Chondrosarcoma Market Size - Analysis

Market Size in USD Mn

CAGR6.8%

| Study Period | 2024 - 2031 |

| Base Year of Estimation | 2023 |

| CAGR | 6.8% |

| Market Concentration | Medium |

| Major Players | Inhibrx, Servier, Eli Lilly and Company, Pfizer, Novartis and Among Others |

please let us know !

Chondrosarcoma Market Trends

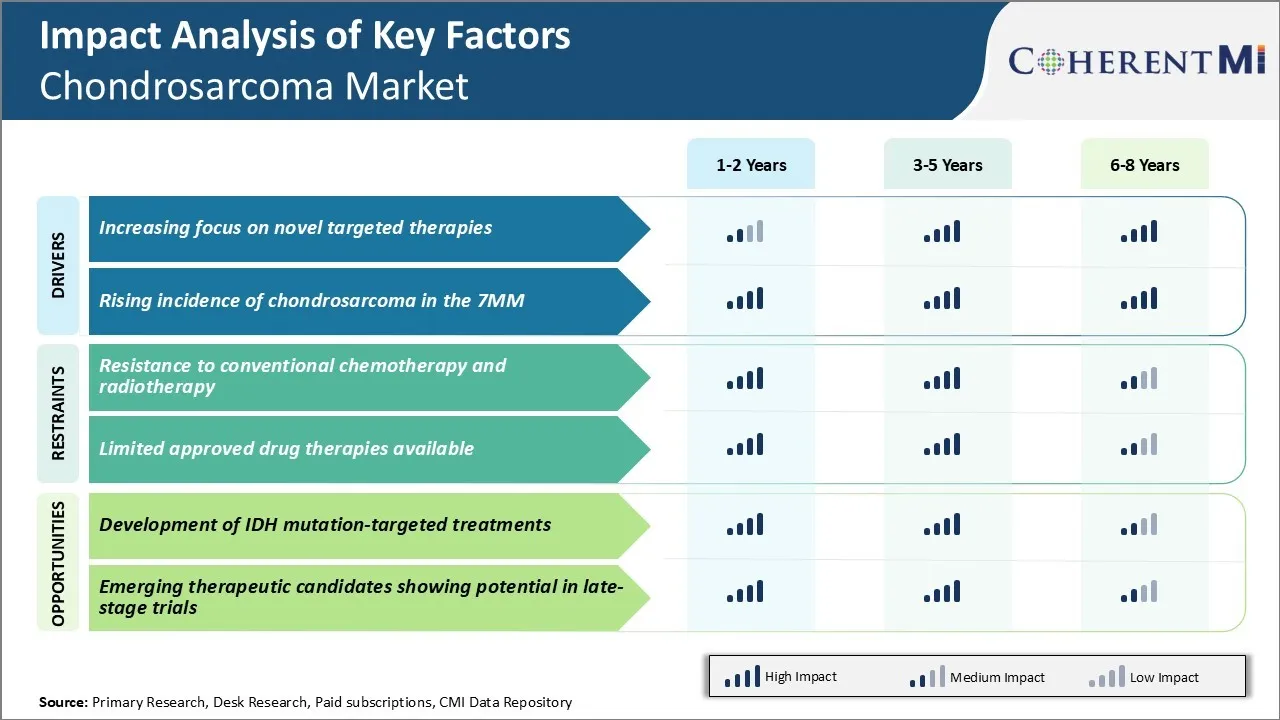

In recent years, advancements in understanding the molecular pathways driving chondrosarcoma pathogenesis have enabled the identification of potential therapeutic targets. Several targeted agents that interfere with pathways implicated in chondrosarcoma such as PI3K/AKT/mTOR and MET are currently being evaluated. Early clinical trial results have shown promise for some of these therapies.

Moreover, the field is steadily progressing towards developing combination regimens through rationally designed clinical trials. Given tumors often evade single agents via alternative pathways, combining targeted agents may yield improved outcomes over monotherapies.

Epidemiological data indicates a gradual rise in the incidence rates of chondrosarcoma across many parts of the world over the past few decades. This rising incidence poses a growing clinical challenge, putting more emphasis on improving outcomes through effective treatments.

The reasons underlying this trend have not been conclusively established. However, experts hypothesize that better diagnostic techniques allowing for improved detection capability and an aging global population susceptible to cartilage tumors may partly explain this observation. In addition, lifestyle changes leading to increasing risk factors cannot be ruled out. Regardless of causes, the increased patient volume highlights the requirement of more robust clinical management approaches. Early diagnosis and intervention could help address disease burden in populations where incidence is rising. Moreover, expanding access to treatments shown to confer survival benefits will be crucial to serve this growing number of patients diagnosed with chondrosarcoma.

One of the major challenges faced in the chondrosarcoma market is the resistance of chondrosarcoma tumors to conventional chemotherapy and radiotherapy. Chondrosarcoma tumors are known to be resistant to conventional chemotherapy and radiotherapy due to their low proliferative and highly differentiated phenotype.

Similarly, radiotherapy also does not provide favorable outcomes in chondrosarcoma due to its radioresistant nature. This intrinsic resistance substantially limits the efficacy of mainstream anticancer therapies for chondrosarcoma and poses a critical challenge for developing effective treatment options.

One major opportunity in the chondrosarcoma market is the development of IDH mutation-targeted treatments. Recent genomic studies have revealed that mutations in the isocitrate dehydrogenase 1 and 2 (IDH1/2) genes are present in a sizable percentage of chondrosarcoma patients. IDH mutations have emerged as important disease drivers and are associated with worse prognosis in chondrosarcoma.

This represents a significant commercial opportunity for pharmaceutical manufacturers to develop the first targeted therapies capable of treating cancers caused by IDH mutations including chondrosarcoma.

Prescribers preferences of Chondrosarcoma Market

Chondrosarco is typically treated with a combination of medications depending on the disease stage. In early stage 1 disease, mild pain medications like paracetamol or NSAIDs such as ibuprofen (Brand: Brufen) are often prescribed. For moderate to severe pain in stage 2, stronger opioid analgesics including tramadol (Brand: Tramal) and codeine are used.

In late stage 4 disease, palliative care focuses on pain management and quality of life. Sustained-release opioids like oxycodone (Brand: Oxycontin) and fentanyl patches (Brand: Durogesic) are frequently prescribed to control pain. Non-opioid alternatives such as neurontin (Brand: Neurontin) are also used.

Treatment Option Analysis of Chondrosarcoma Market

Chondrosarcoma treatment depends on the stage and location of the cancer. It is classified into three stages - local, locally advanced, and metastatic.

In locally advanced tumors not amenable to wide resection, the standard treatment is pre-operative radiation along with chemotherapy. This helps shrink the tumor and make it operable. The preferred chemotherapeutic regimen is ifosfamide and doxorubicin. Post-surgery, adjuvant radiation or chemoradiation further helps control local/regional diseases.

Key winning strategies adopted by key players of Chondrosarcoma Market

Focus on targeted therapies: Major players like Pfizer, Eli Lilly etc. have focused on developing targeted therapies for chondrosarcoma which has a higher success rate compared to traditional chemotherapy. For example, Pfizer's Xalkori (crizotinib) was approved in 2016 for advanced ALK-positive non-small cell lung cancer. It targets genetic mutations which is proving to be more effective for chondrosarcoma patients.

New drug delivery methods: Players are exploring new methods of drug delivery that can allow for targeted, controlled release of therapies directly at the tumor site. For example, in 2016 Astellas entered into partnership with Agilon to develop AST-OPC1, a human mesenchymal stem cell therapy transduced with HSV-TK gene for chondrosarcoma.

Segmental Analysis of Chondrosarcoma Market

As the most effective treatment option available, surgery is estimated to account for 60.5% of the chondrosarcoma market in 2024. When possible, complete surgical excision of the tumor offers the best chance of cure for patients. Advances in surgical techniques allow for more precise removal of the cancerous growth and affected tissues or bones. minimized risk of recurrence.

Overall, surgery remains the gold standard first-line treatment for chondrosarcoma due to its curative potential when tumors are identified early and completely excised.

In 2024, Emerging drugs are estimated to account for 70.2% of share in the chondrosarcoma market. While chemotherapy and radiotherapy have shown limited efficacy against chondrosarcoma historically, emerging drug therapies are bringing new hope. Targeted inhibitors such as ivosidenib, which disrupt tumor-specific mutations, represent a major advance. Ivosidenib is the first FDA-approved targeted therapy for relapsed or refractory IDH1-mutant chondrosarcoma. By interfering with the IDH1 enzyme, it may stop or slow cancer growth.

The availability of genetic profiling and biomarker-guided clinical trials is expanding precision medicine approaches to chondrosarcoma. More pipeline drugs continue entering later stages of testing. Emerging targeted therapies therefore offer new lines of defense against this difficult disease by exploiting its molecular characteristics.

Competitive overview of Chondrosarcoma Market

The major players operating in the Chondrosarcoma Market include Inhibrx, Servier, Pfizer, Eli Lilly and Company, Novartis, Bristol Myers Squibb, and Roche.

Chondrosarcoma Market Leaders

- Inhibrx

- Servier

- Eli Lilly and Company

- Pfizer

- Novartis

Chondrosarcoma Market - Competitive Rivalry

Chondrosarcoma Market

(Dominated by major players)

(Highly competitive with lots of players.)

Recent Developments in Chondrosarcoma Market

- In March 2023, INBRX-109 by Inhibrx shows potential as a new treatment for unresectable conventional chondrosarcoma, extending progression-free survival with a better safety profile. INBRX-109 is being investigated as a targeted therapy in a Phase II clinical trial (NCT04950075), aimed at treating patients with unresectable or metastatic conventional chondrosarcoma. The drug has shown promising results in extending progression-free survival (PFS), with a median PFS of 7.6 months compared to other treatments like chemotherapy, which typically achieve less than 4 months. Additionally, the study indicated that INBRX-109 has a favorable safety profile and demonstrated clinical activity by reducing tumor growth and maintaining disease control in patients.

- According to ESMO 2021 Guidelines, Trabectedin has been added as an option for mesenchymal chondrosarcoma. The guidelines primarily focus on established treatment protocols, such as surgery and chemotherapy regimens typically used for sarcomas.

Chondrosarcoma Market Segmentation

- By Treatment Option

- Surgery (Curative Treatment)

- Chemotherapy (Limited Efficacy)

- Radiotherapy (Resistance in Conventional Types)

- Targeted Therapies (IDH Inhibitors, DR5 Agonists)

- By Drug Type

- Conventional Treatments

- Emerging Drugs (Ivosidenib, INBRX-109)

Would you like to explore the option of buying individual sections of this report?

Vipul Patil is a dynamic management consultant with 6 years of dedicated experience in the pharmaceutical industry. Known for his analytical acumen and strategic insight, Vipul has successfully partnered with pharmaceutical companies to enhance operational efficiency, cross broader expansion, and navigate the complexities of distribution in markets with high revenue potential.

Frequently Asked Questions :

How big is the chondrosarcoma market?

The chondrosarcoma market is estimated to be valued at USD 961.2 Mn in 2024 and is expected to reach USD 1521.1 Mn by 2031.

What are the key factors hampering the growth of the chondrosarcoma market?

The resistance to conventional chemotherapy and radiotherapy and limited approved drug therapies available are the major factor hampering the growth of the chondrosarcoma market.

What are the major factors driving the chondrosarcoma market growth?

The increasing focus on novel targeted therapies and rising incidence of chondrosarcoma in the 7mm are the major factor driving the chondrosarcoma market.

Which is the leading treatment option in the chondrosarcoma market?

The leading treatment option segment is surgery (curative treatment).

Which are the major players operating in the chondrosarcoma market?

Inhibrx, Servier, Pfizer, Eli Lilly and Company, Novartis, Bristol Myers Squibb, Roche are the major players.

What will be the CAGR of the chondrosarcoma market?

The CAGR of the chondrosarcoma market is projected to be 6.8% from 2024-2031.