Secure Access Service Edge Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

Secure Access Service Edge Market is segmented By Component (Platform, Services), By Application (IT & Telecom, BFSI, Manufacturing, Retail & E-commer....

Secure Access Service Edge Market Size

Market Size in USD Bn

CAGR18.1%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 18.1% |

| Market Concentration | High |

| Major Players | Cisco, Palo Alto Networks, VMware, Inc., Versa Networks, Inc., Cato Networks and Among Others. |

please let us know !

Secure Access Service Edge Market Analysis

The Global Secure Access Service Edge Market is estimated to be valued at USD 2.3 Bn in 2024 and is expected to reach USD 19.1 Bn by 2031, growing at a compound annual growth rate (CAGR) of 18.1% from 2024 to 2031. Secure Access Service Edge or SASE is an emerging cloud-delivered security framework that convergences network and security functions. With SASE, access controls, cloud security tools, WAN optimization capabilities are delivered as-a-service through cloud. This helps organizations to secure all users, devices and applications irrespective of location. SASE also provides advanced threat protection, zero trust network access and enables policy-based security posture for compliance. The increasing need for digital transformation across various industries and the rising focus on zero trust architecture is driving more organizations to adopt SASE solutions to secure their network and ensure access. The market is expected to witness significant growth over the forecast period. With growing security concerns and the rise in remote and hybrid work trends, the demand for SASE is increasing as it provides a comprehensive secure access solution through a cloud-delivered platform. Key capabilities of SASE such as SD-WAN, FWaaS, and ZTNA are seeing more traction from enterprises looking to enhance productivity and security.

Secure Access Service Edge Market Trends

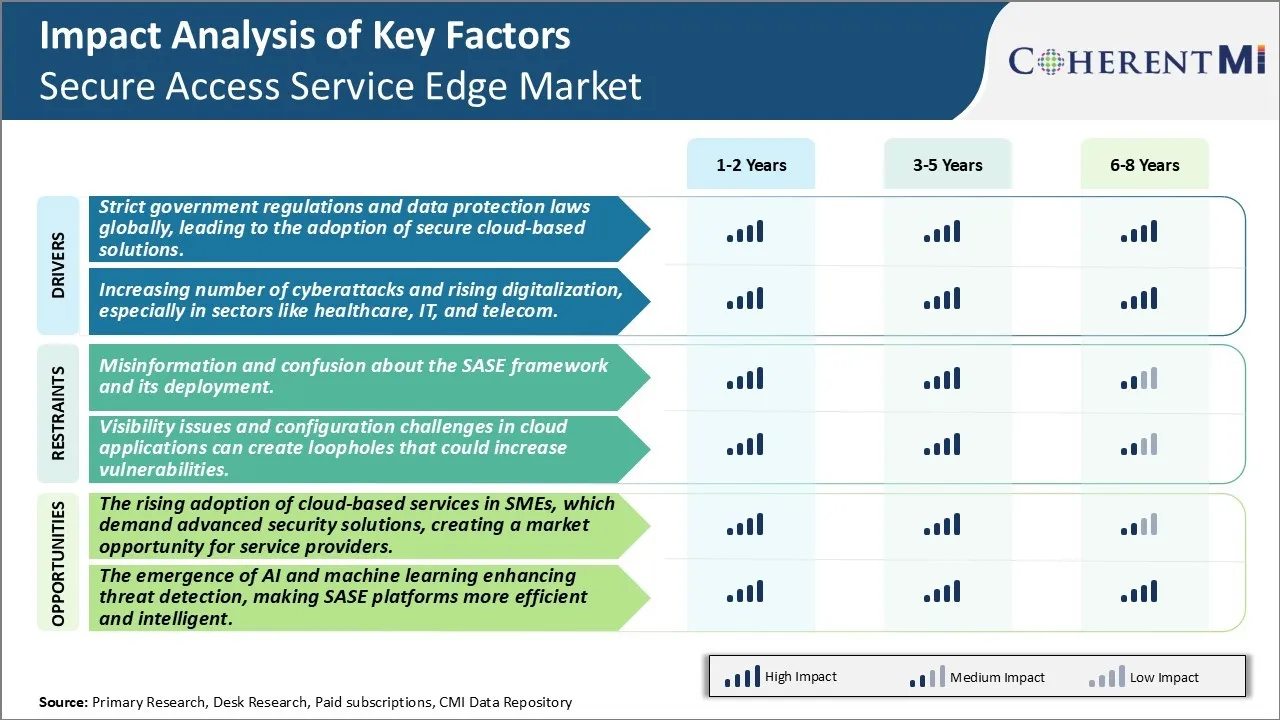

Market Driver - Strict Government Regulations and Data Protection Laws Globally, Leading to the Adoption of Secure Cloud-Based Solutions

Strict government regulations and data protection laws globally, leading to the adoption of secure cloud-based solutions.

With digital transformation gaining rapid momentum worldwide, the concerns around data privacy and security have also increased exponentially. Organizations across all industries are collecting and processing unprecedented amounts of sensitive data such as customer personal information, financial records, health records, intellectual property and more. At the same time, the number of cyber-attacks and data breaches have skyrocketed with threat actors using more sophisticated techniques to steal data.

Governments across the world have realized the growing need to protect their citizens from misuse of personal data and security threats. Stringent data privacy laws such as GDPR in Europe, LGPD in Brazil and state privacy laws in the US have been introduced in the recent years. These regulations impose hefty penalties on companies in case of data breaches or non-compliance. For example, under GDPR the penalties can be up to 20 million euros or 4% of annual global turnover. With such huge financial and legal risks involved, organizations are forced to re-evaluate their legacy IT infrastructure and security practices.

Most companies today host their applications and store data on public and private clouds to benefit from scalability, agility and cost advantages. However, direct internet access to these cloud environments poses serious security concerns. Traditional perimeter-based security tools are unable to secure user access and protect applications in modern cloud and mobile-centric IT environments. There is a need for advanced security solutions that can ensure smooth transition to cloud while maintaining compliance with strict privacy laws.

Market Driver - Increasing Number of Cyberattacks and Rising Digitalization, Especially in Sectors Like Healthcare, IT, And Telecom

Digital transformation has gone mainstream across all industries in order to gain competitive edge and improve customer experiences. The pandemic further accelerated organizations' shift to cloud-first strategies and remote working models. While digital initiatives unlock new opportunities, they also significantly widen the attack surface for cyber criminals. Industries that manage and process highly sensitive data such as healthcare, banking, energy have become lucrative targets for hackers. Even less regulated sectors like telecom and IT are not immune to security breaches considering the growing value of customer and intellectual property data.

Ransomware gangs and nation state actors have taken advantage of the elevated reliance on technology during the pandemic times. In 2021, ransomware attacked rose by 13% globally with healthcare and critical infrastructure facing unprecedented number of disruptive attacks according to reports. The costly and damaging SolarWinds supply chain hack impacted thousands of organizations worldwide including major governments claiming it to be one of the most sophisticated attack s ever. Cyber insurance firm Cyence reported that average data breach costs reached USD 4.35 million in 2021, an 10% increase over the prior year.

With more employees, customers, and business processes moving to public and hybrid clouds, digital transformation has widened the cyber-attack surface significantly for most organizations. Defending static corporate networks is no more sufficient against modern threats. There is a pressing need to implement security approaches that can secure access and protect sensitive work.

Market Challenge: Misinformation and Confusion About the SASE Framework and its Deployment

There is a significant level of misinformation and confusion surrounding the SASE framework and how it can be deployed effectively. While the concept of converging networking and security functions at the edge is appealing, many organisations struggle to understand what a true SASE solution entails and how to evaluate various vendor offerings. Some network and security vendors claim to provide SASE but their products may only address certain components of a full SASE architecture. This has resulted in ineffective time management and resources trialling partial or inaccurate solutions. Additionally, the complexity of migrating from traditional on-premise and hybrid architectures to a cloud-delivered edge has left many potential adopters wary of the transition. Deployment and management challenges of SASE are also not well understood. If these information gaps are not addressed, it could significantly slow down broader adoption of SASE as organisation remain hesitant to invest in technologies they do not fully comprehend.

Market Opportunity: The Rising Adoption of Cloud-Based Services in SMEs, Which Demand Advanced Security Solutions

The shift towards remote and hybrid work models during the pandemic has vastly accelerated the adoption of cloud-based applications and Infrastructure-as-a-Service offerings among small and medium enterprises. This rising usage of public cloud services has heightened security concerns for SMEs, as traditional network perimeter protections no longer apply. Yet most SMEs lack sophisticated security teams and on-premise security infrastructure to protect their borderless networks, remote users, and sensitive data hosted in the cloud. Meanwhile, cloud-native SASE solutions provide advanced capabilities like CASB, ZTNA, firewall-as-a-service and secure web gateway through a single platform accessed via APIs. This offers SMEs an accessible and affordable way to gain enterprise-grade security that scales with their growing usage of cloud services. As cloud adoption continues expansion among SMEs globally, it is generating significant market potential for SASE solution vendors targeting this important customer segment.

Key winning strategies adopted by key players of Secure Access Service Edge Market

Acquisitions and mergers to enhance product portfolio: Leading SASE providers like Cisco, VMware and Zscaler have grown through acquisitions of complementary startups. Cisco acquired ThousandEyes in 2020 to bolster its network and application performance monitoring capabilities. This helped Cisco offer a more complete SASE solution comprising SD-WAN, zero trust network access, secure web gateway, and network visibility.

Similarly, VMware acquired VeloCloud in 2017 and Carbon Black in 2019 to enhance its networking and security offerings. These acquisitions strengthened VMware's SASE portfolio and enabled it to provide integrated SD-WAN, NGFW, CASB and ZTNA functionalities from a single platform.

Zscaler, on the other hand, acquired Edgewise Networks in 2021 to add application segmentation to its zero trust security capabilities. This allows Zscaler to tightly govern application access based on user identity and posture, delivering a more robust SASE solution.

Strategic partnerships with telecom operators: SASE vendors have struck strategic partnerships with telecom operators to leverage their widespread network infrastructure. For example, in 2020 Cisco partnered with Verizon to offer a full-stack managed SASE solution integrating Cisco's security technologies with Verizon's global network and managed services capabilities.

Similarly, VMware partnered with AT&T, Tata Communications and others to deliver fully-managed private networking and SASE solutions to enterprises across various geographies. These partnerships help SASE providers accelerate time-to-market in new regions while reducing upfront infrastructure costs.

Segmental Analysis of Secure Access Service Edge Market

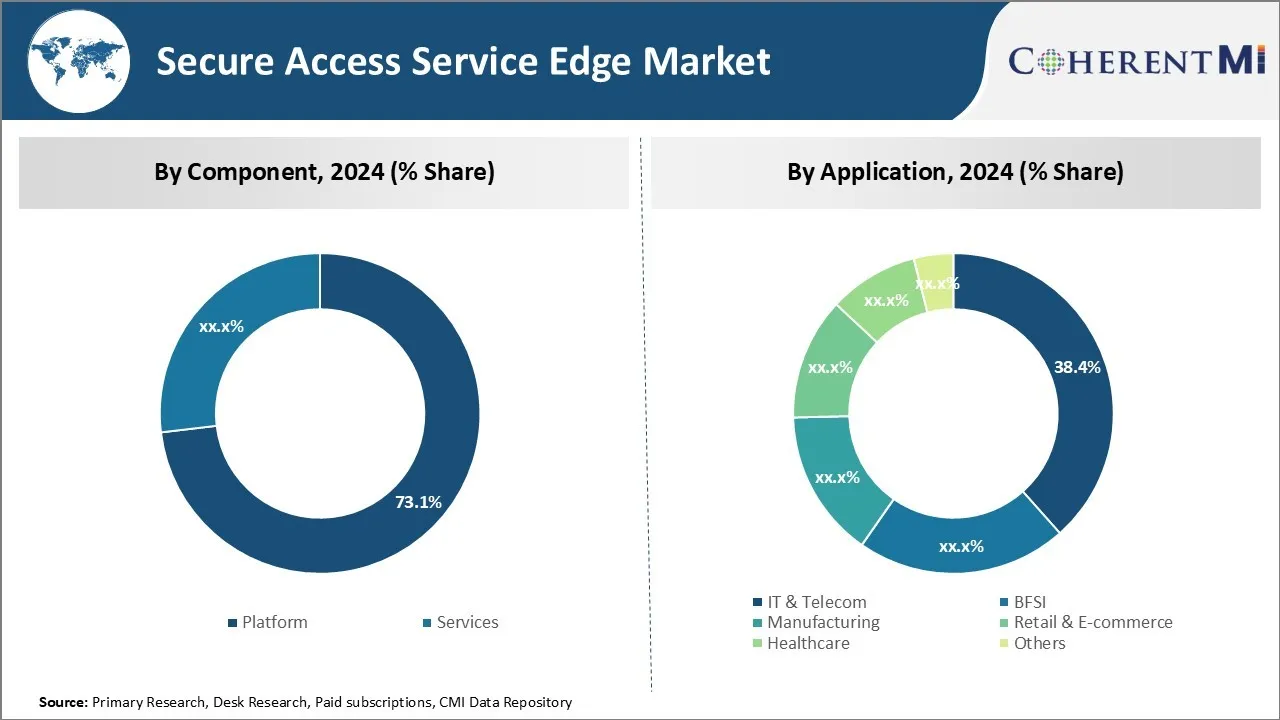

Insights, By Component, Platform Dominates the Secure Access Service Edge Market Due to Extensive Functionality

By Type, the platform component is expected to account for 73.1% market share in 2024. Platforms form the core technological foundation that enables essential Secure Access Service Edge capabilities. They provide a centralized point of control for comprehensive network access, application delivery, security policies and threat protection.

Platforms allow for granular policy management across diverse parts of the network infrastructure and application estates. Administrators can consistently apply security policies regardless of user identity, location or device type. Platforms also integrate a wide array of networking and security tools through their extensive libraries of APIs and connectors. This consolidated approach streamlines access management and eases the burden of maintaining point products.

Another key factor driving platform adoption is their ability to scale dynamically based on organizational needs. As user counts, application portfolios and branch office footprints expand rapidly, platforms can adjust on the fly through elastic computing. They ensure continuity of operations during growth phases without significant overhead. Platforms also future-proof investments through regular feature upgrades delivered via the cloud.

Extensive customization options further augment the value proposition of platforms. Organizations can finely tune access control, authentication workflows, VPN configurations and more based on their unique security postures and business contexts. This flexibility future-proofs implementations for unforeseen changes. Overall, the depth of out-of-the-box functionality and scalability afforded by platforms underpins their dominant market position.

Insights, By Application, IT and Telecom Leads Secure Access Service Edge Usage Due to Sensitivity of Data Assets

By Application, The IT and Telecom industry is expected to account 38.4% in 2024. As digital transformation accelerates across these industries, the sensitivity of data assets has also increased dramatically. IT and telecom companies store and process vast troves of highly confidential customer information, intellectual property, trade secrets and more.

Any breach could have crippling financial and legal repercussions while also severely eroding customer trust. As such, IT and telecom firms rely heavily on Secure Access Service Edge to strengthen the security posture of their hybrid network infrastructure and applications. This encompasses both internal-facing assets as well as supplier/partner ecosystems with access entitlements.

Secure Access Service Edge delivers a zero-trust approach through default-deny policies, multi-factor authentication, session protection and comprehensive visibility. IT and telecom companies gain assurance that only authorized users, systems and processes can access data during both supervised and unsupervised access. The additional layers of security help mitigate threats from both external actors and internal employees. As digital services become ever more critical for business operations, unplanned downtime is simply not an option. Secure Access Service Edge platforms and services ensure maximum uptime through reliable access regardless of user locations. They eliminate friction from previous VPN and legacy remote connectivity methods. The seamless experience further strengthens the competitive edge of IT and telecom firms.

Additional Insights of Secure Access Service Edge Market

The secure access edge services market is growing rapidly due to the rise in cyber threats and the need for a unified security solution that integrates network and security functions in a cloud-native approach. As businesses migrate more services to the cloud, the demand for secure cloud-based solutions has surged. Governments worldwide are enforcing stricter data protection laws, increasing the need for companies to adopt SASE platforms that ensure compliance and provide robust security against cyber threats. The integration of AI and machine learning is transforming the SASE landscape by improving threat detection and enabling real-time security management. This has created an enormous opportunity for service providers to offer customized and scalable security solutions, especially to SMEs and enterprises transitioning to cloud-based models.

Competitive overview of Secure Access Service Edge Market

The major players operating in the Secure Access Service Edge Market include Cisco, Palo Alto Networks, VMware, Inc., Versa Networks, Inc., Cato Networks, Check Point Software Technologies Ltd., McAfee, LLC, Open Systems, Hewlett Packard Enterprise Development LP and Barracuda Networks, Inc.

Secure Access Service Edge Market Leaders

- Cisco

- Palo Alto Networks

- VMware, Inc.

- Versa Networks, Inc.

- Cato Networks

Secure Access Service Edge Market - Competitive Rivalry, 2024

Secure Access Service Edge Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Secure Access Service Edge Market

- In May 2024, iboss introduced its Zero Trust SD-WAN solution, integrating with its existing Zero Trust SSE platform to provide a complete SASE solution.

- In January 2024, Versa Networks launched a series of Unified SASE gateways with over 100 Gbps throughput, designed to meet the growing demand for networking and security integration.

- In June 2024, Tata Communications collaborated with Versa Networks to launch a Unified Secure Access Service Edge solution for global enterprises, integrating SD-WAN and SSE capabilities.

Secure Access Service Edge Market Segmentation

- By Component

- Platform

- Services

- By Application

- IT & Telecom

- BFSI

- Manufacturing

- Retail & E-commerce

- Healthcare

- Others

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

How Big is the Secure Access Service Edge Market?

The Global Secure Access Service Edge Market is estimated to be valued at USD 2.3 Bn in 2024 and is expected to reach USD 19.1 Bn by 2031.

What will be the CAGR of the Secure Access Service Edge Market?

The CAGR of the Secure Access Service Edge Market is projected to be 18.1% from 2024 to 2031.

What are the major factors driving the Secure Access Service Edge Market growth?

The strict government regulations and data protection laws globally, leading to the adoption of secure cloud-based solutions. and increasing number of cyberattacks and rising digitalization, especially in sectors like healthcare, IT, and telecom are the major factors driving the Secure Access Service Edge Market.

What are the key factors hampering the growth of the Secure Access Service Edge Market?

The misinformation and confusion about the SASE framework and its deployment. The visibility issues and configuration challenges in cloud applications can create loopholes that could increase vulnerabilities are the major factors hampering the growth of the Secure Access Service Edge Market.

Which is the leading Component in the Secure Access Service Edge Market?

Platform is the leading Component segment.

Which are the major players operating in the Secure Access Service Edge Market?

Cisco, Palo Alto Networks, VMware, Inc., Versa Networks, Inc., Cato Networks, Check Point Software Technologies Ltd., McAfee, LLC, Open Systems, Hewlett Packard Enterprise Development LP, Barracuda Networks, Inc. are the major players.