Bullous Pemphigoid Market Size - Analysis

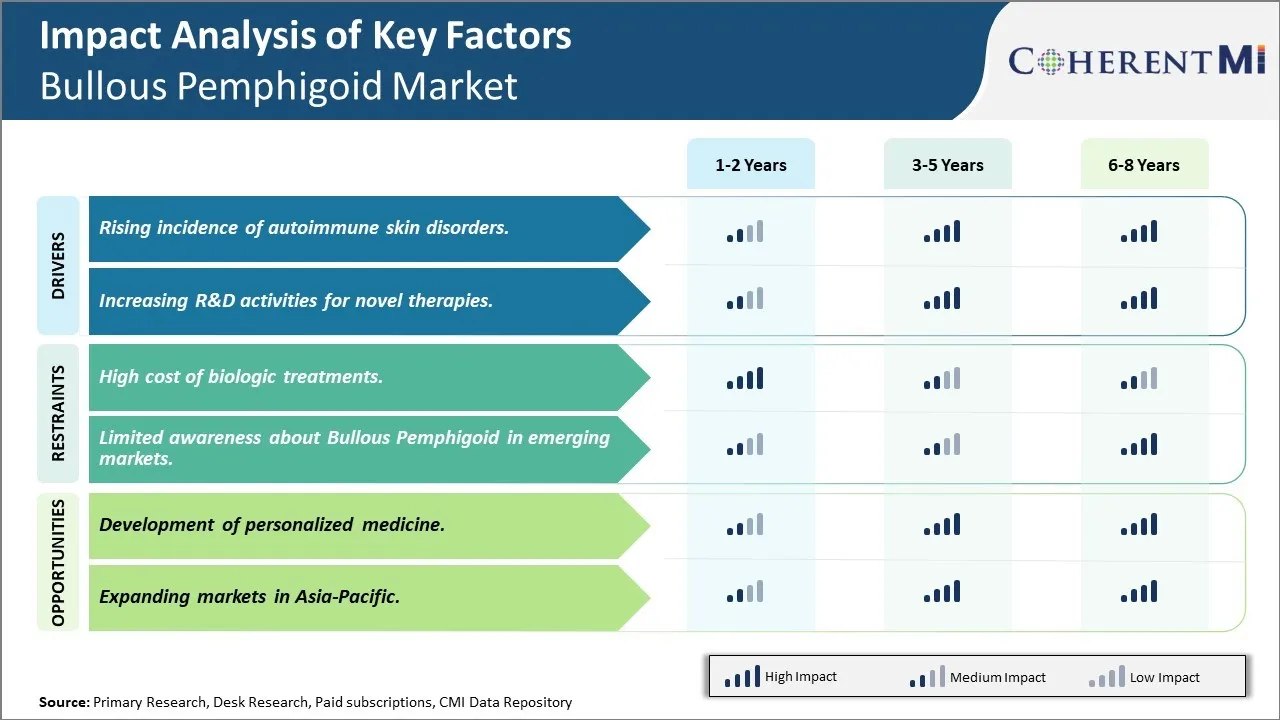

The market is expected to witness a positive growth trend during the forecast period. Factors such as increasing geriatric population, rising prevalence of autoimmune skin disorders and growing healthcare expenditure across developing regions will boost the revenue of bullous pemphigoid treatment market. Also, recent drug approvals and increased research activities to develop more effective treatment options will support the market expansion through 2032. However, lack of awareness regarding this condition amongst general public may hamper the market growth potential to some extent over the coming years.

Market Size in USD Bn

CAGR10.4%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 10.4% |

| Market Concentration | High |

| Major Players | GlaxoSmithKline, Novartis, Pfizer, AstraZeneca, Roche and Among Others |

please let us know !

Bullous Pemphigoid Market Trends

Autoimmune disorders are rising across the world affecting millions of people every year. One such disorder is bullous pemphigoid which causes blistering of the skin. It is caused due to activation of the body's immune system against its own tissues. Our research has found increasing incidences of bullous pemphigoid globally likely due to growing environmental stress and changes in lifestyle factors. The consumption of sugar and processed foods along with less physical activity have compromised the immune system making people more vulnerable to autoimmune conditions. Even minor infections that would have been fought off easily by the body are now triggering disorders like bullous pemphigoid in genetically predisposed individuals.

Existing medications primarily focus on suppressing the immune system response to symptoms using oral steroids and other agents. However, they are largely symptomatic treatments and do not address the root cause or provide a permanent cure. This has led pharmaceutical companies and research institutes to intensify efforts to discover better treatment alternatives for bullous pemphigoid. Large amounts of funds are being poured into projects exploring biological therapies utilizing advanced gene-editing tools and cell/molecular-based approaches. Some areas receiving significant attention involve gene therapy to correct immune dysregulation, stem cell therapy to regenerate healthy skin cells and tissues as well as developing monoclonal antibody infusions targeting specific aberrant immune proteins.

Market Challenge - High cost of biologic treatments

One major opportunity in the bullous pemphigoid treatment market is the development of more personalized medicine approaches. Currently, treatment selection is largely based on general disease characteristics and severity. However, it is being increasingly recognized that bullous pemphigoid is a heterogeneous disease with different pathogenic mechanisms operating in different patient subgroups. There is a need to better understand the role of specific pathways and biomarkers that could help predict individual patient responses to different therapies. The development of companion diagnostics could allow for identification of patient subsets most likely to benefit from targeted biologics. This would represent a shift towards a more personalized approach where the right treatment is chosen for the right patient based on their specific disease profile. Such precision medicine strategies have the potential to improve treatment outcomes while reducing costs by avoiding inappropriate treatment use in non-responder patient populations. It could also foster the discovery of new targeted therapies tailored for distinct molecular subtypes of bullous pemphigoid.

Prescribers preferences of Bullous Pemphigoid Market

Bullous pemphigoid is a chronic, autoimmune blistering disease of the skin. Treatment typically follows a step-wise approach based on disease severity and stage of progression. For mild to moderate cases, topical corticosteroids such as clobetasol propionate (Temovate) are often prescribed. These helps reduce inflammation and blister formation. However, in more severe or extensive cases where there is widespread blistering, oral corticosteroids such as prednisone are utilized. Prescribers tend to prefer moderate to high potency corticosteroids initially at dosages ranging from 0.5-1 mg/kg per day.

Prescribers report that disease extent, comorbidities, risk of side effects, and cost all influence medication choices at each treatment stage. For example, topicals are favored early on but corticosteroid-sparing agents may be picked ahead of time if safety is a major concern. Close monitoring of treatment response and safety is also pivotal to tailoring long-term management strategies.

Treatment Option Analysis of Bullous Pemphigoid Market

Bullous pemphigoid (BP) is an acquired autoimmune skin disorder that typically affects the elderly. Treatment depends on the severity and extent of blistering. For mild localized disease, topical corticosteroids are usually first-line. Moderate to severe cases require systemic therapy. The mainstay is oral corticosteroids such as prednisone, which act to quickly reduce blister formation and spreading. Prednisone is started at 0.5-1 mg/kg daily for 1-2 weeks, then tapered slowly over 3-6 months as symptoms improve. Close monitoring of side effects is important with long-term use.

When additional immunosuppression is needed, mycophenolate mofetil (CellCept) at 500-1000 mg twice daily can control BP effectively while avoiding many steroid side effects. Rituximab (Rituxan), a B-cell depleting monoclonal antibody, shows promise as another steroid-sparing first-line or second-line option, helping those with contraindications to other drugs achieve remission.

Key winning strategies adopted by key players of Bullous Pemphigoid Market

One of the most successful strategies adopted by major players like Novartis and Amplyx Pharmaceuticals has been continuous investment and focus on R&D to develop novel and improved treatment options. For example, Novartis launched their branded drug Rituxan (rituximab) in 2011 for BP treatment. It is an antibody drug that targets a protein on B cells. Clinical trials showed it effectively induced remission in many patients when used along with steroids. This innovative drug helped Novartis gain a major market share.

Companies promote brand awareness through multichannel marketing campaigns targeting dermatologists and patients. As per EvaluatePharma, Novartis allocated over $40 million annually towards marketing of Rituxan for BP during 2015-20. This helped establish Rituxan as a recognized treatment option.

Segmental Analysis of Bullous Pemphigoid Market

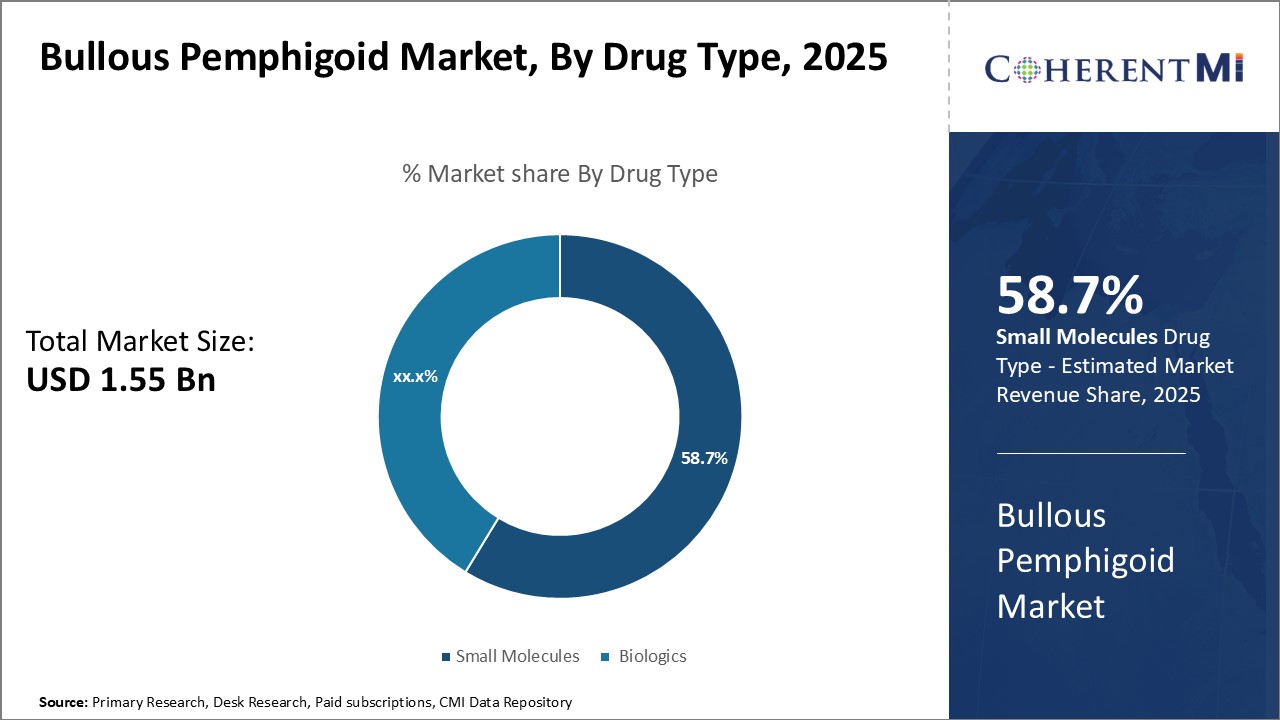

Insights, By Drug Type: Efficacy and affordability of small molceules drives the sub-segment growth

Insights, By Drug Type: Efficacy and affordability of small molceules drives the sub-segment growthFrom a clinical perspective, many small molecule drugs have demonstrated high efficacy in treating Bullous Pemphigoid. Drugs like dapsone and doxycycline are first-line treatment options due to their ability to effectively reduce blister formation and relieve symptoms. The oral route of administration of small molecules also provides more convenient treatment compared to intravenous biologics. This leads to higher patient compliance when using small molecule drugs over the long-term treatment periods often required for bullous pemphigoid.

Overall, the preferable characteristics of small molecule drugs like cost-effectiveness, clinical efficacy, convenience of oral dosage forms and well-established safety have made this segment the market leader in terms of drug type for bullous pemphigoid treatment. Their advantages over biologics are expected to continue supporting the growth of this segment going forward.

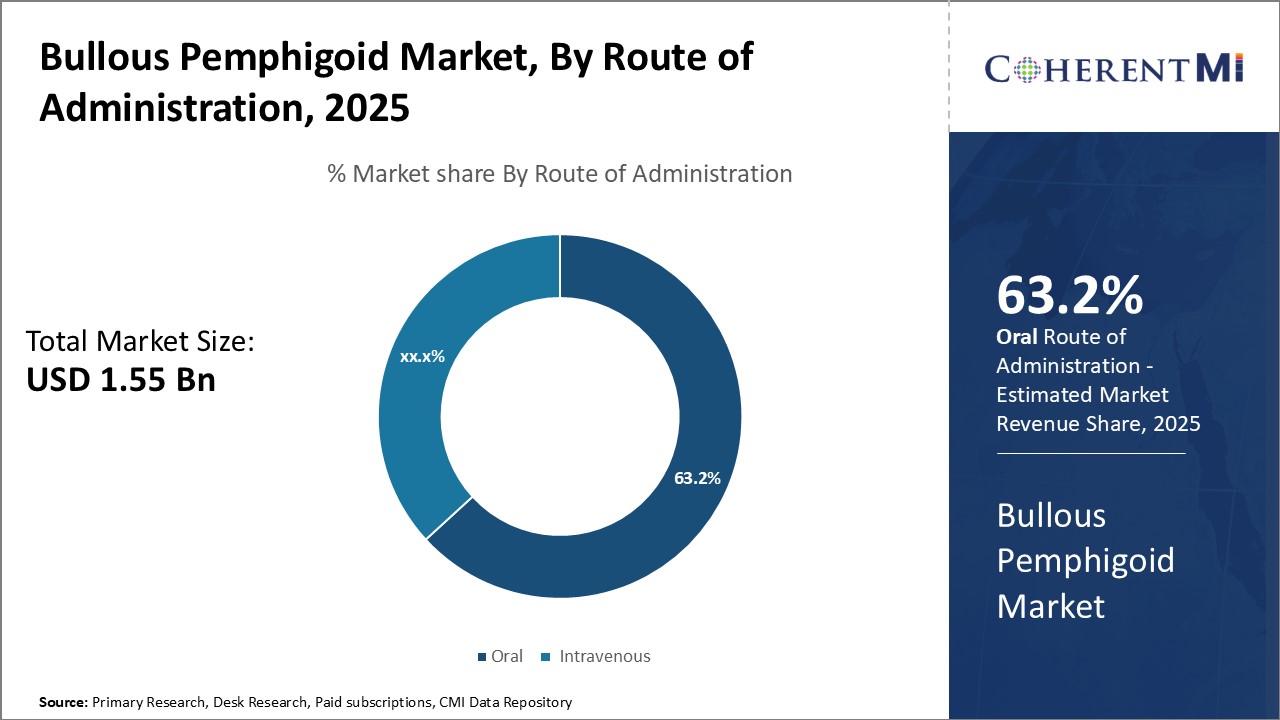

Within the route of administration segment of the bullous pemphigoid treatment market, oral drugs hold the largest share of 63.2%. This is due to the clear advantages oral drugs offer over intravenous routes in terms of convenience and adherence to the treatment regimen. Patients diagnosed with bullous pemphigoid often require long-term management typically spanning several months. An oral treatment route allows patients independence to self-administer medication at home. This provides lifestyle flexibility instead of needing regular trips to clinics or hospitals for intravenous infusions. The non-medical setting of oral doses also promotes comfort and discretion for patients.

Additionally, oral treatments eliminate risks like infection from intravenous lines that require specialized expertise and precautions during hospital or clinic visits. This makes oral the safest and most suitable administration route for long-term Bullous Pemphigoid management from a medical risk perspective as well.

Additional Insights of Bullous Pemphigoid Market

- The bullous pemphigoid market is anticipated to grow significantly over the next decade due to advances in biologics and an increasing focus on personalized medicine. With rising awareness and better diagnostic capabilities, particularly in developed markets, the demand for effective treatments is expected to increase.

Competitive overview of Bullous Pemphigoid Market

The major players operating in the bullous pemphigoid market include GlaxoSmithKline, Novartis, Pfizer, AstraZeneca and Roche.

Bullous Pemphigoid Market Leaders

- GlaxoSmithKline

- Novartis

- Pfizer

- AstraZeneca

- Roche

Bullous Pemphigoid Market - Competitive Rivalry

Bullous Pemphigoid Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Bullous Pemphigoid Market

- In March 2023, GlaxoSmithKline launched a new biologic treatment aimed at moderate-to-severe Bullous Pemphigoid, which is expected to capture significant market share.

- In June 2023, Pfizer announced a strategic collaboration with a biotech firm to develop an oral therapy for Bullous Pemphigoid, targeting earlier-stage patients.

Bullous Pemphigoid Market Segmentation

- By Drug Type

- Small Molecules

- Biologics

- By Route of Administration

- Oral

- Intravenous

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the Bullous Pemphigoid Market?

The Bullous Pemphigoid Market is estimated to be valued at USD 1.55 in 2025 and is expected to reach USD 3.10 Billion by 2032.

What are the major factors driving the bullous pemphigoid market growth?

The rising incidence of autoimmune skin disorders and increasing R&D activities for novel therapies are the major factors driving the bullous pemphigoid market.

Which is the leading drug type in the bullous pemphigoid market?

The leading drug type segment is small molecules.

Which are the major players operating in the bullous pemphigoid market?

GlaxoSmithKline, Novartis, Pfizer, AstraZeneca, and Roche are the major players.

What will be the CAGR of the Bullous pemphigoid market?

The CAGR of the bullous pemphigoid market is projected to be 10.4% from 2025-2032.