Market

- The DNA data storage market is at the frontier of technology, providing solutions that can store massive amounts of data in a stable medium. With exponential data generation and limited traditional storage, DNA storage offers vast capacity and longevity. Challenges remain in cost and retrieval processes, but advancements and partnerships are rapidly addressing these. The market is poised for significant growth, driven by new technologies and the anticipated commercial use of DNA for large-scale data storage.

Competitive overview of DNA Data Storage Market

The major players operating in the DNA Data Storage Market include Thermo Fisher Scientific Inc., Micron Technology, Inc., Helixworks Technologies Ltd., Agilent Technologies, Inc., Beckman Coulter, Eurofins Scientific, Siemens AG, 10X Genomics, DNA Script, Ginkgo Bioworks, ArcherDX, Synthego, Genomatix Software GmbH, Zymergen and Biomemory SAS.

DNA Data Storage Market Leaders

- Illumina, Inc.

- Microsoft

- Iridia, Inc.

- Twist Bioscience

- Catalog Technologies

DNA Data Storage Market - Competitive Rivalry, 2024

DNA Data Storage Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in DNA Data Storage Market

- On March 2024,The DNA Data Storage Alliance, led by industry leaders like Catalog Technologies, Quantum Corporation, Twist Bioscience, and Western Digital, has released its first specifications. These guidelines recommend a standard method for storing vendor and CODEC information within a DNA data archive, facilitating the conversion between digital data and DNA.

- On July 2024, Ceramic Data Solutions, known as Cerabyte, has launched its innovative ceramic-based data storage technology in the U.S. market. The startup's "Ceramic Nano Memory" uses flexible glass material for low-cost, long-term archival data storage with fast write/read speeds. As part of its expansion, Cerabyte has opened offices in Silicon Valley and Boulder, Colorado.

- In December 2023, Biomemory has launched its DNA Cards, marking the first-ever public availability of DNA data storage. These credit card-sized DNA Cards can store one kilobyte of text data each, showcasing the practical use of molecular computing as a sustainable alternative to traditional silicon chips. The cards boast a minimum lifespan of 150 years, setting a new standard for data longevity.

DNA Data Storage Market Segmentation

- By Type

- Cloud

- On-premises

- By Technology

- Sequence-based DNA data storage

- Structure-based DNA data storage

- By End-User

- Research Institutes

- Storage Solution Providers

- Technology Companies

- Biotechnology Companies

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the DNA Data Storage Market?

The challenges in data retrieval. and high costs of dna sequencing. are the major factor hampering the growth of the DNA Data Storage Market.

What are the major factors driving the DNA Data Storage Market growth?

The advantages over silicon-based technologies. and anticipated launch of dna memory cards. are the major factor driving the DNA Data Storage Market.

Which is the leading Type in the DNA Data Storage Market?

The leading Type segment is Cloud.

Which are the major players operating in the DNA Data Storage Market?

Thermo Fisher Scientific Inc., Micron Technology, Inc., Helixworks Technologies Ltd., Agilent Technologies, Inc., Beckman Coulter, Eurofins Scientific, Siemens AG, 10X Genomics, DNA Script, Ginkgo Bioworks, ArcherDX, Synthego, Genomatix Software GmbH, Zymergen, Biomemory SAS are the major players.

What will be the CAGR of the DNA Data Storage Market?

The CAGR of the DNA Data Storage Market is projected to be 28.0% from 2024-2031