Flame Retardant Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Flame Retardant Market is segmented By Product (Non-halogenated, Halogenated), By Application (Epoxy Resins, Polyolefins, PVC, Unsaturated Polyester R....

Flame Retardant Market Size

Market Size in USD Bn

CAGR7.2%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.2% |

| Market Concentration | High |

| Major Players | BASF SE, Clariant AG, Albemarle Corporation, Lanxess AG, ICL Group and Among Others. |

please let us know !

Flame Retardant Market Analysis

The flame retardant market is estimated to be valued at USD 9.82 Bn in 2024 and is expected to reach USD 15.98 Bn by 2031. It is expected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2031. The flame retardant market is expected to witness steady growth during the forecast period mainly attributed to growing construction activities along with rising need for fire protection in buildings.

Flame Retardant Market Trends

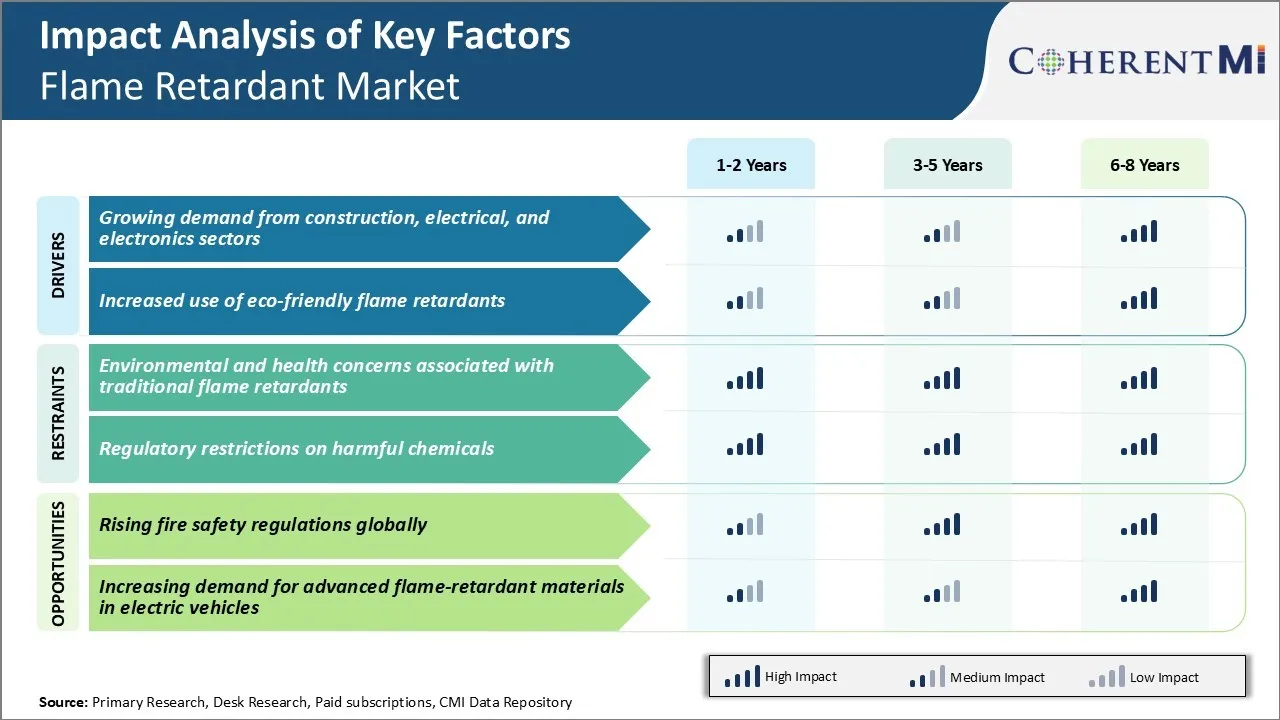

Market Driver - Growing Demand from Construction, Electrical, and Electronics Sectors

Flame retardant market has been experiencing steady growth mainly driven by increasing demand from various end-use industries such as construction, electrical, and electronics. The building and construction sector accounts for a major share of the overall flame retardant market. Strict fire safety regulations worldwide concerning residential and commercial buildings have increased the adoption of flame retardants. With rapid urbanization driving more real estate development projects, the need for flame retardants is projected to increase substantially going forward.

Additionally, the electrical and electronics industry has emerged as a key end-user for flame retardants in recent times. Surging demand for consumer electronics has boosted the production of printed circuit boards, plastics, wires & cables and other components. Since these components can catch fire easily, incorporating flame retardants becomes crucial to ensure safety.

Furthermore, the growing penetration of smart homes and electric vehicles is opening new avenues for flame retardant manufacturers. Advancing technologies are enabling higher integration of electronic control systems in automobiles as well as homes which require effective flame protection. This will bolster growth of the flame retardant market in the coming years.

Market Driver - Increased Use of Eco-friendly Flame Retardants

With growing environmental consciousness, flame retardant producers are increasingly focusing on developing sustainable and eco-friendly product varieties. Stringent regulatory push for non-halogenated and less toxic material alternatives is a key factor driving this change. Regulations such as REACH are also promoting a shift towards phosphorus-based alternatives to halogens.

Another sustainable technology gaining ground is that of intumescent coatings. Made from environmental-friendly substances, these coatings swell into an insulating charred layer when exposed to heat or flame helping surfaces withstand fire for a longer duration. Their barrier properties minimize smoke and toxic emissions during combustion. Intumescent are suitable for a variety of substrates from wood, composites to metallic and are finding increased adoption in construction, transports and industrial applications.

Overall, the rising ecological priorities coupled with new stringent rules will accelerate the utilization of next-gen bio-based and non-halogen solutions. This will support the global flame retardant market in the coming years.

Market Challenge - Environmental and Health Concerns Associated with Traditional Flame Retardants

One of the key challenges faced by the flame retardant market is the environmental and health concerns associated with traditionally used flame retardant chemicals. Several flame retardants such as polybrominated diphenyl ethers (PBDEs) and chlorinated tris phosphate (TDCP) are now banned or being phased out due to evidence of their persistence in the environment and potential impacts on human health.

PBDEs, which were commonly used as additive flame retardants, are known endocrine disruptors and neurotoxicants. Their uncontrolled use has led to wide contamination of the environment as well as accumulation in human and animal tissues. Similarly, TDCP is a known carcinogen and its use has been restricted in many countries. This may create major challenges for growth of players in the flame retardant market.

Market Opportunity - Rising Fire Safety Regulations Globally

The growing fire safety regulations across major industries such as construction, transportation, consumer electronics etc. presents a significant opportunity for the flame retardant market. Stringent regulations such as UL 94, IMO, and various national and international building codes have made flame retardant inclusion mandatory in numerous materials and components. This is driving the demand for innovative and environment-friendly flame retardant solutions.

Especially in developing countries, growing investments in infrastructure, rapid urbanization and rising disposable income are propelling the need for fire safe homes, offices and public buildings. Similarly, stringent norms by FDA and EUROPA for flame retardant content in children's items and upholstery are opening up avenues for alternative green chemistries. This will eventually create lucrative opportunities in the flame retardant market.

Key winning strategies adopted by key players of Flame Retardant Market

Strategy: Product innovation through R&D focus

Players like Albemarle Corporation, BASF SE, Clariant, LANXESS, and DuPont have invested heavily in R&D to develop new and innovative flame retardant solutions. Some examples include:

- In 2020, LANXESS launched new "EcoMer" polymer modifiers for plastics applications requiring flame retardancy. These products help achieve flame retardancy without adding halogen compounds.

- In 2019, Albemarle introduced a new portfolio of non-halogen flame retardants under the name GreenArmor. These products are designed to provide compliance with stringent regulatory standards.

Strategy: Mergers & Acquisitions

Leading players pursue strategic M&A to expand their product portfolio and geographic reach. For example:

- In 2021, LANXESS acquired Italian chemical company ISOTHANE for €80 million to expand its portfolio of polyurethane binders and specialty additives.

- In 2020, Albemarle acquired lithium-based flame retardants business of Israel Chemicals for $330 million, adding key products to its portfolio.

Segmental Analysis of Flame Retardant Market

Insights, By Product: Environmentally-Friendly Options Drive Demand for Non-Halogenated Fire Retardants

In terms of product, non-halogenated flame retardants contributes 62.5% share of the flame retardant market owning to growing environmental regulations. Non-halogenated flame retardants such as aluminum hydroxide and magnesium hydroxide are gaining popularity as they are free from brominated, chlorinated, and phosphorus-based chemicals. Regulations like the Restriction of Hazardous Substances (RoHS) directive and Registration, Evaluation, and Restriction of Chemicals (REACH) are restricting the use of harmful halogenated flame retardants.

Material producers are responding by innovating safer non-halogenated options for applications in construction materials, automotive interiors, and electronics enclosures. As regulations continue to tighten, non-halogenated flame retardants are poised to capture an ever-growing portion of the flame retardant market.

Insights, By Application: Thermoplastics Drive Epoxy Resin Flame Retardancy

In terms of application, epoxy resins contributes 28.7% share of the flame retardant market in 2024. This is due to growing demand from the electrical & electronics sector. Flame retardant epoxy resins are increasingly used as enclosures for electronics devices and components to satisfy stringent safety standards. Epoxy offers desirable properties like heat resistance, dimensional stability and electrical insulation.

The growing market for smartphones, laptops, and other portable electronics is driving volume growth of flame retardant epoxy resins. Additionally, the use of engineering thermoplastics like polycarbonate and nylon in housings and parts requires compatible flame retardant epoxy formulations. As electronic product sophistication and miniaturization advances, the need for specialized flame retardant epoxy systems also rises.

Insights, By End-use Industry: Construction Applications Sustain Flame Retardancy Growth

In terms of end-use industry, construction contributes the highest share of the flame retardant market in 2024 due to stringent fire safety codes. Building codes internationally are mandating greater use of flame retardant materials in flooring, insulation, cables and wiring. The growing construction of commercial buildings, hospitals, schools and other occupancies with high fire risk is supporting demand. Flame retardants allow the use of desirable combustible materials while meeting code requirements.

Growing urbanization worldwide is stimulating new construction activity and the implementation of more protective fire codes. The infrastructure sector is also increasing its use of flame retardants in transportation, energy and maritime projects. With a steady stream of new building projects on the rise, the construction industry ensures sustained demand for flame retardant solutions.

Additional Insights of Flame Retardant Market

- The shift towards non-halogenated flame retardants is gaining momentum due to increased environmental awareness and regulatory pressures to reduce toxic chemical usage.

- Asia-Pacific dominates the flame retardant market, primarily due to rapid industrialization and urbanization in countries like China and India, leading to higher demand in construction and electronics sectors.

- Electronics & Appliances Segment Growth: This segment is projected to witness a CAGR of 7.5% during the forecast period, driven by the increasing demand for flame retardant materials in consumer electronics.

- Construction Industry Demand: Accounting for over 35% of the flame retardant market share, the construction industry remains the largest end-user due to stringent building codes and safety regulations.

Competitive overview of Flame Retardant Market

The major players operating in the flame retardant market include BASF SE, Clariant AG, Albemarle Corporation, Lanxess AG, ICL Group, DuPont de Nemours, Inc., Solvay S.A., The Dow Chemical Company, Akzo Nobel N.V., Nabaltec AG, J.M. Huber Corporation, Italmatch Chemicals S.p.A., Huber Engineered Materials, Celanese Corporation, PolyOne Corporation, FRX Polymers Inc., Kisuma Chemicals, Sibelco, RTP Company, Huntsman International LLC, and Royal DSM NV (DSM) .

Flame Retardant Market Leaders

- BASF SE

- Clariant AG

- Albemarle Corporation

- Lanxess AG

- ICL Group

Flame Retardant Market - Competitive Rivalry, 2024

Flame Retardant Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Flame Retardant Market

- In February 2024, Evonik introduced INFINAM® FR 4100L, a photopolymer resin engineered for digital light processing (DLP) 3D printers. This resin offers both flame retardancy and mechanical durability upon curing. It has achieved a UL 94 V-0 flame retardancy rating at a 3 mm thickness, indicating that burning stops within 10 seconds on a vertical specimen.

- In January 2024, LyondellBasell introduced Petrothene T3XL7420, a cross-linkable, all-in-one flame retardant compound designed to enhance manufacturing efficiency and reduce costs for wire producers in the automotive and appliance industries.

- In October 2023, Clariant opened a state-of-the-art halogen-free flame retardant facility in China, investing CHF 60 million. This substantial investment enhances Clariant's production capacity in the Asia-Pacific region, catering to the growing demand for eco-friendly flame retardant solutions.

- In May 2023, Lanxess showcased a comprehensive portfolio for battery production at the Battery Show Europe 2023, including flame-retardant high-performance plastics for components such as battery modules, housings, and high-voltage connectors in EVs.

Flame Retardant Market Segmentation

- By Product

- Non-halogenated

- Aluminum Hydroxide

- Magnesium Dihydroxide

- Phosphorus Based

- Halogenated

- Brominated

- Chlorinated Phosphates

- Antimony Trioxide

- Others

- Non-halogenated

- By Application

- Epoxy Resins

- Polyolefins

- PVC

- Unsaturated Polyester Resins

- Others (Engineering Thermoplastics and PET)

- By End-use Industry

- Construction

- Transportation

- Electrical & Electronics

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the flame retardant market?

The flame retardant market is estimated to be valued at USD 9.82 Bn in 2024 and is expected to reach USD 15.98 Bn by 2031.

What are the key factors hampering the growth of the flame retardant market?

Environmental and health concerns associated with traditional flame retardants and regulatory restrictions on harmful chemicals are the major factors hampering the growth of the flame retardant market.

What are the major factors driving the flame retardant market growth?

Growing demand from construction, electrical, and electronics sectors and increased use of eco-friendly flame retardants are the major factors driving the flame retardant market.

Which is the leading product in the flame retardant market?

The leading product segment is non-halogenated.

Which are the major players operating in the flame retardant market?

BASF SE, Clariant AG, Albemarle Corporation, Lanxess AG, ICL Group, DuPont de Nemours, Inc., Solvay S.A., The Dow Chemical Company, Akzo Nobel N.V., Nabaltec AG, J.M. Huber Corporation, Italmatch Chemicals S.p.A., Huber Engineered Materials, Celanese Corporation, PolyOne Corporation, FRX Polymers Inc., Kisuma Chemicals, Sibelco, RTP Company, Huntsman International LLC, and Royal DSM NV (DSM) are the major players.

What will be the CAGR of the flame retardant market?

The CAGR of the flame retardant market is projected to be 7.2% from 2024-2031.