Global Kras Inhibitors Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

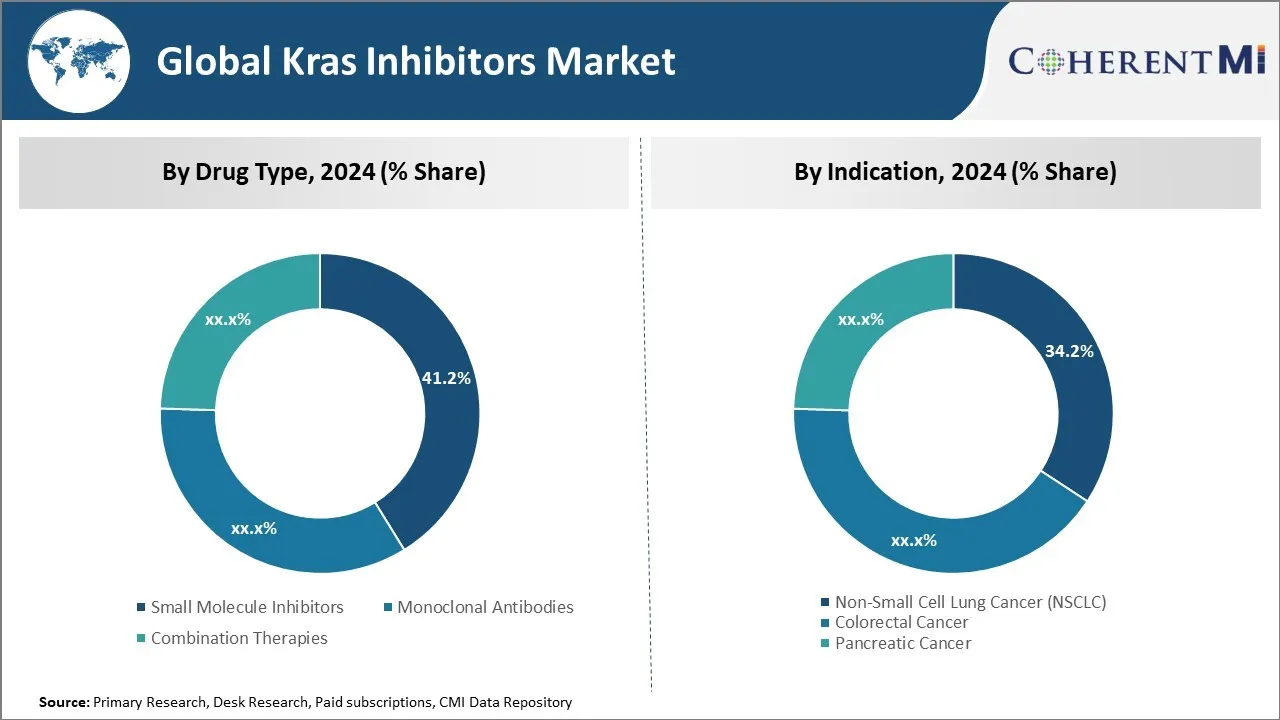

Global Kras Inhibitors Market is segmented By Drug Type (Small Molecule Inhibitors, Monoclonal Antib...

Global Kras Inhibitors Market Size - Analysis

The Global Kras Inhibitors Market is estimated to be valued at USD 104.5 Mn in 2024 and is expected to reach USD 146.6 Mn by 2031, growing at a compound annual growth rate (CAGR) of 4.98% from 2024 to 2031. The market has seen steady growth in recent years driven by increasing demand for targeted cancer therapies and the expanding focus on developing novel therapeutic drugs for treating various cancers.

The Kras inhibitors market is expected to witness positive growth over the forecast period supported by ongoing clinical trials evaluating the efficacy of different Kras inhibitors either as monotherapy or in combination with other targeted drugs. Major pharmaceutical companies have shown increased investments in cancer drug research and development which will accelerate the market trends.

Market Size in USD Mn

CAGR4.98%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.98% |

| Market Concentration | High |

| Major Players | Amgen, Boehringer Ingelheim, Mirati Therapeutics, Novartis, BridgeBio Pharma and Among Others |

please let us know !

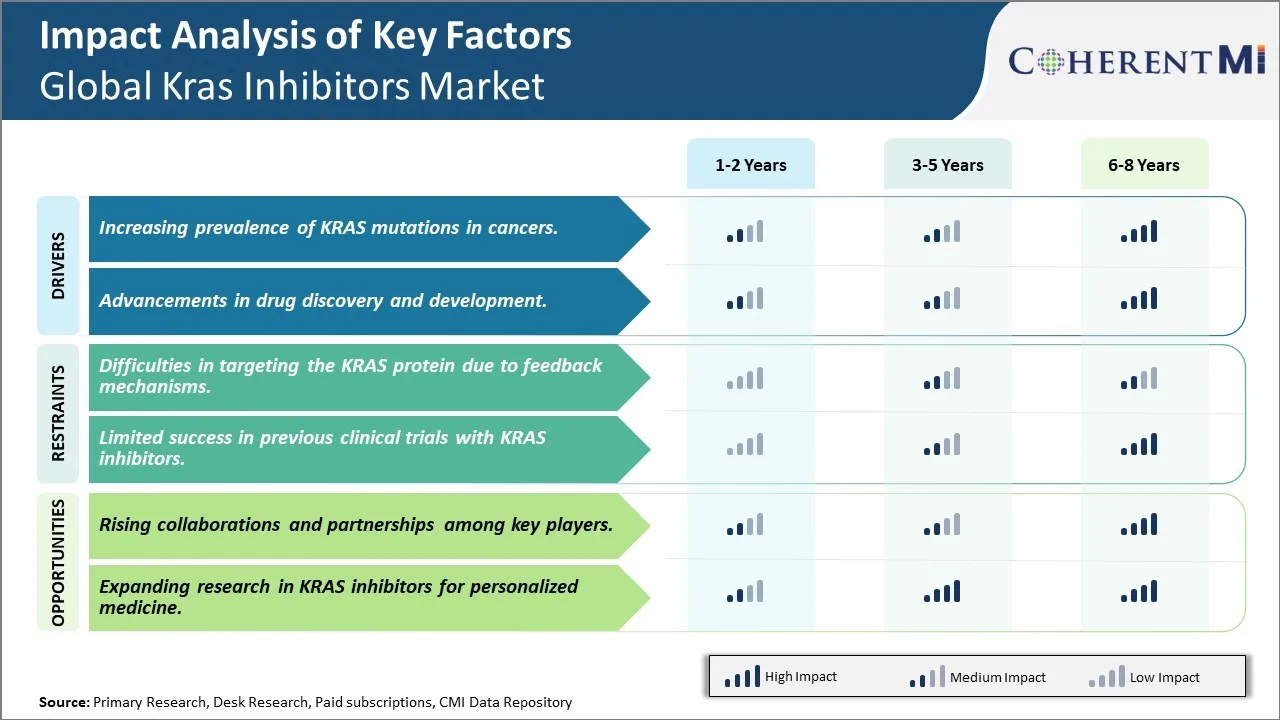

Global Kras Inhibitors Market Trends

Market Driver - Increasing prevalence of KRAS mutations in cancers.

KRAS mutations are commonly observed in many cancer types including lung cancer, colorectal cancer and pancreatic cancer. KRAS is a small GTPase protein that behaves like a molecular on-off switch in cell signaling pathways. When KRAS is activated by mutations, it gets stuck in the "on" position and continuously tells cells to grow and divide - even when its not needed. This results in uncontrolled cell growth which can lead to tumor formation. Research shows KRAS mutations are present in around 25% of all cancers and thus understanding and targeting these mutations is critical for developing more effective cancer treatments.

In lung cancer alone, around 22-25% of non-small cell lung cancers (NSCLC) harbour KRAS mutations which make them one of the most common oncogenic drivers. NSCLC accounts for around 85% of all lung cancers, which is the leading cause of cancer deaths globally. Similarly, around 40-50% of colorectal cancers and as high as 90% of pancreatic cancers have KRAS mutations. With ageing populations and changing lifestyle habits, the worldwide incidence and mortality rates of cancers like lung cancer, colorectal cancer and pancreatic cancer are steadily increasing in recent years. This unfortunately translates to a growing pool of patients who have tumor cells with problematic KRAS mutations. With limited treatment options currently available for KRAS-driven cancers, successful development of KRAS inhibitors will be crucial in fulfilling this significant unmet medical need.

Market Driver -Advancements in drug discovery and development

Researchers have long been working on developing molecules that can directly target and inhibit KRAS for cancer treatment. However, targeting KRAS had been considered one of the toughest challenges in drug development due to its unusually flat shape and lack of accessible pockets where molecules could bind. Nevertheless, advancements in technologies like DNA sequencing, genomics, structural biology and computational modeling are continuously providing new insights into the function and behavior of KRAS at the molecular level. This improved understanding of KRAS biology has helped researchers identify molecules that can potentially disrupt KRAS signaling in cancers.

Several pharmaceutical companies and research institutions have now progressed candidate KRAS inhibitors into clinical trials. While initial molecules were unsuitable due to toxicity or lack of efficacy issues, refinement of molecular properties, delivery methods and combination regimens through ongoing clinical experience is helping improve therapeutic indices. Some trial agents have shown signs of antitumor activity even in heavily pretreated patients. At the same time, the development of laboratory techniques like CRISPR gene-editing and organ-on-chip models that better recapitulate human tumor biology are enabling more efficient screening and testing of novel KRAS inhibitor entities. All these scientific and technological developments in drug design as well as preclinical and clinical evaluation processes support an optimistic outlook for the successful approval of KRAS inhibitors in the coming years.

Market Challenge - Difficulties in targeting the KRAS protein due to feedback mechanisms.

One of the major challenges faced in the global KRAS inhibitors market is effectively targeting the KRAS protein due to complex feedback mechanisms. KRAS is a protein that plays a key role in cell signal transduction pathways. When KRAS is mutated, it gets stuck in an "on" position and signals cells to multiply uncontrollably, leading to cancer. Researchers have struggled to directly inhibit KRAS as it turns on and off rapidly and engages in elaborate feedback loops with other proteins and molecular pathways. Any attempt to block its signaling through conventional small-molecule inhibition has led to compensatory activation of alternative routes that circumvent the blockade. This feedback activation has hindered the development of effective KRAS inhibitors. Substantial research efforts over decades have failed to identify drug compounds that can potently and selectively inhibit the KRAS signal. The dynamic networks and redundancies in KRAS-mediated signaling pose formidable challenges to drug developers. Overcoming these feedback mechanisms will be critical to advance the field of KRAS inhibitor therapeutics.

Market Opportunity- Rising collaborations and partnerships among key players.

One major opportunity in the KRAS inhibitors market is the rising number of collaborations and partnerships between key industry players. Given the difficulties in developing effective KRAS inhibitors independently, pharmaceutical companies and research institutions are increasingly partnering to pool their knowledge, capabilities and resources. This allows them to tackle the complex problem of KRAS inhibition from multiple angles. Notable partnerships in recent years include collaborations between Amgen with Mount Sinai for KRAS(G12C) research, Mirati Therapeutics with Novartis for the development of MRTX849, and Daiichi Sankyo with AstraZeneca for DS-6051. Such partnerships accelerate research progress by enabling cross-functional working, shared risks, and larger drug development programs. They also help companies strengthen their pipelines. If successful, these collaborations are expected to yield more KRAS inhibitor drug candidates entering clinical trials in the coming years. This rising partnership activity bodes well for innovations and future growth within the KRAS inhibitors market.

Key winning strategies adopted by key players of Global Kras Inhibitors Market

Amgen adopted an early market entry strategy by gaining FDA approval for sotorasib (Lumakras) in May 2021, making it the first ever approved drug to directly target KRAS G12C mutations. This gave Amgen a strong first-mover advantage in the market. Lumakras demonstrated significant anti-tumor activity and manageable safety in clinical trials, establishing its efficacy. Amgen has invested heavily in promoting Lumakras and educating physicians about its benefits. This early leadership has helped Amgen capture a major share (~40%) of the nascent KRAS inhibitor market.

Mirati Therapeutics is pursuing an indications expansion strategy. After gaining FDA approval for adagrasib for patients with lung cancer positive for the KRAS G12C mutation in May 2022, Mirati is conducting multiple clinical trials evaluating adagrasib across various solid tumors. It reported positive results from the KRYSTAL-1 trial in colorectal cancer in 2022. By establishing the use of adagrasib across a broader patient pool, Mirati aims to increase its market share.

Johnson & Johnson adopted a strategic partnerships route, collaborating with Novartis to jointly develop and market JNJ-61186372. By leveraging Novartis' oncology expertise and commercial infrastructure, J&J can accelerate the drug's progress and maximize its revenue potential if approved. The partnership de-risks late-stage development by sharing costs. J&J retained US and Japan rights while giving Novartis Europe, ensuring strong commercial coverage globally.

Segmental Analysis of Global Kras Inhibitors Market

Insights, By Drug Type - The Growing Advancements in Small Molecule Therapy Drives its Adoption

In terms of By Drug Type, Small Molecule Inhibitors contributes the highest share of the market with 41.2% in 2024 owing to continuous advancements and improvements in small molecule targeted therapy. Small molecule inhibitors offer highly selective targeting of oncogenic proteins like KRAS with many unique advantages over other therapeutic options. They have ability to penetrate cell membranes easily and interact directly with intracellular or transmembrane target protein. This allows them to inhibit target protein functions effectively inside the cell.

Advancements in drug design and development have enabled discovery of many second and third generation small molecule inhibitors with improved inhibitory potency and selectivity. Use of computational techniques in structure based drug design facilitates optimization of inhibitor structures. This helps in overcoming resistance associated with first generation inhibitors. Several small molecule inhibitors targeting specific KRAS mutations are under clinical trials today. For example, AMG 510 is a potent and selective small molecule KRASG12C inhibitor developed using crystallography and structure-based drug design. If approved, it will offer new targeted treatment option for KRAS mutant cancers.

The ease of administration through oral route and ability to flexibly adjust doses based on tolerability makes small molecule inhibitors attractive for long term use compared to other classes. This drives greater patient acceptability and compliance with small molecule inhibitor-based therapies. Overall, continued progress in enhancing target specificity, potency and overcoming resistance through rational drug design would drive increasing use of small molecule inhibitors for KRAS driven cancer treatment in future.

Insights By Indication - High Incidence and Mortality Drives Focus on Lung Cancer Segment

In terms of By Indication, Non-Small Cell Lung Cancer (NSCLC) contributes the highest share of the market with 34.2% in 2024 due to its high incidence and mortality rates. Lung cancer remains the leading cause of cancer related deaths worldwide. Around 25% of lung cancers are driven by KRAS mutations, making them an important therapeutic target. NSCLC accounts for 85-90% of all lung cancers and KRAS mutations are present in about 30% of NSCLC cases. High unmet need exists in treating KRAS mutant lung cancers effectively as resistance often develops with chemotherapy or other treatments.

Continuous research exploring the specific vulnerabilities of KRAS mutant lung cancer has improved understanding of its underlying biology. This facilitates discovery and testing of new targeted therapies effective against lung cancers with defined molecular aberrations. Regulatory agencies also actively encourage development of therapies for lung cancer with identifiable molecular targets like KRAS. A higher emphasis is laid on exploring novel treatment options for this fatal disease over others that may have lower mortality rates.

Given the high prevalence, poor prognosis and mortality associated with KRAS mutant NSCLC, it receives disproportionately higher research funding and pharma focus compared to other KRAS driven cancer types. This dominant focus on improving lung cancer outcomes through targeted inhibitors including KRAS over other cancer segments drives its large market share currently.

By Route of Administration - Simplicity and Convenience Boosts Oral Administration Preference

In terms of By Route of Administration, Oral contributes the highest share of the market owing to advantages of simplicity and convenience it offers over intravenous or other routes. Successful development of orally available small molecule inhibitors against KRAS or its downstream effectors has strongly promoted this route of delivery.

Patients generally prefer oral medications as they are simpler to self-administer at home without need for hospital/clinic visits. This promotes better compliance especially with long term maintenance therapies. The non-invasiveness of oral administration also makes it more acceptable for conditions requiring life-long control like several cancers.

From the healthcare system perspective, oral drugs reduce costs associated with frequent infusions or injections in clinical settings. They allow shifting treatment from inpatient to outpatient facilities. This eases burden on hospitals and healthcare infrastructure.

Pharma companies also prioritize developing oral forms due to potentially larger markets and better profitability compared to complex parenteral biosimilars. Oral drugs often receive expedited regulatory review and patient access if other routes are not viable options.

These advantages collectively enhance patient experience and make oral pathway practical for most ongoing and long term uses. Hence it remains the most preferred route of administration currently for KRAS inhibitor based targeted therapies.

Additional Insights of Global Kras Inhibitors Market

The KRAS inhibitors market is driven by the increasing prevalence of KRAS mutations across various cancer types, including lung, colorectal, and pancreatic cancers. This has spurred significant interest and investment in developing targeted therapies. Despite challenges in effectively inhibiting KRAS due to complex feedback mechanisms within cancer cells, recent advancements in drug discovery and development hold promise for more potent and selective inhibitors. Additionally, collaborations between pharmaceutical companies are creating new opportunities to combine KRAS inhibitors with other therapies, potentially improving treatment outcomes for patients with limited options. The market is expected to grow steadily, with North America currently leading in market share, while the Asia-Pacific region is projected to experience the fastest growth due to rising investments in healthcare infrastructure and personalized medicine.

Competitive overview of Global Kras Inhibitors Market

The major players operating in the Global Kras Inhibitors Market include Amgen, Boehringer Ingelheim, Mirati Therapeutics, Novartis, BridgeBio Pharma, Erasca, Innovent Biologics, Inc., Incyte, Jemincare and Cardiff Oncology, Inc.

Global Kras Inhibitors Market Leaders

- Amgen

- Boehringer Ingelheim

- Mirati Therapeutics

- Novartis

- BridgeBio Pharma

Global Kras Inhibitors Market - Competitive Rivalry

Global Kras Inhibitors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Global Kras Inhibitors Market

- On June 2024, Bristol Myers Squibb has received FDA accelerated approval for KRAZATI (adagrasib) in combination with cetuximab for treating adult patients with KRASG12C-mutated locally advanced or metastatic colorectal cancer (CRC) who have previously undergone fluoropyrimidine-, oxaliplatin-, and irinotecan-based chemotherapy.

- On April 2024 Merck has initiated a Phase 3 clinical trial to evaluate MK-1084, an investigational oral selective KRAS G12C inhibitor, in combination with KEYTRUDA for first-line treatment of certain patients with metastatic non-small cell lung cancer (NSCLC) harboring KRAS G12C mutations and expressing PD-L1 (TPS ≥50%). This randomized, double-blind trial will enroll approximately 600 patients globally, with primary endpoints focused on progression-free survival and overall survival.

- In April 2023, Innovent Biologics, Inc. presented updated phase 1 clinical trial findings for IBI351, a KRASG12C inhibitor, at the 2023 AACR Annual Meeting.

- In June 2022, Erasca, Inc. announced a trial exploring the combination of KRAS G12C inhibitor with ERK1/2 inhibitor ERAS-007 for NSCLC and colorectal cancer.

- In January 2022 BridgeBio Pharma, Inc. collaborated with Amgen Inc. to assess the combination of BBP-398 and LUMAKRAS (sotorasib) for KRAS G12C mutation in solid tumors.

Global Kras Inhibitors Market Segmentation

- By Drug Type

- Small Molecule Inhibitors

- Monoclonal Antibodies

- Combination Therapies

- By Indication

- Non-Small Cell Lung Cancer (NSCLC)

- Colorectal Cancer

- Pancreatic Cancer

- By Route of Administration:

- Oral

- Intravenous

- Others

- By Cancer Type

- Lung Cancer

- Pancreatic Cancer

- Colorectal Cancer

- Others

- By End User

- Clinic Laboratories

- Cancer Diagnostic Centers

- Hospitals

- Cancer Research Institutes

- Academic Institutions

- Others

Would you like to explore the option of buyingindividual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

What are the key factors hampering the growth of the Global Kras Inhibitors Market?

The difficulties in targeting the kras protein due to feedback mechanisms. and limited success in previous clinical trials with kras inhibitors. are the major factor hampering the growth of the Global Kras Inhibitors Market.

What are the major factors driving the Global Kras Inhibitors Market growth?

The increasing prevalence of kras mutations in cancers. and advancements in drug discovery and development. are the major factor driving the Global Kras Inhibitors Market.

Which is the leading Drug Type in the Global Kras Inhibitors Market?

The leading Drug Type segment is Small Molecule Inhibitors.

Which are the major players operating in the Global Kras Inhibitors Market?

Amgen, Boehringer Ingelheim, Mirati Therapeutics, Novartis, BridgeBio Pharma, Erasca, Innovent Biologics, Inc., Incyte, Jemincare, Cardiff Oncology, Inc. are the major players.

What will be the CAGR of the Global Kras Inhibitors Market?

The CAGR of the Global Kras Inhibitors Market is projected to be 4.98% from 2024-2031.