カメラアクセサリー市場 サイズ - 分析

カメラアクセサリー市場が評価されると推定される 2024年のUSD 4.16 Bn そして到達する予定 2031年までのUSD 11.24 Bnお問い合わせ 化合物の年間成長率で成長する予定 2024年から2031年にかけて15.26%のCAGR。 世界中のDSLRカメラやミラーレスカメラの採用により、カメラアクセサリー市場が成長し続けています。

市場規模(米ドル) Bn

CAGR15.5%

| 調査期間 | 2025-2032 |

| 推定の基準年 | 2024 |

| CAGR | 15.5% |

| 市場集中度 | Medium |

| 主要プレーヤー | キヤノン株式会社, ソニー株式会社, 株式会社ニコン, パナソニック株式会社, ピークデザイン その他 |

お知らせください!

カメラアクセサリー市場 トレンド

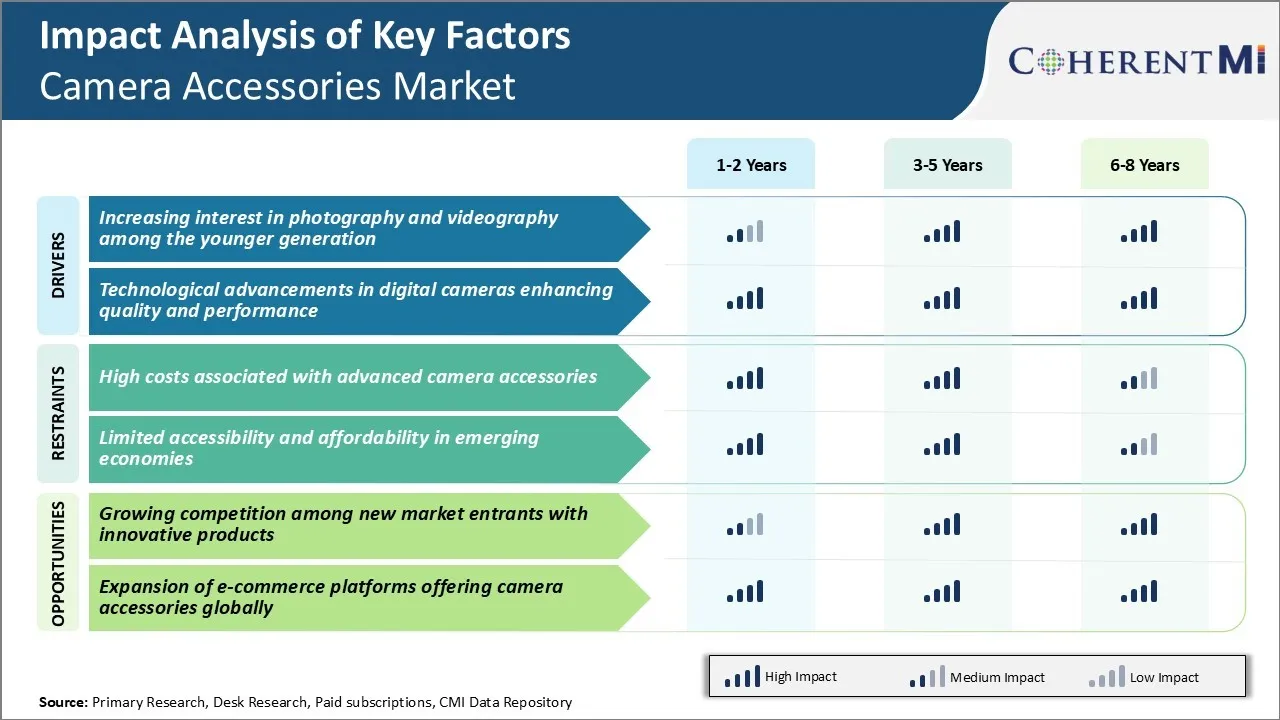

市場ドライバー - 若い世代の中で写真とビデオグラフィーに興味を高める

スマートフォンの上昇と予算のデバイスでも強力なカメラの簡単な可用性で、写真やビデオグラフィに興味は、若い世代の間でマニホールドを育てました。 今では、クリエイティブな映像や動画を撮って日々の生活に欠かせないものとなっています。 ソーシャルメディアプラットフォームは、写真のスキルを披露し、同僚から即座にフィードバックと検証を得ることができるこの傾向を燃やしました。

特に旅行写真は、若い群衆が新しい場所を探索しながら、風光明媚な風景、記念碑や通りを捕獲するのが大好きなので、人気で急激に見てきました。 フード写真は、トラクションを獲得している別の傾向です。 誕生日、結婚式、その他のお祝いのためのイベント写真も今話題になっています。 貴重な瞬間を正確に記録し、その創造性に似合うカメラアクセサリーは、需要を獲得しています。

カメラアクセサリーは、視覚を通して写真のスキルとストーリーテリング能力を高めるために、より大きな制御と柔軟性を提供します。 今後数年で市場の成長を促すことが期待されます。

市場ドライバ - デジタルカメラにおける技術上の優位性は、品質とパフォーマンスを向上させる

カメラメーカーは、進化する消費者ニーズに応えるために、デジタルカメラの機能と機能性を継続的に向上しています。 センサー技術の進歩、画像処理および光学は比類のない細部および低い軽い性能のより高い決断写真を捕獲するためにカメラを可能にしました。 新しいカメラは、超高速連続撮影をサポート, ピンポイント精度と高品質の4kビデオで移動被写体を追跡できる高度なオートフォーカス.

一方、ミラーレスカメラは、コンパクトサイズ、軽量、レンズ交換能力により、広く受け入れられています。 一定の革新によって、カメラの付属品は高い視覚標準に瞬間を捕獲するユーザーに権限を与えます。 撮影能力を補う関連カメラアクセサリーの燃料需要が高まっています。 ビデオグラファーは4k/8kのビデオ サポート、高められたAFの追跡および延長録音の時間からの余りに寄与します。 これにより、カメラアクセサリの市場をさらに向上させることができます。

市場課題 - 高度なカメラアクセサリーと関連した高コスト

現在カメラアクセサリー市場が直面している主要な課題の1つは、高度なカメラアクセサリに関連する高いコストです。 高度なカメラシステムを補完するために必要なカメラアクセサリーは、デザインと機能性でより洗練されたものとなっています。 しかし、これらの新しい技術をカメラアクセサリーに統合するために必要な研究開発と製造コストは、そのような高度なカメラアクセサリーの価格を増加させました。

プロの写真家と真剣な愛好家は、トップオブラインのアクセサリー、カジュアルなユーザーと費用重視の消費者のためのプレミアム価格を支払うことを喜んでいますが、禁止されるために多くの新しい高度なアクセサリーの価格を見つける。 このようなアクセサリの大量採用の障壁として機能し、カメラアクセサリー市場プレーヤーの潜在的な収益機会を制限します。

カメラの付属品の市場の製造業者はスケール、標準化およびより有効な設計および生産の技術の経済を通してコストを運転することに焦点を合わせる必要があります。 この課題に対処するのに役立ちます。

市場機会 - 革新的な製品と新しい市場参入者の間で成長競争

革新的な製品で新しい市場参入者から成長する競争は、カメラアクセサリー市場にとって重要な機会を示しています。 手頃な価格のDSLRとミラーレスカメラでカメラ技術がよりアクセスしやすいようになり、カメラアクセサリー市場における新規企業が参入する障壁はかなり削減されています。

いくつかの新しいスタートアップは、専門ニッチカテゴリに焦点を当てたユニークな価値の提案と、より手頃な価格の代替品でカメラアクセサリー市場に参入しています。 また、人工知能、拡張現実、IoTなどの最新技術動向を活用した新商品の開発も行っています。

競争力のある圧力は、すべての企業がより速いペースで革新し、より良いエンドユーザーの進化ニーズを満たす新しい機能とフォームファクターを導入するために押しています。 新しい市場参入者の数を上げることで、今後数年間にわたって、カメラ全体のアクセサリー市場におけるさらなるイノベーションと成長を促進できます。

主要プレーヤーが採用した主な勝利戦略 カメラアクセサリー市場

イノベーションの焦点: キヤノン、ニコン、ソニーなどのプレイヤーは、新しいカメラアクセサリーを継続的に革新し導入することで、大きな成功を収めています。 たとえば、ソニーは、革新的なジンバル、グリップ、リモートコントロールアクセサリーを最近発売し、エコシステムを拡張しました。

製品範囲を拡大: 市場リーダーは、すべてのフォトグラファーのニーズを満たすためにカメラアクセサリーの巨大な範囲を提供しています。 例えば、2021年にマンフロット(三脚メーカー)がキャジー(セルフスティック&グリップブランド)を買収し、モバイルアクセサリーを拡大。

アクセサリーエコシステムの構築: プレイヤーは、BluetoothやWiFiなどの接続技術により、カメラシステムとシームレスに統合するアクセサリを提供します。 これは、同じカメラのブランドエコシステム内で滞在するユーザーの間で忠実です。

手頃な価格のポイント: : : プレイヤーは、予算からプレミアムまでのすべての価格ポイントでアクセサリを持っていることを確認します。

パートナーシップおよび配分の強さ: アマゾン、BestBuyなどの主要な小売店とカメラアクセサリー市場パートナーの市場リーダーが幅広い流通範囲を確保します。 サードパーティ製のアクセサリメーカーと提携しています。 例えば2022年ニコンでは、シグマやタムロンなどのサードパーティ製のレンズメーカーと連携を強化し、より大きな対応レンズラインアップを実現しました。

セグメント分析 カメラアクセサリー市場

レンズによる洞察:ズームレンズのための汎用性と利便性ドライブ需要

レンズの面では、ズームレンズは、その汎用性と利便性を所有するカメラアクセサリー市場の35.2%のシェアに貢献します。 ズームレンズは、レンズを変更することなく、広角と望遠ショットを容易に確保することなく、幅広い焦点距離から画像をキャプチャすることができます。 ズームレンズは、被写体と背景の異なる距離のシーンに非常に役立ちます。

ズームレンズは、フォトグラファーがレンズを一時停止し、切り替える必要はありませんので、自発的な写真にも便利です。 また、レンズコーティング技術の進歩により、ズームレンズの光学品質を年々向上し、より広い焦点距離で歪んだエッジなどの課題を解決しています。 これらの要因は、画像の品質を損なうことなく、柔軟性を求める写真家のための優先レンズタイプとしてズームレンズを確立しました。

洞察力、配分チャネルによって:オフライン チャネルの広範なプロダクト提供およびアフター セールス サポートSpurの販売

配布チャネルの面では、カメラストアや正規販売店などのオフラインチャネルが、カメラアクセサリー市場への57.6%のシェアに貢献します。 オフライン チャネルは、購入前に、さまざまなカメラアクセサリ製品を検査、テスト、比較するために、フォトグラファーのための広範な店舗のデモンストレーションと試用オプションを提供します。 このハンズオン体験は、フォトグラファーがよく知らぬ購買決定を支援します。 オフライン小売店は、異なるブランドやカテゴリから1つの屋根の下に幅広い製品を選択ストックする傾向があります。

また、機器の修理やメンテナンスサポートなど、ローカルカメラストアは付加価値サービスを提供します。 このようなアフターサポートは、顧客の忠誠性を高め、オフラインチャネルに利益をもたらす、リピートビジネスを奨励します。 オンラインプラットフォームは、より利便性と取引を提供しますが、オフラインチャネルの豊富な顧客エンゲージメントとサポートは引き続き写真愛好家を描いています。

Insights、製品タイプ別:多様な用途の燃料需要が高まるカメラレンズ

製品種別では、レンズ(広角、望遠、マクロ、プライム、ズーム)は、撮影中の多様な用途に向けたカメラアクセサリー市場への最も高いシェアに貢献します。 異なるレンズタイプは、さまざまな写真ニーズに応える - 広角レンズキャプチャ広大な風景;望遠レンズは、遠くから野生動物やスポーツ撮影を容易にします。マクロレンズは、複雑なクローズアップショットを可能にし、プライムレンズは、スタジオとポートレート使用のためのシャープな画像を提供します。

これらの根本的なレンズカテゴリの幅広い適用性は、あらゆるフォトグラファーのキットで重要なツールになります。 フルフレームイメージセンサーのような開発も汎用性と品質を高めています。 様々な被写体を捉えるレンズの能力は、アマチュアとプロの写真家の両方を惹きつけ続けています。

追加の洞察 カメラアクセサリー市場

- シフトトワードミラーレスシステム:ミラーレスカメラは2023年に交換可能なレンズカメラ販売の約45%を占める牽引を得ています。 カメラアクセサリーは、小型カメラバッグやコンパクト三脚など、ミラーレスフォームの要因のために特別に設計されたため、より高い需要を経験しています。

- オンライン小売りの拡張: 初めてのカメラアクセサリーの購入の60%以上は、オンラインチャネルを介して発生し、消費者の購買行動に対するeコマースプラットフォームとインフルエンサー主導のマーケティングの影響を反映しています。

- リモート・ワークおよびEラーニングのサージ: リモートワークとオンライン教育の成長に伴い、高品質のウェブカム、スタンド、照明キットの需要が高まり、仮想プレゼンテーション、講義、会議を容易にします。 ユーザーは、コンパクトで軽量で、簡単に組み立てられたカメラアクセサリーを優先し、自宅で専門的な結果を届けます。

競合の概要 カメラアクセサリー市場

カメラアクセサリー市場における主要プレイヤーは、キヤノン株式会社、ソニー株式会社、ニソニック株式会社、ピークデザイン、サムスン電子株式会社、オリンパス株式会社、富士フイルムホールディングス、ポラロイド株式会社、シグマ株式会社、リコー株式会社などです。

カメラアクセサリー市場 リーダー

- キヤノン株式会社

- ソニー株式会社

- 株式会社ニコン

- パナソニック株式会社

- ピークデザイン

カメラアクセサリー市場 - 競合関係

カメラアクセサリー市場

(大手プレーヤーが支配)

(多くのプレーヤーが参入し、競争が激しい。)

最近の動向 カメラアクセサリー市場

- 2024年6月、ソニーのStarvis 2センサーを搭載したモデルを導入し、IMX664、IMX675、IMX676、優れた画像品質と高い近赤外線(NIR)感度で知られています。 2024年5月、IDSは、イベントベースのIMX636センサーを搭載したuEye XCPファミリーから、ソニーとPropheseeが共同で開発したUSB3カメラを発表し、毎秒10,000以上のフレームをキャプチャすることができます。

- 2024年10月、キヤノンは3つの新しいRFレンズ(RF50mm F1.4、RF70-200mm F2.8、RF24mm F1.4)を、プロのビデオグラフィを目的として発売しました。 これらのレンズは、静かで高速、精密なオートフォーカス、カスタマイズ可能な制御リング、耐久性のある建設などの機能を提供する、高レベルの写真とビデオコンテンツクリエイターの要求を満たすように設計されています。

- 2024年7月、パナソニックが中東・アフリカでAW-UE30 4K PTZカメラを導入 このカメラは、74.1°の広角レンズと20xの光学ズームを備えており、学術的な設定やビジネス会議など、さまざまな用途に適しています。

- 2024年6月、ニコンは24.5メガピクセルを搭載したZ6IIIミラーレスカメラを発表しました。 カメラのパフォーマンスを向上し、読み出し速度を高速化し、オートフォーカス機能を向上させます。

カメラアクセサリー市場 セグメンテーション

- レンズによって

- ズームレンズ

- 主なレンズ

- 広角レンズ

- マクロレンズ

- 流通チャネル

- オフライン

- オンライン

- 製品タイプ別

- レンズ(広角、望遠、マクロ、プライム、ズーム)

- 三脚&サポート (軽量、ヘビーデューティ、旅行、スタジオ)

- メモリーカード(SD、MicroSD、CFexpress、 CompactFlash)

- カメラバッグ&ケース(バックパック、ショルダーバッグ、ハードケース)

- バッテリーパック&充電器

- その他(フィルタ、フラッシュ、リモート、クリーニングキット)

購入オプションを検討しますか?このレポートの個々のセクション?

Pooja Tayade は、半導体およびコンシューマー エレクトロニクス業界で豊富な経験を持つ、経験豊富な経営コンサルタントです。過去 9 年間、これらの分野の大手グローバル企業の業務の最適化、成長の促進、複雑な課題の解決を支援してきました。次のような、ビジネスに大きな影響を与えるプロジェクトを成功に導きました。

- 中規模テクノロジー企業の国際展開を促進し、4 つの新しい国で規制遵守を順守し、海外収益を 50% 増加

- 大手半導体工場でリーン製造原則を導入し、生産コストを 15% 削減

よくある質問 :

カメラアクセサリー市場はどれくらいの大きさですか?

カメラアクセサリー市場は、2024年のUSD 4.16 Bnで評価され、2031年までにUSD 11.24 Bnに達すると予想されます。

カメラアクセサリー市場の成長を妨げる重要な要因は何ですか?

高度なカメラアクセサリーと限られたアクセシビリティと新興経済における手頃な価格に関連する高いコストは、カメラアクセサリー市場の成長を妨げる主要な要因です。

カメラの付属品の市場成長を運転する主要な要因は何ですか。

デジタルカメラのクオリティとパフォーマンスを高めるデジタルカメラの若い世代と技術の進歩の中で写真やビデオグラフィに興味が高まっています。

カメラアクセサリー市場におけるリーディングレンズとは?

主要なレンズの区分はズームレンズです。

カメラアクセサリー市場で動作する主要なプレーヤーはどれですか?

キヤノン株式会社、ソニー株式会社、ニコン株式会社、パナソニック株式会社、ピークデザイン、Samsung Electronics Co Ltd、オリンパス株式会社、GoPro株式会社、富士フイルムホールディングス、ポラロイド株式会社、シグマ株式会社、リコー株式会社、主要プレイヤーです。

カメラアクセサリー市場のCATGは何ですか?

カメラアクセサリー市場は2024-2031から15.26%になるように計画されています。