Poultry Processing Equipment Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Poultry Processing Equipment Market is segmented By Product (Poultry Slaughtering Equipment, De-Feathering Equipment, De-Boning Equipment, Tumbling Eq....

Poultry Processing Equipment Market Size

Market Size in USD Bn

CAGR6.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.8% |

| Market Concentration | High |

| Major Players | Marel hf, John Bean Technologies Corporation, GEA Group AG, Meyn Food Processing Technology B.V., Baader Group and Among Others. |

please let us know !

Poultry Processing Equipment Market Analysis

The Global Poultry Processing Equipment Market is estimated to be valued at USD 4.6 Bn in 2024 and is expected to reach USD 7.8 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2031. Increasing demand for poultry meat and meat products globally is driving the need for more processing equipment in poultry production facilities. Automation and robotics are gaining more focus in poultry processing to improve production efficiency and meet the rising demand for poultry meat and meat products worldwide. The market is witnessing growing adoption of automated and robotic equipment for processing. Automated equipment helps reduce labor costs and improves food safety. Robotic technologies help address challenges around labor shortage and allow 24/7 operations. Technological advancements focused on automation, Food safety, and processing efficiency are key market trends spurring the demand for poultry processing equipment.

Poultry Processing Equipment Market Trends

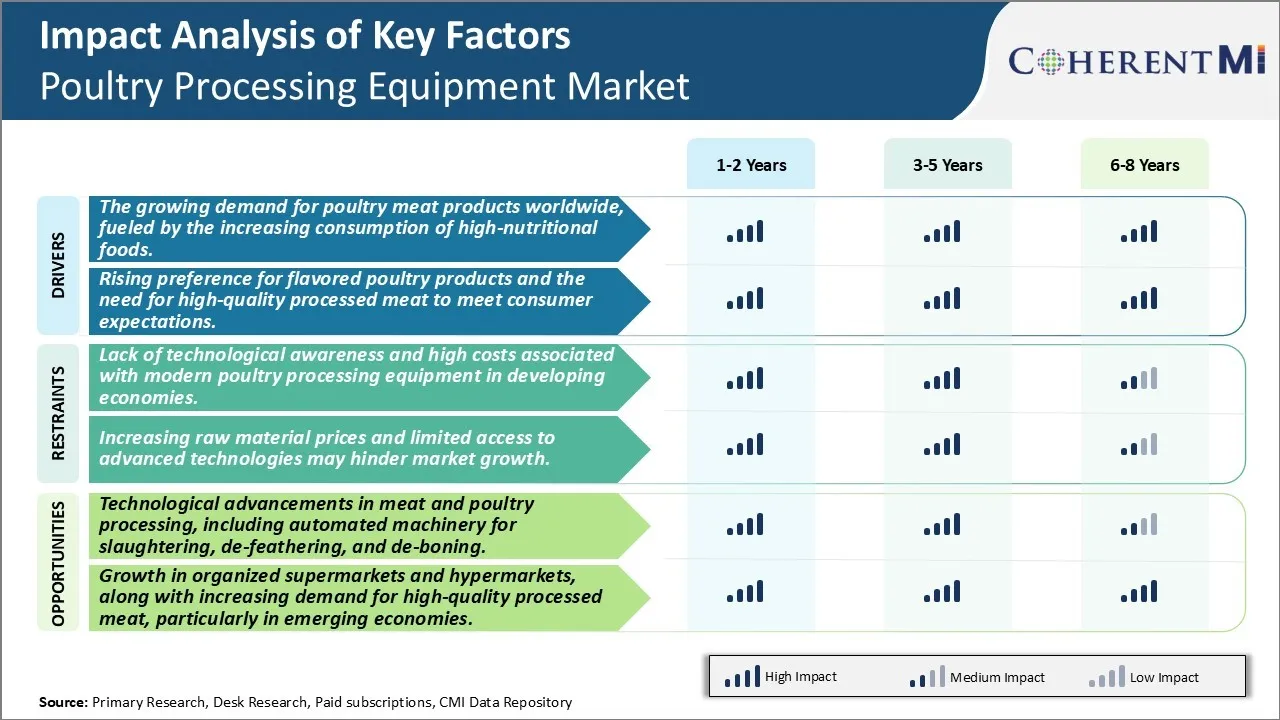

Market Driver - The Growing Demand for Poultry Meat Products Worldwide, Fueled by the Increasing Consumption of High-Nutritional Foods

The rising population and prosperity across the potential markets witness gradually shifting dietary patterns towards high protein foods like meat and meat products. People are now better aware that chicken meat has high biological value and is more nutritious than red meat. It is a rich source of essential nutrients like proteins, vitamins, and minerals. The surging middle-income groups in countries such as India, China, Brazil wanting to adopt a healthy protein-rich diet is driving up demand. Moreover, with urbanization and western influence, ready-to-cook and ready-to-eat foods are gaining tremendous popularity. This has resulted in significant growth of processed chicken, nuggets, patties and other value-added products in retail and foodservice sector. All these factors have compelled poultry processors to focus on productivity and throughput by automated cutting-edge equipment. Advanced technologies allow high yields while maintaining food safety and quality standards. Moreover, automation helps overcome difficulties arising from labor shortage and wage inflation in developing markets.

Market Driver - Need for High-Quality Processed Meat to Meet Consumer Expectations and the Rising Preference for Flavored Poultry Products

Consumers worldwide are looking for variety and new tastes in their diet. This has encouraged poultry processors to innovate and come up with naturally or artificially flavored chicken products. Marinated chicken pieces and wings basted in savory barbecue or tandoori flavors have gained massive popularity. Likewise, breaded or battered chicken nuggets and patties are available in different spices and sauces to suit varied palates. Proper flavor infusion and moisture retention become crucial for tenderness and mouthfeel. This necessitates precise marination, tumbling and massaging equipment. Moreover, discerning customers demand consistent quality, texture and appearance with each bite. High-precision portioning and forming machines ensure uniform shapes and weights. Vision inspection systems check for defects and deviations. Overall, innovations are continuously improving upon established processing lines to deliver personalized customer experiences while complying with stringent food quality and labeling regulations. Significant capital investments in state-of-the-art facilities and equipment have thus become inevitable for poultry companies seeking leadership in this competitive industry.

Market Challenge - Lack of Technological Awareness and High Costs Associated with Modern Poultry Processing Equipment in Developing Economies

One of the major challenges being faced by the poultry processing equipment market in developing economies is the lack of technological awareness and high costs associated with modern processing machinery. Many small and medium poultry farms in developing nations like Africa and parts of Asia are still relying on traditional and manual methods of slaughtering and processing chickens, ducks, etc. Due to low level of education and technical skills, farmers in these countries have limited knowledge about the productivity and food safety benefits of automated and mechanized poultry processing lines. Additionally, the capital costs of setting up a fully automated processing facility with machines for slaughtering, scalding, plucking, evisceration etc. is currently very high for small farms in developing markets. This prevents many farmers from modernizing their practices. Unless awareness drives are conducted and cheaper financing options are made available, adoption of new technology will remain slow in developing regions, limiting the growth potential of the poultry processing equipment market.

Market Opportunity - Technological Advancements in Meat and Poultry Processing, Including Automated Machinery for Slaughtering, De-Feathering, And De-Boning

One of the major opportunities for the poultry processing equipment market is the ongoing technological advancements in machinery and automated solutions. Equipment manufacturers are constantly innovating and developing newer generations of fully automated lines for slaughtering, scalding, plucking, evisceration, de-feathering, chilling, cutting and de-boning of poultry. The latest automated machines ensure higher levels of food safety, productivity, and product quality compared to manual methods. This helps poultry processors to meet the stringent quality and safety standards of global retailers and food service brands. Technologies such as robotics, artificial intelligence and Internet of Things are enabling the next stage of Industry 4.0 transformations in the sector. If small and low-cost automated equipment options become more widely available, it can open up vast untapped markets in developing countries and drive future growth opportunities for poultry processing machinery providers.

Key winning strategies adopted by key players of Poultry Processing Equipment Market

Strategic Acquisitions: One of the most effective strategies used by major players has been strategic acquisitions to expand their product portfolios and geographic footprint. For example, in 2017, Marel acquired German poultry equipment manufacturer Meyn to strengthen its processing lines business in Europe. This helped Marel enter new segments like deboning and portioning to offer a one-stop solution. Similarly, in 2019, JBT acquired Prime Equipment Group to enhance its portfolio of solutions for further processing operations. Such acquisitions have helped players widen their customer base.

Focus on Innovation and Automation: Leading companies like Marel, John Bean Technologies, BFE Services, and Meyn have consistently invested around 5-7% of their annual revenues in R&D to develop advanced automated solutions. For example, in 2018, Marel launched the M2000 line featuring robotics and artificial intelligence for portioning chicken breast fillets with 95% accuracy. Such innovations have helped improve productivity and yield for processors by over 15%, thereby increasing their competitiveness. This strategic focus on automation solutions equipped with latest technologies has enabled players to charge a premium and retain customers.

Strategic Partnerships and Global Expansion: In the last five years, various players have entered into partnership agreements to aid their global expansion. For example, in 2015, Meyn forged a partnership with China-based Guangzhou Lienming Intelligent Equipment to locally manufacture and market its portioning solutions, giving it access to the fast- growing Chinese market. Similarly, in 2019, Marel partnered with Indian poultry major Venky's to set up a processing plant integrating its solutions. Such partnerships and establishment of local manufacturing plants have helped companies reduce trade barriers and compliance issues, while catering to regional customer needs better.

Segmental Analysis of Poultry Processing Equipment Market

Insights, By Product: Poultry Slaughtering Equipment is Essential for Large Scale Operations

By Product, Poultry Slaughtering Equipment is projected to contribute 50.4% market share in 2024 due to its necessity for large scale poultry processing operations. Poultry slaughtering equipment allows processors to efficiently and humanely kill and remove feathers from poultry at high volumes that are required to meet consumer demand. Automatic neck cutters, scald tanks, and inline plucking machines are integral components that allow processors to slaughter thousands of chickens or turkeys per hour in an assembly line fashion.

The large integrated poultry producers that supply the majority of poultry meat to grocery stores and restaurants depend on high-capacity slaughtering equipment. Without fast and reliable slaughtering technology, it would not be possible for a few major companies to satisfy the massive quantities of chicken, turkey, and other poultry purchased by consumers each day. Regional processors also benefit from automated slaughtering lines as it lowers their costs versus manual processing and helps them competitively serve grocery chains and food service distributors.

As consumer appetite for affordably priced poultry grows, larger facilities continue to be built to economies of scale. This drives greater demand for equipment configurations that can seamlessly process tens of thousands of birds in a single shift. Leading equipment manufacturers have responded by innovating new-generation systems with faster cycle times, online product inspection capabilities, and modular designs for easy reconfiguration. They integrate robotics, data analytics, and artificial intelligence to optimize line efficiency and yield. Overall, the essential role of slaughtering equipment in industrial poultry production ensures its primacy within the overall poultry processing equipment market.

Insights, By Application, Chicken Processing Segment to Enjoy Prominent Position in the Forthcoming Years

By Application, Chicken Processing applications are projected to account for 48.3% market share in 2024 owing to chickens being the most consumed poultry globally. However, Turkey Processing is growing rapidly due to increased consumption of turkey meat and products. Equipment versatility that allows processors to efficiently handle various bird types provides advantages over single-purpose machinery.

Processors utilize similar equipment for slaughtering, evisceration, chilling and cutting across chickens and turkeys. Yet subtle differences exist in bird sizes, shapes and meat yields that require optimized equipment configurations. Equipment manufacturers have responded by designing flexible platforms with modular tooling, interchangeable parts and configurable processing lines. For example, a processor can use the same platforms originally set up for chickens and readily reconfigure them with turkey-specific tooling for seasonal production.

These multifunction systems empower processors to changeover production between chickens and turkeys or even smaller bird types like ducks or geese based on market demand cycles. They avoid being locked into a single species and can better serve foodservice customers seeking variety. The modular flexibility also lets regional processors cost-effectively produce different poultry types on demand for local markets versus larger integrated producers focused on single high-volume items. As alternative poultry gains popularity, flexible multi-species equipment able to seamlessly transition between bird types will dominate the poultry processing technology landscape.

Insights, By Distribution Channel, Online Convenience and Customization to Create Novel Opportunities in the Near Future

By Distribution Channel, the online channel contributes the highest share of the market owning to the convenience and customization it provides equipment buyers. Purchasing poultry processing equipment online allows buyers to easily compare specifications, pricing and lead times of various manufacturers from any connected device. Detailed 3D models and virtual reality demonstrations provide an immersive view of line capabilities without physical travel.

Online marketplaces serve as a one-stop-shop where buyers can source equipment, track orders, and get technical support—all digitally. Sellers too benefit from the reach of e-commerce to cost-effectively target global buyers. Exchange of design files and production data enables highly customized configurations developed through an interactive online process. Examples include tailoring line speeds, automated controls, product handling automation and sanitary stainless steel designs per specific plant layouts.

As online equipment sales witness robust gains, interactive customization will be a key differentiator. Front-runners are adopting approaches like generative design where processing goals are inputted and software iterates optimal equipment solutions. Augmented and mixed reality are also being evaluated to collaboratively visualize custom projects in real-time across geographies. Overall, the convenience, engagement and customization afforded by online poultry equipment buying continues to elevate this channel above traditional offline methods.

Additional Insights of Poultry Processing Equipment Market

The poultry processing equipment market is poised for substantial growth, driven by increasing demand for poultry meat worldwide, technological advancements, and the rise of organized retail. North America leads the global market, while Asia Pacific is expected to witness the highest growth, primarily due to rising poultry consumption, urbanization, and government support. Advances in automation and AI are revolutionizing poultry processing, enhancing both efficiency and hygiene. However, challenges remain, particularly in developing countries where access to modern equipment is limited, and raw material prices are rising. The growing consumer preference for high-nutritional, antibiotic-free poultry products is also influencing market trends, pushing producers to adopt more sophisticated processing technologies. The shift toward organized food retail, including supermarkets and hypermarkets, has significantly impacted the demand for automated poultry processing equipment, particularly in developing regions.

Competitive overview of Poultry Processing Equipment Market

The major players operating in the Poultry Processing Equipment Market include Marel hf, John Bean Technologies Corporation, GEA Group AG, Meyn Food Processing Technology B.V., Baader Group, Perdue Farms Inc, Sanderson Farms Inc, Bachoco, Koch Foods, Tyson Foods Inc and Charoen Pokphand Group.

Poultry Processing Equipment Market Leaders

- Marel hf

- John Bean Technologies Corporation

- GEA Group AG

- Meyn Food Processing Technology B.V.

- Baader Group

Poultry Processing Equipment Market - Competitive Rivalry, 2024

Poultry Processing Equipment Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Poultry Processing Equipment Market

- In December 2023, Eagle Product Inspection launched the MAXIMIZER RMI, a hygienic poultry processing solution aimed at enhancing bone detection and reducing labor-related product rejections.

- In May 2023, Kudumbashree opened a poultry processing plant in Kerala, India, to promote quality chicken products under the "Kudumbashree Kerala Chicken" brand.

- In June 2022, Amlan International introduced new natural poultry processing solutions in the U.S. and international markets to enhance production efficiency and sustainability while reducing the reliance on non-natural products.

Poultry Processing Equipment Market Segmentation

- By Product

- Poultry Slaughtering Equipment

- De-Feathering Equipment

- De-Boning Equipment

- Tumbling Equipment

- Others

- By Application

- Chicken Processing

- Turkey Processing

- Duck Processing

- By Distribution Channel

- Online

- Offline

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Poultry Processing Equipment Market?

The Poultry Processing Equipment Market is estimated to be valued at USD 4.6 Bn in 2024 and is expected to reach USD 7.8 Bn by 2031.

What will be the CAGR of the Poultry Processing Equipment Market?

The CAGR of the Poultry Processing Equipment Market is projected to be 6.8% from 2024 to 2031.

What are the major factors driving the Poultry Processing Equipment Market growth?

The growing demand for poultry meat products worldwide, fueled by the increasing consumption of high-nutritional foods. These rising preference for flavored poultry products and the need for high-quality processed meat to meet consumer expectations are the major factors driving the Poultry Processing Equipment Market.

What are the key factors hampering growth of the global semiconductor intellectual property market?

The lack of technological awareness and high costs associated with modern poultry processing equipment in developing economies. Increasing raw material prices and limited access to advanced technologies may hinder market growth are the major factors hampering the growth of the Poultry Processing Equipment Market.

Which is the leading Product in the Poultry Processing Equipment Market?

The leading Product segment is Poultry Slaughtering Equipment.

Which are the major players operating in the Poultry Processing Equipment Market?

Marel hf, John Bean Technologies Corporation, GEA Group AG, Meyn Food Processing Technology B.V., Baader Group, Perdue Farms Inc, Sanderson Farms Inc, Bachoco, Koch Foods, Tyson Foods Inc, Charoen Pokphand Group are the major players.