Checkpoint Inhibitor Refractory Cancer Market Size - Analysis

Market Size in USD Bn

CAGR12.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 12.3% |

| Market Concentration | High |

| Major Players | Bristol-Myers Squibb, Merck, AstraZeneca, F. Hoffmann-La Roche (Genentech), Regeneron Pharmaceuticals and Among Others |

please let us know !

Checkpoint Inhibitor Refractory Cancer Market Trends

With significant advances being made in the area of cancer immunotherapy, checkpoint inhibitors have emerged as an important treatment option for various types of cancer. Checkpoint inhibitors work by blocking certain proteins made by some types of immune system cells, known as 'checkpoints', that can keep the immune system from attacking cancer cells.

With rising incidents of various cancer types globally, the number of patients diagnosed with cancers resistant to checkpoint inhibitors is steadily increasing. As per medical experts, around 40-50% of cancer patients develop resistance to initial checkpoint therapy. This highlights the clear unmet need to develop novel therapies effective for cancers not responding to current immunotherapy options. The large patient pool unable to benefit from standard checkpoint inhibitors is driving significant focus on research and development of new drugs targeting treatment resistance.

Market Driver - Advances in Personalized and Combination Therapies Boosting Treatment Efficacy

One approach gaining momentum is using biomarkers to identify patients most likely to benefit from certain combinations. For example, tumors with high microsatellite instability have been shown to respond very well to checkpoint inhibitors. Similarly, PD-L1 testing helps identify patients with PD-L1 positive tumors that may respond favorably to PD-1/PD-L1 targeted therapies.

Early clinical evidence suggests these personalized, rational combination strategies are helping overcome resistance and improve outcomes for more patients compared to single agent therapies alone. Continued advances in this area are expected to transform treatment paradigms and boost efficacy for cancers unresponsive to existing checkpoint inhibitor options.

While checkpoint inhibitor therapies have shown promising results in certain cancer settings, several critical challenges remain in delivering these emerging treatment options to all patients in need. One major hurdle is the exorbitantly high cost of many immunotherapies currently available or in late-stage development.

Furthermore, most payers rarely approve alternative immunotherapies once patients have progressed on first-line treatment due to comparative lack of evidence, high costs and affordability constraints. This leaves a significant portion of refractory cancer patients with no good treatment options. Additional research is urgently required to develop lower cost combination or sequential regimens that can achieve comparable or better efficacy outcomes at affordable prices.

Market Opportunity - Ongoing Clinical Trials Exploring Novel Combination Therapies and Alternative Immunotherapies

Combining agents with complementary immune modulating mechanisms, like CTLA-4 and PD-1/PD-L1 inhibitors, holds potential for synergistic anti-tumor effects. Alternative approaches being assessed include immunotherapies targeting new checkpoints like LAG-3, TIGIT, TIM-3 and IDO1. Several trials are also repurposing existing immunotherapies in refractory settings to leverage known safety profiles.

Prescribers preferences of Checkpoint Inhibitor Refractory Cancer Market

For first-line treatment of refractory metastatic cancers, prescribers commonly prescribe a combination of Opdivo (nivolumab) or Keytruda (pembrolizumab), checkpoint inhibitors, along with chemotherapy drugs like Alimta (pemetrexed) or carboplatin. This approach aims to synergistically boost the immune response along with reducing tumor size.

For third-line therapy and beyond, treatment selections are largely based on individual case factors like specific mutations, organ dysfunction, co-morbidities, and performance status. Defactinib in combination with chemotherapy may be explored for KRAS-mutated cancers. Alternatively, prescribers may offer clinical trial enrollment if a suitable option is available. Palliative care is prioritized to maximize quality of life once standard options are exhausted.

Treatment Option Analysis of Checkpoint Inhibitor Refractory Cancer Market

Checkpoint inhibitor refractory cancer is a difficult stage of disease where initial immunotherapy has failed. There are few remaining options that offer the potential for response. The line of treatment and tumor characteristics help determine the best approach.

When both immunotherapy and chemotherapy options are exhausted, the disease is considered late-stage refractory cancer. Clinical trials of novel agents remain important here, but aggressive local therapies may provide benefit with minimal side effects if limited metastases are present. Stereotactic radiosurgery has shown promise for controlling selected brain metastases. Ablative techniques like radiofrequency ablation can sometimes control liver or lung tumors.

Key winning strategies adopted by key players of Checkpoint Inhibitor Refractory Cancer Market

Focus on combination therapies: Most major players have focused on developing combination therapies that pair checkpoint inhibitors with other treatment modalities like chemotherapy, targeted therapy etc. For example, Merck & Co. developed Keytruda (pembrolizumab) in combination with chemotherapy for gastric cancer. In a Phase 3 KEYNOTE-062 trial, the combo doubled median overall survival compared to chemotherapy alone.

Partnering with Bio-techs: Bio-techs have novel targets and mechanisms that large pharma can commercialize. AstraZeneca has partnered with other firms, yielding successful drugs. For example, in 2017, it partnered with Daiichi Sankyo on ENHERTU. In a Phase 3 trial, ENHERTU doubled progression-free survival vs. trastuzumab emtansine in HER2-positive metastatic breast cancer.

Segmental Analysis of Checkpoint Inhibitor Refractory Cancer Market

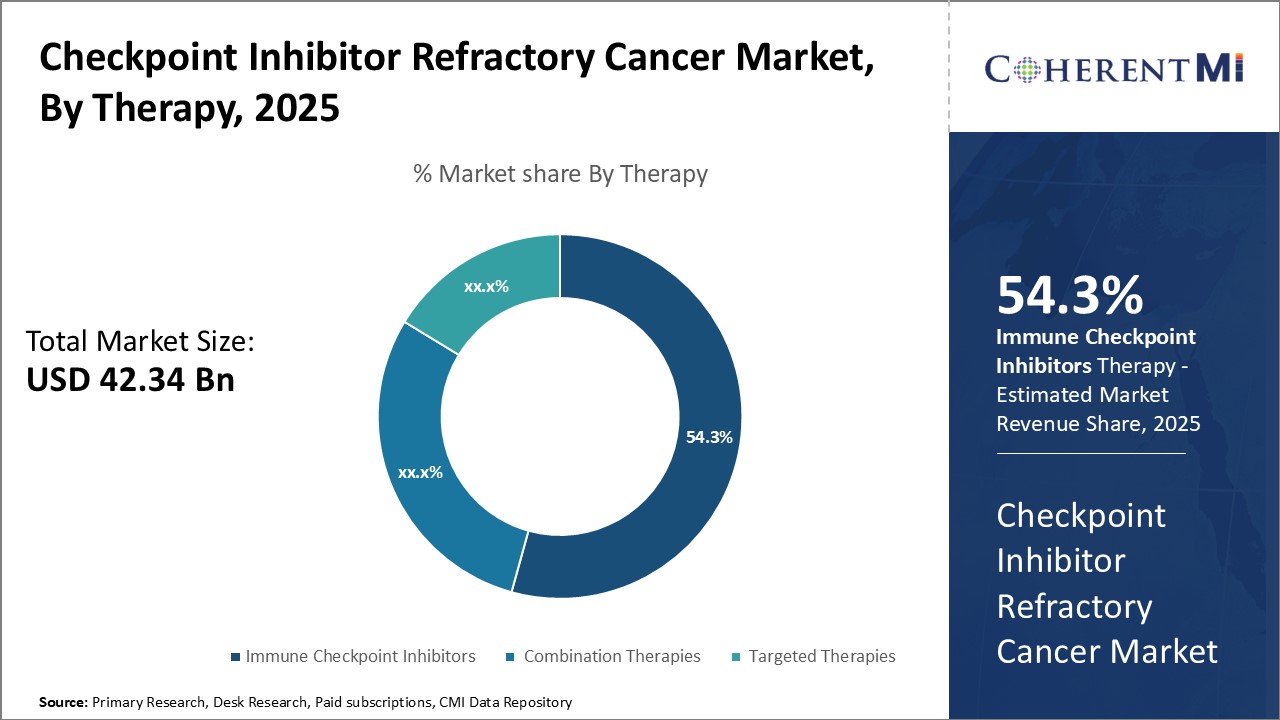

Insights, By Therapy: Immune Checkpoint Inhibitors Lead Due to Effectiveness Against Various Cancers

Insights, By Therapy: Immune Checkpoint Inhibitors Lead Due to Effectiveness Against Various CancersIn terms of therapy, immune checkpoint inhibitors is likely to hold 54.3% revenue share of the checkpoint inhibitor refractory cancer market owning to its effectiveness against various refractory cancer types. Immune checkpoint inhibitors work by blocking proteins made by some types of immune system cells, called T-cells, that act like brakes on the immune system and stop it from attacking the cancer cells.

Its ability to induce durable responses has increased its uptake even in later lines of therapy. Ongoing clinical trials evaluating immune checkpoint inhibitors alone and in combination for other cancer types are further expanding its addressable market.

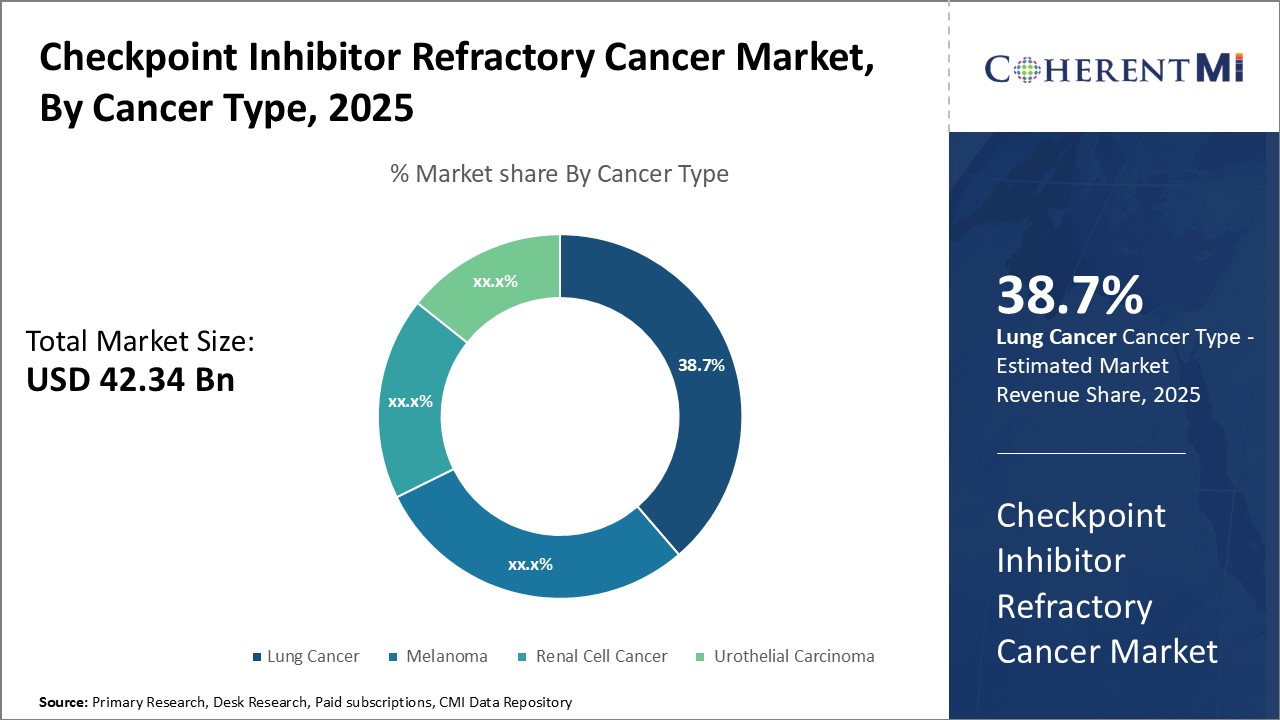

In terms of cancer type, lung cancer is expected to contribute 38.7% of the checkpoint inhibitor refractory cancer market owing to its high prevalence and mortality rates globally. Lung cancer is the second most common cancer but the leading cause of cancer-related deaths worldwide. A majority of lung cancers are diagnosed at an advanced stage when the disease has become refractory to initial treatments.

In terms of treatment line, first-line treatment contributes the highest share of the checkpoint inhibitor refractory cancer market owing to the large patient pool eligible for initial therapies. While cancers like lung cancer often present at an advanced stage, first-line treatment still represents the largest segment as it includes all newly diagnosed patients.

Additional Insights of Checkpoint Inhibitor Refractory Cancer Market

A significant number of patients develop resistance to checkpoint inhibitors, with an estimated 156,370 incident cases of refractory cancer types in the 7MM in 2020, highlighting a critical area of unmet need.

Competitive overview of Checkpoint Inhibitor Refractory Cancer Market

The major players operating in the Checkpoint Inhibitor Refractory Cancer Market include Bristol-Myers Squibb, Merck, AstraZeneca, Hoffmann-La Roche (Genentech) and Regeneron Pharmaceuticals.

Checkpoint Inhibitor Refractory Cancer Market Leaders

- Bristol-Myers Squibb

- Merck

- AstraZeneca

- F. Hoffmann-La Roche (Genentech)

- Regeneron Pharmaceuticals

Checkpoint Inhibitor Refractory Cancer Market - Competitive Rivalry

Checkpoint Inhibitor Refractory Cancer Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Checkpoint Inhibitor Refractory Cancer Market

- In March 2023, Merck announced positive Phase III results for its new checkpoint inhibitor combination aimed at improving survival in refractory lung cancer patients. Merck announced results from multiple Phase III trials involving its checkpoint inhibitor, KEYTRUDA (pembrolizumab), in various settings, including lung cancer. Specifically, the KEYNOTE-671 trial reported positive results for KEYTRUDA in combination with chemotherapy in patients with resectable non-small cell lung cancer (NSCLC), showing improved event-free survival when used as neoadjuvant and adjuvant therapy.

- In January 2023, Bristol-Myers Squibb launched a new clinical trial exploring combination therapies for checkpoint refractory cancers, targeting various solid tumors. Bristol-Myers Squibb has been actively involved in numerous trials and studies focusing on combination therapies with their checkpoint inhibitors, including Opdivo (nivolumab) and Yervoy (ipilimumab), across a wide range of cancer types. Recent updates involve trials like RELATIVITY-123, which evaluates combination therapies for cancers resistant to checkpoint inhibitors.

Checkpoint Inhibitor Refractory Cancer Market Segmentation

- By Therapy

- Immune Checkpoint Inhibitors

- Combination Therapies

- Targeted Therapies

- By Cancer Type

- Lung Cancer

- Melanoma

- Renal Cell Cancer

- Urothelial Carcinoma

- By Treatment Line

- First-Line Treatment

- Second-Line Treatment

- Third-Line and Beyond

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the checkpoint inhibitor refractory cancer market?

The checkpoint inhibitor refractory cancer market is estimated to be valued at USD 42.34 Bn in 2025 and is expected to reach USD 95.37 Bn by 2032.

What are the key factors hampering the growth of the checkpoint inhibitor refractory cancer market?

The rising incidence of cancer types resistant to current checkpoint inhibitors and advances in personalized and combination therapies boosting treatment efficacy are the major factors driving the checkpoint inhibitor refractory cancer market.

Which is the leading therapy in the checkpoint inhibitor refractory cancer market?

The leading therapy segment is immune checkpoint inhibitors.

Which are the major players operating in the checkpoint inhibitor refractory cancer market?

Bristol-Myers Squibb, Merck, AstraZeneca, Hoffmann-La Roche (Genentech), and Regeneron Pharmaceuticals are the major players.

What will be the CAGR of the checkpoint inhibitor refractory cancer market?

The CAGR of the checkpoint inhibitor refractory cancer market is projected to be 12.3% from 2025-2032.