Biliary Tumor Market Size - Analysis

The Global Biliary Tumor Market is estimated to be valued at USD 4.89 Bn in 2025 and is expected to reach USD 8.71 Bn by 2032, growing at a compound annual growth rate (CAGR) of 8.6% from 2025 to 2032.

The market for biliary tumors is expected to witness substantial growth over the forecast period. There is significant increase in risk factors such as obesity, alcohol consumption, and smoking which contributes to higher incidence of biliary tumors. Additionally, rising aging population also adds to the growth of this market. Furthermore, various initiatives undertaken by governments and non-profit organizations in creating awareness about cancer diagnosis and treatment supplements the market expansion. However, high cost of biliary tumor treatment and lack of effective therapeutics for late-stage tumors may hinder the market growth. Overall, increasing prevalence of biliary tumors due to changing lifestyle patterns will drive the demand in coming years.

Market Size in USD Bn

CAGR8.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.6% |

| Market Concentration | High |

| Major Players | AstraZeneca, Jiangsu HengRui Medicine, Amgen, Eli Lilly and Company, Pfizer and Among Others |

please let us know !

Biliary Tumor Market Trends

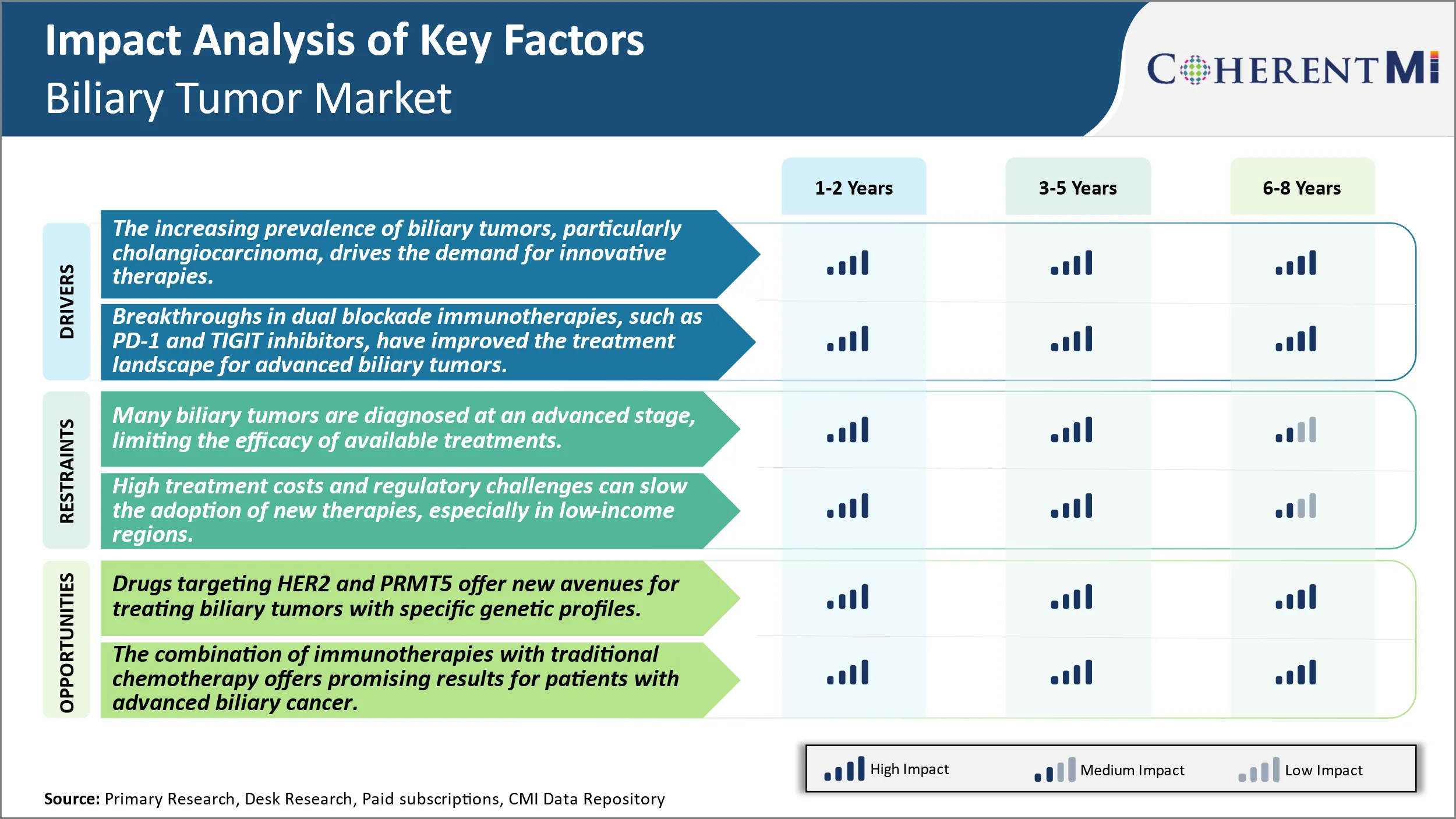

Market Driver - The Increasing Prevalence of Biliary Tumors, Particularly Cholangiocarcinoma, Drives the Demand for Innovative Therapies.

The increasing prevalence of biliary tumors is concerning as cancer rates continue to climb worldwide. The rise in cholangiocarcinoma, a rare yet aggressive cancer of the bile ducts is trending. It is becoming more common potentially due to factors such as older age, underlying conditions like primary sclerosing cholangitis, and other lifestyle influences. Biliary cancers are difficult to detect early as symptoms tend to manifest late in the disease course. By the time a diagnosis is made, the cancer has often advanced significantly, leading to poor survival rates.

Treatment options have historically been limited as well, but research efforts are ongoing to improve outcomes for patients battling these lethal malignancies. Other factors such as the aging population, growing prevalence of risk factors like chronic biliary inflammation, and liver fluke infections contribute to the rising demand for effective treatment options. Innovations in targeted therapies and immunotherapies, such as HER2-targeting antibody-drug conjugates and PD-1 inhibitors, are fueling market expansion. Additionally, improvements in early diagnosis and a growing pipeline of emerging drugs are expected to further drive market growth, improving patient outcomes.

Market Driver - Advances in Immunotherapy Fuels Market Growth.

There has been tremendous progress in immunotherapy for certain cancer types, and biliary tumors are one area primed to benefit greatly from these new weapons in the oncology armament. Checkpoint inhibitor therapies that block inhibitory signals like PD-1 and its ligands have shown early promise, and studies exploring dual blockade strategies are generating encouraging results. Combining PD-1 inhibitors with other immune targets such as TIGIT is a particularly exciting avenue being explored aggressively.

TIGIT plays an important role in suppressing anti-tumor immune activity, so blocking this pathway simultaneously with PD-1 blockade could unleash a more powerful immune response against cancer cells. Results thus far indicate this dual approach may enhance response rates and durations compared to single-agent checkpoint therapy. These immunotherapy breakthroughs have renewed hope that advanced biliary tumors may become chronically manageable diseases. Continued research and more clinical data should further clarify who benefits most from these dual blockade regimens.

Market Challenge - Many Biliary Tumors are Diagnosed at an Advanced Stage, Limiting the Efficacy of Available Treatments.

Many biliary tumors are unfortunately diagnosed at an advanced stage of the disease due to lack of awareness about early symptoms and limitations in diagnostic tools. Biliary tumors arise from the bile ducts or gallbladder and are often asymptomatic in the early stages. Non-specific symptoms like abdominal pain, jaundice, weight loss and fatigue are commonly seen even in late-stages, leading to difficulties in early detection. Existing diagnostic tests like blood tests, imaging and biopsy also have limitations in detecting small tumors or establishing a diagnosis.

By the time a patient may seek medical attention due to symptom worsening, the cancer could have already spread locally or metastasized. Late- stage diagnosis poses serious challenges for effective treatment and management of biliary tumors. Treatment options are limited once the cancer reaches an advanced stage with low survival rates. Increased awareness about potential symptoms amongst both the public and healthcare providers is needed for encouraging early medical visits. Improved diagnostic accuracy and minimally invasive techniques for detection of early-stage or premalignant lesions can significantly boost treatment outcomes in biliary cancers.

Market Driver - Emergence of Targeted Therapies Fuels the Need for Clinical Research.

A promising development has been the emergence of targeted drugs that act on specific molecular pathways driving tumor growth. Drugs like Trastuzumab (Herceptin) targeting HER2 expression have shown success in HER2-positive biliary cancers otherwise resistant to chemotherapy. Similarly, molecules inhibiting the methyltransferase PRMT5 show potential for precision treatment of PRMT5 rearranged biliary tumors.

As understanding of tumor genetics and biomarkers evolves, an increasing number of biliary cancer patients may benefit from molecularly targeted therapies. Tailored therapies enable treating only responsive patient subsets most likely to gain from such interventions, thereby improving outcomes. This represents a major opportunity area for improving biliary cancer management through personalized care. Ongoing research seeks to discover more druggable targets and develop companion diagnostics to identify patients likely to respond to targeted therapies.

Prescribers preferences of Biliary Tumor Market

Biliary tumors are generally treated based on the stage of disease progression. In early-stage tumors localized to the bile ducts, the primary line of treatment involves surgical resection to remove the tumor. For patients where surgery is not an option or the tumor has spread locally, interventional radiology procedures such as radiofrequency ablation or photodynamic therapy may be used.

In locally advanced or metastatic disease, chemotherapy is the standard first-line treatment. Gemcitabine alone or in combination with platinum agents like cisplatin (Platinol) is commonly prescribed. For patients with BRCA gene mutations, PARP inhibitors such as talazoparib (Talzenna) may be considered. Second-line options include regorafenib (Stivarga) or trifluridine/tipiracil (Lonsurf) upon progression on first-line gemcitabine. Entrectinib (Rozlytrek) is a recently approved targeted therapy for tumors with NTRK gene fusions.

Palliative chemotherapy such as gemcitabine/cisplatin may be used in the third-line setting. Factors like performance status, organ function, mutational profile and prior treatments significantly impact drug choice. Given the high unmet need, prescribers closely monitor ongoing trials evaluating newer immuno-oncology agents, targeted therapies and alternatives to gemcitabine.

Treatment Option Analysis of Biliary Tumor Market

Biliary tumors are classified into four main stages - localized, locally advanced, regional, and distant. Treatment varies depending on the stage.

For localized disease, surgical resection is the primary treatment option if the tumor can be completely removed. For unresectable localized tumors, radiofrequency ablation or microwave ablation may be considered.

In locally advanced disease where surgical removal is not possible, gemcitabine-based chemo is recommended. Gemcitabine (Gemzar) alone or in combinations with platinum agents like cisplatin (Platinol) are preferred. This regimen shrank tumors in nearly 30% of patients in clinical trials, making it the standard first-line therapy.

Regional disease involves tumor spread to nearby lymph nodes. For this stage, gemcitabine combined with cisplatin is standard. The gemcitabine/cisplatin combo produced response rates nearly double that of gemcitabine alone and improved survival times significantly compared to 5-FU regimens.

For distant metastatic disease, chemotherapy remains the primary treatment but lacks a clearly defined standard. Gemcitabine monotherapy or combined with cisplatin/ capecitabine (Xeloda)/ oxaliplatin (Eloxatin) are employed based on patient suitability and organ involvement. Clinical trials exploring target therapies in combination with chemotherapy are ongoing to improve outcomes in this advanced stage.

The analysis aimed to comprehensively cover the key stages of biliary tumor and preferred lines of treatment backed by clinical evidence in a structured yet succinct manner to aid informed decision making. Please let me know if you need any clarification or have additional questions.

Key winning strategies adopted by key players of Biliary Tumor Market

Focus on R&D for novel drug development: Leading pharmaceutical companies like Johnson & Johnson, Eli Lilly and Company have invested heavily in R&D to develop novel drug therapies for biliary tumors. For example, in 2019 J&J's Imfinzi became the first immunotherapy approved by FDA for advanced biliary tract cancer. The drug showed significant improvement in overall survival in clinical trials. This helped J&J gain an edge in the market.

Strategic acquisitions of biotech startups: Large players have acquired several small biotech companies focused on biliary cancer research. For example, in 2016 Bristol-Myers Squibb acquired Celgene for USD 74 bn, mainly to gain access to Celgene's robust oncology pipeline including drugs for biliary cancer in clinical trials. Such acquisitions help big pharma players strengthen their portfolios.

Focus on orphan drug designations: Many new drug candidates are receiving orphan drug designation from FDA due to the rare nature of biliary tumors. This provides market exclusivity once approved and makes the drug commercially viable. For instance, Delcath Systems received orphan drug tag for its melanoma tumor candidate in 2009 which drove its revenues once approved in 2015.

Partner with leading cancer centers: Companies partner with top-ranking cancer hospitals and cancer centers to conduct late-stage clinical trials. For example, Exelixis collaborated with Memorial Sloan Kettering Cancer Centre to evaluate cabozantinib in advanced biliary cancer trial in 2018. Partnering with premier cancer centers helps generate robust clinical evidence.

Segmental Analysis of Biliary Tumor Market

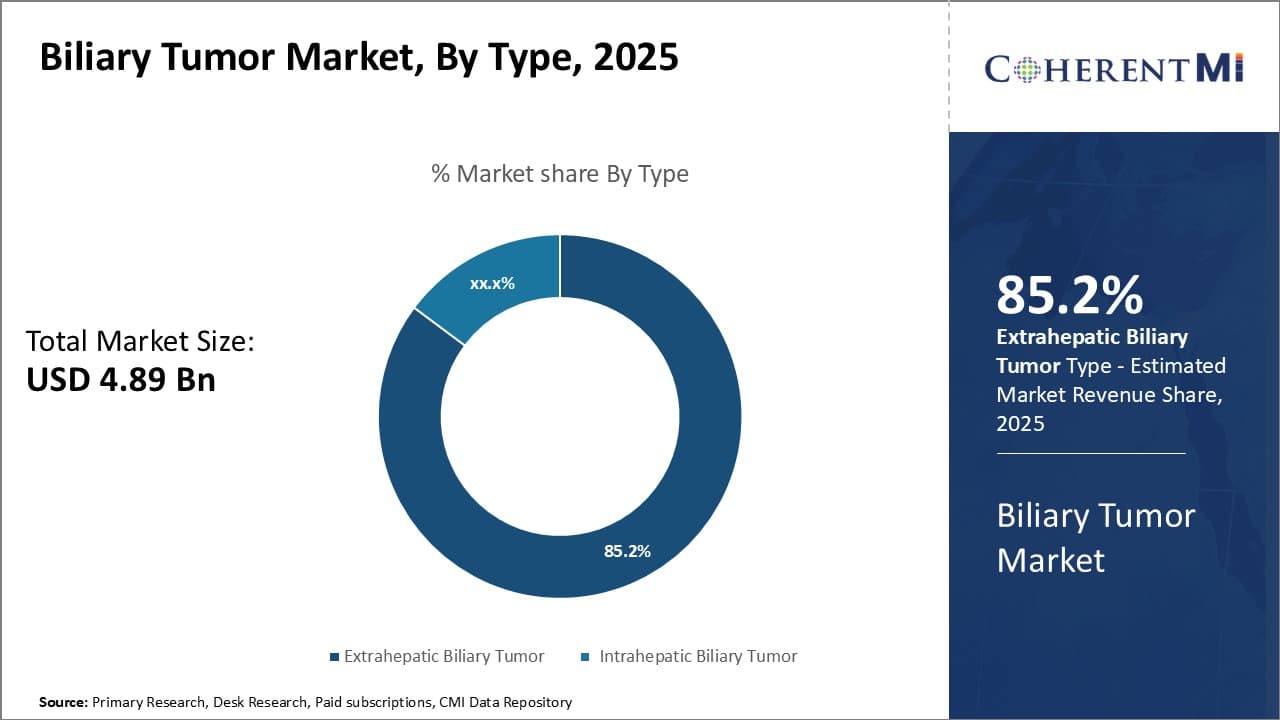

Insights, By Type: Anatomical Advantage Drives Extrahepatic Biliary Tumor Dominance

By Type, Extrahepatic Biliary Tumor is expected to contribute the highest share 85.2% in 2025 due to its anatomical location. Extrahepatic bile duct tumors arise in the bile ducts outside of the liver, usually in the common bile duct or the hepatic duct which connects the liver to the common bile duct. This accessible location makes extrahepatic tumors easier to detect early through non-invasive imaging tests like ultrasound, CT or MRI scans. Symptoms of blockage in the bile duct such as jaundice and abdominal pain also manifest earlier compared to intrahepatic tumors located deeper inside the liver.

The anatomical position of extrahepatic tumors allows for minimally invasive surgical resection as the primary treatment approach. Surgery to remove the tumor along with portions of the bile duct is often possible before the cancer spreads extensively. Even in cases where complete resection is not achievable, palliative procedures like stenting can relieve symptoms of bile duct obstruction. This makes extrahepatic biliary cancer a relatively better managed disease compared to intrahepatic cancer in its early stages.

Advances in surgical techniques have also increased resectability rates for extrahepatic biliary tumors over time. Procedures like hepatectomy with bile duct resection combined with revascularization of the liver allow for wider tumor free margins. Regional therapies utilizing photodynamic therapy can further treat any remaining microscopic disease post-surgery. The scope for aggressive local management boosts patient outcomes and prolongs progression free survival for extrahepatic biliary cancer patients.

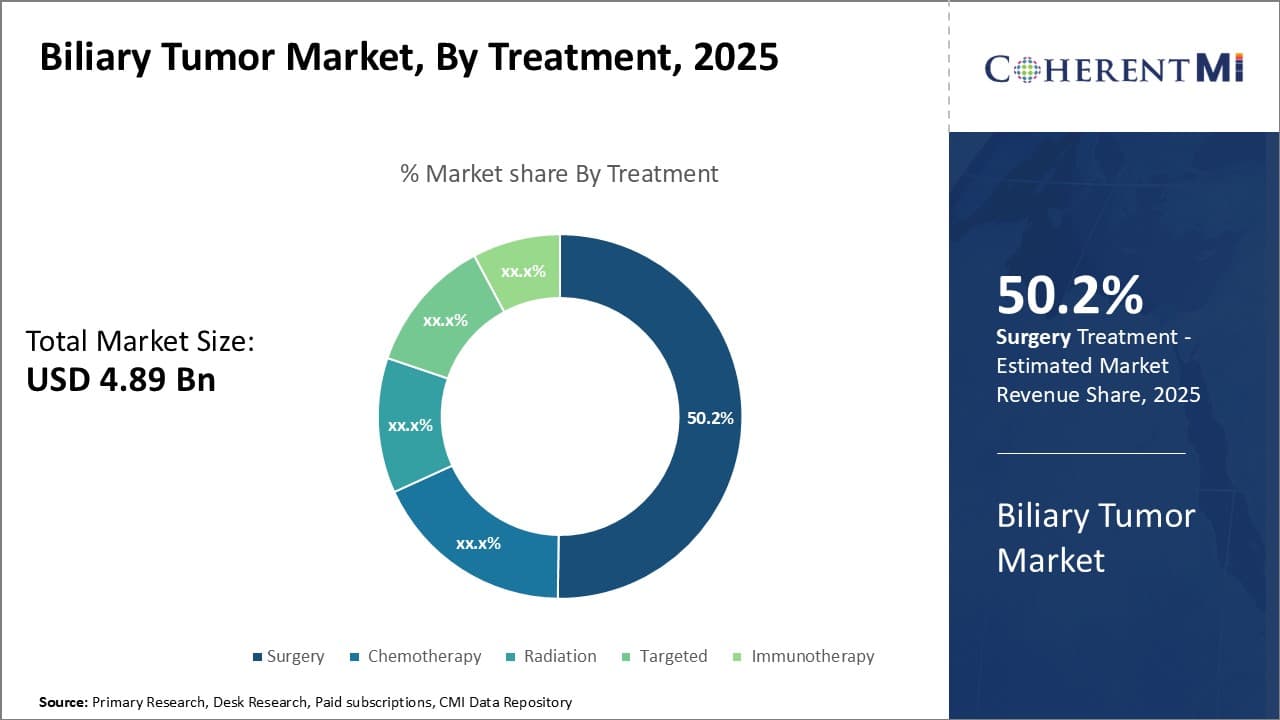

Insights, By Treatment, Surgery Remains Cornerstone for Treatment despite Advanced Disease.

Insights, By Treatment, Surgery Remains Cornerstone for Treatment despite Advanced Disease.

By Treatment, surgery is expected to contribute the highest share 50.2% in 2025. Even with widespread disease, surgery remains the only potentially curative option for biliary tumors. While complete surgical resection with tumor-free margins offers the best chance of cure, approximately two-thirds of patients present with unresectable disease either due to locally advanced tumors or metastasis at diagnosis.

In such cases of locally advanced but potentially resectable disease, neoadjuvant chemotherapy or chemoradiotherapy helps downstage the tumor burden and makes surgical resection feasible in approximately 30% of patients. Portal vein embolization can be conducted prior to extensive liver resections to increase future liver remnant volume.

For patients with borderline resectable or initially unresectable tumors that see good responses to preoperative therapies, surgeons aggressively pursue metastasectomy of limited liver or peritoneal metastases combined with bile duct and liver resections. Cytoreductive surgery also provides relief from cancer related symptoms like itching and abdominal pain from carcinomatosis.

Even palliative surgeries like biliary by-pass procedures via hepaticojejunostomy help prolong survival by maintaining patency of the biliary system and avoiding complications from bile duct obstruction. Surgery therefore maintains an important role across the broad treatment spectrum for biliary tumors.

Insights, By End-use, Concentrated Care in Hospitals Maximizes Treatment Benefit.

By End-Use hospitals dominated owing to the multidisciplinary nature of care required. Being a relatively rare but aggressive cancer, biliary tumors benefit the most from care in high volume specialty centers and renowned academic medical centers. Centralized treatment protocols coordinated across specialized surgeons, medical oncologists, radiation oncologists and radiologists help optimize multimodality therapy. Hospitals concentrate expertise in complex surgical procedures like combined liver-bile duct resections, which achieve superior outcomes compared to low volume centers.

Comprehensive tumor boards aid in patient selection for neoadjuvant therapies and coordinate treatment planning. Radiologists in hospitals also offer the latest imaging modalities to accurately stage disease for resectability and conduct interventional radiology procedures like radiofrequency ablation and chemoembolization.

Support services in hospitals facilitate coordinated post-operative cancer care and management of complications. Patients also gain access to clinical trials of novel agents and immunotherapies in academic settings. With a long road to recovery after extensive surgeries, dependable nursing and in-patient rehabilitation enhance outcomes. Proximity to intensive care further aids recovery from high-risk procedures.

Additional Insights of Biliary Tumor Market

Biliary tumors, especially cholangiocarcinoma, represent a significant challenge in oncology due to their aggressive nature and late-stage diagnosis. These tumors are typically asymptomatic until they obstruct the biliary system, leading to jaundice, pruritus, and weight loss. Diagnosis relies heavily on imaging techniques such as MRI, CT, and ERCP, coupled with biopsy for histopathological confirmation. Emerging therapies in the biliary tumor pipeline focus on immunotherapy, targeted therapy, and antibody-drug conjugates.

AstraZeneca's Rilvegostomig, a bispecific antibody, is leading the charge by targeting both PD-1 and TIGIT to enhance immune responses. Jiangsu HengRui Medicine's SHR-A1811 targets HER2-expressing tumors, offering hope for patients with HER2-positive biliary cancers. The treatment landscape is shifting towards personalized medicine, with therapies targeting specific genetic mutations and biomarkers. Despite these advances, the high cost of new treatments and late-stage diagnoses remain barriers to improving survival rates. However, combination therapies, such as combining immunotherapy with traditional chemotherapy, are showing promise in clinical trials, potentially improving outcomes for patients with advanced biliary tumors.

Competitive overview of Biliary Tumor Market

The major players operating in the Biliary Tumor Market include AstraZeneca, Jiangsu HengRui Medicine, Amgen, Eli Lilly and Company and Pfizer.

Biliary Tumor Market Leaders

- AstraZeneca

- Jiangsu HengRui Medicine

- Amgen

- Eli Lilly and Company

- Pfizer

Biliary Tumor Market - Competitive Rivalry

Biliary Tumor Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Biliary Tumor Market

- In May 2024, AstraZeneca initiated Phase III trials for Rilvegostomig, a bispecific antibody targeting both PD-1 and TIGIT in biliary cancer. The trials are expected to assess the efficacy of combining this therapy with AstraZeneca’s antibody-drug conjugates.

- In April 2024, Jiangsu HengRui Medicine reported positive Phase II results for SHR-A1811, demonstrating enhanced efficacy in HER2-positive biliary tumors.

Biliary Tumor Market Segmentation

- By Type

- Extrahepatic Biliary Tumor

- Intrahepatic Biliary Tumor

- By Treatment

- Surgery

- Chemotherapy

- Radiation

- Targeted

- Immunotherapy

- By End-Use

- Hospitals

- Oncology Centers

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How Big is the Biliary Tumor Market?

The Global Biliary Tumor Market is estimated to be valued at USD 4.89 Bn in 2025 and is expected to reach USD 8.71 Bn by 2032.

What will be the CAGR of the Biliary Tumor Market?

The CAGR of the Biliary Tumor Market is projected to be 8.4% from 2024 to 2031.

What are the major factors driving the Biliary Tumor Market growth?

The increasing prevalence of biliary tumors, particularly cholangiocarcinoma, drives the demand for innovative therapies. Breakthroughs in dual blockade immunotherapies, such as pd-1 and TIGIT inhibitors, have improved the treatment landscape for advanced biliary tumors are the major factor driving the Biliary Tumor Market.

What are the key factors hampering the growth of the Biliary Tumor Market?

Many biliary tumors are diagnosed at an advanced stage, limiting the efficacy of available treatments, limited accessibility to new therapies, high treatment costs and regulatory challenges can slow the adoption of new therapies, especially in low-income regions are the major factor hampering the growth of the Biliary Tumor Market.

Which is the leading Type in the Biliary Tumor Market?

Extrahepatic Biliary Tumor is the leading type segment.

Which are the major players operating in the Biliary Tumor Market?

AstraZeneca, Jiangsu HengRui Medicine, Amgen, Eli Lilly and Company, Pfizer are the major players.