Autosomal Dominant Polycystic Kidney Disease Market Size - Analysis

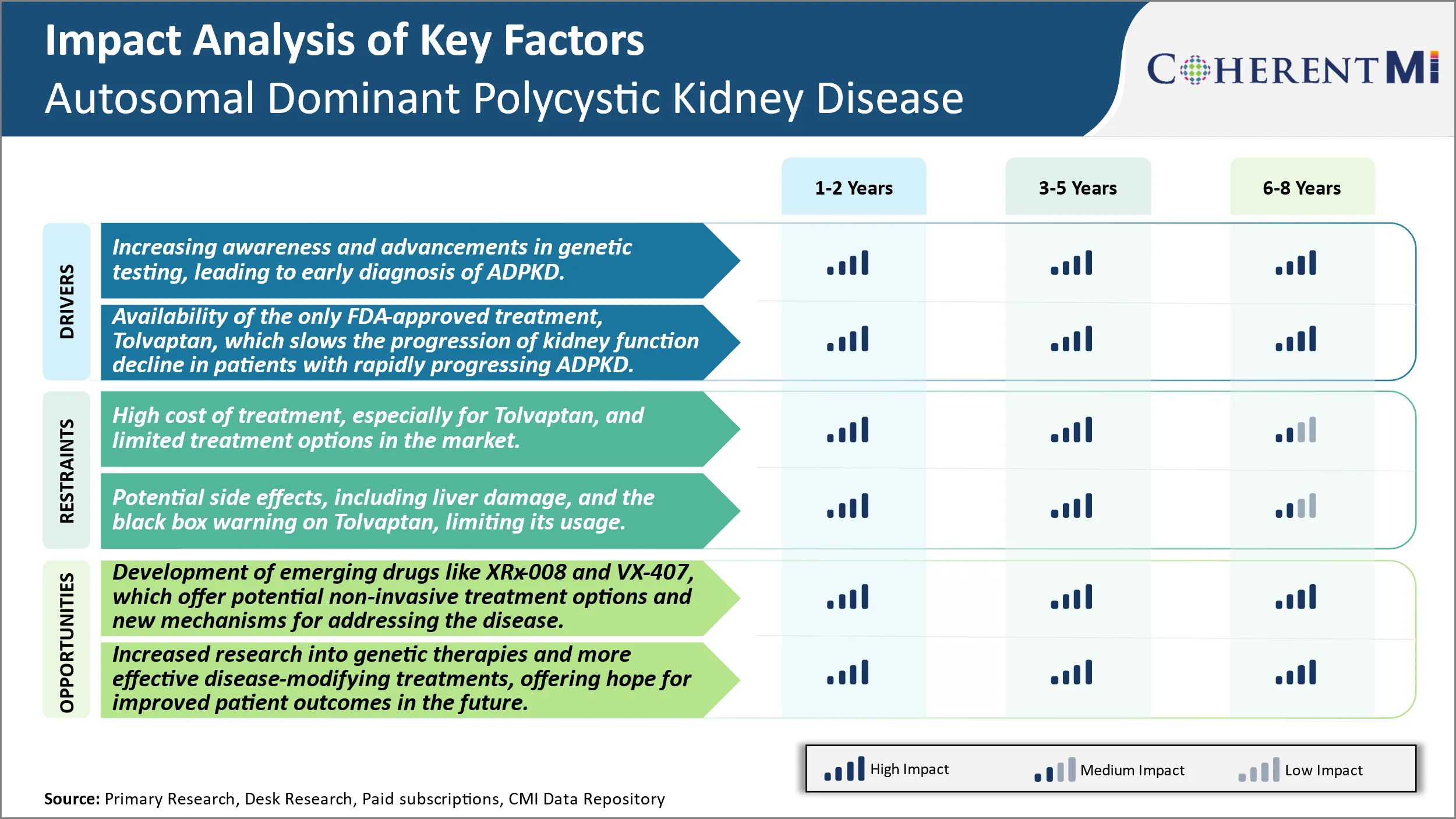

The market has witnessed some positive trends over recent years. Research into new drugs and treatment options has increased substantially. Several pharmaceutical companies have drugs in late-stage clinical trials that could slow cyst growth or progression to kidney failure if approved. Increased awareness about the genetic nature of the disease has led to more families undergoing genetic screening and early detection. Early treatment can help preserve kidney function longer.

Market Size in USD Bn

CAGR6.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.4% |

| Market Concentration | High |

| Major Players | Otsuka Pharmaceutical, Reata Pharmaceuticals, Xortx Therapeutics (XRx-008), Sanofi, Janssen Pharmaceuticals and Among Others |

please let us know !

Autosomal Dominant Polycystic Kidney Disease Market Trends

With increasing awareness about genetic disorders and hereditary conditions, more and more people are opting for genetic testing to understand their risks of developing various diseases. Autosomal dominant polycystic kidney disease is one such hereditary condition where early genetic testing and diagnosis can help patients and their families understand the risks better and seek timely medical management.

Early diagnosis through genetic testing can empower patients and physicians to have timely discussions around treatment planning and disease management. Lifestyle modifications and regular monitoring of kidney function and kidney size scans from a younger age can help slow progression in asymptomatic stages. It also assists in family planning decisions. Cascade genetic testing of family members allows testing of children, siblings and extended family members of known mutation carriers, leading to identification of more newly diagnosed early cases. In summary, growing knowledge about genetics and advancements in molecular diagnosis are positively impacting early identification of autosomal dominant polycystic kidney disease cases.

Market Driver - Availability of Tolvaptan Treatment to Boost Industry Developments.

It is the first and only approved drug therapy shown to slow kidney function decline in patients with rapidly progressing ADPKD. Clinical trials established that Tolvaptan can significantly reduce the total kidney volume increase and the yearly decline in estimated glomerular filtration rate (eGFR) as compared to placebo groups. Given intravenously, it allows for easy administration and monitoring under physician care. The effectiveness has been seen across a range of ADPKD patient groups including those with low or preserved kidney function.

Market Challenge - High Cost of Treatment, Especially for Tolvaptan, And Limited Treatment Options in The Market.

A key opportunity in the autosomal dominant polycystic kidney disease market involves the development of emerging drugs such as XRx-008 and VX-407. These drug candidates offer potential non-invasive treatment options and novel mechanisms of action that could help address some of the limitations of existing therapies. In particular, XRx-008 aims to inhibit the vasopressin V2 receptor without liver toxicity. Positive Phase 2 data demonstrated proof-of-concept for slowing cyst growth, representing an important step forward. Meanwhile, VX-407 works via a new mechanism involving inhibition of the secretory pathway calcium ATPase to reduce intracellular calcium levels and cystogenesis. Its early-stage trials have also yielded promising initial results. The potential availability of well-tolerated oral therapies targeting the underlying causes through different pathways could expand treatment choices and help many more ADPKD patients if approved. This presents a major opportunity for drug developers to address significant unmet needs in the market.

Prescribers preferences of Autosomal Dominant Polycystic Kidney Disease Market

ADPKD is typically treated through a staged approach as the disease progresses. In early stages when kidney function is preserved, prescribers often recommend lifestyle modifications like dietary changes and regular exercise. Medications are usually not initiated unless glomerular filtration rate (GFR) declines below 60 ml/min/1.73m2.

As ADPKD advances to Stage 3 with GFR 30-59 ml/min/1.73m2, prescribers may add an angiotensin-converting enzyme inhibitor (ACEi) or angiotensin receptor blocker (ARB) like Lisinopril (brand name Prinivil) or Losartan (brand name Cozaar). These control blood pressure and proteinuria, providing renal protection.

For end-stage renal disease, dialysis or transplant is recommended. Prescribers consider the patient's prognosis, support system, and preferences in determining the best treatment path.

Treatment Option Analysis of Autosomal Dominant Polycystic Kidney Disease Market

Autosomal dominant polycystic kidney disease (ADPKD) progresses through four stages - early (Stage 1), intermediary (Stage 2), late (Stage 3), and end-stage renal disease (Stage 4).

Stage 3 ADPKD involves significant kidney enlargement and decline in function. At this stage, treatments aim to curb disease progression through medications while preparing the patient for dialysis or transplantation. Tolvaptan continues to be a frontline therapeutic along with ACEi/ARBs. For patients who progress to Stage 4 or end-stage renal disease, dialysis is initiated to replace kidney function. The most common modalities are hemodialysis and peritoneal dialysis.

Key winning strategies adopted by key players of Autosomal Dominant Polycystic Kidney Disease Market

Focus on Developing Novel Drugs - Companies like Otsuka Pharmaceuticals and Reata Pharmaceuticals have focused on developing novel drug therapies to slow cyst growth and kidney damage associated with ADPKD. Otsuka adopted an aggressive clinical trial strategy for their drug tolvaptan in the late 2000s. Their VAPOR trials from 2011-2015 evaluated tolvaptan's ability to slow cyst development and functional decline in over 1400 ADPKD patients. The trials showed clear benefits, with tolvaptan slowing the annual rate of total kidney volume increase by 25% compared to placebo. This was the first therapy to demonstrate a significant benefit in slowing ADPKD progression. Otsuka received FDA approval for tolvaptan in 2018, becoming the first approved drug specifically for ADPKD. Reata followed a similar pathway, advancing bardoxolone methyl through Phases 2 and 3 clinical trials from 2013-2019. Their landmark FALKON trial of 225 patients showed a statistically significant 30% reduction in estimated glomerular filtration rate decline and a 22% slowing of total kidney volume increase compared to placebo. This led to Reata filing for FDA approval in 2022.

In summary, developing drugs through well-designed late phase clinical trials focusing on clear outcomes like cyst growth, kidney function decline, and obtaining FDA approval has proven an effective strategy for companies to become leaders in the ADPKD treatment landscape.

Segmental Analysis of Autosomal Dominant Polycystic Kidney Disease Market

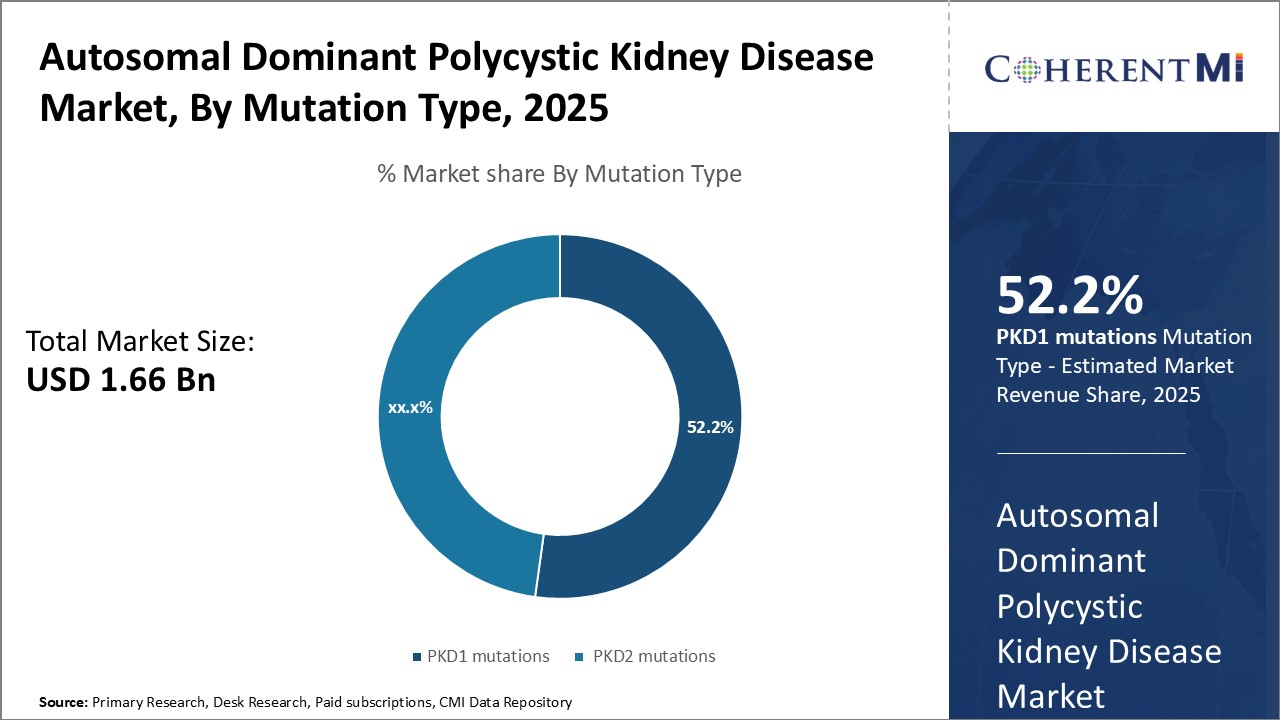

Insights, By Mutation Type, PKD1 mutations is Expected to Register Remarkable Growth as Genetic Factors Determine Disease Severity.

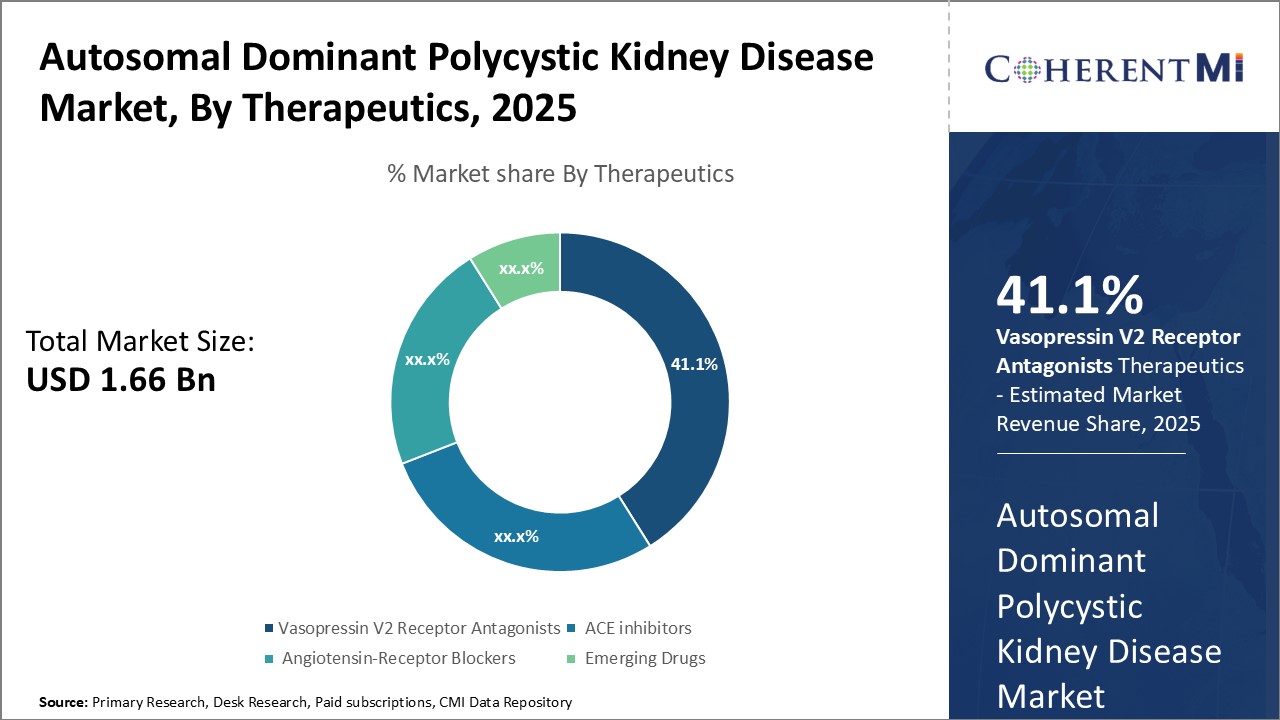

Insights, By Therapeutics, Treatment Options Drive Therapeutic Segment Growth

Insights, By Therapeutics, Treatment Options Drive Therapeutic Segment GrowthBy Therapeutics, Vasopressin V2 Receptor Antagonists is expected to contribute the highest share 41.1% in 2025 due to availability of treatment options and favorable efficacy and safety profile. Tolvaptan remains the only approved vasopressin V2 receptor antagonist for ADPKD, driving segment growth. It significantly lowers the rate of cyst growth and shrinkage and also slows the decline of kidney function. However, its use remains limited due concerns over side effects like thirst. The emergence of XRx-008, an investigational vasopressin V2 receptor antagonist, promises to expand treatment options in this segment. Positive phase 2 trial data suggests XRx-008 has comparable efficacy to tolvaptan but with better tolerability.

Insights, By End-User, Younger Population Prone to Early Disease Manifestations

Additional Insights of Autosomal Dominant Polycystic Kidney Disease Market

Autosomal Dominant Polycystic Kidney Disease (ADPKD) is the most common inherited kidney disorder, affecting millions worldwide. The condition is primarily driven by mutations in the PKD1 and PKD2 genes, leading to the formation of cysts in the kidneys and, eventually, kidney failure. Currently, Tolvaptan is the only FDA-approved drug for ADPKD and is effective in slowing the progression of kidney function decline, although its use is limited by potential liver toxicity and high costs. Emerging therapies, such as XRx-008 and VX-407, are poised to address these unmet needs, offering hope for better and more accessible treatments. The disease burden is expected to grow as awareness increases and genetic testing becomes more common, leading to earlier diagnoses. However, the high cost of treatment, limited therapeutic options, and regulatory hurdles remain significant challenges in this space. With ongoing research and the anticipated introduction of new therapies, the market is set to expand rapidly over the forecast period.

Competitive overview of Autosomal Dominant Polycystic Kidney Disease Market

The major players operating in the Autosomal Dominant Polycystic Kidney Disease Market include Otsuka Pharmaceutical, Reata Pharmaceuticals, Xortx Therapeutics (XRx-008), Sanofi, Janssen Pharmaceuticals, Vertex Pharmaceuticals, Galapagos NV, Palladio Biosciences, Regulus Therapeutics, Primerose Therapeutics, Exelixis Inc, Grupo Olmos and Bayer Healthcare.

Autosomal Dominant Polycystic Kidney Disease Market Leaders

- Otsuka Pharmaceutical

- Reata Pharmaceuticals

- Xortx Therapeutics (XRx-008)

- Sanofi

- Janssen Pharmaceuticals

Autosomal Dominant Polycystic Kidney Disease Market - Competitive Rivalry

Autosomal Dominant Polycystic Kidney Disease Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Autosomal Dominant Polycystic Kidney Disease Market

- In June 2024, VX-407 by Vertex Pharmaceuticals began its Phase I trials. This first-in-class small molecule targets PKD1 variants to stop kidney cyst growth and prevent progression to kidney failure.

- In December 2023, XRx-008 from Xortx Therapeutics is in Phase II trials for treating progressive kidney disease in ADPKD patients. The drug reduces uric acid production, thereby reducing systemic inflammation and improving kidney function.

- In May 2019, Tolvaptan (JYNARQUE) received FDA approval as the first treatment to slow kidney function decline in ADPKD patients. Despite being effective, the drug comes with a black box warning for potential liver damage.

Autosomal Dominant Polycystic Kidney Disease Market Segmentation

- By Mutation Type

- PKD1 mutations

- PKD2 mutations

- By Therapeutics

- Vasopressin V2 Receptor Antagonists

- ACE inhibitors

- Angiotensin-Receptor Blockers (ARBs)

- Emerging Drugs (XRx-008)

- By End-user

- Under 5 years

- 5-14 years

- 15-24 years

- 25-44 years

- 45-64 years

- 65+ years

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How Big is the Autosomal Dominant Polycystic Kidney Disease Market?

The Global Autosomal Dominant Polycystic Kidney Disease Market is estimated to be valued at USD 1.66 Bn in 2025 and is expected to reach USD 2.56 Bn by 2032.

What will be the CAGR of the Autosomal Dominant Polycystic Kidney Disease Market?

The CAGR of the Autosomal Dominant Polycystic Kidney Disease Market is projected to be 6.2% from 2024 to 2031.

What are the major factors driving the Autosomal Dominant Polycystic Kidney Disease Market growth?

The increasing awareness and advancements in genetic testing, leading to early diagnosis of ADPKD and availability of the only FDA-approved treatment, tolvaptan, which slows the progression of kidney function decline in patients with rapidly progressing ADPKD are the major factor driving the Autosomal Dominant Polycystic Kidney Disease Market.x

What are the key factors hampering the growth of the Autosomal Dominant Polycystic Kidney Disease Market?

The high cost of treatment, especially for tolvaptan, and limited treatment options in the market and potential side effects, including liver damage, and the black box warning on tolvaptan, limiting its usage are the major factors hampering the growth of the Autosomal Dominant Polycystic Kidney Disease Market.

Which is the leading Mutation Type in the Autosomal Dominant Polycystic Kidney Disease Market?

PKD1 Mutation is the leading mutation type segment.

Which are the major players operating in the Autosomal Dominant Polycystic Kidney Disease Market?

Otsuka Pharmaceutical, Reata Pharmaceuticals, Xortx Therapeutics (XRx-008), Sanofi, Janssen Pharmaceuticals, Vertex Pharmaceuticals, Galapagos NV, Palladio Biosciences, Regulus Therapeutics, Primerose Therapeutics, Exelixis Inc, Grupo Olmos, Bayer Healthcare are the major players.