Electrolyzer Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Electrolyzer Market is segmented By Type (Alkaline Electrolyzer, PEM Electrolyzer, Solid Oxide Electrolyzer), By Capacity (Above 2 MW, ≤ 500 kW, 500 k....

Electrolyzer Market Size

Market Size in USD Bn

CAGR36.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 36.3% |

| Market Concentration | Medium |

| Major Players | Nel Hydrogen, Asahi Kasei Corporation, Hydrogenics Corporation, Shandong Saikesaisi Hydrogen Energy Co., Ltd., Teledyne Energy Systems and Among Others. |

please let us know !

Electrolyzer Market Analysis

The electrolyzer market is estimated to be valued at USD 17.46 Bn in 2024 and is expected to reach USD 152.6 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 36.3% from 2024 to 2031. The electrolyzer market is witnessing strong growth trends on the back of supportive government policies and regulations regarding hydrogen production.

Electrolyzer Market Trends

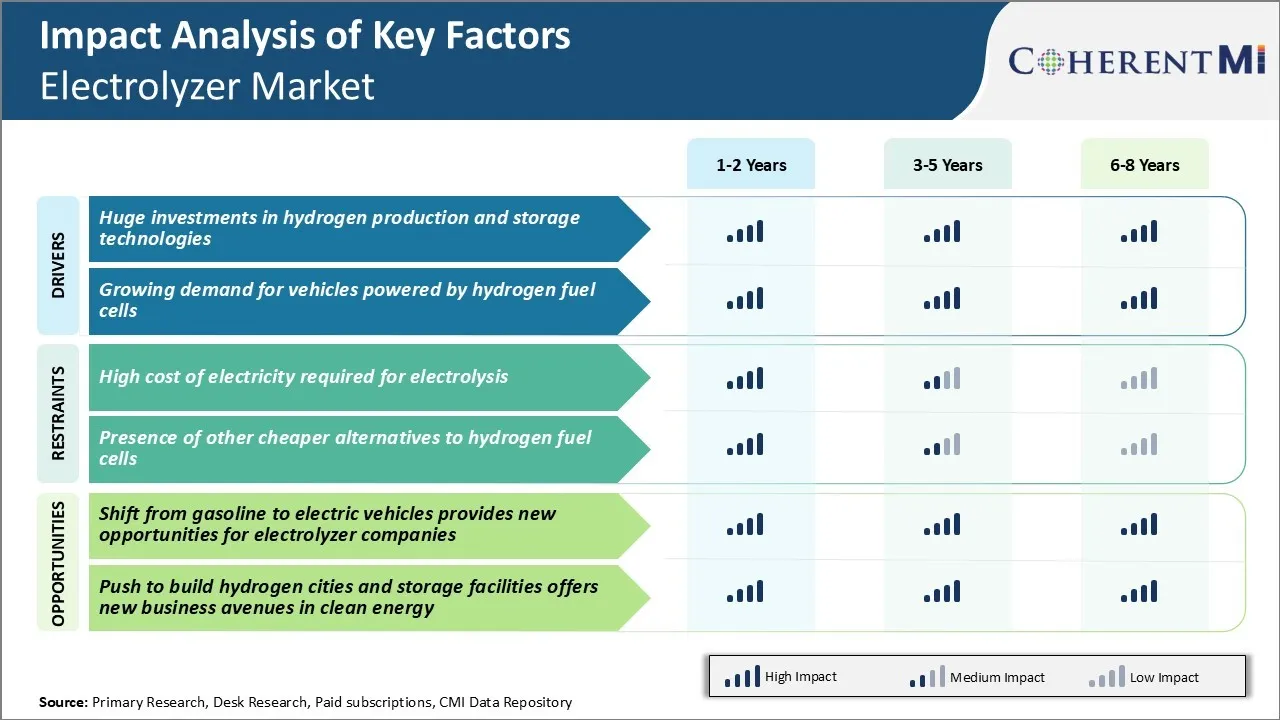

Market Driver - Huge investments in hydrogen production and storage technologies

With the rapidly rising focus on developing cleaner and greener fuel alternatives, hydrogen is emerging as one of the most promising options to reduce emissions from transportation and various industries. Even though hydrogen is still in a nascent stage of adoption, global efforts to cut carbon pollution are driving significant capital towards building the necessary infrastructure for a future hydrogen economy. Electrolyzers play a pivotal role in this ecosystem as they split water into hydrogen and oxygen through an electrochemical reaction.

Over the past few years, governments and large corporations have pledged billions of dollars towards establishing hydrogen hubs, demonstration projects as well as building production facilities for low-carbon hydrogen. For instance, the European Union recently allocated €1 billion to develop regional clean hydrogen valleys before 2030 under its flagship innovation fund. Several countries like Germany, France and Korea have each committed over $1 billion for expanding domestic electrolyzer and renewable hydrogen capacity. Automakers too have joined the movement, with Toyota investing heavily to deploy fuel cell electric vehicles and establish complementary hydrogen refueling stations worldwide. Such substantial investments from both public and private sector are expected to ramp up electrolyzer deployment substantially to deliver large volumes of clean hydrogen on an industrial scale.

Market Driver - Growing Enthusiasm for Fuel Cell Electric Vehicles

With an increasing push for electrification of personal transportation to reduce urban air pollution, zero-emission fuel cell vehicles are garnering significant attention from governments and consumers alike. Several global automakers have unveiled ambitious plans to introduce FCEVs in key markets over the next 5 years backed by supportive policies. For example, Korea and Japan have set aggressive targets to massively enhance the number of hydrogen refueling stations and fuel cell vehicles by the end of this decade. Similarly, in Europe various nations have launched purchase incentives and initiatives to strengthen the surrounding infrastructure. This rapid policy progress and model introduction timeframe is raising hopes of FCEVs finally reaching mainstream adoption.

The establishment of filling stations remains crucial for wider consumer acceptance of fuel cell cars. As such, oil companies are getting involved and teaming up with hydrogen suppliers to put up the initial network of pumps needed. Their expertise, scale and capital towards building fueling forecourts can be highly consequential. Furthermore, improving performance and falling costs of fuel cells and lithium-ion batteries are also making dual-fuel vehicles -capable of running on hydrogen or batteries - more attractive. If automakers deliver on their goals, demand for cleaner hydrogen from electrolyzers to fuel these zero-emission vehicles will undoubtedly see strong growth ahead.

Market Challenge - High Cost of Electricity Required for Electrolysis

One of the major challenges currently facing the electrolyzer market is the high cost of electricity required for the electrolysis process. Electrolysis requires a significant amount of power as it involves using electricity to split water into hydrogen and oxygen. The typical efficiency of electrolysis is around 70-80%, which means that a lot of electricity is needed to produce usable volumes of hydrogen.

With current industrial electricity prices in many regions, the cost of producing hydrogen through electrolysis far exceeds delivery via traditional production methods such as steam methane reforming. For electrolyzer market players to make their products economically viable in the long run, the cost of electricity needs to come down substantially.

This remains one of the biggest roadblocks in the electrolyzer market inhibiting mass commercialization of electrolysis technologies. Considerable research and investment is still needed to improve cell design and material technologies to enhance energy efficiency during electrolysis and ultimately bring down overall production costs.

Market Opportunity - Shift from Gasoline to Electric Vehicles Provides Growth Potential

The transition occurring in the automotive industry away from traditional gasoline vehicles towards electric vehicles provides huge opportunities in the electrolyzer market. As electric vehicles become more mainstream, there will be a growing need for infrastructure to produce and deliver hydrogen as a transportation fuel.

Electrolysis can be used to produce the hydrogen needed to Fuel Cell Electric Vehicles (FCEVs), using renewable energy sources like wind and solar. This creates a massive potential for electrolyzer market players making electrolyzers suitable for large-scale hydrogen production.

Electrolyzer manufacturers that can deliver efficient products on a commercial scale stand to greatly benefit. The demand is likely to ramp up substantially in the coming years as governments introduce supportive policies and more automakers launch FCEV models. By positioning themselves to supply this emerging demand, electrolyzer market players have a major opportunity to enjoy high growth.

Key winning strategies adopted by key players of Electrolyzer Market

Focus on reducing costs through technological advancements - Nel Hydrogen developed their PulseLoad electrolyzer technology that significantly reduces the capital costs and footprint of the electrolyzer system.

Target large scale projects to benefit from economies of scale - In 2021 Nel Hydrogen secured a NOK 7.4 billion contract to supply green hydrogen to Linde for a 600MW alkaline electrolysis project in Denmark. This was one of the largest green hydrogen projects globally at the time.

Form strategic partnerships along the hydrogen value chain - ITM Power partnered with Shell in 2020 on green hydrogen projects in the Netherlands and UK. This allowed them to leverage Shell's retail network and customer base.

Focus on after-sales services to capture recurring revenue - McPhy Energy generates over 50% of its revenues from after-sales services under multi-year operations and maintenance contracts. This creates a stable stream of recurring revenues.

Segmental Analysis of Electrolyzer Market

Insights, By Type: Cost Efficiency Drives Adoption of Alkaline Electrolyzers

In terms of type, alkaline electrolyzer contributes 40% share of the electrolyzer market owing to its cost-efficiency. Alkaline electrolyzers offer a more economically viable option for large-scale hydrogen production compared to other technologies. Their simple and robust alkaline electrolyte system allows for reduced manufacturing costs.

Additionally, alkaline electrolyzers have lower pressure and temperature requirements which eliminate the need for expensive materials like platinum in their production. This makes their initial capital costs significantly lower than competing technologies.

Overall energy efficiency is marginally lower for alkaline electrolyzers compared to other types. However, the gap in energy efficiency is more than compensated by their substantially lower upfront and operating costs. These cost benefits have made alkaline electrolyzers the top choice for large industrial hydrogen applications that prioritize affordable supply over marginal efficiency gains.

Insights, By Capacity: Rising Demand for Massive Hydrogen Production Drives Adoption of Above 2MW Capacity Electrolyzers

In terms of capacity, the above 2 MW segment contributes 93.7% share of the electrolyzer market in 2024. This is owing to increasing needs for bulk hydrogen generation. Massive industrial consumers and green hydrogen projects require electrolyzers with output capacities exceeding 2 MW.

Larger electrolyzer capacities also reap engineering and design benefits. Components can be scaled up efficiently without linear increases in costs. The proportional capital expenditures come down with capacity. Operating costs also see reductions due to better load factors and energy usage optimization at higher throughputs.

Grid interconnection and logistical requirements are optimized for higher capacities. This makes above 2 MW electrolyzers highly suited for the refining, chemical and emerging green ammonia industries and their need for bulk hydrogen on an industrial scale. Their ability to produce hydrogen at a massive scale in a cost-efficient manner drives their adoption.

Insights, By Application: Steel Industry's Heavy Reliance on Hydrogen Drives Adoption in Steel Plants

In terms of application, steel plants contribute the highest share of the electrolyzer market as steel production has a pressing need for hydrogen. Hydrogen is used in bulk quantities in iron and steel manufacturing mainly for quenching and lowering carbon content of alloys. It is estimated that over 50% of global industrial hydrogen demand stems from steel production alone.

Additionally, steel plants have access to waste heat streams which can help improve the efficiency and economics of on-site electrolyzers. Waste heat can be utilized to generate steam for electrolysis, coupling two energy-intensive industrial processes synergistically. This significantly boosts the business case for investing in electrolyzer capacity at steelworks and ensures steel remains the dominant application segment in the electrolyzer market.

Additional Insights of Electrolyzer Market

- Hydrogen City in Wuhan, China: A significant development aiming to showcase the utilization of clean hydrogen energy as part of China's environmental goals.

- Electric Vehicles Shift: The rising demand for hydrogen-powered vehicles, shifting from traditional gasoline-based vehicles, as part of global efforts to reduce carbon emissions.

- North America's Role: North America is the largest electrolyzer market, driven by a high demand for hydrogen in power industries, refining, and manufacturing sectors.

- Asia-Pacific's Growth: With its increasing demand for clean energy, especially in countries like China and India, Asia-Pacific is expected to witness the highest growth in the global electrolyzer market.

Competitive overview of Electrolyzer Market

The major players operating in the electrolyzer market include Nel Hydrogen, Asahi Kasei Corporation, Hydrogenics Corporation, Shandong Saikesaisi Hydrogen Energy Co., Ltd., Teledyne Energy Systems, Siemens AG, Kobelco Eco-Solutions, Green Hydrogen Systems, Next Hydrogen, and H-Tec Systems.

Electrolyzer Market Leaders

- Nel Hydrogen

- Asahi Kasei Corporation

- Hydrogenics Corporation

- Shandong Saikesaisi Hydrogen Energy Co., Ltd.

- Teledyne Energy Systems

Electrolyzer Market - Competitive Rivalry, 2024

Electrolyzer Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Electrolyzer Market

- In November 2023, Siemens announced a partnership with major Asian clean energy companies to expand the production of hydrogen through electrolyzers, increasing its global reach in Asia-Pacific.

- In January 2022, Logan Energy (Edinburgh) signed an agreement with Green Hydrogen Systems for supplying equipment used in electrolysis in England. The deal includes a 40-foot container used as an electrolytic system for a new plant.

Electrolyzer Market Segmentation

- By Type

- Alkaline Electrolyzer

- PEM Electrolyzer

- Solid Oxide Electrolyzer

- By Capacity

- Above 2 MW

- ≤ 500 kW

- 500 kW - 2 MW

- By Application

- Steel Plant

- Power Plants

- Electronics and Photovoltaics

- Energy Storage for Fuel Cells

- Industrial Gases

- Power to Gas

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the electrolyzer market?

The electrolyzer market is estimated to be valued at USD 17.46 Bn in 2024 and is expected to reach USD 152.6 Bn by 2031.

What are the key factors hampering the growth of the electrolyzer market?

High cost of electricity required for electrolysis and presence of other cheaper alternatives to hydrogen fuel cells are the major factors hampering the growth of the electrolyzer market.

What are the major factors driving the electrolyzer market growth?

Huge investments in hydrogen production and storage technologies and growing demand for vehicles powered by hydrogen fuel cells are the major factors driving the electrolyzer market.

Which is the leading type in the electrolyzer market?

The leading type segment is alkaline electrolyzer.

Which are the major players operating in the electrolyzer market?

Nel Hydrogen, Asahi Kasei Corporation, Hydrogenics Corporation, Shandong Saikesaisi Hydrogen Energy Co., Ltd., Teledyne Energy Systems, Siemens AG, Kobelco Eco-Solutions, Green Hydrogen Systems, Next Hydrogen, and H-Tec Systems are the major players.

What will be the CAGR of the electrolyzer market?

The CAGR of the electrolyzer market is projected to be 36.3% from 2024-2031.