Marine Lighting Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Marine Lighting Market is segmented By Technology (LED Lighting, Fluorescent Lighting, Halogen Lighting, Xenon Lighting), By Product Type (Functional ....

Marine Lighting Market Size

Market Size in USD Mn

CAGR5.3%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.3% |

| Market Concentration | Medium |

| Major Players | Phoenix Marine Lighting, LGS Marine Lighting, Hella Marine, Lumitec Lighting, Garmin Switzerland GmbH and Among Others. |

please let us know !

Marine Lighting Market Analysis

The marine lighting market is estimated to be valued at USD 426.33 Mn in 2024 and is expected to reach USD 612.78 Mn by 2031, growing at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2031. The marine lighting market is witnessing high growth due to increasing maritime tourism and water sport activities globally.

Marine Lighting Market Trends

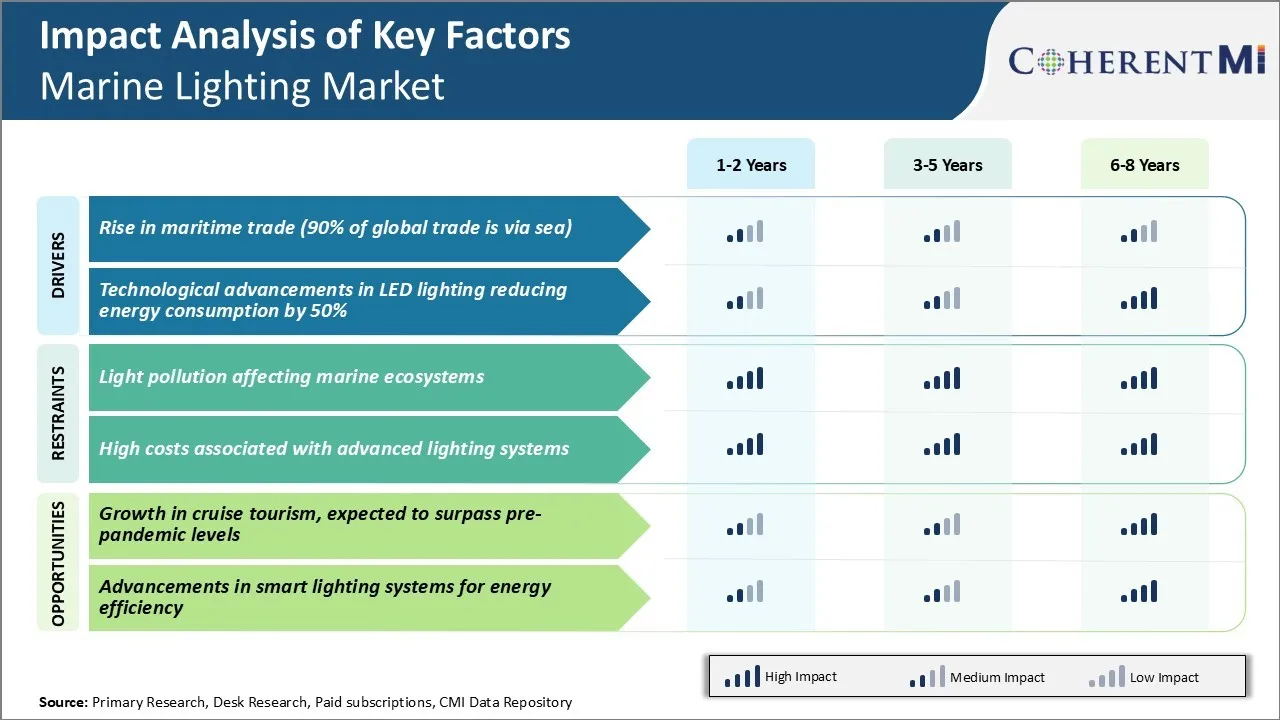

Market Driver - Rise in Maritime Trade (90% of Global Trade is Via Sea)

With over 90% of global trade being transported by sea, maritime trade has seen tremendous growth over the past few decades. Cargo volumes have increased manifold as manufacturing shifted to developing countries and worldwide demand for goods increased.

As international commerce expanded across new trade routes, the number of commercial ships plying the oceans also surged multifold. Marine lighting market players responded to this rise by developing more durable and energy-efficient lighting solutions for ship decks, cargo holds and passenger areas.

Light emitting diode (LED) lights which provide sharp illumination with lesser energy consumption compared to traditional halogen lamps have become widely popular. Ship owners are also outfitting their fleets with modernized lighting during refits and retrofits to cut down fuel costs and meet new IMO regulations.

Port authorities have augmented quay-side lighting and installed navigation aids powered by solar panels at emerging destinations to facilitate round the clock cargo delivery. This boosted commercial maritime traffic and generated higher demand for specialized products within the marine lighting market.

Market Driver - Technological Advancements in LED Lighting Reducing Energy Consumption

LED lights have revolutionized lighting technology with numerous advantages over older lighting sources. Continuous improvements through focused R&D have made LED lights a preferred choice for marine lighting applications today. Ship owners benefit greatly from LED lights that last 6-10 times longer than traditional incandescent bulbs or fluorescent tubes with minimal maintenance.

Newbuilds specify only LED lights to trim electricity requirements substantially from day one of operations. Advanced chip-on-board and modular LED light fixtures simplify installation and replacement at sea. Wireless controls and occupancy sensors linked to LEDs through mobile apps help crews manage power usage efficiently. Their longevity negates frequent lamp changes in hazardous enclosed cargo holds and engine rooms.

Overall, LED marine lamps meeting latest international certifications have emerged as the go-to solution for sustainable and cost-effective lighting. This continues to drive growth of the marine lighting market.

Market Challenge - Light Pollution Affecting Marine Ecosystems

One of the key challenges currently faced in the marine lighting market is light pollution affecting sensitive marine ecosystems. Artificial lighting from ports, cruise ships, and coastal cities has disrupted natural nighttime lighting conditions that many marine species rely on.

Similarly, certain fish, shrimp, and plant species have evolved to use natural light cycles to communicate, feed and protect themselves from predators. Exposure to artificial night lights disrupts these behaviors and makes some species more vulnerable. Environmental groups are raising awareness about this issue, and regulations in certain areas now mandate the use of lighting fixtures that minimize light scattering into the night sky.

Marine lighting market players will need to further innovate fixture designs and light sources that minimize light pollution impact. They will also focus on meeting performance needs for nighttime navigation and operations.

Market Opportunity - Potential for Growth in Cruise Tourism

With an expected growth in cruise tourism, surpassing pre-pandemic levels, there are promising opportunities for the marine lighting market. After multiple years of suspension amid the COVID-19 pandemic, the cruise industry is witnessing a strong revival in bookings for 2023 and beyond. Leading cruise line operators have announced expansion plans involving new ship launches that will drive additional demand for various marine lighting products.

Marine lighting is essential for cruise ships to ensure occupational health and safety of crew members during nighttime operations and maintenance work. There is also a need for decorative lighting and illuminated signage to enhance the nighttime ambiance and experience for passengers. Leading marine lighting manufacturers can expect renewed interest from cruise lines seeking to outfit new ships as well as upgrade existing fleets.

Companies well-positioned in the marine lighting market stand to gain from the cruise industry's comeback in the coming years. Targeted marketing highlighting lighting solutions that improve operational efficiency and passenger experience could help companies secure additional contracts.

Key winning strategies adopted by key players of Marine Lighting Market

Focus on product innovation - Leading companies like Glamox, Lumishore, and Attwood have significantly invested in R&D to develop innovative and technologically advanced marine lighting solutions. For example, in 2018 Glamox launched its Soléa LED line which offered up to 75% more brightness compared to traditional halogen lights.

Target different vessel types - While companies like Glamox and Lumishore have a broad product portfolio catering to all vessel types like yachts, cruise ships, ferries etc., some players have chosen to target specific segments. For example, Tacnic specializes in lights for work boats and smaller commercial vessels.

Develop customized solutions - Leading players also provide customized lighting designs and solutions based on the unique requirements of customers. For instance, in 2020 Lumishore worked with a customized yacht builder to develop a special integrated lighting system for a 90-meter yacht.

Strategic Partnerships - Companies partner with major marine equipment manufacturers to bundle their lighting products. For example, Glamox has partnerships with shipbuilding brands like Princess Yachts and Ferretti to exclusively supply their lighting needs.

Segmental Analysis of Marine Lighting Market

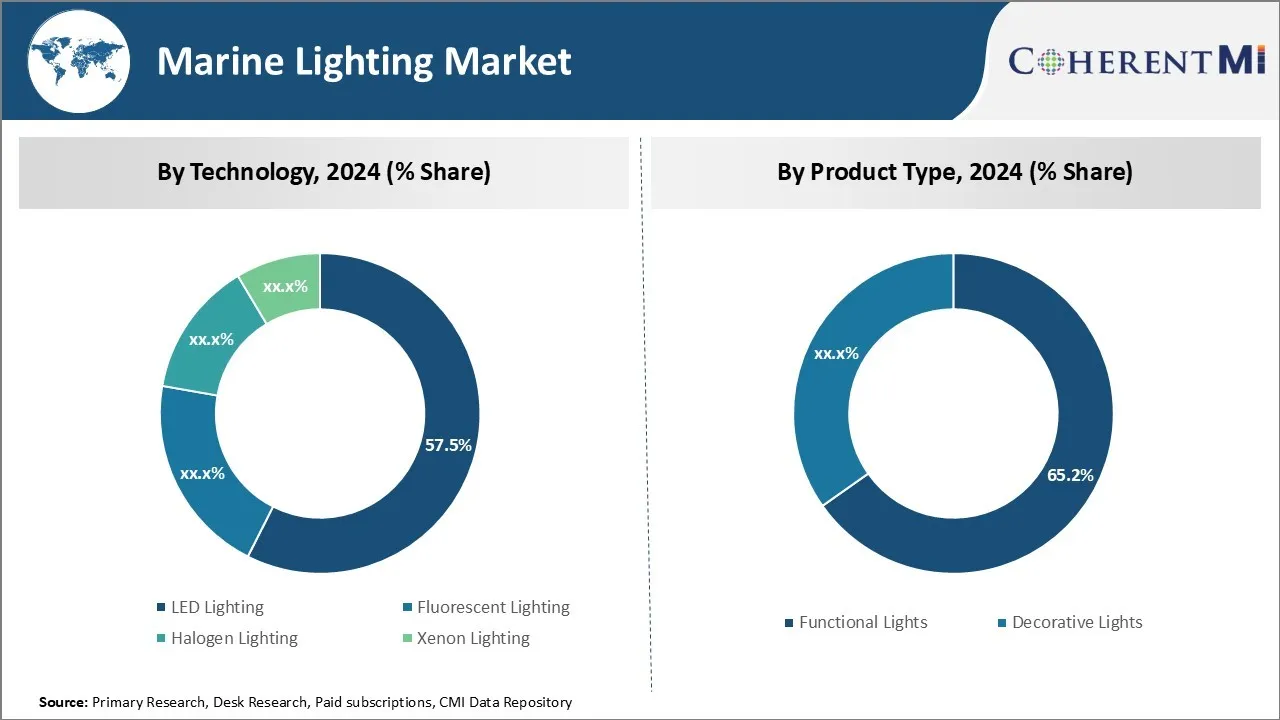

Insights, By Technology: LED Lighting Dominates due to Lower Power Consumption and Higher Luminous Efficacy

In terms of technology, LED lighting contributes 57.5% share of the marine lighting market in 2024. This is due to its lower power consumption and higher luminous efficacy compared to other lighting technologies. LED lights use far less energy to produce the same amount of brightness as incandescent or halogen lights.

LED lights also have a significantly longer lifespan than other lights, lasting upwards of 50,000 hours which greatly reduces replacement and maintenance costs over time. Their durable solid-state design makes them resistant to vibration and impact, important attributes for lights used on moving vessels.

LED lights also come in a wide array of lighting colors and intensities. It gives marine lighting market players more flexibility to tailor lighting schemes according to specific vessel and application needs.

Insights, By Product Type: Functional Lights Lead due to Utilitarian Purpose

In terms of product type, functional lights contribute 65.2% share of the marine lighting market due to their essential utilitarian purpose onboard marine vessels. Functional lights include task lighting used for work areas, inspection lighting used for maintenance and repair, safety lighting used for wayfinding and emergency egress, and navigation lights required by maritime law.

Given the practical requirements for illumination onboard ships and boats, there is continuous demand for robust, long-lasting functional lighting solutions. Comparatively, decorative lighting serves supplemental aesthetic purposes and is more discretionary in nature. As functional lights enable core onboard operations and ensure navigational safety, their utilization remains higher among marine lighting purchasers and installers.

Insights, By Application: Commercial Ships Dominate owing to Scale and Diverse Lighting Needs

In terms of application, commercial ships contributes the highest share of the market owing to their large scale and wide-ranging lighting requirements. Commercial ships, including cargo ships, tankers, ferries and cruise ships, have substantial lighting loads due to their large sizes and passenger/crew capacity.

They require high volumes of functional lighting for work zones, cargo holds, engine rooms, safety systems as well as decorative cabin and lounge lighting. The complexity of commercial ship design and operations also necessitates specialized lighting.

Moreover, commercial ships sail longer routes and have lengthier operational lifetimes than smaller marine vessels, reinforcing replacement sales. Collectively, these factors drive commercial ships to spearhead marine lighting adoption compared to other applications.

Additional Insights of Marine Lighting Market

- The adoption of LED technology in marine lighting has significantly increased due to its energy efficiency and durability, leading to a phasing out of traditional halogen and fluorescent lights in marine lighting market.

- Regulatory bodies like the International Maritime Organization (IMO) are enforcing stricter safety standards, necessitating upgrades in marine lighting systems across fleets globally.

- Energy Efficiency Demand: There is a growing emphasis on energy conservation in marine vessels, driving the demand for LED and solar-powered marine lighting solutions.

- Regional Growth: The Asia-Pacific region is witnessing rapid growth in global marine lighting market due to increased shipbuilding activities in countries like China and South Korea.

Competitive overview of Marine Lighting Market

The major players operating in the marine lighting market include Phoenix Marine Lighting, LGS Marine Lighting, Hella Marine, Lumitec Lighting, Garmin Switzerland GmbH, Aqualuma LED Lighting, Ocean-Led Ltd, IRS Marine, BluefinLED, Underwater Lights Limited, Lopolight Navigation Light Solutions, Archway Marine Lighting, Oxley Group, NaviSafe, Osram GmbH, Foresti & Suardi, Lumishore, Aqua Signal (A brand of Glamox), Perko Inc., Imtra Corp., Dr. LED, and Accon Marine.

Marine Lighting Market Leaders

- Phoenix Marine Lighting

- LGS Marine Lighting

- Hella Marine

- Lumitec Lighting

- Garmin Switzerland GmbH

Marine Lighting Market - Competitive Rivalry, 2024

Marine Lighting Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Marine Lighting Market

- In August 2024, Garmin introduced the Spectra™ LED Control Module, a compact device designed to simplify the management of onboard LED lighting for boaters. This module allows users to control various LED lights—including those integrated into JL Audio and Fusion® marine speakers, subwoofers, wake tower speakers, as well as strip, courtesy, underwater, and cup holder lights—directly from a compatible Garmin chartplotter or the ActiveCaptain® app on a smartphone.

- In July 2024, Hanwha Ocean announced the development of a "Smart Lighting Control System" for ships, which received Approval in Principle (AIP) from the Korean Register (KR). This system dynamically adjusts lighting based on specific areas of the vessel, utilizing motion sensors in corridors and time-based controls in engine rooms to optimize energy usage.

- In October 2023, OceanLED introduced the OceanBridge, a multizone lighting controller designed to manage all of a boat's lights via a multifunction display (MFD), smartphone, or tablet. This innovative system offers comprehensive control over the entire OceanLED range, as well as compatibility with most third-party (DMX or on/off) DC-powered lights.

Marine Lighting Market Segmentation

- By Technology

- LED Lighting

- Fluorescent Lighting

- Halogen Lighting

- Xenon Lighting

- By Product Type

- Functional Lights

- Decorative Lights

- By Application

- Commercial Ships

- Cargo Ships

- Tankers

- Fishing Vessels

- Naval Ships

- Recreational Boats

- Yachts

- Sailboats

- Cruise Ships

- Commercial Ships

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the marine lighting market?

The marine lighting market is estimated to be valued at USD 426.33 Mn in 2024 and is expected to reach USD 612.78 Mn by 2031.

What are the key factors hampering the growth of the marine lighting market?

Light pollution affecting marine ecosystems and high costs associated with advanced lighting systems are the major factors hampering the growth of the marine lighting market.

What are the major factors driving the marine lighting market growth?

Rise in maritime trade, as 90% of global trade is via sea, and technological advancements in LED lighting reducing energy consumption are the major factors driving the marine lighting market.

Which is the leading technology in the marine lighting market?

The leading technology segment is LED lighting.

Which are the major players operating in the marine lighting market?

Phoenix Marine Lighting, LGS Marine Lighting, Hella Marine, Lumitec Lighting, Garmin Switzerland GmbH, Aqualuma LED Lighting, Ocean-Led Ltd, IRS Marine, BluefinLED, Underwater Lights Limited, Lopolight Navigation Light Solutions, Archway Marine Lighting, Oxley Group, NaviSafe, Osram GmbH, Foresti & Suardi, Lumishore, Aqua Signal (A brand of Glamox), Perko Inc., Imtra Corp., Dr. LED, and Accon Marine are the major players.

What will be the CAGR of the marine lighting market?

The CAGR of the marine lighting market is projected to be 5.3% from 2024-2031.