United Kingdom Pelargonic Acid Market SIZE AND SHARE ANALYSIS - GROWTH TRENDS AND FORECASTS (2024 - 2031)

United Kingdom Pelargonic Acid Market is segmented By Grade (Natural Grade, Synthetic Grade), By Application (Motors, Lubricants, Herbicide, Lacquer &....

United Kingdom Pelargonic Acid Market Size

Market Size in USD Mn

CAGR6.7%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.7% |

| Market Concentration | High |

| Major Players | Central Drug House. , Croda International Plc, Emery Oleochemicals UK Limited, Glentham Life Sciences Limited, OQ Chemicals GmbH and Among Others. |

please let us know !

United Kingdom Pelargonic Acid Market Analysis

The United Kingdom Pelargonic Acid Market is estimated to be valued at USD 6.29 Mn in 2024 and is expected to reach USD 10.5 Mn by 2031, growing at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2031.

The market is driven by increasing demand from personal care industries where pelargonic acid is used as a moisturizing agent and preservative. The demand for pelargonic acid in personal care products such as moisturizers, cleansers, and hair care products is expected to increase over the forecast period. Growing consumer awareness regarding the benefits of natural ingredients is surging the demand for pelargonic acid derived from natural sources such as coconut and palm kernel oil. Furthermore, increasing R&D investments by manufacturers to develop multifunctional and eco-friendly products incorporating pelargonic acid will support the market growth in the coming years.

United Kingdom Pelargonic Acid Market Trends

Market Driver - Growing Demand from Agriculture Sector

The use of pelargonic acid in the production of pesticides and herbicides has been rising steadily over the past few years. As a natural fatty acid, it is finding increasing acceptance as a sustainable alternative to conventional synthetic pesticides. Pelargonic acid works by interfering with the fatty acid synthesis in insects and fungi, ultimately resulting in their death. However, being derived from natural sources, it breaks down rapidly in the environment without leaving persistent residues. This has helped pelargonic acid gain approvals for use in organic farming across Europe.

The agriculture industry in the UK has been faced with growing pressures to reduce agrochemical residues and adopt more environmentally-friendly practices. Against the backdrop of the government's new Agriculture Act and Environmental Land Management Schemes, farmers are looking to switch to natural and organic options wherever possible. Pelargonic acid with its target-specific mode of action and rapid degradation has emerged as an ideal solution. Leading players in the agrochemical market have launched pelargonic acid-based products catering to major crops such as fruits & vegetables, cereals and oilseeds. The organic strawberry and apple sectors in particular have seen widened uptake of pelargonic acid formulations over the last few years.

Going forward, the drive for sustainability and focus on strengthening soil health are expected to further boost the demand for natural biopesticides. With the commercial agriculture industry recognising its responsibility towards minimizing environmental footprints, pelargonic acid can find more applications across different systems of farming. Government schemes that incentivize sustainable practices may additionally support increased pelargonic acid consumption. While initial costs tend to be higher, farmers have reported pelargonic acid providing effective pest and disease control at par with synthetic chemicals, besides improving long-term soil quality. This could accelerate its acceptance in mainstream commercial agriculture over time.

Market Driver - Wide Scope in Industrial Cleaning

Pelargonic acid has exhibited excellent properties as a versatile cleaning agent due to its ability to penetrate grease and remove residues. It finds widespread use in industrial and institutional cleaning applications across diverse end-use sectors. In manufacturing industries, pelargonic acid-based formulations are popular for metal degreasing and removal of oils, waxes and related contaminants from fabricated parts and machinery. Its high detergency enables effective cleaning of production equipment, tools and surfaces in automotive manufacturing plants.

Food processing is another major area utilizing pelargonic acid cleaners. Approved for incidental food contact, it is used for sanitizing food processing lines, dairy equipment and surfaces in compliance with stringent hygiene standards. Hospitals and healthcare facilities too employ pelargonic acid-based disinfectants and detergents for cleaning, due to its rapid antimicrobial action and safety. Hotels, restaurants and other hospitality businesses source pelargonic acid cleaners for routine maintenance and deep cleaning of rooms, public restrooms and kitchen areas. Its versatility in hard surface cleaning across varied industries holds potential for continued demand upsurge.

Pelargonic acid cleaners have gained customers looking for environment-friendly options as well. They are biodegradable and leave no toxic or harsh residues, meeting the green cleaning needs of industries adopting sustainability initiatives. Government regulations and consumer demand for non-toxic chemicals are further bolstering pelargonic acid cleaning sales. Overall, its multiple beneficial attributes including affordable costs have enabled pelargonic acid to cement its position as a primary industrial cleaning agent in the UK market.

Market Challenges: Availability of substitutes

The United Kingdom pelargonic acid market faces significant challenges from the availability of substitute products. Pelargonic acid has numerous applications as an emollient, surfactant, and antimicrobial agent in cosmetics, personal care, and other industrial products. However, alternative bio-based ingredients such as capric acid and caprylic acid can often fulfill the same roles as pelargonic acid. Capric acid and caprylic acid are shorter medium-chain fatty acids that share similar properties to pelargonic acid. Both are widely used in cosmetics and personal care formulations. They offer formulators flexibility in product design since they can replace pelargonic acid without significantly altering the end product. The widespread availability and lower prices of capric acid and caprylic acid relative to pelargonic acid threatens market share. For the pelargonic acid market to grow, suppliers must focus on developing unique value propositions that cannot be easily substituted or promote combined system approaches using pelargonic acid and its alternatives.

Market Opportunities: Innovation of bio-based products

The United Kingdom pelargonic acid market presents major opportunities for innovation in bio-based products. Consumers are increasingly seeking out sustainable and natural ingredients in the products they purchase. By developing novel and unique bio-based end products that incorporate pelargonic acid, suppliers have an opportunity to capitalize on this consumer trend and command a premium price point. Some potential application areas include bio-based cosmetics, personal care items, household cleaners, and industrial lubricants that leverage pelargonic acid's emollient and antimicrobial properties. Suppliers could also focus on combining pelargonic acid with other natural ingredients to create synergistic, high-performing product systems. With advancements in green chemistry and bio-processing techniques, entirely new lines of bio-based goods may emerge that feature pelargonic acid as a key component. Those who pioneer such innovations position themselves at the forefront of the transition toward more eco-friendly products and help expand the addressable market potential for pelargonic acid.

Key winning strategies adopted by key players of United Kingdom Pelargonic Acid Market

Strategic partnerships and collaborations: Emery Oleochemicals formed a strategic partnership with INOLEX in 2017 to expand its production capabilities for pelargonic acid. This allowed Emery to meet the growing demand from personal care applications. Such partnerships help companies gain access to new technologies and markets.

Focus on innovation and new product development: Matrica introduced its new line of sustainable emollients including pelargonic acid esters in 2020. These esters provide moisturization and spreadability benefits for personal care products. The launch of new eco-friendly products positioned Matrica as an innovation leader, increasing its market share.

Expansion of production capacities: Oleon increased its pelargonic acid production capacity at its plant in Feluy, Belgium by 20% in 2019. This enabled the company to strengthen supply reliability for customers in Europe. Capacity expansion ensures key players can capitalize on rising demand without supply constraints.

Consumer-centric marketing strategies: Hallstar Biotechnology conducted consumer research studies in 2018 to better understand formulation preferences for clean beauty products. This provided insights into developing pelargonic acid-based emulsifiers that delivered the feel and performance consumers desire. Such data-backed strategies help connect products more effectively to end-user needs.

Segmental Analysis of United Kingdom Pelargonic Acid Market

Insights by grade: Natural Properties Drive Demand for Natural Grade Pelargonic Acid

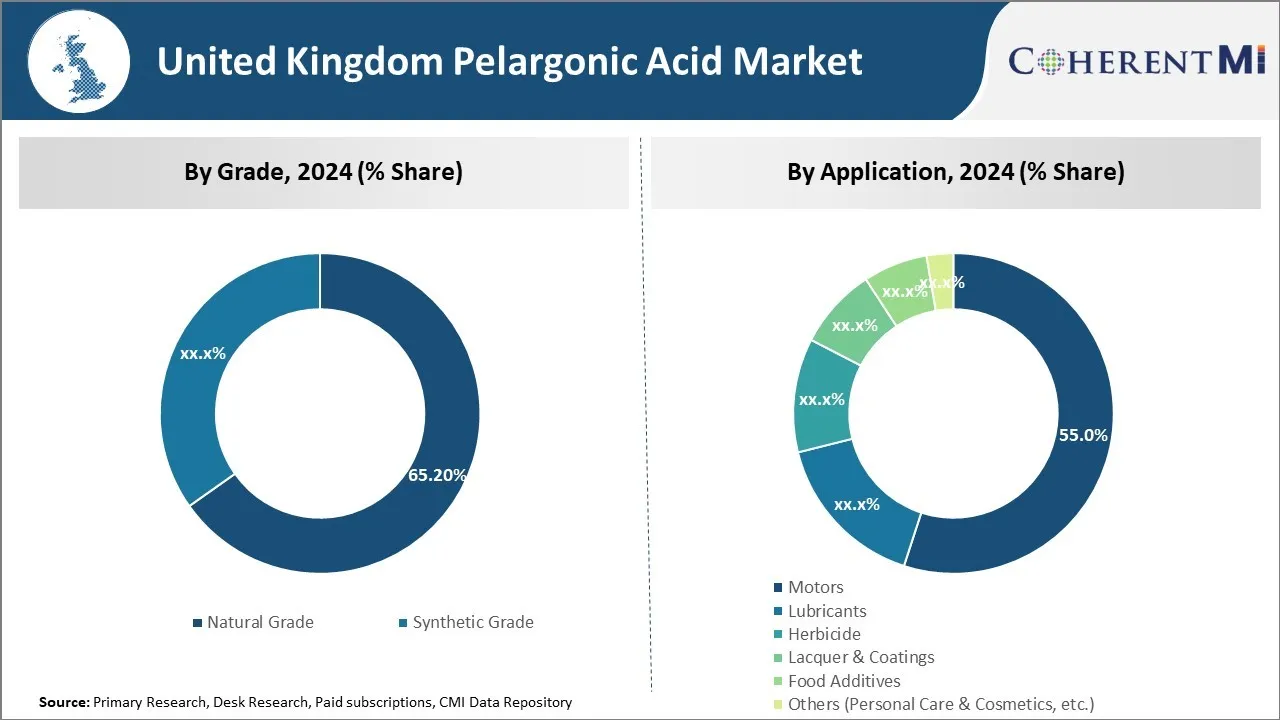

In terms of grade, natural grade pelargonic acid contributes the 65.20% share of the UK market in 2024 owing to strong demand from end users seeking natural ingredients. Pelargonic acid can be produced synthetically or derived from natural sources like palm kernel oil. However, natural grade pelargonic acid has unique properties that make it attractive compared to synthetic alternatives. Being derived from natural palm kernel oil gives natural grade pelargonic acid a perceived cleaner, purer composition that appeals to health-conscious consumers. This 'natural' image allows product formulators to market finished goods as containing 'natural ingredients' which has been shown to boost sales.

Furthermore, studies have found natural grade pelargonic acid to have similar antimicrobial properties as synthetic grades but with potentially lower toxicity risk. While research is still ongoing, this positions natural grade as a preferable active ingredient for applications like household cleaners where product safety is paramount. Natural sourcing also gives pelargonic acid production a smaller carbon footprint than petrochemical methods. For companies pursuing sustainability goals, this environmental benefit of natural grade makes it the grade of choice. Supply chain traceability is enhanced as natural grade originates from identifiable palm kernel oil sources rather than chemical synthesis.

The combination of perceived purity, potential health halo, environmental preference and traceable sourcing underpins natural grade's leadership position in the UK pelargonic acid landscape. As consumers increasingly prioritize naturalness and sustainability, demand looks set to remain robust for natural grade pelargonic acid to serve diverse end uses.

Insights by application: Motors Dominate Applications for Pelargonic Acid

Within pelargonic acid applications in the UK, the motors segment generates the 55.0% share in 2024. Pelargonic acid enjoys widespread use as a multi-functional additive for lubricating engine oils and other lubricants. Its surface-active properties allow it to perform crucial cleaning, corrosion protection and anti-wear functions when blended into lubricants at very low levels. As pelargonic acid safely improves lubricant performance, original equipment manufacturers increasingly specify it for use in high-precision engines across various industries.

Vehicle motors generate especially strong offtake as advances in fuel injection and smaller capacities place greater emphasis on efficient lubrication. With UK automotive manufacturing still significant, pelargonic acid consumption remains high for both domestic and export car production. In industrial settings too, the motors segment expands as factories invest in more energy-efficient equipment relying on high-performing lubricants. Pelargonic acid also contributes to improving the efficiency and longevity of machinery across construction, energy and other capital-intensive sectors.

Lubricated motors will continue occupying the number one slot for pelargonic acid applications locally. Its multi-purpose functionality delivers material cost savings that offset minimal additive levels used. As engine technology progresses, performance demands on lubricants will further propel pelargonic acid consumption through the motors segment for the foreseeable future.

Competitive overview of United Kingdom Pelargonic Acid Market

Central Drug House, Croda International Plc, Emery Oleochemicals UK Limited, Glentham Life Sciences Limited, OQ Chemicals GmbH

United Kingdom Pelargonic Acid Market Leaders

- Central Drug House.

- Croda International Plc

- Emery Oleochemicals UK Limited

- Glentham Life Sciences Limited

- OQ Chemicals GmbH

United Kingdom Pelargonic Acid Market - Competitive Rivalry, 2024

United Kingdom Pelargonic Acid Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in United Kingdom Pelargonic Acid Market

- On December 2021, Glentham Life Sciences Limited announced an expansion in its footprint by launching a new subsidiary for the EU. This expansion has allowed the company to expand its customer base and strengthen its leadership position in the markets of Germany and U.K.

United Kingdom Pelargonic Acid Market Segmentation

- By Grade

- Natural Grade

- Synthetic Grade

- By Application

- Motors

- Lubricants

- Herbicide

- Lacquer & Coatings

- Food Additives

- Others (Personal Care & Cosmetics, etc.)

Would you like to explore the option of buying individual sections of this report?

Frequently Asked Questions :

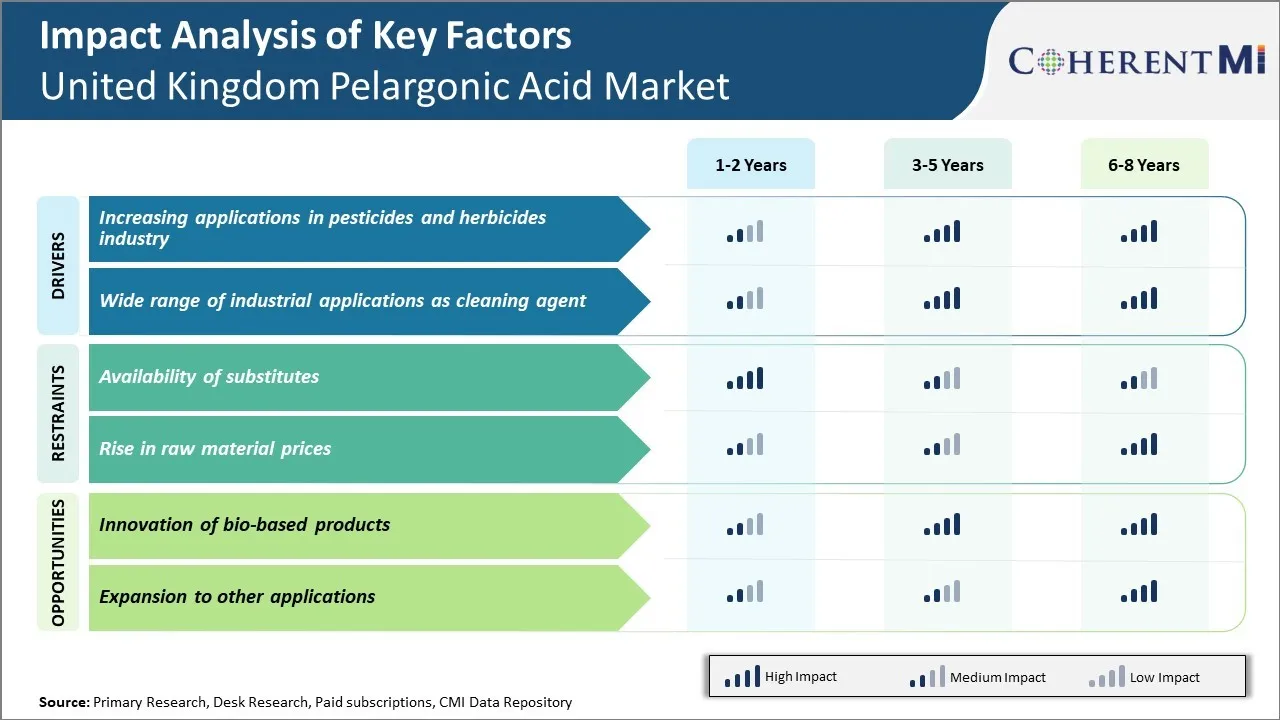

What are the key factors hampering the growth of the United Kingdom Pelargonic Acid Market?

The availability of substitutes and rise in raw material prices are the major factor hampering the growth of the United Kingdom Pelargonic Acid Market.

What are the major factors driving the United Kingdom Pelargonic Acid Market growth?

The increasing applications in pesticides and herbicides industry and wide range of industrial applications as cleaning agent are the major factor driving the United Kingdom Pelargonic Acid Market.

Which is the leading Grade in the United Kingdom Pelargonic Acid Market?

The leading Grade segment is Natural Grade .

Which are the major players operating in the United Kingdom Pelargonic Acid Market?

Croda Internional, Emery Oleochemicals UK Limited, Glentham Life Sciences Limited, OQ Chemicals GmbH, Matrica S.p.A, Thermo Scientific, Croda International Plc are the major players.

What will be the CAGR of the United Kingdom Pelargonic Acid Market?

The CAGR of the United Kingdom Pelargonic Acid Market is projected to be 6.7% from 2024-2031.