South Korea Thermoplastic Elastomer Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

South Korea Thermoplastic Elastomer Market is Segmented By Product Type (Styrenic Block Copolymer, Thermoplastic Polyolefin, Thermoplastic Polyurethan....

South Korea Thermoplastic Elastomer Market Size and Analysis

The South Korea Thermoplastic Elastomer Market is estimated to be valued at USD 510.6 Mn in 2024 and is expected to reach USD 749.2 Mn by 2031, growing at a CAGR of 5.5% from 2024 to 2031.

Automotive production and sales have been increasing in the country which is expected to drive the demand for these materials during the forecast period.

Market Size in USD Mn

CAGR5.5%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | Kumho Petrochemical, Samsung Sdi Co., Ltd, S K Global companies, Songwon Industries, LG Chem and Among Others |

please let us know !

South Korea Thermoplastic Elastomer Market Trends

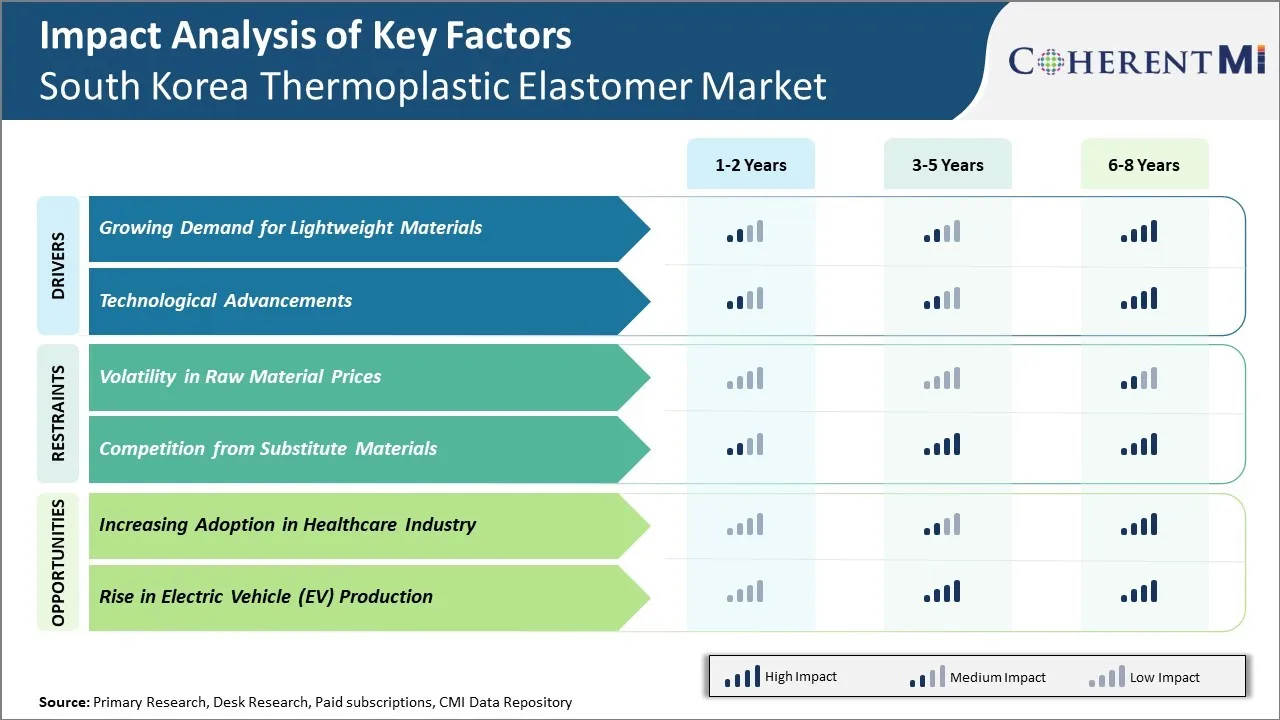

Market Driver – Growing Demand for Lightweight Materials

The growing demand for lightweight materials across various industries such as automotive, consumer goods and construction are a major factor driving the growth of South Korea's thermoplastic elastomer market. Thermoplastic elastomers are becoming increasingly popular as a replacement for conventional materials like metals and thermoset rubber due to their lightweight yet durable nature.

South Korean automobile manufacturers have been at the forefront of adopting thermoplastic elastomers to produce lighter and more fuel-efficient vehicles. According to the International Organization of Motor Vehicle Manufacturers, South Korea's vehicle production increased by 5.2% to 4.1 million units in 2021 compared to the previous year. This upward trend is expected to continue on the back of steady economic growth and demand for personal mobility post-pandemic. The focus on reducing vehicle weight and meeting stringent emission regulations has pushed automakers to use more thermoplastic elastomers in applications like bumpers, door seals and injection-molded interior trims.

The construction industry has also been a major driver of thermoplastic elastomer demand given the push for green and sustainable buildings.

Market Driver – Technological Advancements

Technological advancements are significantly contributing to the growth of South Korea's thermoplastic elastomer market. Thermoplastic elastomers find extensive applications in various industries like automotive, consumer goods, medical, and construction due to their beneficial properties. South Korea being a technologically advanced country is constantly developing advanced materials to boost industrial production through Fourth Industrial Revolution initiatives.

The development of intelligent factories using robotics, artificial intelligence, 3D printing etc. has increased the demand for high-performance yet cost-effective materials like thermoplastic elastomers. They are increasingly being used to manufacture lightweight and durable components for robots, drones, autonomous vehicles and other smart machines and devices. For example, SK Telecom, a leading Korean telecom company has deployed AGVs or automated guided vehicles based on thermoplastic polymer blends to facilitate efficient material transport in its 5G equipment factories (Source: SK Telecom). This signifies how thermoplastic elastomers can support Korea's Industry 4.0 goals by facilitating automation.

The healthcare sector is another major growth driver. As per statistics by Korean Statistical Information Service, South Korea's healthcare spending rose by 5.2% year-on-year to KRW 107.3 trillion in 2020, indicating higher investments in medical technologies.

Market Challenge – Volatility in Raw Material Prices

Volatility in raw material prices has emerged as a major constraint for the growth of South Korea's thermoplastic elastomer market in recent years. Thermoplastic elastomers are made from crude oil-based raw materials like ethylene, propylene, and butylene, whose prices fluctuate greatly due to unstable global oil markets. Any sudden spike in crude oil rates leads to an immediate rise in production costs for thermoplastic elastomer producers. With narrow profit margins, it is difficult for the manufacturers to fully pass on these additional costs to the customers, which squeezes their margins.

This cost uncertainty and margin pressure discourage businesses from making long-term investment decisions in expanding thermoplastic elastomer capacities. According to the UNIDO (United Nations Industrial Development Organization), capital expenditure in the Korean petrochemical industry declined by 6.1% in 2021 compared to the previous year, as investors turned cautious amid raw material price volatility. Higher input costs also reduce the affordability of thermoplastic elastomers for various end-use industries like automotive, construction, footwear etc.

Market Opportunity – Increasing Adoption in Healthcare Industry

The healthcare industry in South Korea is growing rapidly due to an aging population, rising healthcare expenditures and focus on innovation. As per data from Korean Statistical Information Service, the healthcare spending as a percentage of GDP increased from 7.2% in 2015 to 7.8% in 2020 showing prioritization of healthcare. This growing industry offers significant opportunity for the thermoplastic elastomer market in the country.

Thermoplastic elastomers are increasingly being used in medical devices and equipment due to their flexible and durable properties along with ease of processing. Properties like biocompatibility make them suitable for applications involving patient contact like catheters, implants, disposable masks etc. The Korean medical devices market which grew at 5.1% annually between 2015-2020 according to Korea Health Industry Development Institute, is expected to further accelerate post covid focusing on preventive healthcare and remote monitoring. This will boost demand for elastomers in devices and connected health technologies. Furthermore, shifting focus on value-based care where outcome matters more than just volume is increasing use of customized medical solutions requiring innovative material approaches.

Segmental Analysis of South Korea Thermoplastic Elastomer Market

Insights, By Product Type: Styrenic Block Copolymer Well-Suited for Wide Range of Applications

In terms of product type, Styrenic Block Copolymer (SBC) contributes the highest share of the South Korea thermoplastic elastomer market due to its versatility and widespread use across many applications. SBC has a dual polymer structure consisting of both hard polystyrene blocks and soft polyethylene/polybutylene blocks. This gives it properties of both rubber elasticity and plastic processability.

Perhaps most importantly, SBC can perform well over a wide range of temperatures compared to other thermoplastic elastomers. Its heat resistance enables use in everything from footwear and adhesives to automotive parts that must withstand hot engine compartments. It also ages well with UV light exposure, making it common in outdoor or consumer applications that sees sun exposure like toys, sporting goods and even some building products.

SBC is easy to process using existing plastic manufacturing technologies like injection molding, blow molding and extrusion. It delivers cost-effective mass production capabilities. Automakers in particular favor SBC as it can be used to replace rubber in components and allow for simplified, more cost-effective assembly of parts. Other durable goods manufacturers also appreciate its cost benefits.

Insights, By Application: Rising Vehicle Production

In terms of by application, automotive sub-segment contributes the highest share of 30.0% in the market driven by growing vehicle production.

The automotive segment dominates the application landscape of South Korea thermoplastic elastomer market. Automotive industry has been a major consumer of thermoplastic elastomers due to their compatibility with existing manufacturing technologies and versatility. Thermoplastic elastomers are extensively used in automotive exterior and interior components that requires rubber-like elasticity and flexibility along with the processing advantages of thermoplastics.

South Korea has emerged as a prominent automotive manufacturing hub in Asia with presence of leading OEMs such as Hyundai and Kia. Continual automotive industry expansion supported by rising vehicle exports has significantly propelled the demand for thermoplastic elastomers over the past few years. Furthermore, shifting focus of automakers towards fuel-efficient and lightweight vehicles is favoring the adoption of TPEs. Their superior properties allow reducing vehicle weight without compromising on performance. Growing electric mobility trend in the country is another key factor augmenting thermoplastic elastomer consumption in automotive applications including batteries, interior and exterior parts. Thus, robust automotive production acts as a primary driver for the growth of thermoplastic elastomers market in South Korea.

Competitive overview of South Korea Thermoplastic Elastomer Market

The major players operating in the South Korea Thermoplastic Elastomer Market include Kumho Petrochemical, Samsung Sdi Co., Ltd, S K Global companies, Songwon Industries, LG Chem, Hwaseung Industries Co., Ltd., Dupont (Korea) Inc., Posco Daewoo Corporation, Glovis America Inc., and Hyundai Glovis Co., Ltd.

South Korea Thermoplastic Elastomer Market Leaders

- Kumho Petrochemical

- Samsung Sdi Co., Ltd

- S K Global companies

- Songwon Industries

- LG Chem

South Korea Thermoplastic Elastomer Market - Competitive Rivalry

South Korea Thermoplastic Elastomer Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in South Korea Thermoplastic Elastomer Market

- In January 2022, Arkema announced an increase of 25% in its production capacity global Pebax elastomer by investing in Serquigny in France. The investment enabled the increased production of the bio-circular Pebax Rnew and traditional Pebax ranges.

- In August 2020, Lubrizol invested in the thermoplastic polyurethane business globally. The investments include the increased production capabilities of surface paint protection film (PPF) and protection. At the same time, it would provide additional benefits to PPF manufacturers and supply chains.

South Korea Thermoplastic Elastomer Market Segmentation

- By Product Type

- Styrenic Block Copolymer (SBC)

- Thermoplastic Polyolefin (TPO)

- Thermoplastic Polyurethane (TPU)

- Thermoplastic Vulcanizate (TPV)

- Thermoplastic Polyester (TPE)

- Thermoplastic Polyamide (TPA)

- Organo-fluorine Elastomers

- Polyester Ether Elastomer

- Others

- By Application

- Automotive

- Medical & Healthcare

- Consumer Goods

- Adhesives, Sealants & Coatings

- Building & Construction

- Wires & Cables

- Others

- Footwear

- Solar Energy (Photovoltaic Applications)

Would you like to explore the option of buyingindividual sections of this report?

Frequently Asked Questions :

What are the key factors hampering the growth of the South Korea Thermoplastic Elastomer Market?

The volatility in raw material prices and competition from substitute materials are the major factors hampering the growth of the South Korea Thermoplastic Elastomer Market.

What are the major factors driving the South Korea Thermoplastic Elastomer Market growth?

The growing demand for lightweight materials and technological advancements are the major factors driving the South Korea Thermoplastic Elastomer Market growth.

Which is the leading Product Type in the South Korea Thermoplastic Elastomer Market?

The leading Product Type segment is Styrenic Block Copolymer (SBC).

Which are the major players operating in the South Korea Thermoplastic Elastomer Market?

Kumho Petrochemical, Samsung Sdi Co., Ltd, S K Global companies, Songwon Industries, LG Chem, Hwaseung Industries Co., Ltd., Dupont (Korea) Inc., Posco Daewoo Corporation, Glovis America Inc., and Hyundai Glovis Co., Ltd are the major players.

What will be the CAGR of the South Korea Thermoplastic Elastomer Market?

The CAGR of the South Korea Thermoplastic Elastomer Market is projected to be 5.5% from 2024-2031.