Retail Automation Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Retail Automation Market is segmented By Implementation (In-store Implementation, Warehouse Implementation), By Product (Point-of-Sale (POS), RFID & B....

Retail Automation Market Size

Market Size in USD Bn

CAGR9.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 9.5% |

| Market Concentration | Medium |

| Major Players | NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu Limited, Toshiba Global Commerce Solutions, Honeywell International Inc. and Among Others |

please let us know !

Retail Automation Market Analysis

The retail automation market is estimated to be valued at USD 29.02 Bn in 2024 and is expected to reach USD 54.78 Bn by 2031, growing at a compound annual growth rate (CAGR) of 9.5% from 2024 to 2031. Increased use of automation technologies by retailers to enhance operational efficiency and improve customer experience is driving the growth of the retail automation market.

Retail Automation Market Trends

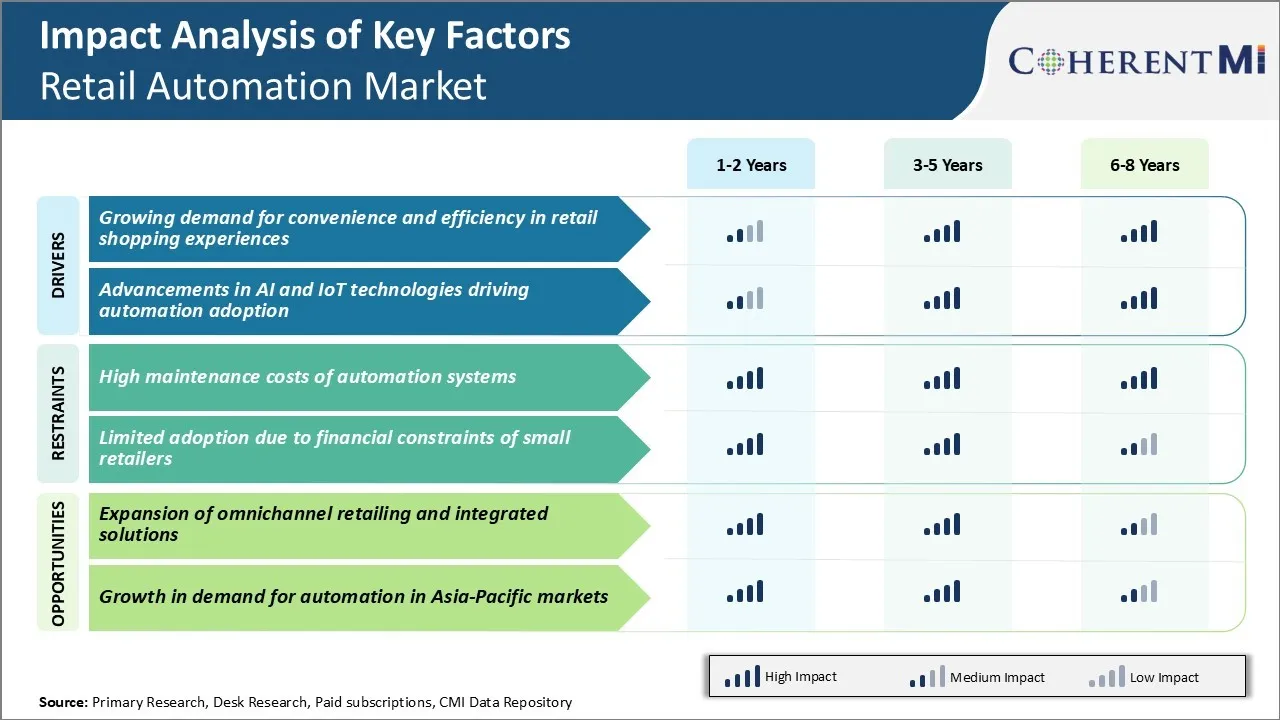

Market Driver - Growing Demand for Convenience and Efficiency in Retail Shopping Experiences

As retail businesses continue striving to provide customers with more convenient and efficient ways to shop, the adoption of automation solutions has significantly increased. Automated technologies allow groceries, apparels and other items to be accessed within no time through self-checkout kiosks and mobile/online ordering systems.

Customers can now do shop for household goods while on the go through smartphones. Robotics has enabled items to be located and retrieved without any fuss. Integration of retail automation at various touchpoints like inventory tracking, warehouse fulfilment, and delivery has streamlined the entire shopping lifecycle for customers.

While in-store shopping will remain indispensable for certain discretionary purchases that require exploring options, retail automation is revolutionizing the way necessities and repeat purchases are made. Younger segments of the population who have grown up with smartphones in their hands expect the same level of convenience from retailers.

The objective is to devote more staff resources on enhancing in-person customer experience for those who still wish to shop conventionally. This will continue to remain a demand booster in the retail automation market.

Market Driver - Technological Evolution in IoT and AI

Advancements in frontier technologies like IoT, Artificial Intelligence, and machine learning have reshaped automation capabilities in the last few years. Retailers can now organize multi-layered supply networks encompassing warehouses, transportation fleets and stores through centralized IoT systems. AI-driven computer vision empowers robots to identify items, track inventory levels and selections in real-time with high accuracy.

AI assistants powered by Natural Language Processing help address customer queries promptly through multiple engagement channels. Advanced algorithms also optimize assortments based on regional preferences mined from comprehensive customer data trails. Such AI-backed cognitive retail automation is vastly streamlining operations while cutting costs compared to labor-intensive manual methods.

Going forward, technologies like augmented reality, autonomous mobility, and blockchain will further boost machine capabilities in the retail automation market.

Market Challenge - High Maintenance Costs of Automation Systems

One of the key challenges faced by the retail automation market is the high maintenance costs associated with automation systems. Retail automation involves the implementation of complex automation technologies such as robotics, artificial intelligence, analytics etc. to automate various retail operations and processes. Retail automation brings significant benefits in terms of improved efficiency, reduced errors, and labor costs savings However, the hardware and software systems used for automation require continuous maintenance and upgrades.

Retailers have to invest extensively in maintaining the IT infrastructure that supports automation systems. They also need to bear the costs of routine checks, debugging, replacing parts and upgrading software on a regular basis. Since retail automation technologies are continuously evolving, retailers need to keep investing in new versions of automation solutions to stay competitive. The maintenance expenditure over the lifecycle of an automation project often outweighs the initial investment costs.

Thereby, high maintenance costs continue to pose a major challenge for players in the retail automation market.

Market Opportunity - Expansion of Omnichannel Retailing and Integrated Solutions

One of the major opportunities in the retail automation market is the growth of omnichannel retailing and increasing demand for integrated retail automation solutions. With online shopping gaining widespread popularity, retailers are extensively adopting omnichannel strategies to provide seamless shopping experience to consumers across all retail channels.

Leading retailers are automating their supply chains, warehouses and fulfilment centers to efficiently handle the complexities of omnichannel operations. There is rising demand for unified retail automation solutions comprising technologies like enterprise resource planning, warehouse management, inventory management etc. that can streamline omnichannel processes.

Vendors in the retail automation market are developing customizable integrated platforms catering to specific omnichannel requirements of retailers. This presents significant revenue opportunities for automation companies to provide cutting-edge integrated solutions and gain new clients in the evolving retail automation market.

Key winning strategies adopted by key players of Retail Automation Market

Investing in Self-Checkout Technologies

A major strategy adopted by retail giants like Amazon, Walmart and Kroger has been investing heavily in self-checkout technologies over the last 5-7 years. This allows customers to scan and pay for items themselves without needing an employee at the checkout.

Adopting Inventory Management Systems

Leading retail chains like Target and CVS have focused on implementing retail automation in inventory management systems that use technologies like RFID, computer vision, and AI.

CVS partnered with AiFi in 2020 to install their AI-powered virtual retail assistance and inventory tracking systems in over 1500 stores. Early results show a 20% improvement in inventory accuracy.

Leveraging Mobile/App-based Order Fulfillment

Online grocery retailers Aldi and Instacart adopted a strategy of integrating mobile applications and automation to optimize order fulfillment across their warehouses and stores. Aldi's acquisition of Anthropic in 2021 focused on applying AI and robotics to digitize workflow and fulfill orders up to 3 times faster.

Segmental Analysis of Retail Automation Market

Insights, By Implementation: Efficiency Gains Drive In-store Implementation

In terms of implementation, in-store implementation contributes 61.4% share of the retail automation market in 2024, owing to the efficiency gains it provides for retailers. Streamlining operations through automated checkout, pricing, and inventory management allows retailers to reduce labor costs and processes in physical stores.

Self-checkout kiosks and computer vision technologies help minimize checkout times for customers while reducing the need for dedicated cashiers. Integration of IoT sensors further aids in tasks like automated replenishment based on real-time inventory levels. This frees up employees for more value-added roles like customer service. Automating repetitive tasks indoors boosts staff productivity and optimizes the in-store experience.

Insights, By Product: Improved Tracking Fuels Point-of-Sale Segment Dominance

In terms of product, point-of-sale (POS) contributes 26.5% share of the retail automation market owing to the improved tracking and insights it provides. Omnichannel POS systems integrate online and physical store operations through a single interface. This allows retailers to gain a unified view of customer purchase behavior, facilitate seamless order fulfillment, and drive personalized engagement.

Advanced POS also enables tracking of item-level sales data in detail. Leveraging analytics on this granular data helps retailers forecast demand accurately, optimize pricing strategies, and minimize out-of-stock instances. The enhanced visibility and business intelligence thus fuels POS dominance in the retail automation market.

Insights, By End-Use: Operational Simplicity Boosts Hypermarket Preference

In terms of By End-Use, Hypermarkets contribute the highest share in the retail automation market owing to the operational simplicity they offer through retail automation. Large hypermarket formats house diverse product categories under a single roof, catering to a wide range of daily needs for customers.

Centralizing operations helps standardize retail automation solutions like computerized inventory and replenishment systems across vast floor spaces in a uniform way. This streamlines product tracking and flow within hypermarkets. Since tasks can be consolidated and standardized, hypermarkets gain higher return on investments through economies of scale. The operational efficiency thus boosts their preference over other retail formats.

Competitive overview of Retail Automation Market

The major players operating in the retail automation market include NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu Limited, Toshiba Global Commerce Solutions, Honeywell International Inc., IBM Corporation, Zebra Technologies Corporation, NCR Corporation, Pricer AB, KUKA AG, Wincor Nixdorf AG, ECR Software Corporation, Posiflex Technology, Inc., ECR Retail Systems, First Data Corporation, and Panasonic Corporation.

Retail Automation Market Leaders

- NCR Corporation

- Diebold Nixdorf, Incorporated

- Fujitsu Limited

- Toshiba Global Commerce Solutions

- Honeywell International Inc.

Retail Automation Market - Competitive Rivalry

Retail Automation Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Retail Automation Market

- In October 2023, Zebra demonstrated a Generative AI large language model running on its handheld mobile computers and tablets without requiring cloud connectivity. This innovation aims to empower frontline workers with new capabilities, offering enhanced privacy, security, and cost savings for businesses.

- In October 2022, Focal Systems partnered with Piggly Wiggly Midwest to pilot its Focal Operating System (FocalOS) in select Wisconsin and Illinois stores. FocalOS digitizes the entire store to automate and optimize ordering, inventory management, merchandising, and in-store labor, aiming to enhance the customer experience.

- In February 2022, RetailNext extended its free traffic system upgrade initiative, reaffirming its commitment to providing cutting-edge, future-proof solutions for retailers.

Retail Automation Market Segmentation

- By Implementation

- In-store Implementation

- Warehouse Implementation

- By Product

- Point-of-Sale (POS)

- RFID & Barcode

- Camera

- Electronic Shelf Label

- Warehouse Robotics

- Others

- By End-Use

- Hypermarkets

- Single Item Stores

- Supermarkets

- Fuel Stations

- Retail Pharmacies

- Others

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

How big is the retail automation market?

The retail automation market is estimated to be valued at USD 29.02 Bn in 2024 and is expected to reach USD 54.78 Bn by 2031.

What are the key factors hampering the growth of the retail automation market?

High maintenance costs of automation systems and limited adoption due to financial constraints of small retailers are the major factors hampering the growth of the retail automation market.

What are the major factors driving the retail automation market growth?

Growing demand for convenience and efficiency in retail shopping experiences and advancements in AI and IoT technologies are the major factors driving the retail automation market.

Which is the leading implementation in the retail automation market?

The leading implementation segment is in-store implementation.

Which are the major players operating in the retail automation market?

NCR Corporation, Diebold Nixdorf, Incorporated, Fujitsu Limited, Toshiba Global Commerce Solutions, Honeywell International Inc., IBM Corporation, Zebra Technologies Corporation, NCR Corporation, Pricer AB, KUKA AG, Wincor Nixdorf AG, ECR Software Corporation, Posiflex Technology, Inc., ECR Retail Systems, First Data Corporation, and Panasonic Corporation are the major players.

What will be the CAGR of the retail automation market?

The CAGR of the retail automation market is projected to be 9.5% from 2024-2031.