Hydro Turbine Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Hydro Turbine Market is segmented By Type (Francis Turbines, Pelton Turbines, Kaplan Turbines, Cross-Flow Turbines), By Application (Hydropower Genera....

Hydro Turbine Market Size

Market Size in USD Bn

CAGR6.4%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.4% |

| Market Concentration | Medium |

| Major Players | General Electric Company, Siemens AG, Andritz AG, Voith Group, Toshiba Corporation and Among Others. |

please let us know !

Hydro Turbine Market Analysis

The hydro turbine market is estimated to be valued at USD 9.9 Bn in 2024 and is expected to reach USD 15.33 Bn by 2031. It is projected to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2031. Growth in renewable energy adoption and supportive government policies promoting clean energy are fueling growth of the hydro turbines market.

Hydro Turbine Market Trends

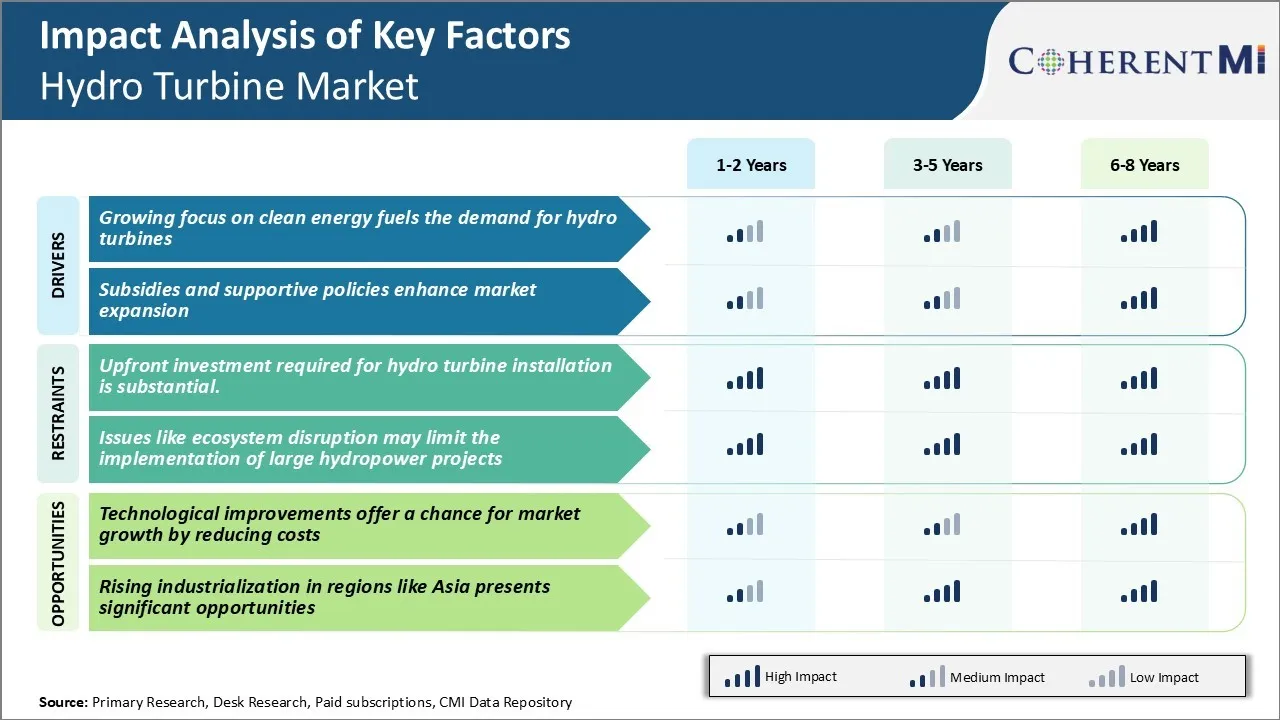

Market Driver - Growing Focus on Clean Energy Fuels the Demand for Hydro Turbines

With the pressing need to curb carbon emissions and shift towards more sustainable sources of energy, global leaders are increasingly prioritizing investments in renewable power generation. Hydropower, being a clean and economically viable source, has emerged as a key area of focus worldwide. Growing emphasis on clean energy is a major driver propelling demand for hydro turbines across mature as well as emerging markets.

Governments and utilities are undertaking significant capacity additions in large-scale hydropower projects as they look to harness their hydropower potential. Some of the major ongoing projects involve setting up new plants as well as modernizing ageing infrastructure with upgraded and more efficient hydro turbines.

Clean energy goals coupled with supportive policy nudges have energized hydropower expansion plans globally. Growing focus on hydropower as a renewable energy source is a key driver stimulating extensive demand in the hydro turbines market.

Market Driver - Subsidies and Supportive Policies Enhance Market Expansion

Many governments offer an array of subsidies, tax benefits and other financial incentives targeted at boosting renewables in general and hydropower specifically. These subsidies and support mechanisms have played a pivotal role in incentivizing higher private sector investment in hydro turbine projects and lowering risks.

Countries provide various subsidies such as capital grants or subsidized loans for setting up new hydropower facilities as well as production-linked incentives for renewable power generation. They also offer tax exemptions or tax credits on turbine equipment and machinery.

Besides financial aid, supportive policies in the form of land rights, environment clearance facilitation, electricity market and grid access norms have greatly aided hydropower expansion. Streamlined approval processes and flexibility in project commissioning deadlines amid COVID-19 have kept hydropower projects on track. The cascading impact of policy frameworks has been remarkable on turbine manufacturing activity by enhancing business prospects and stability for hydro turbine market players.

Market Challenge - Upfront Investment Required for Hydro Turbine Installation is Substantial

Upfront investment required for hydro turbine installation is substantial. Developing hydroelectric power requires heavy initial capital expenditure to construct dams, tunnels, power stations and transmission infrastructure. This high upfront cost poses a major barrier to entry for new companies looking to enter the hydro turbine market.

The large multi-year capital commitment and long payback periods significantly raise the financial risk for investors. High development costs also make smaller hydroelectric projects economically unviable. Geography and site-specific factors further contribute to variances in capital expenditure between projects.

The substantial upfront capital expenditure required thus poses a major challenge for hydro turbine market growth. This necessitates access to low-cost financing options to make projects bankable.

Market Opportunity - Technological Improvements Offer Growth

Technological improvements offer a chance for market growth by reducing costs for market players. Advancements in hydro turbine design now allow for generation of power from low head sites which were previously not economical. Mini and micro hydro technologies have lowered the entry barrier requirements and enable utilization of small water resources. Digitization and use of sensors is improving plant efficiency.

3D printing is enabling cost-effective precision manufacturing of turbine components. Use of composite materials instead of metal further cuts down capital costs. Such technological upgrades are helping boost the viability of small-scale projects. As costs decline, new geographic regions and off-grid applications are opening up for hydro power. This presents lucrative opportunities for hydro turbine market players to expand into new segments and applications.

Segmental Analysis of Hydro Turbine Market

Insights, By Type: Efficiency and Reliability: The Francis Type Turbines Dominate the Market

In terms of type, Francis turbines contribute 33.7% share of the hydro turbine market owing to their high efficiency and reliability across a wide range of heads and flows. Its unique draft tube design helps recover the kinetic energy of water exiting the turbine, resulting in high efficiencies sometimes exceeding 95%.

Additionally, the Francis turbine has fewer moving parts compared to other types, reducing maintenance requirements. Its steady continuous flow of water allows for minimal vibrations, enhancing mechanical stability and reliability over long usage hours.

These advantages have led to Francis turbines becoming a preferred choice for larger-scale hydropower installations where high power output and long-term dependable operations are critical. Its robust and durable construction also makes Francis turbines suitable for harsh environments and locations with limited accessibility for repairs.

Insights, By Application: Renewable Energy Demand Drives Hydropower Generation

In terms of application, hydropower generation contributes 45.2% share of the hydro turbine market in 2024. This is owing to the increasing global demand for renewable energy sources. Hydropower is one of the most cost-effective renewable energy resources that provides electricity on demand without air pollution or greenhouse gas emissions.

With growing concerns around climate change and energy security, many countries are targeting higher shares of renewable energy in their power generation portfolios. This is driving significant investments in new hydropower projects worldwide, especially for large-scale grid-connected stations.

Hydro turbines play a vital role in efficiently converting kinetic energy from flowing water into clean electricity, making hydropower generation a lucrative sector. Developed nations are also upgrading their aging hydro turbine infrastructure to extract more power from existing stations.

Insights, By Installation: Replacement Needs from Aging Infrastructure Boost New Installations

In terms of installation, new installations contribute the highest share due to requirements emerging from aging hydroelectric infrastructure worldwide. Many hydropower plants globally are over 40-50 years old and were not designed to current material and engineering standards.

Prolonged usage is resulting in wear and tear of original turbine equipment installed several decades ago. This is driving the need for complete replacements of worn-out hydro components to maintain or enhance stations' power generation capacities.

Furthermore, developing countries across Asia and Africa are investing heavily in new dams and reservoirs to meet their fast growing electricity demand and boost rural electrification. This is presenting lucrative opportunities for new turbine installations alongside civil works contracts in the global hydro turbine market. Overall, the dual forces of replacing obsolete turbines and fulfilling requirements from hydropower expansion plans are propelling the new installations segment in the hydro turbine market.

Additional Insights of Hydro Turbine Market

- General Electric: Recently upgraded a major hydroelectric project in Canada, increasing energy output by 25% with advanced turbine technologies.

- Andritz AG: Completed the installation of a high-efficiency Francis turbine in a new hydropower plant in Europe.

- The hydro turbine market is witnessing a steady increase in demand due to the global shift toward renewable energy sources. The adoption of eco-friendly technologies in hydropower plants is driving the demand for more efficient turbines, leading to advancements in turbine designs.

Competitive overview of Hydro Turbine Market

The major players operating in the hydro turbine market include General Electric Company, Siemens AG, Andritz AG, Voith Group, Toshiba Corporation, Bharat Heavy Electricals Limited (BHEL), Mitsubishi Heavy Industries, Ltd., Harbin Electric Company Limited, Alstom Hydro, The Columbia Machine Works, Inc., Flovel Energy Private Limited, Canyon Hydro, CKD Blansko Engineering, a.s., Toshiba Hydro Power (Hangzhou) Co., Ltd., and WWS Wasserkraft GmbH.

Hydro Turbine Market Leaders

- General Electric Company

- Siemens AG

- Andritz AG

- Voith Group

- Toshiba Corporation

Hydro Turbine Market - Competitive Rivalry, 2024

Hydro Turbine Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Hydro Turbine Market

- In September 2024, General Electric announced the launch of a new generation of eco-friendly hydro turbines aimed at reducing environmental impact and enhancing efficiency.

- In June 2023, Andritz AG partnered with a leading company in South American hydro turbine market to implement their advanced turbine systems in several hydroelectric plants.

- In March 2023, Voith GmbH unveiled a new turbine model that promises higher efficiency and greater performance, with applications targeted at both large and small hydropower plants.

Hydro Turbine Market Segmentation

- By Type

- Francis Turbines

- Pelton Turbines

- Kaplan Turbines

- Cross-Flow Turbines

- By Application

- Hydropower Generation

- Water Treatment Systems

- Flood Control

- Irrigation

- By Installation

- New Installations

- Upgrades & Replacements

- By Capacity

- Small Scale Hydro Turbines (Less than 10 MW)

- Medium Scale Hydro Turbines (10-100 MW)

- Large Scale Hydro Turbines (Above 100 MW)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the hydro turbine market?

The hydro turbine market is estimated to be valued at USD 9.9 Bn in 2024 and is expected to reach USD 15.33 Bn by 2031.

What are the key factors hampering the growth of the hydro turbine market?

Upfront investment required for hydro turbine installation and ecosystem disruption are the major factors hampering the growth of the hydro turbine market.

What are the major factors driving the hydro turbine market growth?

Growing focus on clean energy and subsidies and supportive policies are the major factors driving the hydro turbine market.

Which is the leading type in the hydro turbine market?

The leading type segment is Francis turbines.

Which are the major players operating in the hydro turbine market?

General Electric Company, Siemens AG, Andritz AG, Voith Group, Toshiba Corporation, Bharat Heavy Electricals Limited (BHEL), Mitsubishi Heavy Industries, Ltd., Harbin Electric Company Limited, Alstom Hydro, The Columbia Machine Works, Inc., Flovel Energy Private Limited, Canyon Hydro, CKD Blansko Engineering, a.s., Toshiba Hydro Power (Hangzhou) Co., Ltd., and WWS Wasserkraft GmbH are the major players.

What will be the CAGR of the hydro turbine market?

The CAGR of the hydro turbine market is projected to be 6.4% from 2024-2031.