BK Virus (BKV) Infection Market Size - Analysis

The BK Virus (BKV) infection market is estimated to be valued at USD 48.3 Mn in 2025 and is expected to reach USD 559.5 Mn by 2032, growing at a compound annual growth rate (CAGR) of 41.9% from 2025 to 2032. The market is expected witness steady growth during the forecast period due to the rising prevalence of BKV infections among immunocompromised patients undergoing organ transplantation or receiving immunosuppressive therapy for autoimmune disorders.

Market Size in USD Mn

CAGR41.9%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 41.9% |

| Market Concentration | High |

| Major Players | AlloVir, Amplyx Pharmaceuticals, SL VAXiGEN, Hybridize Therapeutics, Vera Therapeutics, Inc. and Among Others |

please let us know !

BK Virus (BKV) Infection Market Trends

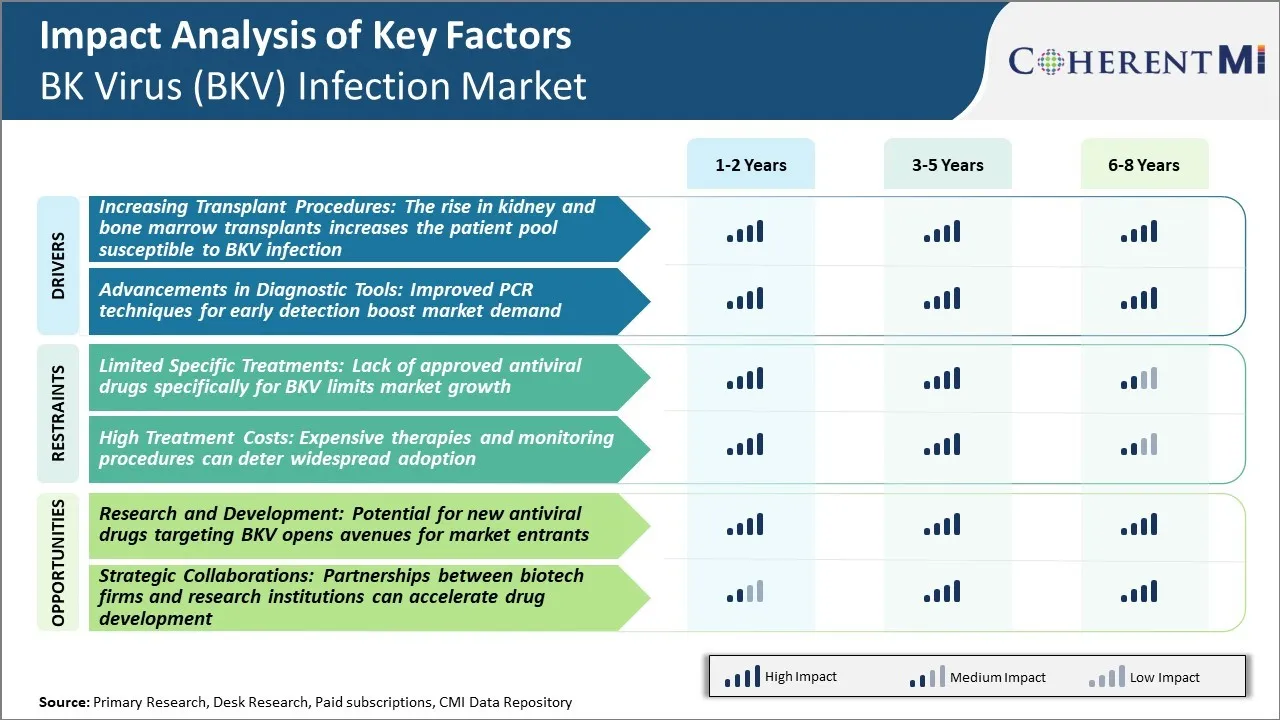

Market Driver - Rise in Kidney and Bone Marrow Transplants Increases the Patient Pool Susceptible to BKV Infection

According to data, there were over 21,000 kidney transplants performed in the United States last year, reflecting a steady year-over-year growth of 2-3%. The rising prevalence of kidney diseases, especially diabetes and hypertension, have resulted in growing numbers of patients developing end-stage renal failure. While dialysis keeps these patients alive, transplant is considered a superior treatment option with potential of improved quality of life. As organ availability still remains limited, more patients are enlisting themselves for transplant. The use of kidneys from expanded criteria donors have also grown due to shortage of donations from healthy individuals.

In addition to kidney transplants, the bone marrow transplant numbers have bounced back after witnessing declines during the peak of the COVID-19 pandemic. Immunosuppressed individuals receiving bone marrow are vulnerable to viral infections owing to weakened immunity post-transplant. Despite inherent risks, patients push for transplants when organ failure leaves them with no alternatives.

With the patient pool on transplant continuing expansion, there is a proportional rise in those at danger of BKV infection. This burgeoning 'at-risk' population directly contributes to market demand for screening, diagnosis and treatment of BKV. Providers endeavor to regularly monitor this growing pool and intervene at early stages to mitigate complications.

Market Driver - Advancements in Diagnostic Tools

Development of advanced diagnostic assays over the past decade have allowed for quicker identification of BKV. Traditional diagnostic techniques were often inadequate in detection, attributing to delayed treatment decisions. Progress on this front considerably impacts the market favorably.

Quantitative TREATMENT, methods have now emerged as gold standard for BK virus screening owing to superior sensitivity. Ability to quantify viral load levels enables physicians to monitor disease progression critically and modulate immunosuppression accordingly. Multiplex TREATMENT, systems examine samples for simultaneous presence of BKV along with other pathogens, avoiding repeat testing. This not only saves turnaround time but also reduces healthcare costs in the long run.

Point-of-care urine testing provides instant qualitative results and allows expedited clinical decision making. Apart from aiding quick diagnosis, reduced waiting period enhances patient compliance. Research into development of BKV antigen assays is further optimizing diagnostic scope. Detection of antigens shed during active viruria could facilitate screening of high-risk groups. Combined with molecular assays, antigen tests promise a comprehensive diagnosis. Ongoing development of treatment-based panels examining immune response to BKV also shows promise for prognosis.

These diagnostic advancements stimulate demand by facilitating prompt management through early-stage intervention. Providers are prompted to frequently screen susceptible patient groups to curb infection spread. Overall, innovations are widening testing opportunities while improving clinical outcomes.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Lack of Approved Antiviral Drugs Specifically for BKV Limits Market Growth

As of now, there are no antiviral drugs that are specifically approved for the treatment of BKV infection. Currently, physicians primarily rely on supportive care and temporary suppression of the patient's immune system using immunosuppressive drugs to control BKV replication. However, using broad-spectrum immunosuppressive therapies can increase the risk of other opportunistic infections.

Additionally, as BKV infects the renal tubular epithelial cells, treatment options are also limited for patients who develop BKV associated nephropathy. The lack of targeted antiviral therapies makes treatment of BKV infection challenging. It also limits physicians' ability to effectively manage the infection and restricts market growth potential of medical interventions designed specifically for BKV. With no direct antiviral treatments available, the medical management of BKV remains a major unmet need. This will pose a major challenge for companies in the BK Virus (BKV) infection market.

Market Opportunity - Research and Development in New Antiviral Drugs for BKV to Open New Growth Avenues

The lack of approved antiviral therapies for BKV provides a significant opportunity for drug developers to enter the BK Virus (BKV) infection market. Currently, there are several candidates in clinical trials that are evaluating the safety and efficacy of new anti-BKV agents. If successful, these new drug therapies could provide the first targeted antiviral treatment options for BKV. This will address a major unmet clinical need and facilitate better management of BKV infection in high-risk patients.

A drug approval would validate the market opportunity and clinical demand for specific anti-BKV therapies. It will also encourage more research & development investments in the BK Virus (BKV) infection market.

Moreover, new mechanisms for blocking BKV replication are still being explored which could accelerate the development of second and third generation antiviral drugs. The potential for innovative new treatments opens promising commercial avenues for BK Virus (BKV) infection market players.

Prescribers preferences of BK Virus (BKV) Infection Market

BK virus infection is commonly seen in transplant recipients and can lead to significant morbidity if not managed appropriately. The standard first-line treatment involves reducing immunosuppression to allow the immune system to clear the virus naturally. For mild infections, reducing immunosuppression alone may be sufficient. However, for moderate to severe infections, prescribers may supplement immunosuppression adjustments with antiviral medications.

Cidofovir (brand name Vistide) is frequently prescribed as a second-line option if the infection fails to clear or progresses despite immunosuppression reduction. Due to its nephrotoxic effects, prescribers closely monitor kidney function when using Cidofovir. For patients with compromised renal function, they may consider alternatives like Leflunomide (brand name Arava), which can be effective against BKV but is more kidney-friendly.

For cases with viruria but no associated disease, prescribers may try observational management by closely tracking for progression before initiating antivirals. However, for those with detectable viremia and/or biopsy-proven BK nephropathy/polyomavirus-associated nephropathy (PVAN), prescribers typically start antiviral therapy along with immunosuppression optimization to prevent renal dysfunction.

The severity of a patient's infection, transplant indication, renal function, and risk of rejection all factor into a prescriber's treatment decisions. Close monitoring is also critical to timely escalation of therapy if initial approaches are ineffective.

Treatment Option Analysis of BK Virus (BKV) Infection Market

BKV infection has various stages based on viral load and associated symptoms. For asymptomatic viruria, no treatment is needed as the virus is cleared naturally by the immune system in most cases.

For viremia without associated nephropathy, immunotherapy drugs like cidofovir and leflunomide are used. Cidofovir (Vistide) is preferred due to its antiviral effectiveness. However, its nephrotoxicity limits its use. Leflunomide (Arava) is a reasonable alternative due to its immune-modulating effects with a better safety profile.

For BK virus-associated nephropathy (BKVAN), reducing immunosuppression is the first-line treatment to allow the immune system to clear the virus. If viral load remains high, off-label use of intravenous immunoglobulin (IVIg) or cidofovir may be used. Large controlled trials have demonstrated the benefits of IVIg (Gamunex, Privigen etc.) in improving renal function in BKVAN.

For allograft dysfunction due to BKVAN, more aggressive approaches are needed. Combinations of leflunomide or cidofovir with IVIg or switching maintenance immunosuppression from calcineurin inhibitors to sirolimus have shown promise. Sirolimus (Rapamune) acts directly on viral replication in addition to its immunosuppressive effects. These multi-targeted combination therapies provide the best outcomes for advanced BKVAN by both modulating immunity and inhibiting viral replication.

Key winning strategies adopted by key players of BK Virus (BKV) Infection Market

Product Development - One of the most important strategies adopted by players has been continuous investment and focus on research and development to develop novel treatment solutions. For example, in 2018 Astellas Pharma developed Vivaglobin (Intravenous immunoglobulin) for treatment of BKV associated hemorrhagic cystitis post hematopoietic stem cell transplantation. The drug received FDA approval and provided an effective therapeutic option for treatment of this condition.

Acquisitions - Companies have supplemented their product pipelines through strategic acquisitions. For example, in 2021 Chimerix acquired Oncoceutics to gain access to ongoing clinical trials of ONC201 for treatment of BKV infection in transplant patients. Thisexpanded Chimerix's portfolio in virology and oncology indications.

Geographic Expansion - Major players have expanded commercial presence globally through regional offices and collabortations to tap high growth international markets. For example, Stemell expanded its commercial operations in Europe and Asia Pacific in 2020 to market its BKV diagnostic tests which contributed 40% of its total revenue.

Awareness Programs - Educational programs targeting physicians and patients helped increase testing and treatment uptake. For example, Astellas's global disease awareness initiatives on BKV management post-transplantation raised testing rate from 30-50% during 2015-2018 boosting sales of its immunoprophylaxis drug.

Segmental Analysis of BK Virus (BKV) Infection Market

-infection-market-by-treatment.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

Insights, By Treatment: Antiviral Medications Dominate Treatment Due to Lower Side Effects

To learn more about this report, Download Free Sample Copy

Insights, By Treatment: Antiviral Medications Dominate Treatment Due to Lower Side Effects

In terms of treatment, antiviral medications contribute the highest share of the BK virus infection market owing to its advantage of fewer side effects compared to other treatment options. Antiviral drugs offer targeted treatment against the BK virus with minimal impact on the immune system of the patient. This makes them well-suited for immunocompromised patients who are at high risk of BK virus infection.

Cidofovir is an antiviral medication used to treat BK virus infection, but it can cause serious side effects like kidney damage if not administered carefully. Leflunomide and Brincidofovir are relatively new to the market. While they demonstrate antiviral activity against BK, data around their safety and efficacy is still emerging. In comparison, established antiviral medications have a proven record of effectively controlling BK virus replication with less potential for additional health complications in patients.

The high adoption of antiviral drugs is also attributed to the fact that BK virus infection requires long-term management to prevent life-threatening consequences like hemorrhagic cystitis. Antivirals allow for outpatient treatment versus immunosuppressive modulation which may require hospital admissions for monitoring. Their extensive use in treatment aligns well with increasing BK virus prevalence in immunocompromised groups.

-infection-market-by-end-user.webp&w=3840&q=75) To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By End User: Hospitals Dominate End-Users Due to Ability to Manage Complications

In terms of end users, hospitals contribute the highest share of the BK virus infection market owing to their ability to manage potential complications. Patients who develop BK virus-associated nephropathy or other complications often require intensive in-patient care and round-the-clock monitoring. Hospitals are best equipped with specialized staff, facilities and multidisciplinary teams to deliver comprehensive care in such critical situations.

While transplant centers, specialty clinics and research institutes also treat BK infected patients, most prefer to refer or transfer high-risk cases to hospitals for management. This is because BK infection in transplant or immunotherapy recipients can take a turn for the worse with issues like graft failure or hemorrhage. Hospitals have the infrastructure and resources to promptly address surgical or emergency interventions if any underlying conditions deteriorate.

The large footprint of hospitals as end-users also comes from their role in screening donor organs, conducting biopsies to diagnose BK virus infection and administering intravenous antiviral therapy or immunomodulating agents which often require hospital admission. The concentration of medical expertise and focus on quality clinical outcomes in hospitals has made them the preferred treatment setting, especially for the growing vulnerable patient population at risk of severe BK virus disease.

Additional Insights of BK Virus (BKV) Infection Market

- Prevalence: BKV infects approximately 80-90% of the global population during childhood, remaining latent in the kidneys.

- Reactivation Rate: In kidney transplant patients, BKV reactivation occurs in 10-25% of cases due to immunosuppression.

Competitive overview of BK Virus (BKV) Infection Market

The major players operating in the BK Virus (BKV) Infection Market include AlloVir, Amplyx Pharmaceuticals, SL VAXiGEN, Hybridize Therapeutics, and Vera Therapeutics, Inc.

BK Virus (BKV) Infection Market Leaders

- AlloVir

- Amplyx Pharmaceuticals

- SL VAXiGEN

- Hybridize Therapeutics

- Vera Therapeutics, Inc.

Recent Developments in BK Virus (BKV) Infection Market

- In December 2023, AlloVir announced it has halted its three Phase III posoleucel studies after pre-planned DSMB futility analyses indicated the trials were unlikely to meet their primary endpoints. The company intends to prioritize capital preservation and consider strategic options.

- Vera Therapeutics, Inc. recently reported positive interim results from a Phase 2 clinical trial evaluating MAU868, an investigational monoclonal antibody, in kidney transplant patients with BK virus (BKV) viremia. MAU868 is designed to neutralize BK virus by targeting and binding to the virus, preventing it from infecting cells. Based on positive interim results, further clinical trials may be conducted to confirm efficacy and safety, potentially leading to regulatory approval.

BK Virus (BKV) Infection Market Segmentation

- By Treatment

- Antiviral Medications

- Cidofovir

- Leflunomide

- Brincidofovir

- Immunosuppressant Modulation

- Reduction of immunosuppressive therapy

- Switching immunosuppressive agents

- Supportive Care

- Hydration therapy

- Symptom management

- Antiviral Medications

- By End User

- Hospitals

- Transplant Centers

- Specialty Clinics

- Research Institutes

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.