Cancer Pain Market Size - Analysis

Market Size in USD Bn

CAGR5.5%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 5.5% |

| Market Concentration | High |

| Major Players | Wex Pharma, Sorrento Therapeutics, Tetra Bio-Pharma, Daiichi Sankyo, Pfizer and Among Others |

please let us know !

Cancer Pain Market Trends

As the incidence of cancer continues to rise worldwide, so too does the burden of cancer pain. Cancer pain arises due to the direct damage caused by the primary tumor or metastases, as well as from diagnostic procedures and therapies employed to treat the disease.

Certain types of cancer are also more strongly linked with pain than others. For instance, bone metastases are a common cause of severe pain in patients with advanced breast or prostate cancers. Likewise, cancers of the pancreas, lung, or colon regularly invade surrounding tissues at advanced stages to cause localized or referred pain.

Pharmaceutical companies and biotech startups recognize the commercial potential for novel technologies that can safely and reliably control cancer pain with minimal down time. Additional incentives also come from regulatory programs supporting development of treatments for vulnerable patient populations with high unmet medical need.

Combination therapies tailored for individual cancer types or genotypes may offer synergistic effects with improved tolerability over existing options like opioids. Alternative modalities such as cryoneuroablation, pulsed radiofrequency treatment, and spinal cord stimulation also seek to provide durable local pain relief.

Overall, the possibility of developing more effective “precision pain medicine” helps attract dedicated research involvement towards solving the urgent unmet needs tied to cancer pain.

One of the major challenges faced by the cancer pain market is the high cost associated with various pain treatment options. Cancer pain management often requires the use of powerful opioid analgesics such as morphine, fentanyl, and oxycodone, which are usually prescribed in high doses for an extended period of time until the pain is managed.

As a result, many patients struggle to afford an optimal pain management regimen, which can considerably impact their quality of life. Healthcare providers and insurers are also reluctant to cover the full costs of long-term cancer pain treatments. This presents a major challenge for broader acceptance and uptake of even effective therapies.

One of the key opportunities in the cancer pain market lies in further expanding the range of therapeutic options available to effectively manage chronic cancer pain. While opioids continue to be the mainstay of treatment, their side effects and issues with long-term usage have driven research into alternative approaches.

Non-pharmacological approaches including nerve blocks, neurostimulation devices, and psychological therapies are emerging as valuable adjuncts to drugs. Integrating these diverse options into a multimodal framework presents an opportunity to gain better chronic pain control while limiting reliance on opioids.

Prescribers preferences of Cancer Pain Market

Cancer pain management varies significantly depending on the stage of disease and prior lines of treatment. In early stage cancers, prescribers typically focus on mild opioids like tramadol (Ultram) as the first line of defense. As the disease progresses to later stages, stronger opioids are often introduced.

If pain persists at severe levels even with opioid rotations and combinations, prescribers consider adjuvant therapies and third line options. Neuroaxial techniques like epidurals may be utilized. Oral medications such as gabapentin (Neurontin), pregabalin (Lyrica) and tricyclic antidepressants are also prescribed to target nerve pain. As a last resort, stronger analgesics like methadone or transdermal buprenorphine (Butrans) may be tried.

Treatment Option Analysis of Cancer Pain Market

Cancer pain can be managed through a variety of treatment approaches depending on the type and stage of cancer. For early-stage disease, over-the-counter medications like acetaminophen and NSAIDs may be sufficient. However, as the cancer progresses, stronger therapies are often required.

If pain persists despite opioid treatment, adjuvant analgesics may be added. Pregabalin or gabapentin are frequently prescribed as they aid opioid activity while also treating nerve-related pain. Other adjuncts include antidepressants, anti-seizure drugs, and topical agents.

As the disease enters the final stages, the focus shifts from cure to comfort. Strong opioids do remain the mainstay but non-drug comfort measures and hospice/palliative care gain prominence to support quality of life.

Key winning strategies adopted by key players of Cancer Pain Market

Focus on combination drug therapies: Several leading companies in the cancer pain market like Pfizer, GSK, and Eli Lilly have focused on developing innovative combination drug therapies to manage cancer pain more effectively. For example, in 2019 Pfizer launched Tramadol/Paracetamol fixed dose combination for moderate to severe acute and chronic pain. Studies have shown combination therapies provide better pain relief with minimal side effects compared to single drugs.

Strategic collaborations and partnerships: Pain management involves an interdisciplinary approach. In 2016, Collegium Pharmaceutical partnered with US Oncology to jointly support programs focused on responsible opioid use and safe chronic pain management. Such partnerships enabled knowledge sharing and coordinated approach, helping companies increase access to oncologists and expand market reach.

Segmental Analysis of Cancer Pain Market

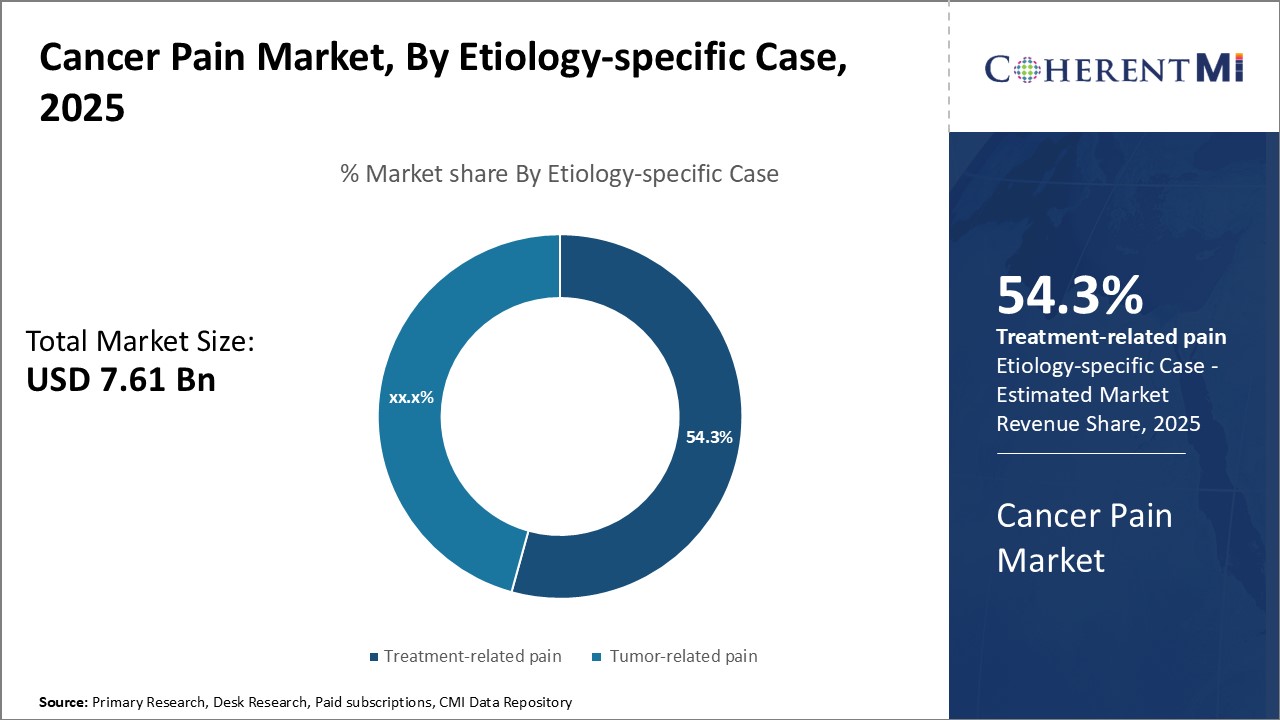

Insights, By Etiology-specific Case: Treatment-related Pain Dominates Due to High Reliance on Therapies

Insights, By Etiology-specific Case: Treatment-related Pain Dominates Due to High Reliance on TherapiesTreatment-related pain contributes the highest share of the cancer pain market owing to the extensive reliance on different therapies for cancer treatment. Pain associated with surgery, chemotherapy, radiation therapy etc. directly impacts a large patient base undergoing such treatments. Therapy-induced side effects and complications often lead to pain episodes requiring management.

Multiple treatment touches within the patient journey additionally drive the need for optimizing pain control. Fine-tuning of analgesic regimens happens regularly as therapy protocols evolve. Adjuvant usage of pain drugs alongside primary treatments contributes to volume growth. The criticality of pain relief when undergoing intensive cancer directed therapies makes it a clinical as well as commercial priority. Focus remains on cutting down interference of pain with therapeutic benefit.

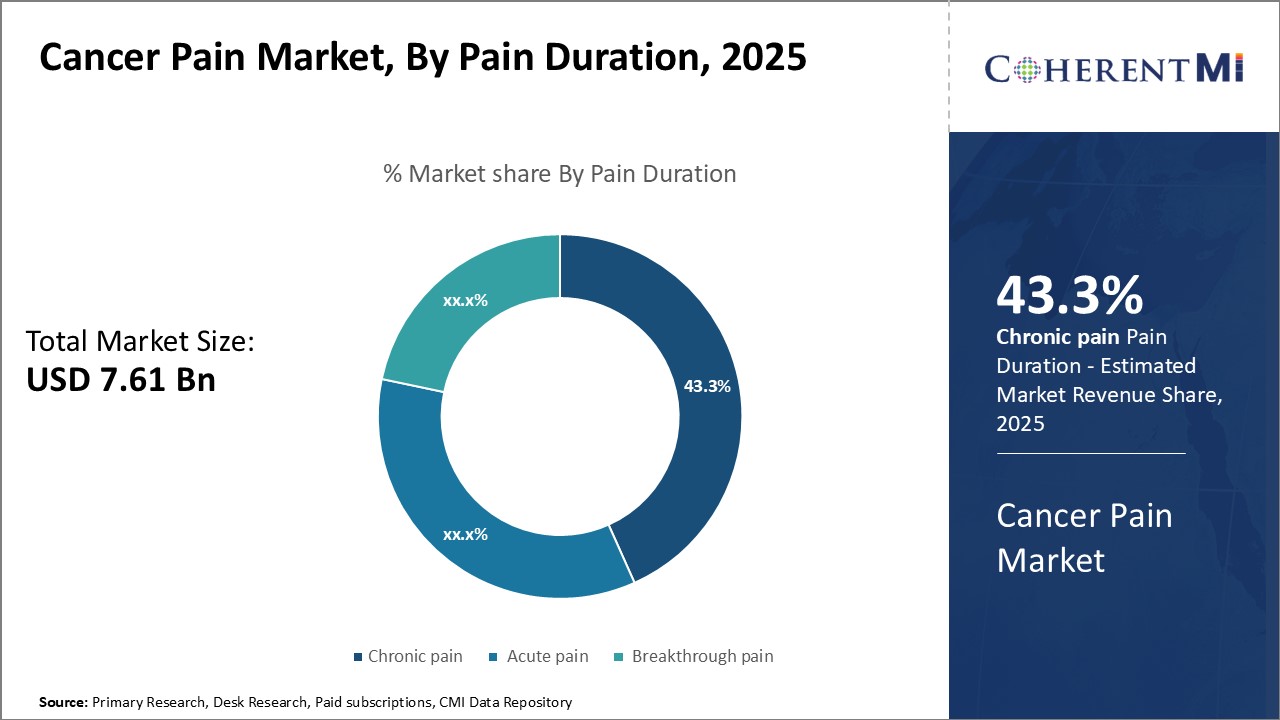

Among different types defined by duration, chronic pain accounts for the major share in the cancer pain market. Its dominance arises from the persistent nature affecting patients for months or years. Chronic pain often emerges from advanced disease stages with widespread metastases or residual pain post treatment. Even after primary treatment ends, around 30% cancer survivors reportedly suffer chronic pain for long periods.

Social and occupational challenges from chronic daily pain also require additional support. Psychological co-morbidities like depression and stress add complexity. Effective chronic cancer pain solutions aim to minimize disease interference maintaining patient role functioning. Both pharmaceutical companies and device innovators focus on improving outcomes for this important segment.

Insights, Severity-specific Case: Mild Pain Segment Dominates in Early Stages

Mild pain often relates to primary tumor site driven by pressure or inflammation. It may result from initial diagnostic or therapeutic procedures like biopsies causing discomfort. Simple analgesics generally suffice at this stage before needs escalate with progression. Optimal pain management boosts patient cooperation with curative intent therapies by allaying fears or interruptions.

Additional Insights of Cancer Pain Market

- Prevalence of Cancer Pain in the U.S is around 2.3 million cases in 2021, expected to rise by 2032.

- Global Pain Management Market is expected to see a steady increase as the cancer survival rate improves, leading to longer-term pain management needs.

Competitive overview of Cancer Pain Market

The major players operating in the Cancer Pain Market include Wex Pharma, Sorrento Therapeutics, Tetra Bio-Pharma, Daiichi Sankyo, Pfizer, Purdue Pharma, Medtronic, Biogen, Eli Lilly, and Sanofi.

Cancer Pain Market Leaders

- Wex Pharma

- Sorrento Therapeutics

- Tetra Bio-Pharma

- Daiichi Sankyo

- Pfizer

Cancer Pain Market - Competitive Rivalry

Cancer Pain Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Cancer Pain Market

- In December 2022, Sorrento Therapeutics announced that it is advancing the development of Resiniferatoxin (RTX), a non-opioid drug targeting chronic cancer pain. RTX selectively binds to TRPV1 receptors in pain-transmitting neurons, which allows it to block pain signals without affecting other sensory functions like touch or coordination. Sorrento Therapeutics has been involved in developing RTX as a non-opioid treatment for chronic pain, particularly cancer pain. RTX is known to target TRPV1 receptors (transient receptor potential vanilloid 1) in pain-transmitting neurons, which is a mechanism designed to block pain signals without impacting other sensory functions such as touch or coordination. This approach has been part of Sorrento's effort to provide alternatives to opioid-based pain treatments, especially for patients with chronic pain conditions.

- In Q4 2022, Wex Pharmaceuticals announced its effort in actively conducting clinical trials for Tetrodotoxin (TTX), primarily under the brand name Halneuron, focusing on its use as a sodium channel blocker for cancer-related pain. In their trials, Tetrodotoxin has shown promising results in reducing pain intensity in cancer patients, with fewer side effects compared to traditional opioid treatments. Additionally, TTX was shown to help reduce opioid usage, which is significant given the challenges of opioid dependency in cancer pain management.

Cancer Pain Market Segmentation

- By Etiology-specific Case

- Treatment-related pain

- Tumor-related pain

- By Pain Duration

- Chronic pain

- Acute pain

- Breakthrough pain

- By Severity-specific Case

- Mild

- Moderate

- Severe

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the cancer pain market?

The cancer pain market is estimated to be valued at USD 7.61 Bn in 2025 and is expected to reach USD 11.07 Bn by 2032.

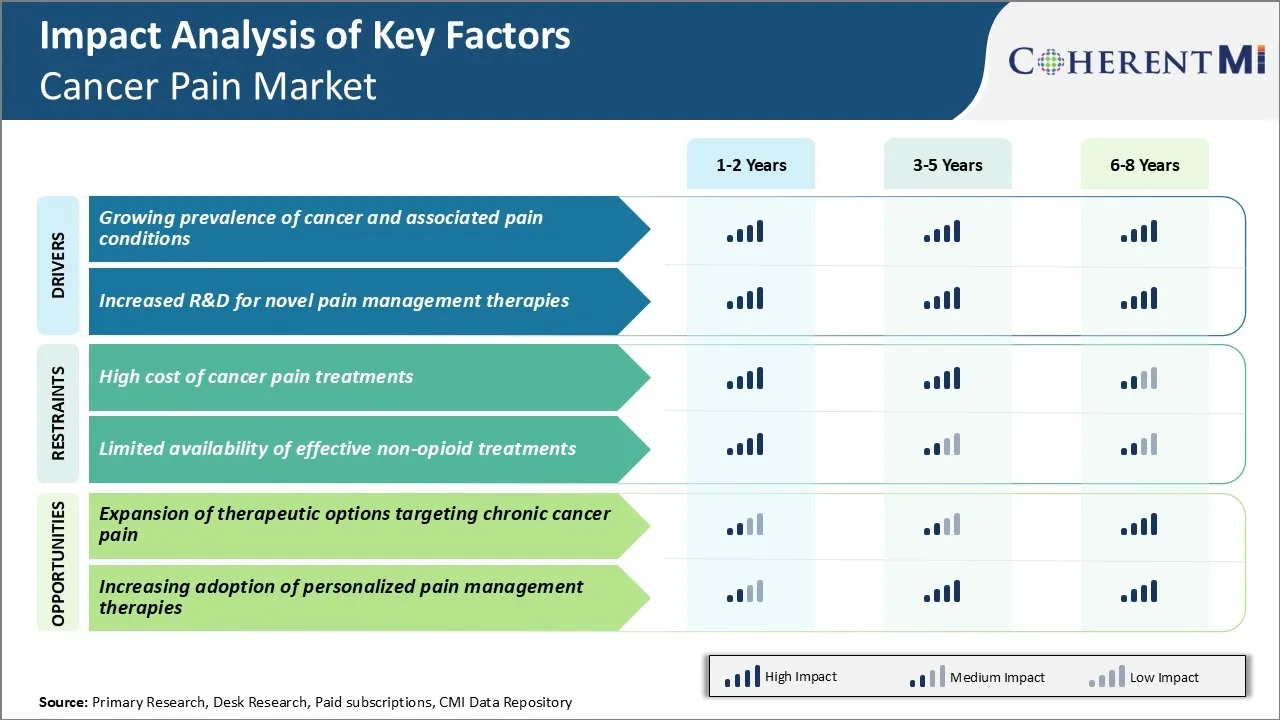

What are the key factors hampering the growth of the cancer pain market?

The high cost of cancer pain treatments and limited availability of effective non-opioid treatments are the major factors hampering the growth of the cancer pain market.

What are the major factors driving the cancer pain market growth?

The growing prevalence of cancer and associated pain conditions, and increased R&D for novel pain management therapies are the major factors driving the cancer pain market.

Which is the leading etiology-specific case in the cancer pain market?

The leading etiology-specific case segment is treatment-related pain.

Which are the major players operating in the cancer pain market?

Wex Pharma, Sorrento Therapeutics, Tetra Bio-Pharma, Daiichi Sankyo, Pfizer, Purdue Pharma, Medtronic, Biogen, Eli Lilly, and Sanofi are the major players.

What will be the CAGR of the cancer pain market?

The CAGR of the cancer pain market is projected to be 5.5% from 2025-2032.