High-performance Composites Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

High-performance Composites Market is segmented By Material (Resins, Fiber), By Application (Aerospa...

High-performance Composites Market Size - Analysis

The Global High-performance Composites Market is estimated to be valued at USD 66.5 Bn in 2024 and is expected to reach USD 159.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2031. The market is driven by increasing demands from various end-use industries such as aerospace, defense, automotive, and wind energy.

The high-performance composites market is expected to witness significant growth over the forecast period. The aerospace and defense industries will continue adopting high-performance composites to manufacture lightweight and fuel-efficient aircraft and vehicles. Moreover, the rising installation of wind turbines equipped with composite blades will also support the market expansion. The lightweight and durable properties of composites make them preferable over metal alloys in structural applications.

Market Size in USD Bn

CAGR11.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.5% |

| Market Concentration | High |

| Major Players | BASF SE, Arkema, Hexcel Corporation, Solvay, TenCate Protective Fabrics and Among Others |

please let us know !

High-performance Composites Market Trends

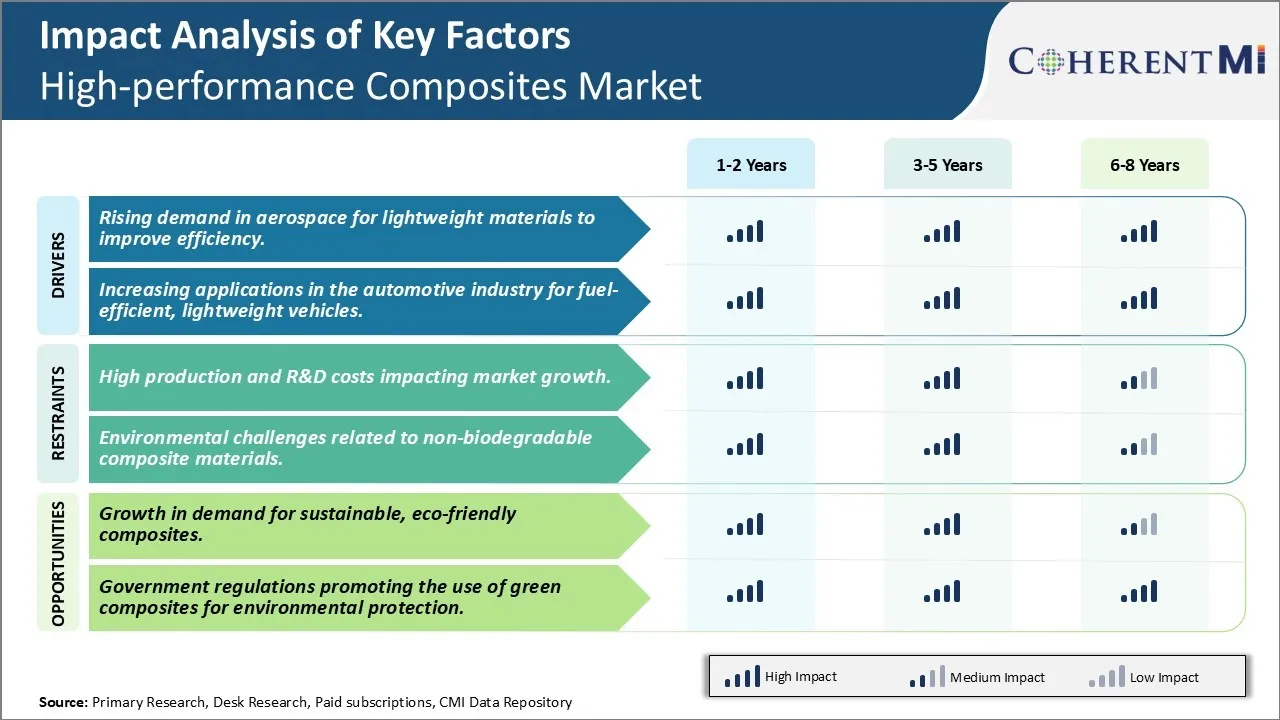

Market Driver - Rising Demand in Aerospace for Lightweight Materials to Improve Efficiency

The aerospace industry has always been focused on improving fuel efficiency and reducing carbon emissions. Airplanes need to fly farther, carry heavier payloads, while burning less fuel per mile flown. This has fueled the search for lightweight yet highly durable materials. High-performance composites have emerged as one of the key materials to help achieve this goal. Their high strength-to-weight ratio allows aircraft manufacturers to replace heavier convention alloys and metals. Composites are now used extensively in various aircraft components such as fuselage, wings, empennage, engine nacelles and landing gear.

Composite materials have enabled major aircraft manufacturers like Boeing and Airbus to build 20% lighter airframes compared to conventional aluminum airframes. This directly translates to fuel savings of 10-15% over the lifetime of the aircraft. Besides, composites are also more corrosion resistant than metals. They require lesser maintenance and offer longer service life. The combined benefits of reduced weight, better durability and performance have made composites an indispensable part of modern aircraft design. Their use is growing steadily with each new aircraft program. For example, Boeing's 787 Dreamliner uses composites for about 50% of its airframe whereas Airbus' A350 uses over 53% composites.

With growing environmental regulations, airlines are under increasing pressure to reduce their carbon footprint. This is driving aircraft manufacturers to rely even more on lightweight composite materials to build more fuel-efficient planes. The coming years will likely see a major rise in demand for advanced composite materials like carbon fiber as their use expands beyond exterior airframes to other critical interior and structural components. Overall, the need for lighter aircraft that burn less fuel perfectly aligns with the inherent properties of high-performance composites. This demand pull from the aerospace industry is a key driver propelling the composites market.

Market Driver - Increasing Applications in the Automotive Industry for Fuel-Efficient, Lightweight Vehicles

The automotive industry is also under intense pressure to reduce vehicle weight in order to enhance fuel efficiency and meet tightening emissions regulations. This presents a massive opportunity for high-performance composites to play a bigger role. Their high strength-to-weight ratio allows automakers to replace heavier metal components and shave off significant pounds from vehicles.

Currently, composites find use in several non-structural exterior parts like front-end modules, hoods, fascias, door panels, lifted gates, and spoilers. Their increasing use is visible - the composite content in average vehicles has grown from around 60 pounds in 2008 to over 100 pounds currently. However, automakers recognize composites can do much more if used for structural load-bearing applications as well. Major efforts are underway to incorporate composites in areas like frames, cross-car beams, B-pillars, hybrid chassis systems and more.

Key players predict up to 50% weight reduction may be achievable through comprehensive use of carbon, natural fiber and other advanced composites - well beyond what can be done through incremental changes. This could dramatically boost fuel efficiency. Apart from reduced weight, composites enable intricate, synchronized designs that integrate multiple functions into single lightweight parts. All of this complements ongoing transitions to hybrid and electric powertrains that are also battery-dependent. Composites can help offset the weight of large batteries and motor systems.

With regulations tightening year after year, automakers are scrambling to quickly reduce their fleet average CO2 emissions through various measures including composites. This growing realization of composites potential is a major driver incentivizing OEMs as well as composites producers to substantially increase investments and collaborations around developing and mass producing next-gen composite car bodies.

Market Challenge - High Production And R&D Costs Impacting Market Growth

The high production and R&D costs associated with high-performance composites pose a significant challenge for market growth. Producing high-performance composites requires advanced manufacturing techniques and specialized materials that make the production process complex and costly. This leads to higher production costs compared to conventional materials like metals. Additionally, continuous R&D is required to develop new formulations with improved strength-to-weight ratios and resistance to corrosion and heat. Sustaining an R&D pipeline comes with considerable expenses. These high costs are passed on to the end consumers in the form of higher product prices. This acts as a barrier, especially in price-sensitive application areas. For the market to expand, bringing down production costs through automation, mass production techniques, and open innovation collaboration will be crucial. Industry players will need to optimize processes and leverage economies of scale. However, achieving meaningful cost reductions is a gradual process and remains a formidable challenge slowing the market's growth trajectory in the near term.

Market Opportunity- Growth in Demand for Sustainable, Eco-Friendly Composites Encourages Industry Growth

There is a growing emphasis on utilizing sustainable and eco-friendly materials to reduce environmental impact. High-performance composites provide an advantage over traditional materials in this regard. Being lightweight, they allow for material savings and contribute to lower emissions over product lifecycles. Additionally, some composite formulations are made using natural fibers like flax, hemp and wood that provide renewable and recyclable options. These sustainable characteristics have led to increased demand from environmentally-conscious customers across industries. Regulatory push for reduced emissions and corporate sustainability goals are further accelerating the preference for eco-friendly alternatives. With environmental issues rising up the global agenda, the demand for sustainable composites is expected to keep expanding over the coming years. Composite producers can capitalize on this opportunity by developing new formulations using recycled materials and building out their portfolio of natural fiber offerings. Targeting the robust wind and automotive sectors is a key strategy to maximizing gains in this growing sustainable materials space.

Key winning strategies adopted by key players of High-performance Composites Market

Innovation in Materials and Processes:

- Companies are continually innovating to develop composites with enhanced properties like higher strength-to-weight ratios, thermal stability, and corrosion resistance. This includes materials like carbon fiber-reinforced polymers (CFRP), glass fiber composites, and thermoplastic composites.

- To meet specific industry needs, many companies are focusing on hybrid composites, which combine multiple types of fibers or resins for optimal performance.

Strategic Partnerships and Collaborations:

- Collaborations with OEMs in aerospace, automotive, and defense sectors help tailor composite materials to specific applications, driving customized solutions and long-term partnerships.

- Partnerships with universities and research institutions enable companies to leverage cutting-edge research in material science, enhancing product offerings and maintaining technological leadership.

Sustainable and Eco-Friendly Solutions:

- Many players are developing recyclable or bio-based composites to meet rising environmental and regulatory pressures, particularly in sectors like automotive and construction.

- Companies are adopting lifecycle management strategies to reduce the environmental impact of composites, focusing on the recyclability of end-of-life components and waste reduction during manufacturing.

Geographic Expansion and Market Penetration:

- Companies are expanding into emerging markets such as Asia-Pacific and Latin America, where industries like automotive, construction, and energy are growing rapidly.

- Setting up manufacturing plants close to high-demand regions like North America and Europe reduces transportation costs and allows companies to respond quickly to local customer needs.

Cost Optimization and Process Efficiency:

- Automated fiber placement, robotic-assisted manufacturing, and resin transfer molding help improve productivity, reduce labor costs, and minimize material waste, making composite manufacturing more scalable and cost-effective.

- Many companies are implementing lean manufacturing principles to reduce production costs and improve operational efficiency, which is essential for maintaining competitiveness.

Segmental Analysis of High-performance Composites Market

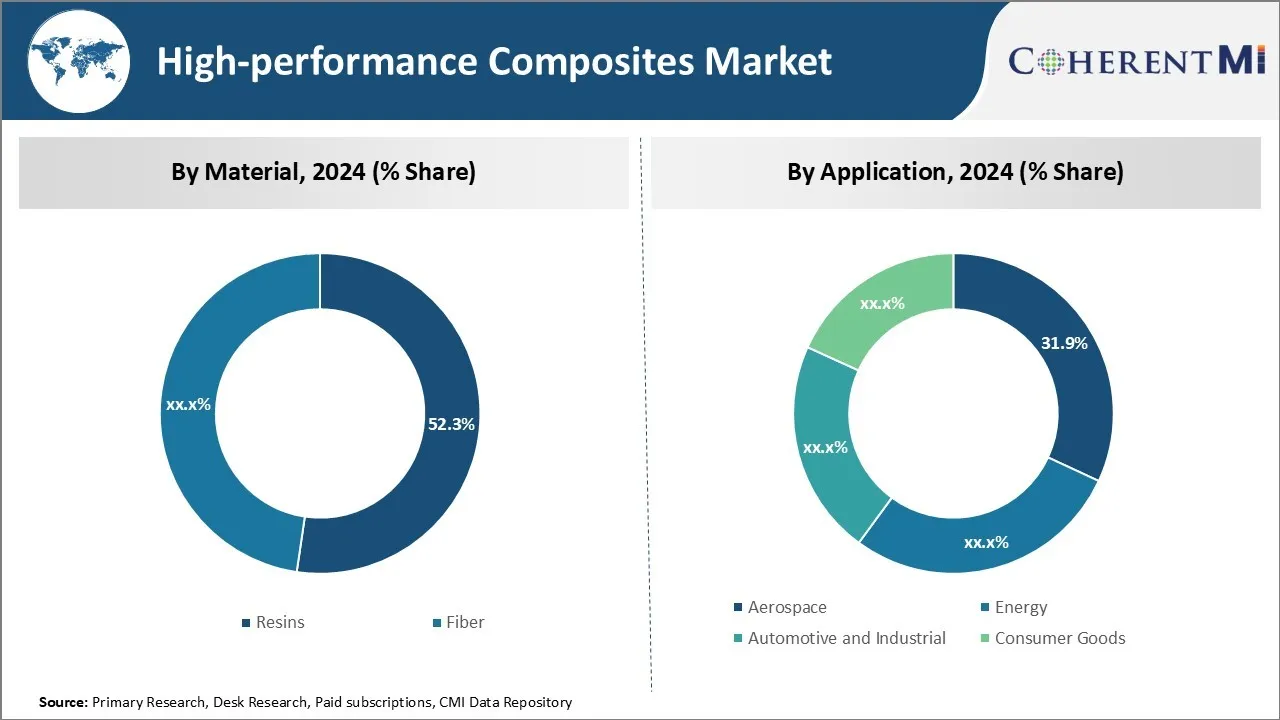

Insights, By Material, Resins Lead the Market Share Based on their High Demand

By material type, resins contribute 52.3% in 2024 owing to their increasing usage in various applications. Resins form the binding matrix in composites and provide strength and durability to the overall structure. The unique properties of resins such as high strength-to-weight ratio, corrosion resistance, and insulation make them ideal for use in composites.

Within resins, thermoset resins dominate market demand due to their advantageous characteristics. Epoxy resins, in particular, are widely used across industries such as aerospace, defense, wind energy, and automotive owing to their excellent adhesion, mechanical properties, and electrical insulation. Other popular thermoset resins include polyester, vinyl ester, and phenolic. Thermoplastic resins are also gaining traction in the market, driven by their recyclability and potential for reuse. Polyamide and polyether ether ketone (PEEK) thermoplastic resins witness increased adoption in transportation and industrial applications.

The continued expansion of end-use industries is a key factor driving resin consumption. Rapid growth of the aerospace industry with the increasing aircraft production and fleet size is necessitating the enhanced use of high-performance epoxy and bismaleimide resins in composites for lightweight applications. Resins are also pivotal in the fast-growing wind energy sector for manufacturing turbine blades and other structural components. The rising need for reinforcement and insulation in infrastructure, oil & gas, and defense applications further complements market growth. Material innovations leading to development of advanced resins with superior thermal and mechanical properties also boost the material's prospects in the composite market.

Insights, By Application, Aerospace Accounts for the Leading Share Based on its Composite Usage

The aerospace industry accounts for 31.9% in 2024 attributable to growing aircraft production and emphasis on lightweight materials. Composite usage in aircraft manufacturing has increased significantly over the past few decades to reduce weight and improve fuel efficiency. Around 50% of an average aircraft's structure is now composed of composites, with efforts to expand this utilization further.

Commercial aircraft such as Boeing 787 and Airbus A350 XWB leverage composites extensively in fuselage, wings, empennage, and engine nacelles. Benefits like corrosion resistance, durability, and tailorability of composites have made them indispensable for new aircraft programs. Military aircraft procurement and modernization programs by countries also require advanced composites for airframes, radomes, flight control surfaces, and other high-load applications. Helicopters similarly use composites in blades, hubs and structural airframe elements.

Spacecraft application presents unique design challenges necessitating high-performance and lightweight materials like composites. Satellite and launch vehicle components including tanks, fairings and heat shields incorporate composites. Composites also find increased usage in stationary and rotating components of modern wind turbines as well as marine vessels owing to their corrosion resistance and strength.

Developments in resin technologies, fiber reinforcements, manufacturing techniques and joining capabilities continue to expand applicability of composites in airframes, aero-engines and other mission-critical aviation domains. Resultant weight savings, durability and production efficiencies enhance viability of air transportation over the long run benefiting overall high-performance composites demand.

Additional Insights of High-performance Composites Market

The high-performance composites market is poised for growth due to its application in sectors requiring lightweight, durable materials, notably aerospace, automotive, and renewable energy. Factors such as rapid industrialization, increased investments in sustainable materials, and advancements in composite technology fuel this growth. Environmental regulations encouraging green composites and innovations in bio-based composites are reshaping the market. High-performance composites' unique properties, like corrosion resistance, strength-to-weight ratio, and flexibility, make them suitable for diverse applications across industries, reinforcing the market's growth trajectory and broadening its reach.

Competitive overview of High-performance Composites Market

The major players operating in the High-performance Composites Market include BASF SE, Arkema, Hexcel Corporation, Solvay, TenCate Protective Fabrics, SGL Carbon, Owens Corning, TPI Composites, DuPont and SABIC.

High-performance Composites Market Leaders

- BASF SE

- Arkema

- Hexcel Corporation

- Solvay

- TenCate Protective Fabrics

High-performance Composites Market - Competitive Rivalry

High-performance Composites Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in High-performance Composites Market

- In September 2024, Toray Advanced Composites released high-performance thermoplastic composite material Toray Cetex PESU, enhancing aerospace applications.

- In August 2024, Greene Tweed launched new composite brackets as lightweight metal replacements.

- In May 2024, TPI Composites collaborated with the University of Maine and Oak Ridge National Laboratory for sustainable wind turbine tooling.

High-performance Composites Market Segmentation

- By Material

- Resins

- Fiber

- By Application

- Aerospace

- Energy

- Automotive and Industrial

- Consumer Goods

Would you like to explore the option of buyingindividual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.

Frequently Asked Questions :

How Big is the High-performance Composites Market?

The Global High-performance Composites Market is estimated to be valued at USD 66.5 Bn in 2024 and is expected to reach USD 159.3 Bn by 2031.

What will be the CAGR of the High-performance Composites Market?

The CAGR of the High-performance Composites Market is projected to be 11.5% from 2024 to 2031.

What are the major factors driving the High-performance Composites Market growth?

The rising demand in aerospace for lightweight materials to improve efficiency and increasing applications in the automotive industry for fuel-efficient, lightweight vehicles are the major factors driving the High-performance Composites Market.

What are the key factors hampering the growth of the High-performance Composites Market?

The high production and R&D costs impacting market growth and environmental challenges related to non-biodegradable composite materials are the major factors hampering the growth of the High-performance Composites Market.

Which is the leading Material in the High-performance Composites Market?

Resins are the leading Material segment.

Which are the major players operating in the High-performance Composites Market?

BASF SE, Arkema, Hexcel Corporation, Solvay, TenCate Protective Fabrics, SGL Carbon, Owens Corning, TPI Composites, DuPont, SABIC are the major players.