Reciprocating Compressors Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Reciprocating Compressors Market is segmented By Type (Single-Acting Reciprocating Compressors, Double-Acting Reciprocating Compressors, Diaphragm Com....

Reciprocating Compressors Market Size

Market Size in USD Bn

CAGR4.53%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 4.53% |

| Market Concentration | Medium |

| Major Players | Ariel Corporation, Atlas Copco, Burckhardt Compression AG, Gardner Denver Holdings Inc., Siemens AG and Among Others. |

please let us know !

Reciprocating Compressors Market Analysis

The reciprocating compressors market is estimated to be valued at US$ 5.72 billion in 2024 and is expected to reach US$ 7.8 billion by 2031, growing at a compound annual growth rate (CAGR) of 4.53% from 2024 to 2031. Reciprocating compressors market is growing as the compressors continue to be deployed across industries such as oil & gas, refining, chemicals & petrochemicals, etc.

Reciprocating Compressors Market Trends

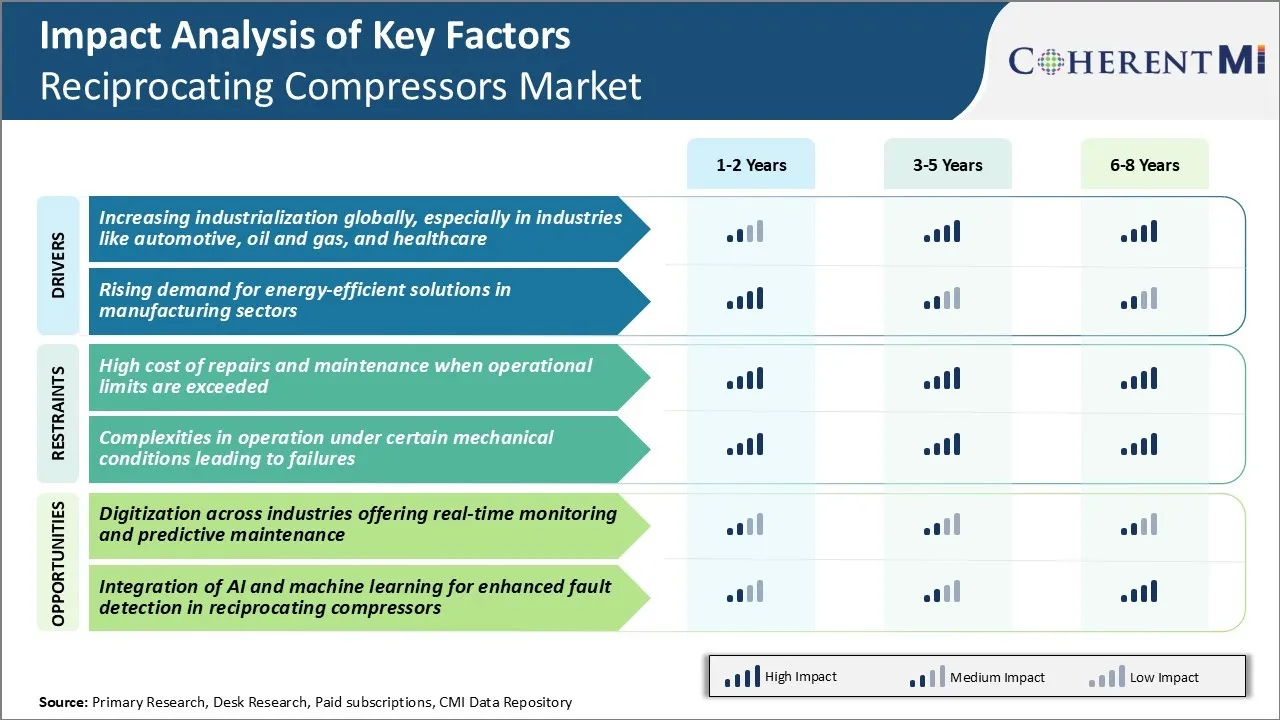

Market Driver - Increasing Industrialization Globally, Especially in Industries like Automotive, Oil and Gas, and Healthcare

Industries like automotive, oil & gas, and healthcare have been the early drivers of industrialization worldwide. All these industries heavily rely on gas compression technologies. Reciprocating compressors play a vital role in compressing natural gas, refinery gas and petrochemical gases in oil & gas facilities. They are widely used for compression applications in automotive manufacturing plants such as paint spray booths, powder coating lines, and packaging. Healthcare sectors deploy reciprocating compressors for various medical gas supply systems including oxygen manifolds, vacuum generating equipment and surgical air compressors.

As industrialization gathers further pace in Asia, MEA, and Latin America going forward, the need for large-scale manufacturing capacities will keep growing. This will translate to rising reciprocating compressor installations across core process industries for applications like gas transmission & distribution, chemical & petrochemical production and medical gas services. In turn, this will drive growth of the reciprocating compressors market.

Market Driver - Rising Demand for Energy-Efficient Solutions in Manufacturing Sectors

With growing environmental consciousness and stringent government regulations worldwide, manufacturing companies are under increasing pressure to reduce energy consumption and carbon footprint of operations. Organizations are actively exploring and adopting advanced technologies that can deliver maximum output while minimizing energy usage.

Reciprocating compressors equipped with smart controls and Variable Frequency Drive (VFD) are emerging as an energy-efficient alternative over conventional units in industrial compressed air systems. The VFD technology allows compressors to modulate motor speed based on real-time air demand instead of running at full speed always. VFD compressors can provide energy savings up to 20-30% compared to fixed-speed compressors of equal capacity.

Manufacturers in the reciprocating compressors market are able to streamline operations, fulfill just-in-time production needs while minimizing the carbon footprint of compressed air generation. As corporate sustainability mandates become more stringent, industries will increasingly prioritize energy management through upgrades to new generation compressors incorporating energy-saving digital solutions. This rising demand for smart, efficient compressed air technologies will significantly benefit leading vendors in the reciprocating compressors market going forward.

Market Challenge - High Cost of Repairs and Maintenance when Operational Limits are Exceeded

One of the key challenges faced by the reciprocating compressors market is the high cost of repairs and maintenance activities that need to be undertaken when the operational limits of compressors are exceeded. Any wear and tear or damage to these delicate parts can significantly reduce the performance and efficiency of compressors over time.

Once compressors start operating outside their recommended pressure ratios, temperatures or speed thresholds, it frequently leads to accelerated component failures and breakdowns. The downtime caused by breakdowns also results in lost production time and reduced revenues for end-use industries that rely on compressed air/gases.

Considering reciprocating compressors are used across a variety of core industries, any unexpected maintenance events can disrupt broader supply chain operations as well. To avoid high maintenance bills, companies need to conduct thorough condition monitoring and planned overhauls of compressors. However, not all plants may have dedicated monitoring systems or trained manpower for such upkeep tasks, which creates a challenge for players in the reciprocating compressors market.

Market Opportunity - Digitization across Industries Offering Real-time Monitoring and Predictive Maintenance

One of the key opportunities for the reciprocating compressors market comes from the rising digitization and integration of remote asset monitoring technologies across various process industries. An increasing number of compressor OEMs as well as third-party solution providers have started offering digital solutions that leverage IoT sensors, cloud computing and data analytics capabilities.

Applications of such condition monitoring and predictive maintenance tools help reduce compressor downtime through planned servicing. They also help optimize maintenance budgets by avoiding unwarranted component replacements. As industries seek to improve asset uptime and cut long-term owning costs, demand is growing for smart reciprocating compressors integrated with remote monitoring systems.

This offers opportunities for both retrofitting existing compressors as well as sales of new reciprocating compressors. Going forward, digitization will play a bigger role in driving the servicing requirements of the reciprocating compressors market.

Key winning strategies adopted by key players of Reciprocating Compressors Market

A key strategy adopted by major players like Ariel Corporation, Dresser-Rand, and GE Oil & Gas has been investing in research and development to develop new technologies and product designs. For example, in 2015, Ariel Corporation launched its Quantum compressor series featuring a modular design that allows for easy maintenance and upgrade. This innovative product helped Ariel gain a larger market share as it provided customers efficiency and flexibility.

Another winning strategy seen is strategic acquisitions that help players broaden their product portfolio and geographical presence. In 2017, Atlas Copco acquired Ohio-based Quincy Compressor to enhance its footprint in the U.S. reciprocating compressor space. This acquisition strengthened Atlas Copco's position as a global leader by adding complementary air and gas products.

Customization as per customer needs and applications has also proven a successful differentiator. In 2018, Siemens customized compressors for offshore oil recovery for BP, enhancing performance and lifecycle. This strengthened customer relationships and references for future projects.

Segmental Analysis of Reciprocating Compressors Market

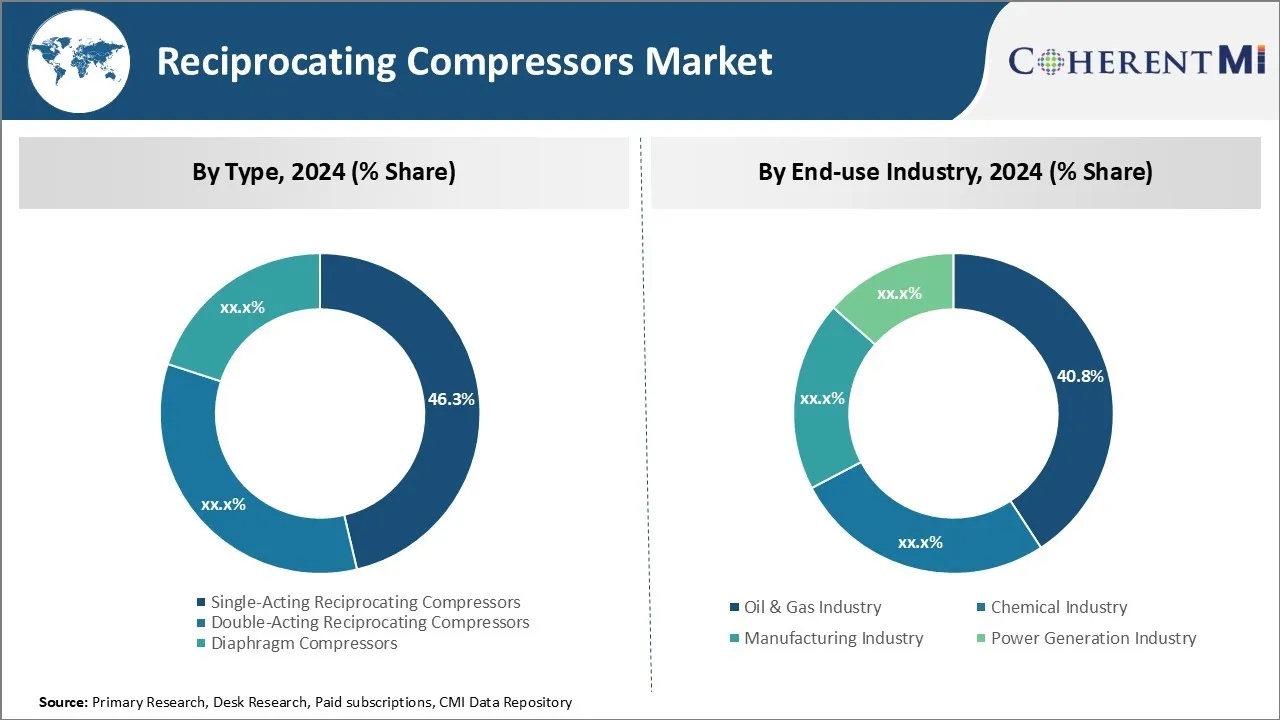

Insights, By Type: Equipment Reliability and Cost-effectiveness Drive Demand for Single-Acting Reciprocating Compressors

In terms of type, single-acting reciprocating compressors contributes 46.3% share of the reciprocating compressors market in 2024, owning to their reliable performance and cost-effectiveness. Single-acting compressors utilize a simple mechanistic design that involves a crankshaft, connecting rod and piston that reciprocates within a cylinder.

This straightforward configuration makes them robust and durable even with continuous heavy-duty operations in various industries. They require less maintenance compared to double-acting compressors as reciprocating parts are less prone to wearing.

Moreover, single-acting compressors have a lower initial price tag which is appealing to cost-conscious end-users. Their energy efficiency, though moderate, is adequate for numerous basic air compression applications. As a result, single-acting compressors remain the workhorse for low-moderate pressure air compression needs across industries like manufacturing, chemical and power generation.

Insights, By Type: Oil and Gas Extraction Drives Demand for Double-Acting Compressors

In terms of end-use industry, the oil & gas industry contributes 40.8% share of the reciprocating compressors market in 2024. The oil and gas sector utilizes reciprocating compressors extensively across both upstream and downstream activities. Increasing exploration and production efforts globally are driving significant demand.

reciprocating compressors are invaluable for injection applications that maintain underground reservoir pressure or repressurize formations for enhanced oil recovery. Their ability to handle wet gases also makes them preferred for gas lift, which injects compressed natural gas into production wells to aid in lifting crude to the surface. Further downstream, reciprocating compressors are critical equipment for natural gas transmission and distribution pipelines.

Emerging LNG export markets additionally need large reciprocating compressor trains to liquefy and transport natural gas internationally. These sector trends point to the oil and gas industry remaining a primary end-market with robust long-term prospects.

Insights, By Lubrication: Growth in process industries lifts demand for oil-free compressors

In terms of lubrication, oil-free reciprocating compressors contributes the highest share of the reciprocating compressors market driven by their increasing uptake across process industries. Oil-free compressors eschew the use of lubricating oil and are capable of delivering oil-free compressed air/gas streams suitable for sensitive industrial applications.

Strict purity and quality standards in sectors like petrochemicals, specialty chemicals and pharmaceuticals are boosting replacement of older lubricated compressors with advanced oil-free models. Their initial high cost is offset by eliminating processes needed to remove oil from compressed gas.

Furthermore, oil-free operation enhances operational safety in hazardous environments by removing fire and explosion risks from oil leaks. Strong projected capacities expansions in Asia Pacific's petrochemical and specialty chemical sectors will further drive oil-free compressor installations aimed at meeting stringent product purity mandates.

Additional Insights of Reciprocating Compressors Market

- Regional Growth: The Asia-Pacific region is expected to witness the highest growth rate in the global reciprocating compressors market, with a projected CAGR of 5.5% from 2023 to 2031, driven by industrialization and infrastructure development.

- North America is expected to grow at a CAGR of 3.03% due to rising investments in oil, gas, and energy industries.

- End-Use Industry Share: The oil & gas industry remains the largest end-user, accounting for 42% of the reciprocating compressors market demand due to ongoing exploration activities.

- The implementation of reciprocating compressors in natural gas processing plants has significantly improved efficiency, leading to cost savings and reduced environmental impact.

- Adoption of advanced materials in compressor components has extended the equipment's lifespan, resulting in lower maintenance frequency and operational costs.

Competitive overview of Reciprocating Compressors Market

The major players operating in the reciprocating compressors market include Ariel Corporation, Atlas Copco, Burckhardt Compression AG, Gardner Denver Holdings Inc., GE Company, IHI Corporation Ltd., Siemens AG, Mitsui E&S Holdings Co., Ltd., Howden Group Ltd., and Mayekawa Mfg. Co, Ltd.

Reciprocating Compressors Market Leaders

- Ariel Corporation

- Atlas Copco

- Burckhardt Compression AG

- Gardner Denver Holdings Inc.

- Siemens AG

Reciprocating Compressors Market - Competitive Rivalry, 2024

Reciprocating Compressors Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Reciprocating Compressors Market

- In June 2024, Hitachi Industrial Equipment Systems launched a predictive diagnosis service utilizing AI, specifically for air compressors used in factories. This new service employs machine learning to analyze data collected through remote monitoring, helping to predict and prevent equipment failures, thereby enhancing operational uptime.

- In May 2024, SIAD Macchine Impianti launched a 550-bar, oil-free, high-pressure hydrogen compressor. This innovative product is specifically designed for the hydrogen refueling station industry, with a focus on enhancing sustainable mobility.

- In April 2024, Frascold introduced the TK HD series, which is a range of transcritical CO2 compressors designed for various refrigeration and air conditioning applications, including high-temperature heat pumps. This series is notable for its energy efficiency and ability to handle continuous and heavy-duty workloads, making it suitable for both industrial and commercial use.

- In July 2023, Atlas Copco AB introduced a new series of energy-efficient reciprocating compressors designed to reduce carbon emissions. This new product line aligns with growing environmental regulations and enhances Atlas Copco's commitment to sustainability. The compressors are built to operate efficiently in various applications, offering features that minimize maintenance and energy use, thereby supporting their goal of increasing market share in the green technology sector.

Reciprocating Compressors Market Segmentation

- By Type

- Single-Acting Reciprocating Compressors

- Double-Acting Reciprocating Compressors

- Diaphragm Compressors

- By End-use Industry

- Oil & Gas Industry

- Onshore

- Offshore

- Chemical Industry

- Petrochemicals

- Fertilizers

- Manufacturing Industry

- Metals & Mining

- Automotive

- Power Generation Industry

- Thermal Power Plants

- Nuclear Power Plants

- Oil & Gas Industry

- By Lubrication

- Oil-free

- Oil Filled

- By Service

- Upstream Services

- Exploration

- Drilling

- Midstream Services

- Transportation

- Storage

- Downstream Services

- Refining

- Distribution

- Upstream Services

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How big is the reciprocating compressors market?

The reciprocating compressors market is estimated to be valued at US$ 5.72 billion in 2024 and is expected to reach US$ 7.8 billion by 2031.

What are the key factors hampering the growth of the reciprocating compressors market?

High cost of repairs and maintenance and complexities in operation under certain mechanical conditions are the major factors hampering the growth of the reciprocating compressors market.

What are the major factors driving the reciprocating compressors market growth?

Increasing industrialization globally, especially in industries like automotive, oil and gas, and healthcare, and rising demand for energy-efficient solutions in manufacturing sectors are the major factors driving the reciprocating compressors market.

Which is the leading type in the reciprocating compressors market?

The leading type segment is single-acting reciprocating compressors.

Which are the major players operating in the reciprocating compressors market?

Ariel Corporation, Atlas Copco, Burckhardt Compression AG, Gardner Denver Holdings Inc., GE Company, IHI Corporation Ltd., Siemens AG, Mitsui E&S Holdings Co., Ltd., Howden Group Ltd., and Mayekawa Mfg. Co, Ltd. are the major players.

What will be the CAGR of the reciprocating compressors market?

The CAGR of the reciprocating compressors market is projected to be 4.53% from 2024-2031.