加速度計市場 サイズ - 分析 加速度計の市場は評価されると推定されます 2024年のUSD 3.16億 そして到達する予定 2031年までのUSD 4.98請求 化合物年間成長率で成長 2024年~2031年(CAGR) 6.7% 市場は、主にスマートフォン、ウェアラブル、モノのインターネットなどのさまざまな消費者電子機器で加速器の使用によって駆動されます。

調査期間 2025-2032 推定の基準年 2024 CAGR 6.9% 市場集中度 High 主要プレーヤー アナログデバイス, ボッシュセンサーテック, ハネウェル国際, 村田製作所, STマイクロエレクトロニクス N.V.の特長 その他

*免責事項:主要プレーヤーは順不同で記載されています。

*出典:Coherent Market Insights

カスタマイズされたレポートを購入しますか?

今すぐカスタマイズ

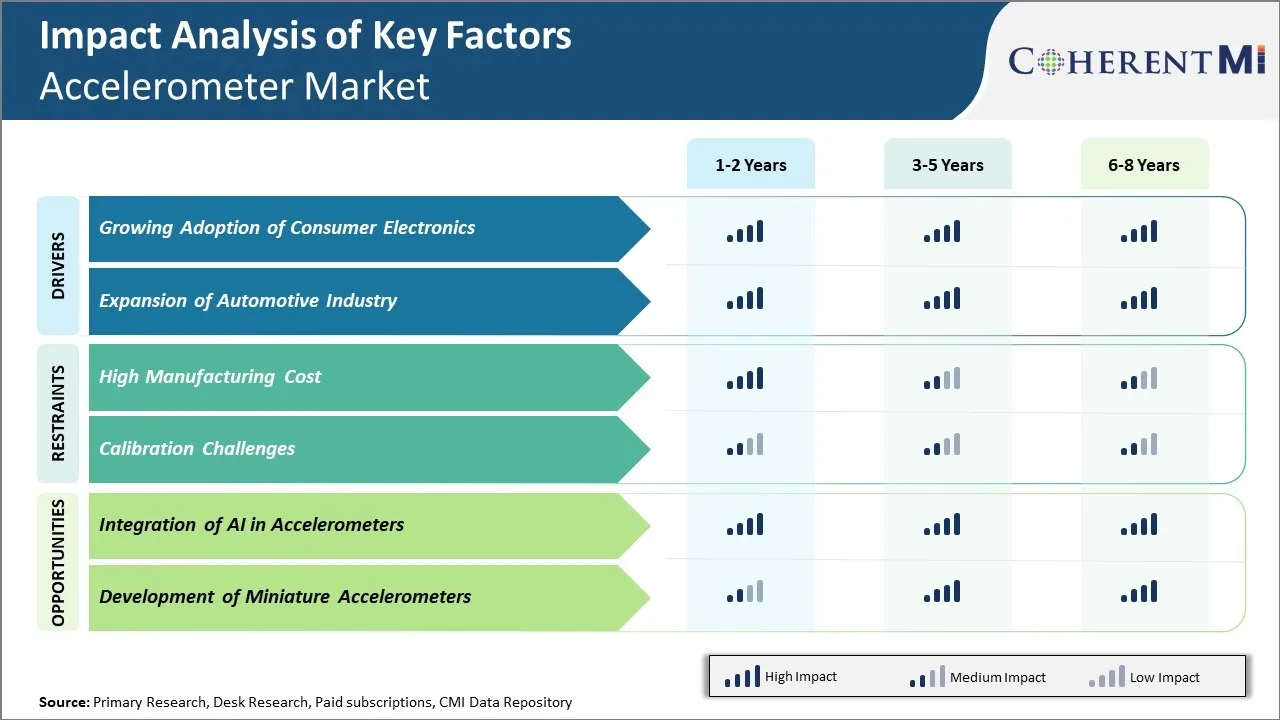

加速度計市場 トレンド 市場ドライバ - 消費者エレクトロニクスの採用を成長させる

スマートフォンは、加速器として、この市場の成長に大きな触媒となっています。自動回転スクリーンなどの重要な機能と内蔵の健康アプリのステップカウンタを有効にします。 スマートフォンは、人口統計と地理学を横断してユビキタスデバイスになるように、加速器の需要は大幅に増加しました。

スマートフォンを超えて、スマートウォッチやリストバンドのようなウェアラブルは、物理的な活動やその他のモーションセンシングアプリケーションを追跡するための一般的なフォーム要因として登場しています。 活動の追跡者、可聴性およびバーチャル/augmented現実のヘッドホーンのような装置はまた加速器を統合します。

継続的な技術の進歩と競争力のある圧力で、消費者のエレクトロニクスブランドは、常に革新し、ユーザーエクスペリエンスを向上させるために探しています。 これは、従来の使用を超えて新しい革新的な方法で展開されている加速器につながりました。 たとえば、ジェスチャーコントロールを有効にし、振動フィードバックを改善し、デバイス内の機能を節約します。 電子機器の小型化により、より薄くてコンパクトなフォームファクターの採用をさらに向上しました。

また、健康とフィットネスに対する成長の焦点は、高度な活動と睡眠追跡能力を提供することを目的としたさまざまなデバイスとして重要なドライバです。 IoTデバイスの手頃な価格と広範な普及により、アクセロメーター向けのアプリケーションの範囲は、ホームオートメーション、環境監視、産業機械監視などの分野全体にわたって広がり続けています。

市場ドライバー - 自動車産業の拡大

自動車業界は、技術革新と新たなモビリティソリューションが急速に進化してきました。 エアバッグ、安定性制御、警報などの高度な機能は、加速器のようなセンサーを必要とし、車両の動き、衝突、キャビン振動を正確に検出します。 多くの国の乗客の保護、政府および規制機関に焦点を合わせることはまたさまざまな活動的、受動的な安全システムを必須にしました。 現代の自動車において、より洗練された動きのセンシング技術が求められています。

同時に、自動運転の上昇は、モーションセンシングのスコープと重要性をさらに高めました。 自己運転車は、さまざまなセンサーからデータを効率的に統合し、このセンサーの融合を効率的に処理し、安全に環境をナビゲートする必要があります。

自動緊急ブレーキのような高度なアプリケーションは、加速器の正確な出力に依存します。 g 力の測定、傾き、振動および動きをすぐにそして正確に検出する能力は安定性制御から衝突の検出に及ぶ適用のために有効にします。 自動艦隊の進歩のテストとロールアウトにより、高性能で信頼性の高いセンシングコンポーネントの自動車メーカーや技術会社からの需要は大幅に成長し続けています。 自動車業界全体の拡大と多様化は、モビリティや電気自動車などの新しい分野にまで広がっており、長年のモーションセンシング技術を採用する機会が増えています。

市場課題 - 高製造 コスト

加速度計市場が直面する大きな課題の1つは、高精度MEMSベースの加速器の製造に関わる高い製造コストです。 MEMSセンサーの製作にはクリーンルーム設備が必要です。また、シリコンウェーハのマイクロアーキテクチャを構築するための複数のリソグラフィ、堆積、エッチング工程を含みます。 量産全体の精度と再現性を向上し、コストを削減します。 金型のサイズを削減し、設計を最適化するコンポーネントを小型化することで、製造の複雑性を高める技術的困難をもたらします。

ダイス、密閉シール、各センサーの試験を行い、軍事レベルの信頼性基準を満たします。 ワークフロー全体で厳格な品質管理の高度に熟練した労力とメンテナンスの必要性は、加速度計の生産資本集中力になります。 平均販売価格の低下による圧力下で来る利益マージンでは、メーカーは、継続的に収率の改善、サプライチェーンの最適化、およびユニットコストを削減するための新しいコスト節約技術に焦点を当てなければなりません。

生産を最適化し、ブレークアウトポイントを下げるのに失敗して、特に競争の激しい市場環境で作業をスケールアップします。

市場機会 - 人工知能の統合を加速器で

加速度計市場での主な機会の1つは、人工知能の能力を統合しています。 加速器は、デバイス全体でユビキタスになり、予測的なメンテナンス、機器の監視、プロセスの最適化を含むmyriad産業IoTアプリケーションを見つけることにより、センサーデータ生成に大きな影響があります。 これらのデータセットから有用な情報やパターンを抽出するのに役立ちます。 たとえば、AI搭載の加速器は、障害が起きる前にも、産業機械の異常や劣化性能を検知できます。 彼らはまた、正確な欠陥診断のための機器振動シグネチャを学び、メンテナンスをスケジュールするために予測アラートを配信することができます。

スマートフォンやウェアラブルセグメントでは、AIアクセロメータは、ユーザーアクティビティ、ジェスチャー、コンテキスト意識を認識し、新しいインタラクティブで支援的な体験を約束します。 これは、基本的なモーション検出からより高い値のアプリケーションへの加速器の役割を拡大するために通路を開きます。 AIの統合は、既存の市場プレーヤーのための追加の収益ストリームのロックを解除し、スマートで接続されたエッジデバイスのための成長した需要にタップしようとしているAI半導体企業を含むより多くの参入者を引き付けることが期待されます。

主要プレーヤーが採用した主な勝利戦略 加速度計市場 技術の進歩および革新に焦点を合わせて下さい- STMicroelectronics、アナログデバイス、ボッシュなどのプレイヤーは、研究開発に一貫して投資し、より高度で正確な加速度計技術を開発しています。 たとえば、2017年のアナログデバイスでは、業界最小の低g 3軸加速度計を導入し、40%の小型化と30%の低電力を実現しました。 このようなイノベーションは、市場シェアを獲得するのに役立ちます。

製品ポートフォリオを拡大 - - - 多様な業界ニーズに対応するため、主要な選手がポートフォリオを拡大 2019年、STMicroelectronicsは産業機械の状態の監視を可能にするために超音波基づいたデジタル加速器を進水させました。 同様に、2020年のボッシュでは、加速器センサーをアルゴリズムと統合し、予測的なメンテナンスのための接続を開始しました。 このポートフォリオの戦略的な拡張により、収益成長が促進されます。

能力と市場アクセスのための買収とパートナーシップ - 企業は、特定の機能を取得し、新しい市場にアクセスするために、他のプレイヤーとパートナーを獲得またはパートナー。 例えば、2018年のTEコネクティビティでは、センサーポートフォリオを強化するためにXensationを取得しました。 2020年、ソフトバンクと提携し、日本進出を加速 これらの戦略的な動きは、顧客基盤を広げるのを助けました。

高い成長の塗布の区分の焦点- ウェアラブル、自動車、産業用IoTなどのアプリケーション分野に積極的に注力 例えば、近年では、STMicroelectronicsとBoschは、現在、収益の30%以上を占める自動車用エアバッグ用途のアクセロメータを大きく推進しています。

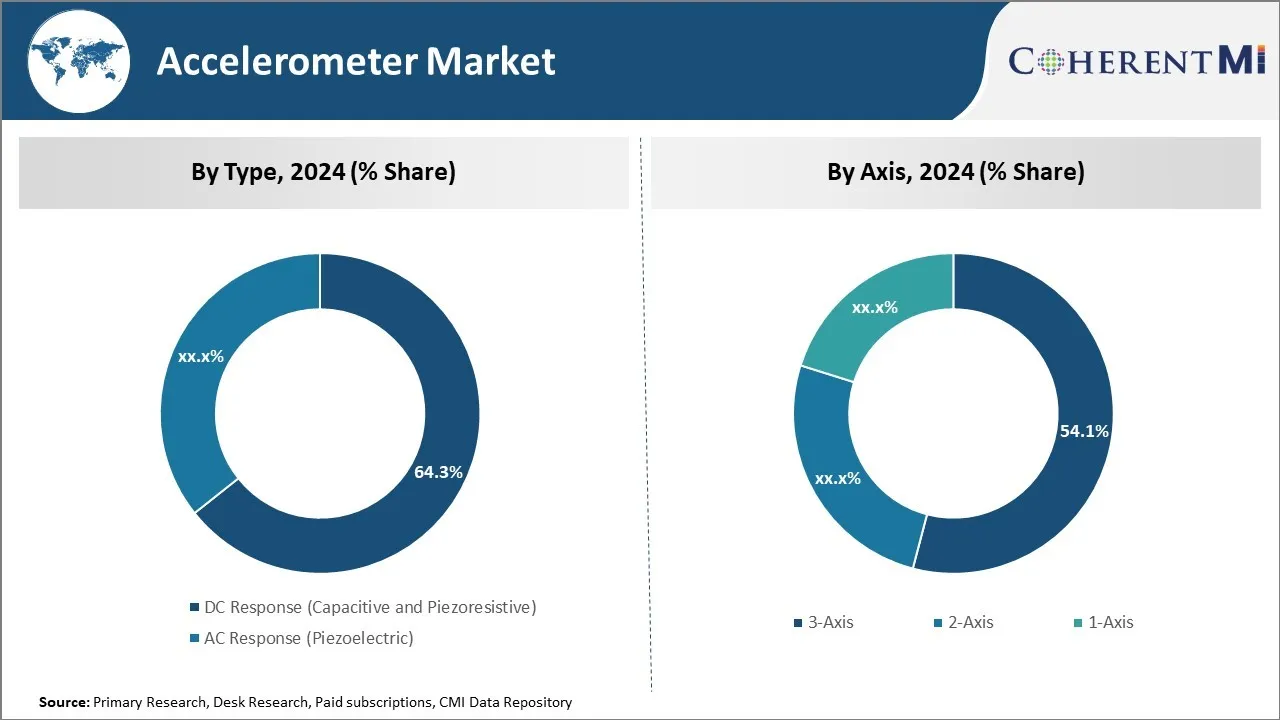

セグメント分析 加速度計市場 Insights、タイプ別-ConvenienceはDC応答の加速器の採用を運転します

型面では、DC応答(容量性およびピエゾリシスティブ)は、使用および統合の容易さを所有する市場の最も高いシェアに貢献します。 DC応答の加速器は付加的な調節回路を要求しないで加速への電圧か抵抗の変更の比例を、直接作り出します。 この結果は、より少ないコンポーネントを必要とするシンプルな設計で、ノイズに敏感でない。 デジタル電子機器やマイクロコントローラと簡単にインターフェースを組み込むことができます。 これにより、DC応答速度計は、スマートフォンやラップトップから家電製品や産業機器に至るまで、あらゆる種類の製品に簡単に組み込まれることができます。

シンプルで堅牢な性質も、DC応答速度計は大量生産に非常に費用対効果が大きいことを意味します。 消費者向け電子機器から自動車、医療機器まで幅広くご使用いただけます。 彼らの努力のないインターフェイスは、最初から彼らの製品にDC応答加速器を設計するために、多くの元の機器メーカー(OEM)を奨励しました。 この初期の採用と統合は、基本的なモーションセンシング要件の基準としてDC応答技術を固化しました。

洞察力、軸線による - 汎用プロペル 3-軸加速度計

軸面では、3軸加速器は、包括的なモーション検出機能を提供するため、最高のシェアに貢献します。 1つの平面に沿って動きを検知できる単軸センサとは異なり、3軸加速器は、3つの直角平面(X、Y、Z軸)に沿って加速力を正確に感じ、測定することができます。 この多次元センシング能力により、3軸加速器が1軸と2軸対向と比較して、より広い用途で利用することができます。

消費者用電子機器、ウェアラブル、産業オートメーション機器、IoT機器などの分野は、広く3軸加速器を採用しています。 ステップカウント、フリーフォール検出、振動監視、チルト補償など、さまざまな用途で複雑な動きを3次元で追跡できます。 3軸加速器によって提供される全体的な動きデータはまた動き活動的な賭博、ジェスチャーの認識インターフェイスおよび活動の追跡のような特徴を促進します。 彼らの汎用性は、新製品のカテゴリと経験を浄化する革新的な使用を駆動し続けています。

企業規模のインサイト - インテグレーション・チャレンジズ・フォーバー・ラー・エンタープライズ

企業規模の面では、大企業は、小企業と比較して少ない統合ハードルに直面しているため、加速器市場の最高シェアに貢献します。 モーションセンサーの統合には、専用のエンジニアリングリソースが必要です。ハードウェアをカスタマイズし、ファームウェアを書き込み、センサーをターゲットシステム内で正常に統合する必要があります。

大企業は、社内のメカトロニクスやファームウェアのチームが、合理化されたセンサーのオンボーディングを可能にする傾向にあります。 過去の統合ノウハウを活用し、高度な設計サポートで加速器メーカーと直接連携できます。 多国籍企業も、大量購入による製造規模のメリットにアクセスします。

逆に、リソースの制約により、統合の複雑性が小さく、中規模の企業(SME)が独立して移動することが困難になります。 大手企業の財務力と技術スタッフが社内であらゆるステップを管理しています。 インテグレーションリスクの遅延と経費の上昇、知覚値の減少 小規模なビジネスイノベーションは、より簡単に導入オプションなしで発見できない可能性があります。

デジタルトランスフォーメーションが分散し続けているため、スケールアップやスタートアップが手頃な価格のセンサー技術に確実に登場します。 簡略化された統合モデルは、製品開発のニーズを制約予算でサポートするために不可欠です。 これは、現在、加速器のための高成長したアプリケーション領域を支配する大企業に対して再生フィールドをレベルアップするのに役立ちます。

追加の洞察 加速度計市場 アジアパシフィック地域は、消費者向け電子機器の需要が高いため、加速器市場を支配し、自動車産業の拡大を図っています。 3-軸加速器は、その高められた動きのセンシング機能による最高の市場シェアを維持することが期待されます 主要な市場トレンドを理解するには、サンプルをダウンロードしてくださいレポート。

競合の概要 加速度計市場 加速器市場で動作する主要なプレーヤーには、アナログデバイス、ボッシュセンサーテック、ハネウェルインターナショナル、ムラタマニュファクチャリング、STMicroelectronics N.V.、NXPセミコンダクターN.V.、TEコネクティビティ、テキサスインスツルメンツ、東芝株式会社、インフィニオンテクノロジーズAG、MEMSIC、マイクロチップ技術、MTSシステム、パナソニック株式会社、PCB Piezotronics、Rohm、Safran SA、シリコンデザイン、Sensataテクノロジーズ、TDKür、Werekt、エレクトリック、エレクトリック、エレクトリック、エレクトリック、エレクトリック、エレクトリック

加速度計市場 リーダー アナログデバイス ボッシュセンサーテック ハネウェル国際 村田製作所 STマイクロエレクトロニクス N.V.の特長 *免責事項:主要プレーヤーは順不同で記載されています。

加速度計市場 - 競合関係 市場が分散 (多くのプレーヤーが参入し、競争が激しい。)

*出典:Coherent Market Insights 最近の動向 加速度計市場 2024年4月、グラディエーターの技術は低雑音を進水させました 精密測定用途に最適なMEMS加速器。 2024年1月、ボッシュセンサーテックは、ウェアラブルやスマートフォンでの正確なジェスチャー認識のための機械学習機能を備えたAI対応アクセロメータを発表しました。 2024年1月、ボッシュ・センサーテックは、世界最小のMEMS加速度計を発売し、音声アクティビティ検知システムとバッテリー寿命を延ばします。 レポートをカスタマイズしますか?

加速度計市場 レポート - 目次 OBJECTIVESとASSUMPTIONSを探す マーケットプレイス レポートの説明

エグゼクティブ・サマリー

加速器市場、タイプによって 加速器市場、軸による 加速器市場、会社規模 加速器市場、エンド ユーザーによる コヒーレントの機会マップ (COM) マーケットダイナミクス、地域、トレンド分析 マーケット・ダイナミクス 衝撃解析 主なハイライト 規制シナリオ プロダクト進水/承認 PEST分析 PORTERの分析 合併・買収シナリオ グローバル加速器市場、タイプ別、2024-2031、(USD Bn) 導入事例

市場シェア分析、2024年、2031年 Y-o-Y成長分析、2019 - 2031 セグメントトレンド AC応答(圧電)

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) DC対応(静電容量・圧迫)

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) Global Accelerometer Market, By Axis, 2024-2031, (USD Bn) により 導入事例

市場シェア分析、2024年、2031年 Y-o-Y成長分析、2019 - 2031 セグメントトレンド 1-軸線

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) 2-軸

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) 3-軸

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) グローバル加速器市場、会社規模、2024-2031、(USD Bn) 導入事例

市場シェア分析、2024年、2031年 Y-o-Y成長分析、2019 - 2031 セグメントトレンド 大企業

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) 中小企業の中小企業

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) グローバル加速器市場、 エンドユーザー、2024-2031、(USD Bn) 導入事例

市場シェア分析、2024年、2031年 Y-o-Y成長分析、2019 - 2031 セグメントトレンド 航空宇宙・防衛

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) 自動車産業

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) 消費者エレクトロニクス

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) 産業

導入事例 市場規模と予測、Y-o-Y成長、2019-2031、(USD Bn) Global Accelerometer Market, By Region, 2019 - 2031, 値 (USD Bn) 導入事例

市場シェア(%) 分析, 2024,2027 & 2031, 値 (USD Bn) 市場Y-o-Y成長分析 (%)、2019 - 2031、値(USD Bn) 地域動向 北アメリカ

導入事例 市場規模と予測, タイプ別, 2019 - 2031, 値 (USD Bn) 市場規模と予測, 軸線による , 2019 - 2031, 値 (USD Bn) 市場規模と予測、会社規模、2019年 - 2031年、価値(USD Bn) 市場規模と予測, エンドユーザーによる , 2019 - 2031, 値 (USD Bn)

ラテンアメリカ

導入事例 市場規模と予測, タイプ別, 2019 - 2031, 値 (USD Bn) 市場規模と予測, 軸線による , 2019 - 2031, 値 (USD Bn) 市場規模と予測、会社規模、2019年 - 2031年、価値(USD Bn) 市場規模と予測, エンドユーザーによる , 2019 - 2031, 値 (USD Bn)

ヨーロッパ

導入事例 市場規模と予測, タイプ別, 2019 - 2031, 値 (USD Bn) 市場規模と予測, 軸線による , 2019 - 2031, 値 (USD Bn) 市場規模と予測、会社規模、2019年 - 2031年、価値(USD Bn) 市場規模と予測, エンドユーザーによる , 2019 - 2031, 値 (USD Bn)

ドイツ アメリカ スペイン フランス イタリア ロシア ヨーロッパの残り アジアパシフィック

導入事例 市場規模と予測, タイプ別, 2019 - 2031, 値 (USD Bn) 市場規模と予測, 軸線による , 2019 - 2031, 値 (USD Bn) 市場規模と予測、会社規模、2019年 - 2031年、価値(USD Bn) 市場規模と予測, エンドユーザーによる , 2019 - 2031, 値 (USD Bn)

中国・中国 インド ジャパンジャパン オーストラリア 韓国 アセアン アジアパシフィック 中東

導入事例 市場規模と予測, タイプ別, 2019 - 2031, 値 (USD Bn) 市場規模と予測, 軸線による , 2019 - 2031, 値 (USD Bn) 市場規模と予測、会社規模、2019年 - 2031年、価値(USD Bn) 市場規模と予測, エンドユーザーによる , 2019 - 2031, 値 (USD Bn)

アフリカ

導入事例 市場規模と予測, タイプ別, 2019 - 2031, 値 (USD Bn) 市場規模と予測, 軸線による , 2019 - 2031, 値 (USD Bn) 市場規模と予測、会社規模、2019年 - 2031年、価値(USD Bn) 市場規模と予測, エンドユーザーによる , 2019 - 2031, 値 (USD Bn)

競争力のある土地 アナログデバイス

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 ボッシュセンサーテック

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 ハネウェル国際

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 村田製作所

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 STマイクロエレクトロニクス N.V.の特長

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 NXPセミコンダクターN.V.

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 TEコネクティビティ

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 テキサス州の器械

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 東芝株式会社

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 インフィニオンテクノロジーズAG

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 コンテンツ

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 マイクロチップ技術

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 ミラーの電子工学

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 MTSシステム

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 パナソニック株式会社

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 プリント基板 ピエゾトロニクス

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 ログイン

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 サフランSA

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 シリコンデザイン

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 センサータテクノロジーズ

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 株式会社TDK

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 ヴュルス・エレクトロニック ログイン

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 矢萩電気株式会社

企業ハイライト 製品ポートフォリオ 主な開発 財務・業績 戦略 アナリストの提言 フォーチュンホイール アナリストビュー コヒーレントの機会マップ 参考文献と研究方法論 加速度計市場 セグメンテーション タイプ別 バイ axis 会社概要 エンドユーザ 航空宇宙・防衛 自動車産業 消費者エレクトロニクス 産業 購入オプションを検討しますか?このレポートの個々のセクション?

価格の内訳を取得します

About author Pooja Tayade は、半導体およびコンシューマー エレクトロニクス業界で豊富な経験を持つ、経験豊富な経営コンサルタントです。過去 9 年間、これらの分野の大手グローバル企業の業務の最適化、成長の促進、複雑な課題の解決を支援してきました。次のような、ビジネスに大きな影響を与えるプロジェクトを成功に導きました。

中規模テクノロジー企業の国際展開を促進し、4 つの新しい国で規制遵守を順守し、海外収益を 50% 増加

大手半導体工場でリーン製造原則を導入し、生産コストを 15% 削減

よくある質問 : 高い製造コストとキャリブレーションの課題は、加速器市場の成長を妨げる主要な要因です。

消費者エレクトロニクスの普及と自動車産業の拡大は、加速度計市場を牽引する主要な要因です。

主要なタイプはDCの応答(容量性および Piezoresistive)です。

アナログ機器、ボッシュセンサーテック、ハネウェル国際、ムラタ製造、STMicroelectronics N.V.、NXPセミコンダクターN.V.、TEコネクティビティ、テキサスインスツルメンツ、東芝株式会社、Infineon Technologies AG、MEMSIC、マイクロチップ技術、MTSシステム、パナソニック株式会社、PCB Piezotronics、Rohm、Safran SA、シリコンデザイン、Sensata Technologies、TDK Corporation、Würth Elektronik GmbH、Yahagi Electric Corporationは主要プレイヤーです。

加速度計市場のCAGRは、2024-2031から6.7%に計画されています。