Sleeping Bag Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2023 - 2030)

Sleeping Bag Market is Segmented By Product Type (Rectangular, Mummy, Double, 3-season, 4-season, Kids, and Others), By End User (Individual, Institut....

Sleeping Bag Market Size

Market Size in USD Bn

CAGR7.9%

| Study Period | 2023 - 2030 |

| Base Year of Estimation | 2022 |

| CAGR | 7.9% |

| Fastest Growing Market | Europe |

| Largest Market | North America |

| Market Concentration | High |

| Major Players | The Coleman Company Inc., Johnson Outdoors Inc., Oase Outdoors ApS, AMG Group, VF Corporation and Among Others. |

please let us know !

Sleeping Bag Market Analysis

The sleeping bag market size is expected to reach US$ 2.79 Bn by 2030, from US$ 1.64 Bn in 2023, at a CAGR of 7.9% during the forecast period. Sleeping bags are portable, insulated bags used for camping, hiking, and other outdoor recreational activities to provide warmth and comfort. The inner lining is typically made of soft fabrics while the outer shell uses durable water-repellent fabrics. They come in different shapes like rectangular, mummy, and double bags with different temperature ratings. The key drivers of the market include the rising popularity of outdoor recreational activities and adventure travel among millennials, product innovations like lightweight and compressible materials, and demand for multifunctional and customized sleeping bags.

The sleeping bag market is segmented based on product type, end user, distribution channel, insulation material, temperature rating, size, and region. By product type, the mummy sleeping bag segment held the largest share in 2023 owing to its body-hugging design that prevents heat loss and versatile usage for 3-season and winter camping.

Sleeping Bag Market Drivers

- Increasing Participation in Outdoor Recreational Activities: The participation in outdoor recreational activities including camping, hiking, trekking, and adventure sports has been steadily rising over the past decade. Consumer inclination towards active lifestyles and nature-based experiences are resulting in strong demand for camping gear like sleeping bags. For instance, according to the Outdoor Industry Association, over 50 million Americans went camping in 2020, reflecting a growth of over 7 million new campers from the previous year. The COVID-19 pandemic has also influenced consumers to opt for open-air recreation rather than public facilities. Higher consumer enthusiasm towards activities like backpacking, mountaineering, and overlanding is creating robust sales potential for sleeping bags.

- Product Innovation and Premiumization: Key players in the market are focusing on frequent product innovations and premiumization to cater to the evolving consumer preferences. Advancements in materials like lightweight ripstop nylons, waterproof breathable fabrics, and temperature regulating insulations are being integrated in new product launches. Brands are offering features like zipper draft tubes, hood cinchers, internal stow pockets, and zipper draft collars for convenience. The introduction of eco-friendly materials like recycled polyester and water-repellent PFC-free durable finishes has widened the product assortment. The premiumization approach with super-soft linings, ergonomic hoods, navigation pockets, and coil zippers is gaining traction in the market.

- Influence of Online Channels: The growing omni-channel presence of companies coupled with the rising popularity of e-commerce is favoring the market outlook. Brand websites offer comprehensive product information, user reviews and discounted prices to attract online traffic. The launch of rental subscription models by online retailers like tentrr.com allows consumers affordable access to sleeping bags along with tents. Social media marketing campaigns help elevate brand visibility and target potential customers. Market leaders are collaborating with prominent e-retailers and launching brand stores on online platforms to capitalize on the e-commerce boom.

- Advances in Temperature Regulation Technologies: Significant investments towards R&D in temperature regulating and heating technologies have enabled the introduction of innovative products. Electronic heating pads and liners with rechargeable batteries provide on-demand warmth inside sleeping bags without layering clothes. Waterproof and stretchable quilted electric blankets designed specifically for sleeping bags are gaining adoption. Temperature monitoring mobile applications coupled with Bluetooth-connected smart sensors integrated in sleeping bags allow adjusting temperatures through an app. Such technological advances are likely to widen the adoption of 3-season and winter sleeping bags for sub-zero conditions.

Sleeping Bag Market Restraints

- Intense Competition and Pricing Pressure: The sleeping bag market is highly competitive with the presence of numerous regional and global brands. The rivalry from merchandise manufacturers, private label brands, and counterfeit products is intense. Established brands are facing growth challenges due to competition from new entrants, providing quality gear at competitive price points. Fluctuating raw material costs also impact profitability margins. The price-sensitive nature of casual campers and occasional outdoor recreationists poses pricing pressures. These factors are challenging brand positioning and sales growth. If companies are not able to differentiate themselves in terms of pricing and product innovation, they risk losing market share.

- Raw Material Sourcing and Cost Challenges: Sleeping bags rely on specific raw materials including ripstop polyester, water-resistant down insulation, breathable linings, and high-quality zippers. Dependence on limited raw material suppliers with fluctuating costs affects production expenses and supply chain. Ethical sourcing of down also remains a key concern. Environmental factors impacting raw materials like cotton, wool, and silk also constrain supplies. Companies sourcing materials globally face added logistics costs. Rising labor wages, energy costs, and overheads are squeezing profit margins. Addressing raw material availability and managing production costs remain key constraints for global scale manufacturing.

- Seasonal Demand Fluctuations: The demand for sleeping bags is highly seasonal with peak sales generated during spring and summer. Demand drastically declines during off-season periods. This results in overstocking and intense pressure to liquidate inventory. Brands are compelled to offer heavy discounts and promotional offers to boost lagging sales in low seasons. The seasonal demand spikes also create manufacturing and inventory challenges. Ensuring optimal production planning and inventory turns remain crucial yet challenging due to demand uncertainty. When businesses misjudge seasonal variations, they run the danger of suffering losses and missing out on sales during periods of high demand. The inherent seasonality of the product poses risks.

Sleeping Bag Market Opportunities

- Product Customization: Providing personalized and customized sleeping bag designs in line with specific user needs presents an attractive opportunity for manufacturers. Implementing customization configurators allowing consumers to select the size, shape, fabric, color, and even add a name or message can enhance brand value. Some companies like Sea to Summit already offer completely customizable sleeping bags by enabling choosing length, width, foot box shape, zipper side, and fabric. Expanding customization to include features like storage pockets, hood fit, and zipper lengths can help gain a competitive edge. Custom-made sleeping bags are poised to be the next growth frontier.

- Expanding Usage in Institutional Sectors: Institutional sectors like educational institutions, adventure learning programs, scout groups, and camping operators offer immense potential for market expansion. Strategic partnerships with schools, universities, charities, and non-profit organizations involved in promoting outdoor recreation activities can help establish sales channels. Providing specially designed sleeping bags for programs teaching survival skills can be an impactful promotional strategy. Bulk purchasing options can be offered to institutional buyers to gain recurring sales. Market players can also maximize renting opportunities to camping enterprises and trail associations.

- Rising Adventure Tourism: The global adventure tourism industry has witnessed exponential growth as traveler preference for authentic local experiences rises. Adventure travel spending accounted for US$ 683 billion in 2021, reflecting a growth of 22% over pre-pandemic levels as per Adventure Travel Trade Association. Immersive cultural experiences paired with soft-adventure activities is gaining prominence. Collaboration with adventure travel operators and online booking platforms can help position sleeping bags as an essential gear for trekking holidays. Promotional tie-ups with tourism boards to attract leisure campers and backpackers can expand customer outreach. The surging adventure tourism presents a lucrative growth platform.

- Partnerships to Boost Distribution: Strategic partnerships with leading online and offline retailers can aid wider product distribution and enhance brand visibility. Tie-ups with specialty equipment and department stores ensure omni-channel presence. Collaborations with prominent consumer goods brands allow showcasing products to wider demographics. Partnerships with material suppliers like recycled plastic manufacturers can ensure transparent sourcing and sustainable positioning. Affiliations with social media influencers and bloggers helps connect with digitally engaged travelers. Effective partnerships across the value chain will continue enabling companies multiply their growth potential.

Sleeping Bag Market Trends

- Sustainability Initiatives: Sustainable manufacturing practices involving recycling programs for down and synthetic insulation fill are gaining prominence in the market. Brands are increasingly sourcing recycled polyester and sustainable bamboo fiber shells. Eco-friendly water-repellent finishes like silicone impregnation without harmful PFCs are being adopted. Companies like REI have introduced product take-back schemes to recycle old sleeping bags. Compact vacuum compression bags for space-saving storage and transportation also promote sustainability. Consumers are exhibiting preference for responsible brands that integrate bio-based materials and ethical sourcing in product design.

- Focus on Enhanced Thermal Efficiency: Advancements in thermal heat reflective linings, breathable membranes, and insulation fills are heightening the efficiency of sleeping bags. Temperature regulating features like Outlast Dual Phase materials offer dynamic cooling and heating for unmatched comfort. Integration of Far and Mid InfraRed fibers transforms body heat into infrared light for warmth. Heatseeker Eco made using recycled plastic bottles provide thermal retention. Water resistance is increased when Nikwax Hydrophobic down is combined with materials that are waterproof and ripstop . Thermo Gills ventilation system and anti-convection design minimizes cold spots. Such thermal innovations catering to different seasonal usage are influencing purchase decisions.

- Launch of Multifunctional Designs: Seeking to enhance product utility and performance, companies are foraying into sleeping bag models with integrated pillow hoods, internal pockets, and external pad sleeves. Some also feature hideaway integrated hoods and blanket extensions for flexible use. Compression bag with attached sleeping pad providing cushioning and insulation has gained popularity. Integration of safety LED lights, and moskito nets in sleeping bags add multifunctional value. Incorporating extra-large footboxes, hood cinch cords, and full-length 2-way zippers aims at ease of use. The launch of modular sleeping bags with removable layers caters to year-round usage. Multifunctionality has become a key differentiator in new product launches.

- Adoption of Smart Technology: The advent of smart sensors, heating systems, and navigation features is revolutionizing sleeping bag technologies. Integrated heated liners and digital smart sensors that can be controlled through mobile apps or voice assistants allow temperature control inside sleeping bags. Some companies have incorporated stretchable carbon fiber heating pads into sleeping bag liners. QR coded smart patches for accessing product information and safety tips are gaining adoption. Other smart features include GPS maps for tracking trek progress and inbuilt power bank compatibility. The incorporation of smart technologies to enhance comfort, convenience, and performance is a notable trend in the market.

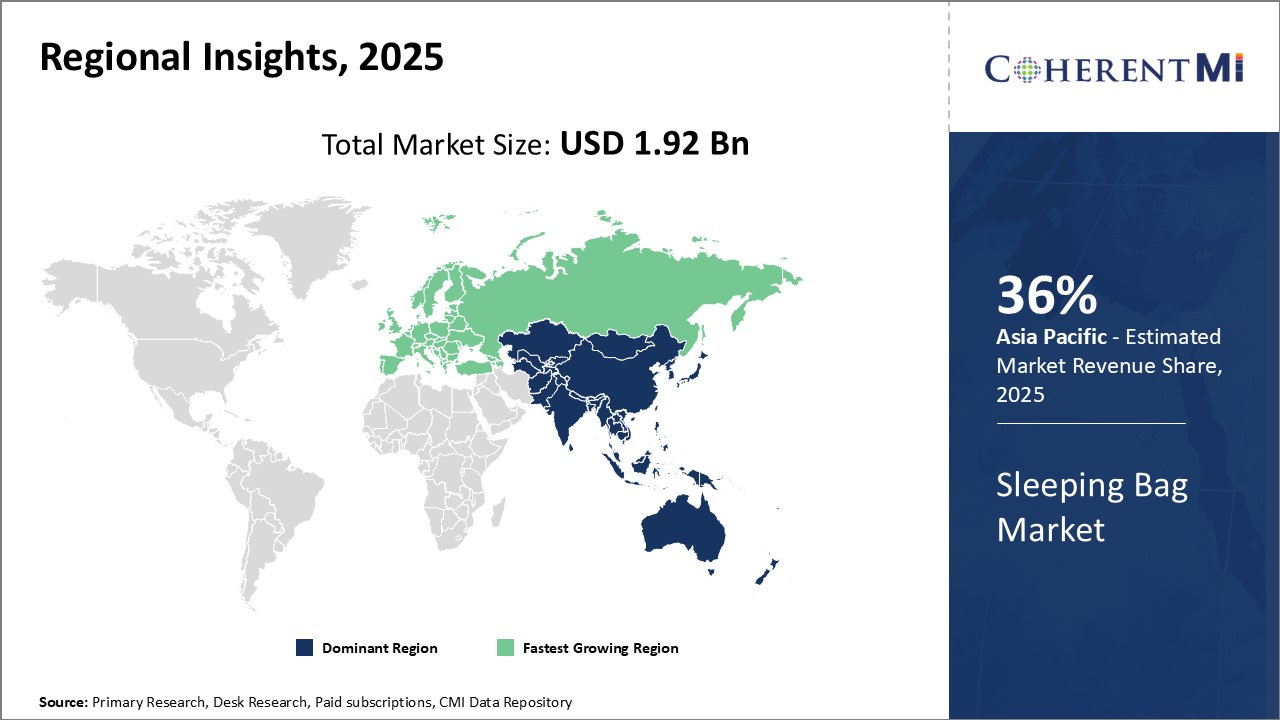

Sleeping Bag Market Regional Insights

- North America is expected to be the largest market for Sleeping Bag Market during the forecast period, accounting for over 36% of the market share in 2023. The growth of the market in North America is attributed to the high participation in camping, hiking and adventure sports activities along with innovations by key players in the region.

- The Asia Pacific market is expected to be the second-largest market for Sleeping Bag Market, accounting for over 27% of the market share in 2023. The growth of the market in the region is attributed to the expanding tourism industry, rise in disposable incomes and increasing consumer awareness regarding outdoor recreational activities in emerging markets.

- The Europe market is expected to be the fastest-growing market for Sleeping Bag Market, with a CAGR of over 18% during the forecast period. The growth of the market in Europe is attributed to the rising trend of eco-tourism and outdoor recreation among millennials along with investments in R&D for product innovations by market players.

Figure 1. Sleeping Bag Market Share (%), By Region, 2023

Competitive overview of Sleeping Bag Market

The major players operating in the sleeping bag market include The Coleman Company Inc., Johnson Outdoors Inc., Oase Outdoors ApS, AMG Group, VF Corporation, Kelty, Marmot, Mountain Equipment, NEMO Equipment Inc., Sierra Designs, Snugpak Ltd., Blackpine Sports, Hyke & Byke LLC, Exxel Outdoors LLC, ALPS Mountaineering, Naturehike, Teton Sports, MalloMe, Western Mountaineering, and Mountain Hardwear.

Sleeping Bag Market Leaders

- The Coleman Company Inc.

- Johnson Outdoors Inc.

- Oase Outdoors ApS

- AMG Group

- VF Corporation

Sleeping Bag Market - Competitive Rivalry, 2023

Sleeping Bag Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Sleeping Bag Market

New product launches

- In September 2022, NEMO Equipment (produces world class tents, sleeping pads, and sleeping bags for all of outdoor needs) introduced the Wagontop 6 and Wagontop 8 tent-top sleeping bags, featuring zippered vents to increase airflow and waterproof floor panels. This move helped expand its 3-season sleeping bag portfolio.

- In March 2021, Kelty (manufacturer of high-end backpacks, tents, and sleeping bags owned by Exxel Outdoors, LLC) released the Galactic 30 degree down sleeping bag using 90% recycled materials and PFC-free durable water repellent finish. This helped the company to strengthen its sustainability initiatives.

- In January 2020, The North Face (leader in outdoor performance clothing & gear for hiking, skiing, trail running, camping, and other adventures) upgraded the Cat's Meow 22 synthetic sleeping bag for women by adding Heatseeker Eco insulation made from recycled plastic bottles. This move supported company's efforts towards sustainability.

Acquisition and partnerships

- In October 2021, AMG Group acquired the Rab and Lowe Alpine brands from Equip Outdoor Technologies Ltd, widening its camping gear portfolio including sleeping bags

- In August 2020, Exxel Outdoors acquired the Kelty brand from Newell Brands, expanding its growing portfolio of outdoor brands and products including sleeping bags

- In January 2020, Logos Enterprises acquired NEMO Equipment, allowing NEMO Equipment to accelerate product development and expand globally, leveraging Logos outdoor industry network

Sleeping Bag Market Segmentation

- By Product Type

-

- Rectangular

- Mummy

- Double

- 3-season

- 4-season

- Kids

- Others (blankets, quilts)

- By End User

-

- Individual

- Institutional (military, scouts)

- Commercial (rentals)

- By Distribution Channel

-

- Offline (specialty stores, department stores)

- Online

- By Insulation Material

-

- Down

- Synthetic (polyester)

- Wool

- Cotton

- Others (silk)

- By Temperature Rating

-

- Summer (+35°F to +50°F)

- 3-season (+15°F to +35°F)

- Winter (0°F to +15°F)

- Extreme (-10°F and below)

- By Size

-

- Kids

- Single

- Double

- Queen/King

- Others (oversized)

- By Region

-

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the sleeping bag market?

The key factors hampering the growth of the sleeping bag market are Seasonality of products, presence of counterfeit products, raw material supply and pricing challenges, highly competitive vendor landscape.

What are the major factors driving the sleeping bag market growth?

The major factors driving the sleeping bag market growth are increasing outdoor recreation activities, product innovations and technology integration, premiumization and customization, demand from millennials.

Which is the leading component segment in the sleeping bag market?

The mummy sleeping bag segment held the largest share owing to its versatile 3-season usage and body-hugging design.

Which are the major players operating in the sleeping bag market?

The Coleman Company Inc., Johnson Outdoors Inc., Oase Outdoors ApS, AMG Group, VF Corporation, Kelty, Marmot, Mountain Equipment, NEMO Equipment Inc., Sierra Designs, Snugpak Ltd., Blackpine Sports, Hyke & Byke LLC, Exxel Outdoors LLC, ALPS Mountaineering, Naturehike, Teton Sports, MalloMe, Western Mountaineering, and Mountain Hardwear are major player in the sleeping bag market.

Which region will lead the sleeping bag market?

North America is expected to lead the sleeping bag market during the forecast period.

What will be the CAGR of the sleeping bag market?

The sleeping bag market is expected to grow at a CAGR of 7.9% from 2023 to 2030.