Position Sensor Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Position Sensor Market is segmented By Technology (Proximity, Linear, Photoelectric, Rotary, Others), By Application (Automotive, Military & Aerospace....

Position Sensor Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | Medium |

| Major Players | Vishay Intertechnology, INC., Siemens AG, Sick AG, Sensata Technologies, Schneider Electric SA and Among Others. |

please let us know !

Position Sensor Market Analysis

The position sensor market is estimated to be valued at USD 5.93 Bn in 2024 and is expected to reach USD 9.58 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. The position sensor market is expected to witness significant growth with the proliferation of automated machinery and robotics across industries.

Position Sensor Market Trends

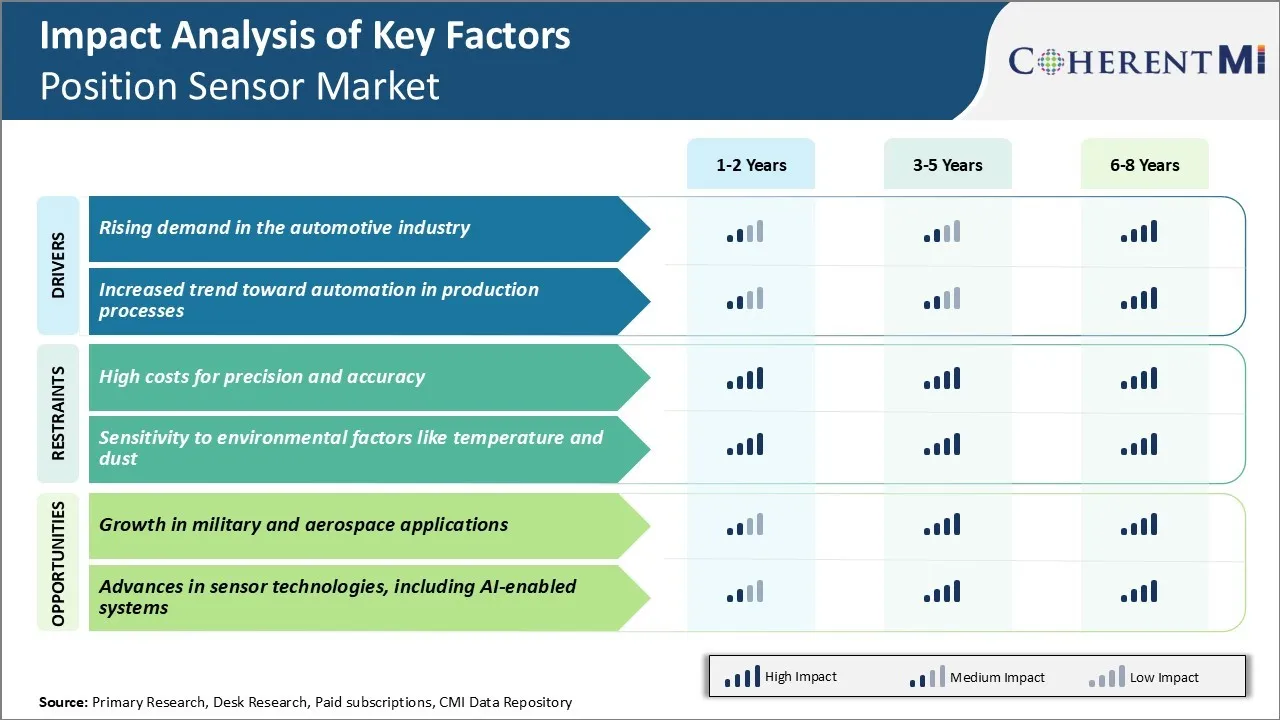

Market Driver - Rising Demand in the Automotive Industry

The automotive industry has been experiencing substantial growth across major economies worldwide. It has increased the demand for position sensors in various applications. As automakers focus on developing autonomous and semi-autonomous vehicles, the need for precise object detection through various sensors, including position sensors, has risen dramatically.

Advanced driver-assistance systems such as parking assistance, blind spot detection, and automatic emergency braking heavily rely on position sensors to monitor vehicle movement and detect obstacles. Steering angle sensors are another important application where position sensors track the position and movement of steering components. With the automotive industry rapidly embracing electronics and alternative fuel vehicles, position sensors that can withstand harsh under-hood conditions are seeing higher usage.

Proliferation of electric vehicles has further expanded the scope as position sensors play a key role in controlling electric motors and monitoring battery charging level. Overall, the growing complexity and technological sophistication of modern vehicles present considerable opportunities in position sensor market.

Market Driver - Increased Trend Toward Automation in Production Processes

Inclination towards automation across manufacturing sectors has led to mounting deployment of industrial robots and automated machinery. Position sensors are integral to robotics and act as the 'eyes' of these robots by providing crucial positional feedback. They help robots understand their precise location and navigate through complex motions accurately.

Automated production lines heavily utilize position sensors for tasks ranging from guiding conveyor belts and robotic arms to tracking components and tooling applications. Industries such as automotive, electronics, food & beverage, and pharmaceuticals have significantly raised their investments in robotics to enhance productivity, reduce errors and lower costs.

Another key driver for position sensor market has been the implementation of Industry 4.0 principles which focuses on interconnectivity, smart machines, and data-driven manufacturing. This ongoing transformation towards smart factories has amplified the need for real-time monitoring capabilities offered by position sensors.

Market Challenge - High Costs for Precision and Accuracy

One of the major challenges faced by the position sensor market is the high costs associated with achieving precision and accuracy in sensor outputs. Developing sensor technologies that can precisely detect small changes in position often requires the use of expensive materials like rare-earth metals and precision mechanical components.

The assembly and manufacturing of these high-precision sensors also tends to be a costly process that involves complex micro or nanofabrication techniques. This increases the per-unit production costs of such sensors significantly. The stringent quality control testing needed to ensure sensor accuracy further adds to the overall expenses.

While there is demand for highly accurate sensors from industries, cost remains a major consideration for mass adoption across different applications. Manufacturers in the position sensor market need to focus on technologies that can reduce reliance on costly materials and manufacturing processes to drive down costs.

Market Opportunity - Growth in Military and Aerospace Applications

The position sensor market is poised to benefit substantially from anticipated growth in military and aerospace applications over the coming years. In the defense sector, position sensors are increasingly being used in complex systems for navigation, fire control, unmanned vehicles and intelligence gathering. They provide crucial real-time data about the location and motion of aircraft, missiles, ships and other military platforms.

Similarly, the commercial aerospace industry relies heavily on accurate position feedback from sensors for flight control systems, landing gear monitoring and engine adjustment mechanisms. The demand for position sensors is expected to increase manifold with rising military modernization budgets globally and higher passenger and cargo aircraft production rates.

Both military and commercial aircraft OEMs are also implementing more sensor-intensive systems for functions like condition-based maintenance. This offers scope for advanced position sensor technologies with enhanced accuracy specifications. Overall, the growth dynamics of these end-use industries make them a lucrative opportunity area in the position sensor market.

Key winning strategies adopted by key players of Position Sensor Market

Product Innovation: Innovation has been one of the key strategies adopted by leading players in position sensor market to gain competitive advantage. For example, in 2019, Honeywell International Inc. launched a new series of position sensors called microMaC Position Sensors.

Customer-centric Approach: Players like ams AG and Renishaw plc have focused on understanding diverse customer needs and offering customized solutions. For example, in 2017, Renishaw launched a magnetic incremental encoder called RGH24 especially for machine tool applications.

Strategic Partnerships and Acquisitions: Companies have also strengthened their position through strategic deals. For instance, in 2021, TE Connectivity acquired First Sensor AG, a leader in sensor technology, for around $308 million.

Focus on Emerging Applications: Leading companies continuously monitor new application areas emerging due to trends like Industry 4.0.

Segmental Analysis of Position Sensor Market

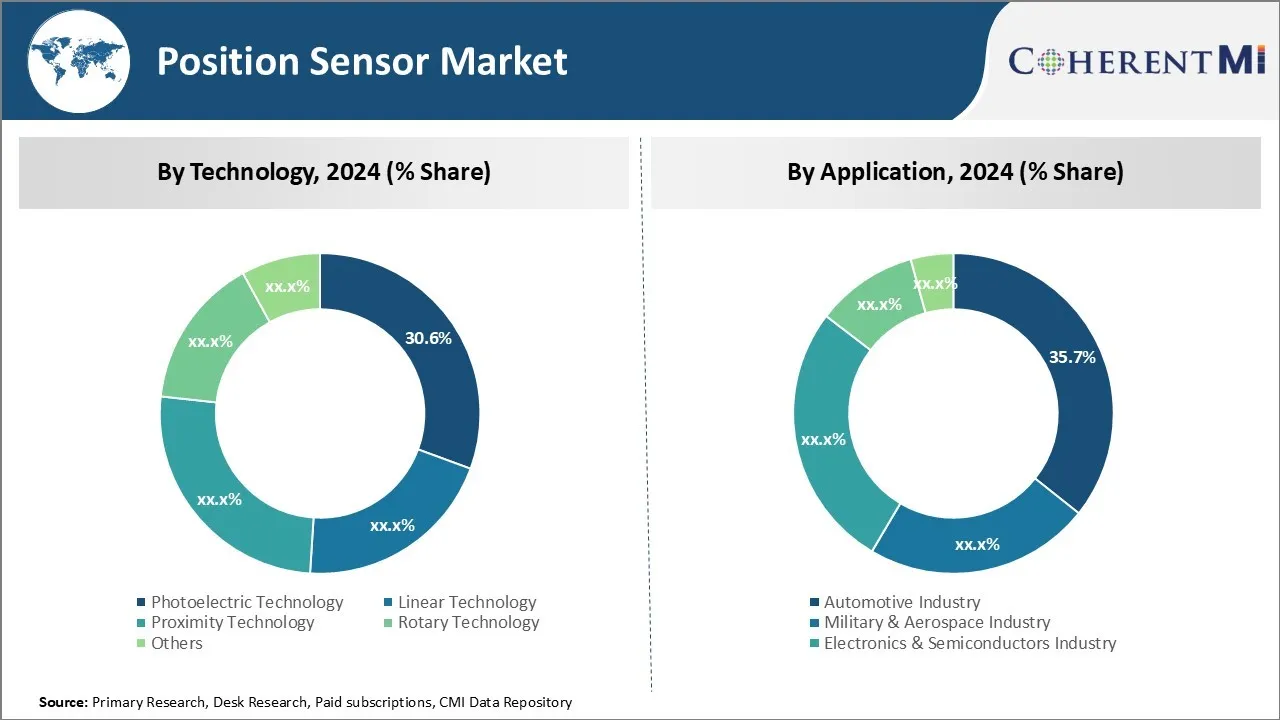

Insights, By Technology: Precision and stability drive photoelectric technology

In terms of technology, photoelectric technology contributes 30.6% share of the position sensor market in 2024, owning to its precise detection capabilities and stability. Photoelectric sensors offer stringent resolution down to millimeters, allowing them to detect even subtle variations or minor object movements. Their digital switching output provides clear reading of the target's position.

Their non-contact design also facilitates longer lifetime than mechanical options as there is no friction or physical contact. Photoelectric technology has reliable and stable performance over time in harsh environments subjected to vibrations, dust, moisture or temperature fluctuations.

Minimal maintenance is required as there are no moving parts in photoelectric position sensors. Overall, photoelectric sensors' precision, stability and versatility have resulted in their widespread use across automotive, industrial, and consumer electronics manufacturing.

Insights, By Application: Automation Driving Strong Demand from Automotive Industry

In terms of application, automotive industry contributes 35.7% share of the position sensor market in 2024. This is due to the rising implementation of position sensors in automotive manufacturing automation and advanced driver-assistance systems. Growing vehicle complexity with more electrical components has prompted automakers to incorporate sensors for precision assembly line processes.

Position sensors are vital for robotic quality control inspection, seam sealing, adhesive dispensing and other automated tasks. They help robots precisely locate vehicle parts and components for assembly. This streamlines production while improving build quality and consistency.

Furthermore, the development of driver-assistance technologies such as collision avoidance, lane keeping and autonomous driving has boosted sensor adoption. Position sensors detect vehicle trajectory and proximity to lane markings or obstacles. Overall, automation across automotive manufacturing and new active safety legislations are key growth drivers for the segment in position sensor market.

Insights, By Sensor Type: Precise Linear Measurement Driving Demand for Linear Position Sensors

In terms of sensor type, linear position sensors contribute the highest share of the position sensor market owing to their application in dimensional inspection and linear motion control.

Linear position sensors monitor dimensional attributes and facilitate fast, repeatable inspection of parts and components. They help optimize processes by promptly identifying manufacturing variances. Furthermore, linear position sensors are crucial for motion feedback control in linear actuators, feed drives and robotics involving translation movement.

Their high accuracy and repeatability enable closed-loop control of linear motion for applications like conveyance, gantry systems, cutting, indexing and feeding. Overall, the many metrological and motion control use cases requiring linear measurement have augmented demand for linear position sensors across industries.

Additional Insights of Position Sensor Market

- Integration in Electric Vehicles: Position sensors are critical in EVs for battery management and motor control, enhancing performance and safety.

- Medical Device Applications: Use of position sensors in robotic surgery equipment allows for precise instrument movement, improving surgical outcomes.

- Automotive Sector Dominance: The automotive industry accounts for approximately 35% share of the position sensor market, driven by the shift towards electrification and automation.

- Asia-Pacific Growth: The Asia-Pacific region is experiencing the fastest growth in position sensor market due to rapid industrialization and increased adoption of consumer electronics.

Competitive overview of Position Sensor Market

The major players operating in the position sensor market include Vishay Intertechnology, Inc., Siemens AG, Sick AG, Sensata Technologies, Schneider Electric SA, Optek Technology, Leuze Electronics GmbH + Co. KG, Keyence Corporation, iFM Efector, Inc., and Honeywell International, Inc.

Position Sensor Market Leaders

- Vishay Intertechnology, INC.

- Siemens AG

- Sick AG

- Sensata Technologies

- Schneider Electric SA

Position Sensor Market - Competitive Rivalry, 2024

Position Sensor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Position Sensor Market

- In October 2023, Renesas Electronics Corporation announced the development of an inductive position sensor (IPS) technology aimed at enhancing motor position sensor integrated circuits (ICs) for applications in medical devices, robotics, and industrial systems. This technology utilizes non-contact coil sensors to detect the position of a metallic target, offering a cost-effective alternative to traditional magnetic and optical encoders.

- In February 2023, Continental announced the development of a new high-speed inductive e-motor Rotor Position Sensor (eRPS) designed for electric vehicles. This sensor accurately detects the rotor's position in synchronous electric machines, thereby enhancing efficiency and ensuring smoother operations. Compared to traditional resolver sensors, the eRPS is more compact and 40% lighter.

Position Sensor Market Segmentation

- By Technology

- Proximity

- Linear

- Photoelectric

- Rotary

- Others

- By Application

- Automotive

- Military & Aerospace

- Electronics & Semiconductor

- Packaging

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Position Sensor Market?

The Global Position Sensor Market is estimated to be valued at USD 5.93 Bn in 2024 and is expected to reach USD 9.58 Bn by 2031.

What will be the CAGR of the Position Sensor Market?

The CAGR of the Position Sensor Market is projected to be 7.1% from 2024 to 2031.

What are the major factors driving the Position Sensor Market growth?

The growing demand in the automotive industry, with position sensors enhancing vehicle performance and safety and rising trend of automation across industries for process efficiency are the major factors driving the Position Sensor Market.

What are the key factors hampering the growth of the Position Sensor Market?

The high expenses associated with precision requirements and extreme environmental sensitivity and limited sensing angles and susceptibility to wear and tear in some sensor types are the major factors hampering the growth of the Position Sensor Market.

Which is the leading Technology in the Position Sensor Market?

Proximity is the leading Technology segment.

Which are the major players operating in the Position Sensor Market?

Vishay Intertechnology, INC., Siemens AG, Sick AG, Sensata Technologies, Schneider Electric SA, Optek Technology, Leuze Electronics GmbH + Co. KG, Keyenence Corporation, iFM Efector, Inc., Honeywell International, Inc., Heidenheim, CTS Corporation, Bourns, Inc., Banner Engineering, Balluff GmbH are the major players.