Chemotherapy Induced Anemia Market Size - Analysis

Market Size in USD Bn

CAGR6.3%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 6.3% |

| Market Concentration | Medium |

| Major Players | Amgen Inc., Johnson & Johnson, Pfizer Inc., F. Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd. and Among Others |

please let us know !

Chemotherapy Induced Anemia Market Trends

As per estimates, nearly three quarters of all cancer patients receive chemotherapy during the course of their treatment. While chemotherapy is aimed at destroying cancer cells, the drugs used also tend to impact healthy cells including red blood cells. This can lead to reduced red blood cell count or hemoglobin levels manifesting as anemia. Anemia due to chemotherapy is quite common, occurring in over 90% of cancer patients receiving the drugs.

However, such intensive chemotherapy comes at the cost of greater hematological toxicities including anemia that requires treatment. Another factor promoting the condition is improved survival rates of cancer allowing patients to receive more cycles of chemotherapy over their lifespan. This prolonged exposure to chemotherapy only elevates their anemia probability long term. Rise in elderly population diagnosed with cancer also heightens chemotherapy induced anemia due to age related decline in bone marrow reserve and function.

Market Driver - Development of Novel Therapies and Biosimilars Enhances Treatment Efficacy and Accessibility

Coming years will see many pipeline drugs entering the commercial stage after gaining regulatory clearances. These next generation drugs hold promise of better targeting multiple pathways involved in anemia management like iron regulation, erythropoiesis stimulation and inflammation control. They may prove more effective at correcting anemia and reducing needs for blood transfusions or hospitalizations.

With rising focus on reducing costs of Specialty drug spending across the world, inclusion of biosimilars in insurance formularies and public health programs are expected to escalate. Their uptake will support in offsetting price inflation pressures owing to monopoly patents expiring on originator brands in the analyzed market over the next five years.

One of the major challenges faced by the chemotherapy induced anemia market is the adverse effects associated with the usage of ESAs (erythropoiesis-stimulating agents) and iron supplements. Both ESAs and intravenous iron supplements which are commonly used to treat chemotherapy induced anemia come with certain risks.

Intravenous iron supplements, on the other hand, may cause severe allergic reactions and anaphylaxis in some patients. The risks of side effects and safety concerns amongst healthcare professionals as well as patients have resulted in more cautious approach towards the usage of ESAs and IV iron, especially when treating non-myeloid cancers.

The chemotherapy induced anemia therapeutics market has strong prospects for growth in developing regions of the world due to improving healthcare infrastructure and rising focus on cancer care. Many countries in Asia Pacific, Latin America, Middle East and Africa are witnessing substantial investments in healthcare delivery systems and expansion of health insurance coverage in the recent years. This is enabling better access to advanced cancer treatments like chemotherapy for a greater number of patients in these countries.

The pharmaceutical companies can tap into this emerging chemotherapy induced anemia markets through partnerships with local distributors, pragmatic pricing of drugs and physician/patient awareness campaigns. The healthcare sector developments in Asia Pacific and other developing economies present significant commercial opportunities for market players over the coming years.

Prescribers preferences of Chemotherapy Induced Anemia Market

Chemotherapy-induced anemia is commonly treated with erythropoiesis-stimulating agents (ESAs). For mild cases (hemoglobin 10-11g/dL), prescribers typically start with a first-line ESA such as epoetin alfa (brand name: Procrit) or darbepoetin alfa (brand name: Aranesp). These agents are administered by subcutaneous injection on a weekly or biweekly basis.

If anemia fails to respond to first-line ESA therapy or becomes dependent on high ESA doses to maintain hemoglobin, prescribers will switch to a second-line long-acting ESA such as methoxy polyethylene glycol-epoetin beta (brand name: Mircera). This second-line option allows for less frequent dosing.

Treatment Option Analysis of Chemotherapy Induced Anemia Market

Chemotherapy-induced anemia can range from mild to severe depending on the type and duration of chemotherapy. Treatment options vary based on the severity of anemia and line of treatment.

For moderate CIA (hemoglobin 8-10 g/dL), ESAs are still the standard first-line treatment but intravenous iron supplementation may be added. Intravenous iron, such as ferric carboxymaltose (Injectafer), corrects iron deficiency and works synergistically with ESAs to produce a faster hematopoietic response.

For later-line CIA treatment, biosimilar ESAs and inexpensive intravenous iron preparations are preferred to minimize costs. Overall, a personalized approach considering disease status and symptom severity guides the most suitable CIA treatment options in each line of therapy.

Key winning strategies adopted by key players of Chemotherapy Induced Anemia Market

Market players have adopted strategic acquisitions and partnerships as a key part of their growth strategy over the past decade.

Similarly, in 2015, Johnson & Johnson partnered with Shanghai Fosun Pharmaceutical to commercialize its anti-anemia drug, DARZALEX (daratumumab), in China. Through this partnership, J&J was able to leverage Fosun's strong regional expertise and network of over 1,300 hospitals to penetrate the fast-growing Chinese market. By 2018, DARZALEX sales in China exceeded $100 million, accounting for over 15% of its global revenues.

Segmental Analysis of Chemotherapy Induced Anemia Market

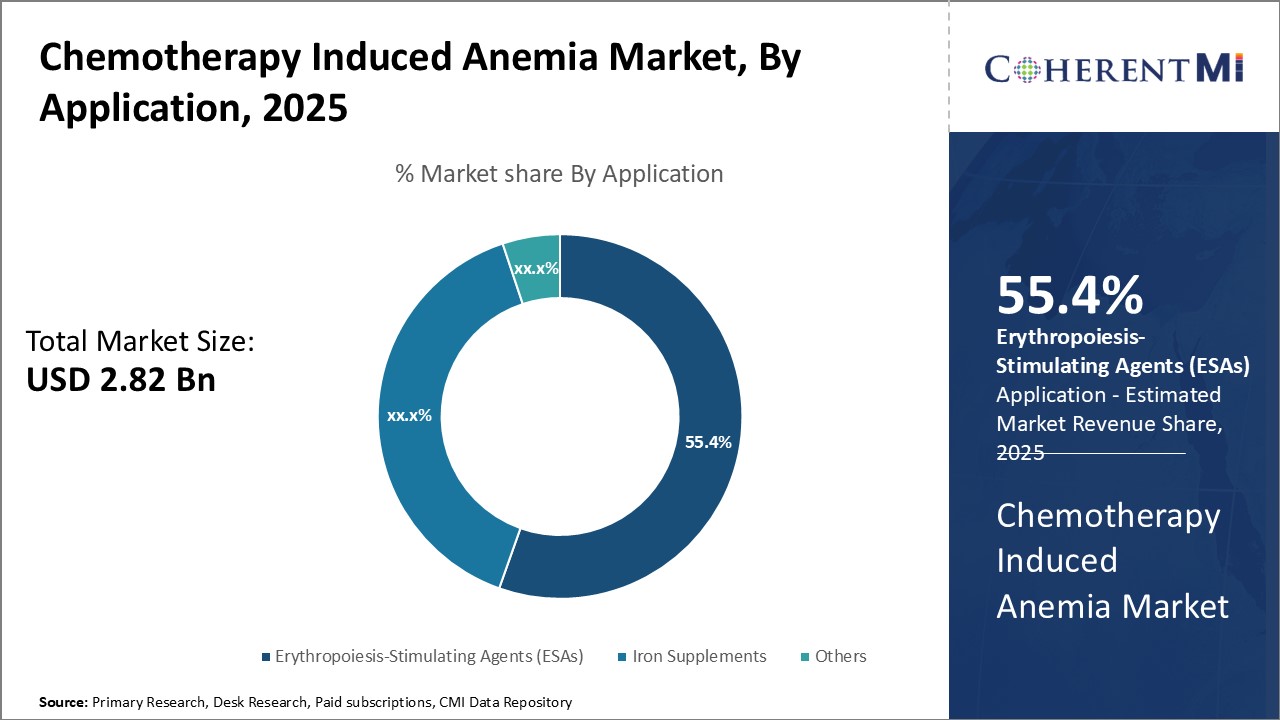

Insights, By Drug: High Efficacy and Safety drives Erythropoiesis-Stimulating Agents (ESAs) Segment Dominance

Insights, By Drug: High Efficacy and Safety drives Erythropoiesis-Stimulating Agents (ESAs) Segment DominanceIn terms of drug, erythropoiesis-stimulating agents (ESAs) is likely to hold 55.4% of the market owning to their well-established safety and efficacy profiles. ESAs work by stimulating the body's natural production of red blood cells, helping to reduce anemia symptoms and decrease the need for blood transfusions in chemotherapy patients. Short-acting ESAs provide a rapid response but require frequent dosing. Meanwhile, long-acting ESAs only need to be administered weekly or bi-weekly, improving convenience.

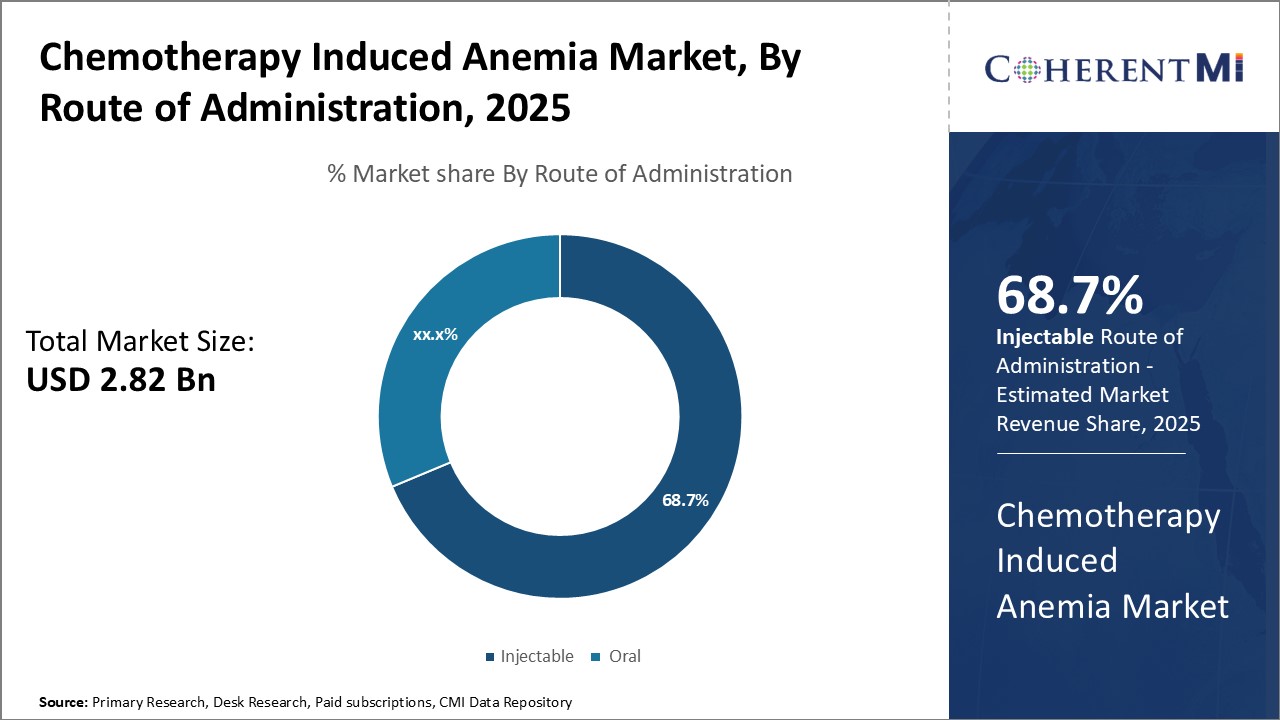

Insights, By Route of Administration: Route of Administration Influences Choice of Therapy

ESAs must be carefully dosed to be effective while avoiding serious side effects like thrombosis. Injectable administration allows for precise dosing according to patient factors like weight and hemoglobin levels. It also bypasses potential issues with oral bioavailability. Many chemotherapy patients already receive other intravenous medications as part of cancer treatment, so adding injectable anemia therapies does not burden them further.

Among distribution channels, hospital pharmacies contribute the highest share. Patients receiving chemotherapy tend to have complex medical needs requiring close monitoring and guidance from clinicians. Cancer care often involves long hospital visits and admissions for chemotherapy administration and management of side effects.

Close collaboration between oncologists, nurses and hospital pharmacists further optimizes anemia management. Any issues can be promptly addressed through convenient in-person discussions. This level of coordinated, integrated care is difficult for retail or online pharmacies to match. For chemotherapy patients dealing with significant illness impacts, the convenience and personalized support of hospital pharmacies remains invaluable.

Additional Insights of Chemotherapy Induced Anemia Market

- Prevalence of Anemia in Chemotherapy Patients: Approximately 70% of chemotherapy patients experience anemia, underscoring the significant need for effective management strategies.

- Impact on Quality of Life: Effective treatment of chemotherapy-induced anemia has been shown to improve patients' quality of life by reducing fatigue and enhancing physical functioning.

- The collaboration between Johnson & Johnson and Teva Pharmaceutical Industries led to the development of biosimilar ESAs, making treatments more affordable and accessible.

- Pfizer Inc. invested in research focusing on minimizing the side effects of iron supplements, improving patient tolerance and adherence to therapy.

Competitive overview of Chemotherapy Induced Anemia Market

The major players operating in the Chemotherapy Induced Anemia Market include Amgen Inc., Johnson & Johnson, Pfizer Inc., Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Mylan N.V., Vifor Pharma, Akebia Therapeutics, Pharmacosmos A/S, and Sandoz International GmbH (a Novartis division).

Chemotherapy Induced Anemia Market Leaders

- Amgen Inc.

- Johnson & Johnson

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceutical Industries Ltd.

Chemotherapy Induced Anemia Market - Competitive Rivalry

Chemotherapy Induced Anemia Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Chemotherapy Induced Anemia Market

- In September 2023, Vifor Pharma partnered with Pharmacosmos A/S to expand the distribution of intravenous iron supplements in Asia Pacific, aiming to address the unmet needs in emerging markets. However, recent news highlights that Vifor Pharma is under investigation by the European Commission for potentially anticompetitive behavior involving disparagement of Pharmacosmos, its main competitor in the intravenous iron treatment market.

- In July 2023, Akebia Therapeutics received FDA approval for Vafseo (vadadustat), an oral hypoxia-inducible factor prolyl hydroxylase inhibitor (HIF-PHI). This approval was specifically for the treatment of anemia due to chronic kidney disease (CKD) in adults who have been on dialysis for at least three months. Vafseo offers a convenient oral alternative to traditional injectable therapies and helps increase hemoglobin and red blood cell production by simulating the body’s response to hypoxia.

- In March 2023, Amgen Inc. announced positive results from a Phase III trial of a long-acting ESA, demonstrating improved efficacy in managing chemotherapy-induced anemia. This advancement may enhance patient compliance and outcomes.

Chemotherapy Induced Anemia Market Segmentation

- By Drug

- Erythropoiesis-Stimulating Agents (ESAs)

- Short-acting ESAs

- Long-acting ESAs

- Iron Supplements

- Oral Iron Supplements

- Intravenous Iron Supplements

- Others

- Blood Transfusions

- Nutritional Supplements

- Erythropoiesis-Stimulating Agents (ESAs)

- By Route of Administration

- Injectable

- Oral

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Would you like to explore the option of buying individual sections of this report?

Ghanshyam Shrivastava - With over 20 years of experience in the management consulting and research, Ghanshyam Shrivastava serves as a Principal Consultant, bringing extensive expertise in biologics and biosimilars. His primary expertise lies in areas such as market entry and expansion strategy, competitive intelligence, and strategic transformation across diversified portfolio of various drugs used for different therapeutic category and APIs. He excels at identifying key challenges faced by clients and providing robust solutions to enhance their strategic decision-making capabilities. His comprehensive understanding of the market ensures valuable contributions to research reports and business decisions.

Ghanshyam is a sought-after speaker at industry conferences and contributes to various publications on pharma industry.

Frequently Asked Questions :

How big is the chemotherapy induced anemia market?

The chemotherapy induced anemia market is estimated to be valued at USD 2.82 Billion in 2025 and is expected to reach USD 4.32 Billion by 2032.

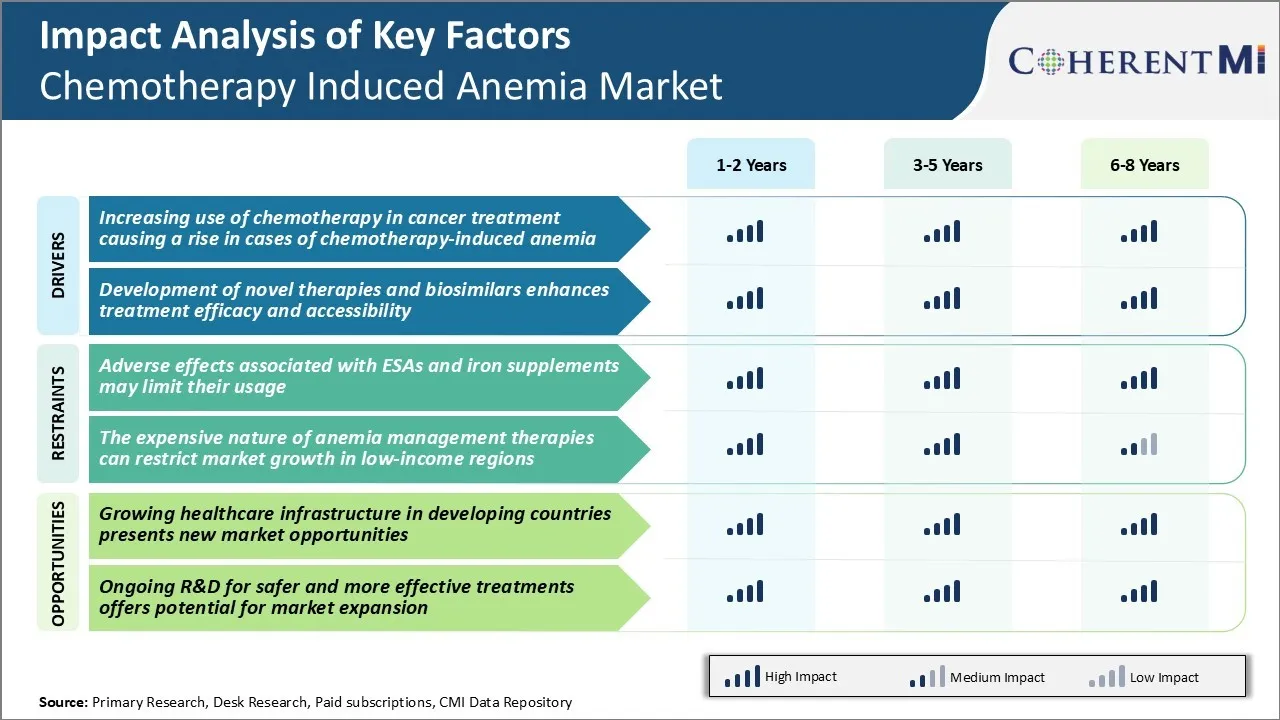

What are the key factors hampering the growth of the chemotherapy induced anemia market?

The adverse effects associated with ESAs and iron supplements may limit their usage. Furthermore, expensive nature of anemia management therapies can restrict market growth in low-income regions.

What are the major factors driving the chemotherapy induced anemia market growth?

The increasing use of chemotherapy in cancer treatment causing a rise in cases of chemotherapy-induced anemia and development of novel therapies and biosimilars, which enhances treatment efficacy and accessibility, are the major factors driving the chemotherapy induced anemia market.

Which is the leading drug in the chemotherapy induced anemia market?

The leading drug segment is erythropoiesis-stimulating agents (ESAs).

Which are the major players operating in the chemotherapy induced anemia market?

Amgen Inc., Johnson & Johnson, Pfizer Inc., Hoffmann-La Roche Ltd., Teva Pharmaceutical Industries Ltd., Mylan N.V., Vifor Pharma, Akebia Therapeutics, Pharmacosmos A/S, and Sandoz International GmbH (a Novartis division) are the major players.

What will be the CAGR of the chemotherapy induced anemia market?

The CAGR of the chemotherapy induced anemia market is projected to be 6.3% from 2025-2032.