Polyolefin Shrink Film Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Polyolefin Shrink Film Market is segmented By Type (General Polyolefin Shrink Film, Cross-Linked Polyolefin Shrink Film), By Application (Food and Bev....

Polyolefin Shrink Film Market Size

Market Size in USD Bn

CAGR3.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 3.5% |

| Market Concentration | High |

| Major Players | Exxon Mobil Corporation, Amcor Plc, Berry Global Inc, Allen Plastic Industries Co., Ltd., FlexiPack and Among Others. |

please let us know !

Polyolefin Shrink Film Market Analysis

The polyolefin shrink film market is estimated to be valued at USD 8.89 Bn in 2024 and is expected to reach USD 11.32 Bn by 2031, growing at a compound annual growth rate (CAGR) of 3.5% from 2024 to 2031. The polyolefin shrink film market is driven by the growing food and beverage industry globally and increasing demand for shrink films in packaging applications.

Polyolefin Shrink Film Market Trends

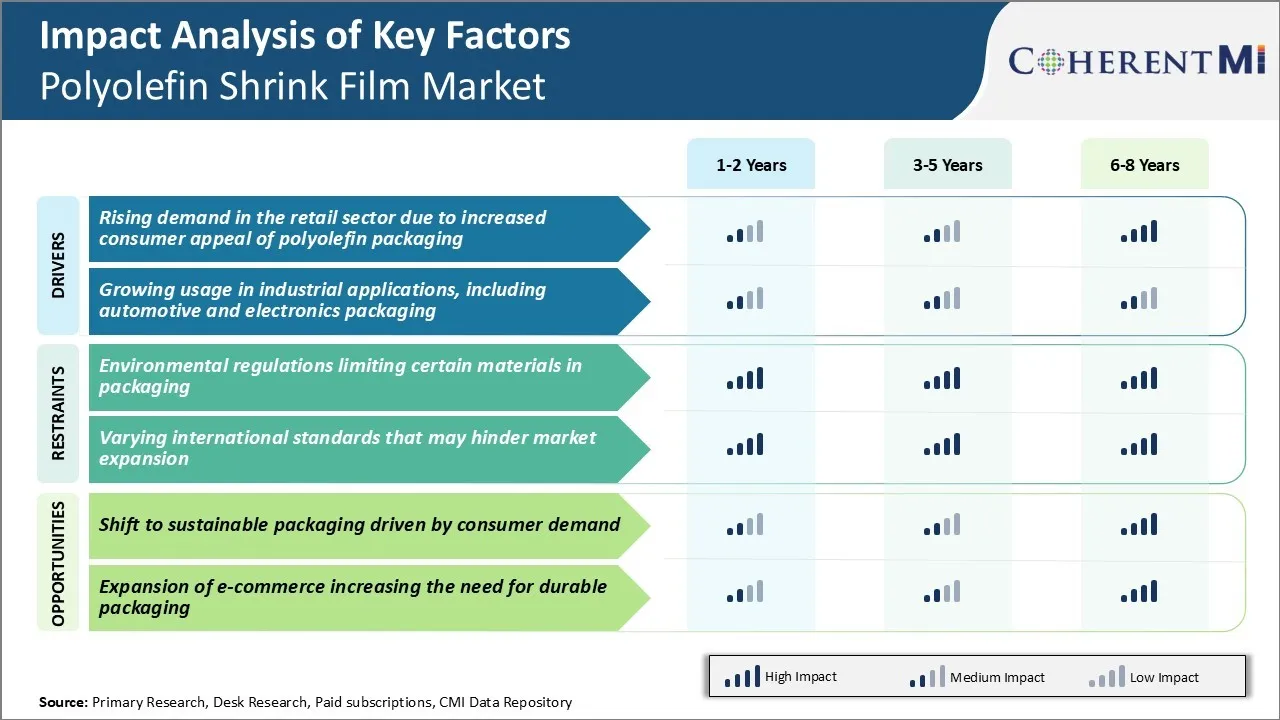

Market Driver - Rising Demand in the Retail Sector due to Increased Consumer Appeal of Polyolefin Packaging

E-commerce has boosted the retail industry manifolds as consumers are increasingly preferring online shopping over the traditional brick and mortar stores. Retailers are focusing more on effective packaging solutions that can attract consumers and improve the overall shopping experience.

When it comes to flexible packaging films, polyolefin shrink films have emerged as a very popular choice for secondary level packaging. Due to their excellent sealing properties and ability to tightly wrap irregular shaped products, polyolefin shrink films offer multiple advantages over other packaging formats.

The trend of single item shrink wrapping is growing as retailers want to improve the impulse buying potential through enhanced product visibility and appeal. This has propelled the demand for polyolefin shrink films from supermarkets, hypermarkets as well as online retailers in the retail sector. Various big brands have also started using unique shrink film designs and graphics to further boost consumer engagement.

Overall, polyolefin shrink film market is witnessing widespread acceptance of the product in the retail segment. The continued growth in the retail industry worldwide especially e-commerce will continue supporting the uptrend in polyolefin shrink film demand over the coming years.

Market Driver - Growing Usage in Industrial Applications

Apart from retail, polyolefin shrink films are also finding increased application across diverse industrial sectors like automotive, electronics, and machinery manufacturing. In automotive manufacturing, just-in-time delivery of components is a critical aspect to maintain lean production processes. Polyolefin shrink films help create component specific sized packages that can withstand rigorous transportation and take up less space during shipping.

They provide robust protection from dust, moisture and minor impacts while movement. This has led to their rising preference over alternative formats like cardboard boxes and foam. Manufacturers can also customize shrink film prints with tagging information for easy identification and tracking during in plant logistics.

Similarly, in consumer electronics manufacturing several small components need to be packaged securely without any damage. Static dissipative property of polyolefin shrink films additionally offers anti-static shielding. This boosts packaging efficiency.

All these advantages have led to growing preference for polyolefin shrink films among automotive, electronics as well as industrial machinery manufacturers over traditional packaging options. This will continue to drive growth of the polyolefin shrink film market in the coming years.

Market Challenge - Environmental Regulations Limiting Certain Materials in Packaging

One of the major challenges facing the polyolefin shrink film market is the implementation of stricter environmental regulations around the world that are limiting the use of certain materials in packaging. Governments are increasingly recognizing the dangers of plastic pollution and are introducing policies to curb the consumption of single-use plastics.

Many countries have either banned or put limitations on the use of shrink films made from conventional plastics that have low recycling rates. This is negatively impacting the demand for polyolefin shrink film market.

Manufacturers will have to find alternative materials that have less environmental impact over their lifecycle. They also need to improve the recyclability of existing polyolefin shrink films to comply with various plastic waste management rules being introduced globally.

Failing to do so in a timely manner could result in some shrink film products becoming obsolete altogether. This presents a significant technical and investments challenge for players operating in this industry.

Market Opportunity - Shift to Sustainable Packaging

One major opportunity for the polyolefin shrink film market is the increasing demand for sustainable packaging solutions driven by growing consumer awareness. Consumers are now more informed about the environmental damage caused by single-use plastics and are looking to shift to brands that use green packaging. This change in attitudes and purchasing preferences is pressuring brands and retailers to move away from conventional shrink films and explore alternatives that have better sustainability credentials.

Polyolefin shrink film market players can tap into this demand shift by developing bio-based, compostable and recyclable shrink film formulations. Offering sustainable products made from renewable resources is a good way to not only fulfill consumer needs but also to gain a competitive advantage.

A successful transition to providing environmentally-friendly shrink packaging solutions can help companies secure new customers and expand into lucrative market segments. It can also future-proof their business model against tighter regulations restricting certain plastics.

Key winning strategies adopted by key players of Polyolefin Shrink Film Market

Focus on product innovation - Companies are continuously investing in R&D to develop innovative shrink films with enhanced properties. For example, Dow introduced DowlexTM shrink films in 2012 which offered 40-60% more shrinkage compared to conventional films. This helped Dow gain significant share.

Target developing markets - Many players have adopted strategies to tap demand from emerging economies in Asia Pacific and Latin America. For instance, Berry Global expanded its production footprint in India and Brazil in 2017-18.

Pursue strategic acquisitions - Leading companies acquire local producers to enhance their market access. For example, Coveris acquired UK-based Loparex in 2016 for $976 million. This acquisition expanded Coveris' product portfolio and global footprint across 30 countries.

Emphasize customer-centric innovation - Companies partner with OEMs to develop application-specific shrink films. For instance, Bemis worked closely with major food producers in 2015-17 to develop films tailored for packaged meat, snacks and fresh produce.

Segmental Analysis of Polyolefin Shrink Film Market

Insights, By Type: General Polyolefin Shrink Film Witness High Demand

In terms of type, general polyolefin shrink film contributes 57% share of the polyolefin shrink film market in 2024 owing to its versatility across various types of packaging needs. General polyolefin shrink films are made from basic polyolefins like polyethylene and polypropylene, which makes them cheaper to produce than cross-linked films. This lower cost allows General films to be used for a wider variety of packaging where the cost needs to be optimized.

In addition, General Polyolefin films are highly flexible and can be tailored through thickness and composition for different packaging requirements. They provide an effective barrier against moisture and gases while maintaining clarity. The absence of cross-linking also makes general films easier to apply and remove from containers as compared to their Cross-Linked counterparts. This has made general polyolefin shrink film the packaging solution of choice for a broad spectrum of products ranging from food and beverage to industrial and consumer goods.

Insights, By Application: Food and Beverage Remains Top Application due to Growth of Packaged Foods

The food and beverage industry is the largest end-user of polyolefin shrink films. It accounts for 30% revenue share of the polyolefin shrink film market in 2024. The ever-growing demand for packaged and processed foods and drinks has fueled the need for effective packaging solutions to contain, protect, and market products. Polyolefin shrink films perfectly meet these needs of the food and beverage sector.

Shrink films create a tight, tamper-evident seal around packages which helps prevent spillage and contamination. They extend the shelf-life of products by serving as an excellent moisture, gas and grease barrier. Shrink films also allow for customizable printing and labeling which helps brands showcase their products appealingly on shelves.

Polyolefin shrink films have enabled convenience revolution in food, driving their use. With urbanization and increasing disposable incomes, the packaged food trend seems set to grow stronger, making food and beverage the largest application segment.

Additional Insights of Polyolefin Shrink Film Market

- Polyolefin shrink film is widely used in packaging across industries due to its flexibility, providing security to complex products of various shapes and sizes.

- In Asia Pacific, polyolefin shrink films are integral for consumer goods, food, and electronic packaging, driven by manufacturing hubs like China.

- The Asia Pacific region leads the polyolefin shrink film market, accounting for 40% of the global market share in 2023, with a significant consumer base in countries like China, India, and Japan.

- The electronics industry is increasingly utilizing polyolefin shrink films for packaging due to their superior insulation properties and ability to protect sensitive components from moisture and dust. These films are preferred for their lightweight and moisture-resistant properties, providing secure packaging solutions for varied applications.

Competitive overview of Polyolefin Shrink Film Market

The major players operating in the polyolefin shrink film market include Exxon Mobil Corporation, Amcor Plc, Berry Global Inc, Allen Plastic Industries Co., Ltd., FlexiPack, SABIC, Sigma Plastics Group, DM PACK SRL, Vibgyor International, Plásticos Retráctiles S.L., Berry Global Inc., Sealed Air Corporation, Intertape Polymer Group Inc., and Coveris Holdings SA.

Polyolefin Shrink Film Market Leaders

- Exxon Mobil Corporation

- Amcor Plc

- Berry Global Inc

- Allen Plastic Industries Co., Ltd.

- FlexiPack

Polyolefin Shrink Film Market - Competitive Rivalry, 2024

Polyolefin Shrink Film Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Polyolefin Shrink Film Market

- In April 2024, LyondellBasell and Zhengxin Packaging Co. Ltd. announced a collaboration to advance heat shrink film technology. This partnership focuses on developing high-performance packaging solutions utilizing LyondellBasell's CirculenRecover polyethylene, sourced from post-consumer plastic waste.

- In February 2024, Intertape Polymer Group (IPG) introduced ExlfilmPlus PCR, a polyolefin shrink film containing 35% recycled content. This composition includes at least 10% certified post-consumer recycled (PCR) content and 25% certified post-industrial recycled (PIR) content.

- In February 2024, Innovia Films introduced RayoFloat™ white APO (WAPO), a floatable white polyolefin shrink film tailored for light-sensitive products. This low-density film maintains floatability even after printing, enhancing light-blocking properties for applications such as dairy, food supplements, nutritional products, and cosmetics.

Polyolefin Shrink Film Market Segmentation

- By Type

- General Polyolefin Shrink Film

- Cross-Linked Polyolefin Shrink Film

- By Application

- Food and Beverage

- Industrial Packaging

- Pharmaceuticals

- Personal Care and Cosmetics

- Printing and Stationery

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the polyolefin shrink film market size?

The polyolefin shrink film market is estimated to be valued at USD 8.89 Bn in 2024 and is expected to reach USD 11.32 Bn by 2031.

What are the key factors hampering the growth of the polyolefin shrink film market?

Environmental regulations limiting certain materials in packaging and varying international standards the major factors hampering the growth of the polyolefin shrink film market.

What are the major factors driving the polyolefin shrink film market growth?

Rising demand in the retail sector due to increased consumer appeal of polyolefin packaging and growing usage in industrial applications, including automotive and electronics packaging, are the major factors driving the polyolefin shrink film market.

Which is the leading type in the polyolefin shrink film market?

The leading type segment is general polyolefin shrink film.

Which are the major players operating in the polyolefin shrink film market?

Exxon Mobil Corporation, Amcor Plc, Berry Global Inc, Allen Plastic Industries Co., Ltd., FlexiPack, SABIC, Sigma Plastics Group, DM PACK SRL, Vibgyor International, Plásticos Retráctiles S.L., Berry Global Inc., Sealed Air Corporation, Intertape Polymer Group Inc., and Coveris Holdings SA are the major players.

What will be the CAGR of the polyolefin shrink film market?

The CAGR of the polyolefin shrink film market is projected to be 3.5% from 2024-2031.