Oilfield Equipment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Oilfield Equipment Market is segmented By Equipment (Drilling Equipment, Field Production Machinery, Pumps, Valves), By Application (Onshore, Offshore....

Oilfield Equipment Market Size

Market Size in USD Bn

CAGR3.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.7% |

| Market Concentration | High |

| Major Players | Baker Hughes, ABB, Delta Corporation, Weir Group, Sunnda Corporation and Among Others. |

please let us know !

Oilfield Equipment Market Analysis

The Global Oilfield Equipment Market is estimated to be valued at USD 129.6 Bn in 2024 and is expected to reach USD 173.3 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.7% from 2024 to 2031. This steady growth can be attributed to rising oil and gas exploration activities as energy demand increases worldwide.

The trend in the oilfield equipment market has been positive over the past few years. Global demand for oil and gas has picked up from the lull caused by the pandemic, driving more investments in upstream activities. Major players are investing in technologically advanced equipment to enable efficient exploration and production processes. On the other hand, the transition to sustainable energy sources poses a challenge for long term growth in this market.

Oilfield Equipment Market Trends

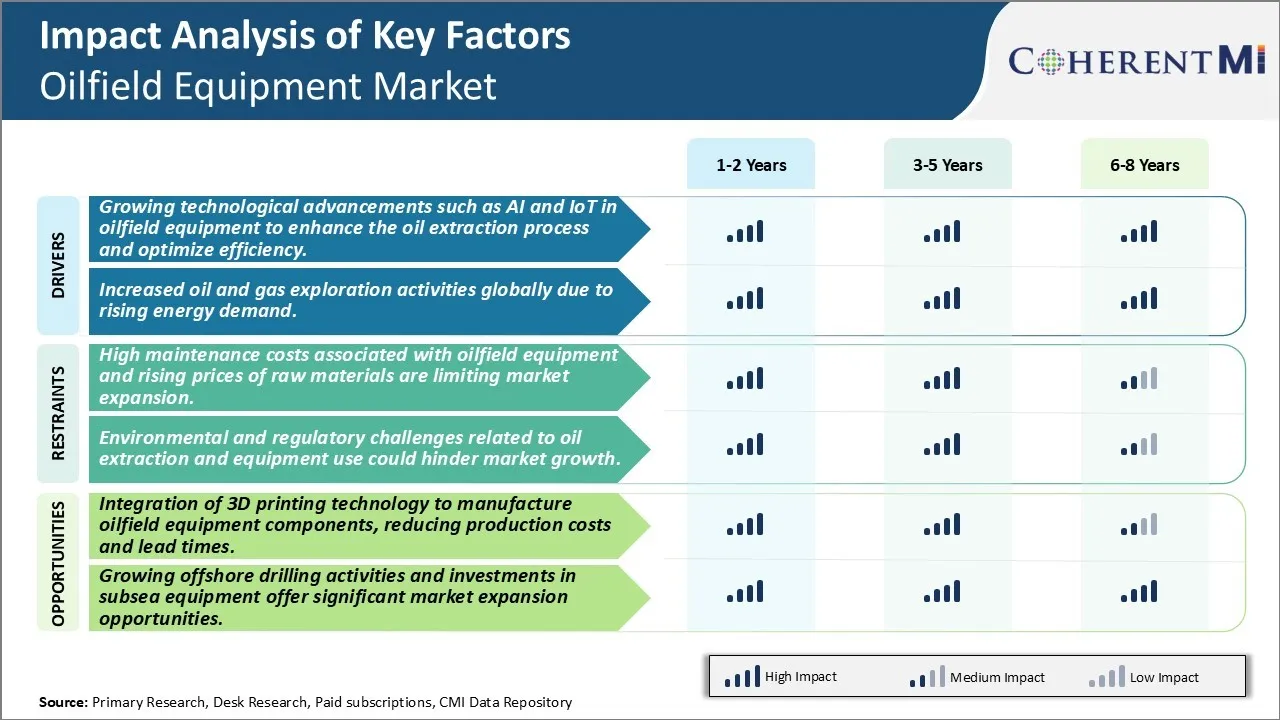

Market Driver - Growing Technological Advancements Such As AI And IoT in Oilfield Equipment to Enhance the Oil Extraction Process And Optimize Efficiency

As the oil and gas industry continues facing several challenges to optimize extraction processes and maximize efficiency, new-age technological advancements are emerging as a key driver to transform operations. Oilfield equipment manufacturers have increasingly been integrating the power of AI and IoT into their offerings. AI-powered systems can analyze vast amounts of operational data in real-time to provide actionable insights to operators. They help detect anomalies, predict failures, and recommend remedial actions to improve performance metrics. For instance, AI is helping predict downhole problems by monitoring vibration signatures and infer trends. This enables preemptive maintenance and reduces unplanned downtime.

IoT integration allows connecting oilfield assets like pumps, valves, and sensors to a common network. Real-time streaming and analysis of equipment condition data helps monitor assets remotely. Small sensors attached to oilfield equipment continuously transmit operational parameters like pressure, temperature, rpm to a central control system. Even variables like noise patterns and energy consumption are tracked. This centralized condition monitoring and predictive maintenance enables fixing or replacing equipment just before failure occurs. Consequently, IoT driven automation and remote operations improve productivity and reduce service visits. It also helps achieve proactive servicing aligned with actual equipment health rather than fixed time-based schedules.

Market Driver - Rising Global Energy Demand Fuels the Need for Robust Oil Extraction Equipment

Another key factor driving investments in oilfield equipment worldwide is increased oil and gas exploration activities influenced majorly by rising energy demand. With rapid urbanization and industrialization across developing regions, global energy consumption has grown substantially over the past decades. The IEA predicts energy demand could increase by as much as 50% by 2050 if no corrective actions are taken. Much of this demand will have to be met by oil and gas which are expected to account for over half of the global energy mix for the foreseeable future.

Moreover, continued depletion of conventional reserves has forced operators to explore hydrocarbon resources from challenging geographies and reservoirs. Efforts are ongoing to extract oil and gas trapped in deepwater fields, shale reserves, and offshore Arctic regions which require technologically advanced equipment. Nations are also offering new exploration acreages and production-sharing contracts to boost reserve additions. All these factors are compelling national oil companies and private E&P players to invest greater capital in high-performing oilfield equipment and services to facilitate exploration and production activities from diverse terrains. This growing demand for technologically advanced gear will remain a key driver for the oilfield equipment market in the long-run.

Market Challenge - High Maintenance Costs Associated with Oilfield Equipment and Rising Prices of Raw Materials Are Limiting Market Expansion

The oilfield equipment market is facing significant challenges due to high operation and maintenance costs associated with oilfield machinery. The equipment need to work under extreme pressure and temperature conditions deep underground and offshore. As a result, they tend to wear out faster and require frequent repairs and replacement of parts. Maintaining these specialized industrial tools entails substantial costs which oil and gas companies need to incur on a regular basis. Moreover, prices of raw materials required for manufacturing oilfield components like metals and alloys have witnessed a sharp rise in recent times. Steel, which is the primary material, became considerably more expensive putting pressure on equipment makers. The fluctuating costs heavily impact project economics for exploration and production activities. This makes companies hesitant to invest heavily in new oil extraction ventures or renewing existing machinery. The rising expenditures associated with upkeep and procurement of essential resources have limited the scope for expansion in demand for oilfield equipment. Equipment manufacturers are finding it difficult to pass on entire cost burdens to clients and are facing compression in margins.

Market Opportunity - Integration of 3D Printing Enhances Production Efficiency

The oilfield equipment industry is actively adopting 3D printing technology to gain significant advantages in manufacturing. This advanced fabrication method allows complex parts to be built using digital models in layers of material. 3D printing offers versatility to produce intricate oilfield components with customized designs suited for specific field conditions that were previously impossible to manufacture through conventional subtractive methods. As the 3D printer can build objects of any form directly from CAD files without additional tooling, it dramatically reduces time taken from design to production. This helps shorten lead times for deliveries and speeds up repairs when replacements are urgently needed at rig sites. 3D printing also enables on-demand and decentralized production minimizing warehousing costs. With no need for tooling changes, manufacturers can efficiently produce small batch components on-demand. Additionally, 3D printed parts are often lighter and require fewer raw materials through optimized designs. This slashes both material consumption and production costs bringing tangible economic benefits. Leading oilfield equipment brands have begun leveraging 3D printing to manufacture critical downhole parts, pumps, and other machinery aiding their competitive advantage.

Key winning strategies adopted by key players of Oilfield Equipment Market

Focus on technological innovation: Leading players like Schlumberger, Halliburton, and Baker Hughes have continuously invested sizable portions of their revenues in R&D to develop innovative technology and equipment. For example, in 2018 Schlumberger launched its digital oilfield platform called DELFI that integrates IoT solutions, AI/ML capabilities, and cloud computing to enhance oil & gas production and recovery rates. Such advanced technology helped these companies gain an edge over competitors.

Expand product portfolio through strategic acquisitions: Players pursue strategic acquisitions to expand their product offerings and services across the oilfield equipment value chain. For instance, in 2017 Baker Hughes acquired GE Oil & Gas, vastly expanding its portfolio of products including compressors, turbines, and pumps. Similarly, in 2021 Schlumberger acquired closely-held ROGII, a provider of measurement and analytical services, to bolster its well construction and well integrity business segment.

Widen global footprint: Leading oilfield equipment companies focus on deepening presence through establishing facilities, production plants and strengthening distribution networks across key oil/gas regions globally. For example, over 2010-2015 Halliburton opened/expanded nearly 30 manufacturing facilities across Asia Pacific, North America and Middle East regions to directly support offshore/onshore drilling operations of clients.

Focus on after-sales services: Players recognize recurring services revenue contributes 50-60% of total revenues. They emphasis on offering turnkey integrated solutions including maintenance/repairs, equipment rentals, and field operations. For instance, in 2021 Baker Hughes signed a 10-year integrated offshore services agreement with Petrobras in Brazil that includes repairs/maintenance of subsea trees, manifolds, and controls equipment.

Segmental Analysis of Oilfield Equipment Market

Insights, By Equipment, Drilling Equipment Is Expected to Register a Remarkable Growth in the Coming Years

By Equipment, the drilling equipment segment dominates the oilfield equipment market and is projected to register 44.5% market share in 2024 due to large-scale exploration and production activities undertaken by companies globally. Drilling equipment such as drill bits, drill pipes, casings and drill collars see heavy demand as they form a crucial part of exploration and production. Exploration activity has increased substantially in recent times as oil and gas companies seek to replenish reserves and reduce dependence on depleting conventional reserves. Many newfield wildcat wells are being drilled both onshore and offshore to explore unconventional resources such as tight oil and shale gas. This has translated to robust demand for drilling tools required for such complex drilling operations.

Existing oil and gas fields also require continuous drilling of development wells to maintain and boost production levels over time. As mature fields undergo enhanced oil recovery techniques using advanced drilling methods, it fuels the need for high-performance drilling equipment. Growth in unconventional oil and gas production using horizontal and directional drilling techniques has also expanded the market scope for measurement and logging equipment. These are increasingly being used for reservoir mapping and optimization of well placement in unconventional resources.

Rig manufacturers are meanwhile incorporating the latest drilling technologies such as telemetry systems, e-drilling capabilities and automated pipe handling systems to deliver higher efficiency. This modernizes the oilfield and generates sustained replacement demand.

Insights, By Application, Onshore Contributes the Highest Share of the Market Owing to Large Proven Reserves and Mature Infrastructure

By Application, the onshore segment is projected to register 57.1% market share in 2024 due to significant proven reserves and well-developed infrastructure for production and transportation on land. According to oil and gas governing bodies, more than 65% of proven global hydrocarbon reserves are located onshore, with many concentrated in the Middle East, North America and Russia.

Onshore oil and gas fields are generally more stable, familiar terrains to operate in compared to offshore environments. They also have easier access for Equipment setup and deployment, reducing project timelines and costs. Established transportation networks expedite the movement of oilfield machinery, personnel, rigs and supplies to onshore rig sites and production facilities.

Countries restarting oil and gas production from dormant fields or aiming to enhance recovery from mature fields rely predominantly on brownfield onshore projects. This stimulates demand for production-optimizing equipment like pumps, separators, valves and downstream gas processing units.

Large producing nations are undertaking mega drilling plans and operating Oilfield mega-projects to sustain and boost domestic hydrocarbon supplies as per their energy security needs. Vast onshore reserves consequently see aggressive exploitation and secondary/tertiary recovery using advanced equipment and technologies.

The extensive pipeline network in major onshore production regions also supports the monetization of smaller, decentralized oil and gas reserves that can feed directly into local and inter-state distribution infrastructure. This enables complete asset utilization over the long run.

Additional Insights of Oilfield Equipment Market

The global oilfield equipment market is set for steady growth, driven by increasing demand for energy and oil extraction activities both onshore and offshore. North America remains a dominant market due to high investments in drilling activities, while Asia-Pacific is experiencing rapid growth due to expanding infrastructure and increased exploration activities. Technological advancements in equipment such as AI-powered drilling rigs and the integration of 3D printing are reshaping the industry, reducing production costs and improving efficiency. However, the market faces challenges related to high maintenance costs and regulatory hurdles, particularly concerning environmental impacts. Despite these challenges, the growing demand for hydrocarbons and the development of offshore drilling technologies are expected to fuel market growth.

Competitive overview of Oilfield Equipment Market

The major players operating in the Oilfield Equipment Market include Baker Hughes, ABB, Delta Corporation, Weir Group, Sunnda Corporation, Schlumberger, Superior Energy Services, Pioneer Energy Services, C&J Energy Services Ltd, National Owell Varco, Inc, Halliburton and Basic Energy Services, Inc.

Oilfield Equipment Market Leaders

- Baker Hughes

- ABB

- Delta Corporation

- Weir Group

- Sunnda Corporation

Oilfield Equipment Market - Competitive Rivalry, 2024

Oilfield Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Oilfield Equipment Market

- In March 2023, Diamond Offshore Drilling extended its contract with BP in the Gulf of Mexico, valued at USD 350 million. This highlights the growing offshore drilling activities.

- In June 2023, Halliburton partnered with Nabors Industries to develop an automation platform for drilling operations, enhancing efficiency in oilfield processes.

- In April 2024, Deep Well Services launched a new partnership with CNX Resources Corp. to establish AutoSep Technologies, focusing on automated flowback solutions for oil and gas extraction.

Oilfield Equipment Market Segmentation

- By Equipment

- Drilling Equipment

- Field Production Machinery

- Pumps

- Valves

- By Application

- Onshore

- Offshore

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Oilfield Equipment Market?

The Global Oilfield Equipment Market is estimated to be valued at USD 129.6 Bn in 2024 and is expected to reach USD 173.3 Bn by 2031.

What will be the CAGR of the Oilfield Equipment Market?

The CAGR of the Oilfield Equipment Market is projected to be 3.7% from 2024 to 2031.

What are the major factors driving the Oilfield Equipment Market growth?

The growing technological advancements such as AI and IoT in oilfield equipment to enhance the oil extraction process and optimize efficiency and increased oil and gas exploration activities globally due to rising energy demand are the major factors driving the Oilfield Equipment Market.

What are the key factors hampering the growth of the Oilfield Equipment Market?

The high maintenance costs associated with oilfield equipment and rising prices of raw materials are limiting market expansion and environmental and regulatory challenges related to oil extraction and equipment hinders market growth are the major factors hampering the growth of the Oilfield Equipment Market.

Which is the leading Equipment in the Oilfield Equipment Market?

Drilling Equipment is the leading Equipment segment.

Which are the major players operating in the Oilfield Equipment Market?

Baker Hughes, ABB, Delta Corporation, Weir Group, Sunnda Corporation, Schlumberger, Superior Energy Services, Pioneer Energy Services, C&J Energy Services Ltd, National Owell Varco, Inc, Halliburton, Basic Energy Services, Inc. are the major players.