Premium Bottled Water Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Premium Bottled Water Market is segmented By Product Type (Still Premium Bottled Water, Sparkling Premium Bottled Water, Flavored Premium Bottled Wate....

Premium Bottled Water Market Size

Market Size in USD Bn

CAGR7.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 7.1% |

| Market Concentration | High |

| Major Players | Bling H20, Roiwater, Beverly Hills Drink Company, NEVAS GmbH, Lofoten Arctic Water AS and Among Others. |

please let us know !

Premium Bottled Water Market Analysis

The premium bottled water market is estimated to be valued at USD 21.95 Bn in 2024 and is expected to reach USD 35.42 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2031. The premium bottled water market is expected to witness positive growth as increased awareness about the health benefits of consuming pure water without any contaminants is driving the demand.

Premium Bottled Water Market Trends

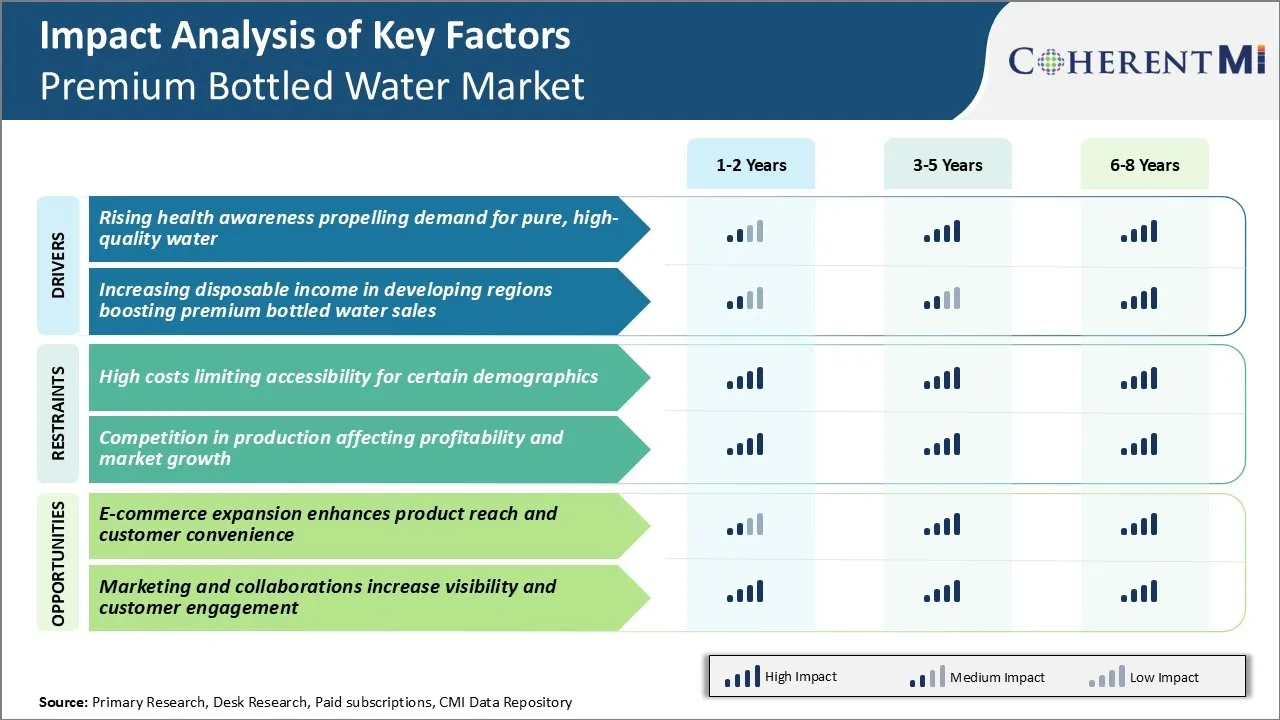

Market Driver - Rising Health Awareness Propelling Demand for Pure, High-quality Water

There is a growing perception that bottled water is purer and contains fewer contaminants than tap water which comes through aging pipelines. Furthermore, people want to avoid potential long-term health risks and opt for water that has undergone rigorous purification processes.

Companies in the premium bottled water market promote their products as offering mineral-rich formulas that can balance electrolytes and hydrate the body better. Some brands tout benefits like alkaline properties that may help reduce acidity levels. While the full health benefits of different types of bottled water are still being researched, marketing highlights functional positions and purity to improve customer perception.

The COVID pandemic has further emphasized the need for clean drinking water and boosted hygiene-related spending. Avoiding public water fountains and points during the crisis drove more people to trusted bottled water options. Some prefer them as a safeguard for their families with concerns around virus transmission through shared water infrastructure. With greater awareness about strengthening immunity through diet and hydration habits, premium variants satisfying purity and quality requirements are gaining traction. This will drive growth of the premium bottled water market.

Market Driver - Increasing Disposable Income in Developing Regions Boosting Premium Bottled Water Sales

Rising economic growth has improved living standards and spending power in developing nations over the past decade. While bottled water was earlier considered a luxury confined to the affluent, wider availability of high-paying employment opportunities has made it accessible to a broader segment.

Domestic markets in developing economies are becoming more lucrative. So, leading companies in the global premium bottled water market have amplified their focus on marketing and distribution within priority growth territories. Aggressive in-country investments and manufacturing expansion allow suitable product localization to cater local tastes. Local production also helps optimize costs to offer premium variants at competitive price-points relatable to the regional spending ability. Partnerships with modern retail chains ensure extensive penetration into lower-tier cities and towns witnessing substantial income gains.

Changing consumption patterns signal preference shifts towards convenient packaged and ready-to-consume items rather than traditional sources as a symbol of progress. This continues stimulating growth for premium bottled water market in dynamically evolving developing regions.

Market Challenge - High Costs Limiting Accessibility for Certain Demographics

The premium bottled water market faces the challenge that high product costs can limit its accessibility for certain demographic segments. Restricted affordability translates into the fact that addressable premium bottled water market is confined to middle-to-high income households who can justify the premium.

However, by not being affordable for mass consumption, the total potential market size may be capped compared to other beverage categories. The industry will need to consider strategies such as targeted pricing or package formats to expand its demographic base and tap into wider demand pools.

Another barrier is that value consciousness has grown amid economic uncertainties, making consumers across segments more reluctant to pay premiums without clear functional benefits. Focused communication of the brand image and purity advantages will be important to justify the price-quality proposition.

Market Opportunity - E-commerce Expansion Enhances Product Reach and Customer Convenience for Market

The premium bottled water market possesses an opportunity to expand its reach and enhance customer convenience through increasing penetration of e-commerce sales channels. As more consumers conduct groceries and other purchases online, e-commerce platforms offer an accessible new avenue for premium bottled water brands to meet customer needs. Especially for time-pressed demographics, the ease and safety of digital purchasing can help drive trials and repeat sales.

E-commerce also helps brands surmount logistical and geographic challenges in physical distribution as online networks allow broad, even nationwide delivery coverage. Players in the premium bottled water market must implement strategies with optimized online branding, engaging subscription options, and logistic efficiency. That way, e-commerce would represent a powerful opportunity for them to access new customers as well as deepen engagement with existing buyers in this evolving marketplace.

Key winning strategies adopted by key players of Premium Bottled Water Market

Strategic Marketing & Brand Positioning: Evian spends over $100 million per year on global marketing, positioning itself as a hydration solution for an active lifestyle and sponsoring events like fashion shows and marathons.

Premium Packaging & Design: Gerolsteiner redesigned its bottle in 2018 from glass to plastic, maintaining its artisanal design to stay premium-priced. This packaging signals quality to consumers compared to generic plastic bottles.

International Expansion: Fiji started export to U.S. in 1996 and grew sales to over $250 million by 2015. Its tropical branding resonated with Americans. Evian expanded to over 170 countries, also utilizing sponsorship of global athletic events to raise brand awareness internationally.

Pricing Power: Evian charges around $16 for an 8-pack at US retailers. Fiji can cost over $3 per bottle in some markets. This pricing power means premium water firms enjoy higher profit margins.

Segmental Analysis of Premium Bottled Water Market

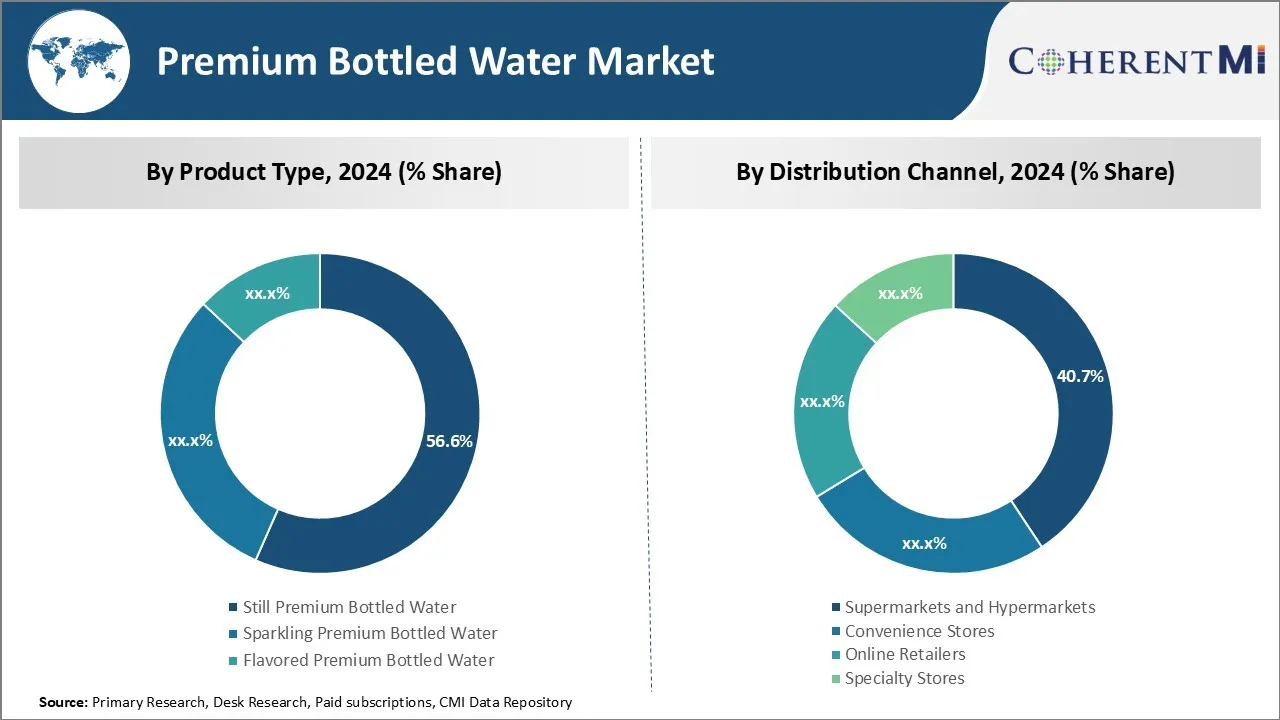

Insights, By Product Type: Consumer Preference for Pure Natural Sources Drives Still Premium Bottled Water Segment

In terms of product type, still premium bottled water segment contributes 56.6% share of the premium bottled water market in 2024. This is due to growing consumer preference for bottled water sources that are all-natural without any additives. The segment has witnessed steady gains as health-conscious consumers seek hydration options perceived as pure and free from contaminants.

Still premium bottled water is often marketed as having been sourced from protected springs and natural aquifers, directly resonating with the clean label trend. Additionally, the absence of added sugars, preservatives or other artificial ingredients makes still premium bottled water an attractive proposition for those monitoring their dietary lifestyles.

Insights, By Distribution Channel: Superior Convenience and Product Visibility Spurs Supermarkets and Hypermarkets Dominance

In terms of distribution channel, supermarkets and hypermarkets contributes 40.7% share of the premium bottled water market in 2024. This trend is driven by compelling value proposition that supermarkets and hypermarkets offer to consumers. As one-stop shopping destinations, they offer unparalleled visibility to a wide portfolio of premium bottled water brands all under one roof. This saves time for harried buyers and facilitates easy price, size and variety comparisons. Their large storage capacities also ensure stable inventory levels of popular stock keeping units.

Gradually, their private labels have emerged as strong alternatives, further boosting store loyalty programs for repeated shoppers. Efficient supply chain logistics also help these retailers sustain competitive prices.

Insights, By Packaging Material: Perceptions of Premium Quality and Elegance Boost Glass Bottles Prominence

In terms of packaging material, glass bottles contribute the highest share of the market owing to their premium image over other formats. Made from recyclable material, glass is perceived by many as purer and safer compared to options like plastic which raises health and sustainability issues. They retain flavors better without imparting any of their own.

Furthermore, glass bottles enhance the perceived value with their elegant appearance with labels and designs prominently on display. They also feel more durable and long-lasting for repeated usage. Many premium water brands cultivate an aura of quality and refinement through their association with glass bottles. This has kept the segment attractive over time despite higher costs involved versus other packaging materials.

Additional Insights of Premium Bottled Water Market

- Consumer Preference for Glass Packaging: Over 62.5% of consumers prefer premium bottled water in glass containers due to perceived purity and environmental benefits.

- Growth in Online Sales: Online retail channels have witnessed a 15.8% annual growth rate, reflecting changing consumer shopping habits and the convenience of e-commerce.

- Europe led the premium bottled water market with a 35% revenue share in 2023, driven by high tourism and demand for premium water at hospitality venues.

- Asia Pacific is expected to witness the fastest growth in the global premium bottled water market due to urbanization in China, India, and Japan and rising health awareness in these regions.

Competitive overview of Premium Bottled Water Market

The major players operating in the premium bottled water market include Bling H20, Roiwater, Beverly Hills Drink Company, NEVAS GmbH, Lofoten Arctic Water AS, VEEN, Uisge Source, Berg Water, BLVD Water, Alpine Glacier Water Inc., Minus 181 GmbH, Perrier (Nestlé Waters), Evian (Danone Group), Fiji Water, San Pellegrino (Nestlé Waters), Voss Water, Mountain Valley Spring Company, and Icelandic Glacial.

Premium Bottled Water Market Leaders

- Bling H20

- Roiwater

- Beverly Hills Drink Company

- NEVAS GmbH

- Lofoten Arctic Water AS

Premium Bottled Water Market - Competitive Rivalry, 2024

Premium Bottled Water Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Premium Bottled Water Market

- In March 2024, JM Financial Private Equity invested ₹45 crore in Energy Beverages Private Limited, the company behind the "Clear" bottled water brand. This investment aims to support brand-building initiatives and expand the company's distribution network across India.

- In September 2023, Icelandic Glacial announced an expansion of its operations, supported by new investments from Iceland Star Property Ltd. and funds managed by BlackRock's U.S. Private Credit team. This investment involved both the injection of new capital and the conversion of existing loans into equity, leading to a revised shareholder structure.

- In September 2023, Clear Premium Water introduced "NubyClear" (NU) in India, a premium natural mineral water sourced from the Himalayas. This premium bottled water product is designed to cater to health-conscious elite consumers. It offers the natural mineral compositions of calcium, bicarbonate, magnesium, fluorides, sodium, chlorides, potassium, nitrates, and an alkalinity of 7.70 ±.

- In March 2023, Evian introduced a new range of premium bottled water products made entirely from recycled plastic. In May 2024, Evian announced that all new bottles manufactured for sale in the U.S. are made from 100% recycled plastic, excluding the label and cap. As of September 2024, 70% of Evian bottles are made from recycled plastic (rPET), with a goal to reach 100% rPET by 2025.

Premium Bottled Water Market Segmentation

- By Product Type

- Still Premium Bottled Water

- Natural Spring Water

- Artesian Water

- Sparkling Premium Bottled Water

- Carbonated Mineral Water

- Flavored Sparkling Water

- Flavored Premium Bottled Water

- Fruit-Infused Water

- Herb-Infused Water

- Still Premium Bottled Water

- By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retailers

- Specialty Stores

- By Packaging Material

- Glass Bottles

- Clear Glass

- Frosted Glass

- Plastic Bottles

- PET Bottles

- Recycled Plastic

- Others

- Metal Cans

- Tetrapaks

- Glass Bottles

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the premium bottled water market size?

The premium bottled water market is estimated to be valued at USD 21.95 Bn in 2024 and is expected to reach USD 35.42 Bn by 2031.

What are the key factors hampering the growth of the premium bottled water market?

High costs limiting accessibility for certain demographics and competition in production affecting profitability are the major factors hampering the growth of the premium bottled water market.

What are the major factors driving the premium bottled water market growth?

Rising health awareness propelling demand for pure, high-quality water and increasing disposable income in developing regions boosting premium bottled water sales are the major factors driving the premium bottled water market.

Which is the leading product type in the premium bottled water market?

The leading product type segment is still premium bottled water.

Which are the major players operating in the premium bottled water market?

Bling H20, Roiwater, Beverly Hills Drink Company, NEVAS GmbH, Lofoten Arctic Water AS, VEEN, Uisge Source, Berg Water, BLVD Water, Alpine Glacier Water Inc., Minus 181 GmbH, Perrier (Nestlé Waters), Evian (Danone Group), Fiji Water, San Pellegrino (Nestlé Waters), Voss Water, Mountain Valley Spring Company, and Icelandic Glacial are the major players.

What will be the CAGR of the premium bottled water market?

The CAGR of the premium bottled water market is projected to be 7.1% from 2024-2031.