Antibody Discovery Market Size - Analysis

The antibody discovery market is expected to witness significant growth due to increasing R&D spending by pharmaceutical and biotechnology companies. Further, the rise in research activities pertaining to antibody-based therapeutics and diagnostics will support the growth of this market. Additionally, the growing focus on development of next-generation antibody therapeutics is anticipated to provide lucrative opportunities for vendors in the coming years.

Market Size in USD Bn

CAGR12.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.5% |

| Market Concentration | High |

| Major Players | WuXi Biologics, GenScript, Genmab, Harbour BioMed, ImmunoPrecise and Among Others |

please let us know !

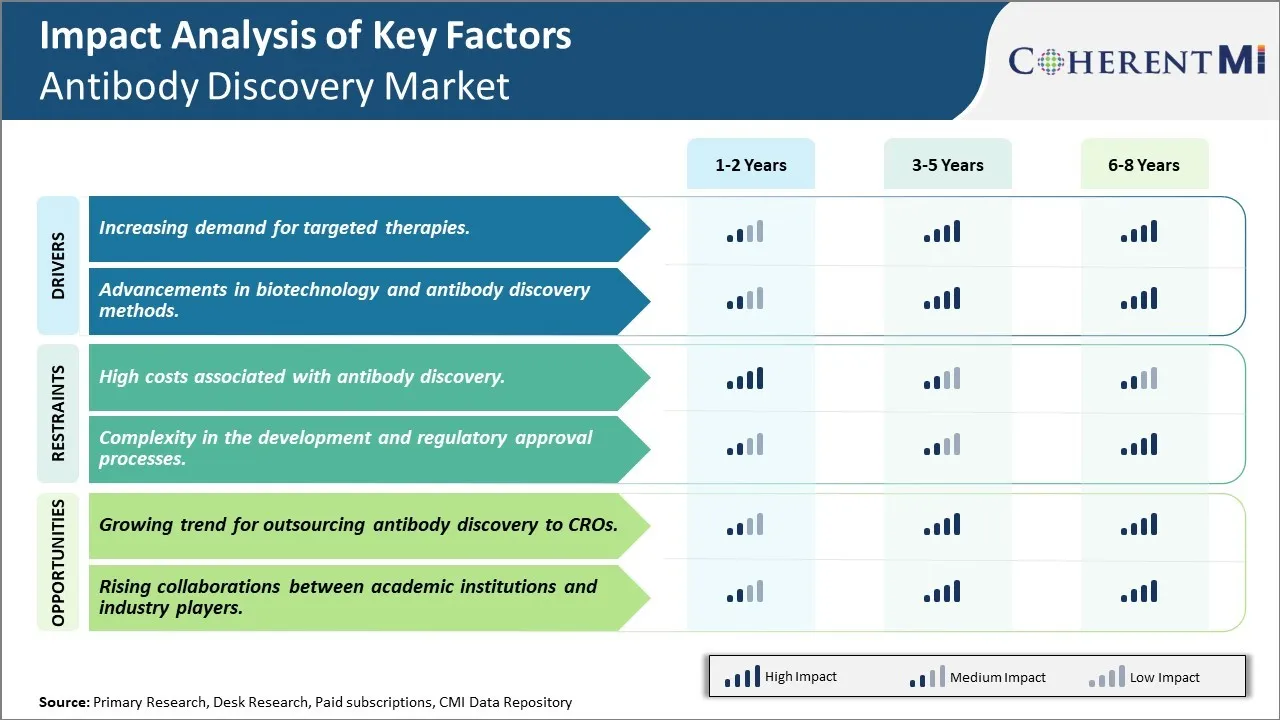

Antibody Discovery Market Trends

The need for more precise and effective treatments has been driving significant growth in the antibody discovery market. Conventional therapies such as chemotherapy are not able to distinguish between healthy and unhealthy cells, often resulting in harmful side effects. However, with targeted cancer therapies, specifically monoclonal antibodies, doctors are now able to deliver treatments that precisely attack cancer molecules without affecting healthy cells. As the understanding of the molecular basis of diseases improves, targeted therapies are being developed for conditions such as rheumatoid arthritis, cardio-metabolic disorders, infectious diseases and more.

Rapid technological advancement is another key factor propelling growth in the antibody discovery market. The application of powerful techniques such as phage display, yeast display, and ribosomal display has enabled researchers to identify antibodies that can specifically bind to almost any antigen or molecular target. High-throughput screening now allows millions of antibody fragments to be screened simultaneously, significantly enhancing the chances of discovering rare antibody sequences with desirable pharmacological properties.

New technologies are making it possible to humanize monoclonal antibodies by grafting mouse complementary determining regions onto human antibody frameworks. This enhances their safety, immunogenicity and pharmacokinetic profiles. With the ability to derive fully human antibodies directly from human donors, the immunogenicity concerns of previous generation antibodies are also being addressed. Continued advances in recombinant antibody engineering technologies and high-throughput screening methods will only serve to further fuel the antibody discovery market in the coming years.

One of the major challenges faced by players in the antibody discovery market is the high costs associated with research and development of novel antibodies. Developing an innovative therapeutic antibody from scratch requires massive investments of both time and capital. It can take up to 5-7 years and over $1 billion to develop a new monoclonal antibody and take it through clinical trials to approval. The complex process involves developing high-throughput screening methods, producing and validating large antibody libraries, conducting thorough testing and characterization of candidate antibodies, undertaking rigorous preclinical and clinical safety and efficacy testing, and navigating regulatory requirements. Additionally, the success rate of an antibody candidate making it from discovery to approval is very low, estimated to be less than 10%. This means much of the invested capital does not generate any returns. The high attrition rates and lengthy development cycles significantly drive up the per-antibody development costs. Such high costs present a major hindrance for players, especially small biotech companies, in advancing more antibody therapies through the pipeline. Ways to reduce development costs and improve success rates remain a key challenge that needs to be addressed to sustain growth in the market.

Market Opportunity - Growing trend for outsourcing antibody discovery to CROs

Key winning strategies adopted by key players of Antibody Discovery Market

One of the most effective strategies adopted by companies has been forming strategic partnerships and collaborations. For example, in 2021, Sino Biological partnered with GenScript to expand its antibody discovery capabilities using GenScript's transgenic animal platforms. This allows both companies to leverage each other's strengths and accelerate antibody discovery programs.

Leading players are investing heavily in R&D to develop novel antibody discovery platforms using cutting-edge technologies like AI, machine learning, single-cell profiling etc. For instance, Anthropic recently raised $135 million to advance their AI technology for antibody development. Their system has shown promise in speeding up the discovery and engineering of novel antibodies.

Providing a seamless, high-quality customer experience from target identification to lead development has helped companies like GenScript and Creative Biolabs build loyalty in a highly competitive market. Streamlined processes and project management tools ensure timelines are met as customers expect.

Segmental Analysis of Antibody Discovery Market

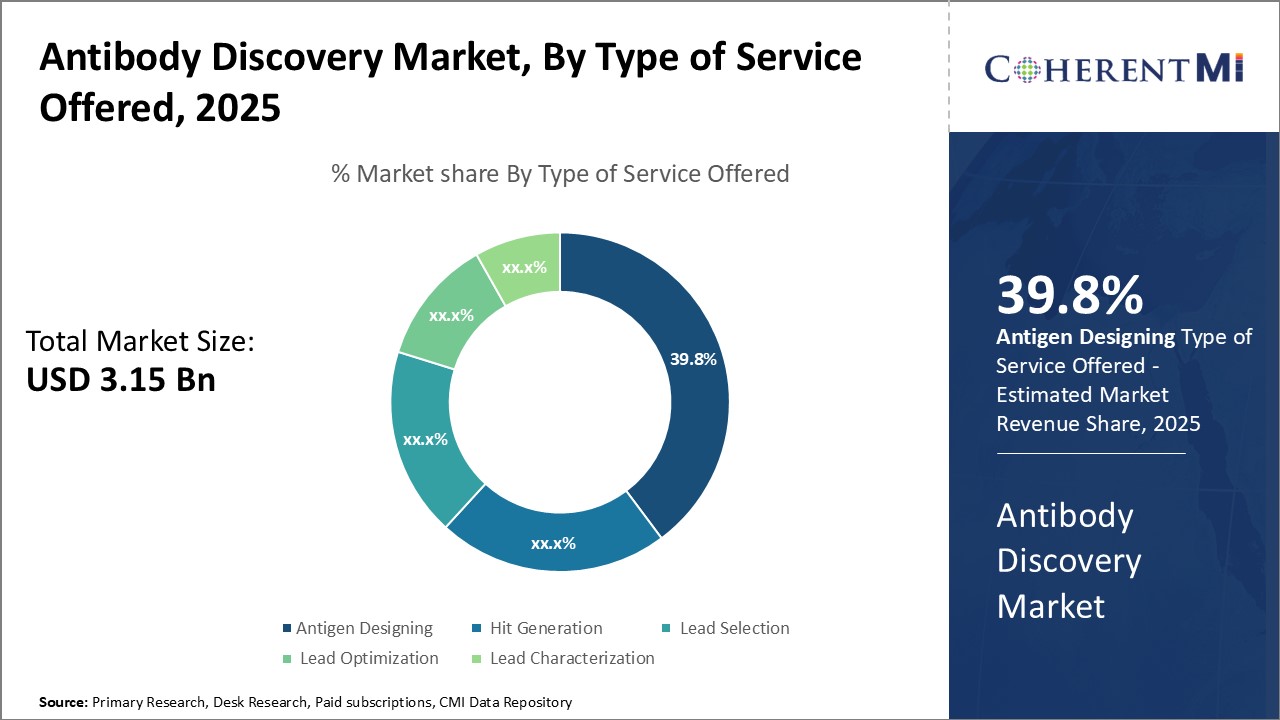

Insights, By Type of Service Offered: Antigen designing: fueling innovation in therapeutic development

Insights, By Type of Service Offered: Antigen designing: fueling innovation in therapeutic developmentIn terms of type of service offered, antigen designing sub-segment contributes the highest share of 39.8% in the antibody discovery market owing to its critical role in identifying novel targets for therapeutic development. The specific molecular identity of the antigen dictates whether an antibody can be generated, making antigen design a fundamental first step. As researchers seek to develop treatments against more elusive targets like intracellular and allosteric proteins, the demand for innovative antigen design techniques is growing.

The rising complexity of disease biology and greater understanding of pathogenesis at the molecular level are also driving needs for more sophisticated antigens. Developing antigens that mimic disease states or selectively target specific pathogen strains requires highly specialized design skills. Meeting these specific research objectives fuels continued demand for enhanced antigen design support. Additionally, demands to improve assay performance, such as increasing sensitivity and multiplexing abilities, necessitates antigen optimization.

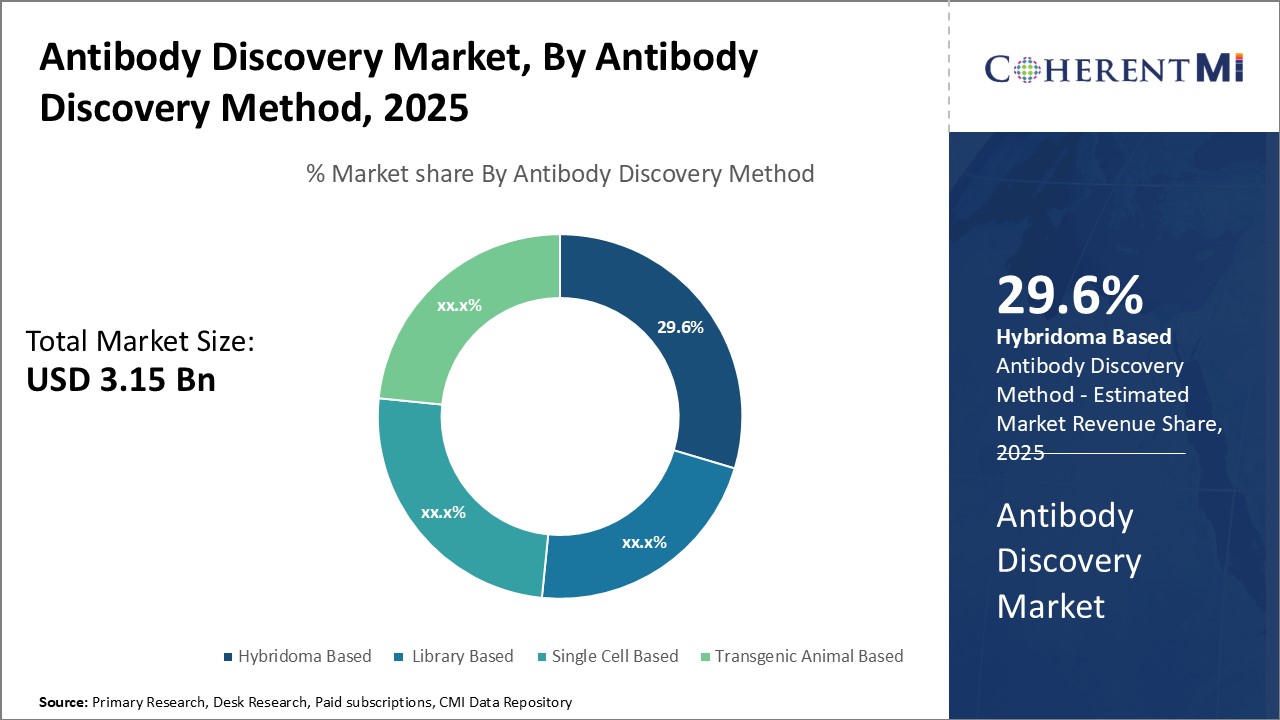

In terms of antibody discovery method, hybridoma-based sub-segment contribute the highest market share of 29.6% due to their indispensable role in historically groundbreaking antibody discoveries. Since their inception in 1975, hybridomas have facilitated the generation of innumerable clinically useful antibodies, such as therapeutic monoclonal antibodies which now represent the largest class of biologics on the market. As a result, hybridoma protocols are deeply entrenched in standard operating procedures across industry and academia.

Even as newer platforms challenge hybridomas' dominance, their essential abilities will sustain important roles in antibody discovery for the foreseeable future. Many complex disease programs still rely on hybridomas to secure the most potent and precise research and clinical tools. Their compatibility with standard monoclonal antibody workflows facilitates seamless integration into existing development pipelines. As long as whole antibody therapeutics remain clinically meaningful, hybridoma-based methods will retain a solid hold on the discovery market. Continuous improvements, like expanding cell fusion efficiency and growing culture stability, will support hybridomas' lasting utility.

Additional Insights of Antibody Discovery Market

The antibody discovery market is poised for significant growth, driven by increasing reliance on CROs for outsourcing, advancements in antibody engineering, and the rising demand for targeted therapies. The integration of innovative technologies, such as transgenic animals and single-cell screening, is expected to enhance the efficiency and success rate of antibody discovery processes.

Competitive overview of Antibody Discovery Market

The major players operating in the antibody discovery market include WuXi Biologics, GenScript, Genmab, Harbour BioMed, ImmunoPrecise, Ablexis, Antibody Solutions, ChemPartner, Creative Biolabs, Mabsilico, Myrio Therapeutics, Nona Biosciences, Rockland Immunochemicals and Synbio Technologies.

Antibody Discovery Market Leaders

- WuXi Biologics

- GenScript

- Genmab

- Harbour BioMed

- ImmunoPrecise

Antibody Discovery Market - Competitive Rivalry

Antibody Discovery Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Antibody Discovery Market

- In June 2023, AbTherx launched the transgenic mouse-based antibody discovery platform, Atlas™ Mice. This platform is designed to enhance the discovery of novel antibodies, supporting the development of new therapeutic options.

- In June 2023, Sanyou Biopharmaceuticals introduced its Sanyou Super Trillion Common Light Chain Antibody Discovery Platform, enabling the discovery of bispecific antibody formats, furthering innovation in therapeutic antibody development.

- In March 2023, Twist Bioscience launched its antibody discovery services under Twist Biopharma Solutions, following the acquisition of Abveris. This acquisition enhances Twist’s capabilities in single-cell screening and hybridoma approaches.

Antibody Discovery Market Segmentation

- By Type of Service Offered

- Antigen Designing

- Hit Generation

- Lead Selection

- Lead Optimization

- Lead Characterization

- By Antibody Discovery Method

- Hybridoma Based

- Library Based

- Single Cell Based

- Transgenic Animal Based

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the Antibody Discovery Market?

The Antibody Discovery Market is estimated to be valued at USD 3.15 in 2025 and is expected to reach USD 7.18 Billion by 2032.

What are the major factors driving the antibody discovery market growth?

The increasing demand for targeted therapies and advancements in biotechnology and antibody discovery methods are the major factors driving the antibody discovery market.

Which is the leading type of service offered in the antibody discovery market?

The leading type of service offered segment is hit generation.

Which are the major players operating in the antibody discovery market?

WuXi Biologics, GenScript, Genmab, Harbour BioMed, ImmunoPrecise, Ablexis, Antibody Solutions, ChemPartner, Creative Biolabs, Mabsilico, Myrio Therapeutics, Nona Biosciences, Rockland Immunochemicals, and Synbio Technologies are the major players.

What will be the CAGR of the antibody discovery market?

The CAGR of the antibody discovery market is projected to be 12.5% from 2025-2032.