Graphene Batteries Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Graphene Batteries Market is segmenetd By Type (Lithium-Ion Graphene Battery, Graphene Supercapacitor, Lithium-Sulfur Graphene Battery, Others), By En....

Graphene Batteries Market Size

Market Size in USD Bn

CAGR24.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 24.1% |

| Market Concentration | Medium |

| Major Players | Targray Group, XG Sciences, Inc., Vorbeck Materials Corp., Cambridge Nanosystems Ltd., G6 Materials Corp. and Among Others. |

please let us know !

Graphene Batteries Market Analysis

The graphene batteries market is estimated to be valued at USD 196.22 Bn in 2024 and is expected to reach USD 889.5 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 24.1% from 2024 to 2031. The graphene batteries market is set to showcase substantial growth due to graphene's exceptional properties that allow it to improve battery performance significantly.

Graphene Batteries Market Trends

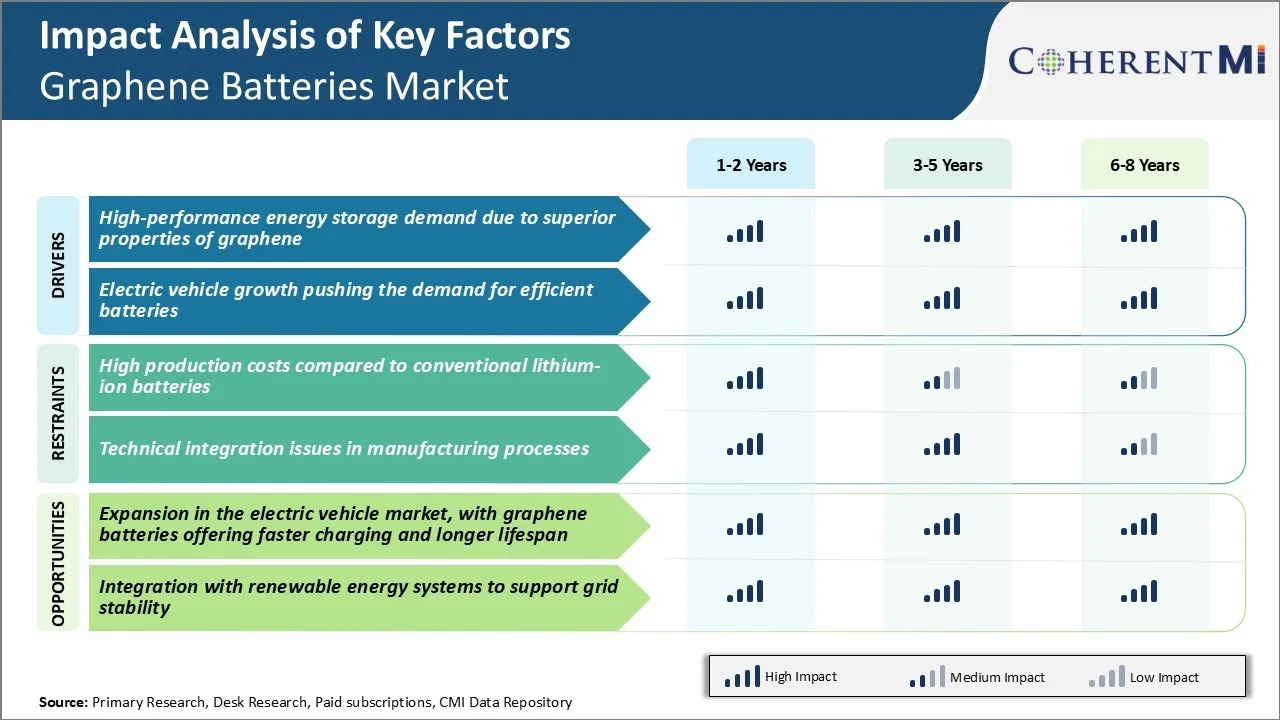

Market Driver - Superior Properties of Graphene Creating Demand for High-performance Energy Storage

The outstanding properties of graphene make it an ideal material for developing next-generation batteries with high storage capacity and rapid charging and discharging capabilities. Graphene has incredibly high electrical and thermal conductivity combined with exceptional mechanical strength and flexibility. It also finds applications in electric vehicles where extended range is crucial and fast charging solutions are paramount.

Robotics, automation, 3D printing, and other advanced manufacturing rely on compact yet powerful battery backups. Graphene with its outstanding power attributes fulfills this need. Similarly, portable medical equipment and devices require reliable long-life batteries that graphene is perfectly positioned to deliver. Wearable tech is another frontier market where lightweight energy sources like graphene batteries could propel future innovations.

This will push graphene batteries market players to support development of revolutionary devices empowered by next-gen power sources. The widespread demand for high performance energy storage spurred by the superior attributes of graphene thus, will drive growth of the graphene batteries market.

Market Driver - Electric Vehicles Driving the Need for Efficient Battery Solutions

The automotive industry is amidst a paradigm shift towards electrification with major carmakers globally launching electric vehicles at an unprecedented rate. Both battery-powered and plug-in hybrid electric vehicles are gaining widespread acceptance. A critical success factor for the mass adoption of EVs, however, remains the development of higher capacity and faster charging batteries.

For electric cars to truly replace gasoline models, batteries need to empower longer driving distance between charges and re-fuel way more rapidly. This is where the potential of graphene comes into play; its extraordinary properties allow for batteries with higher energy and power density compared to graphite batteries.

Automakers are increasingly collaborating with graphene battery developers to engineer cutting-edge solutions. These advanced batteries will allay consumer anxiety over range and usability. The proliferation of high-performing graphene batteries is undeniably critical to achieving the sector's ambitious electrification goals.

Market Challenge - High Production Costs Compared to Conventional Lithium-ion Batteries

One of the key challenges currently faced by the graphene batteries market is its significantly higher production costs compared to conventional lithium-ion batteries. Producing graphene in large volumes and incorporating it into battery materials and cells is a highly complex process that requires specialized equipment and facilities.

Furthermore, the process of assembling graphene components into battery anodes and cathodes with the required nano-scale structures and dispersions also adds to expenses.

All these factors make graphene batteries much more expensive to manufacture on a commercial scale at present. For widespread adoption, especially in mass consumer markets like smartphones and electric vehicles, the costs need to come down significantly. This can be done through manufacturing optimizations, economies of scale, and technological advancements that enable simpler, lower-cost production processes.

Until costs approach parity with lithium-ion, graphene batteries market growth may remain constrained to niche high-performance applications.

Market Opportunity - Expansion in the Electric Vehicle Market

One major opportunity for the graphene batteries market lies in the rapidly expanding electric vehicle industry. As more automakers invest heavily in electric vehicle production to transition to greener mobility solutions, the need for higher performing battery technologies is growing. Graphene batteries offer compelling advantages for electric vehicles by enabling much faster charging times as well as a longer driving range per charge compared to lithium-ion. This is because graphene's properties allow for faster ion conduction and higher energy density.

As a result, graphene batteries could power the next generation of long-range electric vehicles and accelerate the mass adoption of EVs. With many governments also announcing plans to phase out combustion engine vehicles in the coming years, the electric vehicle market is projected to experience exponential worldwide growth.

Thereby, growing EV market demand presents a massive opportunity for graphene batteries to play a pivotal role if costs can be reduced.

Key winning strategies adopted by key players of Graphene Batteries Market

- R&D Investments in Graphene Technology: Players like Samsung, Sony, QuantumScape have invested heavily in R&D to develop advanced graphene materials and battery cell designs that can leverage graphene's high conductivity and density.

- Partnering with Graphene Producers: Battery makers like QuantumScape have partnered with specialist graphene producers to secure a steady supply of high quality, scalable graphene. QuantumScape's partnership with Haydale allows it to source custom engineered graphene materials required for its solid-state battery technology under development. Such strategic partnerships lower supply chain risks for graphene batteries market players.

- Acquiring Graphene Startups: In 2015, Samsung acquired US-based graphene battery startup Anthropic to accelerate its in-house graphene battery R&D and commercialization program. This strategic acquisition gave Samsung access to Anthropic's IP, talent and knowledge base in the fast-paced graphene batteries market.

- Pilot Projects with Automakers: In 2021, Daimler partnered with SVOLT to test graphene-enhanced lithium-ion batteries in China-made EQS electric sedans. Based on initial success, SVOLT will ramp up graphene battery production. Such pilot collaborations help battery makers gain valuable feedback and proof-points before mass production.

Segmental Analysis of Graphene Batteries Market

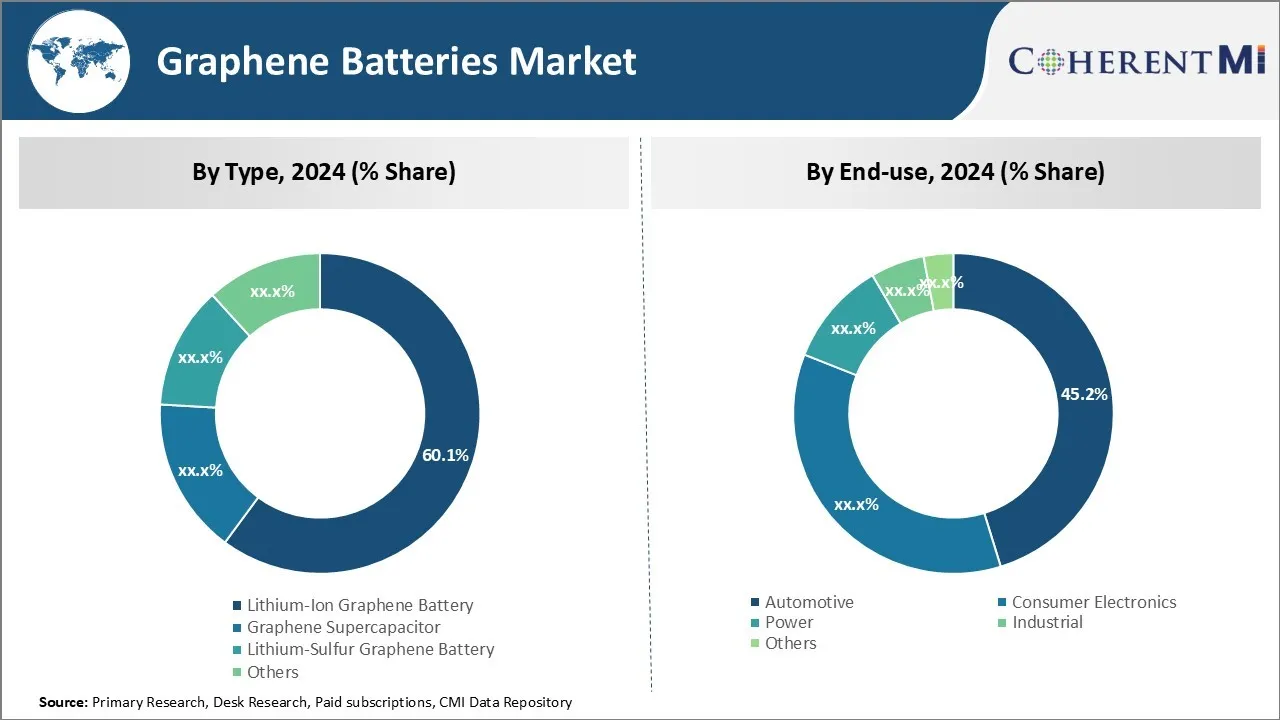

Insights, By Type: Superior Energy Density Drives Demand for Lithium-Ion Graphene Batteries

The lithium-ion graphene battery segment contributes 60.1% share to the graphene batteries market in 2024. This is due to its unmatched energy density. Graphene's ultra-thin, tightly packed hexagonal carbon lattice structure allows it to store lithium ions more densely than conventional graphite anodes. When incorporated into lithium-ion battery anodes, graphene enhances storage capacity without increasing anode volume. This boosts overall battery energy density by 15-20% compared to conventional lithium-ion batteries.

Higher energy density per unit volume is critical for applications where space is limited, such as consumer electronics and electric vehicles. Graphene's high conductivity further improves battery performance over multiple charge-discharge cycles. This superior cycle life reduces overall battery replacement costs. For these compelling reasons, lithium-ion graphene batteries will continue dominating the graphene batteries market.

Insights, By End Use: Graphene Enhances Automotive Battery Performance and Safety

The automotive segment holds 45.2% share of the graphene batteries market in 2024. This is due to graphene's ability to resolve many challenges conventionally facing electric vehicle batteries. In EVs, batteries must withstand immense operational stresses including hundreds of charging cycles and wide temperature ranges. Graphene excels at stabilizing battery anodes against such stresses through its robust structure.

Notably, graphene's single-atom thickness enables it to behave as an artificial "solid-state electrolyte" within lithium-ion batteries. It facilitates fast lithium-ion transport while also acting as an effective barrier to prevent dendrite formation. For automakers and customers, the complete elimination of battery fire risk fosters confidence in EVs that will bolster market demand. Given these key advantages, graphene batteries are paramount for advancing EV battery technology.

Additional Insights of Graphene Batteries Market

- The GRAPHERGIA Project (November 2023) aims to innovate in energy harvesting technologies using graphene in textiles.

- iPowe Batteries Pvt Ltd's launch of graphene-based lead-acid batteries in India addresses the growing demand for advanced storage solutions.

- Asia Pacific dominated the graphene batteries market in 2023, accounting for the largest share due to rapid industrialization, technological advancements, and key market players like China, Japan, and South Korea.

- Europe is expected to grow at the fastest CAGR between 2024 and 2033, led by countries like Germany, the UK, and France.

Competitive overview of Graphene Batteries Market

The major players operating in the graphene batteries market include Targray Group, XG Sciences, Inc., Vorbeck Materials Corp., Cambridge Nanosystems Ltd., G6 Materials Corp., Graphenano S.L., Graphene NanoChem plc, and Graphenea S.A.

Graphene Batteries Market Leaders

- Targray Group

- XG Sciences, Inc.

- Vorbeck Materials Corp.

- Cambridge Nanosystems Ltd.

- G6 Materials Corp.

Graphene Batteries Market - Competitive Rivalry, 2024

Graphene Batteries Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Graphene Batteries Market

- In January 2024, iPowe Batteries Pvt Ltd introduced graphene series lead-acid batteries in India, marking a major step for the Indian battery industry.

- In November 2023, GRAPHERGIA Project Launch – A consortium of 11 European partners, led by a group of innovators, unveiled the GRAPHERGIA project aimed at revolutionizing textile energy harvesting and battery tech, with a focus on graphene.

Graphene Batteries Market Segmentation

- By Type

- Lithium-Ion Graphene Battery

- Graphene Supercapacitor

- Lithium-Sulfur Graphene Battery

- Others

- By End-use

- Automotive

- Consumer Electronics

- Power

- Industrial

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the graphene batteries market?

The graphene batteries market is estimated to be valued at USD 196.22 Bn in 2024 and is expected to reach USD 889.5 Bn by 2031.

What are the key factors hampering the growth of the graphene batteries market?

High production costs compared to conventional lithium-ion batteries and technical integration issues in manufacturing processes are the major factors hampering the growth of the graphene batteries market.

What are the major factors driving the graphene batteries market growth?

High-performance energy storage demand due to superior properties of graphene and electric vehicle growth are the major factors driving the graphene batteries market.

Which is the leading type in the graphene batteries market?

The leading type segment is lithium-ion graphene battery.

Which are the major players operating in the graphene batteries market?

Targray Group, XG Sciences, Inc., Vorbeck Materials Corp., Cambridge Nanosystems Ltd., G6 Materials Corp., Graphenano S.L., Graphene NanoChem plc, and Graphenea S.A. are the major players.

What will be the CAGR of the graphene batteries market?

The CAGR of the graphene batteries market is projected to be 24.1% from 2024-2031.