Micro Inverter Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Micro Inverter Market is segmented By Phase (Single-Phase Micro Inverters, Three-Phase Micro Inverters), By Application (Residential, Commercial, Util....

Micro Inverter Market Size

Market Size in USD Bn

CAGR11.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 11.5% |

| Market Concentration | High |

| Major Players | Enphase Energy, SMA Solar Technology AG, Darfon Electronics Corp., Fimer Group, Growatt New Energy and Among Others |

please let us know !

Micro Inverter Market Analysis

The micro inverter market is estimated to be valued at USD 3.74 Bn in 2024 and is expected to reach USD 4.17 Bn by 2031, growing at a compound annual growth rate (CAGR) of 11.5% from 2024 to 2031. The global micro inverter market is expected to witness steady growth over the forecast period owing to rising emphasis on distributed solar systems coupled with declining prices of energy harvesters.

Micro Inverter Market Trends

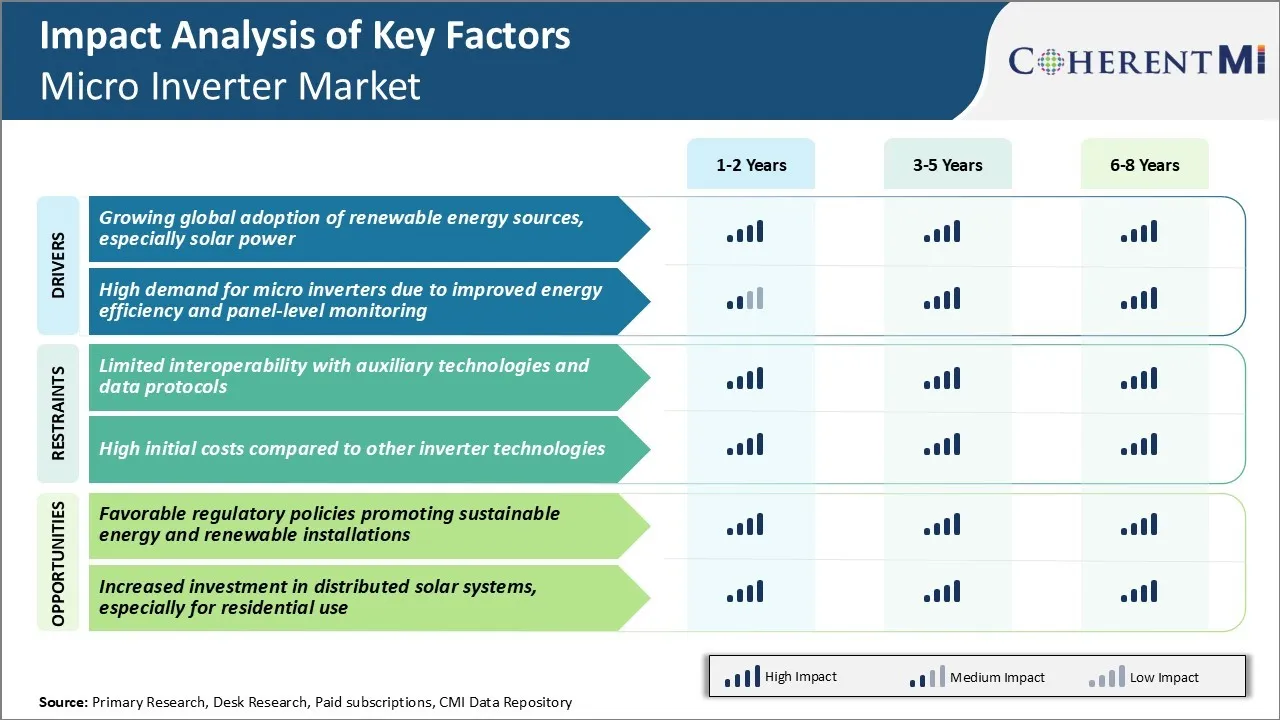

Market Driver - Growing Global Adoption of Renewable Energy Sources, Especially Solar Power

According to estimates, over 180 countries have adopted renewable energy targets and more than 100 countries have renewable energy support policies in place. Solar energy has emerged as one of the most viable and cost-effective renewable option for both large-scale projects as well as rooftop installations.

The rapid capacity additions in solar PV have fueled the demand for associated balance of system components, especially solar inverters that play a critical role in converting the direct current produced by solar panels into alternating current usable by the utility grid or commercial establishments.

The key advantages of micro inverters like module-level monitoring, higher energy yields especially in partial shading conditions, easier installation and maintenance are resonating well with customers. Leading solar installers and some governments have also been promoting module-level power electronics for its reliability and performance benefits. The growing adoption of renewable energy sources globally will thus serve as a key tailwind for the micro inverter market.

Market Driver - High Demand for Micro Inverters due to Improved Energy Efficiency and Panel-level Monitoring

Micro inverters have emerged as a compelling alternative to traditional central and string inverters used in solar installations due to their ability to optimize system performance at the module level. By placing an inverter at the back of each photovoltaic module, micro inverters ensure that each panel operates independently at its maximum power point regardless of the performance of other panels in the array.

Additionally, roof spaces are often limited for larger installations requiring high density packing of solar panels. In such situations, individual module-level maximum power point tracking becomes even more important to extract maximum power from each panel.

Some other advantages like simplified installation without heavy string cables, redundancy to keep producing energy even if one panel fails further strengthen the value proposition of micro inverters. Micro inverters are becoming an essential product choice for residential and commercial rooftop installations. This is significantly driving up the demand growth in the global micro inverter market.

Market Challenge - Limited Interoperability with Auxiliary Technologies and Data Protocols

One of the key challenges currently being faced by the micro inverter market is limited interoperability with auxiliary technologies and data protocols. While micro inverters offer several advantages like module level monitoring and increased system efficiency, their integration with other smart home technologies and protocols has been an area of concern.

Most micro inverters currently work as independent systems and use proprietary communication protocols, limiting their interaction with energy management systems, home automation solutions, storage technologies and other IoT devices. This siloed approach means that homeowners are unable to centrally monitor and control micro inverters along with other smart products on a single platform.

Lack of adoption of open communication standards by micro inverter manufacturers restricts widespread interoperability. This challenge of limited interoperability can negatively impact the future growth potential of the micro inverter market as the integration of distributed energy resources and home automation gains more prominence.

Market Opportunity - Favorable Regulatory Policies Promoting Sustainable Energy and Renewable Installations

The micro inverter market is presented with significant opportunities arising from increasing policy support for sustainable energy and distributed solar installations across various countries and regions. Governments around the world are implementing favorable regulations to incentivize deployment of renewable energy sources in order to meet ambitious climate change goals.

Many national and state/provincial levels policies offer subsidies, tax credits and net metering provisions to homeowners for installing residential solar PV systems. Since micro inverters provide module level power optimization, their adoption is rising among small commercial and residential solar projects that are eligible under such incentive schemes.

Rising public awareness about carbon footprint reduction is also driving demand for localized solar energy harnessing where micro inverters play a crucial role. If supportive regulatory framework and subsidies for distributed energy continue to be strengthened globally, it will drive significant opportunities in micro inverters market in the coming years.

Key winning strategies adopted by key players of Micro Inverter Market

Enphase Energy has been one of the most successful companies in the micro inverter market. In early 2010s, Enphase adopted a strategy of positioning microinverters as a more reliable alternative to central or string inverters for residential solar installations. By 2014, Enphase had captured over 40% of the U.S. residential microinverter market.

Another strategy adopted by Enphase was expanding its product portfolio. In 2012, it launched the IQ microinverter family which improved on power specs and connectivity features. This allowed Enphase to tap higher power solar modules gaining popularity. It also launched an Envoy communications gateway in 2013 to provide easy system monitoring.

Similarly, SolarEdge adopted the strategy of penetrating the commercial solar segment in early 2010s which was still dominated by string inverters. It launched optimized commercial inverters and power optimizers suitable for large rooftop installations.

By 2015, SolarEdge had captured over 15% market share in the U.S. commercial segment. It gained large rooftop projects for warehouses, schools etc. leveraging technical advantages like module level power optimization.

Segmental Analysis of Micro Inverter Market

Insights, By Phase: Convenience and Lower Cost Drive Demand for Single-Phase Micro Inverters

In terms of phase, single-phase micro inverters contribute 67.3% share of the micro inverter market in 2024. This is due to their convenience and lower cost compared to three-phase micro inverters. Single-phase micro inverters are compatible with standard residential homes that use single-phase power. This makes them easier to install as they do not require complex rewiring of the home's electrical system. Their compact size allows them to be mounted directly onto solar panels without occupying additional space.

Additionally, single-phase micro inverters tend to be less expensive than three-phase alternatives as their internal components and design are simpler. This lower cost of ownership makes them an attractive proposition for homeowners looking for an affordable way to harness solar energy. Three-phase micro inverters, on the other hand, are more suitable for large commercial and industrial installations that require higher power capacities.

Insights, By Application: Residential Solar Adoption Drives Demand in the Residential Application Segment

In terms of application, the residential segment contributes 58.7% share of the micro inverter market in 2024, owing to strong growth in rooftop solar installations across homes. Government incentives and falling solar equipment prices have encouraged many homeowners to invest in personal solar power systems in recent years.

Rooftop solar is increasingly becoming a mainstream energy source for residential properties worldwide. This is creating a steady demand for micro inverters optimized for integration into residential solar arrays.

Micro inverters are well-suited for residential solar thanks to their ease of installation and ability to maximize energy harvest from each individual solar panel. In contrast, commercial and utility-scale installations usually deploy central or string inverters due to their large power requirements. However, the residential segment will continue to be a major driver of micro inverter sales globally.

Insights, By Connectivity: Grid Connectivity Allows for Higher Solar Penetration

In terms of connectivity, the grid-connected systems segment holds the largest share in micro inverter market due to the ability to leverage existing power infrastructure. Grid-tied solar systems with micro inverters can feed any excess power generated from solar panels back into the wider electricity network.

Grid connectivity also provides a reliable backup source of power when solar energy is insufficient. Standalone systems disconnected from the grid are more complex to install and maintain battery backups, restricting their usage to mostly off-grid rural applications. Their inability to feed power bi-directionally into the grid limits widespread solar adoption. This makes grid-connected systems the most viable option for micro inverter installations aimed at mainstream energy consumers.

Additional Insights of Micro Inverter Market

- Increasing adoption of single-phase microinverters for their improved efficiency and safety, addressing shading issues and optimizing individual solar panel output.

- Significant rise in demand for on-grid micro inverters due to the global shift toward renewable energy and reduced inverter costs.

- North America dominated the micro inverter market in 2023, driven by rising solar PV installations in residential and commercial sectors.

- Europe shows substantial growth in global micro inverter market, aided by lower costs for solar components and rising investments in solar power across the region.

Competitive overview of Micro Inverter Market

The major players operating in the micro inverter market include Enphase Energy, SMA Solar Technology AG, Darfon Electronics Corp., Fimer Group, Growatt New Energy, Alternate Power System, Inc., Chilicon Power LLC, AEconversion GmbH & Co., Sensata Technologies, Inc., Northern Electric Power Technology Inc., Sparq System, and Yotta Energy.

Micro Inverter Market Leaders

- Enphase Energy

- SMA Solar Technology AG

- Darfon Electronics Corp.

- Fimer Group

- Growatt New Energy

Micro Inverter Market - Competitive Rivalry

Micro Inverter Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Micro Inverter Market

- In October 2023, FIMER, an Indian inverter manufacturer, announced a new 5 MVA bidirectional converter aimed at large-scale grid storage applications, with a product release planned for early 2024. This product aims to enhance large-scale energy storage capabilities, meeting the rising demand in India.

- In September 2023, SMA Solar Technology AG announced partnerships with major solar installers to provide integrated solutions for residential customers. This move is expected to expand their reach in micro inverter market and improve customer service through streamlined installations.

- In June 2023, Enphase Energy introduced its latest IQ8 micro inverter series, featuring enhanced efficiency and grid-forming capabilities. This development allows for better energy management and backup during grid outages, strengthening Enphase's position in micro inverter market.

- In March 2023, SolaX Power launched new residential grid-tied inverters in India, namely the X1-MINI G4 and X1-BOOST G4, targeting the expanding micro inverter market. These inverters are expected to boost residential solar adoption in India by offering efficient, compact solutions.

Micro Inverter Market Segmentation

- By Phase

- Single-Phase Micro Inverters

- Three-Phase Micro Inverters

- By Application

- Residential

- Commercial

- Utility

- By Connectivity

- Grid-Connected Systems

- Standalone Systems

- By Sales Channel

- Direct Sales

- Distributor Sales

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How big is the micro inverter market?

The micro inverter market is estimated to be valued at USD 3.74 Bn in 2024 and is expected to reach USD 4.17 Bn by 2031.

What are the key factors hampering the growth of the micro inverter market?

Limited interoperability with auxiliary technologies and data protocols, and high initial costs compared to other inverter technologies are the major factors hampering the growth of the micro inverter market.

What are the major factors driving the micro inverter market growth?

Growing global adoption of renewable energy sources, especially solar power, and high demand for micro inverters due to improved energy efficiency are the major factors driving the micro inverter market.

Which is the leading phase in the micro inverter market?

The leading phase segment is single-phase micro inverters.

Which are the major players operating in the micro inverter market?

Enphase Energy, SMA Solar Technology AG, Darfon Electronics Corp., Fimer Group, Growatt New Energy, Alternate Power System, Inc., Chilicon Power LLC, AEconversion GmbH & Co., Sensata Technologies, Inc., Northern Electric Power Technology Inc., Sparq System, Yotta Energy are the major players.

What will be the CAGR of the micro inverter market?

The CAGR of the micro inverter market is projected to be 11.5% from 2024-2031.